Original title: A New Bitcoin Metaprotocol Emerges: Alkanes

Original author: AJC @AvgJoesCrypto @MessariCrypto Head of Corporate Research

Original translation: Ray.bit @bitlaser_btc

I am Ray.bit, a man with Bitcoin passion and technical insight, X (Twitter): https://x.com/bitlaser_btc

Messari @MessariCrypto , one of the most authoritative and professional investment research institutions in Web3, analyzed the Alkanes protocol and expressed a very optimistic view that the Bitcoin ecosystem will enter a period of explosive growth in the second half of 2025.

Metaprotocols are second-level protocols built on top of Bitcoin that embed and interpret custom data in Bitcoin transactions to enable additional functionality and uses not natively supported by the Bitcoin network. So far, Ordinals and Runes are the most prominent examples, facilitating the issuance of non-fungible tokens (NFTs) and fungible tokens on Bitcoin. However, a significant limitation of these metaprotocols is that they primarily support token issuance and basic peer-to-peer transfers, with limited functionality in terms of broader programmability. This lack of functional depth has caused adoption and innovation to stagnate after the initial hype phase.

Alkanes is a new meta-protocol developed by @oylwallet that aims to address the shortcomings of Ordinals and Runes by introducing a complete smart contract environment based on WASM. In theory, Alkanes can directly implement decentralized applications on the Bitcoin underlying layer, such as automated market makers (AMM) DEX, lending protocols, derivatives, yield aggregators, etc.

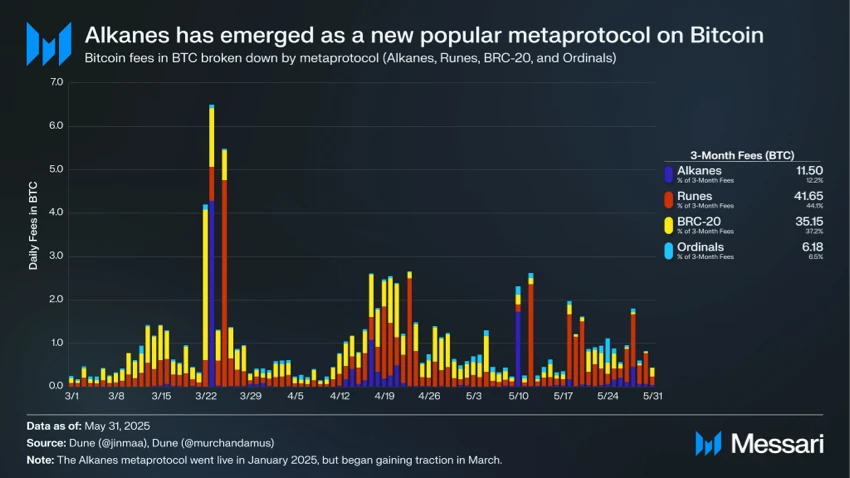

Alkanes first went live in January 2025, but did not start to gain traction until March. Over the next 3 months, transactions interacting with the Alkanes protocol consumed a total of 11.5 BTC in gas fees. To date, most of the activity has been concentrated in the following areas:

• Tokens created using the Alkanes Token Standard, such as $DIESEL and $METHANE (@MethaneFund).

• NFTs created using the Orbitals standard, such as @AlkanePandas and @OylyOnAlkanes.

• ClockInSystem, a smart contract developed by @jin_maa, allows users to “punch in” and have their transactions included in a “special block” that occurs every day. Users who successfully include transactions will have their “punch in” count increased and move up the leaderboard.

In comparison, Alkanes have higher demand than Ordinals (excluding BRC-20 tokens), which generated 6.2 BTC in transaction fees during the same period, but Runes (41.7 BTC) and BRC-20 tokens (35.2 BTC) have slightly lower demand. Alkanes currently offers most of the same features as Runes and Ordinals. Currently, most transactions occur on @idclub_ord , a PSBT-based Alkanes trading platform. In other words, Alkanes-based assets are traded in much the same way as Runes and Ordinals.

However, once the OYL AMM goes live next year, Alkanes will significantly improve the user experience of existing meta-protocols. Although current trading activity still relies on PSBT-based markets like iDclub, the launch of a native AMM DEX will mark a significant shift. For the first time, Bitcoin-based assets will be traded through smart contract-driven liquidity pools, which will eliminate the friction of manual order matching and simplify trading. In this sense, Alkanes has the potential to bridge the UX gap between Bitcoin and the modern smart contract ecosystem, positioning itself as the base layer for more expressive and DeFi-native activity on Bitcoin.

Essentially, Alkanes represents the next evolutionary stage of the Bitcoin meta-protocol, shifting the narrative from static token issuance to dynamic application deployment. By enabling smart contracts directly on Bitcoin, it opens the door to decentralized applications such as automated market makers (AMMs), lending markets, and NFT platforms. With early signs of adoption and a growing ecosystem, Alkanes has the potential to become the base layer for more expressive and composable Bitcoin-native applications.