Original | Odaily Planet Daily ( @OdailyChina )

Author | Dingdang ( @XiaMiPP )

As Bitcoin broke through $120,000 and Ethereum returned to $3,400, market discussions about the return of the altcoin season have gradually heated up.

There is still uncertainty about whether the cottage season is really coming, but if a new round of capital inflow cycle begins, what investment opportunities should we pay attention to? Starting from a subjective perspective, this article discusses five tracks: asset reserves, ETF candidates, RWA, DeFi, and stablecoins. The projects mentioned in this article are not short-term speculative targets, but based on the current market trends, the author believes that they may attract more structural attention in the future. The cryptocurrency market fluctuates violently, with risks and opportunities coexisting. Investments must remain rational and combined with independent judgment. This article is for reference only and does not constitute any investment advice.

How is this round of “copycat season” different from previous ones?

In the past, when people mentioned the “altcoin season”, what came to mind was often the successive rise of sectors, and the increase of small and medium-sized market capitalization currencies was much higher than that of Bitcoin. However, this time, the dominant logic of the market may be different.

First, the macro environment has changed significantly. With the breakthrough progress of the GENIUS Act and the CLARITY Act, the regulatory boundaries have become clearer, and the entry barriers of traditional financial institutions are being cleared. Unlike the barbaric growth driven by retail investors and speculative sentiment in the past, the participation of institutional funds will change the ownership of market pricing power. Their funds are larger, their investment logic is more rigorous, they pay more attention to compliance and fundamentals, and they have a stronger voice in the market. This means that in the future, areas that can attract large institutional funds are likely to become market hotspots.

This has already shown a clear differentiation in the current market trend. Although the price of Bitcoin has reached a record high, the price recovery of most altcoins since the plunge at the beginning of the year is generally less than 50%, and some are even less than 30%. Market liquidity continues to concentrate on Bitcoin, and the liquidity of altcoins has tightened significantly. The driving force behind this differentiation mainly comes from the following two aspects:

1. Institutional drive for Bitcoin spot ETF

The flow trend of Bitcoin spot ETFs clearly reflects the profound impact of institutions on the market. From the data, the large-scale net inflow of Bitcoin spot ETFs is basically synchronized with the three-stage structural rise of Bitcoin . Institutional funds have become an important driving force for Bitcoin price trends.

Bitcoin spot ETF net inflow and outflow

Bitcoin price trend (weekly)

2. The siphon effect of listed companies hoarding coins

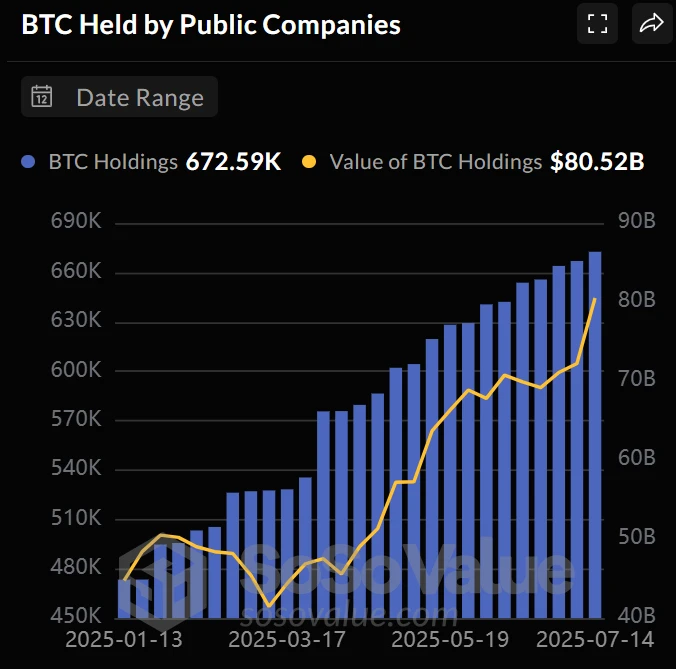

The accelerated hoarding of Bitcoin by US-listed companies has further amplified the capital siphoning effect. On the one hand, the increase in Bitcoin holdings by listed companies has directly pushed up market demand and strengthened the narrative of Bitcoins scarcity; on the other hand, the hoarding of coins has become a traffic password to attract market attention, driving up the stock prices of related companies . In the past six months, the speed at which listed companies have increased their holdings of Bitcoin has significantly accelerated, with an increase of up to 40%. As of July 2025, the total amount of Bitcoin held by listed companies is about 673,000, accounting for 3.2% of the total supply of Bitcoin. Among them, Strategy alone accounts for 2.8% of the share.

