Original - Odaily

Author - 0xSekiro

On October 24, when the channel height reached 17856000,The first batch of 113 million DOTs participating in crowd lending in the Polkadot ecosystem will be unlocked. These DOTs account for approximately 7.4% of the total issuance.The amount involved in this unlocking, based on DOT’s current price of $4, is approximately $605 million.

From November 11 to December 16, 2021, 5 winners on Polkadot, represented by Acala Network and Moonbeam, obtained the right to use the first batch of slots. It was also from this moment that the parallel chain development of Polkadot, a well-known public chain, officially began its external operations.

Two years have passed by, and the Web3 industry has been turbulent with frequent iterations. We have witnessed the rise of DeFi Summer, the emergence of Layer 2 concepts and BTC ecological concepts. At the same time, the birth of new public chains such as Aptos and Sui and the explosion of LUNA and FTX also reflect the cold alternation of old and new in the Web3 industry.

The old ones are out and the new ones are on the scene. After the industry structure has been reshuffled many times, there are still some holdouts, such as Polkadot.

With the arrival of the first crowd-lending DOT unlocking node, Polkadot will unlock DOT 6 times in the next 2 years. There is no doubt that the big test has arrived.

For the current ecosystem where LSD is the mainstream DeFi sector, how to maximize the investment of this capital after unlocking has become an important task for all project parties, especially the parachains of Polkadot.

Odaily will try to deduce the direction of Polkadot from the perspective of the five projects unlocked in the first phase, through their recent actions, and in conjunction with the recently released Polkadot 2023 financial report.

What is crowdlending?

Crowdloan is a way for other parallel links to connect to the Polkadot mainnet slot and become a Polkadot mainnet parachain. The slots of the Polkadot mainnet are rented in the form of auctions. Each ecology requires contributors to provide a certain number of DOTs for pledge, and win the slot auction held by Polkadot.

Up to now, Polkadot has conducted a total of 9 rounds of auctions with a total of 45 slots. Since this unlocking has not yet started, Polkadot will conduct 6 rounds of crowd loan unlocking in the next two years. Thats exactly what it is,The Polkadot community launched a referendum to increase the ideal staking rate from the current 52.5% to 60% to cope with the upcoming unlocking pressure.

