Geopolitical tensions escalated further over the weekend when U.S. bombers launched swift and precise strikes on three deep-seated nuclear facilities in Iran. The U.S. reported extensive damage to the facilities, but has yet to officially confirm whether the nuclear material had been destroyed or evacuated in advance.

The market instinctively sold risky assets, and cryptocurrencies, as the only asset class that continued to trade on weekends, were naturally the first to be hit. When the attack began, BTC fell about 4% from over 102k to around 99k. It should be noted that in the eyes of traditional financial investors, cryptocurrencies continue to be regarded as cutting-edge/high-risk assets.

The market had originally worried about a sharp risk reaction at the start of Mondays trading due to the escalation, but such concerns quickly dissipated in early Asian trading, and a view gradually emerged in the market that this action may represent a successful escalate to de-escalate, that is, to promote progress in negotiations through a key show of force. In addition, the practical difficulties of blocking the Strait of Hormuz (most of Irans oil and gas exports go to China) also eased market concerns about an uncontrolled surge in oil prices.

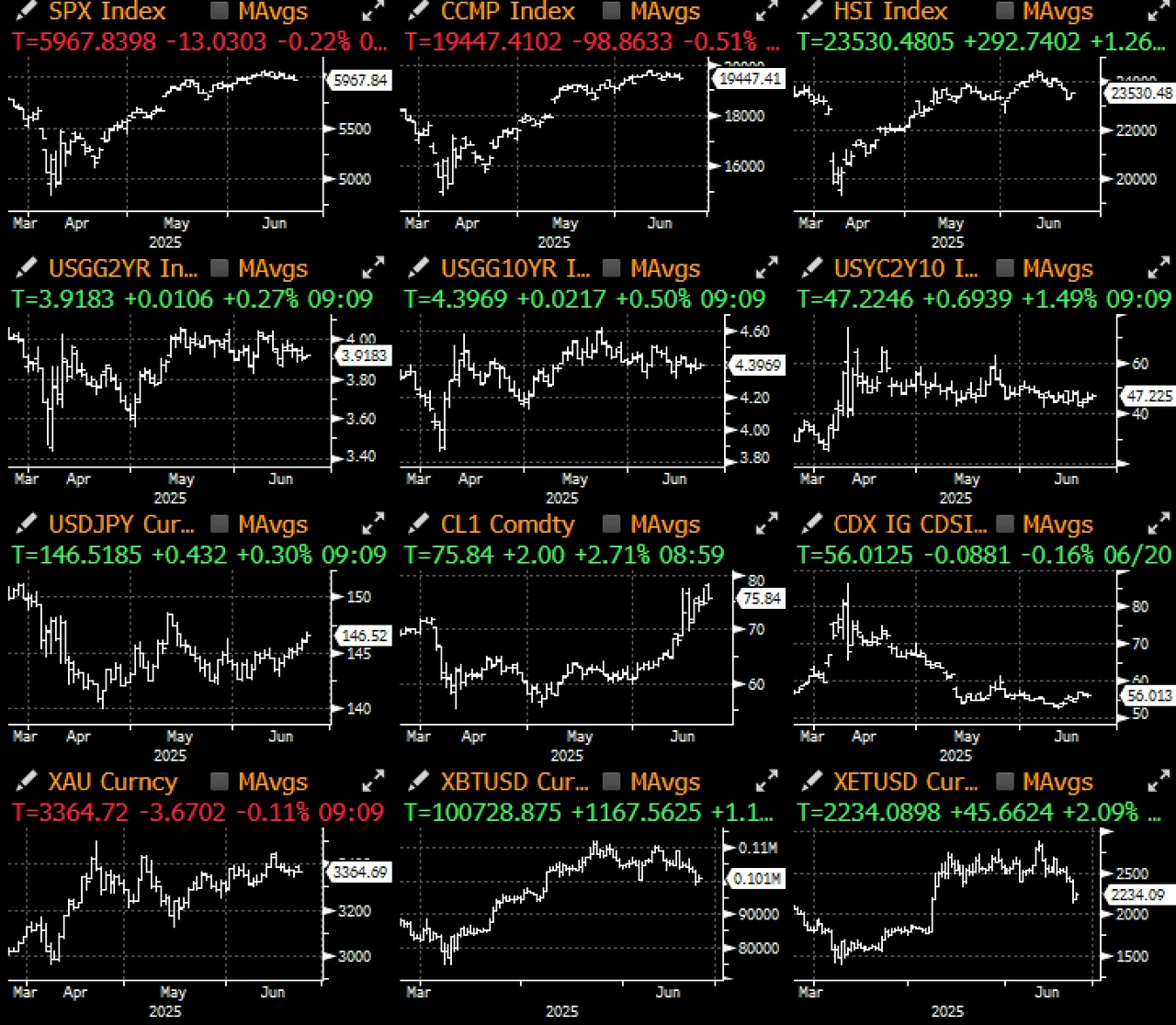

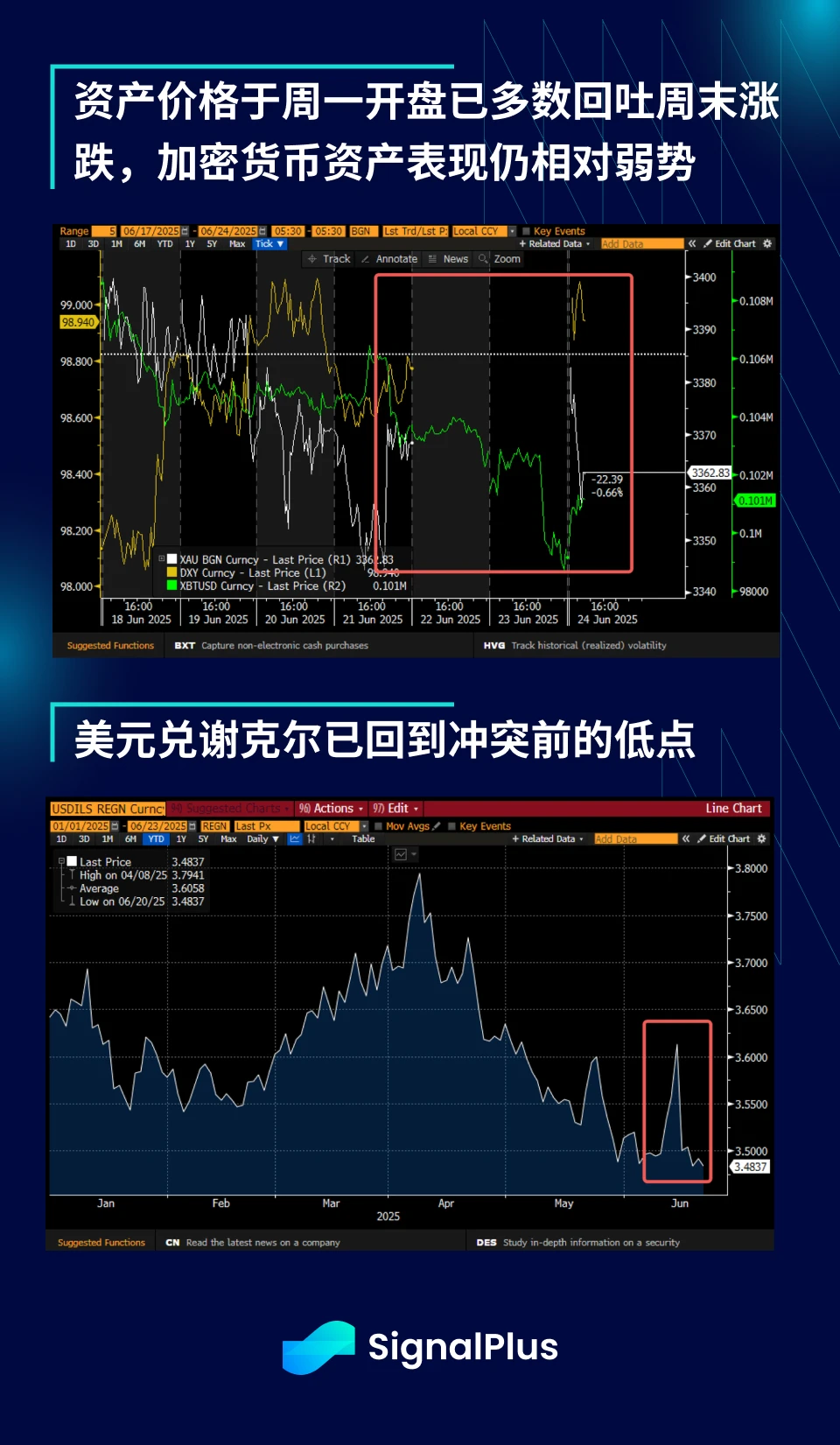

Price performance in early trading on Monday seemed to confirm this view, with U.S. stock futures almost back to Fridays levels, oil prices stabilizing at around $75 a barrel, spot gold giving up earlier gains, and the dollar falling back to pre-conflict lows against the Israeli new shekel.

