Key Takeaways

● The total market value of global cryptocurrencies is $3.36 trillion, down 7.4% from $3.63 trillion last week. As of press time, the total net inflow of the US Bitcoin spot ETF is about $40.35 billion, with a net outflow of $230 million this week; the total net inflow of the US Ethereum spot ETF is about $2.84 billion, with a net inflow of $83 million this week.

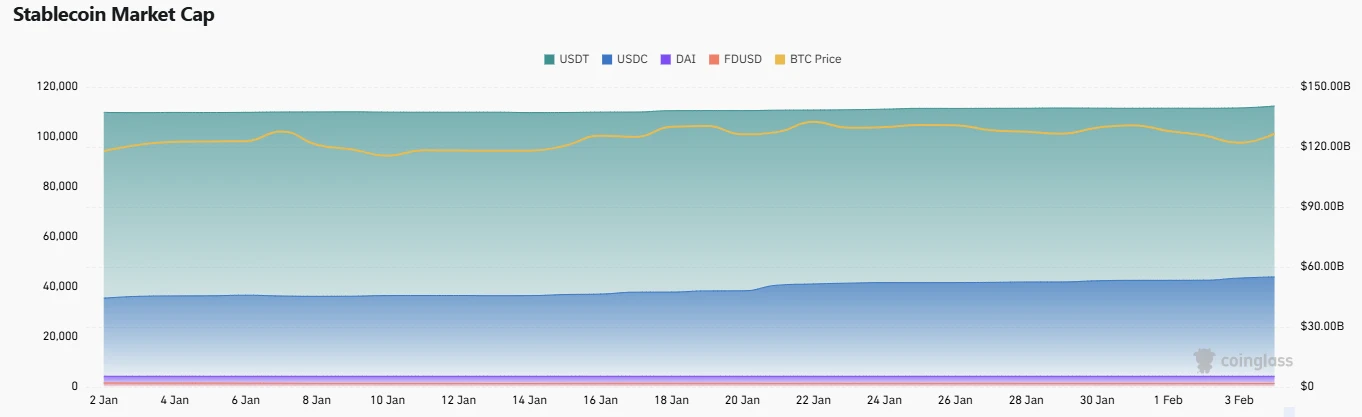

● The total market value of stablecoins is $227 billion. Among them, the market value of USDT is $140.5 billion, accounting for 61.9% of the total market value of stablecoins; followed by USDC with a market value of $55 billion, accounting for 24.2% of the total market value of stablecoins; and DAI with a market value of $5.36 billion, accounting for 2.4% of the total market value of stablecoins.

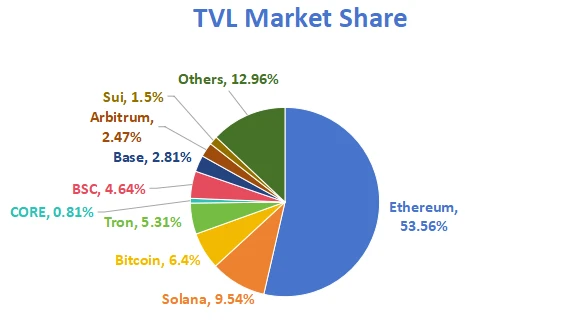

● This week, the total TVL of DeFi is 107.4 billion US dollars, a decrease of 12.4% from last week. By public chain, the three public chains with the highest TVL are Ethereum chain accounting for 53.56%; Solana chain accounting for 9.54%; Bitcoin chain accounting for 6.4%. This week, the data on the Bitcoin chain surpassed the Tron chain and ranked in the top three.

