Original title: Popular Science: How to use NAV to evaluate how much your crypto stocks are worth?

Original author: TechFlow

There is no doubt that this round of crypto bull market first started in the US stock market.

When the crypto treasury reserve strategy becomes the trend of the US stock market and the cryptocurrency and stock are linked, how should we evaluate the quality of a stock? Should we look at who has a large amount of crypto assets in reserve, or who has the money to keep buying crypto assets?

If you have been paying close attention to the analysis of crypto stocks recently, you will have seen a term appearing repeatedly - NAV, which stands for Net Asset Value.

Some people use NAV to analyze whether crypto stocks are overvalued or undervalued, while others use NAV to compare the stock price of a new crypto reserve company with the stock price of MicroStrategy; but the more critical wealth code lies in:

If a publicly listed U.S. company implements a crypto reserve strategy and holds $1 in cryptocurrency, its value is greater than $1.

These companies with crypto asset reserves can continue to increase their holdings or repurchase their own shares, resulting in their market value often far exceeding their NAV (net asset value).

But for ordinary investors, most projects in the cryptocurrency world are rarely evaluated using serious indicators, let alone using them to evaluate the value of stocks in the traditional capital market.

Therefore, the editor also plans to do a popular science introduction to the NAV indicator to help players who are concerned about the linkage between coins and stocks to better understand the operating logic and evaluation methods of coins and stocks.

NAV: How much are your stocks worth?

Before we delve into the world of crypto stocks, we need to first understand a basic concept.

NAV is not an indicator designed specifically for the crypto market, but one of the most common ways to measure a company’s value in traditional financial analysis. Its essence is to answer a simple question:

“How much is each share of a company’s stock worth?”

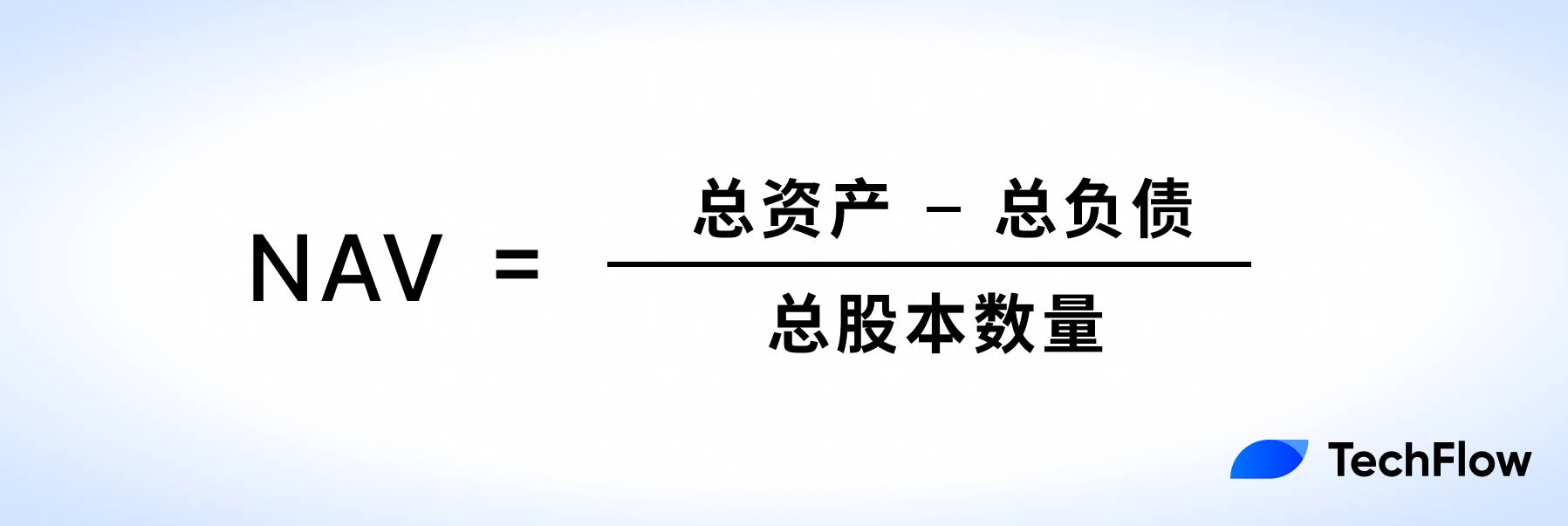

The calculation method of NAV is very intuitive, that is, the value that shareholders can get per share after deducting liabilities from the companys assets.