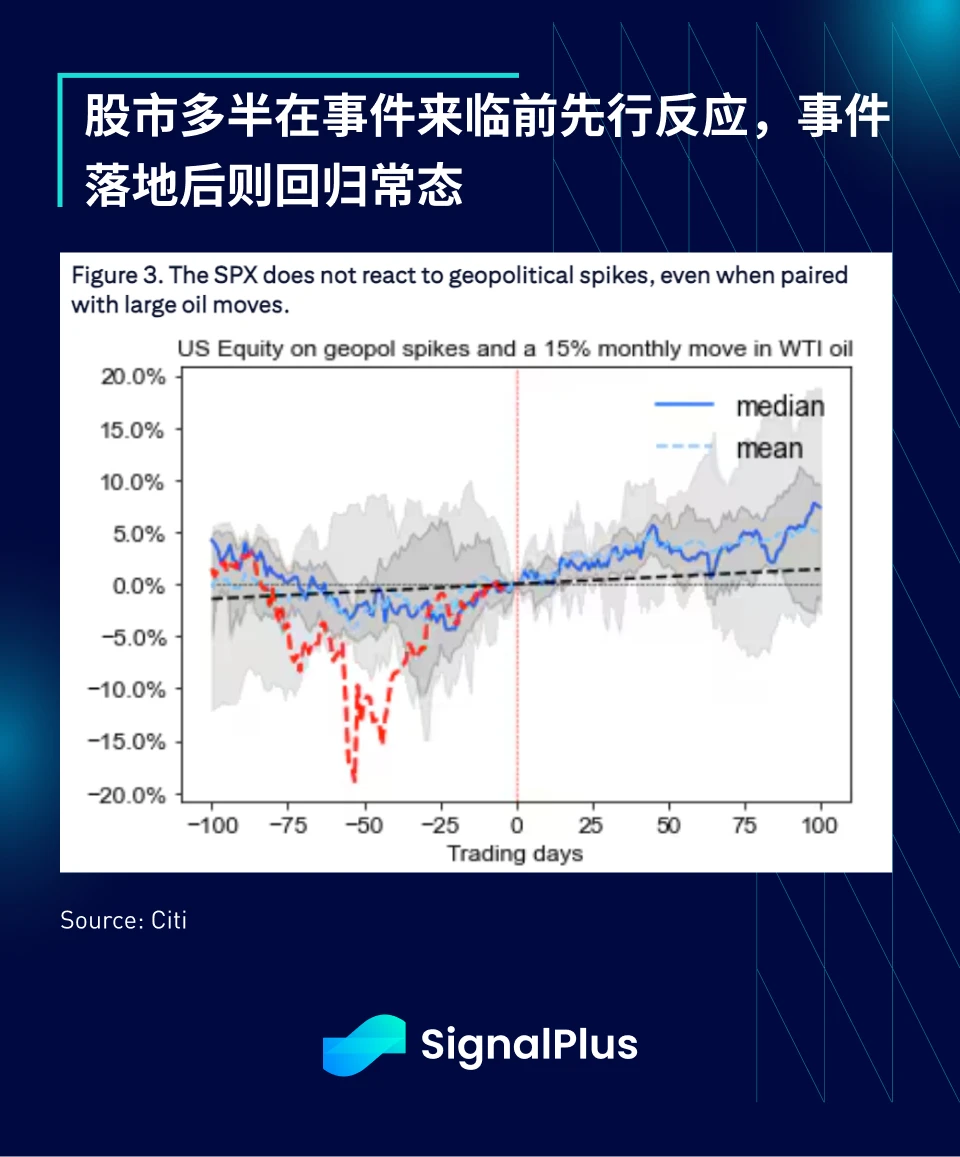

Generally speaking, geopolitical stresses tend to be short-lived and have only a temporary impact on the stock market. A recent Citi study showed that the SPX tends to react negatively before the risk of a geopolitical event heats up, but once the event actually occurs, it usually performs well. This conclusion is reasonable if we believe that the stock market is efficient and can proactively reflect known and foreseeable unknown risks. Unless there is an unimaginable WMD attack or other extreme sudden event, we expect risk markets to gradually adjust to this round of conflict and refocus on ongoing tariff negotiations and economic developments.

In the interest rate market, despite the markets constant discussion on the huge interest expenses and potential inflation risks in the United States, the implied volatility of interest rates has fallen back to a medium-term low, indicating that the market does not expect central banks in developed countries to take substantive actions. The overall forward interest rate trajectory has also remained stable, and bond traders have returned to normal operations.

At the same time, according to the majority view on Wall Street, the current market liquidity (i.e. the financial situation) is still quite abundant, allowing risk assets (such as stocks) to continue to climb the wall of worry. Even after Liberation Day, the ongoing Russia-Ukraine conflict and the tensions between Israel and Iran, the SPX index has been able to rebound strongly.

Although macro observers may still hold a pessimistic stance in the long term, investors vote with actual funds. Amid various warnings, risk sentiment remains clearly bullish, the overall economy continues to operate, and corporate profits are rising steadily.

