Original author: Weilin, PANews

The alt season is here, but its not happening in cryptocurrency, but in crypto stocks. As SharpLink (SBET), a U.S. listed company, announced that it had raised funds to purchase ETH and its price rose 10 times in a week, the crypto community joked, which shows the popularity of crypto concept stocks.

MicroStrategys successful transformation has allowed listed companies to see the benefits of incorporating crypto assets into corporate financial strategies. More and more global listed companies are proactively incorporating crypto assets such as Bitcoin, Ethereum, SOL and XRP into their treasuries, whether they are technology giants with a market value of hundreds of billions of dollars or small listed companies that were originally on the margins.

In this article, PANews sorted out the listed companies with active crypto holdings based on market value, number of crypto asset holdings and changes in holdings since 2025, covering multiple industries such as e-commerce, financial technology, traditional banks, mining, etc. The main data comes from the Bitcoin Treasuries website.

It is not difficult to find that companies whose main business is cryptocurrencies (such as Coinbase) have strong financial configurations, but their stock prices are still highly correlated with the volatility of the crypto market. Some small and medium-sized companies have been hyped by the capital market due to their sudden coin purchases, and their stock prices have doubled or even increased several times in a short period of time. Many companies that were previously in a growth dilemma are realizing a financial turn by releasing digital asset reserve strategies, and their stock price trends have reversed significantly.

First-tier companies: high market value + large holdings

Strategy(MSTR)|Market value: $103.3 billion|Holdings: 580,955 BTC

As a pioneer of the Bitcoin Treasury strategy, MicroStrategy is still the company with the most Bitcoin among listed companies in the world. As of June 3, the company has purchased a total of 580,955 BTC, with a total cost of US$40.67 billion and an average purchase price of US$70,023. Since the beginning of this year, the company has continued to increase its holdings slightly, and currently has a book profit of 49%.

Despite entering a high buying range, the company still maintains a firm belief in BTC. Its CEO Michael Saylor said in an interview at the Bitcoin 2025 Conference that there is no upper limit to his Bitcoin holding plan. As the price of Bitcoin continues to rise, the difficulty of buying Bitcoin will increase exponentially in the future, but Strategy will buy Bitcoin with higher efficiency. As of June 1, MSTRs stock price has risen 23.02% this year, reflecting the capital markets partial recognition of its Bitcoin strategy.

