Original | Odaily Planet Daily ( @OdailyChina )

Author: Golem ( @web3_golem )

On July 22, people familiar with the matter revealed that the crypto prediction market platform Polymarket is evaluating the possibility of launching its own stablecoin in order to control the returns from the high reserve funds supported by Circles USDC. Although Polymarket has not made a final decision, combined with the recent end of the US Department of Justices investigation into Polymarket and the platforms acquisition of the US compliant trading platform QCX, many users speculated that Polymarkets coin issuance is also on the way, so they stepped up the frequency of interaction.

The rumor that Polymarket will issue a coin has been mentioned since 2024, so much so that some studios have been interacting with it in batches for as long as a year. So, if you are a user who has never interacted with Polymarket before or has a low frequency, is it necessary and timely to start using Polymarket now?

Polymarket remains competitive after US election

Before considering whether it is too late to start interacting with Polymarket now, we need to first understand the current operation of the Polymarket platform. Polymarkets popularity stems from the 2024 US presidential election, and it has become famous for successfully predicting Trumps victory and up to $8 billion in betting funds during the period. However, since the end of the US election, the number of times Polymarket has been mentioned in the media has begun to decline, so some people believe that after losing the topic of predicting the US election, Polymarket users will be lost in large numbers. But the facts may disappoint them. The following data shows that after the hype of the US election and outside the political field, Polymarket is still a popular platform that processes 100,000 transactions a day and serves tens of thousands of users every day.

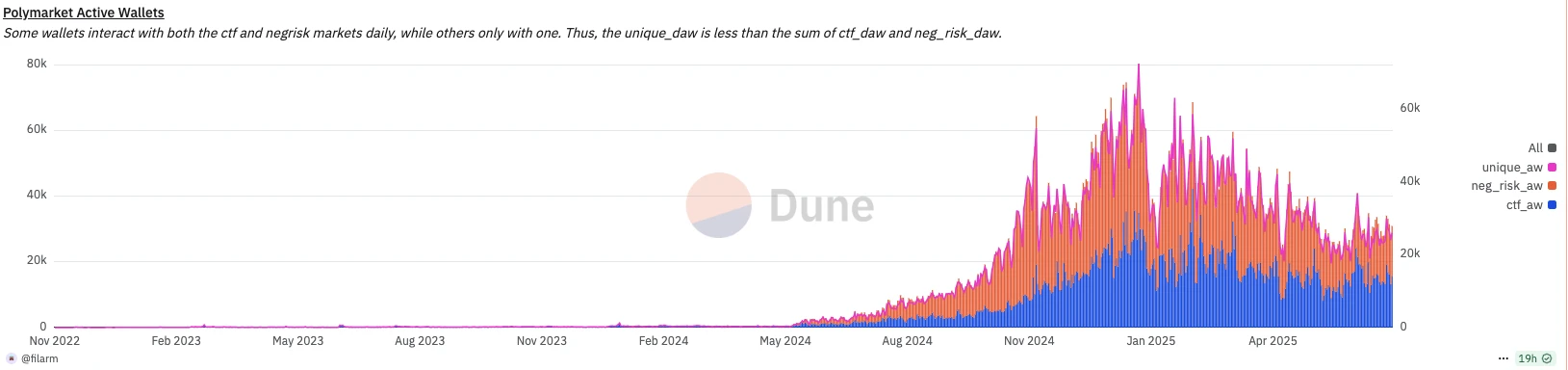

Daily active wallets

According to Dune data , starting from May 2024, the number of daily active wallets on Polymarket has increased from 0 to 70,000 in half a year. Although the platforms wallet activity declined from late January to early February 2025 due to Trumps official inauguration, it rebounded afterwards. Currently, the number of daily active wallets on Polymarket remains at 20,000-30,000. Although it cannot be compared with the daily activity of meme launch platforms such as Pump.fun, it is still ahead of L2 such as Starknet and ZKsync. The high wallet activity after the boom also verifies that Polymarket has a solid product-market fit.