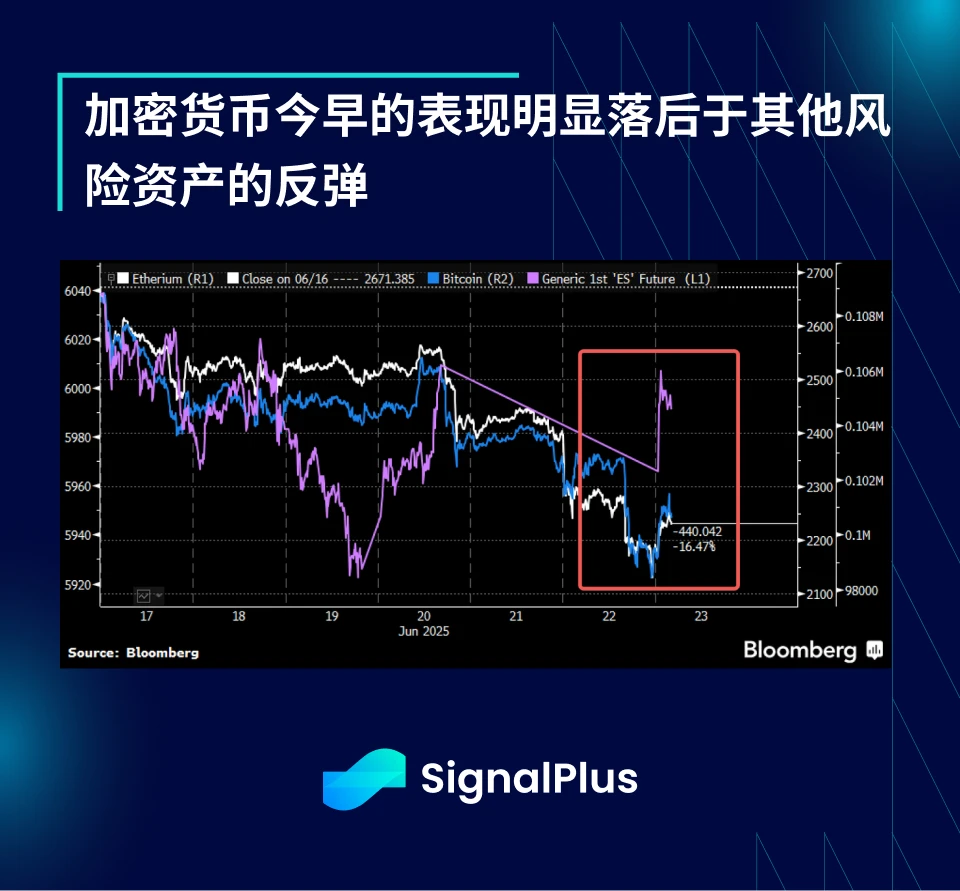

Unfortunately, this was not the case for the cryptocurrency market. BTC fell 4% to around $98.9k, while ETH plunged about 10% to $2,150, hitting its lowest intraday level since early May. As news of the Iranian airstrike broke, cryptocurrencies, as the only assets still trading, naturally sold off, with over $1 billion in futures positions liquidated over the weekend.

Although stocks, crude oil and gold prices have reversed their weekend trends in early trading, cryptocurrency prices have struggled to rebound in sync. Investors were still in long positions when the conflict occurred, and the books have fluctuated sharply in the past month. Cryptocurrency prices have not been able to effectively break out since the first quarter, and BTC has also struggled to break through the highs of February.

