From 2022, the world economy will enter a more magical rhythm. The Feds interest rate hike and Chinas policies will affect the nerves of the world economy. Now adding the more uncertain factor of war,The economic value in 2022 may further tend to return to pragmatism and practical applications, and the long-term sustainability of pure Fomo hype should drop significantly.The world may enter a depression cycle at any time. Of course, even in the depression cycle, there will be bright spots.

The long-term value of BTC, as long as the network exists, should not be affected much at present. Because there is no national currency and entity that can achieve objective consensus, deflation, and convenience at the same time. The long-term potential of the renminbi is great, but it has not yet been used on a large scale at the level of international settlement. After being stuck, RD investment has reached a new peak, but it will take time. The international status of the U.S. dollar is gradually weakening, but the research and development capabilities of the United States to create new products are still very strong.Gold is very valuable, but the transportation and trading of gold for daily use is not very easy.

Therefore, projects with enough active users, scalability, etc., and practical application-level development that can see long-term value will be more likely to be truly proven.

secondary title

i. Basic value introduction

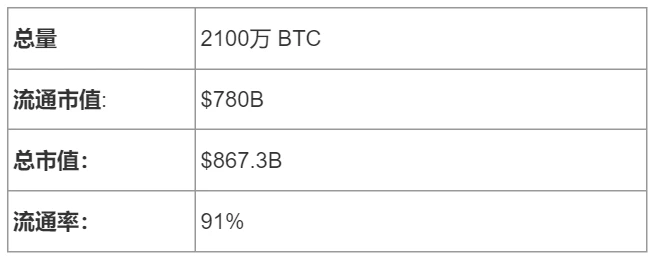

The total amount is 21 million, the deflation model, and the mining reward is halved every 4 years, which means that the number of bitcoins injected into the market will be halved, and the inflation rate relative to the existing base will be reduced. At present, 6.25BTC/Block, one block every 10 minutes, the circulation is about 19.01 million,Inflation rate accounts for about 1.56% of the total, which is lower than the monetary inflation rate of most countries in the world, and it is more obvious when compared with the inflation rate of various countries during the epidemic.

The figure below shows the inflation rate of the G20 countries last year. Except for Japan, China and Saudi Arabia, the basic inflation rate is significantly higher than the inflation rate of BTC. The United States is about 8.5%, and Argentina and Turkey have experienced extremely hyperinflation. Moreover, this trend in 2022 may not necessarily be curbed. Even if the domestic currency does not have too much inflation, many people can experience the inflation of local prices and the decline in purchasing power. andsecondary title。

ii. Token Economic Analysis

As of 2022-4-15:

Token Utility application scenarios and value:

Product Governance Decision Voting -

Store of value and medium

payment for certain goods and services

Attributes of legal currency in some countries

secondary title

iii. BTC long-term core value point analysis:

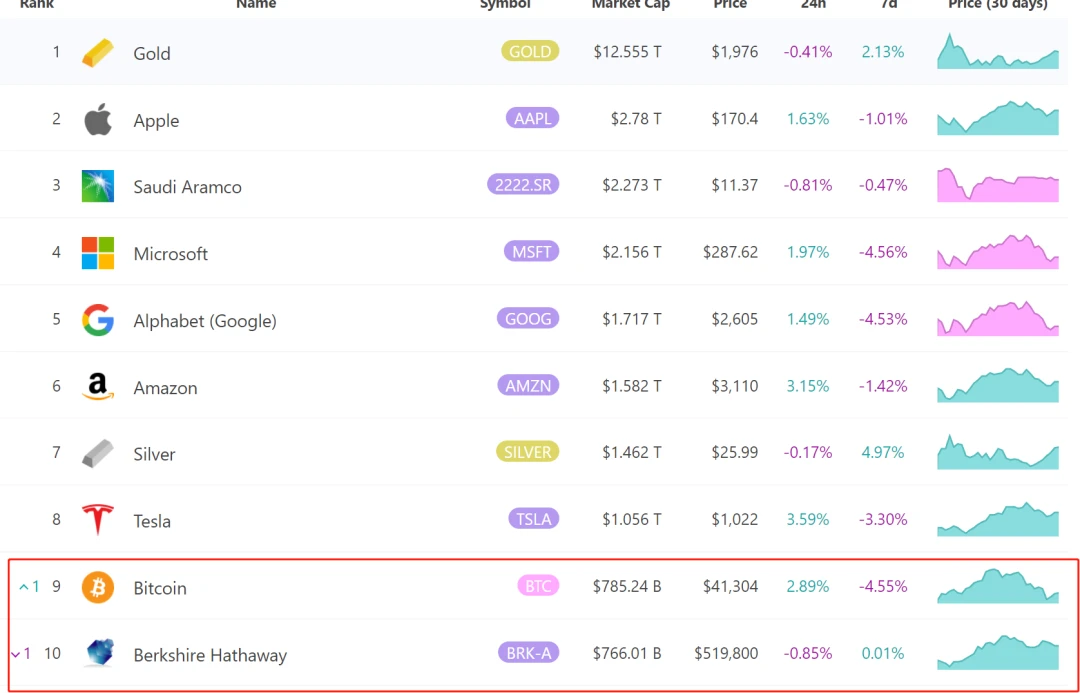

The total market value of gold is currently 12.5 trillion ($12.584T). Compared to BTC’s price of 5W USD, MC is about 1 trillion. Taking 20% of the market value of gold is about 200,000 USD/BTC. From a long-term perspective , as long as the earths network is not subject to long-term destructive blows from solar storms, the current trend and the trend of technology applications, the probability of BTCs status is increasing day by day and gradually occupying a dominant position.Because there is currently no other digital currency that can possess the objectivity and decentralization of BTC while taking into account simplicity and practicality.

The cornerstone of BTCs long-term value:

Sufficient value objectivity and universality

Sufficient decentralization and consensus

Sufficient scarcity (Gold has been discovered by Mars rovers at present, and similar mineral photos have been discovered. With the advancement of human technology, it may appear like diamonds. When people can mine a large amount of gold, the real value will be affected)

The advancement of technology and the convenience of use, the gradual liberalization and compliance trend of governments in various countries

Switzerland and other old reputation countries have collapsed, and rich people from all over the world have to think about the absolute neutral target

Risk factors for BTC:

There is no physical factor, relying on the network, and the network is greatly affected by the cosmic black swan and human wars cutting off the network, especially sports such as solar storms. When a black swan occurs, BTC will be unusable for a period of time, but it will not disappear.

Short-term financial measures such as interest rate hikes will cause asset price volatility due to the return of liquidity. A large number of long-term investors may hold cash and wait for a good opportunity to enter the market.

first level title

secondary title

have

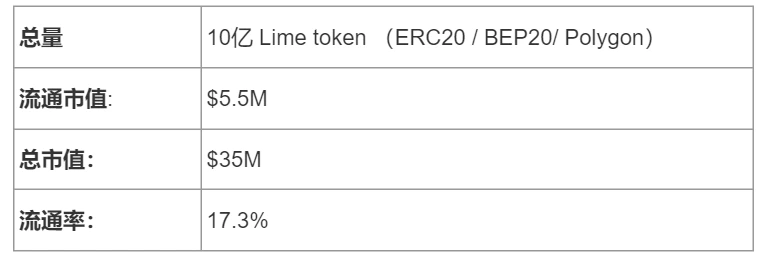

have400W usersIme Lime maybeIt is also a blockchain empowerment project with a win-win cooperation with Telegram。

1. Ime Messenger is essentially an enhanced version of Telegram Plus, which integrates Defi+binance pay+wallet+dex (Uniswap, Pancake, etc.)+cex function+NFT+Game Metaverse, etc.Integrates text direct Google translation function, DIY icon and optimized music, note and other functions and can directly use Telegram account.

2. Groups can be customized to organize and optimize the overall telegram layout and group management for special needs, unread reminders and other functions, which optimize the work efficiency and reading efficiency of native telegram.

3. Ime enables Telegram friends to transfer different digital assets directly through telegram, similar to the function of direct transfer between WeChat friends. This function can also directly activate the huge user group of telegram, and develop the donation donation function within TG, including the group crypto red envelopes and other function incentives under development

4. Multi-chain function integrationsecondary title

ii. Token Economic Analysis

As of 2022-4-15:

Token Utility application scenarios and value:

Product governance decision voting - according to stake weight

Ladder ranking system, for example, in the future, according to the ranking, you can participate in the start-up activities of integrated new projects, whitelist, etc.

