Introduction

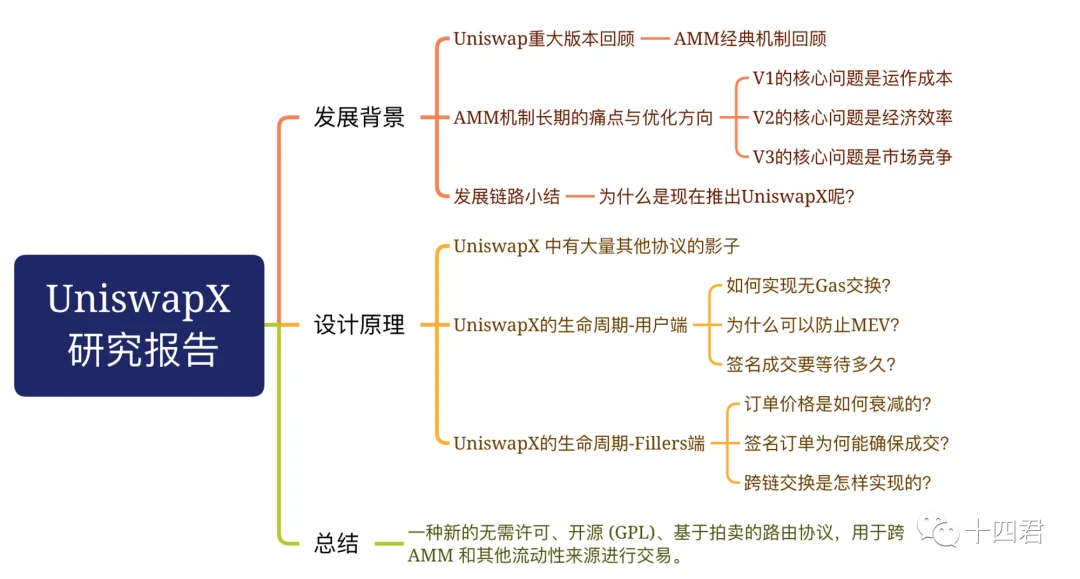

There are few protocols that have completely changed the landscape of an on-chain ecosystem, and Uniswap V1 is one, and UniswapX is another. As the largest decentralized trading protocol, it has launched five versions and processed a cumulative transaction value of over $1.5 trillion. After V1, the huge MEV potential of AMM was explored, and countless arbitrage opportunities spread among nodes on the chain's public memory pool. Although it seems that MEV impedes users and always leads them to trade at worse prices, it actually solidly promotes price consistency between upper and lower chains! This is the core essence of UniswapX - "collective games," which allows decentralized systems to achieve the ultimate balance in the motivational game of smart people. Follow this article to delve into the changes in the Uniswap series and the trading mechanism of AMM, and ultimately trace back to the operational principle of UniswapX to feel this game and find opportunities from the game.

1. Major Uniswap Versions Review

Uniswap is a team that persists in the belief of complete decentralization and keeps innovating with every version launched, accompanied by significant changes in the Defi landscape.

Uniswap V1 was launched in November 2018. Although it only allowed exchanges between ETH and tokens, it started with just a few hundred lines of code and kicked off the long journey of DEX trying to challenge CEX.

Uniswap V2 was launched in March 2020. It is a huge improvement over V1, allowing direct and chain exchanges between any ERC-20 tokens.

Uniswap V3 was launched in May 2021. Building on the achievements of V2, V3 significantly improves capital efficiency, enabling liquidity providers to achieve the same rewards with smaller liquidity costs.

Uniswap V 4 was launched in June 2023, and it is more focused on system optimization for developers. It runs specific contracts at various points in the lifecycle of a trading pair through the Hook mechanism. It is a mechanism to further release the value of liquidity in V 2 and V 3, and it is still in the early stages of iteration.

Uniswap X was launched in July 2023. It is a new permissionless, open-source (GPL), and auction-based routing protocol for trading across AMMs and other liquidity sources, even across chains for information interoperability.