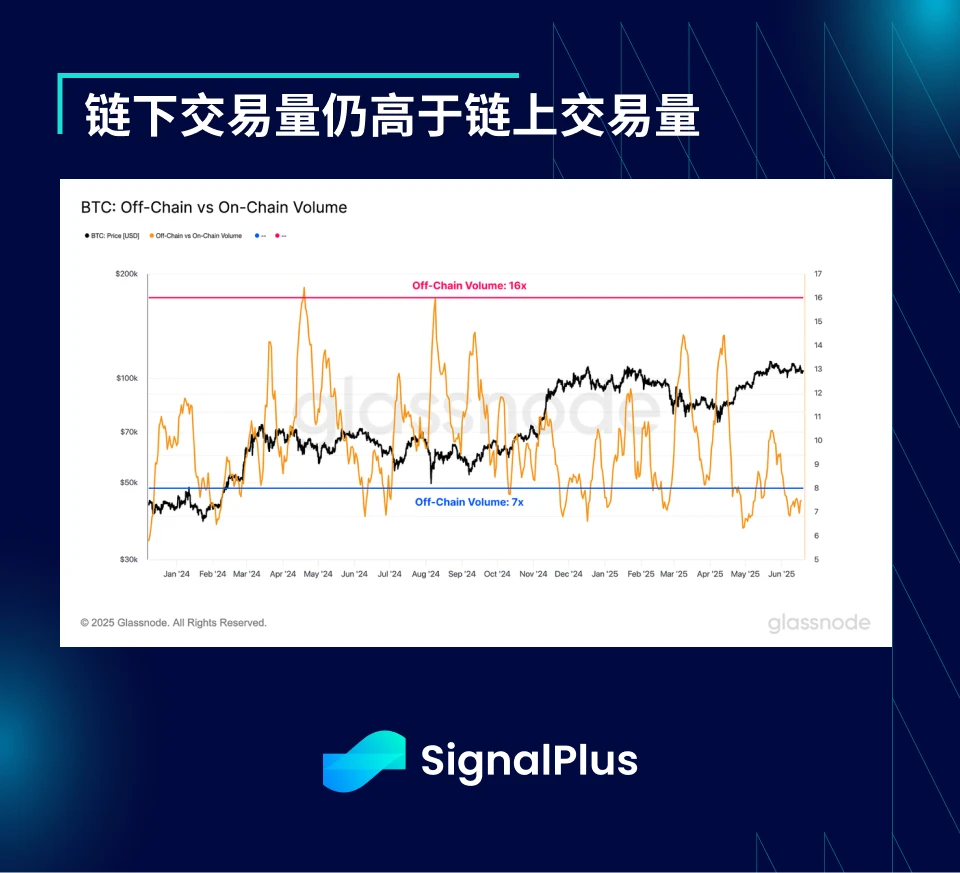

Glassnode did an excellent analysis last week showing that despite the strong interest in BTC from the TradFi community, on-chain trading activity has slowed significantly. In short, off-chain OTC trading is active as mainstream investors try to gain BTC exposure through traditional instruments (e.g. ETFs, futures), but on-chain activity has not recovered since FTX, which is reflected in the sluggish performance of DeFi and Altcoins and the lack of new narratives (except stablecoins/RWA).

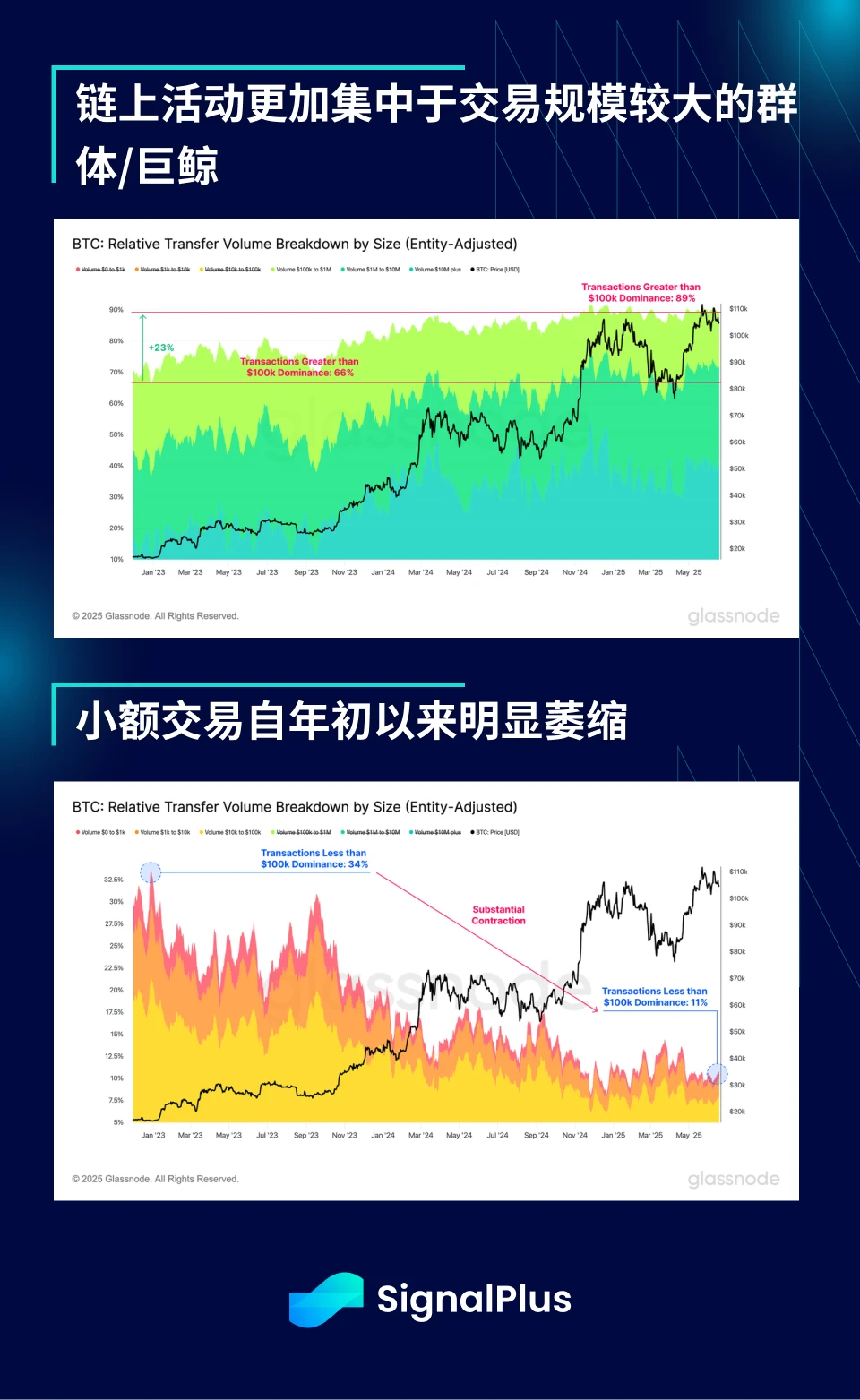

Similarly, the power law distribution phenomenon is becoming more common in the cryptocurrency field. On the one hand, BTCs market capitalization dominance continues to rise, and on the other hand, its own on-chain transfer activities are increasingly concentrated in large wallets. According to Glassnode data, the proportion of transactions with a single amount of more than $100,000 has increased from 66% in 2022 to 89% today, further confirming the view that whales dominate the market, and small accounts have less and less influence and participation in the market.

