Original article from Grayscale Research

Compiled by Odaily Planet Daily Golem ( @web3_golem )

Summarize:

Summarize:

Crypto markets surged in Q4 2024, with the FTSE/Grayscale Crypto Sectors Index showing strong market performance. The gains largely reflected the market’s positive reaction to the results of the U.S. election.

Competition in the smart contract platform space remains fierce. Ethereum, the leader in the space, has lagged behind Solana, the second-largest competitor by market cap, and investors are increasingly paying attention to other layer 1 networks such as Sui and The Open Network (TON).

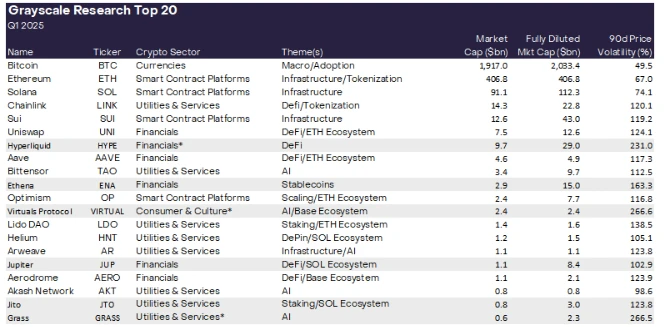

Grayscale Research has updated its Top 20 tokens list. The list represents diversified assets in the cryptocurrency industry that could have high potential in the coming quarter. Newly added assets in Q1 2025 include HYPE, ENA, VIRTUAL, JUP, JTO, and GRASS. All assets in the Top 20 list have high price volatility and should be considered high risk.

Grayscale Crypto Sectors Index

Grayscale Crypto Sectors provides a comprehensive framework for understanding the range of investable digital assets and their relationship to the underlying technology. Based on this framework, and in collaboration with FTSE Russell, Grayscale developed the FTSE Grayscale Crypto Sectors Index Series to measure and monitor crypto assets (Figure 1). Grayscale Research incorporates the index into its analysis of the digital asset market.

Chart 1: Grayscale Crypto Sectors Index Positive Returns in 2024

Cryptocurrency valuations surged in the fourth quarter of 2024, largely due to the market s positive reaction to the results of the US election. According to the Cryptocurrency Sector Market Index (CSMI), the total industry market capitalization increased from $1 trillion to $3 trillion during the quarter. Figure 2 below compares the total cryptocurrency market capitalization to various traditional public and private market asset classes. For example, the market capitalization of the digital asset industry today is roughly equivalent to the market capitalization of the global inflation-linked bond market - more than twice the size of the US high-yield bond market, but still far lower than the global hedge fund industry or the Japanese stock market.

Figure 2: Cryptocurrency market capitalization increased by $1 trillion in the fourth quarter of 2024

Due to the increase in valuations, many new tokens meet the inclusion criteria of Grayscales Crypto Sectors framework (which has a minimum market capitalization requirement of $100 million for most tokens). With this quarterly rebalancing, Grayscale added 63 new assets to the index series, which now includes a total of 283 tokens. The consumer and cultural sectors added the most new tokens, reflecting the continued strong returns of meme coins and the appreciation of various assets related to gaming and social media.

The largest new addition to Crypto Sectors by market cap is Mantle, an Ethereum Layer 2 protocol that has now met the minimum liquidity requirements (for more details on Grayscale Index inclusion criteria, see here ).

Smart Contract Platform Competition

The smart contract platform space is perhaps the most competitive segment in the digital asset industry. While 2024 was a milestone year for Ethereum, the leader in the space — it received approval for a spot exchange-traded product (ETP) in the U.S. and underwent a major upgrade — ETH has underperformed some competitors, such as Solana, the second-largest asset in the space by market cap. Investors have also turned their attention to other L1 networks, including high-performance blockchains such as Sui and TON, a blockchain integrated with the Telegram platform.

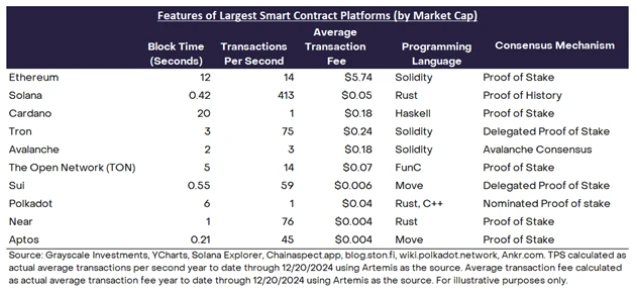

Architects of smart contract blockchains face a variety of design choices when creating infrastructure for application developers. These design choices affect the three factors that make up the “blockchain impossible triangle”: network scalability, network security, and network decentralization. For example, prioritizing scalability often manifests as high transaction throughput and low fees (such as Solana), while prioritizing decentralization and network security may result in lower throughput and higher fees (such as Ethereum). These design choices lead to different block times, transaction throughput, and average transaction fees (Figure 3).