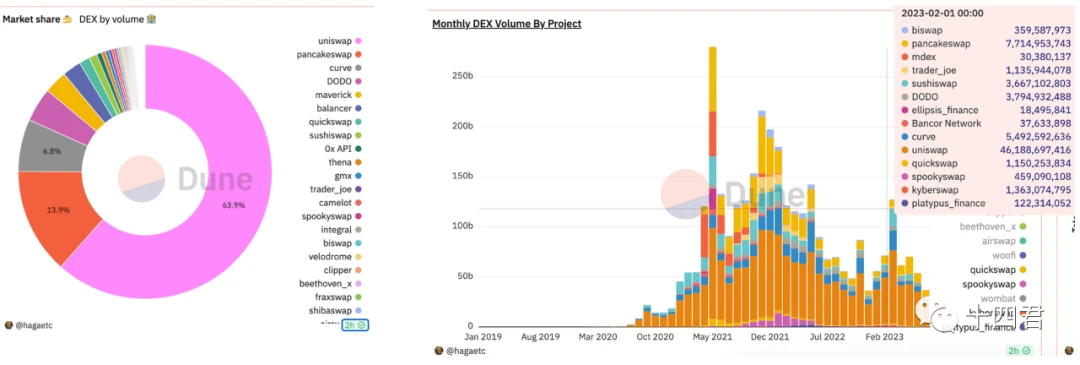

From V 1 to V 4 can be seen as a continuous iteration of ideas, while the birth of X is expected to open up information interoperability among multi-chain and multi-protocol through the implied meaning of X. Under the strong brand effect of Uniswap, the overall operation mode of DEX will change. In multiple iterations, the Uni series protocol firmly occupies over 60% of the DEX market share, and most DeFi protocols are either forks or compatible, becoming the most fundamental financial infrastructure on-chain with the largest trading pool depth.

https://dune.com/hagaetc/dex-metrics

2. AMM Mechanism's Long-term Pain Points and Optimization Direction

Was AMM impressive enough in V 1, so it's good enough? Definitely not. Being able to swap is just the most basic service, and there are more potential opportunities beneath the implementation of functionality. LP (Liquidity Provider) and its derivative, TVL (Total Value Locked), always strive for no profit, no gain. How to obtain higher operational efficiency at a lower cost is always their theme.

2.1 The core issue of V 1 is operational costs

Due to the fact that he only provides the conversion between Token and native tokens, cost issues are inevitable

Transaction cost: Users need to complete two transactions to convert Dai and Usdt, first DaiETH and then ETHUsdt

Slippage cost: Furthermore, atomic transaction capabilities are not provided in these two transactions, so there may be slippage changes during the separate on-chain processing.

Therefore, there won't be too much trading unless there is significant on-chain profit. However, the fee collection method of Uniswap is to deduct 0.3% from the traded Token, which belongs to a per-transaction fee mode, and ultimately, it is accumulated in the pool and shared through LPToken dividends.

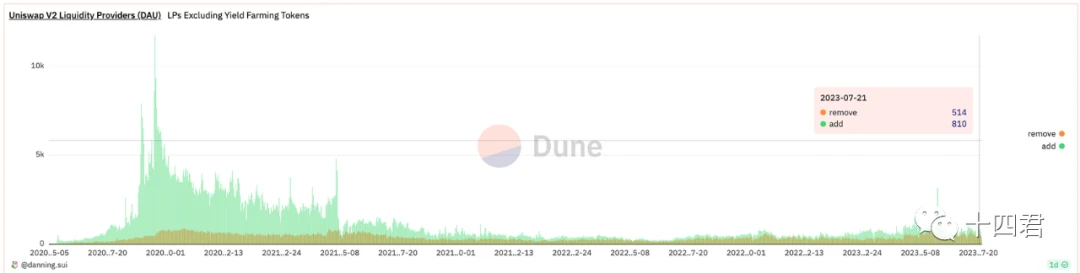

2.2 The core issue of V 2 is economic efficiency

The change in V 2 further optimizes the pool mode of V 1. It also uses the smart contract factory deployment mode to allow the construction of pools between Tokens and Tokens, and realizes the customization of chain transaction paths. From the figure below, you can see that since the launch of Uniswap V 2 three years ago, the number of operations (DAU) that have been added as LP to the liquidity pool is greater than the outflow. Although it is not the best business, it is also widely recognized in the market.

https://dune.com/danning.sui/uniswap-user-base

Currently, Ethereum alone has 22,000 transaction pools, so the Path pattern not only reduces meaningless asset lockups on the chain, but also makes finding better trading paths a difficult task on the chain.

The analysis of trading paths here is a significant efficiency loss point. Teams without strong on-chain data analysis capabilities find it difficult to build sufficiently good trading paths. Another more important point is the efficiency loss of capital. For most stablecoin trading pairs, a large portion of the funds within the entire lifecycle of the pool is unnecessary. This is because most of the time, DAIUSDC fluctuates within a price ratio of 99.99%, which leads to a low utilization rate of the capital pool.

By deducing the formula for impermanent loss, the sources of impermanent loss can be identified: the loss of LPs on ETH due to being left empty, or the value of the pool being taken by external arbitrageurs.