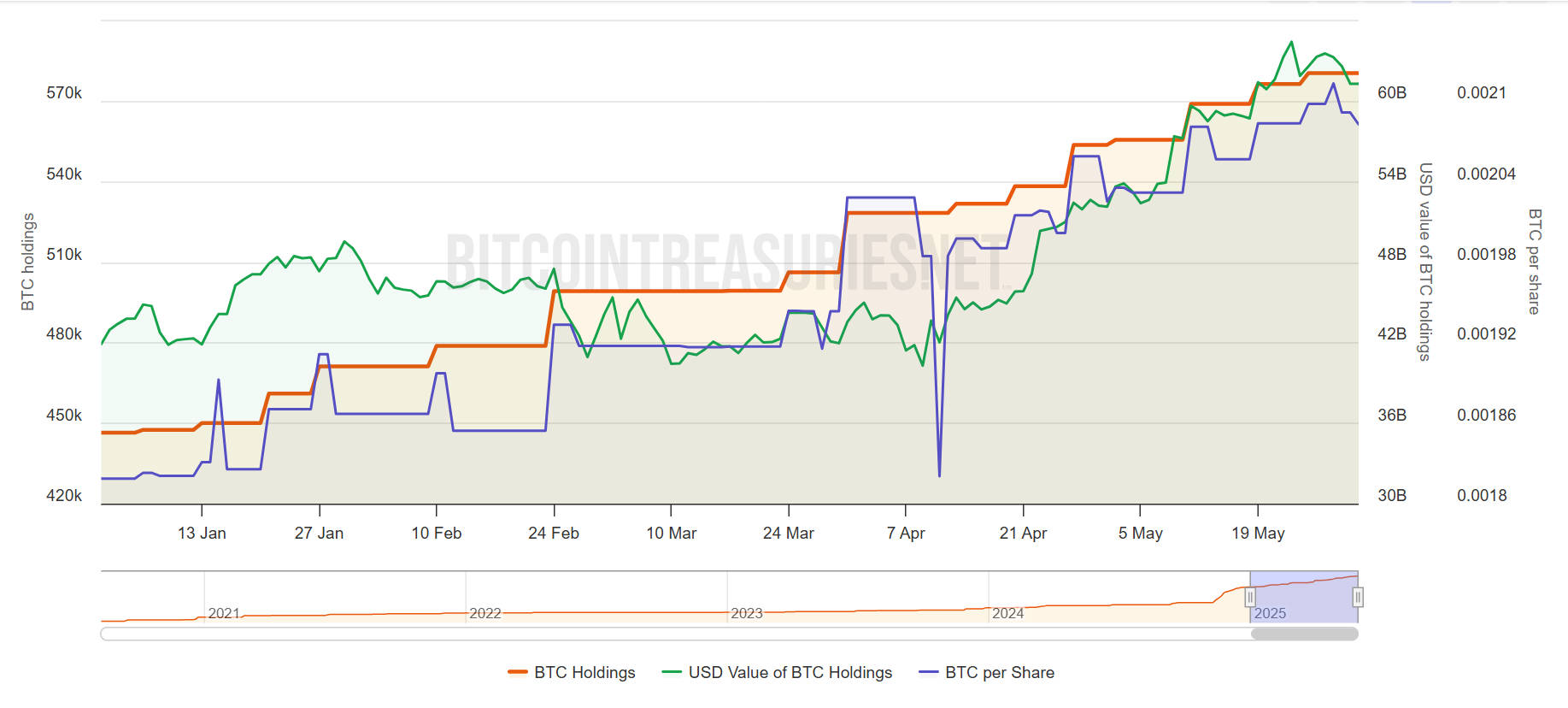

Strategy BTC holdings changes in the past year (red) MercadoLibre (MELI) | Market value: $130 billion | Holdings: 570.4 BTC

Latin American e-commerce and fintech giant MercadoLibre has included Bitcoin in its financial assets since 2021. At the end of the first quarter of 2025, the companys holdings increased from 412.7 to 570.4, reflecting the continued allocation of its crypto assets.

Although MercadoLibre allows users to pay with Bitcoin, Ethereum and stablecoins in Brazil and other places through its payment platform MercadoPago, the cryptocurrencies paid by these users are mainly used for transactions on the platform (such as purchasing goods or real estate) rather than directly entering MercadoLibres balance sheet. The companys first-quarter financial report was strong, with 67 million active buyers and a 31% increase in monthly active fintech users. Supported by strong fundamentals, its stock price has risen 45.23% this year. The average holding cost of Bitcoin is $38,569, and the book profit is 169.06%.

Coinbase (COIN) | Market cap: $62.8 billion | Holdings: 9,267 BTC

As the largest crypto trading platform in the United States, Coinbase not only serves as a trading portal, but also expresses its confidence in Bitcoin through practical actions. On March 31, 2025, the company increased its holdings by 2,382 BTC, bringing its holdings to 9,267, with an average cost of $55,937.

However, affected by the decline in Q1 performance and the sluggish market, Coinbases stock price has fallen 4.12% since the beginning of the year. On April 18, it fell to a low of $151.47, and then gradually recovered. Despite this, its Bitcoin holdings still have a paper profit of more than 85%.

Block (formerly Square) | Market cap: $38 billion | Holdings: 8,584 BTC

Block, led by Jack Dorsey, is integrating Bitcoin strategy into its products and ecosystem. As of the end of March this year, the company held 8,584 BTC, with an average cost of only $30,405 and a book profit of 243.15%. The Block ecosystem includes many popular products such as Cash App, Square point-of-sale system, and the recently launched Bitkey Bitcoin self-custody wallet.

However, despite the companys solid fundamentals, its share price has fallen 28.82% since 2025, reflecting investors dual concerns about the macro environment and the profitability of the payment business.

Traditional financial giants’ attempts at encryption

Intesa Sanpaolo (ISP.MI) | Market cap: $99.1 billion | Holdings: 11 BTC

Italys largest bank, Intesa Sanpaolo, purchased 11 bitcoins for the first time on January 14, 2025, with a market value of approximately 1 million euros, marking the beginning of traditional banks exploration of cryptocurrencies in the form of test operations. Although the move is small in scale, it sends an important signal that compliant currency holding is becoming a trend.

As the largest bank in Italy by assets, Intesa Sanpaolo is an important pillar of the countrys financial system. With a strong presence in retail, corporate and investment banking, it serves millions of customers in Italy and internationally.

As of June 1, its shares were up 27.1% year to date.

Virtu Financial (VIRT) | Market cap: $6.2 billion | Holdings: 235 BTC

Virtu Financial, a market making and execution service provider, was founded in 2008 and is headquartered in New York City, USA. The company is testing the waters of digital asset trading and reserves. As of now, its Bitcoin holdings are 235, with an average purchase price of $82,621. Despite the high cost, the floating profit still reached 26.47%. Virtu also uses Bitcoin as part of a strategic risk hedging tool.

Year to date, Virtu stock is up 11.42%.

Leading mining companies and new coin holders

MARA Holdings (MARA) | Market cap: $5.1 billion | Holdings: 49,228 BTC

MARA, one of the largest Bitcoin miners in the United States, has continued to expand its coffers significantly this year. Since 2025, the company has purchased Bitcoin several times in January, February, March, April and May. On May 30 alone, it increased its holdings by 1,003 BTC, bringing its total holdings to 49,228, ranking second among listed companies in the world in terms of the number of Bitcoin holdings.