To better understand the core logic of NAV, we can use a traditional example. Suppose there is a real estate company with the following financial status:

Assets: 10 buildings, with a total value of US$1 billion; Liabilities: US$200 million in loans; Total equity: 100 million shares.

The net asset value of this company is $80 per share. This means that if the company liquidates its assets and repays all debts, the holder of each share can theoretically receive $80.

NAV is a very common financial indicator, especially suitable for asset-driven companies, such as real estate companies, investment fund companies, etc. The assets owned by these companies are usually more transparent and relatively easy to value, so NAV can well reflect the intrinsic value of their stocks.

In traditional markets, investors typically compare NAV to the stock’s current market price to determine whether a stock is overvalued or undervalued:

If Share Price > NAV: The stock may be trading at a premium and investors are confident in the company’s future growth potential;

If Share Price < NAV: The stock may be undervalued, the market has low confidence in the company, or there is uncertainty in asset valuation.

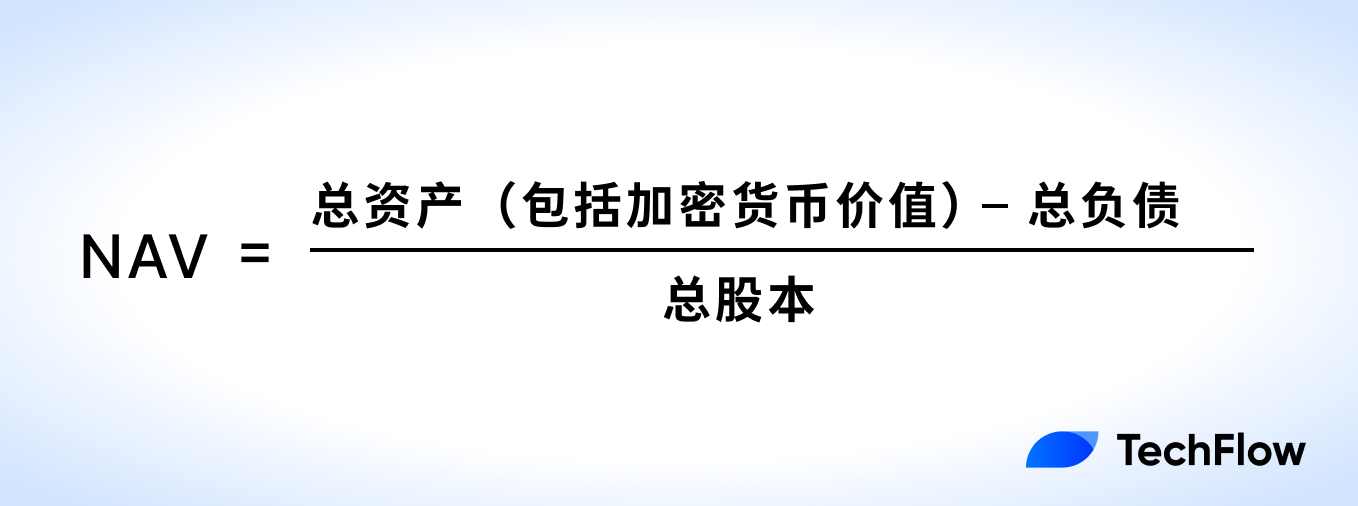

When NAV is applied to crypto stocks, its meaning changes subtly.

In the field of crypto US stocks, the core role of NAV can be summarized as follows:

Measures the impact of a publicly traded company’s crypto holdings on its stock value.

This means that NAV is no longer just the traditional “assets minus liabilities” formula, but needs to specifically consider the value of the crypto assets held by the company. The price fluctuations of these crypto assets will directly affect the company’s NAV and indirectly affect its stock price.

