Key Points

Major U.S. data days: Mays jobs report, the Federal Reserve meeting, inflation data, and first quarter GDP/PCE updates often trigger sharp fluctuations in the crypto market as traders re-price expectations for rate cuts.

Global policy shift: From the European Central Bank to the Reserve Bank of Australia, more and more central banks are leaning dovish or pausing rate hikes, which has driven buying of risky assets and is generally good for Bitcoin and some altcoins.

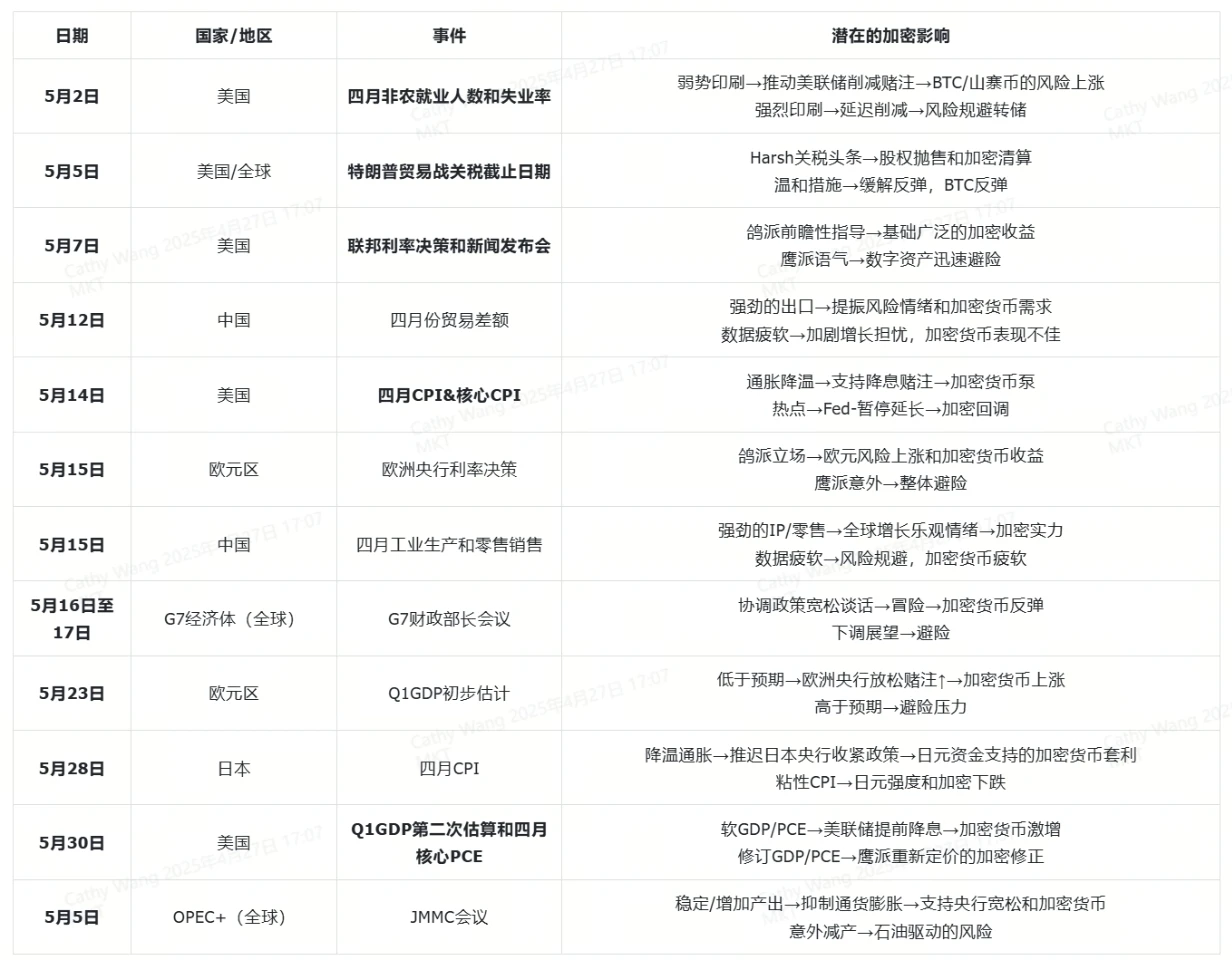

Geo-economic variables: Pay attention to new tariff news, OPEC+ production discussions and G7 finance ministers meetings, which may trigger unexpected market conditions. Key dates: May 5, 7, 14, 15 and 30.

