On March 16, Bedrock stated on the X platform: BR token airdrop query is now live . 5.5% of the total BR supply will be airdropped in TGE (first quarter); the points program will continue to be used for future rewards; the number of addresses eligible for airdrops exceeds 200,000; more than 100,000 wallets will receive additional loyalty rewards; all community airdropped BR tokens will be fully unlocked.

On the same day, Bedrock announced that its token BR has supported the pre-deposit function of Bitget, Bybit and Gate.io. Subsequently, the above three exchanges also confirmed the launch of BR spot trading.

These two important pieces of news directly related to tokens quickly attracted market attention and received enthusiastic community feedback:

Babylon officially held an online Space on the X platform to discuss the ecological progress of Bedrock, indicating its high attention to Bedrock;

Bedrock partner Penpie ( @Penpiexyz_io ) retweeted Bedrock’s official airdrop announcement;

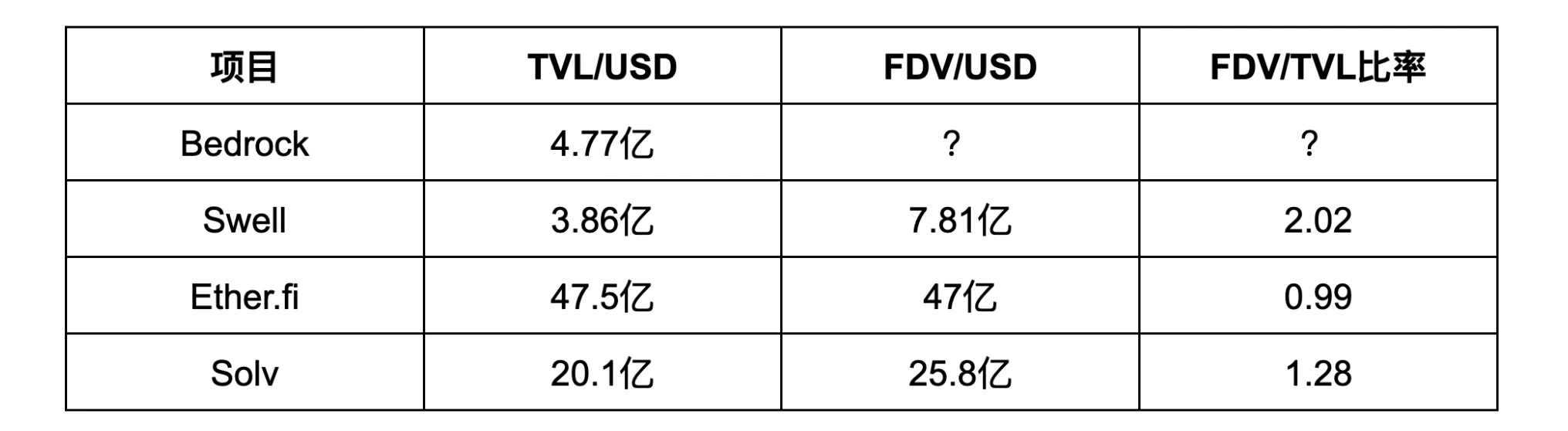

Community member BILI ( @BiliSquare ), who has 56,000 followers, said that Bedrock has a high investment potential by comparing the FDV to TVL ratio with similar projects;

Community member cryptodoggy ( @MultiDoggy ) actively promoted it by releasing related videos.

…

What makes the Bedrock project frequently receive positive affirmation from the community and continue to attract attention in todays sluggish market? Combining information from all parties, we summarize the following four core reasons:

1. Bedrock’s airdrop rules and TGE (token generation event) rhythm are in line with market expectations;

(ii) The current FDV valuation is relatively low ($200-300 million) and has significant growth potential;

(3) The project has a high degree of communityization, a large proportion of retail investors, and is obviously driven by the community itself, without being dominated by large institutions;

(IV) Fundamental data performance is outstanding: total TVL reached US$443 million, the user scale exceeded 278,000, the project ecosystem covered 19 chains, and more than 60 DeFi protocols have been integrated.