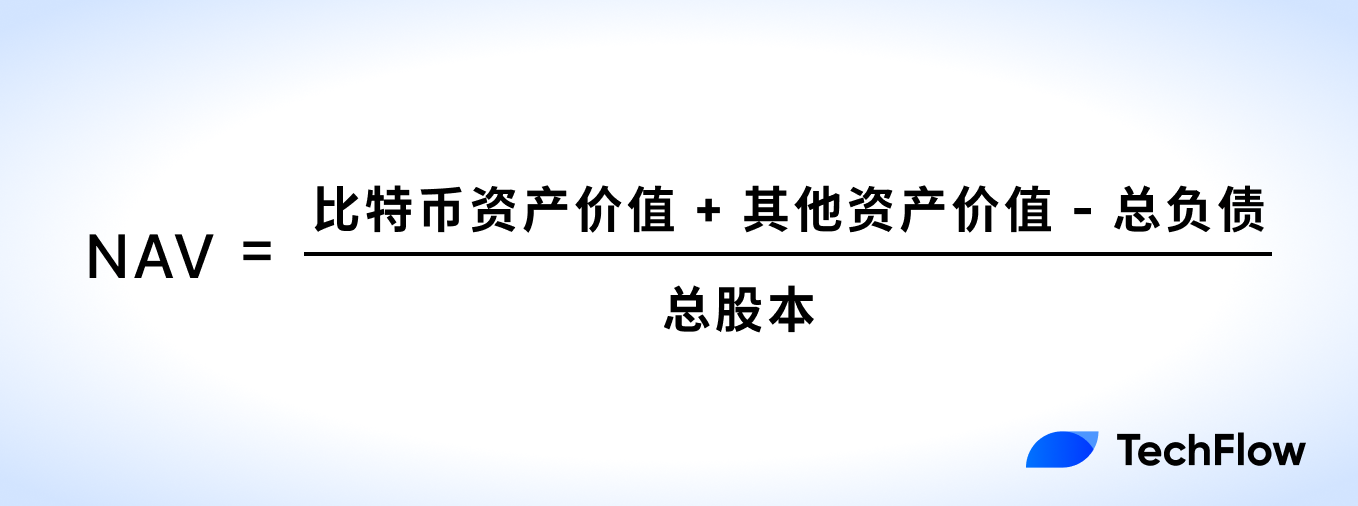

For a company like MicroStrategy, the calculation of its NAV places special emphasis on the value of its Bitcoin holdings, as this asset accounts for the vast majority of the companys total assets.

So the above calculation method is slightly extended:

When crypto assets are added to the NAV calculation, some of the changes you have to consider are:

NAV volatility has increased significantly: Due to the sharp price fluctuations of cryptocurrencies, NAV is no longer as stable as real estate or fund assets in traditional markets.

The value of NAV is magnified by crypto assets: Crypto assets usually receive a premium in the market, which means that investors are willing to pay a price higher than their book value to buy related stocks. For example, a company holds $100 million in Bitcoin assets, but its stock price may reflect the markets expectation of Bitcoins future appreciation, resulting in a company market value of $200 million.

When the market is bullish on the future price of Bitcoin, the companys NAV may be given an additional premium by investors; conversely, when market sentiment is depressed, the reference value of NAV may decline.

If you still don’t understand NAV, let’s use MicroStrategy as an example.

As of press time (July 22), public data shows that MicroStrategy holds 607,770 bitcoins at a current price of $117,903. The total value of Bitcoin assets is around $72 billion, other assets are around $100 million, and the companys liabilities are $8.2 billion.

MicroStrategys total share capital is about 260 million, and according to the above calculation, its NAV is about $248 per share. In other words, if BTC is held as a crypto reserve, one share of MicroStrategy should be worth $248.

However, in the last U.S. stock trading day, MicroStrategys actual share price was US$426.

This reflects the market premium, that is, if the market believes that Bitcoin will continue to rise in the future, then investors will factor this expectation into the stock price, making its stock price higher than NAV.

This premium reflects that NAV is unable to fully capture the markets optimistic expectations for crypto assets.

mNAV: Crypto Stock Sentiment Thermometer

In addition to NAV, you can often see some analysts and KOLs talking about another similar indicator - mNAV.

If NAV is a basic indicator to measure how much a share is worth, then mNAV is an advanced tool that is more in line with the dynamics of the crypto market.