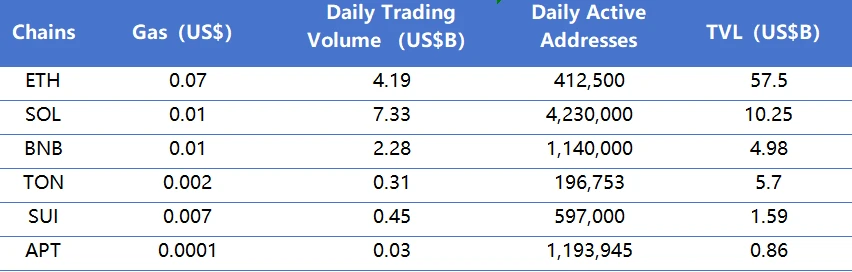

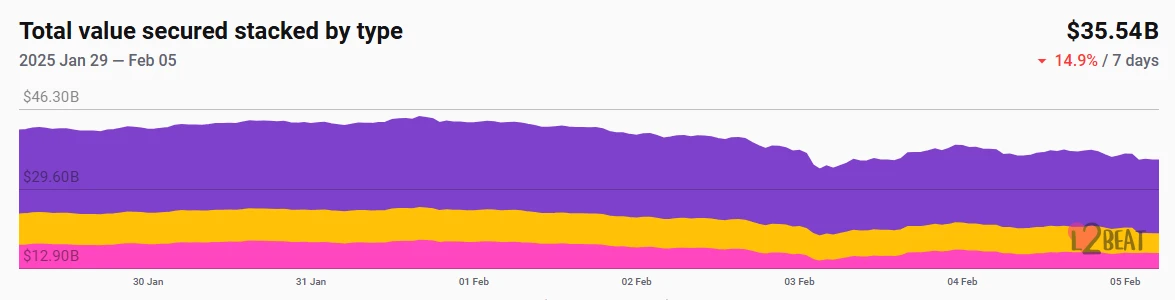

● From the on-chain data, the daily transaction volume and transaction fees of Layer 1 public chains are generally on a downward trend this week, among which ETHs daily transaction volume has the most significant downward trend, down 10.56% from last week. Among the daily active addresses, except for TON/APT, the overall trend is downward. The total TVL of Ethereum Layer 2 is 35.54 billion US dollars, down 14.9% from last week.

● Innovative project focus: Herd: By simplifying smart contracts, etc., it realizes more intelligent AI agents. The project is in the initial stage, and angel investors include Dune co-founders, etc.; Liquity : Launched V2 on the Ethereum mainnet, introducing a novel architecture designed to enhance capital utilization efficiency and achieve more value accumulation; Exponent : Build Solanas DeFi fixed-rate market to help users choose between predictable or leveraged returns.

Table of contents

Key Takeaways

1. Total cryptocurrency market value/Bitcoin market value share

2. Fear Index

3. ETF inflow and outflow data

4. ETH/BTC and ETH/USD exchange ratio

5. Decentralized Finance (DeFi)

6. On-chain data

7. Stablecoin market value and issuance

2. Hot money trends this week

1. The top five VC coins and meme coins with the highest growth this week

2. New Project Insights

3. New trends in the industry

1. Major industry events this week

2. Big events coming up next week

3. Important investment and financing last week

1. Market Overview

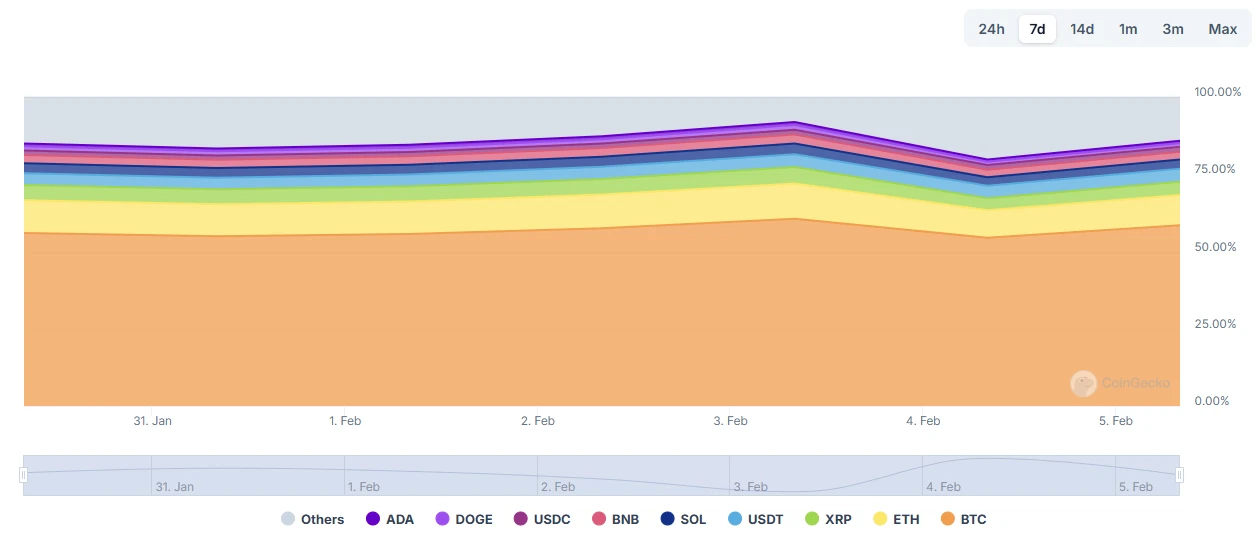

1. Total cryptocurrency market value/Bitcoin market value share

The total market value of global cryptocurrencies is $3.36 trillion, down 7.4% from $3.63 trillion last week.

