A. Market Viewpoints

I. Macro Liquidity

Tightening of monetary liquidity. The US job market has cooled down, and it is highly probable that there will be no interest rate hike in September, with the last rate hike likely being postponed to November. Market expectations are that the Fed's interest rate cuts will start in June next year. The US dollar index strengthened on a weekly basis. US stocks rebounded slightly, and the cryptocurrency market followed the rebound of US stocks.

II. Market Overview

Top 100 market cap gainers:

This week, the market experienced an oversold rebound. In terms of news, Grayscale won the SEC lawsuit, increasing the probability of a Bitcoin spot ETF approval, and the discount of GBTC converged from 25% to 17%. The market focus is on new stocks and the AI sector.

RLB: The annual revenue of the spinach platform RLB is now $350 million, corresponding to a market value of $600 million. It has a 9% annual deflationary buyback. RLB's revenue is three times that of Uniswap, and the buyback and burn have been increasing in the past few weeks.

FET: The stock price of the leading AI company Nvidia in the US is approaching a new high, which may have an impact on the crypto market. FET was the leading player in the previous AI hype, and DWF may be the market maker.

AIMBOT: It is a robot that automatically buys in the first two blocks of XINBI and avoids the PIXIU board. There is a dividend mechanism for income, and the current APY is approximately 50%.

Three, BTC market

1) On-chain data

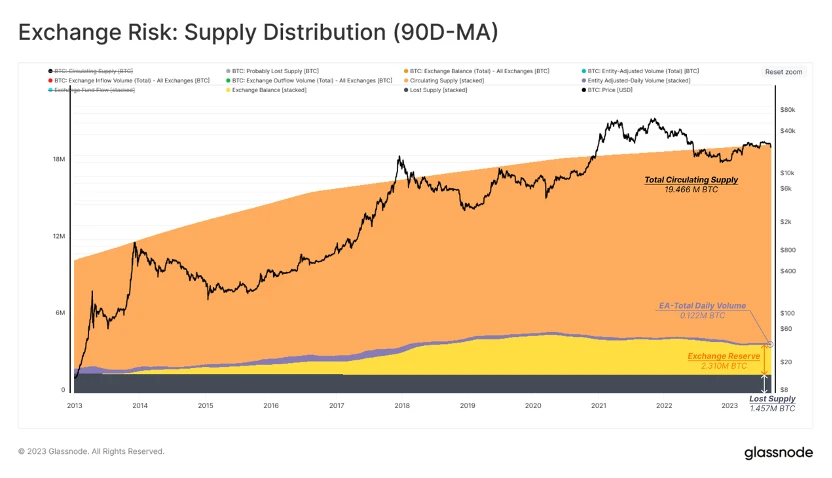

The dominance of centralized exchanges is declining. The supply of BTC on centralized exchanges reached a peak of 3.2 million coins in March 2020 and has been steadily declining since. This week, the total exchange balance reached 2.25 million BTC, a five-year low.

Stablecoins are stable with a slight increase. Compared to last week, the overall market value of stablecoins has not fluctuated significantly.

The long-term trend indicator MVRV-ZScore reflects the overall profitability of the market based on the total cost. When the indicator is greater than 6, it is in the top range; when the indicator is less than 2, it is in the bottom range. When MVRV drops below the critical level of 1, holders are generally in a loss state. The current indicator is 0.51, entering the recovery phase.