Further reading: "Interpreting Impermanent Loss in Dex: Principles, Mechanisms, Derivation of the Formula"

In the face of the uncertainty of unpredictable losses (no one knows the future price direction of Token), becoming a stablecoin LP can withstand impermanent losses and earn swap fees (as the prices of the two Tokens are likely to remain unchanged in the long term). However, if too much capital is allocated to stablecoin LP, it will dilute the fee-sharing income but gradually increase the value of the two pools to millions of US dollars.

In conclusion, the inefficiency of V2 comes from the difficulty in constructing the optimal trading path and the low utilization of funds in dealing with impermanent loss.

The core issue of V3 is market competition

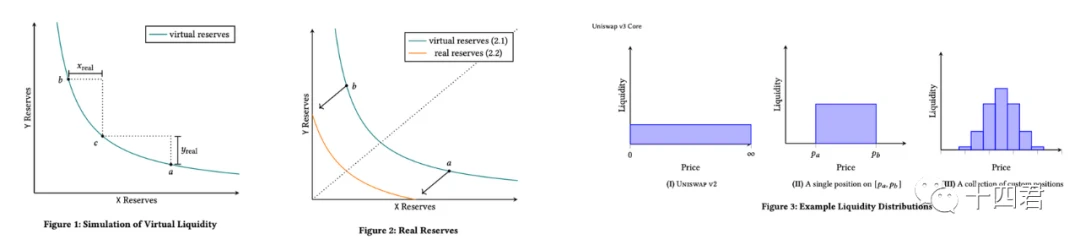

To address the funding efficiency issue of V2, Uniswap V3 introduces Concentrated Liquidity, which limits the range of liquidity. This reduces the ineffective allocation of funds in local areas. As shown in Figure 1, the "Virtual Reserves" refer to funds that only provide liquidity in a specific range on the fixed-product curve. LP can provide liquidity in the specified range XY to achieve the same price as the price calculated from the total funds.

In summary, as shown in Figure 3, V2 liquidity is "universal" and consistent at all price points. V3 liquidity is composed of liquidity in different ranges.

Compared to V2, liquidity is relatively higher around the current price. LPs can only earn trading fees by providing tradable liquidity. They can even implement limit order mechanisms by slicing multiple intervals. There are more formulas involved in this part, so researchers are recommended to refer to the original whitepaper.

https://uniswap.org/whitepaper-v3.pdf

Although V 3 still has many optimizations (such as oracle price based on geometric mean), the market dynamics have changed. Even though V 3 is more friendly to LP, when everyone in this circle is smart, they will all choose the appropriate range. In general, this does not improve the issue of capital accumulation.

In addition, optimizing LP efficiency does not effectively feedback profits to users. For most users, the moment an AMM transaction is added to the memory pool, it will be closely monitored. They will be caught in the dilemma where profits are higher than transaction costs. In order to counteract this, there have even been experts developing a contract specifically to combat malicious bots, including a contract named Salmonella.

Further reading: https://github.com/Defi-Cartel/salmonella

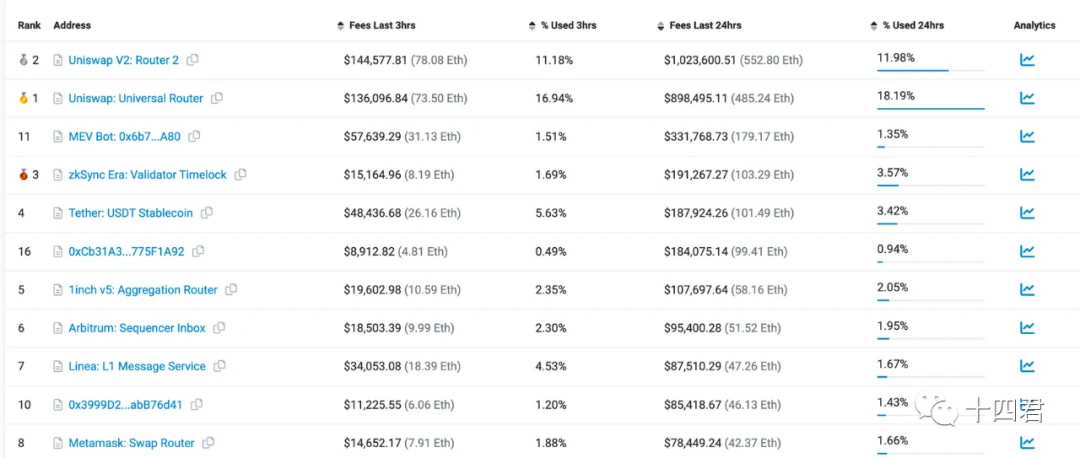

The reason why it is said that the market dynamics have changed is because if you look at the current on-chain Gas consumption rankings, you will find that Uniswap ranks first and second (the aggregator for NFTs). However, V 3 is nowhere to be found, but there are other Swap aggregators in the background (such as rank 5/8 in the figure below). Moreover, the competition landscape of different blockchain ecosystems is not solely dominated by Uniswap.