Against the backdrop of positive market response, the specific valuation of the soon-to-be-launched Bedrock token has also become a topic of greatest concern to investors.

Bedrock Token (BR) Valuation Analysis and Potential Prediction

Comparison of Valuation Logic and FDV

First, based on the current size of the BTC re-staking market (approximately US$3.5 billion) and Bedrock’s market share (approximately 15%), its reasonable initial FDV is between US$200 million and US$300 million.

Based on TVL and referring to the valuation data of competing projects in the same track (Swell, Ether.fi, Solv) (TVL data from Deflama ; FDV data from Coinmarketcap ), the results show that Bedrock has obvious FDV price advantages and great growth potential:

As shown in the table above, the average FDV/TVL of similar products that have issued tokens is about 1.43. Based on this coefficient, Bedrocks FDV has the potential to grow to US$682 million (477 million * 1.43) in the future.

Diamonds Points and BR Link

As an important component protocol of the Babylon ecosystem, Bedrock encourages users to actively participate in asset staking and liquidity provision through a unique Diamonds points mechanism to enhance the activity of the ecosystem. This mechanism has been widely recognized by the community since the mainnet was launched on January 28, 2024. The Season 1 points reward has now ended and the snapshot has been completed. It has automatically entered the Season 2 stage. The specific points rules are yet to be announced.

Bedrock core contributor Zhuling ( @czhuling ) publicly stated in the TGE community call that Diamonds points will be exchanged for native BR tokens according to a specific mechanism at TGE. Users who hold uniToken for a long time after TGE and users who actively participate in uniToken DeFi will receive higher airdrop rewards, further enhancing the communitys confidence in the long-term development of the project.

Community valuation calculation and investment value analysis

As of now, Bedrock has not officially disclosed the total supply of BR tokens.

However, according to the analysis of KOL BITWU.ETH , Bedrock, as an important participant in the BTCFi 2.0 field, is estimated to have an FDV of about $200-300 million, which is much lower than similar competitors. At the same time, the FDV/TVL of emerging cross-chain staking or yield aggregation protocols is often 3 to 5 times higher. Even if estimated at the industry average, Bedrocks FDV still has significant room for upward adjustment - even if it only reaches the median level, Bedrocks FDV has the potential to double compared to the current level.

According to the speculation of Jerry, a member of the Discord community, based on the FDV range of US$200 to 300 million, the unit price of Diamonds points is expected to be in the range of US$0.003 to US$0.007. Although this valuation is low, considering the growth potential, the BR token price may reach an optimistic range of US$0.2 to US$0.3.

The airdrop APY calculation is based on the communitys optimistic speculation of a BR token price range of $0.2 to $0.3: Assuming an active user stakes 1.3 uniBTC (worth $85,000) on the Pendle platform for 6 months, he will receive an airdrop reward of 23,824 BR tokens:

If the BR price is $0.2, the corresponding annualized rate of return (APY) is about 9%;

If the BR price is $0.3, the corresponding APY reaches 13%;

This predicted yield range (9% -13%) highlights the attractiveness of Bedrock’s airdrop strategy, and the return level is quite substantial (note that the above estimates are based on community user cases, and actual results may vary with market conditions).

Now that we understand the FDV valuation and BR APY yield forecast, let’s dive into Bedrock’s unique token economic design and learn about the innovations of the PoSL and veBR models.