Unfortunately, as the cryptocurrency industry matures and institutionalization accelerates, this trend is likely to continue, and this is perhaps inevitable.

In addition, as BTC becomes a mainstream asset class, it must naturally follow the operating rules of other macro assets, which means that it is dominated by participants with the largest capital volume, and off-chain transactions are far more active than on-chain transactions. Long-term observers point out that this cycle is different from the past, lacking the popularity of altcoins or the rise of new narratives, but this is actually expected. TradFi participants prefer to participate in the market through tools they are familiar with (off-chain). Self-custody and on-chain narratives have limited appeal to this group. However, because the scale of funds they have is much larger than that of native users, their behavior and preferences will increasingly dominate price trends.

This change in macro correlation can be observed through the sharp increase in BTC futures open interest, which is the main reason why we have seen more frequent liquidation gaps (such as last weekend) since the fourth quarter of 2024. Off-chain activities and futures-driven price changes mean higher macro correlation, and the impact of the native momentum of cryptocurrencies is weaker.

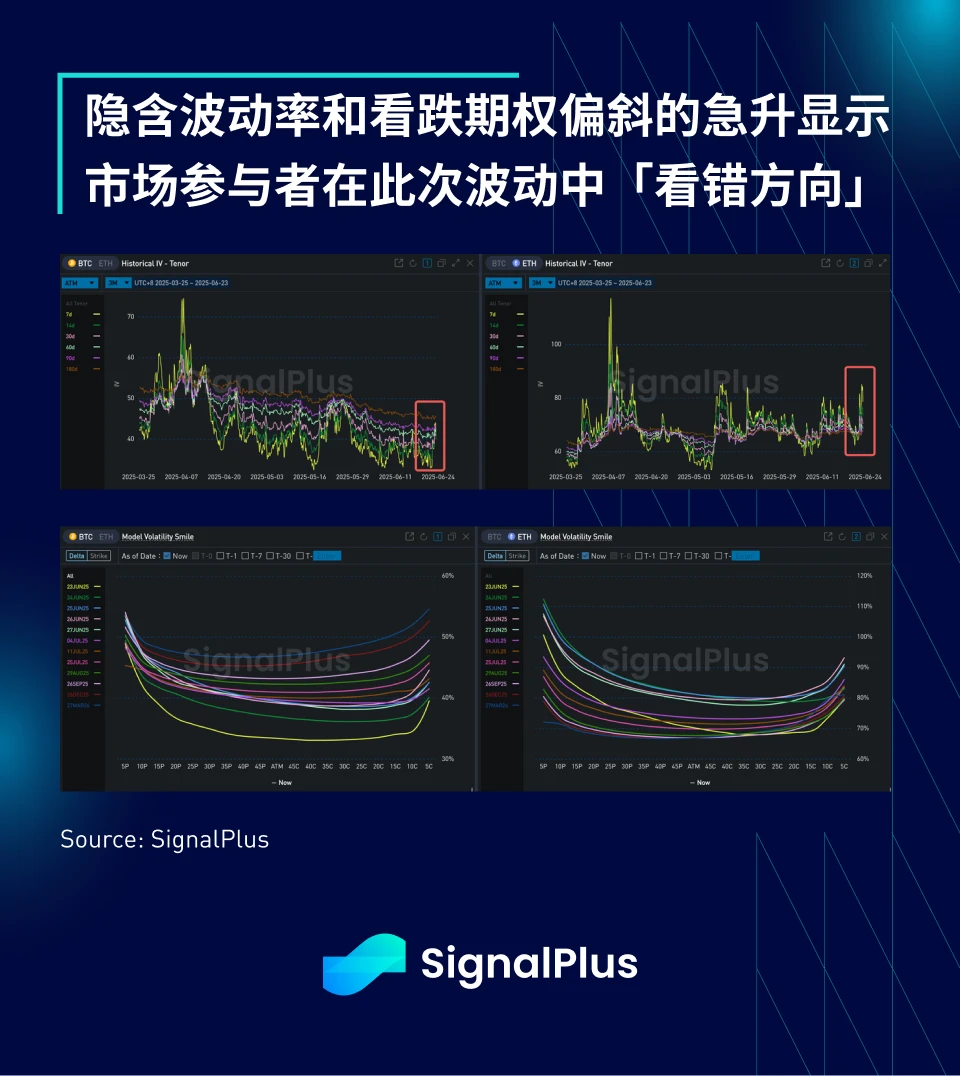

At the same time, the activity of cryptocurrency options trading has also increased significantly in this cycle. The overall market daily trading volume has climbed from $1.5 billion in 2024 to a recent high of $5 billion, indicating that increasingly mature market participants are adopting more options strategies to manage risks. Welcome to continue to contact the SignalPlus team, we will wholeheartedly assist you in exploring more options strategy applications!

