Market Overview

This week, the cryptocurrency market showed a volatile downward trend. Bitcoin continued its volatile downward trend last week. Altcoins generally followed the market and showed a volatile downward trend. The market sentiment index fell slightly from 30% last week to 28%, and was generally in a bearish range.

Stablecoin Market Dynamics

The overall stablecoin market maintained its upward trend last week, showing a trend of simultaneous rise in USDT and USDC:

USDT: The market value reached 155.7 billion US dollars, with a weekly increase of 0.32%. Although it continued to rise, the weekly incremental funds were less than 1 billion US dollars for the first time recently. It can be seen that the intensity of capital inflows has begun to decline.

USDC: The market value is 61.4 billion US dollars, a weekly increase of 0.33%, ending the downward trend last week and starting a small increase.

This phenomenon deserves investors attention: Although the market value of USDT continues to rise, it only increased by US$500 million this week, ending the previous six consecutive weeks of weekly growth of more than US$1 billion, indicating that the strength of funds entering the market mainly from non-US users has declined, and the uses of USDT are relatively diverse, so the actual funds entering the Crypto market may be less than US$500 million; the market value of USDC has risen this week, reflecting that funds mainly from US investors have begun to re-enter the market. Although only US$200 million entered this week, the inflow amount is not large, but this signal needs to be continuously monitored.

Market performance is divided

This week, the cryptocurrency market showed obvious structural differentiation: Bitcoin maintained a volatile downward trend, while altcoins suffered a sharp decline. This differentiation reflects the risk-averse nature of funds concentrating on relatively safe assets in an uncertain environment, and Bitcoins status as a safe haven for cryptocurrencies is reflected.

Geopolitical risks escalate

Intensified conflict in the Middle East: The conflict between Israel and Iran continues to escalate, and the US military deployment around Iran continues to increase, and the market is increasingly concerned about the USs direct involvement in the conflict.

Risk transmission mechanism: Geopolitical tensions directly impact risky assets through the path of declining risk appetite. Cryptocurrencies, as high-risk assets, are the first to be hit, especially altcoins with relatively poor liquidity, which are more vulnerable.

Monetary policy expectations shift

The Feds stance becomes more hawkish: Although the interest rate was kept at 4.5% at this weeks meeting, as expected, the minutes showed a subtle change in the attitude of policymakers.

Expectations for interest rate cuts were significantly reduced: the number of officials who would not cut interest rates increased to 7, and the expectation for interest rate cuts in 2025 was reduced from two to one. This shift in expectations directly hit the markets expectations for liquidity easing.

Adjustment of economic expectations: The Federal Reserve simultaneously lowered its growth expectations and raised its inflation expectations. This stagflation concern further exacerbated market pessimism.

Positive policy factors

Positive legislative progress: The GENIUS Act was passed by a large margin in the U.S. Senate, providing policy support for the development of the cryptocurrency industry.

Stablecoin market prospects: Finance Minister Bessant expects the stablecoin market to reach $3.7 trillion by the end of 2029. This expectation injects confidence into the long-term development of the cryptocurrency ecosystem.

Limited sentiment boost: Despite favorable policies, the boosting effect of positive factors is relatively limited under the dual pressure of geopolitical risks and tightening monetary policy.

Investment strategy advice: Be cautious and defensive

Risk aversion is rising: As the Middle East geopolitical crisis continues to ferment, global risk aversion is likely to further heat up, which will continue to suppress risky assets.

Increased market fragility: With multiple uncertainties intertwined, the volatility and fragility of the cryptocurrency market have increased significantly, and the risk of flash crashes cannot be ignored.

Prudent strategy advice: Investors should remain highly cautious, focus on the development of geopolitical events, appropriately control their positions, and guard against sudden risk events that may cause major impacts on their investment portfolios.

