Original Author: Jeff@Foresight Ventures

1. The impregnable wall surrounding Asgard and how to improve on-chain asset liquidity is an eternal topic

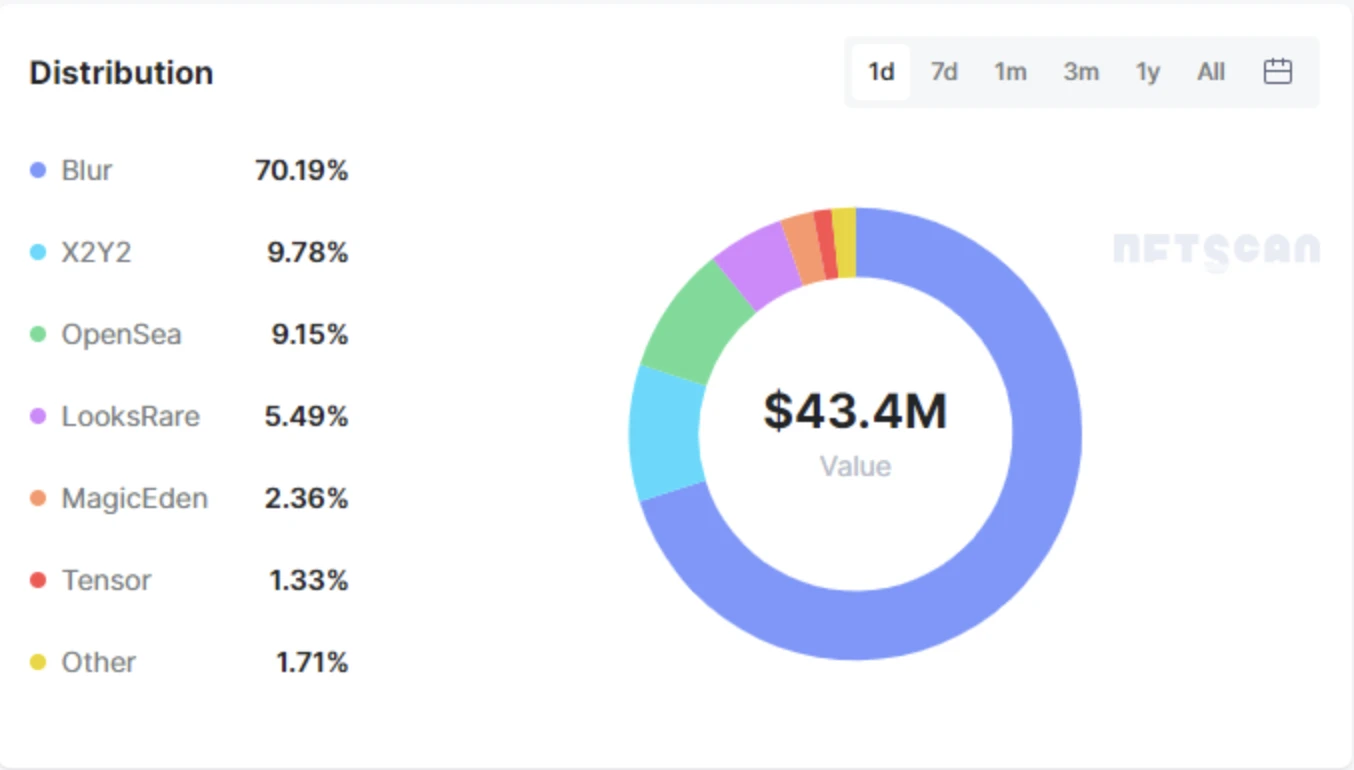

The emergence of DeFi has opened up a rainbow bridge straight to Asgard, where liquidity is fully unleashed. Designing innovative trading models aimed at improving NFT liquidity is also the direction of effort for all NFT trading platforms. Although there is currently no mature and unified pricing model in the NFT market, data from the trading volume of blue-chip NFTs shows that the "order book" model of the marketplace accounts for over 95% of the trading volume; while a variety of marketplaces based on the AMM model account for less than 5% of the transaction volume.