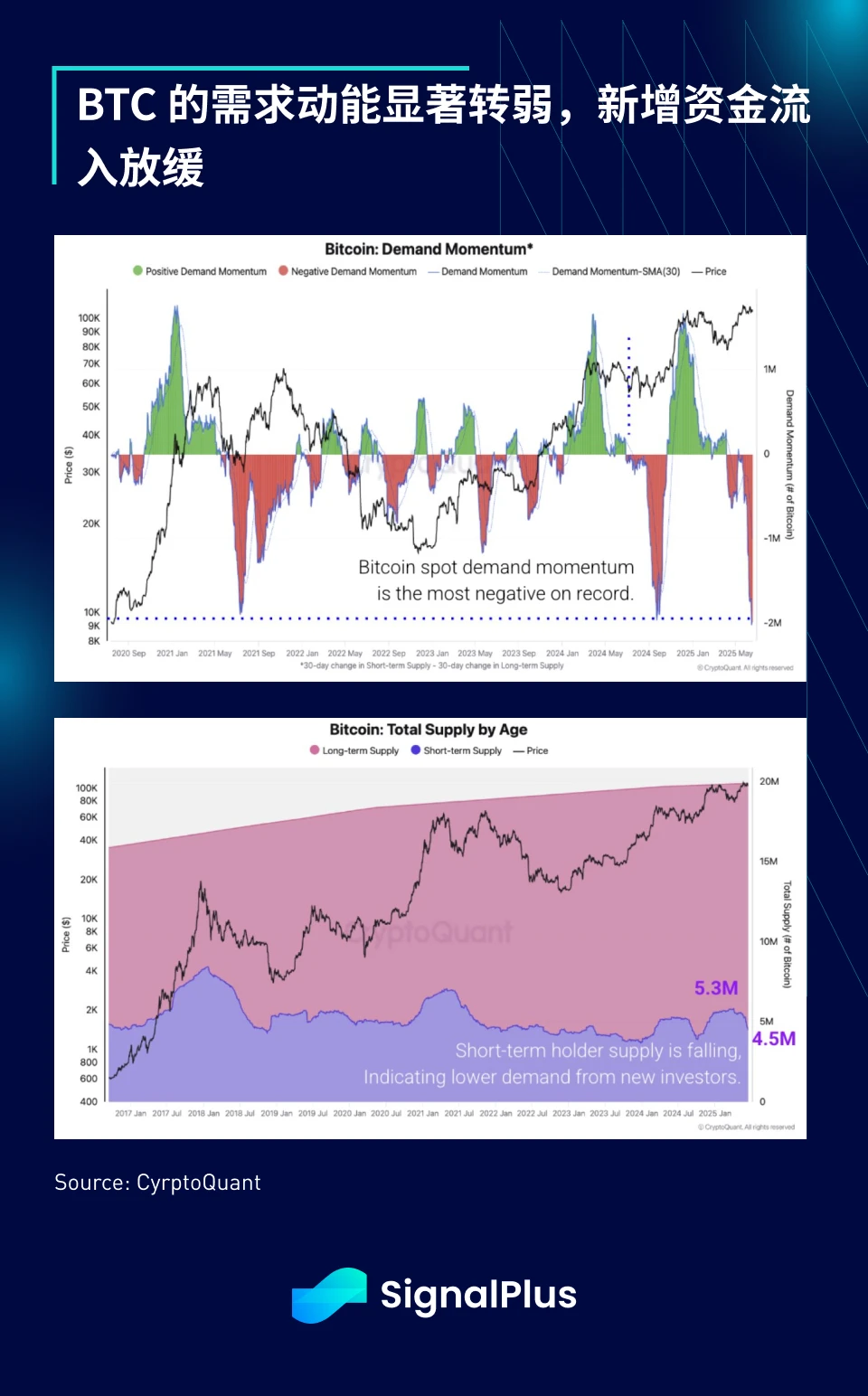

Back to the current point in time, BTCs demand momentum seems weak. According to CryptoQuant data, its demand momentum index hit a record low. Even though the market has a series of favorable policies (such as the Genius Act, Hong Kongs stablecoin policy, etc.), the price still cannot effectively break through the previous high, and the supply of short-term holders (i.e. new funds) seems to be slowing down.

In the volatility market, price changes show that traders were caught off guard by this volatility, and implied volatility suddenly soared from the previous unilateral downward trend. There was significant buying of put options, especially ETH, indicating that market participants sought downside protection while holding long deltas, and the market may face further downward pressure in the short term.