Market Outlook

The cryptocurrency market will continue to face severe challenges in the coming week. The further escalation of geopolitical conflicts in the Middle East and the possibility of US military intervention will continue to push up global risk aversion. Coupled with the expectation of monetary policy tightening strengthened by the hawkish stance of the Federal Reserve, Bitcoin is expected to find a difficult balance between its safe-haven attributes and risky asset characteristics, while altcoins may face greater selling pressure and liquidity depletion risks. Under the multiple pressures of key technical support levels facing tests, institutional funds remaining cautious, and retail panic sentiment that may further ferment, the market is at risk of flash crashes and chain reactions. Investors should adopt a defensive strategy, strictly control positions and leverage, pay close attention to geopolitical dynamics and important economic data, and guard against violent market fluctuations caused by emergencies.

Next week forecast

Bullish target: AERO

AERO: Analysis of the revaluation of ecological leaders and strategic opportunities under the catalysis of Coinbases integration of Base chain DEX

Last weekend, at the 2025 Cryptocurrency Summit, Max Branzburg, Vice President of Consumer Product Management at Coinbase, announced that Coinbase will integrate the DEX on the Base chain into the main application, and future applications will have built-in DEX transactions.

The fundamental impact of liquidity integration

Liquidity foundation brought by platform scale effect

As the industrys leading exchange, Coinbase has over 100 million registered users and 8 million monthly active trading users, with customer assets valued at $428 billion. This huge user base and asset scale provide an unprecedented source of liquidity for the Base Chain DEX. When these users directly access the Base Chain DEX through the Coinbase main application, a large-scale liquidity import effect will be formed.

Structural advantages of institutional funds

Data shows that the proportion of institutional client trading volume on the Coinbase platform continues to rise, reaching 82.05% (US$256 billion) in Q1 2024, while retail trading accounts for only 18%. This institutional-led trading structure means that the funds entering the Base chain have greater stability and larger single transaction sizes, which is conducive to improving the trading depth of DEX and reducing slippage.

Competitive advantages brought by market concentration

As the largest DEX project in the Base ecosystem, Aerodromes trading volume accounts for about 60% of the entire Base ecosystem DEX. According to the liquidity aggregation effect, the newly added liquidity will flow to the platform with the largest trading volume and the best depth first. Aerodromes market leadership makes it the main undertaker of Coinbases liquidity.

The proportion of transaction volume of each DEX in the Base chain (data source: https://dune.com/x_drome_analytics/base-dex-landscape )

Economic model analysis of Aerodrome benefits

The positive cycle mechanism of token economics

Incentive structure for revenue sharing

Aerodrome adopts a 100% revenue distribution mechanism: veAERO holders receive 100% of the fees and bribes from their voting pools, and LPs receive 100% of AERO emission incentives. This design ensures that the growth of protocol revenue can be directly converted into increased revenue for token holders.

Staking-driven supply crunch

When Coinbase liquidity imports increase Aerodromes trading volume and revenue, the APY of veAERO holders will increase significantly. High yields will encourage more users to stake AERO as veAERO, thereby reducing the circulating supply of AERO and forming a positive cycle in which the imbalance between supply and demand drives up prices.

Realizing the value of governance weight

veAERO holders decide the distribution of AERO emissions by voting, and this governance weight is more valuable in a high liquidity environment. As the protocol revenue grows, the economic value of governance rights will attract more long-term investors to participate in staking.

The carrying capacity advantage of the technical architecture

Efficiency improvement through integration of multiple technologies

Aerodrome combines the token economics of Curve/Convex, the centralized automated market maker (clAMM) of Uniswap v3, and the optimized Solidly codebase. This technical fusion ensures that the platform can efficiently handle large-scale liquidity and provide users with better transaction execution results.

The competitive advantage of capital efficiency

clAMM technology enables efficient capital exchange and can provide lower slippage and better price execution under the same liquidity conditions. When Coinbase liquidity is injected, this technical advantage will be further amplified, consolidating Aerodromes competitive position in the Base ecosystem.

Long-term guarantee of scalability

Aerodromes technical architecture has good scalability and can handle large-scale capital inflows without affecting system stability. This provides a technical foundation for its long-term benefits from Coinbase integration.