Therefore, the structure of on-chain transactions has evolved into a separation of front-end and back-end for a long time. The optimizations of V 3 have taken a divergent path from the current market choices.

https://etherscan.io/gastracker

3. Summary of the Development Path

3.1. Why did aggregators emerge? Why did UniswapX also move towards the role of aggregator?

Looking at the mechanisms of V1-V3 and the limitations arising from them, and the attempts to improve and optimize, it can be said that the Uniswap team has been deeply involved in the management of LP profits. However, in today's market, aggregators are everywhere. Uni, as the number one Swap brand and a solid backend infrastructure, is connected to countless frontend aggregators. Although it still earns a 0.3% transaction fee, its share of profits is 0.25% distributed to LPs, while the protocol itself only accounts for 0.05% (which has not yet taken effect).

Therefore, the answer to this question needs to trace back to the five major core issues mentioned earlier in the iterations of several major versions, namely user costs, transaction prices, trading paths, routing services, and LP incentives.

The introduction of UniswapX is an attempt to address these issues from another dimension by completely changing the AMM transaction mechanism.

And it seems that the charging model of UniswapX is still based on extracting fees from transactions, but in reality, the source of this funds does not only come from the pool in their own protocol, but from the back-end protocol moving towards front-end aggregation, and the value relies on the transformation from the massive competition of pools to the branding effect of the front-end.

When the back-end moves towards the front-end, the unique aggregation that the front-end product chain relies on for survival becomes less significant.

This development path has actually been explored in the NFT market.

Initially, OS did not have the ability to batch transactions or conduct cross-market transactions, so a large number of aggregators, created mainly for speculation purposes, emerged (with bulk scanning as the core function to help project parties), and later when Opensea launched the new Seaport protocol, it already had the basic protocol capabilities for batch transactions, circular transactions, and partial transactions, leading to a further dilution of the market share of NFT aggregators.

Even if NFT trading itself is declining, the leading position remains consistent.

3.2, Why is UniswapX being launched now?

Looking back at the launch of the Uniswap V1 version, which quickly ignited the market, a major reason was based on the market conditions at that time. There was a large number of new-generation ERC20 issuances, and the project itself needed to maintain an on-chain real-time liquidity pool to provide permissionless swapping capabilities (after all, there was still a certain threshold for trading on exchanges). The market situation of Swap today is similar:

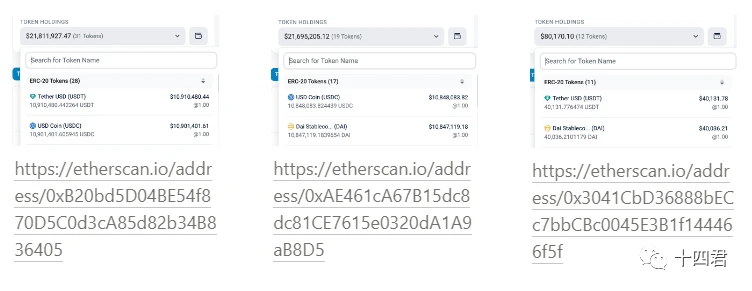

On one hand, as MEV completely surrounds the on-chain mempool, every large-scale swap transaction almost faces front-running and even in the above chart, we can see that MEV Bots rank 11th in terms of total gas consumption on the network, consuming 180 ETH in transaction fees every day. Ultimately, these users will be forced back to CEX's low-priced market.

On the other hand, one common solution to combat MEV is the split routing model, where 1 ETH converted to 1900 U is not directly completed through the ETHUSDT pool, but is split into 30% going to Pool A and 40% going through Pool B. This kind of split model reduces the slippage per transaction and increases the cost for MEV attackers. This is the complexity of routing, finding the best split combination among millions of pools to achieve the best price for users.

So, in the face of MEV and the complexity of routing, will UniSwapX succeed? What are its advantages? We need to evaluate its potential value from its operational principles.

This article is 9,700 words long. The first part outlines the development path of the Uni series, summarizes the background and protocol goals of X. The second part explains the details of X's principles. I will provide a dual interpretation of the order's lifecycle from the perspectives of users and fillers to ultimately answer its protocol characteristics and advantages. The article has been submitted to the Web 3 Caff platform (a high-quality paid research platform). You can click on the link below to read the original article or use this link: https://research.web3caff.com/zh/archives/10004?ref=shisi

Contact the author in the background to discuss web 3 industry issues.

Like and follow, Fourteen brings you value from a technical perspective.

Weekly blogger, recommended to mark with a star to reduce missing out on the latest viewpoints!