Volatility windows: The crypto market never sleeps and can fluctuate wildly during off-peak trading hours. Be sure to set up hedging, stop-loss, and position management in advance around major calendar events.

In May 2025, a number of key data and policy decisions that will affect market sentiment will be released intensively - including the US employment report on May 2, the Federal Reserves interest rate decision on May 7, the Eurozone economic data on May 15, and Chinas trade and retail sales data to be released in the middle of the month.

For cryptocurrency traders, understanding the potential impact of each data release on market risk appetite is key to capturing the start of Bitcoin market or avoiding sudden declines.

The following are key events and market layout guidelines for this month to help you cope with possible market fluctuations.

Table of contents

Why Macro Factors Still Matter to Crypto Markets

The United States: The Leader of Global Market Sentiment

Europe and the UK: Monetary easing, inflation and growth prospects

China: Trade, retail and production data

Japan: Focus on CPI (Consumer Price Index)

Other central bank developments and important events

Crypto Market Trends: Key Considerations

Macroeconomic Background

The global economy has entered a new phase of slowing growth and falling inflation from the post-epidemic boom. Developed economies face the risk of stagnant growth, Chinas export engine is coping with a new round of tariffs from the United States, and emerging markets are struggling to balance high commodity prices with the risk of continued capital outflows. Geopolitical risk points - from trade war conflicts to ongoing conflicts in local regions - have exacerbated market risk aversion, while global central banks have generally shifted to monetary easing or a pause in interest rate hikes.

For cryptocurrency traders, the tug-of-war between slowing growth and loose policies continues to bring market volatility and trading opportunities.

Why Macro Factors Still Matter to Crypto Markets

Bitcoin and other crypto assets no longer fluctuate independently, but move in sync with stocks, bonds and the dollar. When central banks signal rate cuts or expand their balance sheets, risk-on funds tend to flow into the crypto market, driving weeks of gains. But if there is an unexpected hawkish turn or weak economic data, risk aversion sentiment may trigger a rapid sell-off in the crypto market, and the leverage effect will further exacerbate the decline.

Paying attention to key macro events in advance will help traders predict market volatility windows, seize rising opportunities, and avoid downside risks.

The United States: Leading Global Market Sentiment

The US continues to play a leading role in global risk appetite. The Federal Reserve’s May meeting and a series of high-frequency data releases will be in focus:

May 2 – Employment report (April nonfarm payrolls and unemployment rate)

The U.S. Bureau of Labor Statistics will release April nonfarm payrolls data and the unemployment rate.

Bullish scenario: If the data is weaker than expected, it may strengthen the markets bets on rate cuts and boost risky assets including crypto assets.

Bearish scenario: Strong job growth and falling unemployment could delay the Fed’s interest rate cuts, weighing on stocks and Bitcoin .

Image Credit: Trading Economics

May 7 – Federal Open Market Committee (FOMC) rate decision and press conference

The Fed is widely expected to keep the federal funds rate in the 4.25 – 4.50% range but update its economic forecasts.

Dovish signals (such as a decrease in the number of officials supporting rate hikes, an earlier timetable for rate cuts, etc.) often trigger an emotional rebound in the crypto market.

Any opposition to rate cuts or hawkish rhetoric could quickly trigger a sell-off in risky assets.

Image Credit: fxstreet

May 14 - April Consumer Price Index (CPI) and Core CPI

U.S. consumer inflation data for April is about to be released, among which the core CPI, which excludes food and energy prices, is the Federal Reserves preferred inflation indicator.

If the year-on-year growth rate approaches 2%, it will strengthen deflationary expectations and increase the attractiveness of crypto assets.

If the data unexpectedly rises, it may weigh on risk assets as the Fed may stick to its policy stance of maintaining higher interest rates for longer

Image Credit: Trading Economics

May 30 – Second estimate of Q1 GDP and April core PCE

The U.S. Bureau of Economic Analysis (BEA) will release its second estimate of first-quarter GDP, as well as the core personal consumption expenditures price index (PCE) for April, which is closely watched by the Federal Reserve.