On-chain data analysis

TVL of Aerodrome (data source: https ://de fillama.com/protocol/aerodrome )

As can be seen from the above figure, after Aerodromes TVL reached a low point in early April, it began to rebound rapidly and has now reached US$1 billion, a rebound of 56%.

Aerodrome transaction volume (data source: https://defillama.com/protocol/aerodrome )

As can be seen from the above figure, Aerodromes trading volume has seen a rapid and substantial increase after Coinbase integrated the DEX on the Base chain into the main application, and it is very consistent with Coinbases trading hours. The peak trading volume is often concentrated from Monday to Friday, while the trading volume on Saturdays and Sundays shows a significant decline. It can be seen that funds from Coinbase have obviously flowed into Aerodrome.

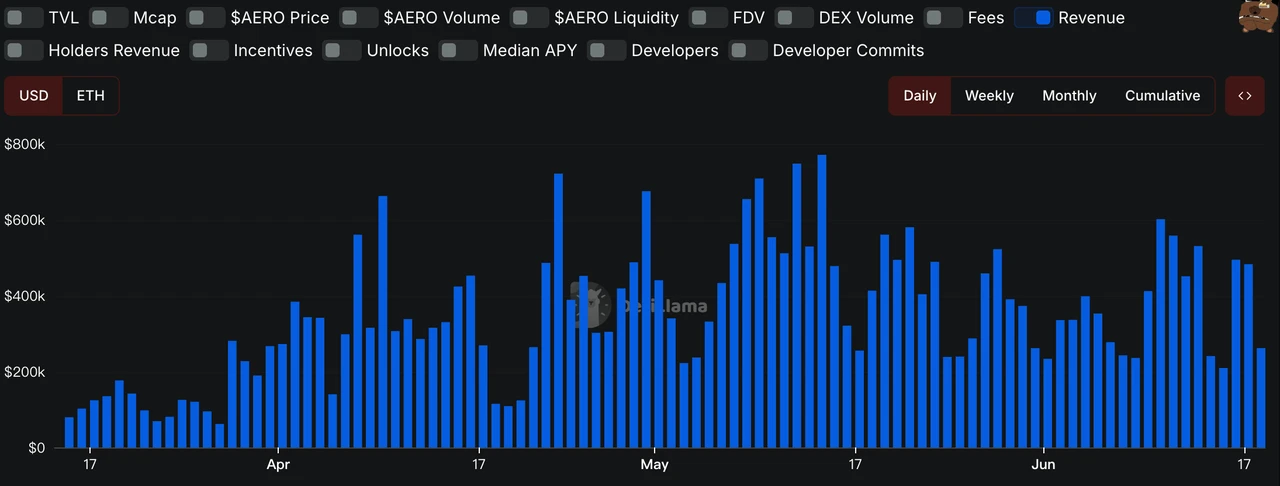

Aerodrome project revenue (data source: https://defillama.com/ protocol/aerodrome? de xVolume=falsetvl=falserevenue=true )

As can be seen from the above figure, Aerodromes project revenue has also seen a rapid increase along with trading volume after Coinbase integrated the DEX on the Base chain into the main application, and it is also very consistent with Coinbases trading time.

Base ecosystem projects ranked by revenue (data source : https://defillama.com/chain/base )

As can be seen from the above figure, Aerodromes project revenue ranks first among all projects on the Base chain, with a daily revenue of around $500,000 (average daily revenue of around $600,000)

Base ecosystem DEX projects ranked by transaction volume (data source: https://defillama.com/chain/base )

As can be seen from the above figure, Aerodromes trading volume has far exceeded Uniswap, reaching US$525 million (the average daily trading volume is about US$600 million), ranking first among the DEX projects in the Base ecosystem.

