Original author: The Kobeissi Letter ( @KobeissiLetter )

Compiled by | Odaily Planet Daily ( @OdailyChina )

Translator | Ethan ( @ethanzhang_web3 )

Editors note: This is not another bull market, but a Bitcoin crisis market that broke out amid the flood of deficits, the depreciation of the US dollar and the reconstruction of the financial order. When gold prices and BTC soared simultaneously, Wall Street ETF funds surged, and even conservative funds no longer hesitated, we have to admit that the market is entering an unprecedented new cycle. Why has Bitcoin become a winner in the unconventional macro context? Is this wave of rise a bubble, a hedge, or a repricing of power? Odaily Planet Daily will help you see the real direction of capital betting.

The original text is as follows

These are not “normal” times. Bitcoin has been on a crazy, straight-line rise. Interest rates are rising, the dollar has lost 11% of its value in six months, and the total crypto market value has increased by $1 trillion in just three months.

What exactly happened? The answer is clear: Bitcoin has entered crisis mode.

Bitcoin is so strong right now that it can hit all-time highs (ATHs) multiple times a day. Since the U.S. House of Representatives passed President Trump’s Big, Beautiful Act on July 3, the price of Bitcoin has skyrocketed by $15,000. If gold doesn’t raise alarm bells, then Bitcoin’s surge should be enough to do so.

Is there a more obvious signal than this? Looking at the trend comparison between Bitcoin and the US dollar index ($DXY) since the beginning of the year, there are two obvious divergences:

April 9 (after the 90-day tariff suspension period ends)

July 1 (when the Big, Beautiful Act was passed)

Everything is self-evident.

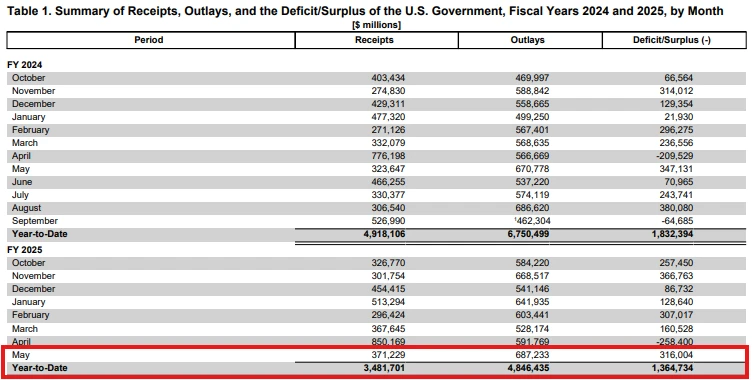

In July, the market received data showing that the United States recorded a fiscal deficit of $316 billion in May 2025 alone. This is the third highest monthly deficit level in history. At first, the market had expectations because Musk opposed the spending bill.

However, that hope quickly faded in early July.

At the time, Bitcoins rise seemed to benefit from the markets expectations for a trade agreement. But it turns out that whether a trade agreement is announced or not, the market results are surprisingly consistent: bond yields climb, Bitcoin soars, the dollar falls, and gold rises.

