Author of the article: Metaer

Unconsciously, it has been 26 years since Hong Kongs return to the motherland. Although time has flown by, no matter how the world has changed, when it comes to finance and free ports, I believe the first Asian city that comes to most peoples minds is still Hong Kong, China. As a highly prosperous international metropolis, Hong Kong is the worlds undisputed financial center and an important international trade, shipping and innovation and technology center. Now, Hong Kong will strive to become another center - a global virtual asset center.

Last week, the 8th FinTech Week co-organized by the Hong Kong Monetary Authority (HKMA) and Invest Hong Kong came to a successful conclusion. If the previous FinTech Weeks were more about seeking technological innovation breakthroughs, then this FinTech Week is more about seeking breakthroughs in technological innovation. More inclined to implement multiple applications and policies. Just as its theme New Definition of Fintech implies, this Fintech Week has pointed out three key directions for the future development of Web 3.0 in Hong Kong, namely: retail investors, digital Hong Kong dollar and digital RMB, and stable currency.

Retail investors: The door for Hong Kong retail investors to enter virtual assets has opened

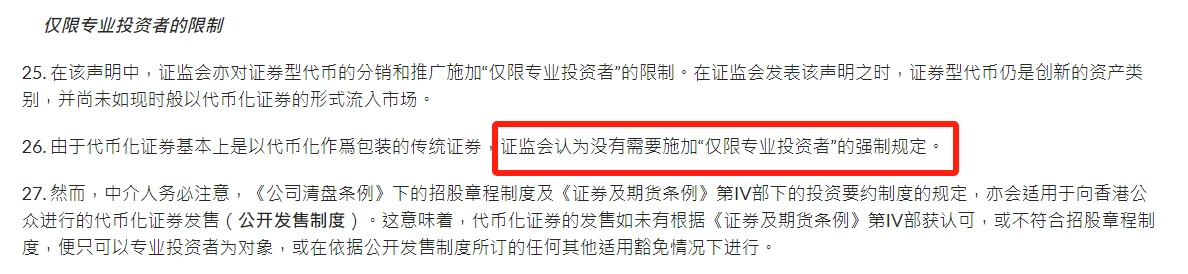

On November 2, the Hong Kong Securities and Futures Commission issued two guidelines. Among them, the Circular Regarding Intermediaries Engaging in Tokenized Securities-related Activities officially replaced the 2019 STO (Security Token) Statement. One of the most important changes is that All security tokens are no longer considered “complex products.” If they are traditional securities packaged in tokenization, such as bonds or funds, the “professional investors only” restriction can be lifted to allow retail investors to participate.

Of course, given the special nature, terms and characteristics of certain digital securities, as well as the existence of large legal uncertainties, it is unlikely that retail investors will understand these digital securities under reasonable circumstances, and therefore they are not tokenized securities. Securities may still be considered complex products and Hong Kong regulators may impose restrictions if such products are marketed to retail investors. It is reported that traditional securities firms in Hong Kong are already handling or providing advice on tokenized securities, fund managers have begun to explore the issuance and distribution of tokenized funds, and manage funds investing in tokenized securities, while licensed virtual asset trading platform operators Also trying to integrate tokenization into their business operations, it can be said that these service providers are eager to try and provide support for retail investors to explore the virtual asset market.

However, the entry of retail investors will inevitably further promote supervision. Speaking at the Financial Technology Week Forum, Hong Kong Securities and Futures Commission Chief Executive Liang Fengyi said that the suspected fraud case of the virtual asset trading platform JPEX highlighted the market’s need for a regulatory system that pays attention to investor protection. For When it comes to retail investors entering the virtual asset market, the China Securities Regulatory Commission’s principle is that retail investors will only be allowed to participate when the product ecology matures and intermediaries are regulated. Just as last year, fund companies were allowed to launch cryptocurrency ETFs that track traditional exchange futures. This year A regulatory system for virtual asset trading platforms will be introduced.