Bitcoin holdings trends of listed companies

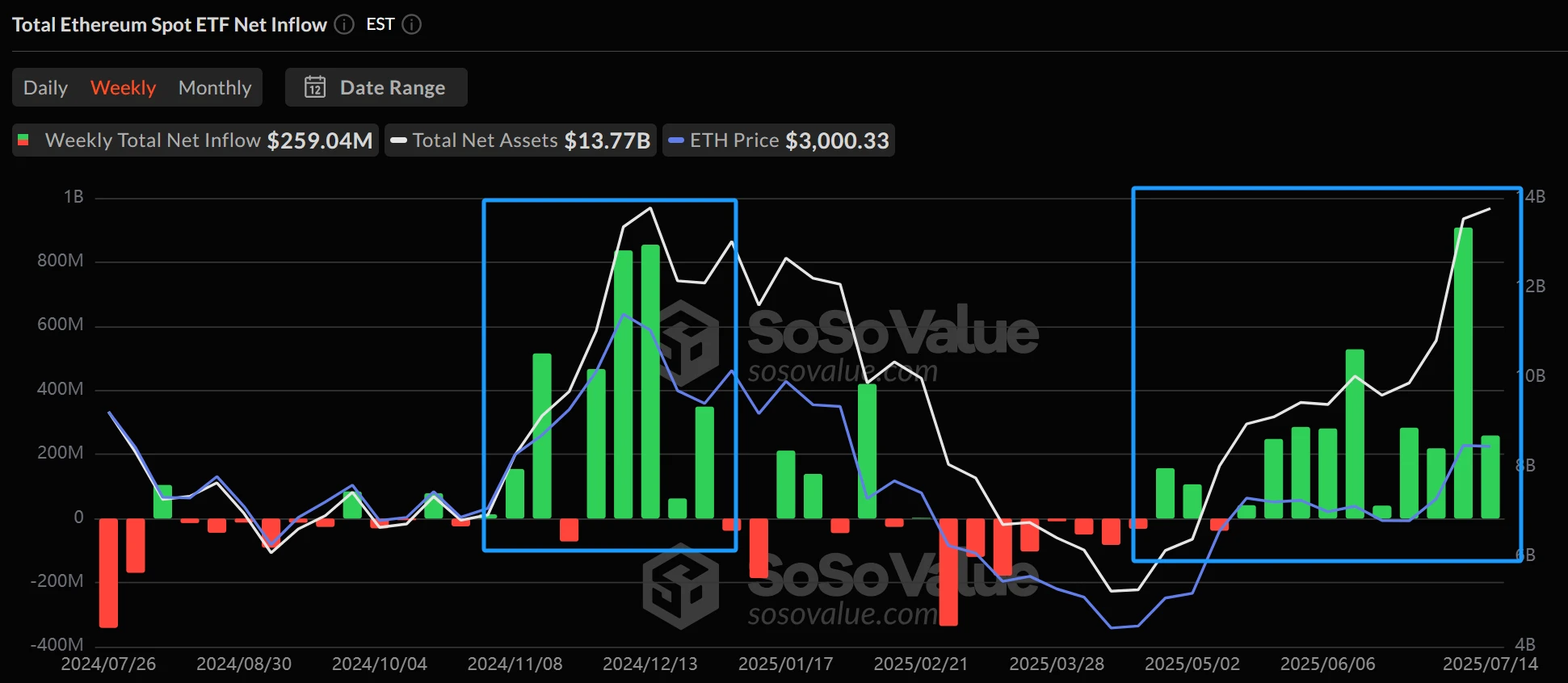

Looking at Ethereum, its recent rise also shows a trend dominated by institutional funds. First, Ethereum spot ETFs have seen net inflows for nine consecutive weeks , with total holdings reaching $13.4 billion, completely reversing Ethereums previous decline.

Ethereum spot ETF net inflow and outflow

Ethereum price trend (weekly)

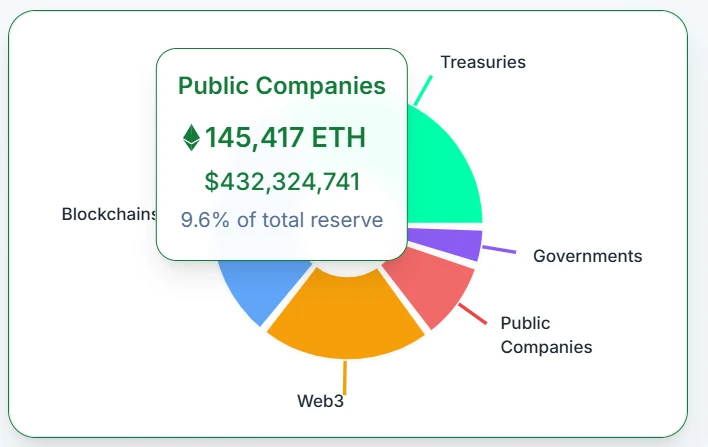

Secondly, a new narrative of Ethereum as an asset reserve is taking shape . Since SharpLink Gaming took the lead in announcing the inclusion of ETH in its asset reserves, many listed companies such as Bitmine Immersion, Bit Digital, and BTCS have followed suit. Currently, the Ethereum reserves held by listed companies account for 9.6% of the total ETH, of which SharpLink Gaming alone accounts for 3%, surpassing the Ethereum Foundation to become the largest holding address, and is still continuing to increase its holdings.

Ethereum holdings by listed companies

This trend shows that the narrative of Ethereum as an institutional asset reserve is rapidly heating up. The support of institutional funds has caused Ethereums market positioning to shift from a simple technical asset to a dual role of value storage and technical empowerment.

From Bitcoin to Ethereum, they all point to a core trend: where institutional funds are, there are market hot spots. This means that if this round of copycat season begins, it may be driven more by institutional funds rather than traditional sector rotation or speculative craze. In other words, tracks that can carry large amounts of funds or sectors with overflow of institutional funds may be more attractive. Moreover, the participation of institutional funds not only brings more stable capital flows, but may also drive the market in a more mature and rational direction.

It should be noted that the tokens recommended in this article are mainly large-cap projects because they are more in line with the preferences of institutional investors. These projects are usually verified by multiple rounds of market cycles, have strong fundamental support and user base, and meet the institutional preference for long-term value. In addition, institutional investors are subject to strict compliance requirements. Large-cap tokens are more likely to pass regulatory review due to their high market transparency and wide recognition, and have compliance advantages. This makes institutions prefer such tokens rather than small-cap projects with strong short-term speculation while avoiding legal risks.