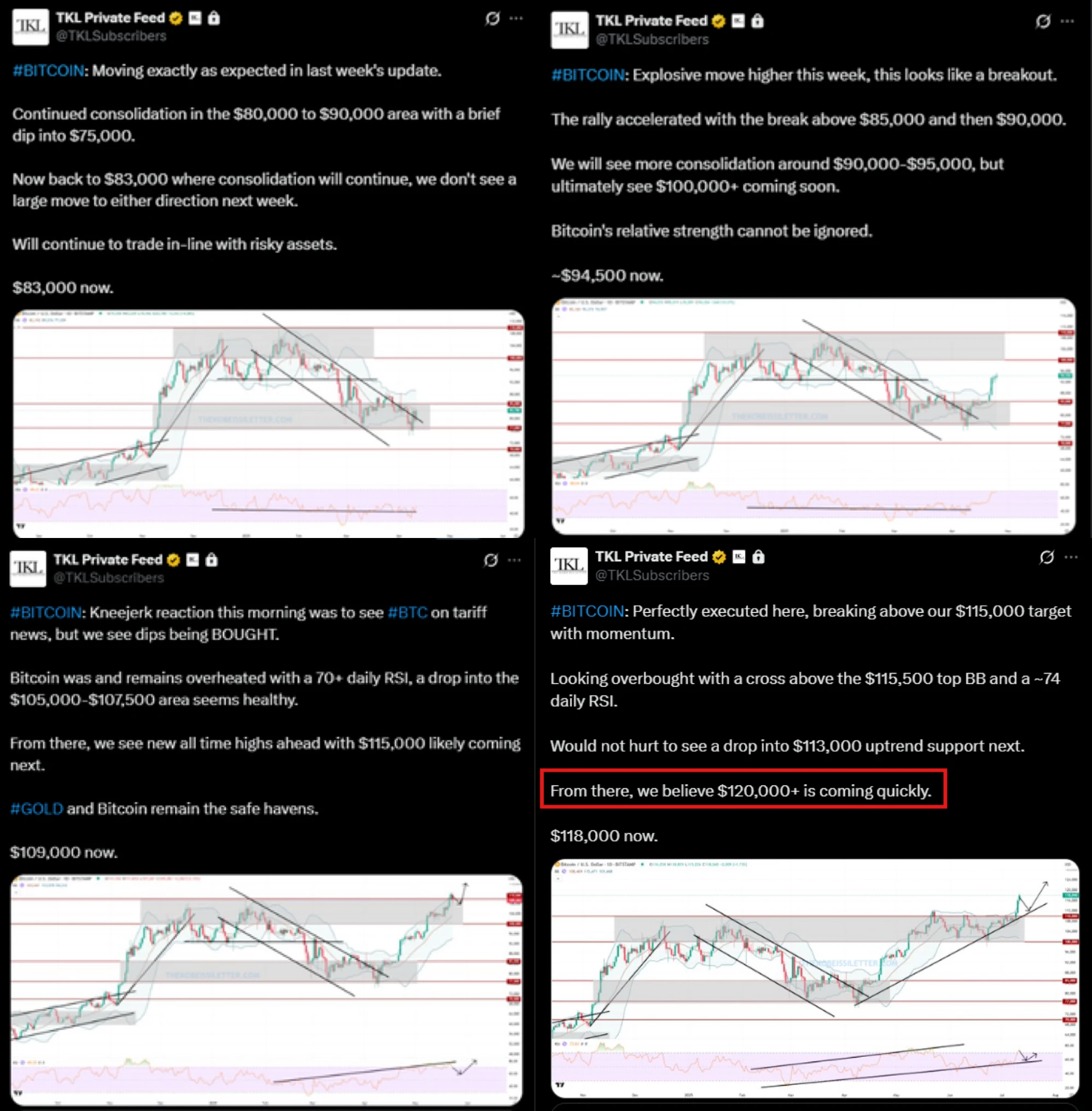

This is not a “normal” market condition. We anticipated and caught this trend: We bought the pullbacks at $80,000, $90,000, and $100,000, with a target price of $115,000.

Last Friday, we raised our target further to over $120, 000 – a level that has just been hit.

This is undoubtedly a double boost (double benefit) for gold and Bitcoin.

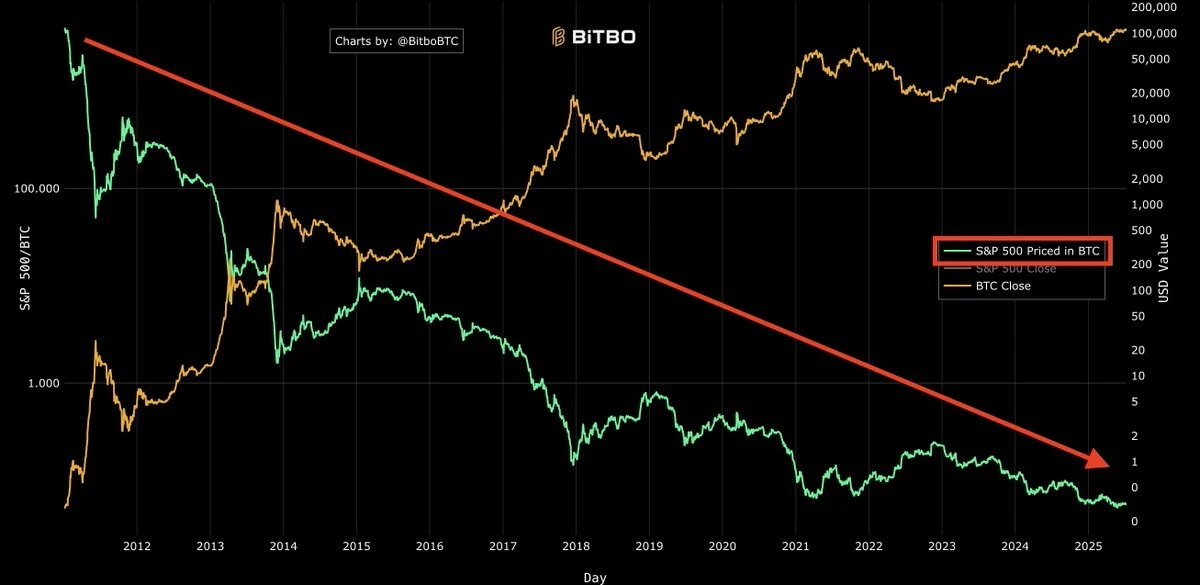

So far this year, the SP 500 has fallen 15% in bitcoin terms. And going back to 2012, the SP 500 has plunged a staggering 99.98% in bitcoin terms. The current situation is: the value of Bitcoin has soared, and the value of the US dollar has shrunk.