2) Futures market

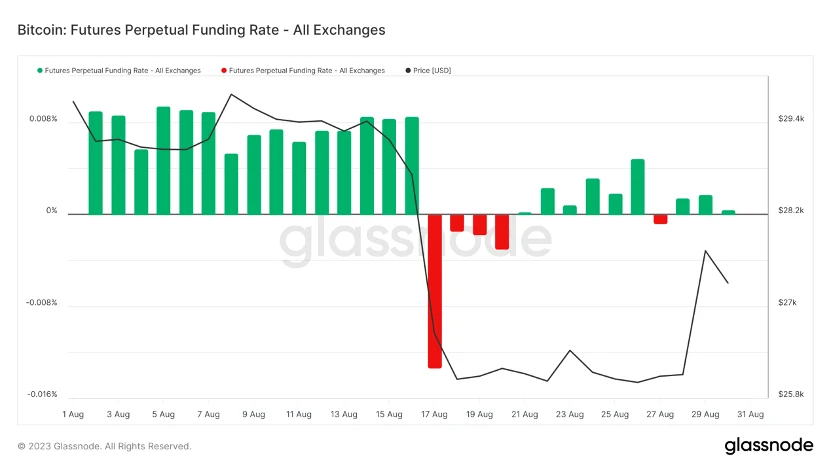

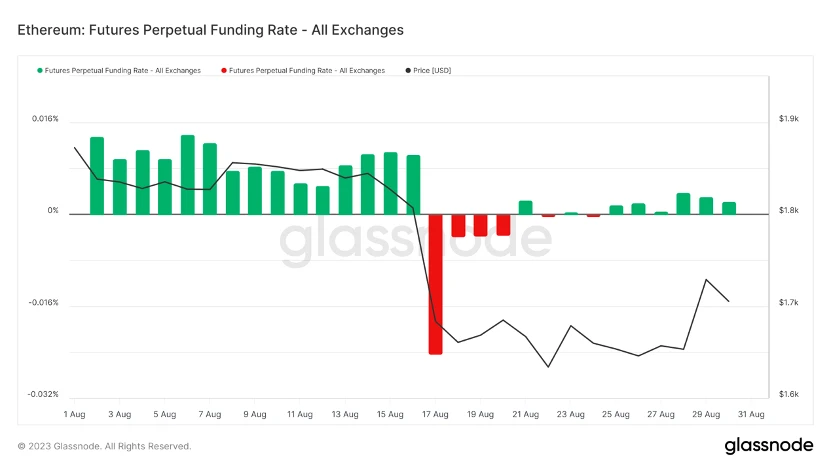

Funding rate: Neutral this week. Rates are between 0.05% and 0.1%, indicating more long leverages, which may be a short-term market top; rates between -0.1% and 0%, indicating more short leverages, which may be a short-term market bottom.

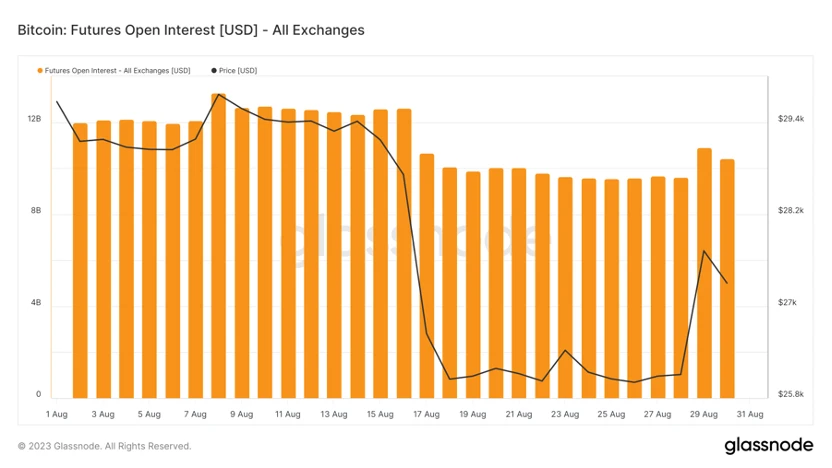

Futures position: BTC total position increased slightly this week, with main players returning.

Futures long/short ratio: 2.0. Market sentiment for bargain hunting is strong. Retail investor sentiment is often a contrarian indicator, with levels below 0.7 indicating fear and levels above 2.0 indicating greed. The long/short ratio data is volatile and has weakened significance as a reference.

3) Current market situation

BTC experienced an oversold rebound this week, mainly influenced by the Grayscale lawsuit victory. According to historical patterns, the news-driven rally is expected to have limited sustainability and the weekly trend is still downward. Currently, global mining costs for BTC are around 23,000, making it difficult to break through with high probability. The AI sector has shown resistance to the downturn and may present opportunities in the future.