PoSL and veBR Token Model: An Enhanced Paradigm for Building a Bitcoin Staking Economy

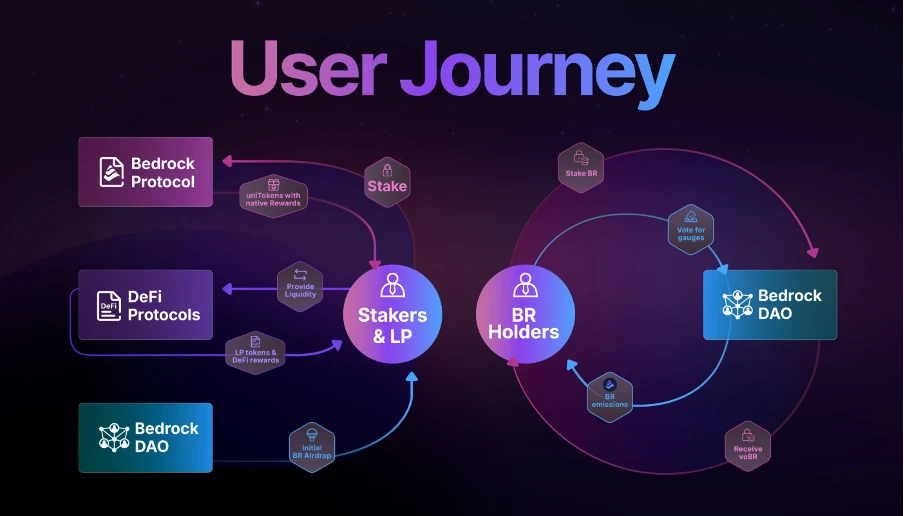

In the context of traditional staking protocols generally adopting a single token incentive model and the separation of governance rights and capital efficiency, Bedrock innovatively introduced the ve (voting custody) token model, and for the first time applied the PoSL (Proof of Staking Liquidity) framework to the Bitcoin re-staking scenario, building a dual-token system that deeply combines governance and returns.

As the first governance token designed for staking liquidity, veBR deeply binds the users time preference with the long-term development of the protocol through the BR token lock-up casting mechanism. This design not only solves the problem of separating capital efficiency and governance rights in the re-staking scenario, but also realizes the value conversion of liquidity is governance rights for the first time in the Bitcoin ecosystem through the design of non-transferable governance certificates.

PoSL: Combination of Staking and Liquidity

PoSL is different from the traditional single-income model staking protocol. Its core advantage is that it motivates users to stake multiple assets (such as uniBTC, uniETH) to earn BR tokens, thereby achieving a dual increase in income and liquidity. The user staking operation is simple and easy to participate, but it should be noted that the income level will be directly affected by market activity and changes in the ecosystem TVL.

veBR: Balancing governance and benefits

BR is a tradable governance token, and veBR is obtained by locking BR, giving holders the following rights:

Governance rights: Participate in decision-making such as protocol upgrades and BR emission allocation;

Yield bonus: Increase staking returns and provide additional rewards for long-term holders;

Season Voting Rights: Participate in Season operations. Voting rights will be reset every Season to ensure fair and dynamic participation.

This mechanism reduces the market circulation by locking up BR, which helps stabilize and enhance the long-term value of BR tokens. However, for ordinary investors, it also means that they must accept the risk of limited liquidity. The cooperation between Bedrock and Aragon further enhances the transparency of the governance process and helps to increase investors confidence in long-term holding and participation in governance.

After the TGE, when Diamonds are automatically converted to BR, users can choose to sell them directly, or further lock BR to obtain veBR and enjoy higher profit bonuses. The mechanism design of PoSL and veBR closely links investor returns with the long-term development of the platform. The user participation threshold is low, and users only need to hold BTC or ETH to join. However, special attention should be paid to market risks: a decline in ecosystem TVL may lead to a decline in overall returns; the previous $2 million vulnerability incident of uniBTC (now compensated) also reminds users to be cautious about protocol security risks.

In summary, Bedrocks Diamonds points mechanism is a more clear and effective incentive mechanism that helps to improve user enthusiasm and ecological participation. At the same time, its innovative economic model and technical layout also lay a solid foundation for the sustainable development of the project, which deserves further attention and research from investors.

