Earlier this month, Financial Times columnist Robert Armstrong first coined the term TACO, a little-known acronym that stands for Trump Always Chickens Out, to mock the president for always backing down after a tough start. Armstrong suggested that in the face of the Trump administrations trade threats, rival countries could simply wait a while to avoid danger.

The TACO acronym gained mainstream attention when the president was asked directly about it during a White House press conference, and it certainly wasn’t welcomed by the Trump administration. Perhaps in response to the taunt, the Trump administration’s stance became noticeably tougher late last week, as escalating tensions between China and the U.S. dominated the headlines:

Trump accuses China of total violation of Geneva trade deal

Treasury Secretary Bessent criticizes China for deliberately blocking exports of rare earths critical to U.S. supply chains

US Trade Representative Greer accuses China of deliberately delaying rare earth export approvals

Beijing hits back, accusing U.S. of abusing semiconductor export controls

U.S. government further expands restrictions on technology licensing to Chinas tech sector

U.S. Commerce Department restricts sales of chip design software and some aviation engine components to China

Following Harvards ban on foreign students, US Secretary of State Marco Rubio announced that he will begin revoking Chinese student visas

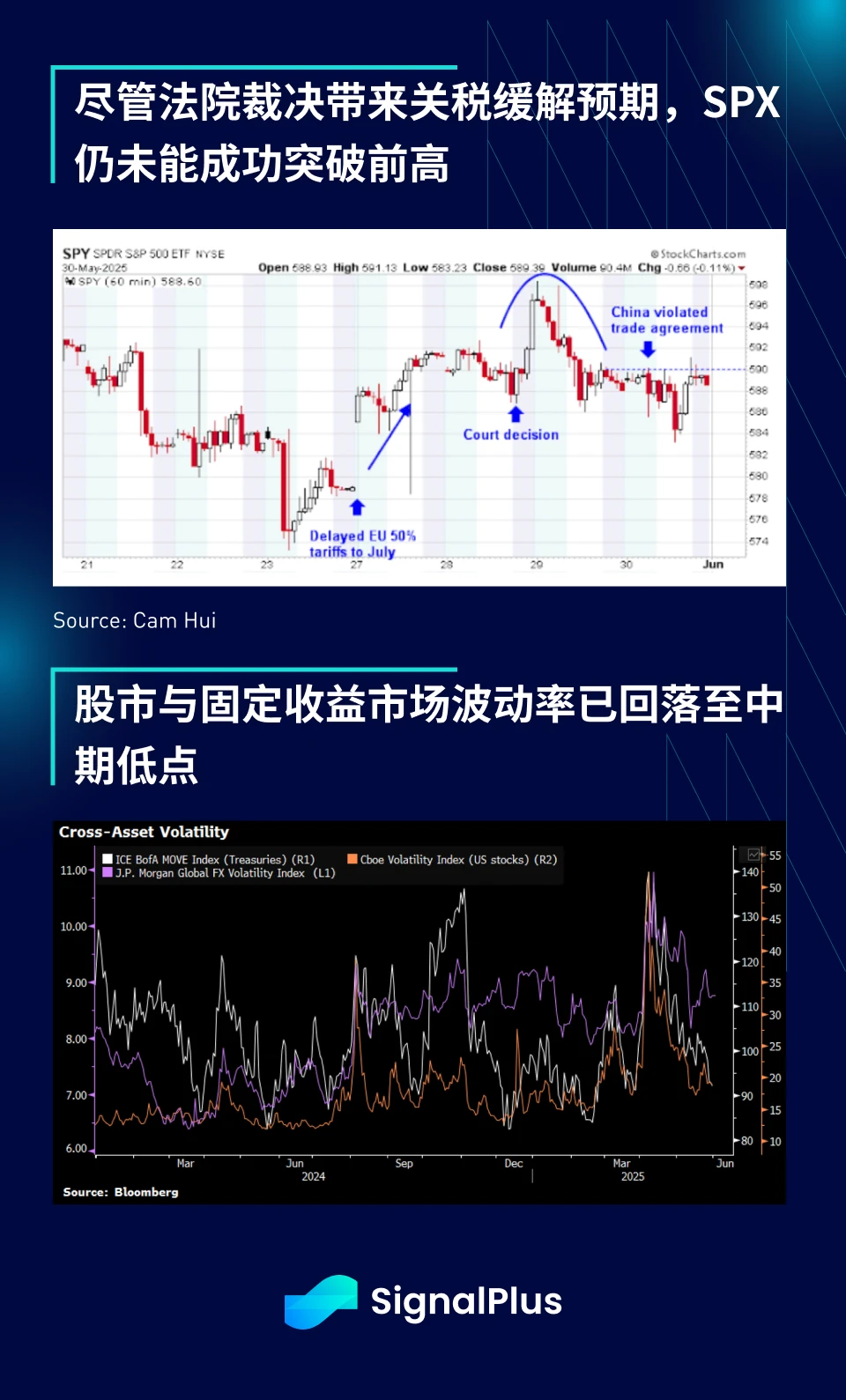

Overall, markets clearly shifted into risk-off mode late last week, with stocks failing to break out to new highs despite volatility in both equities and fixed income falling back to cycle lows.

Earlier concerns about runaway bond yields have also gradually eased, with 30-year Japanese government bond yields falling in tandem with US Treasuries, making it difficult to tell which is leading the other. This further suggests that the overall rise in yields in the recent period is mainly due to de-risking in the fixed income market and concerns about the overall macro environment, rather than specific or structural issues, giving us more confidence that yields should steadily fall as we enter the summer.

Apart from the daily tariff-related news (which the market has become accustomed to), the overall market sentiment is still weak, and various assets lack clear direction. The market focus may be on the non-farm payrolls report later this week to see whether it can continue to buck the trend of weakening survey data and economic growth expectations. Considering the continued weakness of recent employment surveys and initial jobless claims data, coupled with the current high stock market level, the short-term risk is probably still biased to the downside.

