Original | Odaily Planet Daily ( @OdailyChina )

Author | Asher ( @Asher_0210 )

The US tariff policy has taken a new turn. This morning, Trump announced that considering that more than 75 countries have actively negotiated with the US on trade, currency and tariff-related issues, he decided to implement a 90-day tariff suspension period for these countries. During this period, the tariff will be significantly reduced to 10%, but a 125% tariff will be immediately imposed on China. With such a change in tariff policy, the US stock market and the cryptocurrency market have soared.

OKX real-time market data shows that as of 8:00 today (hereinafter referred to as this time point), BTC has exceeded 83,500 US dollars and is currently reported at 82,600 US dollars, with a 24- hour increase of 8.23%;

In addition to BTC, ETH has exceeded $1,680 at its highest point and is currently trading at $1,670, a 24- hour increase of 13.27%; SOL has briefly broken through the $120 mark and is currently trading at $119, a 24- hour increase of 12.60%;

Other mainstream altcoins also saw a sharp rise. Among the top 100 currencies by market value, HYPE broke through $14, with a 24- hour increase of 25.9% and a temporary report of $14.01; S broke through $0.5, with a 24- hour increase of 24.9% and a temporary report of $0.5002; PEPE broke through $0.000007, with a 24- hour increase of 17.5% and a temporary report of $0.00000702;

As for U.S. stocks, as of the close of the day, all three major stock indexes rose, with the Dow Jones Industrial Average closing up 7.87%, the largest single-day gain since March 24, 2020. The SP 500 closed up 9.52%, the largest single-day gain since October 28, 2008. The Nasdaq closed up 12.16%, the largest single-day gain since January 3, 2001, and the second largest gain in history. The Russell 2000 closed up 8.66%, the largest single-day gain since March 24, 2020;

Affected by the overall upward trend, the total market value of cryptocurrencies has also risen rapidly. According to CoinGecko data, the total market value of cryptocurrencies has exceeded 2.7 trillion US dollars, up 6.2% in 24 hours;

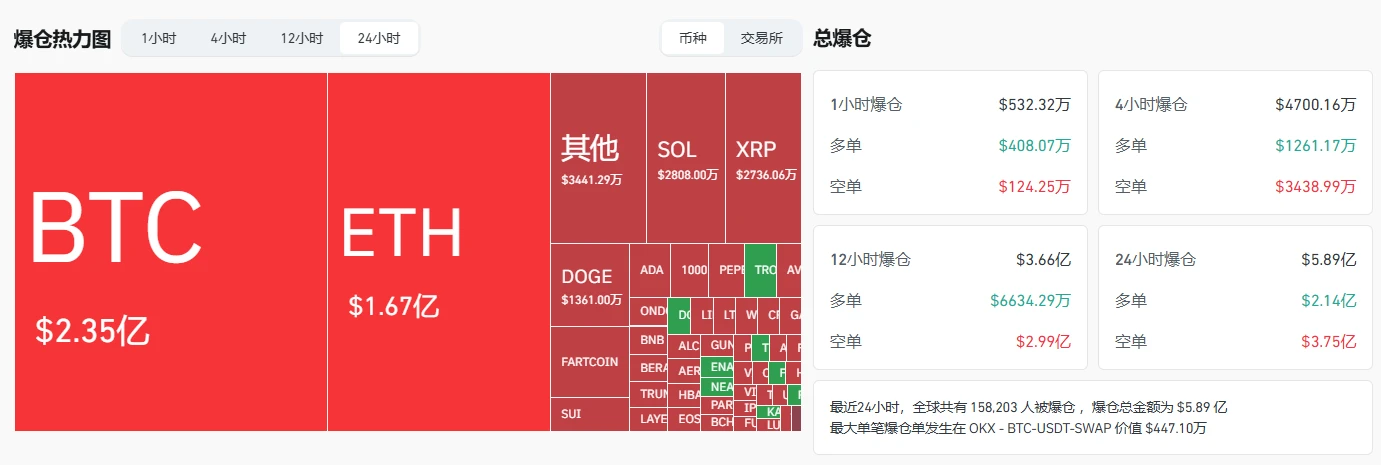

In terms of derivatives trading, Coinglass data shows that in the past 24 hours, the entire network has a liquidation of US$589 million, of which long orders have a liquidation of US$214 million and short orders have a liquidation of US$375 million. In terms of currencies, BTC has a liquidation of US$235 million and ETH has a liquidation of US$167 million.