In the future, whether Bedrocks veBR token model can truly form a flywheel effect depends on whether the governance incentives and long-term lock-up mechanism can continue to promote the circular growth of ecological value. The answer must be found in the products and technologies of the project itself.

Product layout and technological advantages

Bedrocks product layout and technical design focus on providing users with safe and sustainable investment returns. This positioning has driven Bedrock to form a differentiated development strategy featuring multi-asset and multi-chain layout and focusing on the BTCFi track.

Bedrock supports multiple assets such as Bitcoin (BTC), Ethereum (ETH) and IoTeX (IOTX). The multi-asset layout enables retail investors to flexibly choose investment targets and effectively reduce the risk of price fluctuations of a single asset. Cross-chain deployment has covered 19 chains including Ethereum and BNB Chain, and plans to connect to more networks to further increase the flexibility of asset participation.

BTCFi’s priority layout and the launch of brBTC

Bedrock regards BTCFi as its core direction and is committed to fully exploring the potential of Bitcoin in the DeFi field. In the BTCFi 1.0 phase, Bedrock launched the uniBTC product based on the single income of the Babylon protocol, with a cumulative pledge of more than 4,400 BTC, which has been widely recognized by users.

In order to further meet the diverse strategic needs of investors, Bedrock officially launched brBTC on December 20, 2024, and fully entered the BTCFi 2.0 stage. brBTC supports a variety of Bitcoin derivatives (such as WBTC, FBTC, mBTC, cbBTC, BTCB, uniBTC), with a cumulative pledge of about 500 BTC. brBTC not only integrates Babylons income channels, but also superimposes Babylon, Kernel, Pell and other multiple protocols to provide income, showing the following specific features:

Multi-protocol returns: By connecting protocols such as Babylon, Kernel, Pell, SatLayer and Mellow, retail investors can obtain returns from multiple sources through a single asset, reducing their reliance on a single strategy.

Ecosystem integration: unifies various Bitcoin derivatives and simplifies the participation process, suitable for retail investors who want to use BTC directly.

Application expansion: Support functions such as stablecoins to increase asset practicality, but the actual benefits depend on market acceptance.

brBTC has been initially deployed on Ethereum and BNB Chain. Retail investors can deposit and pledge assets through mainstream wallets. In the future, as more blockchains are connected, the threshold for using brBTC will be further lowered, and the user range will be wider. However, users need to pay attention to the compatibility and risks of cross-chain assets between different chains.

Security is an important consideration for retail investors. To ensure the safety and reliability of the protocol, Bedrock has worked with a number of professional auditing agencies to conduct strict audits and continuous monitoring of smart contracts and related protocols. In addition, brBTC has passed the audit before its launch, and has further reduced asset security risks by deploying Layer-2 technology.

Bedrocks current product layout and technological advantages have begun to show results and have been clearly reflected in its market data performance throughout the process.

