Author of the article: Meta Era guest author 0x ShinChan」

At the eighth Hong Kong Fintech Week, which concluded last week, the Hong Kong Monetary Authority and Invest Hong Kong demonstrated their firm commitment to promoting the advancement of fintech. The event brought together more than 500 speakers and 650 exhibitors from all over the world, becoming a large-scale stage for financial technology innovation and cooperation. What is particularly noteworthy is that Hong Kong SAR government officials took this opportunity to clearly express their open attitude towards virtual assets, demonstrating the Hong Kong government’s strategic layout and foresight on the global financial technology stage. This article will review the key speeches of important officials and well-known projects, and provide an in-depth analysis of the Hong Kong government’s future deployment of financial technology.

Hong Kong Chief Executive Lee Ka-chiu: Hong Kong’s unique advantages are irreplaceable

Chief Executive Lee Ka-chiu said in his speech at the Hong Kong FinTech Week that Hong Kong is one of the worlds leading financial centers and a major financial center in China. Hong Kong has many advantages, including an open, highly internationalized market and free flow of capital. wait.

He pointed out that Hong Kong has more advantages and covers more aspects in financial services, and Hong Kong is also Asias asset and wealth management center. Last year, Hong Kong managed nearly US$4 trillion in assets. About two-thirds of these came from investors outside Hong Kong. He mentioned that Hong Kong is also the worlds largest offshore RMB business center. Hong Kong has approximately 1 trillion yuan in RMB deposits and handles approximately 75% of the worlds offshore RMB payments. Hong Kong is also Asias leader in green and sustainable finance. Last year, more than US$80 billion of green and sustainable bonds were issued in Hong Kong, and green and sustainable bonds arranged in Hong Kong accounted for more than one-third of the Asian market.

(Photo credit:Hong Kong Economic Journal)

Hong Kong Chief Executive Lee Chia-chaos speech reflected Hong Kongs strategic position in the global financial map. Chief Executive Lee emphasized the irreplaceable advantages of the Hong Kong market: an open international market and free flow of capital. He discussed Hong Kongs leading position in asset and wealth management, revealing that Hong Kong manages assets from around the world, especially its leading role in offshore RMB business and Asias green and sustainable finance. Lis remarks not only reiterated Hong Kongs financial strength, but also pointed out Hong Kongs potential and responsibility in promoting financial technology innovation and sustainable development.

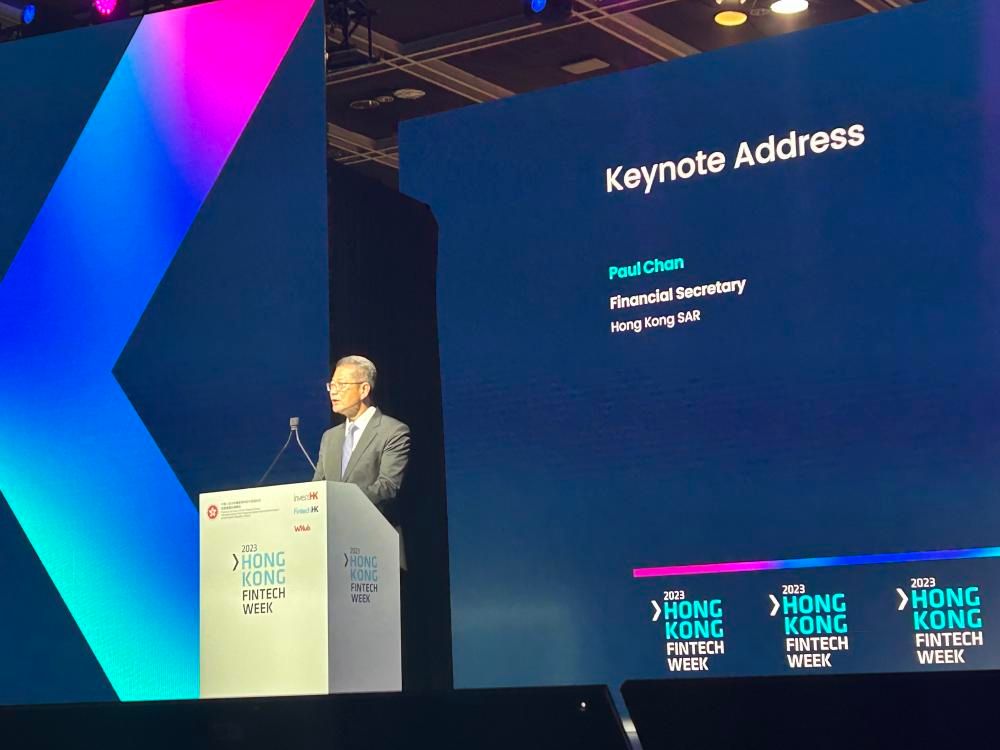

Hong Kong Financial Secretary Paul Chan Mo-po: Explains the Hong Kong government’s strategic outlook for establishing a digital asset center

(Photo credit:21 Economic Network)

Hong Kong Financial Secretary Paul Chan Mo-po demonstrated the Hong Kong government’s determination to become a digital asset center. In his speech, he clarified the governments vision, supervision and experimental plans for virtual assets, clearly expressed its policy stance on the international market, and showed his desire to make full use of the opportunities for technological progress and financial innovation brought by virtual assets.