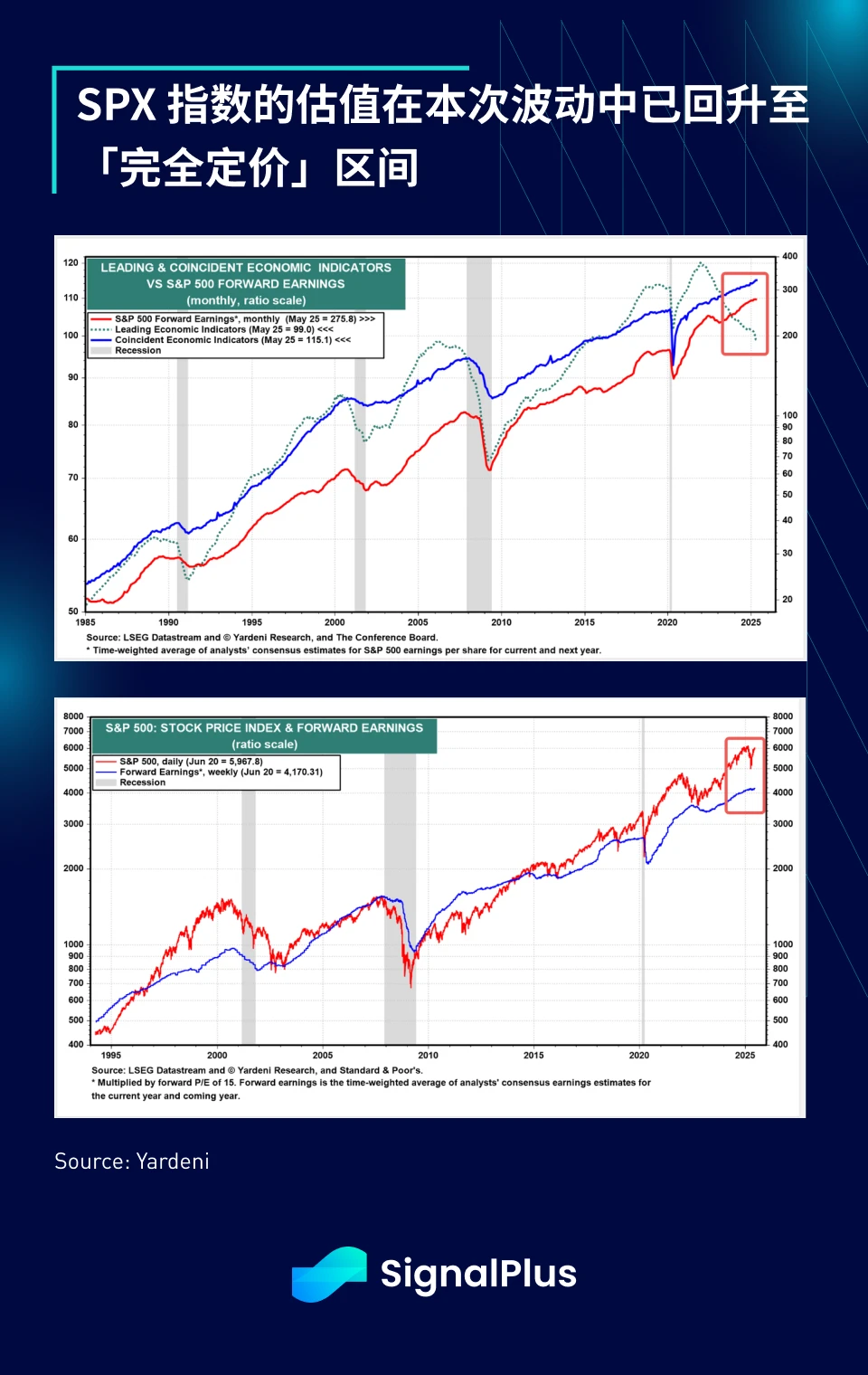

Looking ahead, we think the market will quickly digest and move past this geopolitical event, and may even see some sort of peace breakthrough in both Russia and Iran, as well as real progress in tariff negotiations. The market will naturally rally on these developments, but the focus will then return to the high valuation issue, with the SPX already pricing in +12% earnings growth expectations at $296 (equivalent to 20x forward P/E), while the US economy actually seems to be slowing down (employment indicators, CEO layoff expectations, etc.).

As we have always said, we do not recommend shorting the current stock market uptrend, but we believe that this rebound is coming to an end, and we should focus on reducing risks at this stage. In the cryptocurrency market, given the recent price performance, we are more worried that the market may see a larger adjustment to clean up the recent high-chasing funds and floating chips. We are also wary of the financial engineering operation of many listed companies to include BTC in the companys currency holdings, which may be a negative FOMO signal.

Keep calm, control risks, and may cool heads prevail over the current situation. Good luck to everyone.

You can use the SignalPlus trading vane function for free at t.signalplus.com/crypto-news/all, which integrates market information through AI and makes market sentiment clear at a glance. If you want to receive our updates in real time, please follow our Twitter account @SignalPlusCN, or join our WeChat group (add the assistant WeChat, please delete the space between English and numbers: SignalPlus 666), Telegram group and Discord community to communicate and interact with more friends.

SignalPlus Official Website: https://www.signalplus.com