Image: Platform trading volume proportion, Resource: https://www.nftscan.com/marketplace, data snapshot time June 27, 2023

II. Referring to the ratio of trading volume between Fungible Tokens (FT) in CEX and DEX, we are very excited about the huge growth potential of NFT trading volume based on the AMM trading model

Unlike FT, NFT has various types, and pricing rules and trading habits determine that only some NFTs are suitable for solving liquidity issues using AMM. Here, according to functionality, NFT can be divided into the following four categories: Picture Artworks (PFP) / Virtual Assets (In-game Items) / On-chain Assets (RWA) / On-chain Identities (Domains/Tickets, etc.). Based on the issuance quantity and trading demand from holders, PFP and Virtual Asset NFTs are more suitable for the AMM trading model at the current stage.

III. Why do we have a positive long-term outlook on the NFT-AMM track?

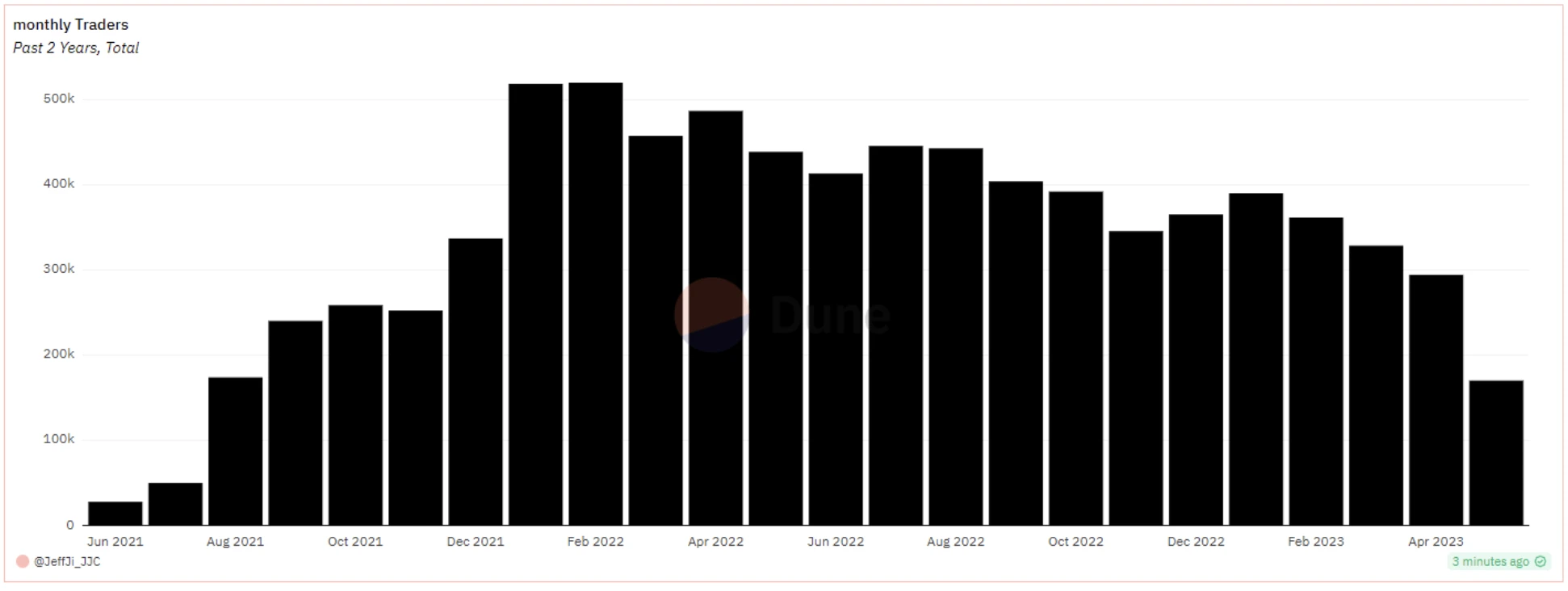

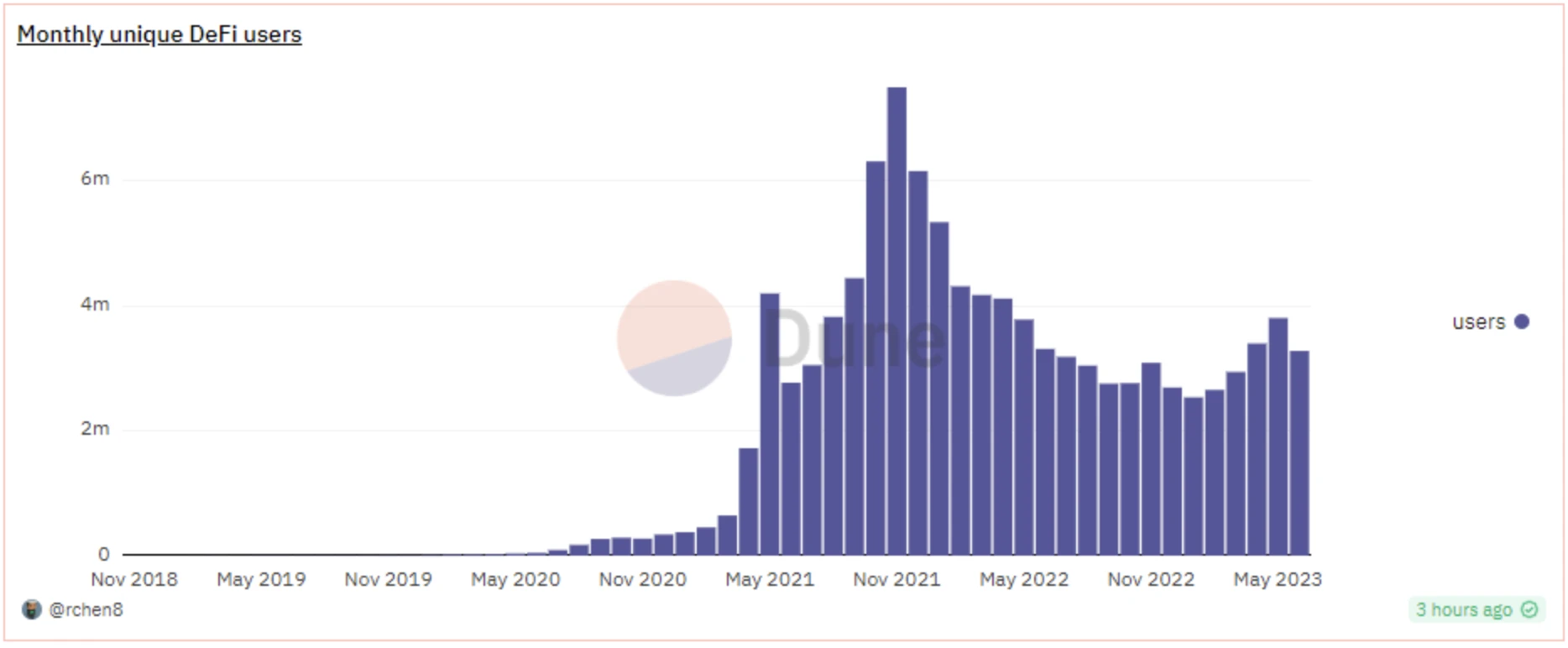

a) Large user base. From the perspective of the entire ecosystem, the users of Defi are potential users of the NFT-AMM track. Currently, the monthly active users of the Defi ecosystem are about 1 million, while the number of independent NFT traders is only about 200,000. The trading model of NFT-AMM can expand the scope of users injecting liquidity, from NFT holders and NFT trading users to all participants in the Defi ecosystem.