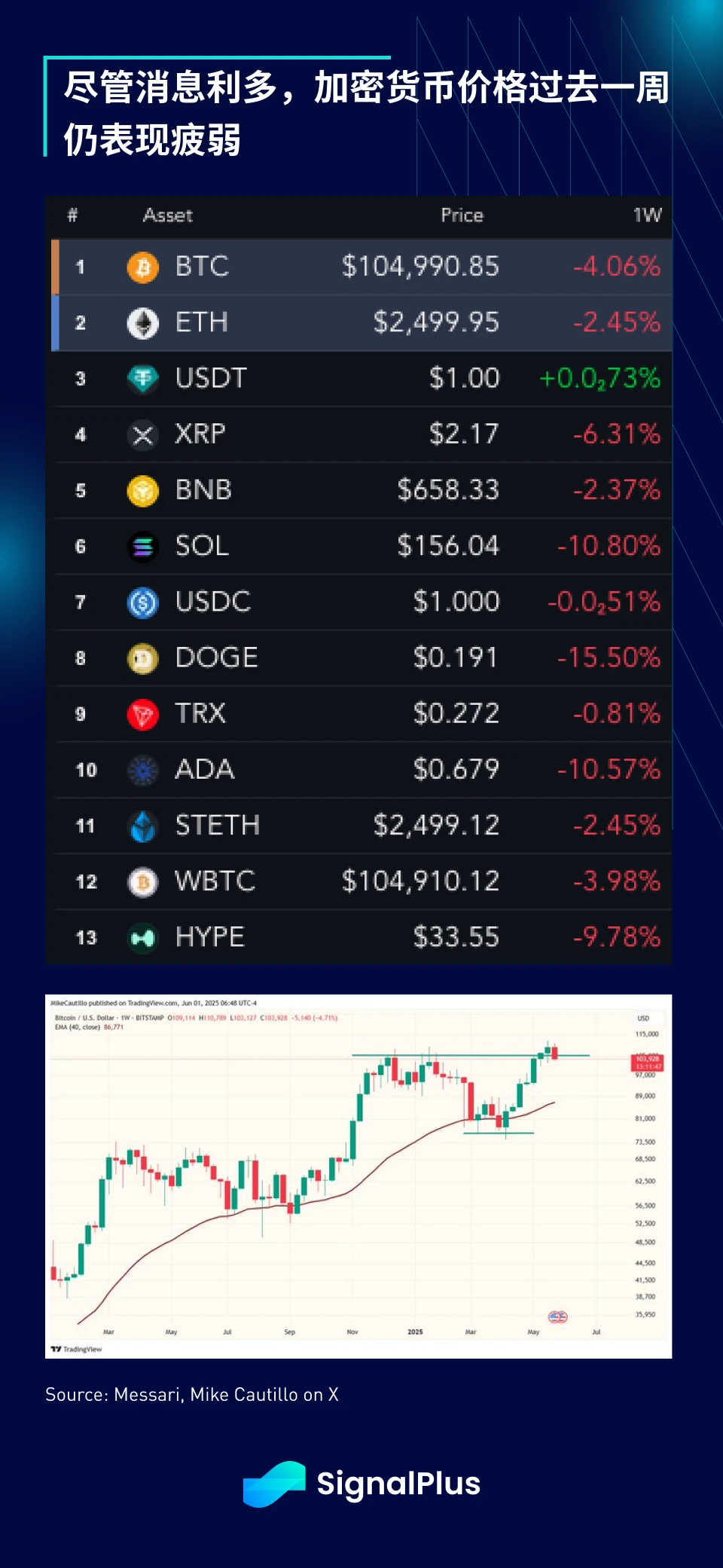

In terms of cryptocurrency, despite the recent positive news, price performance remains weak. Both BTC and MSTR have failed to effectively break through the upper pressure, and most mainstream tokens have fallen by about 5-10% in the past week.