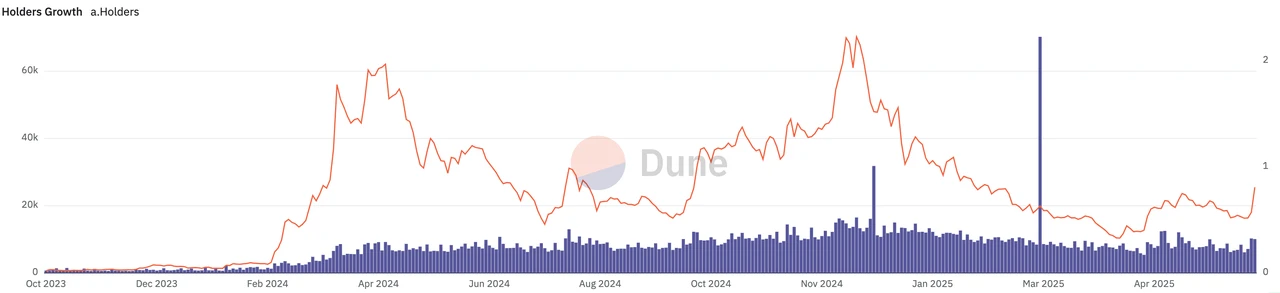

AERO token holding address (data source : https://dune.com/thechriscen/aerodrome-analysis )

As can be seen from the above figure, the number of addresses holding AERO tokens has increased rapidly after Coinbase announced the integration of DEX on the Base chain into the main application. It can be seen that this policy has promoted users holding of AERO tokens.

Summarize

From the analysis of Coinbases policy of integrating Base chain DEX, it can be seen through on-chain data that the theoretical analysis is highly consistent with the actual data, verifying the true effectiveness of the favorable conditions: after the integration policy was announced, Aerodromes transaction volume surged to an average of US$600 million per day, surpassing Uniswap, and project revenue ranked first in the Base chain at an average of US$600,000 per day. TVL rebounded by 56% to exceed US$1 billion, and the number of AERO holding addresses grew rapidly. The data showed obvious Coinbase transaction time characteristics, which directly confirmed the capital inflow effect.

Bearish targets: ALT, REZ

ALT: Token unlocking risk warning and price downward trend analysis under triple pressure

Project fundamentals analysis

As a decentralized elastic Rollup-as-a-Service (RaaS) protocol, AltLayer focuses on providing scalable second-layer solutions for blockchain applications. The project has certain innovation and practical value at the technical level, but the main challenge it currently faces is the unfavorable market environment.

Factors that may cause the market environment to deteriorate

The overall performance of the Ethereum ecosystem is currently weak, and the markets doubts about Layer-2 solutions are growing. The main problem is that Layer-2 is considered to be the root cause of the obstruction of the development of the Ethereum ecosystem, resulting in a serious split in market liquidity. This negative market sentiment directly affects the market performance and capital inflow of all Layer-2 related projects, including AltLayer.

Project usage and attention declined

As the popularity of the entire Layer-2 track has decreased, the actual utilization rate of AltLayer as a RaaS project has been significantly insufficient, and both market attention and capital injection have declined significantly. This vicious cycle has further weakened the fundamental support and market confidence of the project.

Token unlocking pressure analysis

Unlocking scale and time node: On June 25, 195 million ALT tokens will be unlocked, accounting for 1.95% of the total locked amount, and the unlocking scale is relatively large.

Unlocking object structure: According to the linear unlocking diagram in the white paper, the main beneficiaries of this unlocking are investment institutions and project teams. Such holders usually have a strong motivation to cash out.

Summarize

Taking into account the triple pressures of deteriorating market environment, declining project attention and large-scale token unlocking, ALT tokens face a relatively severe price downside risk. Potential selling by institutions and teams may trigger a chain reaction in a market environment with limited liquidity, which will have a significant negative impact on token prices.

REZ: Analysis of price downside risks due to deteriorating fundamentals and large-scale unlocking

Project fundamentals and positioning

As a liquidity re-staking protocol based on the EigenLayer ecosystem, Renzos core value lies in simplifying complex staking mechanisms for end users and promoting rapid cooperation with EigenLayer node operators and Active Verification Services (AVS). The project relies on EigenLayers innovative infrastructure in terms of technical architecture and has certain ecological value and application prospects.

External environmental pressure analysis

The overall weakness of the Ethereum ecosystem: The current Ethereum ecosystem performance continues to be sluggish, which directly affects the activity and capital inflow of the entire Ethereum DeFi ecosystem.