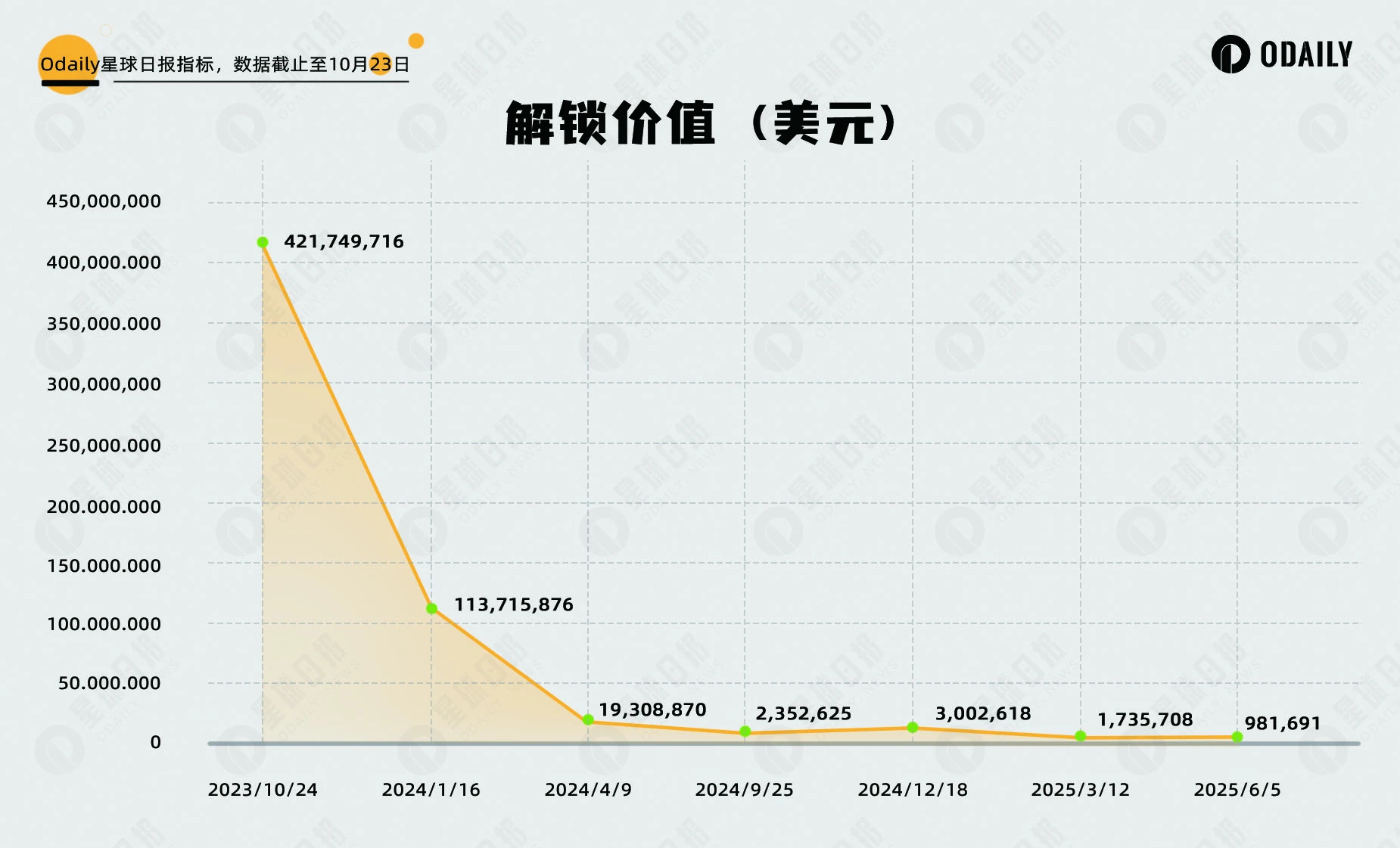

The following is the size and schedule of each round of crowd lending unlocked by Polkadot:

According to the chart, we can see that in a total of 7 rounds of unlocking, a total of approximately 151 million DOTs were unlocked. Calculated at the current price of US$4, a total of US$605 million of DOT will be unlocked, and the value unlocked in each round of crowd lending is in a decreasing state. The biggest selling pressure comes from the upcoming first round of unlocking and the third round on January 16 next year. Unlocked in second round.

In the first round of the 5 slot auction, five teams were awarded: Acala Network, Moonbeam, Astar, Parallel Finance and Clover Finance. These five parallel chains are also the protagonists of the crowdlending DOT unlock on October 24.

According to statistics, among the 113 million DOTs unlocked this time, each team has a different share. in,Moonbeam and Acala are the biggest unlockers, unlocking 35.76 million DOT and 32.52 million DOT respectively; Parallel, Astar, and Clover have unlocked 10.75 million DOT, 10.33 million DOT, and 9.75 million DOT respectively.The figure below shows a detailed comparison of the specific amounts unlocked by the five teams and the current TVL of each team based on statistics from the DeFilama platform.

From this point of view, the current main competitors are from Moonbeam and Acala. Compared with the current TVL of the two, the amount of unlocked DOT reaches 368% and 704% respectively. Especially Acala, which suffered a hacker attack on August 14 this year. More than 130 million aUSD were mined by mistake, causing the price of aUSD on the chain to fall below US$0.01 and severely destabilizing. Although Acala actively carried out subsequent recovery actions, this black swan also severely damaged the confidence of users. We can see that after this, Acalas TVL plummeted from the previous $11 billion to around $17 million now.

In contrast, Moonbeams TVL has also been declining after experiencing a peak in 2022.

therefore,For these DOTs that are about to be unlocked, for parachains such as Moonbeam and Acala, whoever can intercept them as much as possible and convert them into their own Holders may take the leading position in the subsequent development process. Bit.

What preparations have been made for the five ecologies?

Among the five relevant parachains, the most obvious ones are Acala and Moonbeam. This is not only because these two parachains have the largest amount of DOT pledged, but also because they have a relatively large number of contributors, with Acala at 24,934; Moon to 48,346 people. As for the other three, in addition to Parallel Finance, which has also launched staking mining services, Astar has deployed Ethereum Layer 2 early and has transformed into the B-side. Clover Finance also focuses on wallets and cross-chains, plus the amount involved. There are few reasons, so we did not query the corresponding actions of these two ecologies.

Acala

Launched Euphrates staking service to attract LCDOT staking.