If GDP is weak and PCE falls: it will strengthen expectations for a rate cut in June and boost the performance of risky assets.

If GDP is revised upward or PCE remains stubbornly high: it could dampen the market’s dovish expectations and put pressure on crypto assets.

Image Credit: Trading Economics

Europe and the UK: Easing, inflation and growth

Europe is still in a low growth and low inflation environment, with several important policy meetings in May:

Early May - Eurozone May CPI preliminary value

Preliminary inflation data released by Eurostat will set the stage for the next policy move by the European Central Bank (ECB).

If the year-on-year growth rate further approaches 2%, it will support the easing trend and drive inflows into risky assets.

If inflation unexpectedly rises, it could dampen market expectations for rate cuts.

May 8 – Bank of England (BoE) interest rate decision

The Bank of England will decide the base interest rate (currently 5.00%).

If it chooses to maintain or lean towards a rate cut, it will be in line with the global dovish trend and help boost sentiment for crypto assets.

If hawkish signals are unexpectedly released, it may hit market risk appetite.

May 15 – European Central Bank (ECB) interest rate decision

The market expects the deposit rate (currently 2.25%) to remain unchanged or to be slightly reduced by 10 basis points.

If the press conference conveys a dovish message, it is expected to boost the stock market and the crypto market.

If it suggests that interest rates will remain high for longer, it may trigger a sell-off in risky assets.

May 23 – Eurozone first quarter GDP preliminary estimate

GDP growth data will verify whether the region is heading into a recession.

If growth is weak, it will further strengthen the markets expectations of easing.

If growth unexpectedly improves, it is expected to support the performance of cyclical assets.

China: Trade, Retail and Production

A series of data from China to be released in mid-May will serve as a bellwether for global demand:

May 12 – Trade balance for April

Export and import data will provide clues on global logistics and demand sentiment.

If export growth is strong, it will help support the performance of risky assets.

A sharp drop in exports could weigh on commodity-related crypto asset strategies.

Image Credit: Trading Economics

May 15 - Industrial production and retail sales in April

Industrial output measures manufacturing momentum, while retail sales reflect consumer confidence.

If the data is better than expected, it is expected to boost global economic growth expectations and be good for crypto assets.

Any weak data could shake market sentiment, which is already wary of the impact of the trade war.

Japan: Focus on CPI data

While the Bank of Japan (BoJ) typically holds monthly meetings, there was no policy decision in May and the focus turned to inflation data:

No Bank of Japan meeting in May

Still, any signs of a policy shift in speeches by Governor Kazuo Ueda or Bank of Japan officials could trigger market volatility.

May 28 – Consumer Price Index (CPI) for April

Japan is to release consumer inflation data for April, with year-on-year growth expected to be close to 3%.

A retreat in inflation would dampen expectations for the Bank of Japan to tighten policy, which typically helps ease pressure on yen-funded carry trades in crypto assets.

If inflation remains stubbornly high, it could push up the yen, weighing on risk assets.

Other central banks and important events

In addition to the major economies, there are several dates worth noting:

May 6 – Reserve Bank of Australia (RBA) interest rate decision

The Reserve Bank of Australia will hold its meeting against the backdrop of falling inflation; traders will be closely watching for any hint of a rate cut.

May 14 – Reserve Bank of New Zealand (RBNZ) interest rate decision

The decision of the Reserve Bank of New Zealand will affect risk sentiment in the Australia-New Zealand (ANZ-Pacific) region and influence the flow of funds for crypto assets funded by the Australian dollar.

May 29 – Bank of Canada (BoC) interest rate decision

The Bank of Canada’s outlook on interest rates and economic growth could impact crypto asset strategies related to the Canadian dollar and risk appetite in North America.

May 5 – OPEC+ Joint Ministerial Monitoring Committee (JMMC) meeting

The mid-term meeting will assess member countries production implementation; any potential changes in production guidance could affect oil prices and broader risk asset sentiment.

May 16-17 – G7 Finance Ministers’ Meeting

Coordination on trade, debt, and sanctions policies could change global risk pricing expectations and occasionally trigger a re-evaluation of the crypto market as a whole.