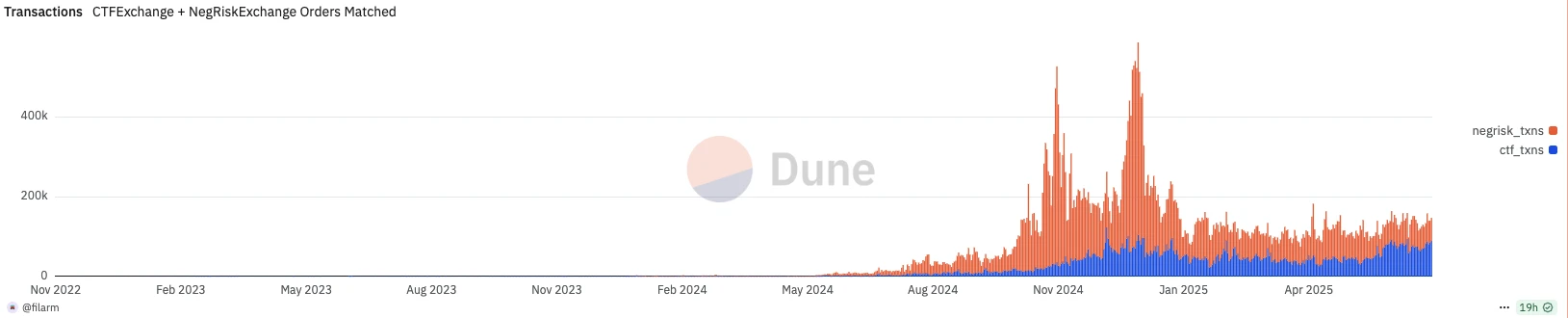

Number of daily transactions

Similarly, Polymarket’s daily transaction volume peaked during the 2024 US presidential election, reaching nearly 500,000. But even after the election cooled down, the number of transactions on the Polymarket platform remained above 100,000. This means that although Polymarket’s usage rate declined during the election, it still retained a large number of loyal users compared to before 2024.

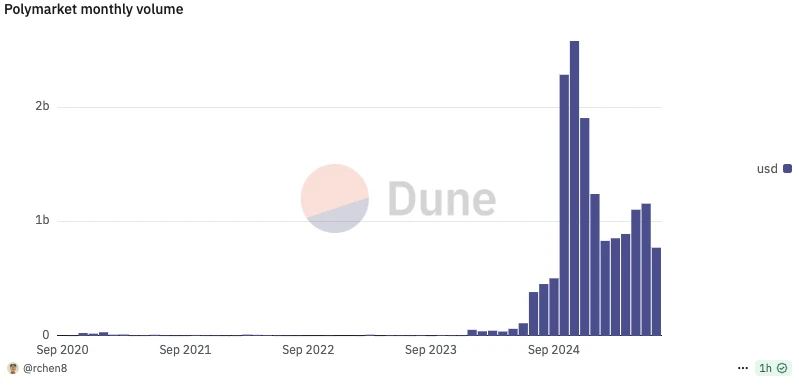

Monthly Trading Volume

According to Dune data , the monthly trading volume of the Polymarket platform peaked at $2.5 billion in November 2024. However, after the election, from February 2025 to date, the Polymarket platform still has a monthly trading volume of $700 million to $1.1 billion. According to DeFiLlama data , in the past 30 days, Polymarkets trading volume ranked 40th, ahead of old DEXs such as Sushi and GMX.