Digital Hong Kong dollar and digital renminbi: moving forward together and interconnected

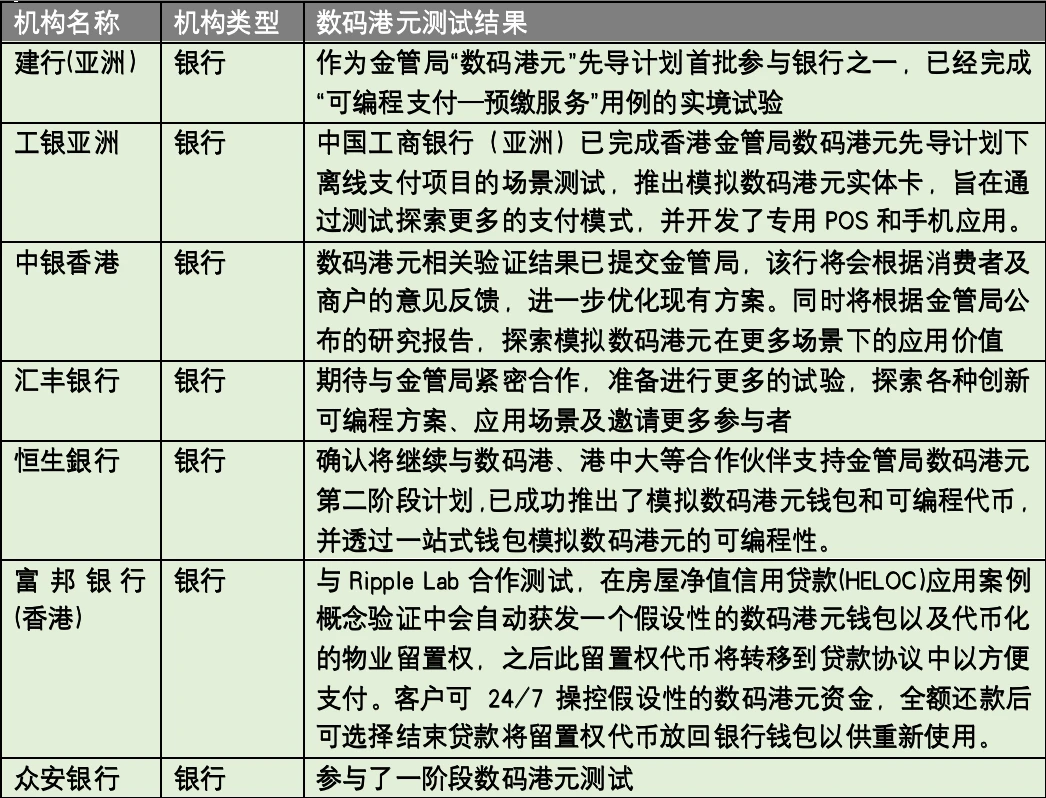

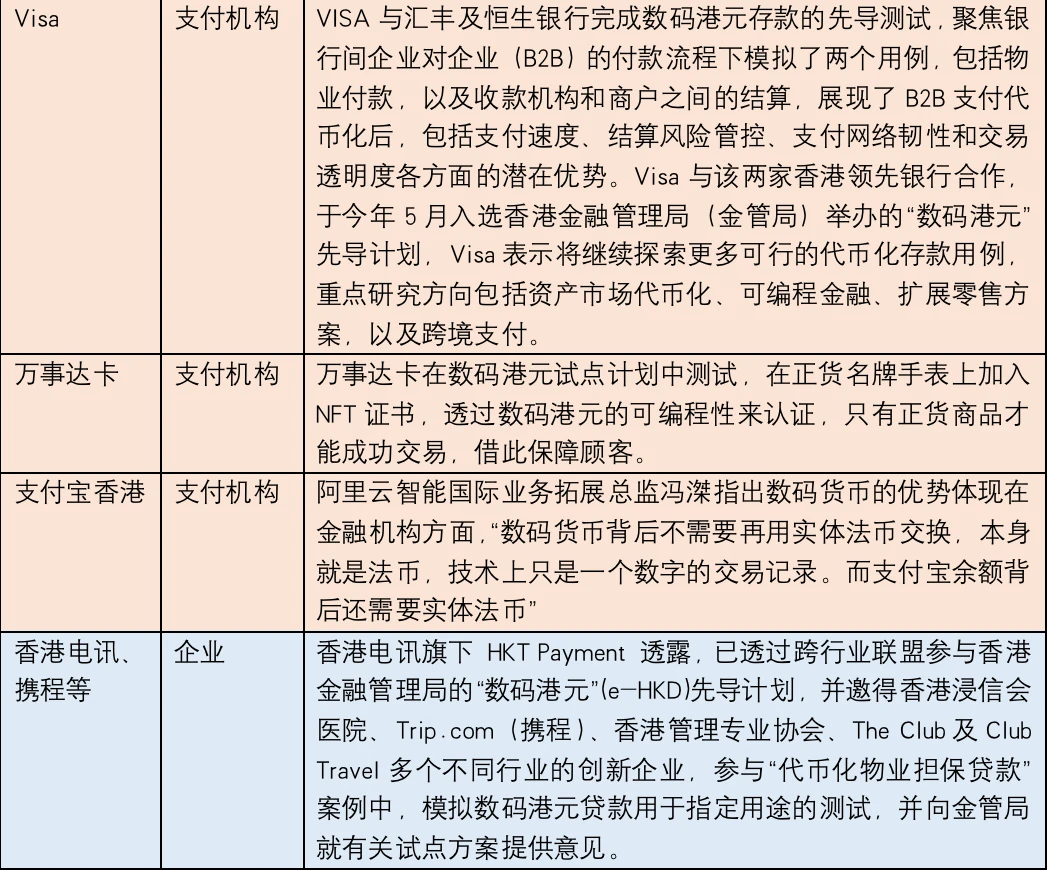

The Hong Kong Monetary Authority released the Digital Hong Kong Dollar Pilot Plan Phase 1 Report on October 30. At the same time, it confirmed at FinTech Week that the second phase will be launched in 2024 and will focus on the programmability, tokenization and real-time development of the digital Hong Kong dollar. Conduct in-depth research on the three aspects of settlement, and explore other new use cases including enterprises, cross-border payments, blockchain interaction, etc.

Chief Financial Technology Officer Chow Wai-keung pointed out that the second phase of Hong Kong’s “Digital Hong Kong Dollar” pilot plan is planned to be launched in 2024, and will explore other new use cases of the Digital Hong Kong Dollar and conduct in-depth research on some of the experiments in the first phase. At the same time, we continue to carry out the first track work to lay the legal and technical foundation for the possible issuance of digital Hong Kong dollars in the future. Although the issuance schedule of digital Hong Kong dollars has not yet been officially announced, it has received support from most banks.

More importantly, Li Dazhi, Vice President of the Hong Kong Monetary Authority, has made it clear before: If a digital Hong Kong dollar is launched in the future, it will be connected to the digital renminbi!

In fact, at the main forum of this Fintech Week, the Hong Kong government made it clear that it would fully support financial institutions and enterprises in developing cross-border applications of digital renminbi, focusing on retail payments and two-way connectivity. Mainland tourists can already use digital renminbi to add value to their Octopus. . Xu Zhengyu revealed that the next step will be to use the infrastructure of the Hong Kong market for digital renminbi retail settlement, so that mainland tourists can also use digital renminbi at the retail level when they come to Hong Kong, but the timetable will depend on technology and specific conditions.