The staking market is shrinking: The ETH staking rate has dropped to 28.35%. The decline in the ETH staking rate reflects the markets lack of confidence in staking returns. This trend directly impacts the basic demand of the Restaking track, causing related projects to lose market attention and financial support.

ETH staking fund flow (data source: https://dune.com/hildobby/eth2-staking )

Project operation data deteriorated

TVL has shrunk significantly: Renzo’s TVL plummeted from US$1.83 billion at the beginning of the year to US$945 million, a drop of nearly 50%. This data reflects the continued outflow of funds and a serious lack of market confidence.

Renzo TVL (data source: https://defillama.com/protocol/renzo?revenue=falsedevMetrics=falsedevCommits=falsetvl=truefees=false )

Revenue continues to decline: The average daily revenue of the project is only maintained at a low level of around US$5,000, and it shows a continuous downward trend, indicating a significant decline in user activity and protocol usage. The continued deterioration of revenue data directly reflects the continuous decline in the frequency of market users use of the Renzo protocol, forming a negative cycle effect.

Renzo project revenue (data source: https://defillama.com/protocol/renzo?revenue=truedevMetrics=falsedevCommits=falsetvl=falsefees=false )

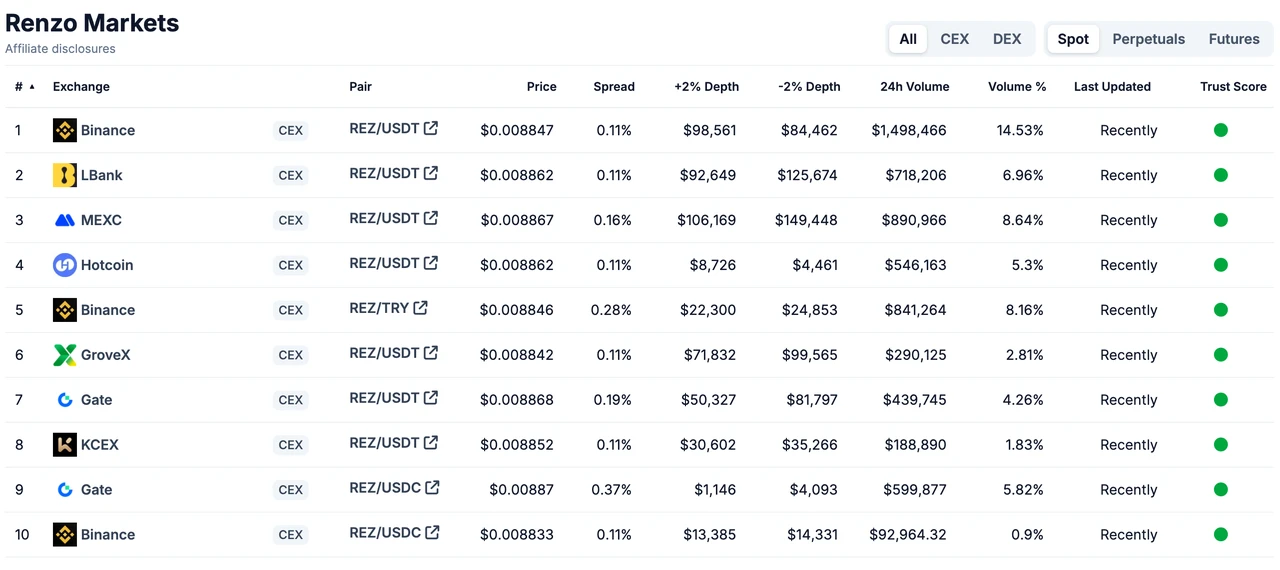

Token Unlocking Risk Assessment

Unlocking scale and structure: 423 million REZ tokens will be unlocked on June 29, accounting for 4.24% of the total locked amount. Considering that the current total circulation rate is only 32.63%, this unlocking will significantly increase the market circulation supply.

Unlocking object risk: According to the linear unlocking plan in the white paper, this unlocking mainly involves investment institutions and project teams. Such holders have strong cash-out motivation and selling pressure in the current market environment.