Data source: Cryptorank

As of press time, Bitcoin’s market cap is $1.96 trillion, accounting for 58.32% of the total cryptocurrency market cap. Meanwhile, stablecoins’ market cap is $227 billion, accounting for 6.77% of the total cryptocurrency market cap.

Data source: coingeck

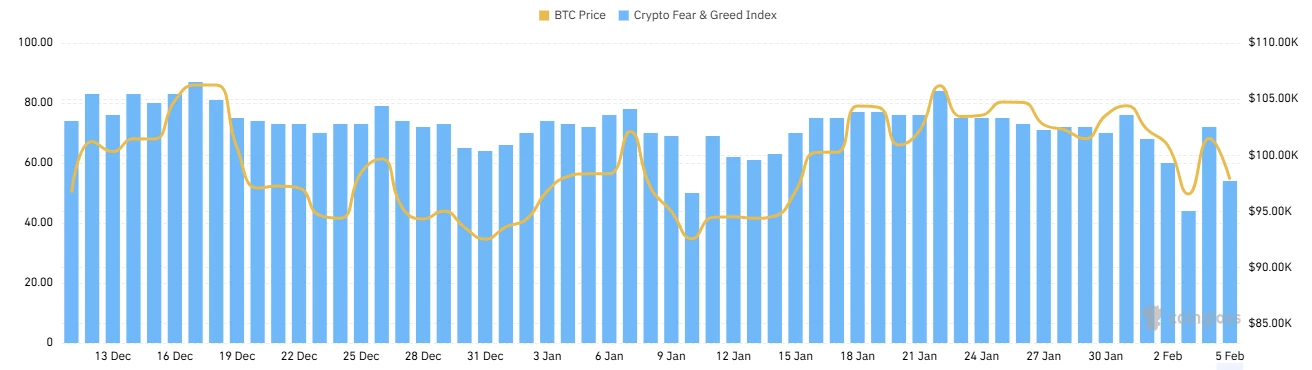

2. Fear Index

The cryptocurrency fear index is at 71, indicating greed.

Data source: coinglass

3. ETF inflow and outflow data

As of press time, the U.S. Bitcoin spot ETF has accumulated a total net inflow of approximately US$40.35 billion, with a net outflow of US$230 million this week; the U.S. Ethereum spot ETF has accumulated a total net inflow of approximately US$2.84 billion, with a net inflow of US$83 million this week.

Data source: sosovalue

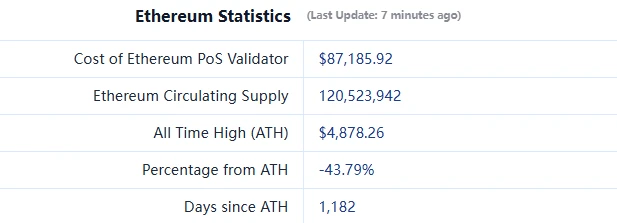

4. ETH/BTC and ETH/USD exchange ratio

ETHUSD: Current price is $2,731, the highest price in history is $4,878, and the decline from the highest price is about 43.79%

ETHBTC: Currently 0.027868, the highest in history is 0.1238

Data source: ratiogang

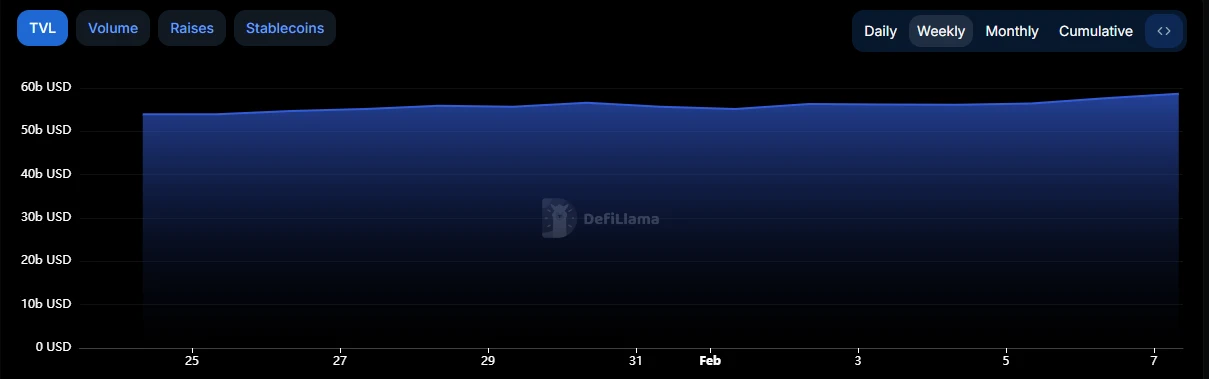

5. Decentralized Finance (DeFi)

According to DeFiLlama, the total TVL of DeFi this week is $107.4 billion, down 12.4% from last week.