B. Market Data

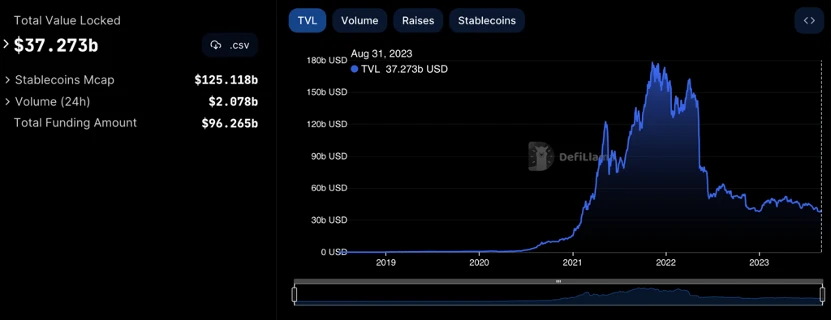

I. Total Lock-up Volume of Public Chains

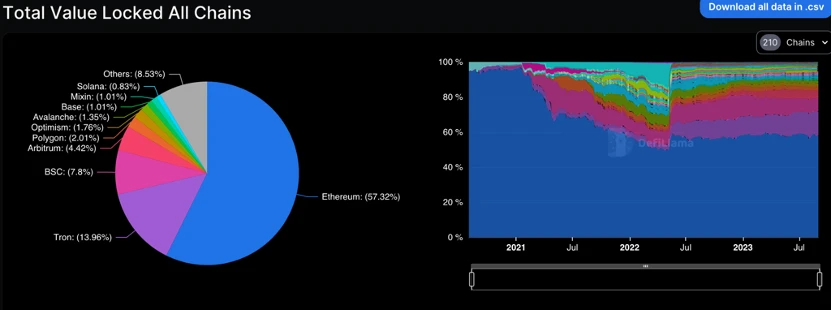

II. Proportion of TVL for each public chain

This week, the overall TVL decreased by 0.9b, with a decrease of about 2%. In recent weeks, the TVL has been continuously declining, with a cumulative decrease of over 10%. The proportion of ETH chain has not changed much this week, slightly decreasing. Apart from a 95% increase in the Base chain and a 2% increase in the BSC chain, almost all popular public chains have been declining. It is worth noting that the growth of the Base chain, after a slight slowdown last week, has experienced a sharp increase this week.