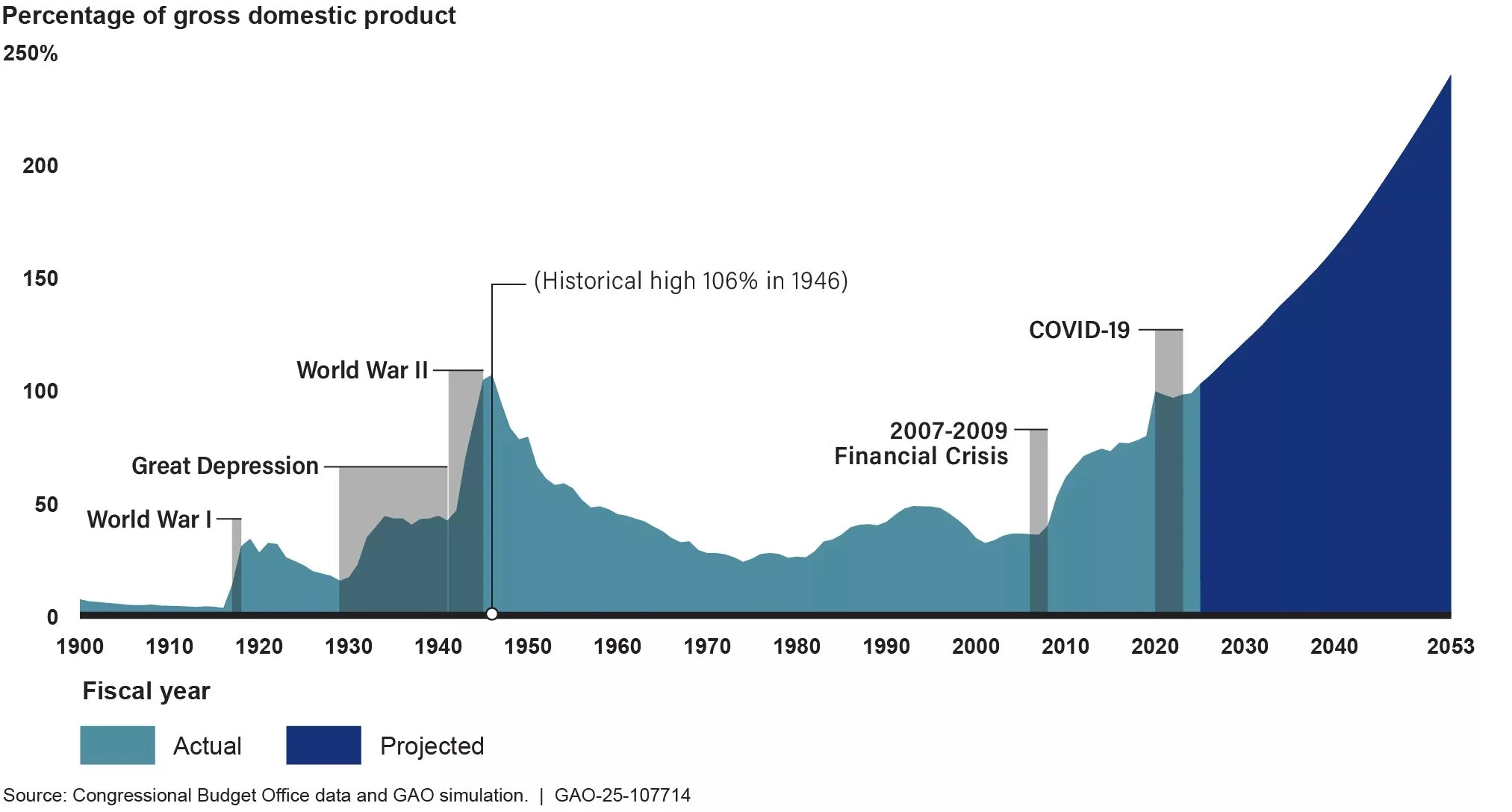

Again, keep a close eye on the U.S. fiscal deficit.