Image: Defi monthly active users, Resource: https://dune.com/rchen8/Defi-users-over-time, Data extracted on June 27, 2023

Image: NFT Monthly Active Trader Count, Resource: https://dune.com/queries/2670914/4440079, Data captured on June 27, 2023

b) NFT asset types and quantities have significant growth potential. NFT continuously innovates in functionality and composability, and user numbers still have significant growth potential. In May 2023, almost all trades in Opensea originated from the Top 100 NFTs, compared to only 65% in February 2022 (https://dune.com/mizmatcat/OpenSea), indicating the market's strong need for new categories of NFTs in a sluggish market. Additionally, AAA game asset-based NFTs will experience a peak in adoption from 2023-2024, providing ample space for active trading pairs of NFTs.

c) The AMM track of NFTs can serve as a bridge between NFT and FT assets. Similar to DeFi tools, its innovative composability represents growth potential. The liquidity of FT assets was previously limited to centralized exchanges in the form of order books before the rise of DeFi. AMM tools like Curve/Uniswap have unlocked the range of on-chain asset activities and gained new value recognition. Similarly, NFT assets need to be mediated through AMM tools to enable greater liquidity and value exchange.

;AMM Tools, achieving new value recognition and creating new pricing models. We envision the following innovations for the AMM model of NFTs:Combination with derivatives: NFT derivatives are also a sub-track of innovative aggregation, in the article "IOSG Weekly Brief | From commodity speculation to financial speculation: the symbolic game of NFT derivatives #174", the author Sally divides trading demand into the following categories: speculation (earning NFT price fluctuation returns with small capital), yield leverage (increasing capital utilization through leverage), risk hedging, and diversified investment portfolios. Driven by many market demands, by creating a leveraged speculative market, the NFT-AMM trading model can create dynamic games within the liquidity pool, providing dynamic on-chain data for the market and expanding the game space. We look forward to the possibility of creating new NFT pricing rules through the combination with derivatives.

Combination with mortgage lending platforms: Mortgage lending platforms led by BendDAO/Paraspace are still using traditional models, which means users mortgage NFT assets and calculate the borrowing amount through the floor price collateral model. Even after Blur joined this battle, the competitive landscape has not changed significantly. We look forward to seeing that after the NFT-AMM model gains market and funding support, LP tokens can be used as a new interest-bearing, mortgageable, and liquid asset proof. By revitalizing the liquidity of LP tokens, the existing pattern of the mortgage lending market can be changed and non-NFT holders can be attracted to participate by injecting liquidity.

Reduce liquidity management costs for project parties through the NFT-AMM trading model. In particular, for game-oriented NFTs, if a pure Order Book trading model is used, project parties have to spend a lot of effort to focus on the floor price, and liquidity cannot be automatically managed. In the NFT-AMM model, we expect project parties to be able to inject corresponding assets into the pool, thereby dynamically and batch-adjusting NFT liquidity strategies.

IV. In the existing AMM market landscape, many platforms are trying in different directions

In this, we illustrate the existing product highlights and corresponding problems in the market through several examples.

a) NFTX, which is built on the concept of fractionalizing NFTs, is an early platform that attempts to introduce AMM model into NFT trading.

They aim to use fractionalized NFT tokens as an asset in liquidity pools, where users can pair them with assets like ETH to create trading pairs. This is a bold innovation that quickly gained market attention. However, as the number of NFT types increased, users started to realize that this trading model only increased the price volatility of NFTs while sacrificing their inherent scarcity, trading off collecting value for trading space, gradually losing market recognition.

b) Building upon Uniswap V1, platforms like Sudoswap are trying to introduce Uni-V3 into the NFTAMM market.

Sudoswap attempts to bring the Uni-V3 mechanism into the NFT liquidity market and innovatively proposes diversified multiplication curves suitable for NFT trading to meet different user needs. Users can create liquidity pools in selected price ranges that have high trading density (usually near the floor price), improving capital efficiency. The initial liquidity of this pool can only be determined by the creator, and only the creator can inject liquidity into it. Thus, on the price curve, Sudoswap creates multiple sub-liquidity pools arranged in order of optimal execution prices, with each price range having different numbers and depths of sub-pools, and the liquidity between pools is not interconnected.

c) Midaswap introduces the Liquidity Book mode from Trader Joe V2 on top of the aforementioned AMM model.