Data performance and market activities

TVL and on-chain performance

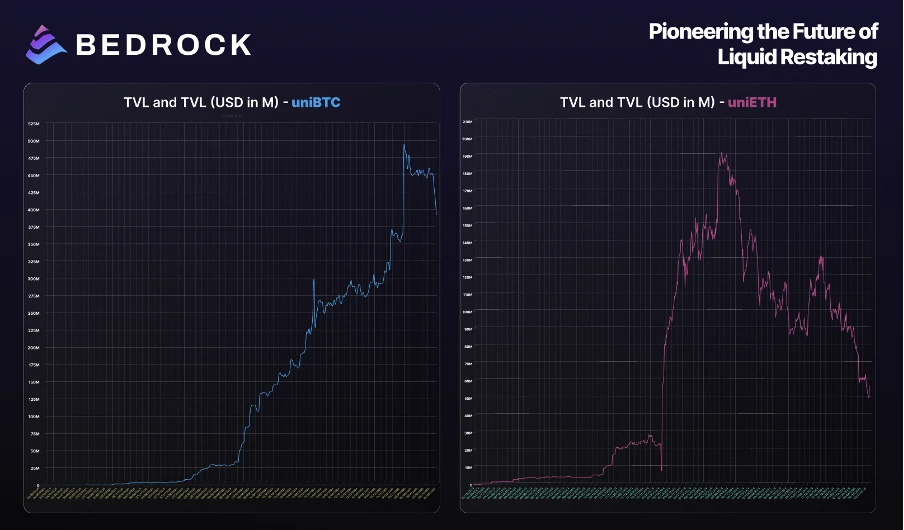

Left: uniBTC TVL; Right: uniETH TVL

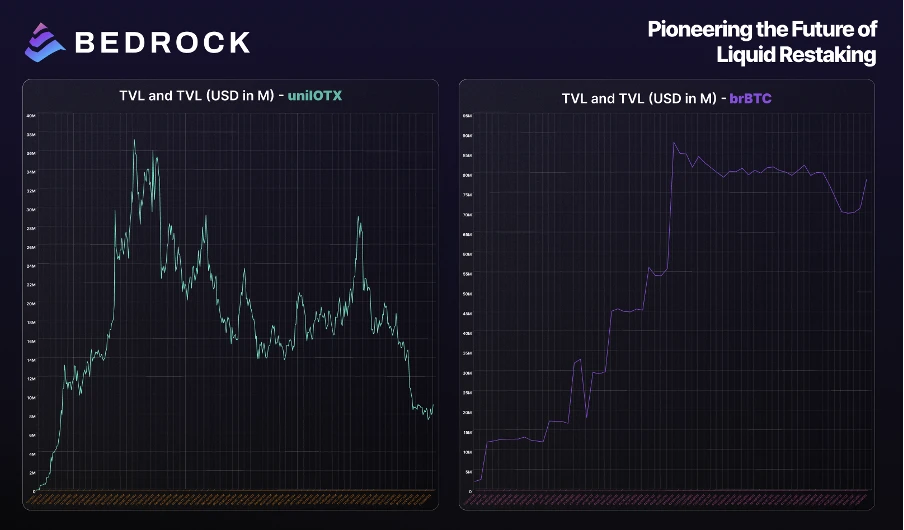

Left: uniIOTX TVL; Right: brBTC TVL

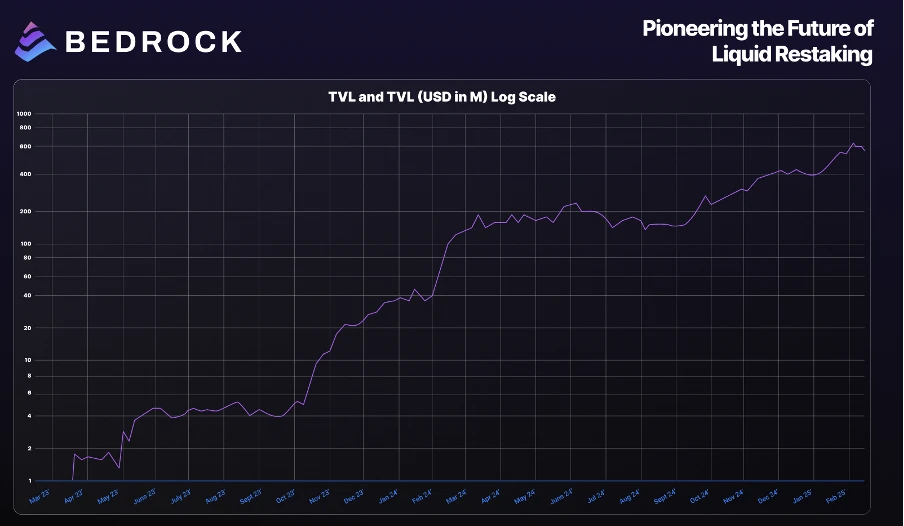

According to Bedrocks official report, the total TVL of the project has continued to rise since April 2024.