MARA Holdings is headquartered in the United States and is known for its large-scale, institutional-level Bitcoin mining business, relying on advanced technology and strategic partners to maximize mining efficiency and output. MARAs business model is centered on securing and verifying Bitcoin transactions, relying on block rewards and transaction fees to make profits, while holding a considerable portion of mined Bitcoin as treasury assets for the long term.

GameStop (GME) | Market cap: $13.3 billion | Holdings: 4,710 BTC

GameStop Corp. is a specialty retailer that offers gaming and entertainment products through its stores and e-commerce platforms in the United States, Canada, Australia, and Europe. The company sells new and used gaming platforms, accessories (such as controllers and gaming headsets), new and used gaming software, as well as in-game digital currency, digital downloadable content, and downloadable versions of full games. GameStop Corp., formerly known as GSC Holdings Corp., was founded in 1996 and is headquartered in Texas, USA.

This gaming retailer, known for its retail investor myth, is transforming to digital assets. On March 25, local time, according to GameStops official announcement, the companys board of directors has unanimously approved the update of its investment policy and included Bitcoin as one of the companys reserve assets. On May 28, GameStop announced that it would include Bitcoin in its reserves and quickly purchased 4,710 coins, becoming one of the fastest traditional companies to increase its holdings this year. Although the stock price is still down 2.80% this year, its market attention has increased significantly.

In addition to the high-market-cap companies and well-known listed companies mentioned above, companies with relatively small market capitalizations that are actively increasing their Bitcoin holdings in 2025 include Metaplanet, Core Scientific, Rumble, and Bitdeer Technologies. In addition, some companies that have been hot in the market recently have also begun to deploy crypto assets, showing a strong interest in this track.

A new force with a smaller market value but big moves

SharpLink(SBET)|Market Cap: $53.58 Million|ETH Treasury Strategy

On May 27, SharpLink, a small U.S. stock company that had been little-known and whose stock price was on the verge of delisting, announced the completion of approximately US$425 million in private placement financing and will purchase a large amount of ETH as its main treasury reserve asset. Many people even called it the Ethereum version of Strategy.

Betting on ETH as a treasury reserve asset, it received 425 million in financing with a market value of 2 million. This round of financing has a luxurious lineup, led by Ethereum infrastructure developer ConsenSys. On the day the financing news was announced, SharpLinks stock price soared to $50, a new high since May 2023.

Trump Media Technology Group (TMTG) | Market Cap: $4.7 billion | Bitcoin Treasury Plan

Trump Media Technology Group (TMTG), founded by US President Trump, announced in late May that it would launch a $2.5 billion financing plan to establish a Bitcoin treasury and create a Truth Social ecosystem with crypto finance at its core. Its policy direction has also triggered a continuous discussion in the industry about the intersection of politics and crypto.

Asset Entities (ASST) + Strive | Market value: to be updated after the merger | BTC Treasury target

On May 7, digital marketing and content delivery service provider Asset Entities (NASDAQ: ASST) announced that it had reached a final merger agreement with Strive Asset Management. The merged company will be renamed Strive, continue to be listed on NASDAQ, and transform into a listed Bitcoin financial company. On May 27, Strive Asset Management has completed a $750 million private equity investment (PIPE) round of financing, with a subscription price of $1.35 per share, a premium of 121% over ASSTs previous closing price, and has the opportunity to expand to $1.5 billion through warrants. The funds will be used to acquire undervalued biotech companies, buy Mt. Gox and other Bitcoin debts, and discounted structured BTC credit products to build its Bitcoin vault.

Upexi (UPXI) | Market Cap: $400 million | Solana Strategy

On April 21, GSR, a well-known cryptocurrency trading and investment company, announced that it had made a $100 million private equity investment (PIPE) in Nasdaq-listed consumer goods company Upexi, Inc. (stock code: UPXI), betting on its upcoming comprehensive transformation of Solanas financial strategy. Influenced by the news, Upexis stock price soared more than six times during the day.

VivoPower(VVPR)|Market Cap: $46.92 Million|XRP Treasury Strategy

On May 29, Nasdaq-listed energy company VivoPower International (VVPR) announced the completion of a $121 million private placement financing, and will transform into a crypto asset reserve strategy centered on XRP. Saudi Prince Abdulaziz bin Turki Abdulaziz Al Saud led the investment of $100 million.

Conclusion

As Bitcoin gradually moves from a fringe asset into the mainstream, from MicroStrategy to MercadoLibre, from banking giant Intesa to SharpLink, more and more listed companies are embracing crypto assets in different ways. Some of them regard Bitcoin as a reserve of value, some try to build a new financial system around Ethereum or Solana, and some even use a treasury strategy to promote corporate transformation.

This is not only a reflection of financial diversification, but also reflects that crypto assets are becoming part of a new trend in the global capital market. In the future, as supervision becomes clearer and infrastructure continues to improve, more companies with market capitalizations of tens or even hundreds of billions may join the coin holding club.