Users can choose a price range to provide liquidity in Midaswap. Since the price is fixed in each Bin, under this model, all LPs' trading pair positions are aggregated into the same liquidity pool, thereby increasing the depth of the liquidity pool. LPs only need to provide liquidity unilaterally to receive ERC 721 LP tokens as liquidity certificates. By cleverly using the tokenid of the ERC 721 LP token to lock the NFT liquidity added by LPs in the liquidity pool, two innovative functions can be achieved, both aggregating NFT liquidity in one pool and not losing the scarcity attributes of the NFT, compatible with the strengths of NFTX and Sudoswap. Additionally, Midaswap is exploring the integration of LP tokens and NFT lending protocols across platforms to realize cross-platform collateralized lending or liquidity mining based on project needs.

5. In the innovation of the above products, users will give market feedback with on-chain data. Although we believe that there are still some issues that have not been fully resolved, there has been a significant improvement compared to the monotonous market of one year ago.

The following are some areas that still need improvement:

a) Due to the isolation of liquidity pools, the liquidity dispersion issue is more prominent in NFT trading. In the AMM design of the above platforms, NFT liquidity pools of the same series are composed of multiple trading pools, mostly centered around the floor price. This results in a lack of liquidity connectivity between each trading pool, and each independent liquidity pool may be breached when there are price fluctuations or oracle attacks. Since liquidity and trading depth are only increased locally, users can only trade in small pools, making this model unable to support large-scale selling/buying functions.

b) The floor price still directly affects the price range of the liquidity pool, and there is no way to form a new pricing model. Dispersed liquidity causes LPs to create liquidity pools can only reference the market's floor price passively and track the floor price of the Order Book platform, missing the opportunity to become a new pricing model.

c) Similar to the above issue, when the price range of the liquidity pool excessively relies on the floor price, the pool becomes susceptible to manipulative attacks. As the pool is not connected, when there are large buy/sell orders, the price becomes vulnerable to attacks and causes strategy disarray among trading robots on the platform.

d) The lack of diversity in the asset pool hinders composability. The introduction of the AMM model aims to bring more on-chain assets into the liquidity pool, thereby stimulating greater trading demand. However, the existing AMM models still only support ETH or another single ecosystem asset as the trading pair, which excludes the possibility of other assets entering the NFT trading market as LP.

Six, after summarizing the above issues and market pain points, we predict that future NFT-AMM popular projects should have the following characteristics or effectively solve the following problems:

a) Accommodate more asset types and user types, allowing users without NFTs to inject their assets into the liquidity pool.

b) Composability with other DeFi tools, bridging diverse DeFi platforms through LP tokens and introducing DeFi users' assets through various interest calculation methods.

c) Composability with NFTFi assets, enabling asset interoperability with platforms that offer collateral lending, options, futures, and other features, to enhance collateral categories and improve capital efficiency.

d) Formulate new pricing models, wherein AMM improves users' trading efficiency, no longer solely relying on oracle price feeds, and establishes its own pricing power.

Seven, despite the imperfections of existing market products, we remain optimistic that a perfect solution will emerge for NFT liquidity and composability.

The wheel of Heimdall has begun to tremble, anticipating that NFT AMM will build a new rainbow bridge.

About Foresight Ventures

Foresight Ventures is a journey of innovation in cryptocurrency for the next several decades, managing multiple funds: VC Fund, Secondary Active Management Fund, Multi-Strategy FOF, and Special Purpose S Fund "Foresight Secondary Fund I", with total assets under management exceeding $400 million. Foresight Ventures adheres to the philosophy of "Unique, Independent, Aggressive, Long-term" and provides extensive support for projects through its strong ecological power. Its team consists of senior professionals from top financial and technology companies including Sequoia China, CICC, Google, Bitmain, etc.

Website: https://www.foresightventures.com

Disclaimer: All articles of Foresight Ventures are not intended as investment advice. Investments involve risks, please assess your personal risk tolerance and make investment decisions prudently.