Data source: defillama

According to the public chain, the three public chains with the highest TVL are Ethereum chain accounting for 53.56%; Solana chain accounting for 9.54%; Bitcoin chain accounting for 6.4%. This week, the data on the Bitcoin chain surpassed the Tron chain and ranked in the top three. The Ethereum chain is still the leader in the DeFi field.

Data source: CoinW Research Institute, defillama

Data as of February 4, 2025

6. On-chain data

Layer 1 Data

The main data of Layer 1 including ETH, SOL, BNB, TON, SUI and APT are analyzed mainly from the perspective of daily transaction volume, daily active addresses and transaction fees.

Data source: CoinW Research Institute, defillama, Nansen

Data as of February 4, 2025

● Daily trading volume and transaction fees: Daily trading volume and transaction fees are core indicators for measuring the activity of public chains and user experience. This week, both daily trading volume and transaction fees are on a downward trend overall, with ETH trading volume showing the most significant downward trend, down 10.56% from last week.

● Daily active addresses and TVL: Daily active addresses reflect the ecological participation and user stickiness of the public chain, and TVL reflects the users trust in the platform. From the perspective of daily active addresses, except for TON/APT, the overall trend is downward, and the overall change is small. From the perspective of TVL, ETH has a clear downward trend, with a drop of 11.4% from last week.

Layer 2 Data

According to L2B eat data, the total TVL of Ethereum Layer 2 is US$35.54 billion, a 14.9% drop from last week.

Data source: L2Beat

Data as of February 4, 2025

● Arbitrum and Base took the top spot with 35.56% and 26.61% market shares respectively, but their overall share declined.

Data source: footprint

Data as of February 4, 2025

7. Stablecoin market value and issuance

According to Coinglass data, the total market value of stablecoins is $227 billion. Among them, USDT has a market value of $140.5 billion, accounting for 61.9% of the total market value of stablecoins; followed by USDC with a market value of $55 billion, accounting for 24.2% of the total market value of stablecoins; and DAI with a market value of $5.36 billion, accounting for 2.4% of the total market value of stablecoins.

Data source: CoinW Research Institute, Coinglass

Data as of February 4, 2025

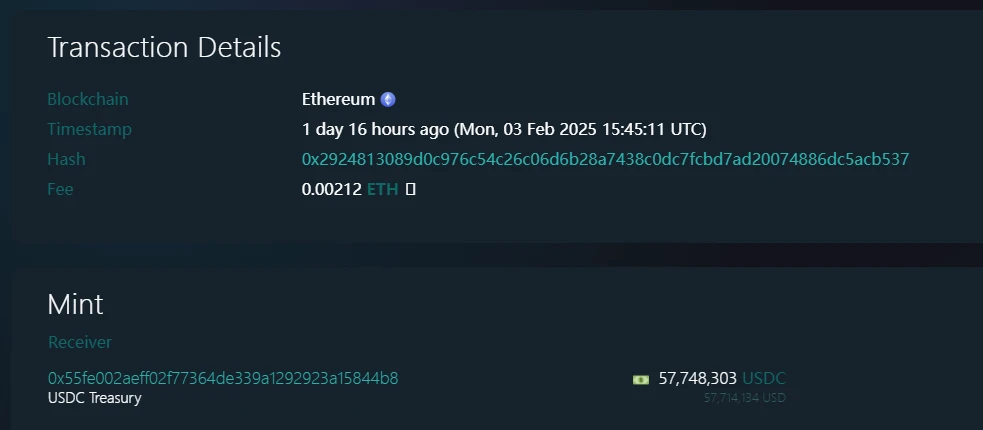

According to Whale Alert data, the USDC Treasury issued a total of 790 million USDC this week. In addition, Tether Treasury issued 1 billion USDT. The total issuance of stablecoins this week was 1.79 billion, a decrease of 31.2% from the total issuance of stablecoins last week.