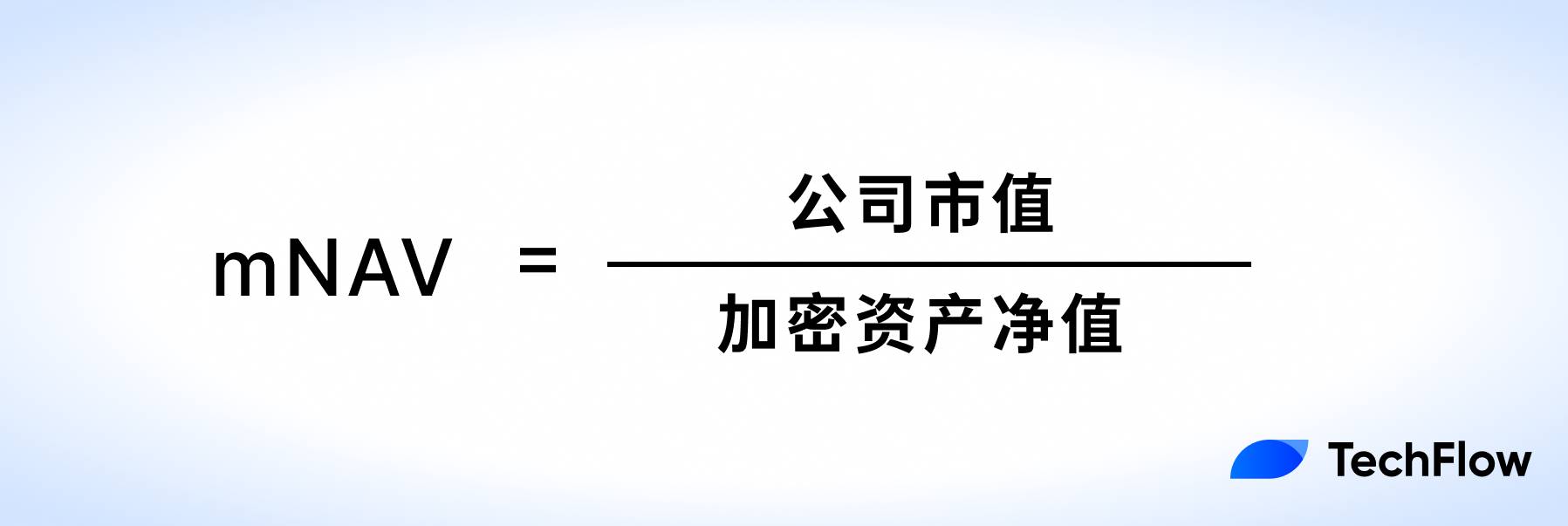

As mentioned earlier, NAV focuses on reflecting the companys current net assets (mostly crypto assets) without involving the markets expectations for these assets; mNAV is a more market-oriented indicator used to measure the relationship between a companys market value and the net value of its crypto assets. Its calculation formula is:

The “crypto asset net worth” here refers to the value of the company’s cryptocurrency assets minus related liabilities.