Figure 3: Smart contract platforms have different technical characteristics

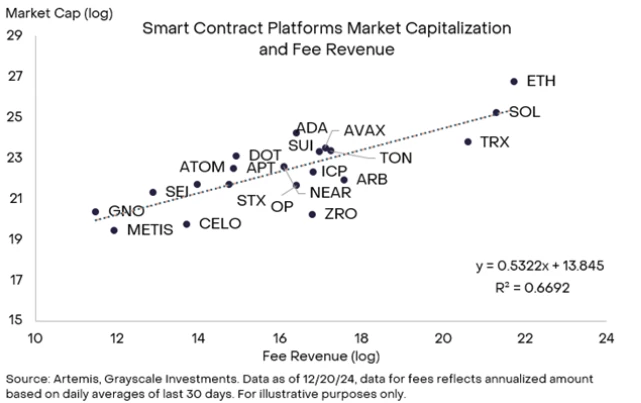

Regardless of design choices and the strengths and weaknesses of the network, smart contract platforms derive their value through the network fee revenue they generate. While other metrics such as total TVL are also important, fee revenue can be considered the primary driver of token value accumulation in this market segment (Related reading: The Battle for Value in Smart Contract Platforms ).

As shown in Figure 4, there is a statistical relationship between smart contract platform fee income and market capitalization. The greater the ability of the network to generate fee income, the greater the ability of the network to pass value to the network in the form of token burns or staking rewards. This quarter, Grayscale Researchs list of top 20 tokens included several smart contract platform tokens: ETH, SOL, SUI, and OP.

Figure 4: All smart contract platforms compete for fee income

Grayscale Research Top 20 Tokens List

Every quarter, the Grayscale Research team analyzes hundreds of digital assets to inform the rebalancing process of the FTSE/Grayscale Crypto Sectors series of indices. After this process, Grayscale Research generates a list of the top 20 assets within the Crypto Sectors space. The top 20 represents diversified assets across Crypto Sectors that may have high potential in the coming quarter (Figure 4). The list is screened based on a combination of factors, including network growth/adoption, upcoming catalysts, sustainability of fundamentals, token valuations, token supply inflation, and potential tail risks.

In Q1 2025, Grayscale will focus on tokens that involve at least one of the following three core market themes:

The US election and its potential impact on industry regulation , particularly in areas such as decentralized finance (DeFi) and staking;

Continued breakthroughs in decentralized AI technology and the use of AI agents in blockchain;

Growth of the Solana ecosystem.

Based on these themes, the following six assets were added to the Top 20 list for Q1 2025:

Hyperliquid (HYPE) : Hyperliquid is a L1 blockchain designed to support on-chain financial applications. Its main application is a decentralized exchange (DEX) for perpetual futures with a fully on-chain order book.

Ethena (ENA) : The Ethena protocol has evolved into a new stablecoin, USDe, which is primarily secured by hedged positions in Bitcoin and Ethereum. Specifically, the protocol holds long positions in Bitcoin and Ethereum and short positions in perpetual futures contracts for the same assets. The collateralized version of the token provides returns through the difference between spot and futures prices.

Virtual Protocol (VIRTUAL) : Virtual Protocol is a platform for creating AI agents on the Ethereum L2 network Base. These AI agents are designed to mimic human decision-making and perform tasks autonomously. The platform allows the creation and co-ownership of tokenized AI agents that can interact with their environment and other users.

Jupiter (JUP) : Jupiter is the top DEX aggregator on Solana, with the highest TVL on the network. As retail traders increasingly enter the cryptocurrency market through Solana, and speculation around Solana-based memecoins and AI agent tokens intensifies, we believe Jupiter is well-positioned to capitalize on this growing market.

Jito (JTO) : Jito is a liquidity protocol on Solana. Jito has seen massive growth in adoption over the past year and has the best financials in the crypto space, with over $550M in fee revenue in 2024.

Grass (GRASS) : Grass is a decentralized data network that rewards users for sharing their unused internet bandwidth through a Chrome extension. This bandwidth is used to scrape online data, which is then sold to AI companies and developers to train machine learning models, effectively scraping the web while compensating users.

Figure 5: Top 20 additions include DeFi applications, AI agents, and the Solana ecosystem

Note: Shading indicates new additions to the upcoming quarter (Q1 2025). “*” indicates sector assets not included in the Crypto Sectors index. Source: Artemis, Grayscale Investments. Data as of December 20, 2024, for reference only. Assets subject to change. Assets subject to change. Grayscale and its affiliates and clients may hold positions in the digital assets discussed in this article. All Top 20 assets have high price volatility and should be considered high risk.

In addition to the new themes mentioned above, Grayscale is still optimistic about the themes of previous quarters, such as Ethereum scaling solutions, tokenization, and decentralized physical infrastructure (DePIN). These themes are still reflected by some protocols that have returned to the top 20, such as Optimism, Chainlink, and Helium.

This quarter, we removed Celo from the Top 20. Grayscale Research continues to be bullish on these projects and believes they remain important components of the crypto ecosystem. However, the revised Top 20 list may provide more attractive venture returns in the coming quarter.

Investing in crypto asset classes involves risks, some of which are unique to the crypto asset class, including smart contract vulnerabilities and regulatory uncertainty. In addition, all assets in the Top 20 are highly volatile and should be considered high risk, and therefore are not suitable for all investors. Given the risks of the asset class, any investment in digital assets should be considered in the context of a portfolio and take into account the investors financial goals.