Although large-cap tokens have advantages in the institutionalization trend, the crypto market is full of uncertainty, and changes in macroeconomics, regulatory policies or market sentiment may affect the flow of funds. Investors should remain cautious, comprehensively evaluate opportunities and risks through independent research, and make rational investment decisions.

Asset reserve track: Which coins can be included in corporate balance sheets?

Based on the trends of Bitcoin and Ethereum, tokens included in corporate balance sheets are more likely to become an important investment direction in this round of copycat season. Currently, listed companies have included some mainstream copycats in their asset reserves, including BNB, SOL, TRX, and HYPE. For related reading, please refer to US Stock Cryptocurrency Frenzy Escalates, Copycat Summer Market Is About to Explode .

BNB : As the core of the Binance ecosystem, BNB has strong cash flow support under the endorsement of the worlds largest exchange. Binance recently announced a settlement with US regulators, further consolidating its compliance status.

SOL : Solana is known for its high-performance blockchain, and has very strong advantages and a relatively complete ecosystem in Meme transactions. In 2024, the Solana Foundation cooperated with a number of traditional financial institutions to explore the tokenization of RWA (real world assets), which attracted the attention of institutional funds. Recently, the rise of Letsbonk.fun has driven a surge in Solanas trading volume, showing that the activity of the ecosystem continues to increase. The SOL spot pledge ETF has been approved, which may provide some reference for the launch of the spot SOL ETF, but the specific progress still needs to observe market and regulatory dynamics.

TRX : TRON has attracted a large number of stablecoin transactions with low cost and high throughput, and USDT accounts for more than 50% of the TRON chain. In early 2025, TRON announced a partnership with a Hong Kong fintech company to explore compliant stablecoin applications. Through cooperation with Nasdaq-listed SRM Entertainment (SRM for short), a reverse merger was carried out to achieve listing and enter the mainstream US capital market.

HYPE : Unlike the above three assets that have gone through multiple market cycles. As an emerging public chain token, HYPE has topped the throne of on-chain contracts due to its continued increase in derivatives trading volume. It is one of the few new projects that can demonstrate cash flow capabilities in the early stages. More detailed data will be provided in the DeFi section below.

Recommended reason

From my personal perspective, although the above are basically large-cap projects, the core motivation for investors to chase altcoins is to expect their growth to surpass Bitcoin. From the perspective of price elasticity, SOL performed the weakest in this round of price repair, and the chip structure was relatively loose. Therefore, under the premise that the fundamentals are not damaged, once the market funds flow back, the price elasticity of SOL may be more prominent.

There has always been a saying in the cryptocurrency circle that buy new, not old. As an emerging project, HYPE has a short life cycle, but it may have more growth dividends in the new cycle.

From a long-term perspective, the tokens that can appear on corporate balance sheets will be part of the institutional mainline of the crypto market. If more tokens are included in corporate balance sheets in the future, it is still worth keeping track of them.

ETF candidate track: What are the altcoins that institutions can invest in?

