Original | Odaily Planet Daily ( @OdailyChina )

Author: Azuma ( @azuma_eth )

This column aims to cover the low-risk return strategies based on stablecoins (and their derivative tokens) in the current market (Odaily Note: code risks can never be ruled out) to help users who hope to gradually increase the scale of funds through U-based financial management to find more ideal interest-earning opportunities.

Previous records

Special emphasis

In view of the recent uproar over the Resupply hacking incident ( for details, see Review of the Resupply incident: hackers are at large, users are forced to fill the hole, and the security incident has evolved into a racial discrimination scandal ), it is once again reminded that the security issues of DeFi are difficult to completely eliminate. Therefore, before choosing to participate, please be sure to do your own risk and endorsement research. At the same time, remember to do a good job of position division and do not concentrate your funds in a few protocols.

Follow up of old mines

Pendle and RateX partial LP migration

Perena (USD*) has been mentioned many times before. The main LP pool of this project on RateX expired on June 28. Since RateX does not yet support a one-click migration (roll over) function like Pendle, it is necessary to manually withdraw funds or migrate to the future to prevent idle funds.

A similar situation is the Upshift (upUSDC) pool on Pendle, whose main LP pool will expire on July 3, at which time it can consider withdrawing funds or migrating backwards.

New opportunities

Spark SPK Incentives

Sky and Spark jointly announced yesterday that they will provide SPK incentives for USDS deposits through Spark Farm. Currently, the overall APY after the incentive is about 10%. Although the yield is not high, considering the security endorsement of Sky and Spark, it is more suitable for users with larger funds and higher security requirements.

Portal: https://app.spark.fi/spk/farm

Gauntlet USD Alpha Strategy

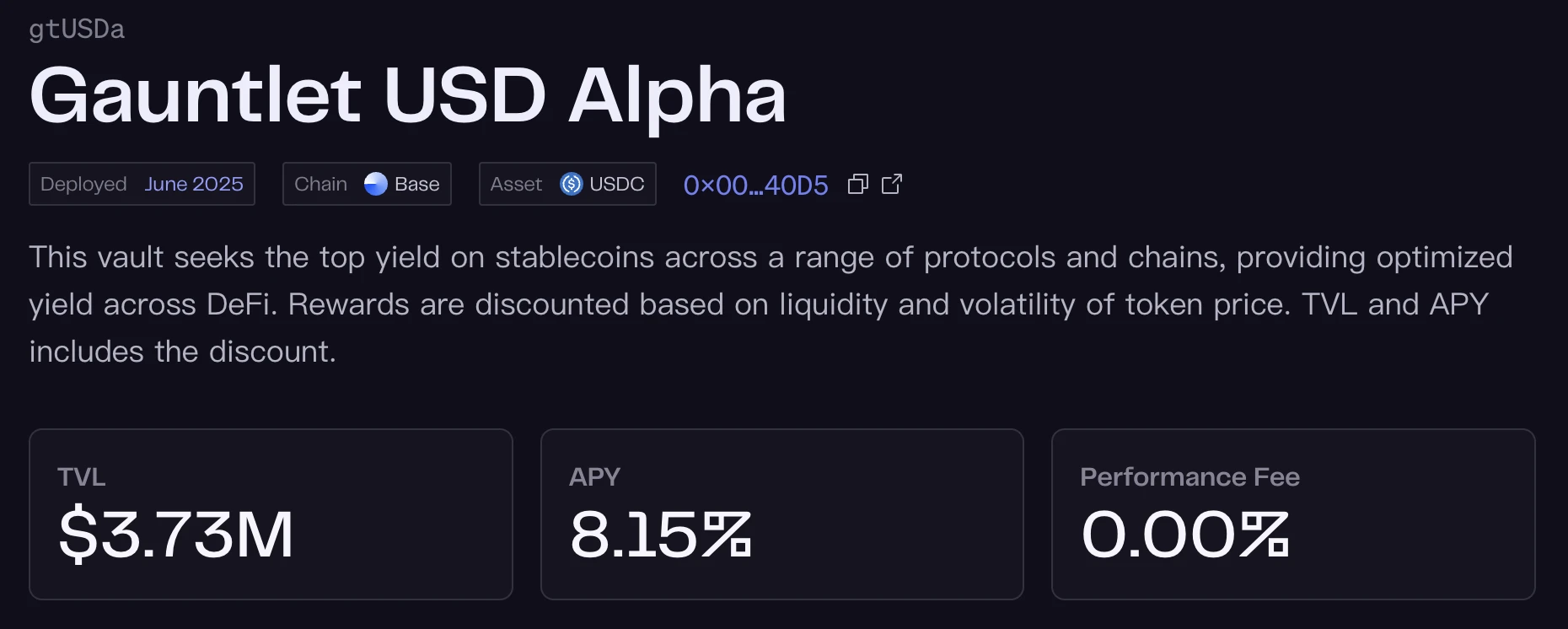

On June 24, DeFi research and risk management company Gauntlet announced the launch of Gauntlet USD Alpha (gtUSDa), which is positioned as a fund pool that provides institutional-level yield management and risk adjustment for stablecoins. It is open to all users and has no management fees. USD Alpha is supported by Gauntlets quantitative team and currently only supports revenue generation through Morpho. Subsequent plans are to expand to cross-chain revenue opportunities.