Acala launched LCDOT’s unilateral pledge function Euphrates at the end of September this year, which allows LCDOT Holders to pledge DOT’s single currency and obtain the output income of ACATAI tokens. In this event, Acala prepared 5 million ACA representatives and TAI tokens for rewards.Officials expect the average annualized rate to be around 35% -55%。

When Acalas slot lease expires on October 24, its originally pledged LCDOT will also be unlocked. Users can choose to convert DOT to Acala Liquid Stake DOT (LDOT) or Taiga DOT (tDOT) and make corresponding pledges.

The current TVL of the LDOT pledge pool is US$3.56 million, and the initial annualized interest rate after unlocking is expected to be 214.2%; the TVL of the tDOT pledge pool is US$4.79 million, and the initial annualized interest rate after unlocking is 212.75%.

Holders who complete the pledge on Euphrates will receive the corresponding LST, which can be used to participate in DeFi investments in the Acala ecosystem, such as Taiga Finance and Meta Defender.

Moonbeam

Moonbeams lending protocol Moonwell provides an xcDOT lending model, providing users with an annualized staking return of about 13%.At the same time, Moonbeam recently started cooperation with Bifrost, another project in the Polkadot ecosystem. The latter launched Omni LST based on Moonbeam, aiming to encourage unlocked DOT to participate in staking.

Parallel Finance

The cDOT pledge mining service was launched. Users can deposit DOT into Parallel’s own lending system.Mining rewards of 10% -15% can be achieved.

From this we can see that in addition to multi-chain deployments like Clover, other parties are trying to attract DOT unlocks. On the one hand, they launch staking mining activities related to cDOT, and on the other hand, they are also actively using Projects in their respective ecology are favored by DOT Holders.

In addition, Bifrost, which has no pressure to unlock in the short term, has also recently launched the Polkadot Unlock Harvest event to attract the participation of DOT users through airdrops and incentives to share the prize pool.