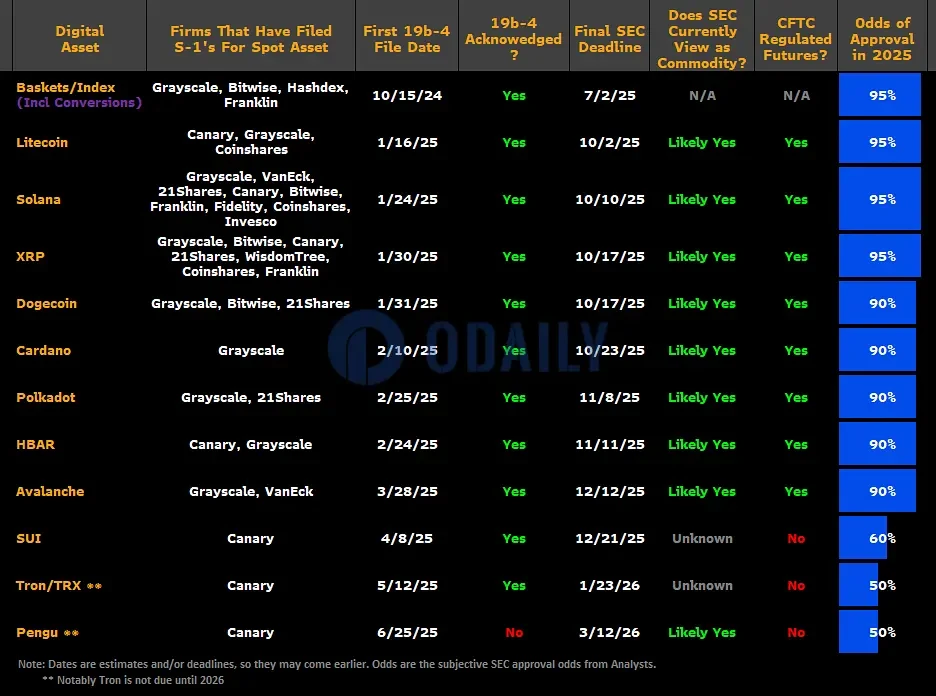

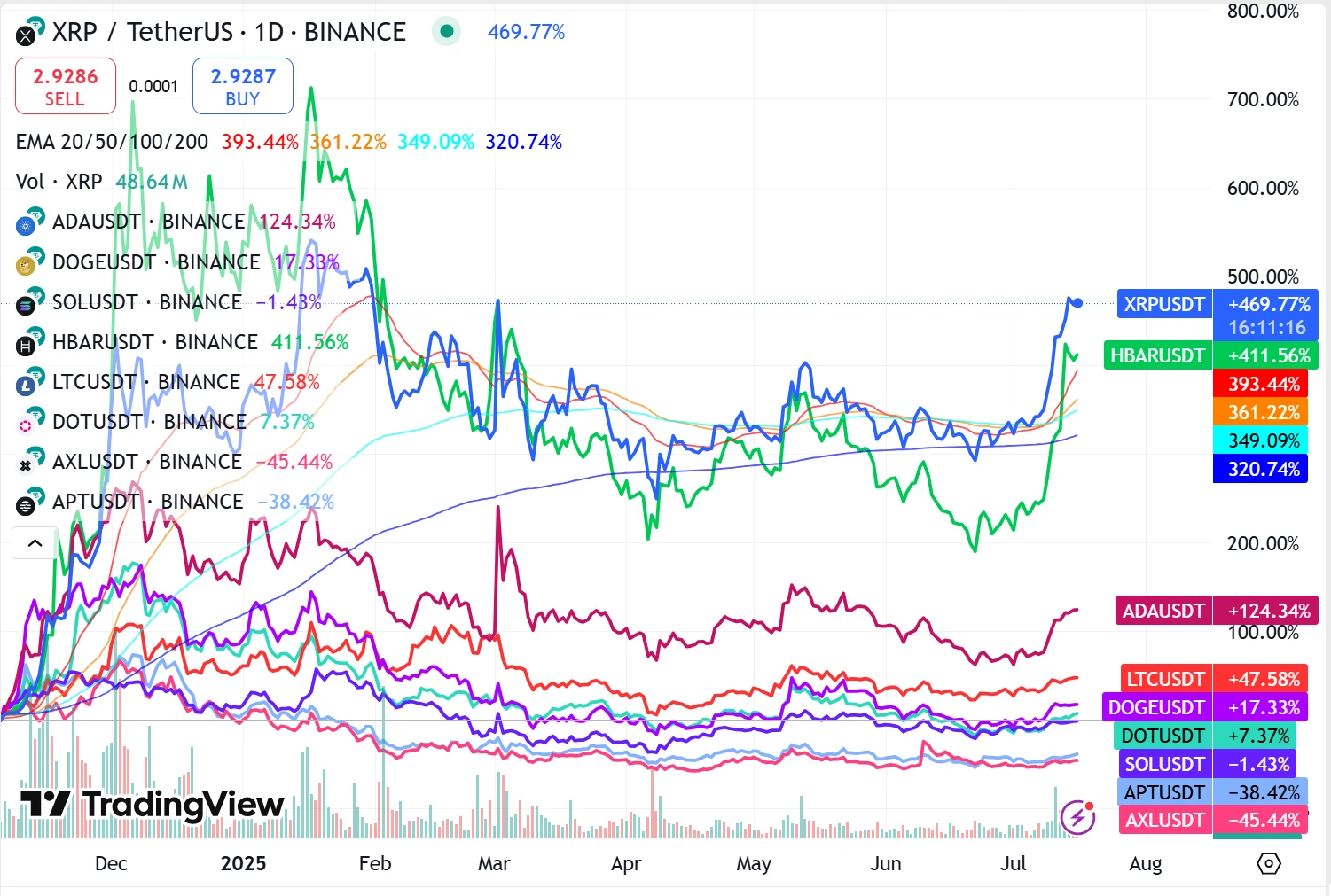

Since the US approved spot ETFs in January 2024, the total net asset value of Bitcoin spot ETFs has exceeded US$149.6 billion, and the total net asset value of Ethereum spot ETFs has reached US$14.2 billion since its approval in 2024. ETFs are an important channel for institutional funds to enter the market, and are also becoming an important narrative for altcoins. Potential ETF candidate currencies include: SOL, XRP, LTC, DOGE, ADA, DOT, HBAR, AXL, APT. For related reading, please refer to A large number of altcoin ETF applications, is the ETF 2.0 era coming?

Most of these currencies are large-cap public chain tokens. Although the functions of some currencies are limited to trading media or units of account and have gradually faded out of the market focus in the past, since the end of 2024, ETF-related benefits have made them regain the attention of institutions and the market.

Altcoin ETF Approval Probability Chart

Solana (SOL) is the first to emerge in the altcoin ETF track. On June 30, the Solana spot pledge ETF jointly applied by REX-Osprey was approved, but according to the issuer, the C-Corp (ordinary C-type company) structure adopted by the fund can hold spot SOL and pledge on the chain, thereby obtaining income and including it in the fund assets, but because of this, the ETF does not enjoy the tax-free channel treatment of ETF funds, but needs to pay income tax at the corporate level. Therefore, it is different from the ETFs applied for by VanEck, 21 Shares, Bitwise, etc.

Recommended reason

If the traditional spot SOL ETF is approved in the future, it may further enhance its market appeal, which we have recommended in the above article. XRP is facing a similar situation. At present, the New York Stock Exchange has approved ProShares Ultras futures-based XRP ETF, and the regulatory dispute between Ripple Labs and the US SEC may be coming to an end. The probability of the SEC approving the XRP spot ETF this year is very high. And from the price trend of XRP itself, it has always maintained a pressure-resistant posture in multiple rounds of market callbacks. The strong will always be strong, which can always be well verified in the currency circle.