Participate in different types of activities such as cooperative project staking to obtain rewards such as partner tokens and U

Obtain derivative values such as NFT and Game Item

Based on the characteristics and characteristics of Ime, get more permissions and opportunities to participate in the construction in the future

secondary title

iii.Ime’s analysis of Telegram’s empowerment value points:

Most of the software developed based on TG API codes on the market has problems of delay and lag, and the number of basic users is insufficient. Ime Limes software has the same smoothness as TG under the premise of adding many functions. It can be seen that the technical skills of the Tech team

Make Telegram more flexible and easy to use, greatly improve office and communication efficiency, users can use tokens directly with friends, integrate DEX, CEX, DEFI and other comprehensive blockchain tools and applications, and empower SocialFi

With a user base of 4 million+, and there is a tendency for further TG users to use it at the same time, TG’s unlisted B-round financing valuation has exceeded 15 billion US dollars.

Buy cryptocurrency with legal currency through Simplex, Binance pay, coinbase pay and other future diversified financial tools integration potential.

The difference between Telegram TON and Ime Lime:

(The difference between Ime and Ton, the difference between Lime and Ton, SEO optimization, remember to edit as an invisible font)

Ton is essentially a Telegram chain, and TON is used as an ecological token. Under the supervision of the US SEC, the official Telegram team has given up on the research and development of Ton or at least will not continue to support it on the surface. Compared with the popularity and status of the largest IC0 in history that year, this has indeed dropped a lot. Some unknown external teams continue to hype the trend. There is a high probability that Chinese people will take over. The actual development effect and role have yet to be verified.

first level title

secondary title

i. Basic value introduction

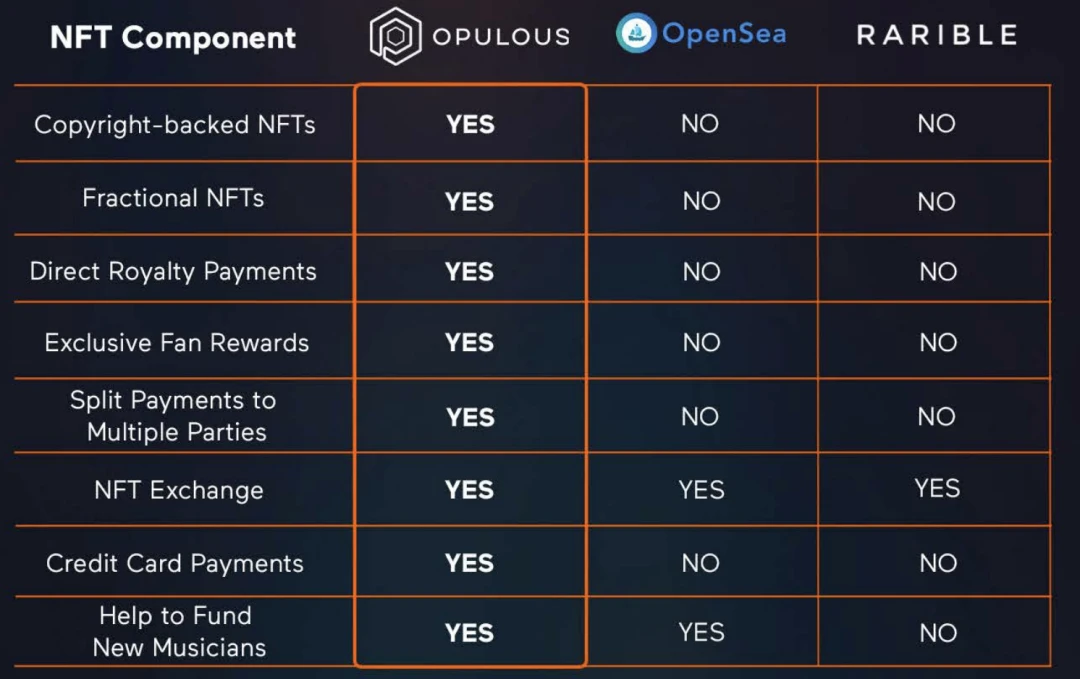

Opulous is a music NFT and Defi project based on the Algorand public chain. The founding team is the head of Ditto Music. Ditto has tens of thousands of artists, including top stars such as ED Sheeran and Sam Smith. SONY CEO is also the main consultant for the project. The artists that Opulous initially cooperated with in the project are all artists with tens of millions of fans abroad, which is also a value point that has expectations for its long-term value.