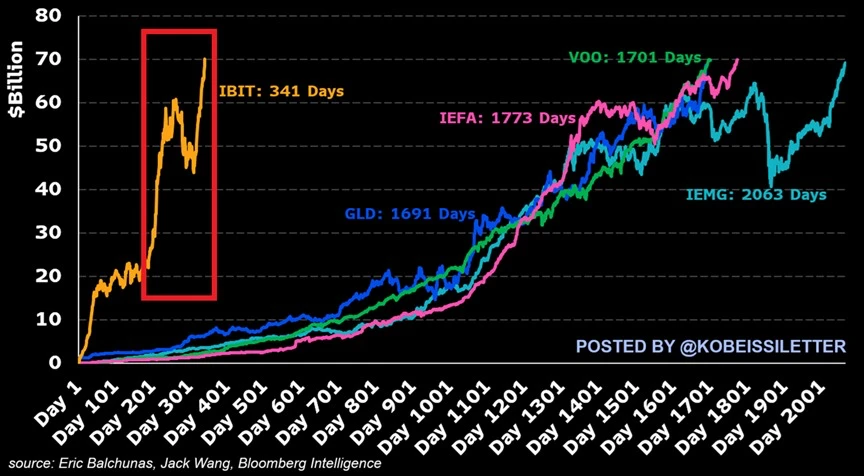

More importantly, institutional funds seem to be rushing into the market to chase this round of Bitcoin market.

The asset management scale (AUM) of Bitcoin ETF IBIT has rapidly climbed to a record high of US$76 billion in less than 350 days. In comparison, it took the worlds largest gold ETF GLD more than 15 years to reach the same scale.

In our in-depth exchanges with institutional investors, we have noticed a recurring consensus: broadly speaking, institutional capital such as family offices and hedge funds can no longer ignore Bitcoin . Even conservative funds are considering allocating about 1% of their assets under management (AUM) to Bitcoin .

It should be noted that when we say Bitcoin is in crisis mode, we are not bearish on other assets. In fact, the short-term stimulus effect of more deficit spending is positive, and risk assets may continue to rise in the short term .

Of course, its long-term negative impact cannot be ignored .

Ironically, if the deficit problem were solved, all of America’s woes would be solved. It would lower interest rates, curb inflation, and boost the dollar. But Bitcoin knows that this is almost impossible to happen — just look at how its gains accelerated after the spending bill was passed.

Changes in the economic landscape are precisely where opportunities for investors lie. As the market gradually digests this ongoing deficit spending crisis, capital is undergoing a large-scale rotation, and asset prices are fluctuating violently as a result.

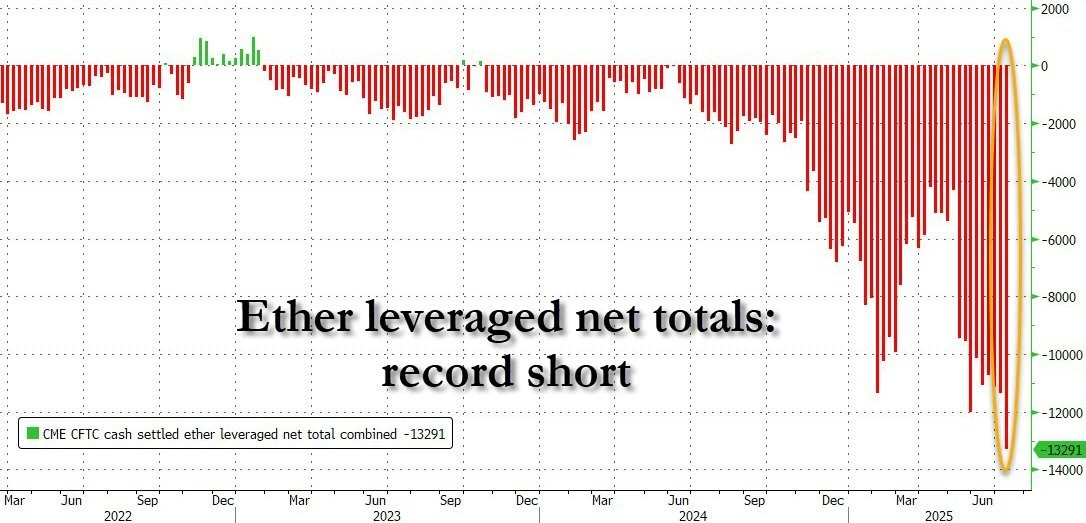

Finally, it’s interesting to note that leveraged short positions in Ethereum are currently at an all-time high, as reported by ZeroHedge. This mirrors what we observed prior to the market bottom in April 2025.

Is a massive crypto market short squeeze about to begin? Something may be brewing…