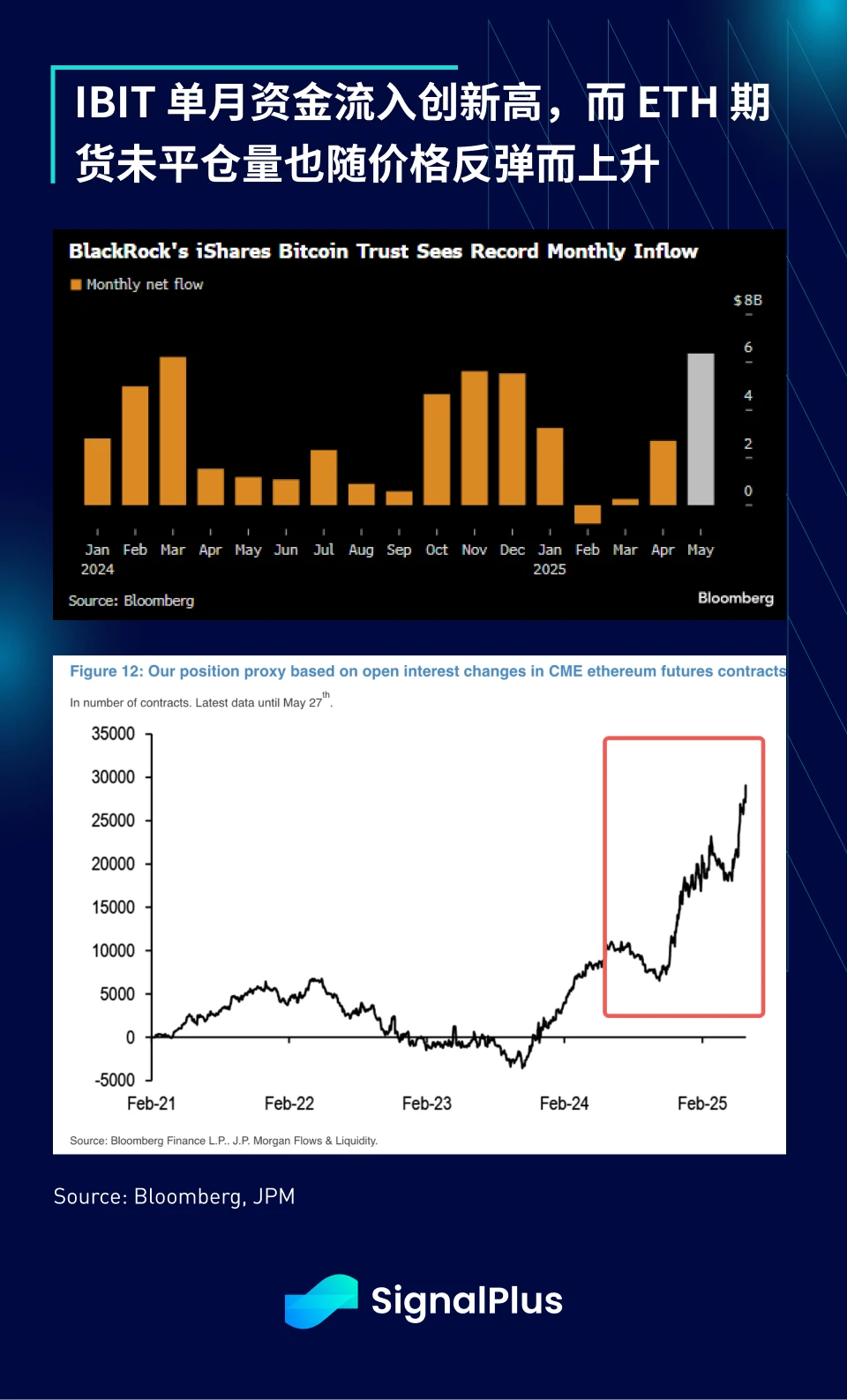

On a more positive note, Blackrocks IBIT ETF hit a record high in monthly inflows, exceeding $6 billion; at the same time, ETH futures open interest continued to rise as prices rebounded in the first quarter, indicating that there are still new long orders entering the market.

On the news front, Stripe is reportedly seriously discussing plans to use stablecoins for transactions with traditional banks; and Trump Media has raised about $2.3 billion through equity and convertible bonds to further allocate BTC. In addition, the SEC has officially withdrawn its lawsuit against Binance (and cannot reopen the case), symbolizing the end of the past cryptocurrency era and the beginning of a new era, although it is accompanied by more intervention from traditional finance and politics.

However, in such a positive environment, BTC still failed to hold the upward channel last week. When the market fails to respond positively to bullish news, it is an internal warning. In addition, BTCs recent strength has not been confirmed in cryptocurrency concept stocks. For example, MSTR has failed to rise synchronously, and its leveraged ETF has even seen capital outflows, which is significantly different from the BTC and ETH ETFs.