The tariff suspension is just a small respite, and the market is still in a wait-and-see mood

After Trump released the latest tariff policy, many traditional financial analysts also expressed their attitudes and opinions. At present, although the market has rebounded in the short term, most analysts and observers generally pointed out that this probationary tariff policy has not really eliminated uncertainty, but may bring more chaos, and may even be regarded as a political expedient operation rather than a rational economic decision. The following are some representative opinions:

U.S. Senate Minority Leader: The U.S. government is in chaos and the cabinet cannot take on the responsibility of governing the country

U.S. Senate Minority Leader Schumer said, The government under Trump is chaotic. He changes every day, and his advisers quarrel with each other. It is unacceptable for such a chaotic cabinet to govern a country. Trump seems to be playing a red light and green light game. Sometimes he turns the red light on the U.S. economy, and sometimes he turns the green light. I have never seen such chaotic government actions.

Chief Analyst at Oxford Economics in New York: Pause or reduction, Trumps wording is vague

“It’s not entirely clear from the way President Trump phrased it whether it was a true suspension (of tariffs) or just a reduction in the reciprocal tariffs to 10%,” said John Canavan, chief economist at Oxford Economics in New York. “But in any case, it’s clear that Trump is backing off some of his worst tariff threats here, and I think that’s clearly a net positive for risk assets that can be sustained. One thing it doesn’t do is remove the uncertainty that comes from the fact that tariff levels seem to change on a daily basis.”

INTERACTIVE BROKERS Chief Market Strategist: Doubtful that US tariffs will be restored within 90 days, uncertainty has decreased but not disappeared

INTERACTIVE BROKERS chief market strategist Steve Sosnick said, Trumps suspension of tariffs was definitely a surprise, considering the administration had been saying they would not remove them and that they were non-negotiable. It was a very understandable relief rally. We now have to wonder if the tariffs will be reinstated in 90 days. This will hamper companies from planning for the immediate future and providing guidance for the current quarter. The uncertainty has decreased, but it has not completely gone away.

FX Executive Director: Trumps 90-day tariff suspension will only bring more uncertainty

Regarding Trumps announcement of a 90-day suspension of reciprocal tariffs, Amarjit Sahota, executive director of FX, said, There is currently huge volatility in the market, especially the stock market, which has reacted well to the news. But the question that follows is: why did we see this reprieve today, and is it really a good idea? Personally, I dont think it is a good idea: a 90-day suspension will only bring more uncertainty to the 90 days. This looks like a very bad policy decision, or at least it was poorly planned or executed.

Chief market strategist at Philadelphia National Investment Management Group: An 8% increase in the Nasdaq within 20 minutes is no healthier than an 8% decrease

“It’s definitely good news that Trump is pausing tariffs because it suggests the negotiations are in a good enough place that they feel they’ve accomplished what they needed to accomplish through the initial conversations,” said Mark Hackett, chief market strategist at National Investment Management Group in Philadelphia. “But I want to offer a very important caveat because an 8% increase in the Nasdaq in 20 minutes is not much healthier than an 8% decrease, so I’d be careful right now.”

How will the crypto market perform in the future?

Arthur Hayes: RMB exchange rate may be the key, whether China will fight back remains a mystery

BitMEX co-founder Arthur Hayes wrote, This is not the policy response I expected, but it is still a response nonetheless. The question remains: Will China fight back? He also pointed out that investors can pay attention to how the Peoples Bank of China adjusts the RMB exchange rate on Thursday to determine the next step.

Ali Martinez: If BTC holds $80,700, it may rise to $84,000 to $87,000

Crypto analyst Ali Martinez wrote that BTC is breaking out of the range. If the $80,700 support level can be maintained, BTC is expected to rise, with the target pointing to $84,000 or even $87,000.

Santiment: Markets reacted sharply to tariff news, but it is still a temporary relief from ongoing problems

Analysts at blockchain analysis platform Santiment said that although the latest tariff suspension policy is positive news and temporarily relieves some market tensions, it is still a temporary relief for an ongoing problem. Just 48 hours ago, the market experienced a buy rumors, sell facts reaction due to misreporting of tariff suspensions, and then the United States announced on Tuesday that it would impose tariffs of up to 104% on Chinese goods, which undoubtedly exacerbated the markets disappointment again.

Analysts point out that the current fundamentals remain fuzzy and difficult to rely on, and the market relies more on the greed and fear of the public as a reverse indicator. In these unprecedented times, the markets overreaction to tariff news has become a signal worthy of close attention.

Grayscale Research: Tariffs trigger stagflation shock, which may be good for Bitcoin

“The tariffs are delivering a stagflation shock,” said Zach Pandl, head of Grayscale Research. “Stagflation is generally negative for returns on traditional assets, but positive for scarce commodities like gold (and potentially Bitcoin).”

Currently, although there has been some positive news in the short term that has eased some market sentiment, the continued uncertainty over tariffs continues to weigh on the market.