The Hong Kong government’s clear stance has undoubtedly given a shot in the arm to the digital renminbi that is being vigorously promoted. If the digital renminbi can find a breakthrough at the retail level in the Hong Kong market, it will undoubtedly be able to more smoothly expand to cross-border payments for bulk commodities or service trade in the future. Di Gang, deputy director of the Digital Currency Research Institute of the Peoples Bank of China, previously pointed out that through some corporate surveys, it was found that many companies have single channels for international trade, high costs, low efficiency and other issues, and the use of digital renminbi can effectively reduce corporate costs. cross-border costs, and some companies have expressed their desire to participate in bilateral pilot projects similar to those between the mainland and Hong Kong.

There is no doubt that the connection of digital renminbi and digital Hong Kong dollar in Hong Kong can on the one hand deepen the exchanges between mainland and Hong Kong residents, attract mainland tourists to travel to Hong Kong, promote the development of Hong Kongs tourism industry, and at the same time promote economic exchanges and cooperation between the two places; On the other hand, the use of financial technology means such as digital RMB smart contracts to continue to improve and enhance the cross-border infrastructure capabilities between the mainland and Hong Kong and smooth the cross-border capital flow channels between the two places will certainly strengthen Hong Kong’s status as an offshore RMB business center and enhance Hong Kong’s international competitiveness.

Stablecoins: a bridge between the virtual world and real-world assets

As early as October 2022, in the Policy Declaration on the Development of Virtual Assets in Hong Kong, the Hong Kong Treasury Bureau proposed to focus on stablecoins. As a trading medium for cryptocurrencies and legal currencies, stablecoins have the potential to compete with traditional finance. Markets (such as payment systems) are interconnected and appropriately regulated in terms of governance, stability and redemption mechanisms.