New trends in Polkadot

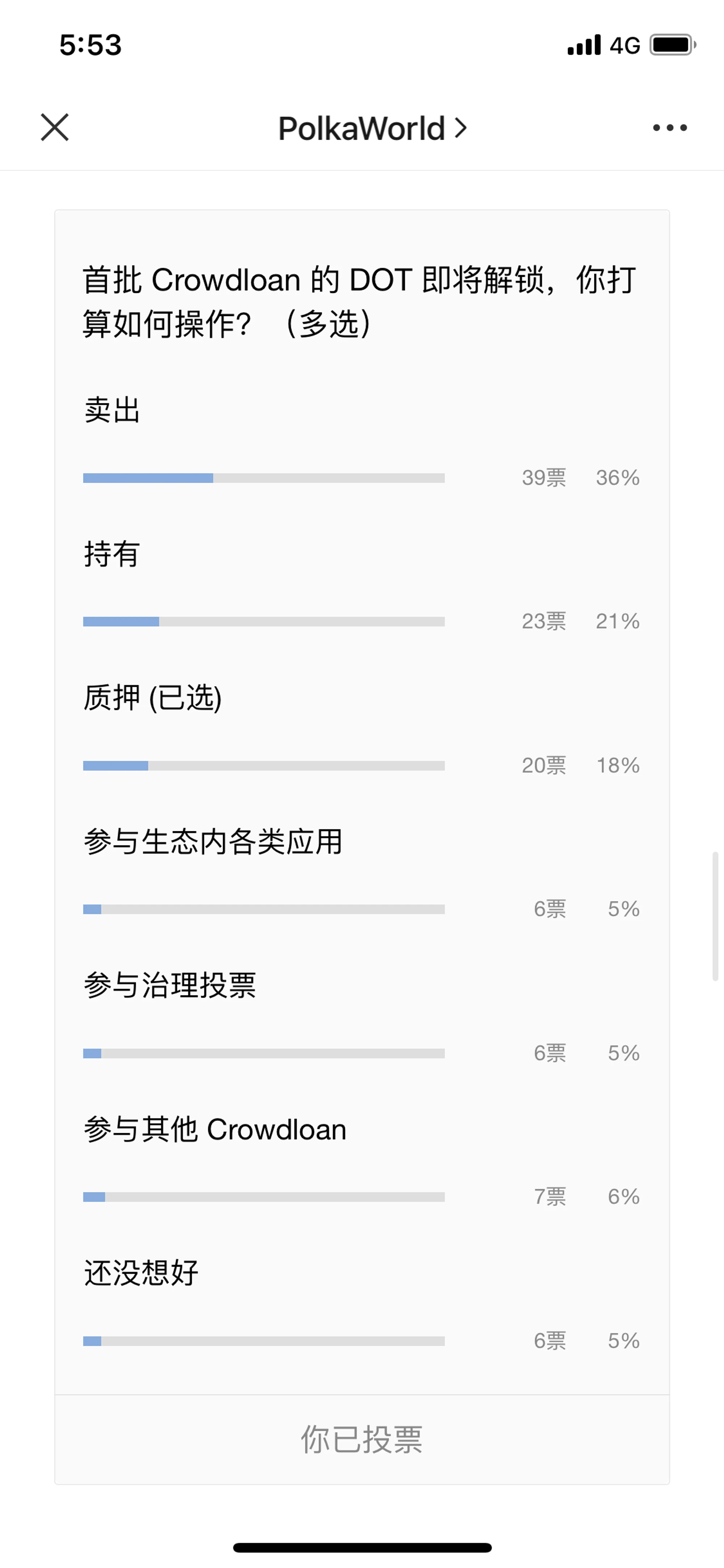

Polkadot’s official WeChat public account, PolkaWorld, launched a poll on October 13: The first batch of Crowdloan DOTs will be unlocked soon, and how users plan to operate.

Among the 7 options in total: Sell, Hold, Pledge, Participate in ecological projects, Participate in governance voting, Participate in other Crowdloans and Not yet thought about it, there were more than 100 people on that day. users voted. in,The highest proportion was the “sell” option, with 39 votes, accounting for approximately 36% of the total votes.There were 23 votes, accounting for 21%, for the “hold” option, while 20 votes, accounting for 18%, were chosen for the “staking” option.

Judging from the voting data, Holders who have been staking for 2 years seem to have less trust in DOT. In a TG community in Acala, the group members are discussing whether DOT will plummet after it is unlocked.

Phala governance member Cappex posted a message on the Holders who had low confidence in DOT during the previous crowd lending period may have fled by selling pledged certificates. In other words,The price of DOT after unlocking may have been confirmed by the market before unlocking.

In addition, a considerable number of members are not bothered by the selling pressure on DOT, and are discussing what mining projects the DOT on hand should participate in after it is unlocked.

Two years ago, various ecosystems borrowed DOT from users and locked them for two years. These DOTs were locked tightly, causing the entire ecosystem to miss the opportunity for the bull market to break out.As the crowd loan expires, each ecology will also try its best to use the ecology itself or ecological projects to undertake it, so it may be a new opportunity for DOT holders.

In fact, the unlocking of crowd-lending DOT is not only a new opportunity for DOT holders and project parties, but also a new starting point for Polkadot itself.

As early as August this year, at the Polkadot Decoded conference, Polkadot founder Gavin Wood proposed the idea of Polkadot 2.0.

In new ideas,Polkadot will change its past slot auction leasing mechanism to adopt a Coretime procurement mechanism, which is similar to the concept of carbon emission indicator trading in the traditional financial field.Coretime refers to the time required to perform validation and consensus on the Polkadot relay chain. Each connected ecology purchases the share of Coretime according to its own needs.

In addition, in Polkadot’s 2023 Q3 quarter financial report just announced not long ago, we can also see the overall changes in Polkadot. For example, RD costs increased by 65%, from US$5.8 million last year to US$11.43 million this year. In contrast, funding for external expansion such as external media traditions will drop by 10%. At the same time, we are also aware that Polkadot is currently experiencing some non-essential funding expenditures, such as the US$350,000 handed over to Messari for related research...(See A quick look at Polkadot’s Q3 financial report: Where was the $21 million spent?》)

In addition, the Web3 Foundation recently announced a $40 million community incentive plan and the 19th batch of Grant recipients. It can be seen that Polkadot is making steady progress.

Summarize

Polkadot currently ranks 16th in market capitalization across the entire network, at approximately US$4.7 billion.As a veteran king-level public chain, it is still in a relatively advantageous position. Although the challenges from Layer 2 and new public chains have become increasingly severe in the past two years, with the launch of a series of iterative ideas of Polkadot, we can still give optimistic expectations in the future.