Altcoin ETF price chart (daily)

Other currencies with a higher probability of approval include LTC and HBAR. Both of them are not marked as securities and have clear compliance attributes. HBAR has also shown strong resistance to declines in multiple rounds of market shocks.

RWA Track: On-chain Mapping of Real Assets

RWA (Real World Assets) unlocks the potential of asset liquidity, transparency, and global accessibility by tokenizing traditional assets such as real estate, bonds, stocks, and artworks. This on-chain assetization model provides investors with a more flexible trading method while opening up new investment channels for traditional financial institutions.

As the regulatory environment gradually improves, the RWA track has received policy support. For example, the Digital Asset Manifesto 2.0 launched by Hong Kong in 2025 explicitly supports the RWA tokenization pilot, providing policy endorsement for its large-scale development. RWAs popular narrative stems from its unique positioning in the integration of traditional finance and blockchain. Combined with the continuous inflow of institutional funds, the improvement of the regulatory environment, the attractiveness of real returns and the support of mature technology, it is expected to become one of the important tracks in this round of copycat season.

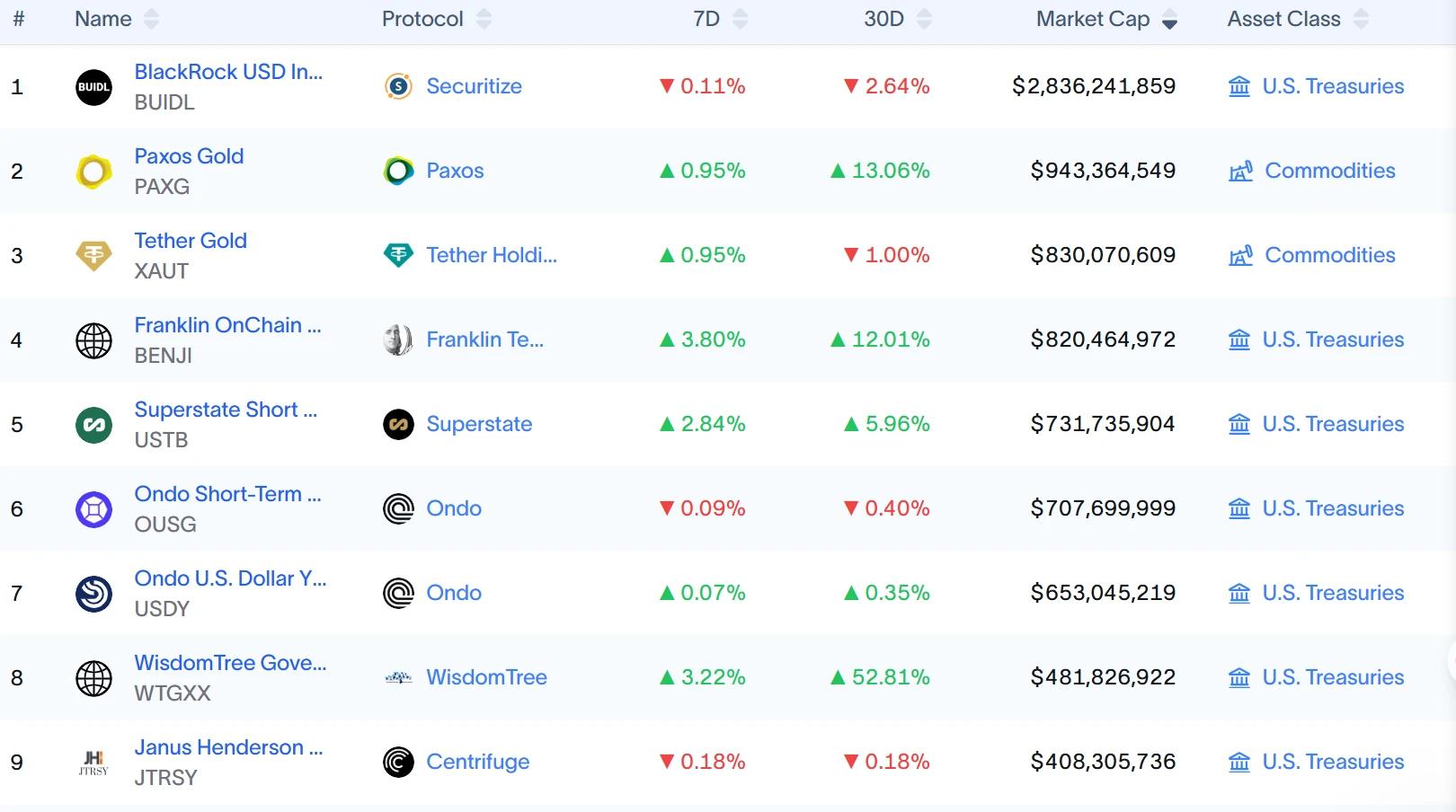

According to rwa.xyz data, the fund with the largest RWA asset market value is BlackRock’s BUIDL fund, which cooperates with Securitize. In addition, Exodus Movement (EXOD) and Blockchain Capital (BCAP) have also cooperated with Securitize, but Securitize itself has not issued a coin. It has cooperated with Ethean to launch Converge, which focuses on RWA and plans to launch the mainnet in Q2 this year. The next ones are Ondo, Superstate, and Centrifuge.