III. Lock-up volume of various chains

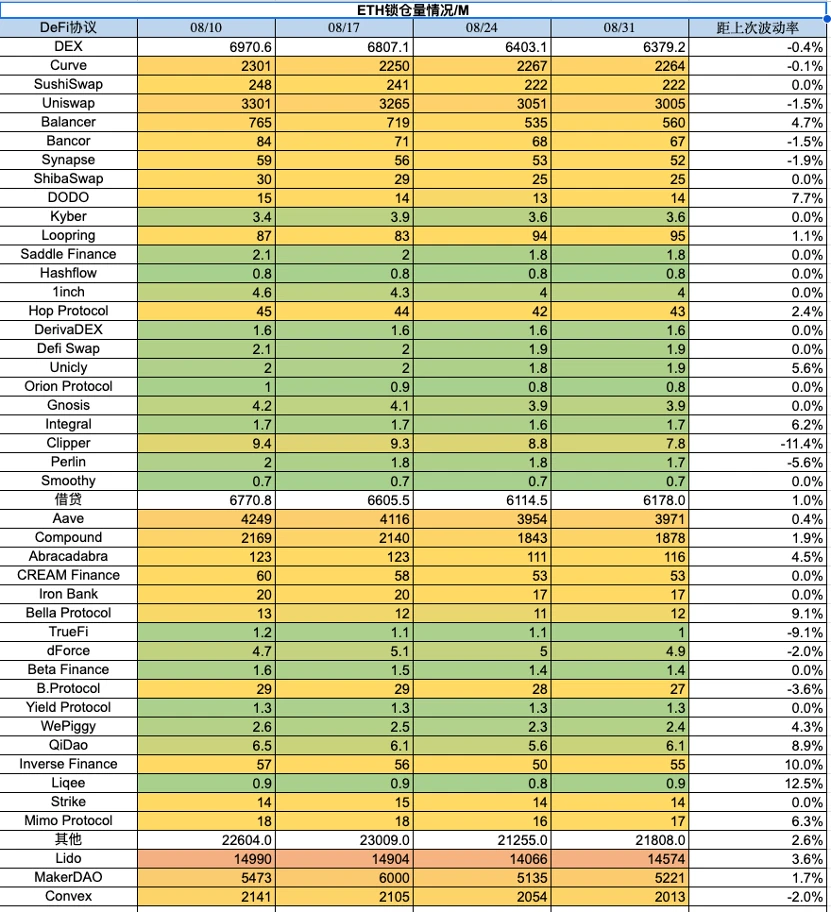

1)ETH lock-up volume

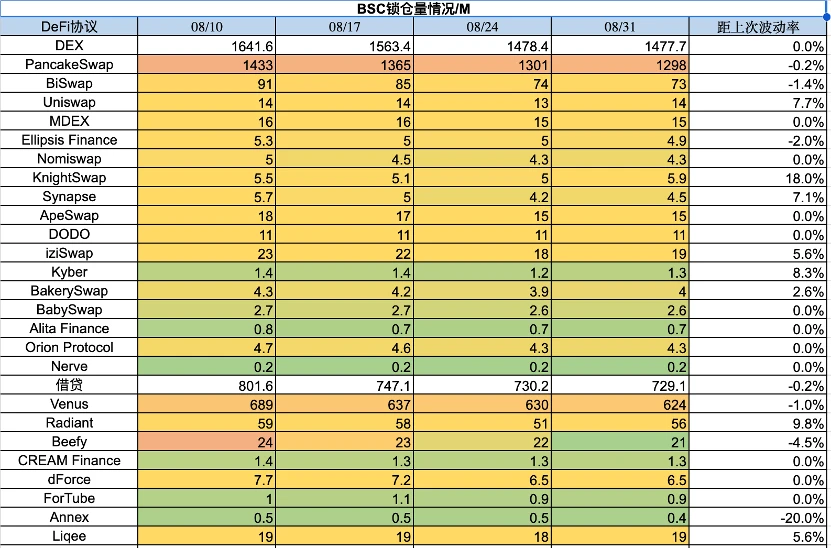

2)BSC lock-up volume

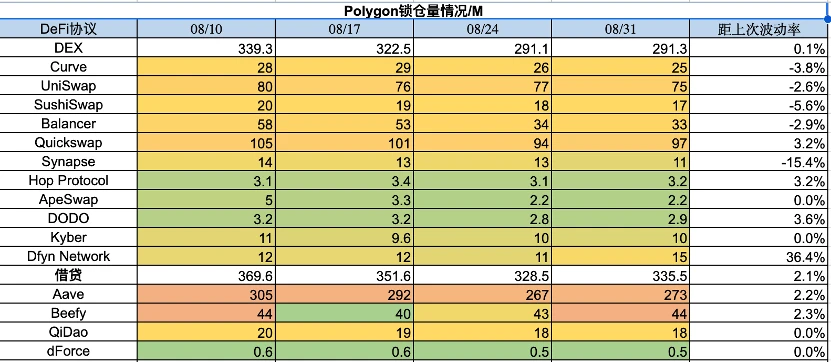

3)Polygon lock-up volume

4)Arbitrum lock-up volume

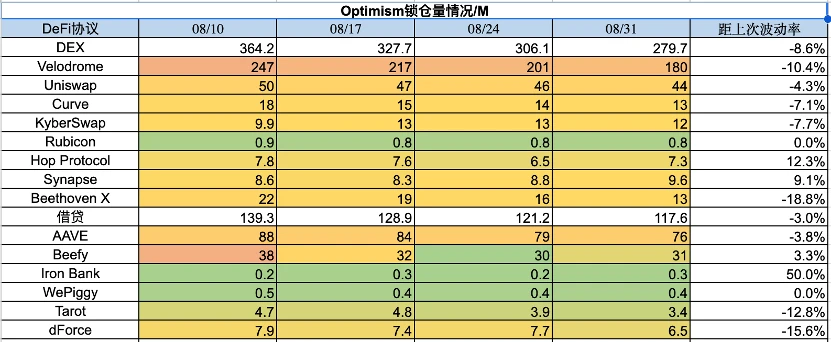

5) Optimism Lock-up Situation

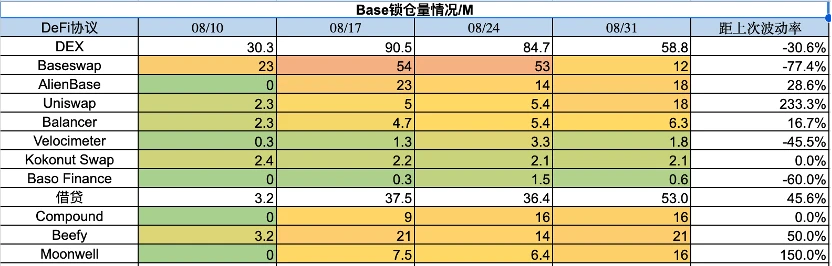

6) Base Lock-up Situation

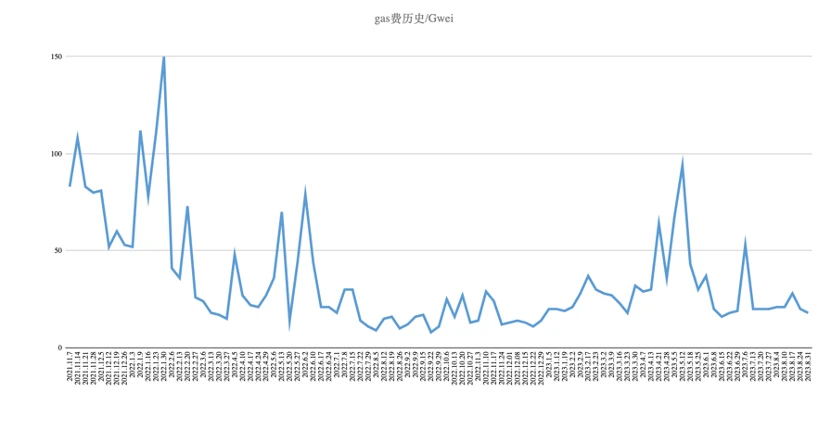

