On June 25, 2025, SEI cryptocurrency took the market by storm with its stunning performance, breaking through $0.33, rising 23.66% in 24 hours, and up 107% in the past seven days, with its market value soaring to $1.812 billion. This explosive growth not only demonstrates SEIs strong momentum in the crypto market, but also sparked heated discussions among investors about its future potential. As a Layer 1 blockchain optimized for decentralized exchanges (DEX), why can SEI achieve such a significant breakthrough in a short period of time?

The technical drivers behind the price surge

SEIs price performance is impressive, and its breakthrough of $0.33 is inseparable from strong technical support. Currently, SEI has broken through the 50-day and 200-day moving averages, establishing a medium-term and long-term bullish trend, and the price has stabilized around $0.33, with the next key resistance level likely to be $0.40. Trading volume data further confirms market enthusiasm. In the past 24 hours, SEIs trading volume surged 253% to $780 million, showing high investor participation and increased market liquidity.

The relative strength index (RSI) is currently around 50, indicating that the market momentum is biased towards the bulls, but it has not yet entered the overbought area, and there is still room for upside in the short term. However, investors should be wary of potential pullback risks, especially if market sentiment changes and prices may retrace the support range of $0.25 to $0.28. Technical analysis shows that the long SEI arrangement and market greed (Fear and Greed Index is 34) together provide momentum for further price increases, and it is expected to challenge the highs of $0.34 or even $0.44 in the short term.