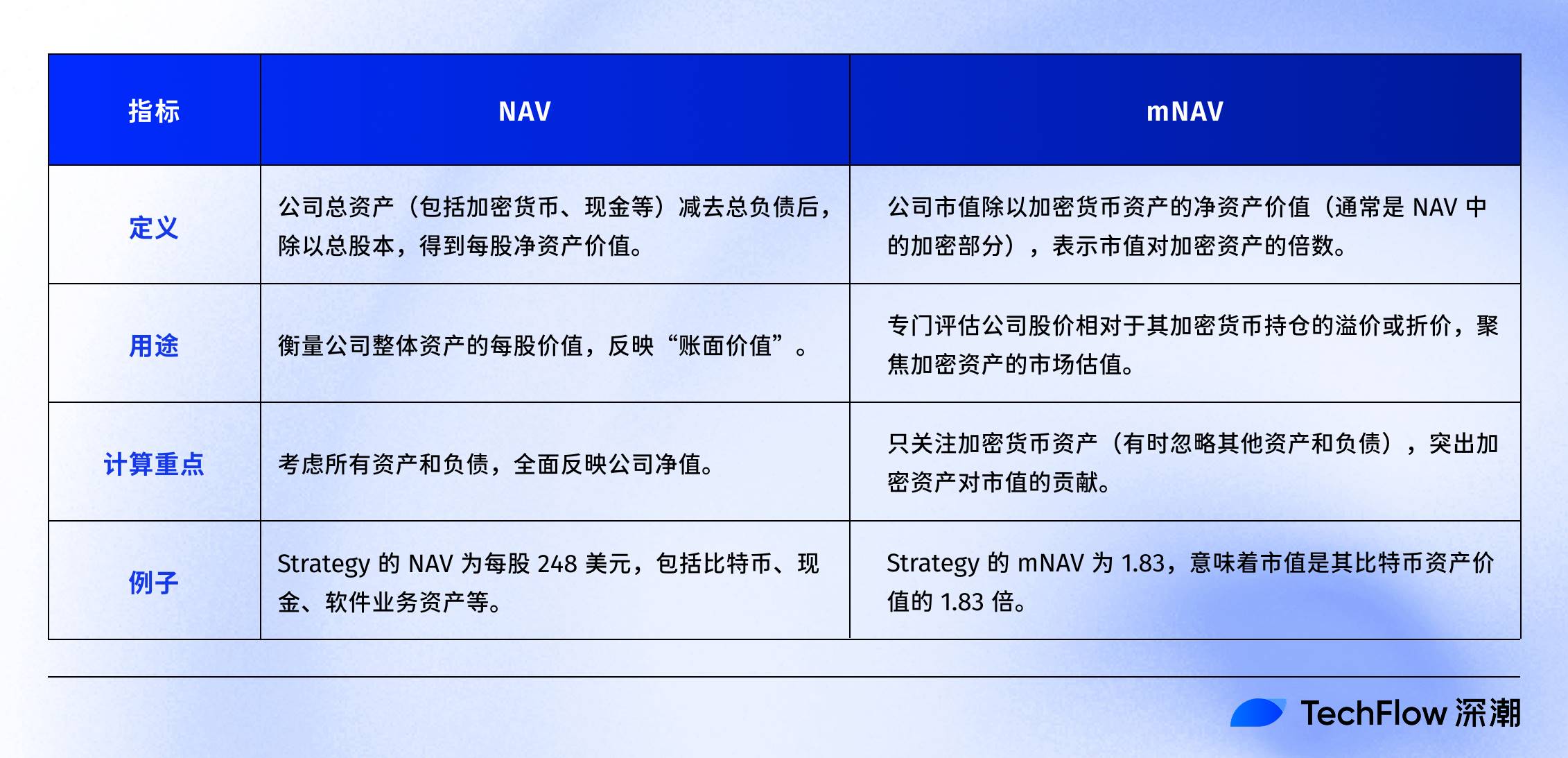

We can use a table to clearly compare the difference between the two indicators:

Also according to the previous calculation, the total market value of MicroStrategys stock is about 120 billion US dollars, and the net value of the BTC held (crypto assets + other company assets - liabilities) is about 63.5 billion, so its mNAV is about 1.83.

That is, MicroStrategy’s market cap is 1.83 times the value of its Bitcoin assets.

Therefore, when a company holds a large amount of cryptocurrency assets, mNAV can better reveal the markets expectations for these assets and reflect the premium or discount that investors place on the companys crypto assets; for example, in the example above, MicroStrategys stock price is 1.83 times higher than its crypto net assets.

For short-term investors who focus on market sentiment , mNAV is a more sensitive reference indicator:

When the price of Bitcoin rises, investors may become more optimistic about the future performance of crypto-asset-driven companies. This optimism is reflected through mNAV, causing the market price of a companys stock to be higher than its book value (NAV).

An mNAV above 1 indicates that the market has a premium on the value of the companys crypto assets; an mNAV below 1 means that the market lacks confidence in the companys crypto assets.

Premiums, reflexive flywheels, and death spirals

As mentioned before, MicroStrategy’s mNAV is currently around 1.83;

As ETH increasingly becomes an asset reserve for listed companies, understanding the mNAV of these companies will also be of certain reference significance for identifying whether the corresponding U.S. stocks are overvalued or undervalued.