IV. ETH Gas fee History

Current on-chain transfer fee is about $0.75, Uniswap trading fee is about $6.85, Opensea transaction fee is about $2.66. Gas continues to decline this week, and gas has been slightly decreasing in the past few weeks. From gas consumption perspective, Uniswap takes the lead.

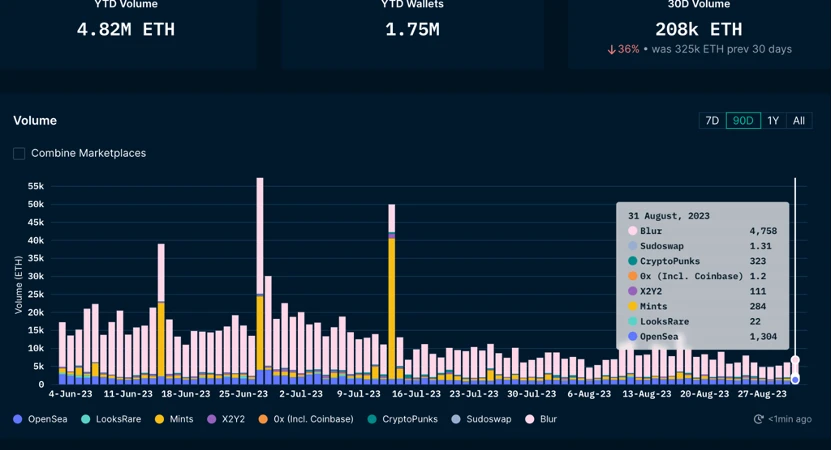

V. NFT Market Data Changes

1) NFT-500 Index:

2) NFT Market Situation:

3) NFT Market Share:

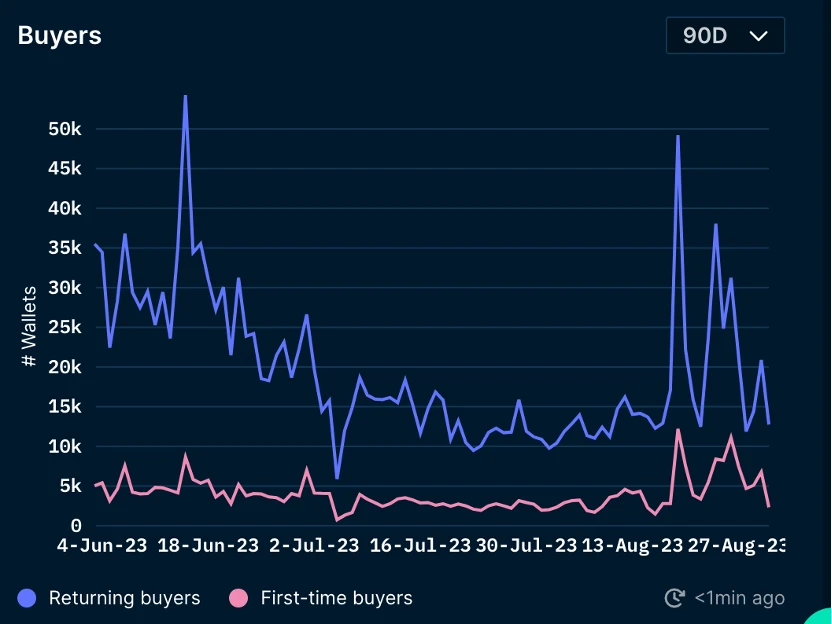

4) NFT Buyer Analysis:

Some top blue-chip projects saw a slight increase in floor prices this week, with BAYC rising by 14%, MAYC up 7.8% last week, and DeGod showing a trend of increased trading volume, resulting in a 2% increase. Other NFTs are still mostly declining. The total market value of the entire NFT market is still steadily decreasing recently.

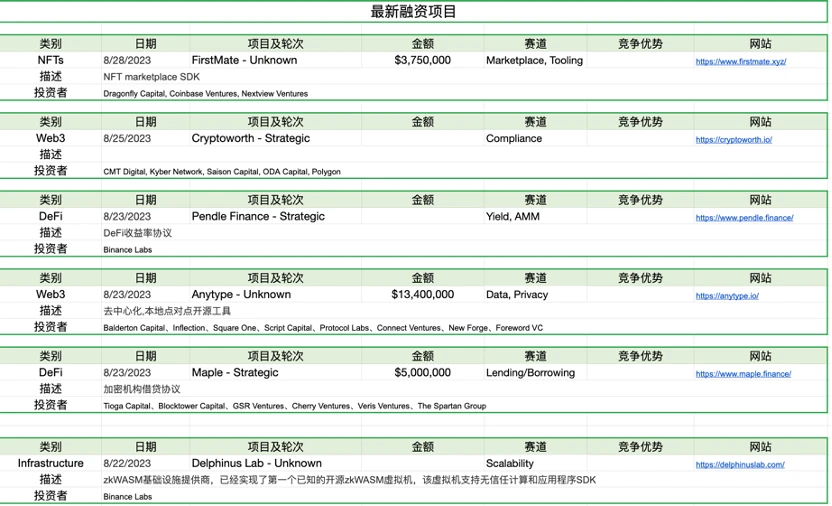

VI. Latest Project Financing Situation

About Foresight Ventures

Foresight Ventures bets on the innovative journey of cryptocurrency for the next few decades. It manages multiple funds: VC Fund, Secondary Active Management Fund, Multi-Strategy FOF, and Special Purpose S Fund - "Foresight Secondary Fund l", with total assets under management exceeding $400 million. Foresight Ventures adheres to the philosophy of "Unique, Independent, Aggressive, Long-term", providing extensive support to projects through its strong ecological power. Its team comprises seasoned professionals from top financial and technology companies, including Sequoia China, China International Capital Corporation, Google, Bitmain, and others.