Ranking of asset tokenization protocols by market capitalization

In addition, Chainlinks decentralized oracle is a key infrastructure for many RWA projects. In 2024, Chainlink reached cooperation with many financial institutions such as Goldman Sachs, Morgan Stanley, and Wells Fargo to provide data and settlement support for tokenized bonds and real estate asset tokenization.

Recommended reason

RWA naturally meets the investment preferences of institutions and is a bridge track that combines realistic returns with compliance expectations. However, only Ondo (ONDO) and Centrifuge (CFG) have achieved scale and issued tokens. In addition, Chainlink (LINK), an indispensable technical pillar of the RWA track, is also worthy of attention.

DeFi track: real cash flow, institutional exemption catalysis

As one of the core applications of blockchain, DeFi (decentralized finance) is gaining support at the policy level. The US SEC plans to launch an innovation exemption policy to pave the way for the compliant development of DeFi projects and reduce regulatory uncertainty.

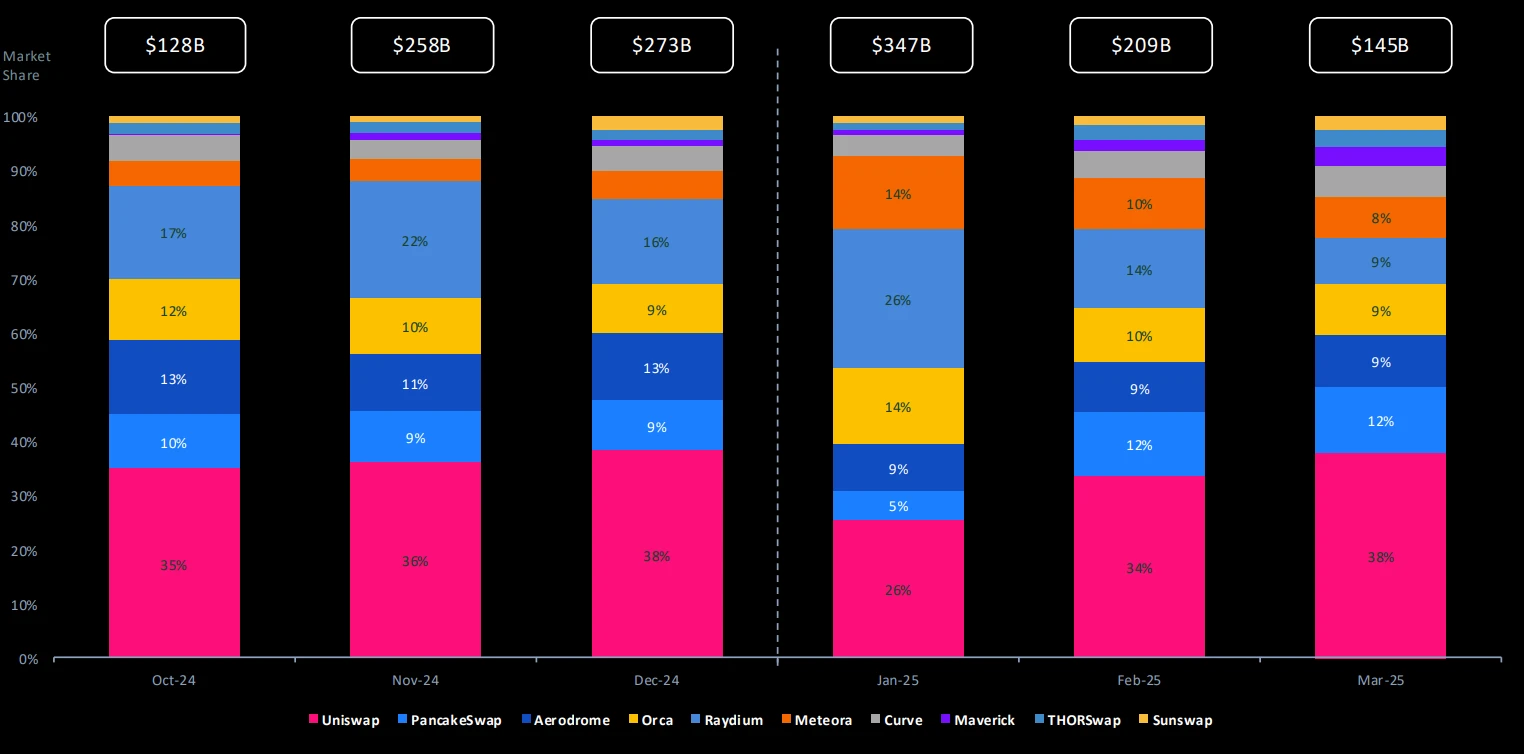

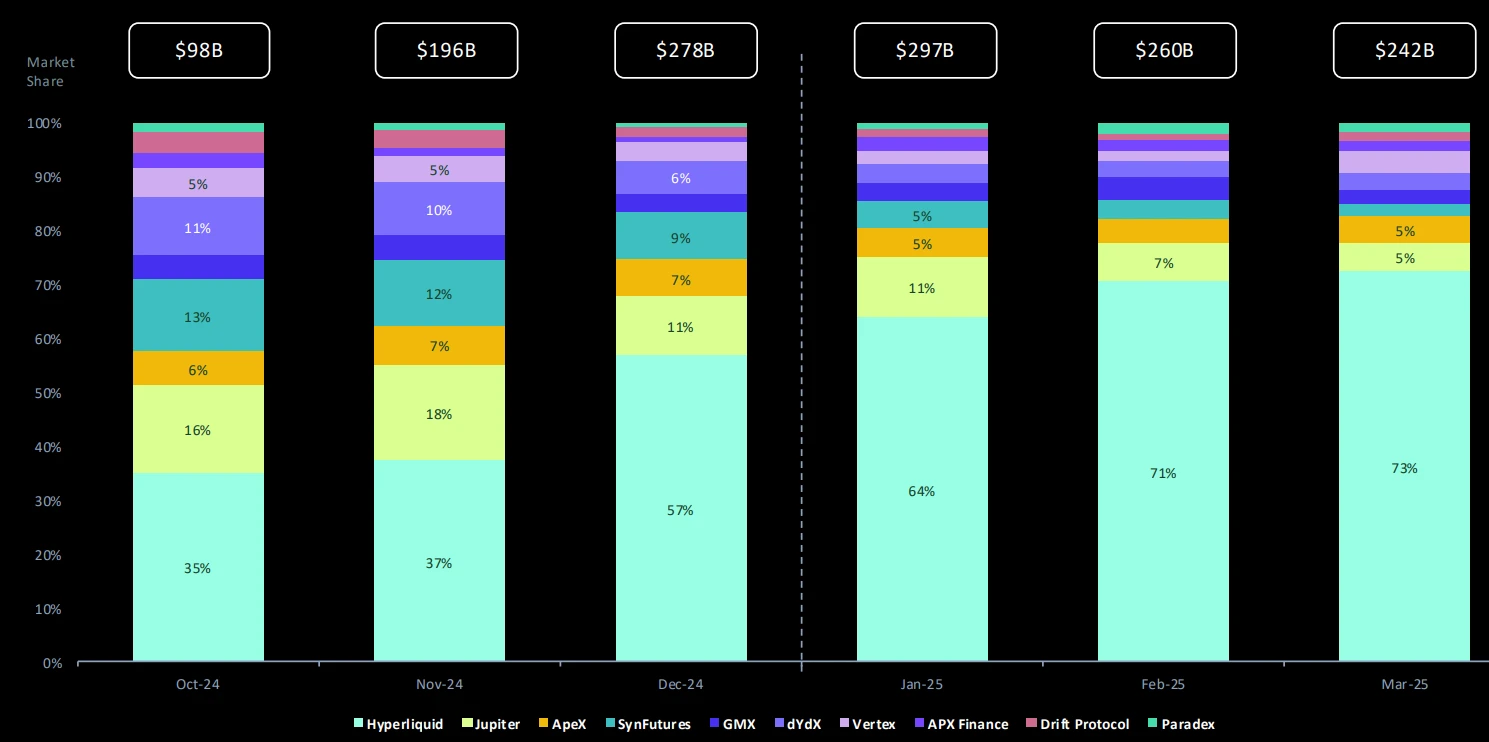

In addition, the DeFi on-chain data performed strongly. According to the industry report for the first quarter of 2025 released by Coingecko, compared with the general decline in spot trading volume of centralized exchanges (CEX), DEX spot trading volume increased slightly by 6.2% month-on-month, and the quarterly trading volume of derivatives DEX hit a new record high of US$799.1 billion, even exceeding the total trading volume for the whole year of 2023. Mainly due to the outstanding performance of Hyperliquid, it has now become the eighth-ranked trading platform among all DEX and CEX derivatives exchanges.