Rapid expansion of the ecosystem

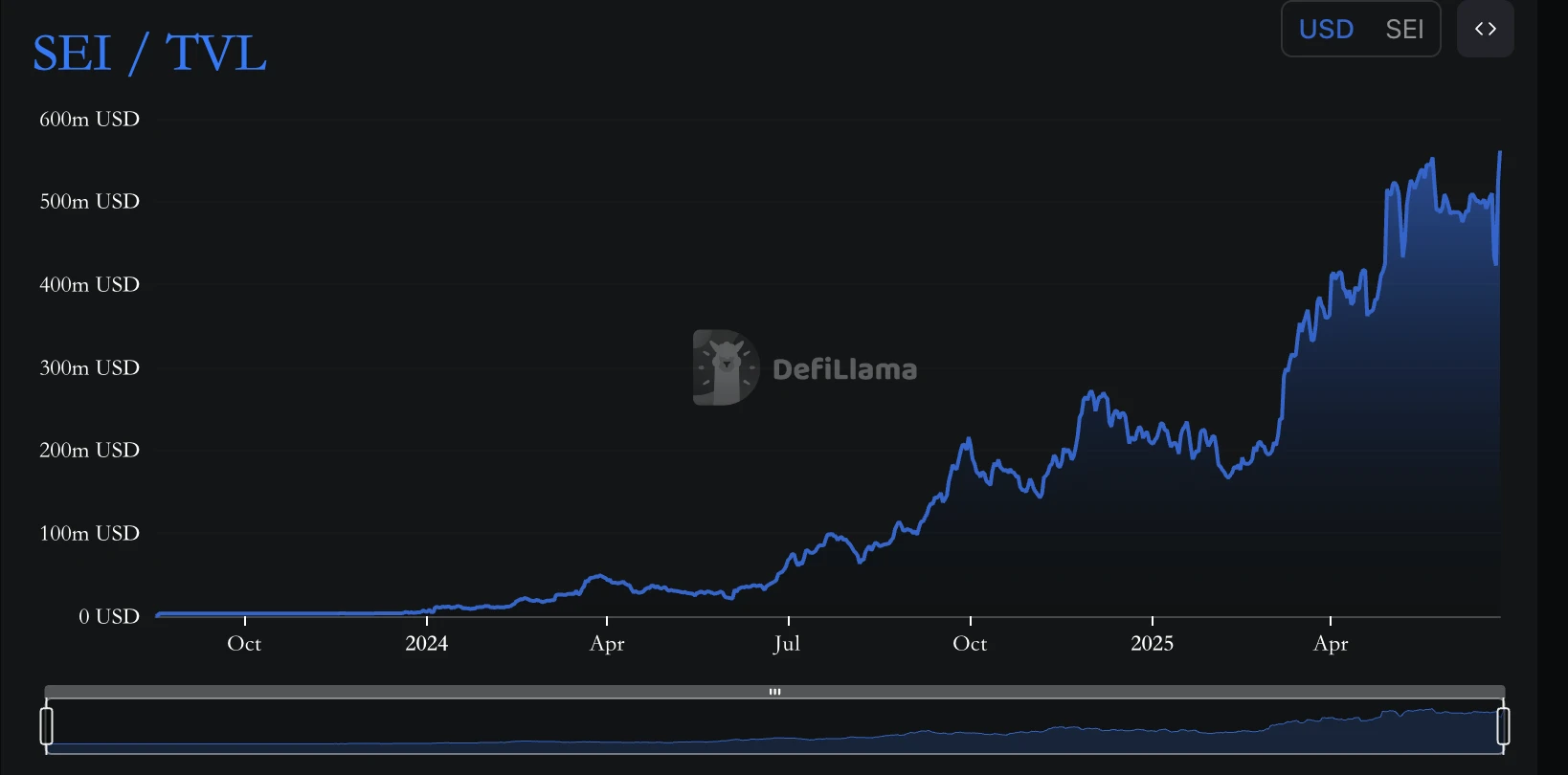

SEIs success is not only reflected in the price, but also in the rapid development of its ecosystem, which provides solid fundamental support. As a Layer 1 blockchain optimized for decentralized exchanges, SEI has attracted a large number of developers and users with its high performance and low-cost transactions. According to on-chain data, in the third quarter of 2024, the number of active wallets on the SEI network exceeded 600,000, and the daily transaction volume increased significantly, reflecting the increasing activity of its ecosystem. The total locked value (TVL) soared from US$185 million at the beginning of the year to US$540 million in June 2025, showing the booming development of decentralized financial protocols on the SEI network.

SEI also further promotes the development of the ecosystem through its long-term cooperation with Binance. Since the launch of the SEI mainnet and Binance Launchpool in August 2023, SEI has continued to carry out activities on the Binance platform, such as staking and Launchpool activities supported by Binance Wallet, attracting users to stake assets such as BNB, TUSD and FDUSD to obtain SEI rewards.

These activities usually last for 30 days or longer, providing users with passive income opportunities while enhancing the liquidity and community participation of SEI tokens. For example, Binance BNB Vault supports SEI Launchpool, and users who stake BNB can automatically participate in SEI reward distribution and obtain daily income. This long-term activity not only increases the popularity of SEI, but also injects more liquidity into its ecosystem through Binances large user base. SEI adopts the Twin-Turbo consensus mechanism and parallel order execution technology to shorten the transaction confirmation time to milliseconds. This technical advantage is particularly suitable for high-frequency trading scenarios and has attracted a large number of decentralized exchanges and GameFi applications. Compatibility with the Ethereum Virtual Machine (EVM) also allows SEI to seamlessly integrate the developer resources of the Ethereum ecosystem, further broadening its application scenarios in non-fungible tokens (NFTs), social media, and games. This multi-dimensional ecological expansion has laid a solid foundation for the long-term value growth of SEI.

Favorable policies and boost to market sentiment

Recently, SEI has also benefited from a series of external positive factors, which significantly increased the markets confidence in it. On June 19, SEI was selected as a candidate network for the Wyoming State Stablecoin Pilot Project (WYST), surpassing mainstream public chains such as Ethereum and Solana with a score of 30. This news quickly sparked heated discussions in the crypto community and was seen as an important catalyst for the rise in SEI prices.

Discussions on the X platform continued to heat up, with users expressing their optimistic expectations that SEI would break through $0.40 or even higher. In addition, the SEI exchange-traded fund (ETF) application submitted by Canary Capital on May 1 further ignited market enthusiasm and attracted the attention of institutional investors. These policies and institutional support not only enhanced the credibility of SEI, but also provided external momentum for its continued price increase. At the same time, the growth of the SEI Marines community has injected a strong user base into the project, and the active participation and promotion of community members have further amplified SEIs market influence. Against the backdrop of the overall cryptocurrency market recovery, SEIs outstanding performance has formed a resonance effect with its technical advantages and external benefits.

Investment considerations and risk warnings

Although SEI shows strong growth potential, the high volatility of the cryptocurrency market still needs to be treated with caution. Rapid changes in market sentiment, macroeconomic factors, and uncertainty in regulatory policies may lead to short-term price corrections. In addition, SEIs token economics show that the unlocking of approximately 33.33 million tokens per month may create some selling pressure on prices. In terms of competition, the rise of high-performance public chains such as Solana and SUI also poses a challenge to SEI, which needs to continue to innovate to maintain its market advantage. For investors, short-term traders can focus on the resistance levels of $0.34 and $0.40, and formulate strategies in combination with RSI and trading volume indicators; long-term investors should focus on tracking SEIs ecological development and institutional adoption dynamics, and build positions in batches to reduce risks. It is recommended to use non-custodial wallets such as Keplr or Ledger to store SEI to ensure asset security, while conducting sufficient market research and avoiding emotional trading.

Can SEI become a star public chain in 2025?

On June 25, 2025, SEI proved its unique position in the crypto market with its amazing performance of breaking through $0.33. Its high-performance Layer 1 architecture, thriving ecosystem, and policy and institutional support have jointly driven its soaring price and the growth of its market value. SEIs potential in the fields of decentralized finance, non-fungible tokens, and GameFi makes it an investment target worth paying attention to in 2025. However, crypto investment requires caution, and investors are advised to conduct sufficient research and develop risk management strategies. Token prices are not only affected by the development and technological progress of the project itself, but also by the overall liquidity of the financial market, the macroeconomic environment, and the pressure of selling project tokens. For example, regular token unlocking may lead to short-term price fluctuations, and tightening policies in global financial markets may affect the inflow of funds into crypto assets. Investors should fully assess their own risk tolerance, develop a reasonable investment strategy, and avoid investing all their funds in a single asset.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrency investment is high risk, please make decisions with caution.