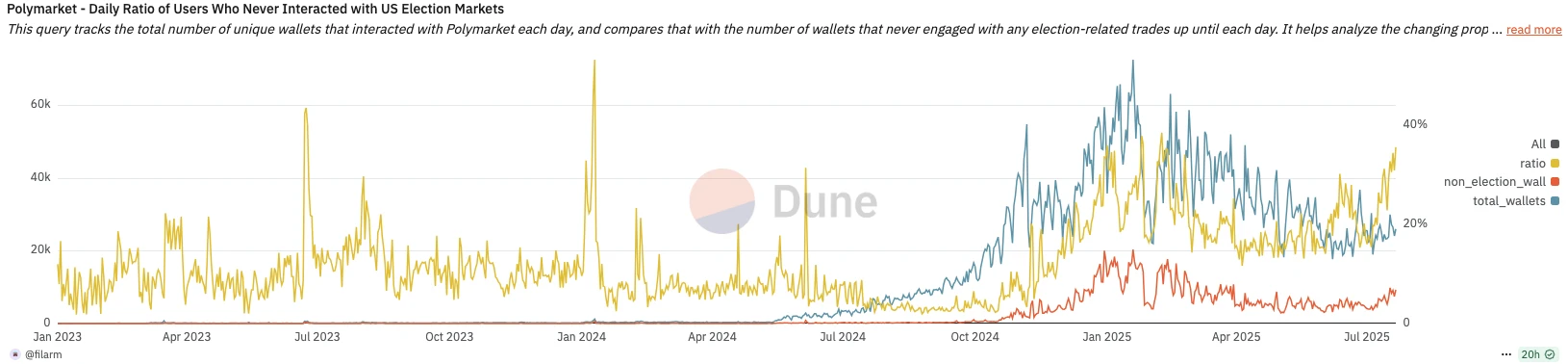

Percentage of users outside of US elections

The above chart reflects the proportion of users who have never participated in the US election market. As can be seen from the figure, after the US election, the total number of wallets is decreasing, but the number of wallets that have never participated in the US election remains stable, which means that although Polymakert has lost a large number of short-term speculative users after the election, the number of loyal platform users has not decreased significantly. The proportion of users who have never participated in the US election market is gradually increasing.

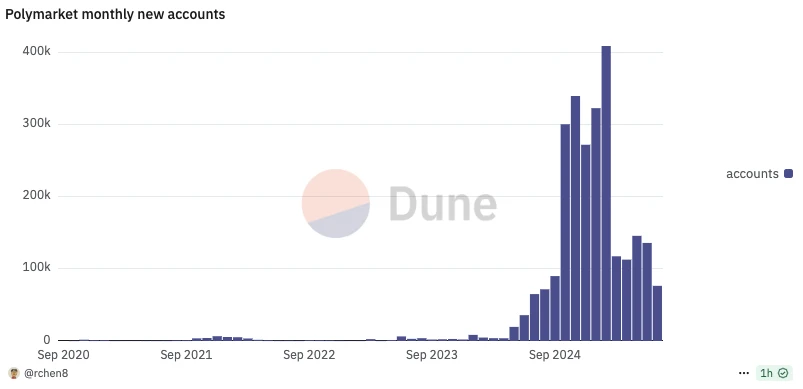

Monthly new users

The above chart reflects the monthly new users of Polymarket. The US election period is the period with the most new users per month on Polymarket, but it is also the main period of platform growth for Polymarket. However, after the US election, when speculators who came because of the election left one after another, Polymarket has maintained a monthly growth of 110,000 to 140,000 accounts since March 2025. This shows that in addition to the US election, other prediction areas of Polymarket are still attracting players to enter the market. At the same time, this is also a big change in the composition of Polymarket platform users from short-term hot event speculation to long-term use.

The above chart reflects the monthly new users of Polymarket. The US election period is the period with the most new users per month on Polymarket, but it is also the main period of platform growth for Polymarket. However, after the US election, when speculators who came because of the election left one after another, Polymarket has maintained a monthly growth of 110,000 to 140,000 accounts since March 2025. This shows that in addition to the US election, other prediction areas of Polymarket are still attracting players to enter the market. At the same time, this is also a big change in the composition of Polymarket platform users from short-term hot event speculation to long-term use.

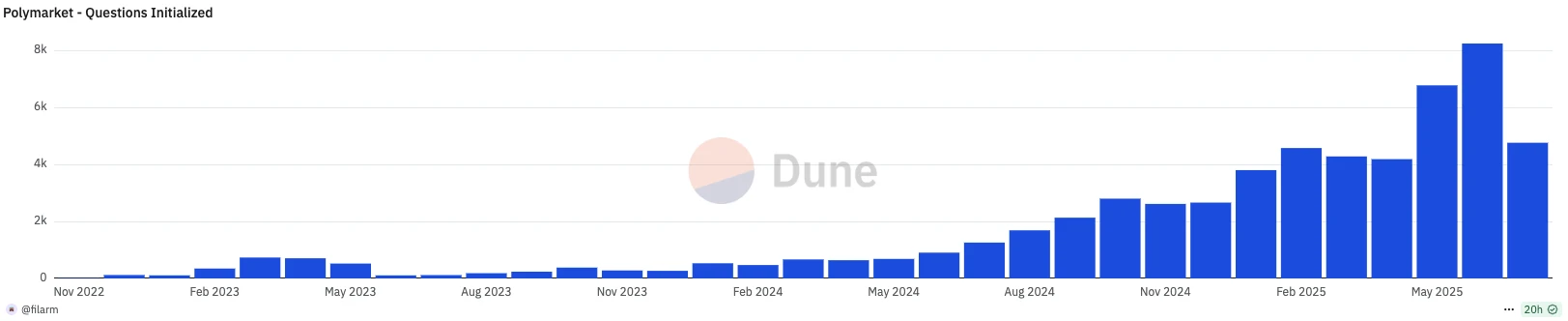

Number of prediction pools

The above chart reflects the number of prediction pools on the Polymarket platform each month. As can be seen from the above chart, since 2025, the number of prediction pools on Polymarket has been more than during the 2024 US election. In May and June 2025, the number of prediction pools exceeded 5,000, reaching 6,771 and 8,238 respectively. This means that the prediction betting field of the Polymarket platform is constantly expanding, and it is expected to attract more players who like different fields to join.