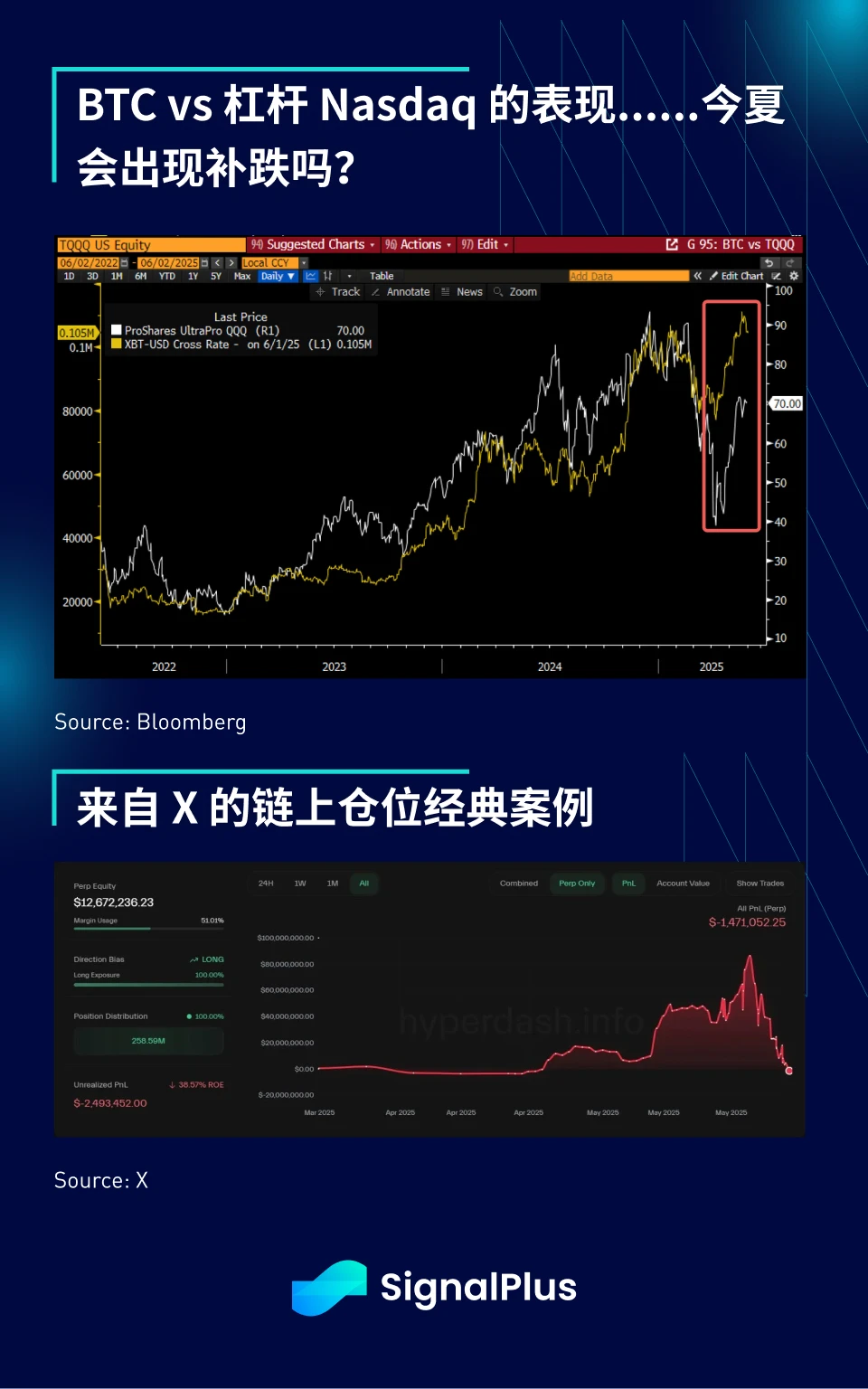

BTC has outperformed all macro assets year to date, but short-term signs suggest that the market may be facing a more challenging phase, with OG and native users continuing to take profits on rallies, while mainstream buying takes over.

If macro risks heat up again in the summer, will BTC also fall? Our basic view is that the market may turn flat in the second half of the year and no longer fluctuate as drastically as in the first half of the year. I wish you all a smooth trading this week. If possible, please try to avoid opening high-leverage BTC positions.

You can use the SignalPlus trading indicator function for free at t.signalplus.com/crypto-news/all, which integrates market information through AI and makes market sentiment clear at a glance.

If you want to receive our updates in real time, please follow our Twitter account @SignalPlusCN, or join our WeChat group (add the assistant WeChat, please delete the space between English and numbers: SignalPlus 123), Telegram group and Discord community to communicate and interact with more friends.

SignalPlus Official Website: https://www.signalplus.com