Gauntlet backtested this strategy and found it can achieve 11.02%, and the current APY shown on the official page is 8.15%. The advantage of this strategy is that it is relatively easy and does not require frequent adjustments, but the disadvantage is that the absolute rate of return is still slightly low.

Telegram Limited Time USD Deposit Incentive

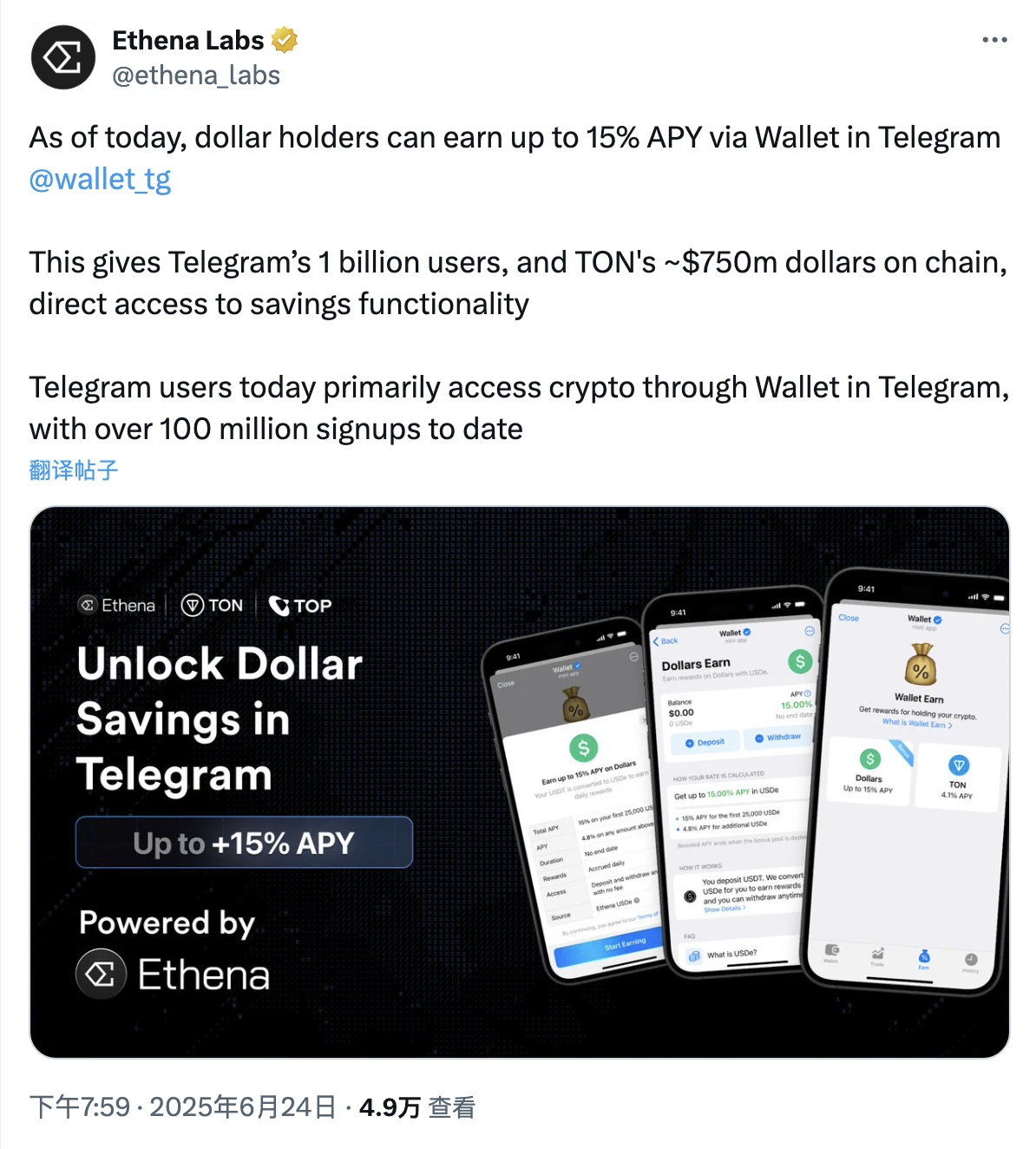

On June 24, Telegram announced a partnership with Ethena to launch a built-in US dollar income function in Telegrams custodial wallet application Wallet in Telegram with the help of Ethenas back-end savings support.

Both parties also announced that they would provide users with a limited-time 15% return, which can be regarded as a short-term wool benefit.