Is it too late to play Polymarket now?

From the above data, we can see that the Polymarket platform is still not outdated, and such projects with product-market fit are also popular in the financing market. According to Rootdata data, Polymarket has completed three rounds of financing with a total amount of US$74 million. At the same time, according to news in June, Polymarket is still seeking nearly US$200 million in financing with a valuation of over US$1 billion.

For an application like Polymarket that has influenced traditional political media and brought encryption to the outside world, a valuation of $1 billion is actually not high. If a token is really issued, even airdropping 10% of the token supply to platform users may be a big loss. So, considering whether it is too late to invest in Polymarket now is actually considering the degree of involution of platform users and various transaction costs.

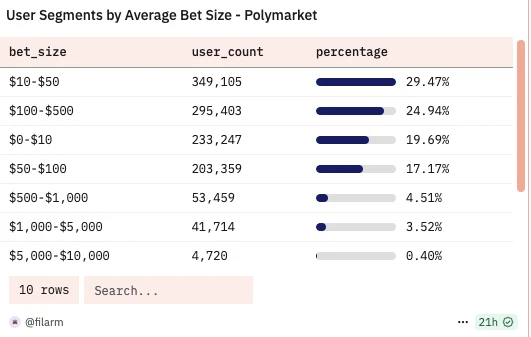

Polymarket is not a scam

The above chart reflects the distribution of betting funds of Polymakert users. As shown in the above figure, more than 90% of users bet less than $500, and whales betting $5,000-10,000 only account for 0.4%. Therefore, if there is a trading ranking in the Polymarket airdrop conditions, it is not difficult to rank in the top 10% at present. This also indirectly reflects that the current Polymarket is not competitive, and most people still stay at small and low-frequency trading volume and transaction times.

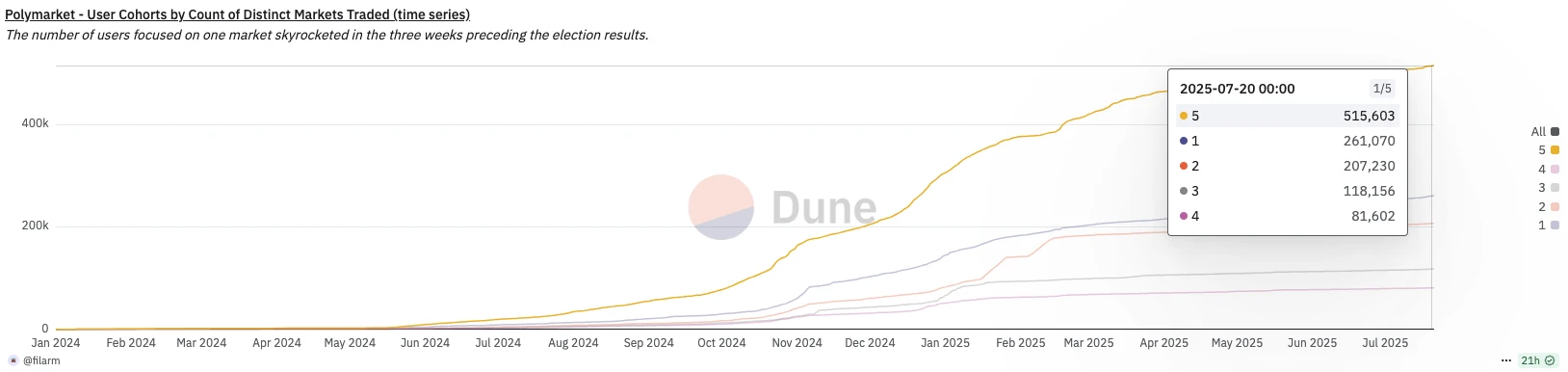

At the same time, among the approximately 1.2 million wallets on the Polymarket platform, the number of wallets participating in more than 5 different markets is about 510,000, which is less than 50%. Participating in different markets is also considered one of the important dimensions of interactive Polymarket. This indicator also reflects the number of wallets that use Polymarket airdrops. Combined with the above data that Polymarket has 20,000 to 30,000 daily active wallets, it is conceivable that there are only tens of thousands of wallets that continue to use Polymarket on the entire network. Compared with the hundreds of thousands of interactive addresses on the public chain, this is already a treasure agreement.