Image Credit: World Atlas

Crypto Market Dynamics: Key Points to Watch

Inflation and interest rate expectations

Lower CPI/PCE data will strengthen market bets on rate cuts and increase the attractiveness of cryptocurrency arbitrage trading and margin leveraged positions.

If a hawkish surprise occurs, it could trigger a rapid deleveraging of the market and lead to a chain liquidation of Bitcoin and highly leveraged altcoin positions.

Risk appetite switch

The crypto market is often highly correlated with stock market trends: when the stock market rises under the stimulus of loose policies, crypto assets tend to perform more strongly.

Geopolitical conflicts or policy mistakes could trigger a synchronized sell-off in risky assets.

Relevance Index

Institutional capital flows are increasingly dependent on cross-asset correlation models; high-beta crypto assets (such as DeFi tokens and small-cap currencies) experience more dramatic ups and downs in market fluctuations.

Tariffs and trade conflict risks

Any new U.S. tariff announcements or developments in U.S.-China trade negotiations could overshadow the economic data itself and trigger sharp intraday fluctuations in the crypto market.

Strategy Advice for Crypto Traders

Schedule reminders and advance planning

Mark each important date in your trading platform calendar. Before high-impact data releases, you can build small, risk-aware positions to benefit from directional moves while avoiding excessive leverage.

Hedging and option combination strategies

Around May 7 and May 14, using options collars or calendar spreads to hedge risk while limiting downside risk while retaining upside potential.

When event risk is binary (such as a hawkish or dovish Fed divergence), consider using straddles to capture volatility.

Strict stop loss

Stops should be tightened during FOMC meetings and CPI data releases; avoid adjusting positions during the initial 30-60 minutes after the release, as there is high volatility and you should avoid being shaken out of the market.

Cross-asset signal monitoring

Pay attention to the U.S. Treasury yields and the U.S. dollar index (DXY) in real time. A decline in the U.S. dollar or long-term Treasury yields is usually a leading indicator of a stronger crypto market.

Position management and diversification

Avoid concentrating funds on a single crypto asset; during uncertain periods, diversify your investments among large-cap currencies (such as BTC, ETH) and defensive tokens (such as projects based on stablecoin returns).

Be careful during non-trading hours

The crypto market operates 24/7, and key data is often released during US market closures. It is recommended to use automatic triggers or limit orders to manage risk.

Conclusion

May 2025 marks a critical turning point for both the macro and crypto markets.

The Federal Reserves interest rate decision on May 7, U.S. employment and inflation data, and a series of central bank meetings from the European Central Bank (ECB) to the Reserve Bank of Australia (RBA) will bring traders multiple risk appetite/risk aversion turning points. At the same time, the development of the trade war, OPEC+ production guidance and the joint statement of G7 finance ministers also increase the possibility of sudden changes in market sentiment.

Experienced crypto traders know that strict schedule management and event-driven strategies can turn uncertainty into opportunity. By marking every important release in advance, properly controlling the size of positions, and hedging with options or inverse products, traders can more calmly deal with the sharp fluctuations in the market. Real-time attention to cross-asset signals (such as Treasury yields, the US dollar index, and stock market breadth indicators) can provide early warnings before market trends change, allowing crypto asset positions to be adjusted in a timely manner.

Ultimately, the key to a successful May is to find a balance between sticking to your trading convictions and staying flexible. Whether it is to deploy Bitcoin longs based on the Feds dovish stance or to adopt a short strategy when inflation unexpectedly rises, building a structured trading plan around the economic calendar will help traders seize opportunities in a rapidly changing market.

As global central banks gradually shift from tightening to easing and geopolitical conflicts continue to occur, the ability to keenly capture macro signals and respond quickly will be the key to determining the success or failure of a transaction.

The market schedule in May is busy, but for prepared crypto traders, it also contains abundant excess return (Alpha) opportunities.

About XT.COM

Founded in 2018, XT.COM currently has more than 7.8 million registered users, more than 1 million monthly active users, and more than 40 million user traffic within the ecosystem. We are a comprehensive trading platform that supports 800+ high-quality currencies and 1,000+ trading pairs. XT.COM cryptocurrency trading platform supports a variety of trading products such as spot trading , leveraged trading , and contract trading . XT.COM also has a safe and reliable NFT trading platform . We are committed to providing users with the safest, most efficient, and most professional digital asset investment services.