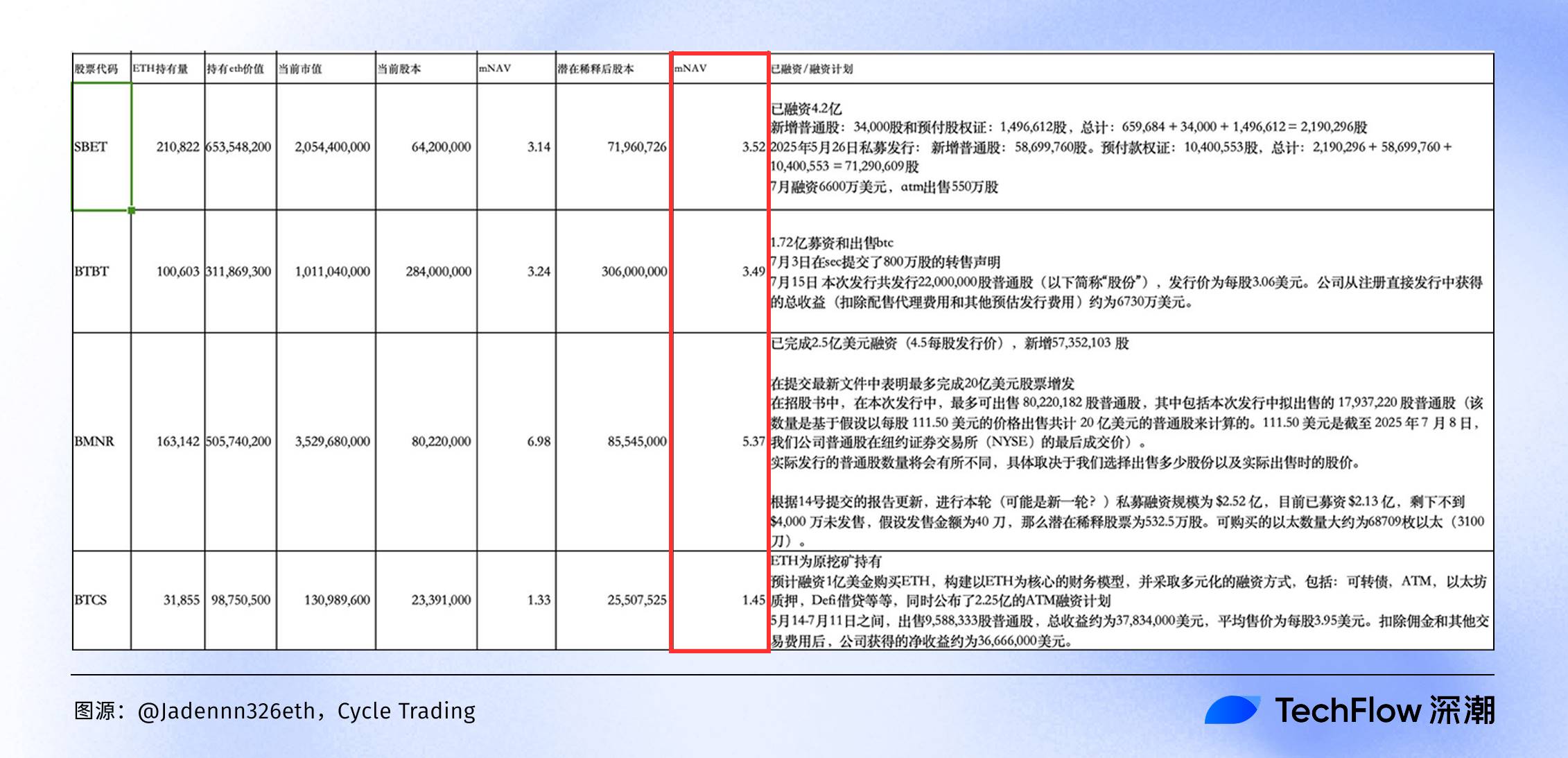

Analyst @Jadenn n3 26 eth from Cycle Trading has compiled a fairly detailed table that intuitively shows the assets and liabilities and mNAV values of the major ETH reserve companies (data as of last week).

(Image source: @Jadenn n3 26 eth , Cycle Trading)

From this ETH reserve company mNAV comparison chart, we can see at a glance the wealth map of the currency-stock linkage in 2025:

BMNR tops the list with 6.98 times mNAV, and its market value far exceeds the value of its ETH holdings, but this may hide an overvaluation bubble - once ETH pulls back, the stock price will be the first to be damaged. BTCS is only 1.53 times mNAV, which is relatively low in premium.