What should retail investors do now?

In the early years, some users speculated on the dimensions that Polymarket might refer to for issuing coins and airdrops:

Trading Volume

Number of transactions

Trading frequency

Participation in different markets

Trading method (market price, limit price, AMM)

Holding time

Single transaction volume (if at least one transaction amount is greater than $500)

The above dimensions are just a reference. As a retail investor, the dimensions that should be paid most attention to at present are trading volume, number of transactions and frequency, and holding time, while controlling the cost of investment. For holding time, players can bet on the 2028 US Presidential Election, because the prediction pool is large, and the settlement time is long and not prone to drastic fluctuations, and the official also has a 4% annualized holding reward.

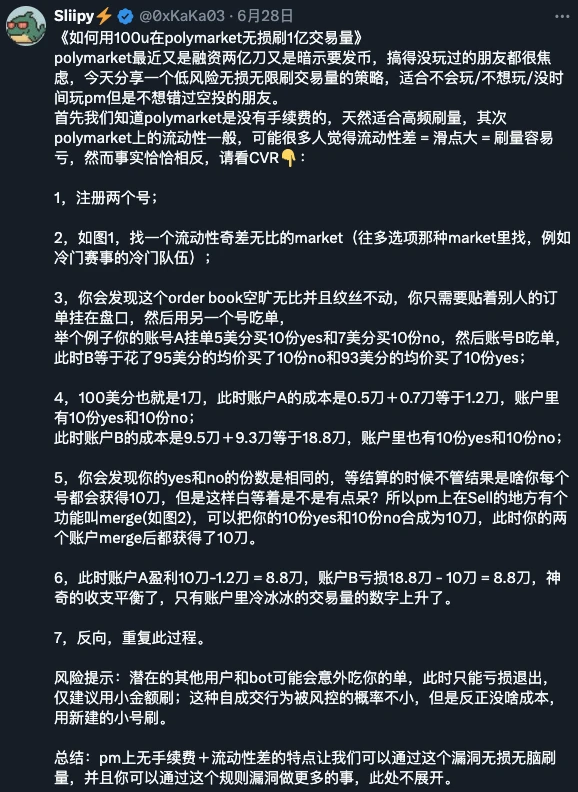

To reduce wear and tear in order to increase transaction volume, crypto blogger SIiipy shared his own approach, which is to find a prediction pool with poor liquidity and use two wallets to increase the volume back and forth. The specific operations are shown in the figure below.

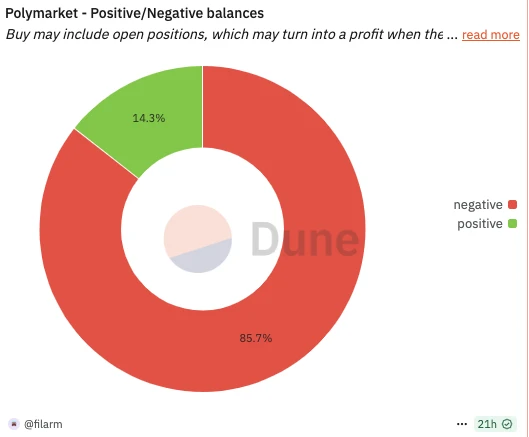

In addition to the above small-amount high-frequency swiping, users can also choose to be a real user and make real bets on the Polymarket platform to win future airdrop opportunities. However, the principle of nine out of ten bets are lost also applies to Polymarket. According to Dune data, only 14.3% of Polymarket users are profitable, while about 86% of user accounts have negative balances.

Polymarket positive and negative account balance ratio

Therefore, in order to reduce the interaction cost, a Polymarket gameplay using option arbitrage was born. This gameplay is limited to the Crypto market on Polymarket, such as the prediction pool Will BTC fall below $118,000 on July 28? The specific operation is to buy a 118,000 put option expiring on July 28 on the exchange, and then buy a no position on Polymarket (betting that BTC will not fall below $118,000 on July 28). In this way, you will provide your own hedge, but players should also pay attention to the time difference risk caused by the inconsistent settlement time between the exchange and Polymarket. (Related reading: Polymarket has a new gameplay? Use option arbitrage )

Related Reading

$112 million breakthrough: Polymarket returns to the U.S. through QCX backdoor listing