Bedrock TVL

In addition to the impressive TVL data, Bedrocks data on the BNB chain in the past few weeks is also impressive. It ranked first in user growth and trading activity for two consecutive weeks, and also held an exclusive pre-tge event on the Binance wallet with the BNB chain.

User growth and activity

According to the latest ranking of the BNB Chain platform (as of March 18, 2025), Bedrock has ranked fifth in the DeFi category, reflecting the projects strong competitiveness and user recognition on the chain.

The number of users increased by 18,000 in 7 days, and in most time periods, the daily user growth was far higher than the industry average of 685; the trading volume increased by 29,000 in 7 days, and the daily trading volume exceeded the industry average of 2,300 in most time periods.

Both its number of users and transaction activity have shown a significant growth trend, which further confirms the strong market demand for its products and the active participation of users.

Community Impact

It is worth noting that the number of Bedrock users has exceeded 278,000. Unlike other leading protocols (such as Lido, Renzo, etc.) which are dominated by institutions, Bedrock has a high proportion of retail investors and is obviously driven by the community. This decentralized community ecology gives the project a more solid foundation for long-term development.

Against the backdrop of rising data and excellent market performance, investors are most concerned about post-TGE performance and future development layout.

TGE expectations and future layout - how to seize Bedrocks explosive window

As the BR token TGE enters the countdown, the markets expectations for Bedrock are focusing on two core logics: the value depression under the low FDV valuation and the strong narrative drive of the BTCFi track explosion. At present, the project has released three key benefits - the launch of the airdrop checker, the opening of the pre-deposit channels of the three major exchanges, and the continued deepening of the Babylon ecological linkage, and the potential listing expectations (such as Binance, OKX) may become the next catalyst after TGE.

It is worth noting that BR token activities have been launched on OKX Web3 Wallet and Binance Wallet. If the team announces new cooperation with top CEX and progress in brBTC ecosystem integration (such as compatibility with Solana or Layer 2 protocols) before TGE, its FDV is expected to exceed US$300 million and hit the valuation range of US$500 million.

From a long-term perspective, Bedrock is building a Bitcoin liquidity layer through the PoSL mechanism + veBR governance model , which is connecting the nested value of BTC staking income and DeFi Lego. With the penetration of brBTC in 19 chains and the deep integration of 60+ protocols, the project may lead the paradigm iteration of BTCFi 2.0 - making Bitcoin not only an interest-bearing asset, but also the underlying fuel of the cross-chain liquidity network. The feasibility of this path has been verified by data: the participation of more than 270,000 users and a 15% market share of BTC re-staking give it a strong user base for ecological expansion.

For investors, post-TGE participation strategies can be divided into:

Season 2 participation window: Season 2 has been automatically entered on March 7. Current staking can still capture unannounced bonus points. It is recommended to complete the uniBTC position deployment within 1 week before and after TGE;

Airdrop token disposal: Based on the triangular balance principle (profitability, security and liquidity), it is recommended that 30% be used to obtain veBR governance rights by staking BR (estimated APY 15% -20%), 40% be cashed out on exchanges to lock in basic profits, and 30% be used to participate in brBTC liquidity mining to amplify profits (such as Pendle and Curve pools);

Loyalty Program Bonus: According to recent community information disclosure, long-term holders are expected to receive additional rewards in subsequent quarters (users who participated in the first quarter have received airdrop incentives, and additional rewards after TGE are for users who continue to participate in the second quarter and subsequent quarters), such as BR token airdrop bonus, Diamonds points conversion rate increase, and special weighting of governance rights, to further incentivize long-term participation and ecological contribution.

In general, Bedrock is currently at a critical development juncture, and the market is full of optimistic expectations for it. Investors need to make strategic arrangements to seize the development dividends brought by the BTCFi craze.