Insufficient market capacity: With the Restaking track being sluggish and participants scarce, the daily trading volume of REZ tokens is only around US$2.25 million, and the markets ability to absorb the increase in large token supply is seriously insufficient.

Daily trading volume of REZ tokens (data source : https://www.coingecko.com/en/coins/renzo )

Summarize

Renzo is facing the dilemma of a deteriorating macro environment, continued deterioration of fundamental data, and the unlocking of large amounts of tokens. Against the backdrop of a weak Ethereum ecosystem and a decline in both project TVL and revenue, the concentrated unlocking of 423 million REZ tokens may trigger severe selling pressure and have a significant negative impact on token prices.

Market Sentiment Index Analysis

TOTA L3 (data source: https://c n.tradingview.com/chart/KBp zaW 4 x/?symbol=ICEUS%3A DXY )

The market sentiment index dropped slightly from 30% last week to 28%. BTC fell 0.78% this week, ETH fell 0.97% this week, and TOTA L3 rose 0.73% this week. Altcoins were generally in a short range and maintained a panic level.

Overall overview of market themes

Data source: SoSoValue

In terms of weekly returns, the PayFi track performed the best, while the AI track performed the worst.

PayFi track: XRP, BCH, XLM, and LTC account for a large proportion in the PayFi track, with a total share of 99.09%. This week, their increases and decreases were -3.41%, 12.35%, -8.96%, and -3.12%, respectively. It can be seen that the projects in the PayFi track have mixed ups and downs, which is better than the projects in other tracks that are all on a downward trend, making the PayFi track the best performing.

AI track: TAO, FET, RENDER, WLD, VIRTUAL, and FARTCOIN account for a large proportion of the AI track, with a total share of 91.63%. This week, their increases and decreases were -10.79%, -7.96%, -14.59%, -12.28%, -17.68%, and -20.83%, respectively. It can be seen that the average decline is higher than that of projects in other tracks, so the AI track performed the worst.

Crypto Events Next Week

On Monday (June 23), NFT NYC 2025 was held in New York, USA.

On Tuesday (June 24), Federal Reserve Chairman Powell delivered his semi-annual monetary policy testimony in the House of Representatives.

Friday (June 27): U.S. Core PCE Price Index for May; Final U.S. University of Michigan Consumer Confidence Index for June

Summarize

This week, the cryptocurrency market showed a structural decline under the interweaving of multiple negative factors. The market sentiment index fell slightly from 30% to 28%, entering the bearish range. Although the stablecoin market maintained its growth trend, the incremental funds of USDT fell below the threshold of 1 billion US dollars for the first time, reflecting a significant weakening of the intensity of capital inflows, while the slight rebound of USDC suggested that US funds began to enter the market tentatively. Geopolitical risks, the hawkish stance of the Federal Reserve, and the differentiation of fundamentals of various tracks together constitute the triple pressure facing the current market.

In the current market environment, investment strategies should focus on accurately grasping structural opportunities and effectively avoiding risks. As the leading DEX in the Base ecosystem, AERO has benefited from the catalysis of Coinbases integration policy. On-chain data has verified the significant improvement in its trading volume, revenue, and TVL, representing a typical case of finding policy-driven growth in a market with strong uncertainty.

Looking ahead to the next week, investors should pay close attention to Powells monetary policy testimony on June 24, the core PCE data on June 27, and the latest developments in the Middle East geopolitical situation. These key events will directly affect market risk appetite and liquidity expectations. It is recommended to adopt a defense-oriented, selection-assisted strategy. On the basis of strictly controlling positions and leverage, focus on high-quality targets with policy catalysts and fundamental improvements, and at the same time remain highly vigilant about projects that are about to face large-scale unlocking. Through precise risk management and opportunity identification, seek stable investment returns in a challenging market environment.

Company Introduction

Weekly crypto market insights, produced by FrontierLab. If you would like to receive regular updates or stay in touch, feel free to contact us.

Explore more → frontierlab.xyz | Contact us → @FrontierLab_ZH