Data source: Whale Alert

Data as of February 4, 2025

2. Hot money trends this week

1. The top five VC coins and meme coins with the highest growth this week

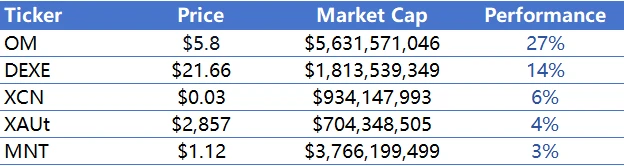

Top five VC coins with the highest growth in the past week

Data source: CoinW Research Institute, coinmarketcap

Data as of February 4, 2025

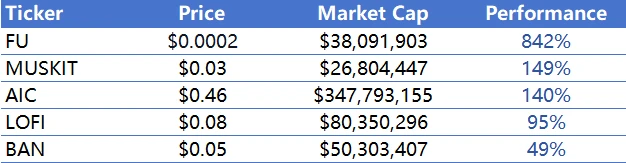

Top 5 Meme Coins That Gained in the Past Week

Data source: CoinW Research Institute, coinmarketcap

Data as of February 4, 2025

2. New Project Insights

● Herd: Achieve smarter AI agents by simplifying smart contracts. The project is in its early stages and has received $1.8 million in funding led by @SemanticVC , followed by @archetypevc and @hardi_meybaum . Angel investors include Dune co-founders.

● Liquity : V2 was launched on the Ethereum mainnet, introducing a novel architecture designed to enhance capital utilization efficiency and achieve more value accumulation.

● Exponent : Building Solana’s DeFi fixed-rate market to help users choose between predictable or leveraged returns.

3. New Industry Trends

1. Major industry events this week

● A member of the DeSci project Pump Science team said that the next round of 17 tokens is planned to be released this Saturday, which may be delayed until next week. Among them, some projects may decide to pre-sell, and Pump Science cannot guarantee the pre-sale.

● Ondo Finance announced the launch of Ondo Global Markets (Ondo GM), which aims to enable global investors to access U.S. listed securities through blockchain technology. The platform will provide tokenized assets based on securities. These tokens are paired 1:1 with underlying assets such as stocks, bonds and ETFs, and have liquidity similar to stablecoins and can be freely transferred outside the United States.

● JPMorgan reported that the growth of Bitcoin network computing power slowed down in January, with the average monthly computing power rising by only 1% to 785 EH/s, while the mining difficulty fell by 2% month-on-month, which is relatively rare in history. The report pointed out that as of the end of January, the 7-day moving average computing power reached a record high of 833 EH/s, but the computing power at the end of the month fell by 2% from the end of December to 781 EH/s.

● Metamask already supports the function of paying Swap transaction gas fees with tokens, and users can directly perform exchange operations without ETH.

● Berachain token will launch the mainnet and conduct TGE on February 6, and release token economics and Checker on February 5.

2. Big events coming up next week

● Web3 social application plug-in IDRISS will start airdropping tokens on Base on February 11. IDRISS DAO will allocate 20% of IDRISS airdrops to early users, @Gitcoin donors, supporters of token sales, and active members of the cooperative community.

● Artificial intelligence data platform Pundi AI announced that its token FX will be upgraded to PUNDIAI on February 10, 2025, and the token supply will be reduced to 1/100.

● The application deadline for the AI data analysis platform bitsCrunch ecosystem funding program is February 15, 2025. The total prize money is US$5 million, covering multiple categories such as artificial intelligence, games, NFTs, security, and communities.

● The TON Foundation is working with Jupiter to incubate new liquidity aggregators on TON. The winning projects will be announced on February 15, 2025.

● Solar releases Kamino writing bounty task, submission deadline is February 10th.

3. Important investment and financing last week

● D3, with a financing amount of US$25 million, and investors include Paradigm, Coinbase Ventures, etc. D3 is a next-generation domain name company dedicated to building interoperable web2<>web3 domain names. Its goal is to authorize and provide secure, decentralized identities with domain names as the core. (January 29, 2025)

● Cipher Mining, with a financing amount of US$50 million, and investment institutions include SoftBank and others. Cipher Mining is a Bitcoin mining company dedicated to expanding and strengthening the critical infrastructure of the Bitcoin network in the United States. (January 31, 2025)

● Taproot Wizards, Series A financing, financing amount of US$30 million, investment institutions include Standard Crypto, Cyber Fund, Geometry, Collider Ventures, Newman Capital, etc. Taproot Wizards is an Ordinals project focusing on Bitcoin, inspired by the original Bitcoin Wizard Reddit meme ten years ago. (February 4, 2025)