During this year’s FinTech Week, Hong Kong Monetary Authority President Yu Weiman stated that the first market consultation on the stablecoin regulatory framework has been completed and will be optimized based on the opinions received. The second market consultation will be conducted very soon and is expected to be submitted early next year. The Legislative Council reviewed that the main responsibility of the Hong Kong Monetary Authority is to ensure that when stablecoins are issued in the market, they are subject to high-standard supervision so that investors are properly protected.

Previously, at the 9th Blockchain Global Summit that ended in September this year, Xiao Feng, chairman of Wanxiang Blockchain and chairman and CEO of HashKey Group, also mentioned in the closing speech: Stablecoins are not only It is a trading tool for exchanges and a bridge connecting the real world and the virtual world, the real economy and the digital economy, and private ledgers and public ledgers. The so-called private ledger is the ledger of each financial institution, and the so-called public ledger is the blockchain. Therefore, stablecoins are also a bridge between bank accounts and blockchain accounts. That is, stablecoins are a bridge that converts legal currency in bank accounts into digital currencies. It is also a bridge connecting CeFi and DeFi, fiat currency and digital currency, non-programmable currency and programmable currency. So its importance cannot be overstated. Every region has a stablecoin anchored to its own currency. If not, this would be unthinkable.

In addition, Wang Yang, Vice President of the Hong Kong University of Science and Technology, also pointed out that Hong Kongs next step on the development path of Web3.0 should focus on the in-depth integration of virtual world and real-world assets. It has become an inevitable trend to make full use of blockchain technology and build a powerful Web3 ecosystem based on Hong Kong dollar stable currency. Our focus should be on the digitization and tokenization of Real World Assets (RWA). The tokenization of RWA - that is, the conversion of tangible or intangible assets into digital tokens - is the first step in the field of digital assets. A groundbreaking shift that promises to redefine the market landscape. The introduction of blockchain technology makes RWA a revolutionary optimization compared to traditional securitization.

In fact, the tokenization of RWA is not only the greatest potential for the development of Web3 in Hong Kong, but also the future trend of Web3 in the world. In a well-regulated environment, RWA can provide legitimate players with a chance to truly prosper and not just fall victim to being “killed for holding a license.” This transformation will undoubtedly lead Hong Kong to the forefront of global Web3 development.

Therefore, when Hong Kong has a clear regulatory framework for stablecoins, stablecoins will naturally appear in the market, and now there are institutions taking precautions and beginning to deploy in the Hong Kong stablecoin market. For example, Hong Kongs licensed exchange Hashkey Group launched the Hong Kong stablecoin market during the financial week. It was revealed that it will jointly issue stablecoins with Yuanbi Technology and Zhongan Bank.

It is reported that Yuanbi Technology has issued a Yuanbi stable currency, consisting of 25 Hong Kong dollars, 47 yuan, and 550 yen. The original intention of the issuance is to help enterprises manage foreign exchange risk. Hashkey Exchange may support the provision of liquidity and transactions. scenario, and ZhongAn’s advantage lies in the nearly 700,000 users it has accumulated through its deep involvement in traditional finance. If ZhongAn Bank successfully completes the upgrade and opens up the virtual asset retail business, it will be able to promote stablecoins to a large number of traditional bank users.

Directly speaking, Hong Kong’s stablecoin market is bound to have greater room for development in the future.

Summarize

Mong Kok is a paradise for ordinary people, with the bustling life of Sheung Wan and the brilliant lights of Central - every sunrise and sunset in Victoria Harbor, busy ferry boats shuttle between the north and south shores, fishing boats, cruise ships, sightseeing boats, 10,000-ton giant ships and the blaring The sound of the whistle creates a wonderful sea scene; the scenery under the Lion Rock is beautiful. When night falls, you can look around at thousands of lights and tall buildings.

It is undeniable that the virtual asset market in Hong Kong and even Asia is still in its early stages of development and requires the entry of more professional institutions and the support of regulatory agencies to help the market flourish. But for now, Hong Kong’s virtual asset compliance benefits have gradually surfaced, and it has begun to gain first-mover advantages globally. I believe that Hong Kong will feed back its experience and lessons to the entire virtual asset industry in the future, promoting the overall healthy development of the market. .

The small river flows southward and flows to the Xiangjiang River to have a look. Perhaps in the near future, the Asian virtual asset market, led by Hong Kong, will be even more beautiful.