DEX spot trading volume trend changes

Hyperliquid Market Share

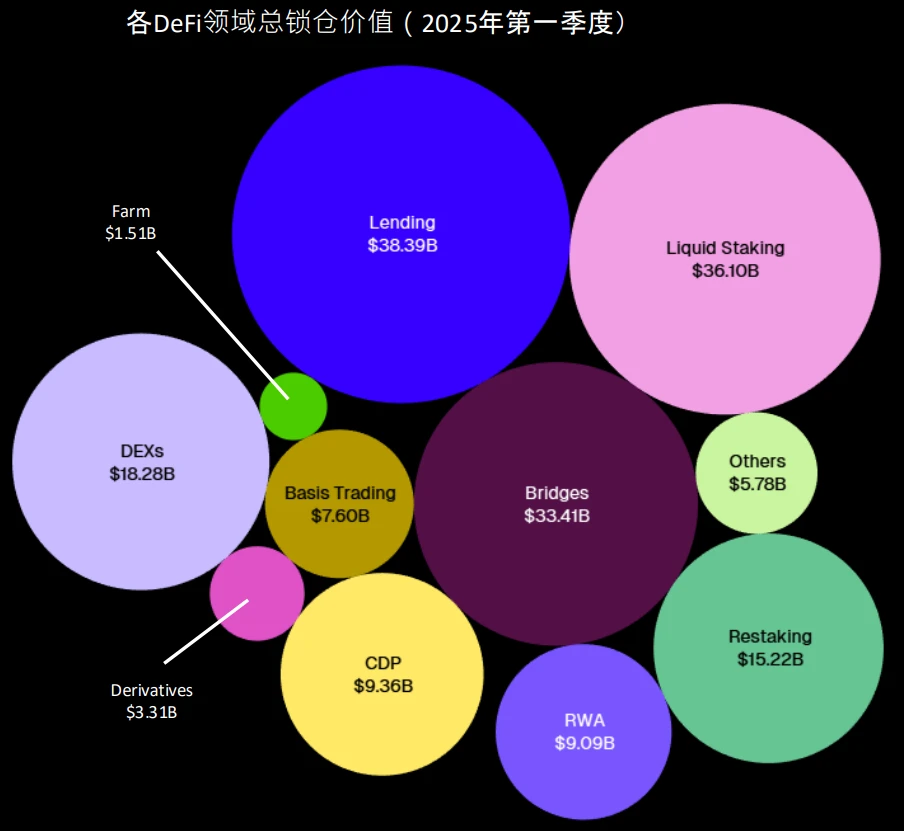

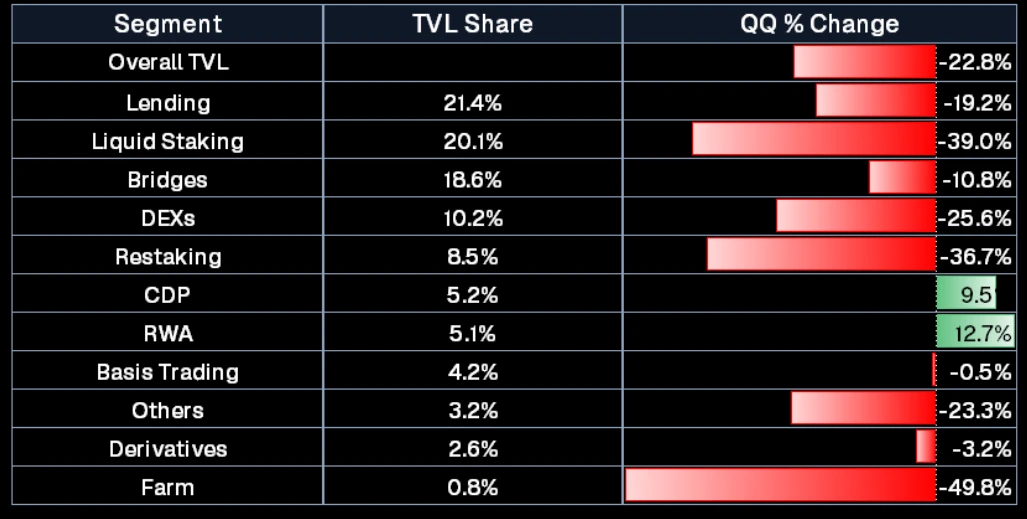

In the DeFi track, the locked value (TVL) of lending protocols accounts for the highest proportion, followed by liquidity staking protocols, and the leading protocols are Aave and Lido respectively.

DeFi track asset lock-up value ratio

In addition, DeFi projects are usually the track with the most real cash flow returns. In a cycle where confidence is scarce, healthy finances are the key factor in supporting the survival of the project. For related reading, please refer to From Growth Illusion to Cash Flow Reality: When Buyback Becomes the Collective Narrative of Altcoins .

DeFi protocol fee income

There are many investment options in the DeFi track, among which DEX is one of the most profitable protocol types. The leading DEXs on different public chains have performed particularly well, such as Uniswap on Ethereum, PancakeSwap on the BSC chain, and Raydium on the Solana chain. As the core hubs of their respective on-chain ecosystems, these DEXs directly benefit from the outbreak of on-chain activities.

Take Letbonk.fun in the Solana ecosystem as an example. Its rapid rise has driven the price of BONK tokens to soar by about 3 times, and at the same time, it has driven the price of RAY, the token of Raydium, the leader of Solanas on-chain DEX, to nearly double. This phenomenon shows that the prosperity of the on-chain ecosystem often amplifies the profit potential of DEX, making it a direct beneficiary of capital spillover. However, the performance of DEX is highly dependent on the activity of the on-chain ecosystem and market sentiment.

Recommended reason

As the Ethereum ecosystem continues to heat up, DeFi projects on it are most likely to benefit from the capital spillover effect. AAVE, the leader in the lending track, and UNI, the leader in the DEX track, may become the preferred choice of funds with their mature ecological status and stable profit model. HYPE, as an emerging potential project (previously mentioned in the asset reserve track), has shown certain investment appeal due to its rapid growth in the field of derivatives trading.

Stablecoin Track: The Narrative Closest to Real Payment Landing

The next wave of real adoption of cryptocurrencies may come from stablecoins and payments. With the introduction of the Genius Act, the regulatory framework for stablecoins is becoming clearer.

The stablecoin track usually forms a synergistic effect with the RWA and DeFi tracks. While the DeFi track suffered capital outflows and depreciation of protocol deposits, RWA and CDP (collateralized debt position) achieved significant growth in TVL.

In the stablecoin market, centralized stablecoins such as USDT and USDC dominate due to their USD reserve anchoring and have a wide range of application scenarios. If you want to invest in them, you can only choose the governance tokens of decentralized stablecoins, such as MKR behind DAI or ENA behind USDe.

Recommended reason

Sky (formerly MakerDAO) is a leader in the decentralized stablecoin space. By investing in tokenized U.S. bonds, its financial position remains healthy and shows solid fundamentals. It is currently trying to create its own ecological narrative through brand reshaping.

Ethena is a protocol that will be launched in 2024, but the scale of locked funds is already comparable to Sky, and it is working with Securitize to launch Converge, a public chain focusing on RWA.

Conclusion

The real explosion of the altcoin market has never been shouted out, but the result of the joint catalysis of capital structure, policy environment and market narrative. When Bitcoin and Ethereum become the core assets of institutional holdings, the new altcoin logic has also quietly taken shape: only coins with fundamentals, clear stories, and institutions can pass through the fog of valuation reconstruction in the next cycle and become the real winners.