secondary title

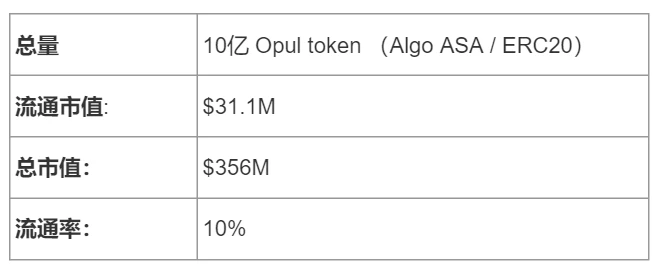

ii. Token Economic Analysis

As of 2022-4-15:

Token Utility application scenarios and value:

Participate in ecological governance

Staking rights and NFT staking options by 100 million

Participate in the priority purchase of the rights and interests of artist music NFT

secondary title

iii.Opulous core value analysis

The music copyright NFT project is an area where I personally think blockchain empowers traditional businesses a lot, but as more and more entrepreneurs join in, failure cases are not uncommon.The core reason is that the blockchain and NFT technology itself is a huge optimization of the gameplay and process, but it does not represent the complete sharing and equality of resources.Therefore, music is an industry whose copyrights are still mostly in the hands of traditional economic companies. As an artist, many new financing and display channels may be added, but as a project party, original and original resources are particularly important.

Therefore, project parties that already have sufficient resources, including those of traditional music brokerage companies, will have a greater competitive advantage in the transition to the use of new technologies. It is also easier to gain the trust of outstanding artists. Obviously, OpulousIn terms of resources and experience in the music field behind it, it has a competitive advantage that many competing projects do not have. This is also one of its core values.

For Algorand, whether Opulous can grow into a major ecological project is also a crucial part. After all, Algorand currently has top-notch technology, top-level underlying security, top-level government resources, and great potential. However, the market operation is relatively second-tier, and promotion is also an objective problem. Except for long-term institutions and investors with in-depth research, there are relatively few KOLs in the analysis, which may be caused by the sequelae of the early Dutch post-sale release mechanism and the imbalance of incentives for market contributors. But fortunately, all the early institutions have been released, and it is inevitable that the DNA will flow in compliance.

Risk Analysis:

Since the entire industry is still in its early stages, the NFT works of traffic artists may not be known by fans how to play and participate, so it may not be directly converted into a direct value increase for the Opul token itself. However, with the popularization of knowledge and the increase of operations, the benign chemical reaction will gradually increase.

Summarize:

Summarize:

The beginning of 2022 is indeed a year that is very difficult to summarize with any analysis techniques and laws, the confluence of the century-old economic cycle, short-term economic inflation pressure, the pressure of the inevitability of interest rate hikes, rare epidemics, wars, and natural disasters. Even metaphysical astrology and other comprehensive influences are intertwined, and it is very difficult to judge short-term value. Except for BTC, LIME, and OPUL mentioned in the article, due to space limitations,The long-term value research of Algorand, SOL, AVAX, Polygon, ICP and other public chains, and the overestimation and underestimation research of certain projects in Korea such as AI, Aergo, and Luna cannot be written in one article. Layer 2s initial project Truebit et al.

However, long-term value will gradually develop to the position of value realization under the joint action of several reasonable factors.The shorter the time span, the higher the difficulty coefficient of judgment. The higher the accuracy of the short-term stimulus information required, this is similar to sprinting 100 meters, you need to be Bolt to have enough dominance for a period of time (hedge fund strategy), but if it is a distance of 1 million meters, you need The only thing is to survive and have good habits and enough tools and environment to help you complete this journey. in other words,The shorter the time, the more terrifying your competitors are, perhaps Goldman Sachs, JP, MSs most advanced short-term analysis system, and the most first-hand inside information.

Therefore, for the judgment of the situation and the value of the project, on an objective basis, as time goes by, whether these logics can also make sense on the basis of time measurement is the key factor for us to find long-term value.For example, BTC, as time goes by, the initial basic logic in 2013 will still apply in 2022, and more and more people recognize its objective value.The country has also begun to gradually discuss its compliance. In another 10 years, perhaps BTC has become a thing that ordinary parents can use every day like digital legal currency. If Lime can operate steadily, its supporting components are gradually improved, and it can work hand in hand with telegram to support a huge social scene and financial application, what will its long-term value be? The happiest thing about investment or research is to watch an undervalued person or project grow into a moat under the bath of time.

This article is not investment advice, it belongs to personal feelings about the overall macro and trends, and investors are asked to make rational judgments.

PS: Never ignore Blackswan Never ignore the possibility of black swan happening