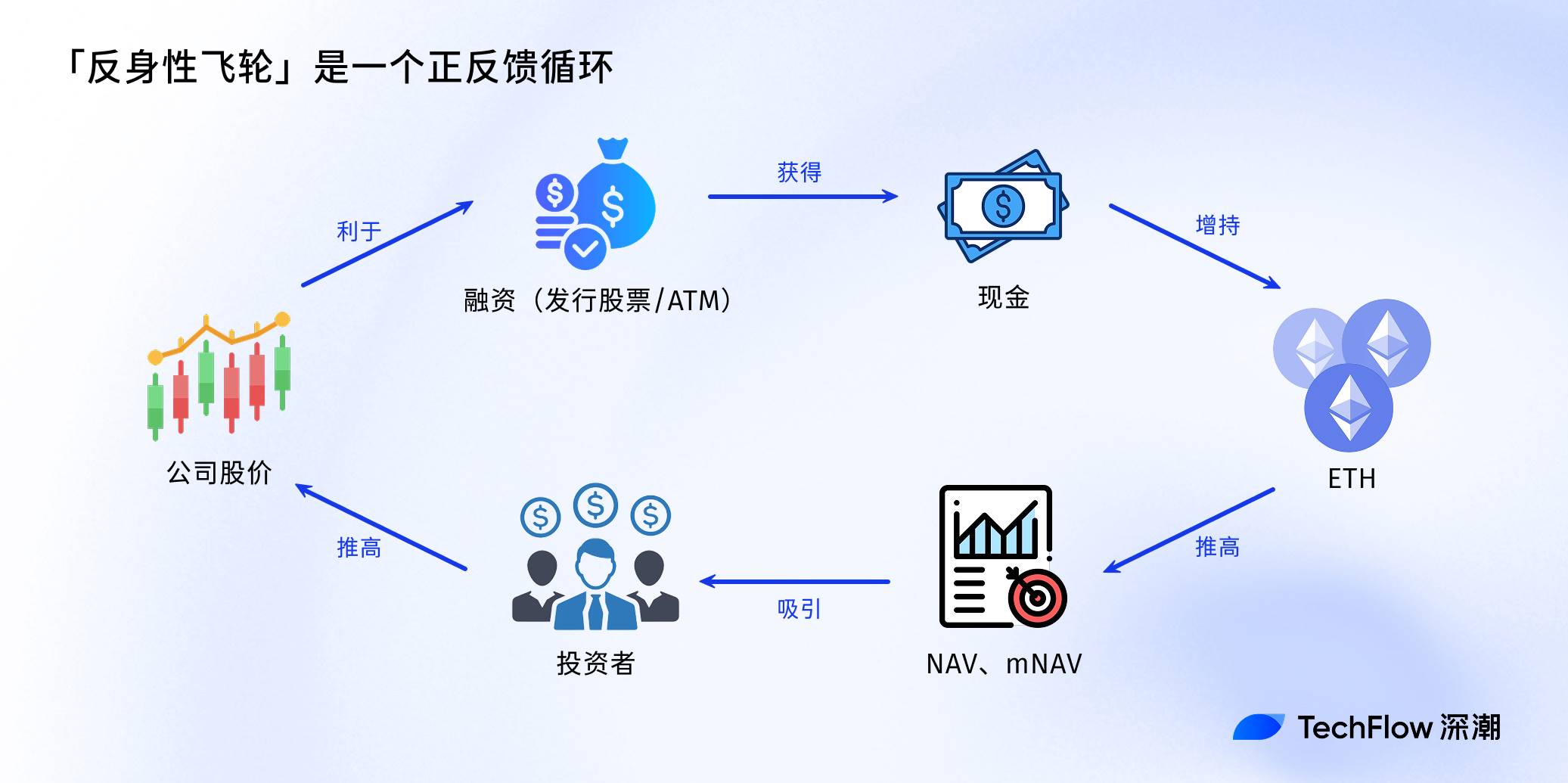

Now that we have seen the data of these companies, we have to talk about the “Reflexivity Flywheel”.

This concept originated from the reflexivity theory of financial tycoon Soros. In the 2025 bull market when cryptocurrencies and stocks are linked, it has become the secret engine for the surge in the stock prices of these companies.

Simply put, the reflexive flywheel is a positive feedback loop: the company first issues stocks or ATM (At-The-Market) financing, in exchange for cash to buy ETH in large quantities; the increase in ETH holdings pushes up NAV and mNAV, attracting more investors to chase after it, and the stock price soars; the higher market value makes it easier for the company to refinance and continue to increase its holdings of ETH... In this way, a self-reinforcing, snowball-like flywheel effect is formed.

However, once the ETH price falls back, regulation tightens (such as the SECs review of the crypto reserve model), or financing costs soar, the ascension flywheel may reverse into a death spiral: the stock price collapses, mNAV plummets, and the people who get hurt in the end may also be the leeks in the stock market.

Finally, you should understand:

Indicators like NAV are not a panacea, but they are a powerful tool in the toolbox.

When players are chasing the coin-stock linkage, they should make rational assessments based on the macro trends of Bitcoin/Ethereum, corporate debt levels and growth rates, so that they can find their own opportunities in this new cycle that seems to be full of opportunities but is actually dangerous.