Paul Chan also emphasized that Hong Kong virtual banks are providing convenient, innovative and competitive services to individuals and small and medium-sized enterprises, promoting traditional financial institutions to accelerate the pace of digitalization and product innovation, and promoting the entire region while continuously expanding the Southeast Asian market. development of financial technology.

The importance of this speech is that Paul Chan not only confirmed Hong Kongs status as a global leader in financial technology, but also clarified the governments specific actions to support the development of financial technology. This reflects Hong Kong’s desire to become a hub for international digital asset trading and its strategy to maintain its competitiveness and influence in the global digital economy. By promoting the clarification of the regulatory framework and the implementation of pilot plans, Hong Kong is actively laying out the future financial technology landscape and embarking on creating a more inclusive and innovative financial environment.

Secretary for Financial Services and the Treasury, Mr Hui Ching-yu: Hong Kong’s strategic initiatives for fintech

At the main forum of FinTech Week, the Secretary for Financial Services and the Treasury, Mr Hui Ching-yu, proposed three key measures aimed at extending the achievements of FinTech to the real economy. First, Hong Kong will promote a new integrated fund platform aimed at further solidifying its position as an international asset and wealth management center. This move not only demonstrates Hong Kong’s new trend in optimizing asset management infrastructure, but also heralds the development of a more diversified and integrated financial services model.

Regarding the application of digital renminbi, Xu Zhengyu’s speech marked a new milestone in Hong Kong’s cross-border financial service innovation. Connecting the digital RMB ecosystem with Hong Kongs payment tools and bank payment systems not only brings convenience to the retail payment field, but also promotes financial interconnection with the Greater Bay Area. These measures pave the way for wider application and use of digital renminbi in the Greater Bay Area in the future.

Xu Zhengyu has shown a clear attitude towards promoting innovation in the field of virtual assets and Web 3.0. The government’s goal is to promote applications related to the real economy, such as tokenizing real-world assets or traditional financial assets, while further improving the relevant regulatory framework. Director Hui’s remarks not only demonstrate Hong Kong’s innovative spirit in the field of financial technology, but also highlight Hong Kong’s forward-looking thinking in digital asset management and supervision.

Deputy Secretary for Financial Services and the Treasury, Chan Ho-Lin: Hong Kong’s forward-looking layout for virtual asset supervision

At the same time, Deputy Secretary for Financial Services and the Treasury, Chan Ho-Lin, painted a dynamic picture for us: Web 3.0 is becoming the key to solving various challenges in the traditional financial field. Deputy Director Chen’s speech not only reflects the Hong Kong SAR government’s recognition of the potential of financial technology, but also reveals that the region is becoming a springboard for international financial technology companies to enter the Asian market. Behind this positive attitude is Hong Kong’s clear and firm regulatory roadmap, which provides companies with a fertile ground for reliable development.

Chen Haolian further revealed that as the market evolves, Hong Kong will continue to optimize its virtual asset regulatory framework. Expanding the regulatory scope of over-the-counter transactions, launching a public consultation on the regulation of stablecoin issuance, and providing industry guidance for banks to provide virtual asset custody services, these measures not only demonstrate Hong Kong’s sensitivity to changes in emerging markets, but also highlight the government’s role in financial affairs. Determination to find a balance between technological innovation and risk control. This meticulous regulatory strategy aims to provide solid protection for consumer assets while also ensuring Hong Kongs competitiveness as an international financial center.

The strategic perspective of Zhang Qingsong, deputy governor of the Peoples Bank of China

(Photo credit:interface news)

At the Hong Kong Fintech Week Forum, Zhang Qingsong, deputy governor of the People’s Bank of China, revealed a new chapter in China-Hong Kong relations in the field of fintech cooperation. Vice Governor Zhang announced that the Peoples Bank of China will sign a memorandum of cooperation with the Hong Kong Monetary Authority and the Macau Monetary Authority. This move marks that the three parties will jointly use innovative mechanisms such as financial technology regulatory tools and regulatory sandboxes to strengthen financial technology innovation and development in the Greater Bay Area. cooperate.

Zhang Qingsong further emphasized Hong Kongs unique role as an international financial center and innovation and technology center, and the important part it plays in promoting the Greater Bay Area to become a globally competitive region. He pointed out that Hong Kong has favorable conditions for the development of financial technology and inclusive finance, and will further strengthen exchanges and cooperation with central banks and international financial institutions in other regions in the future. Vice Governor Zhang’s remarks not only reflect the affirmation of Hong Kong’s financial technology potential, but also highlight the central government’s strategic intention and determination to deepen financial cooperation between China and Hong Kong, especially in the field of financial technology.

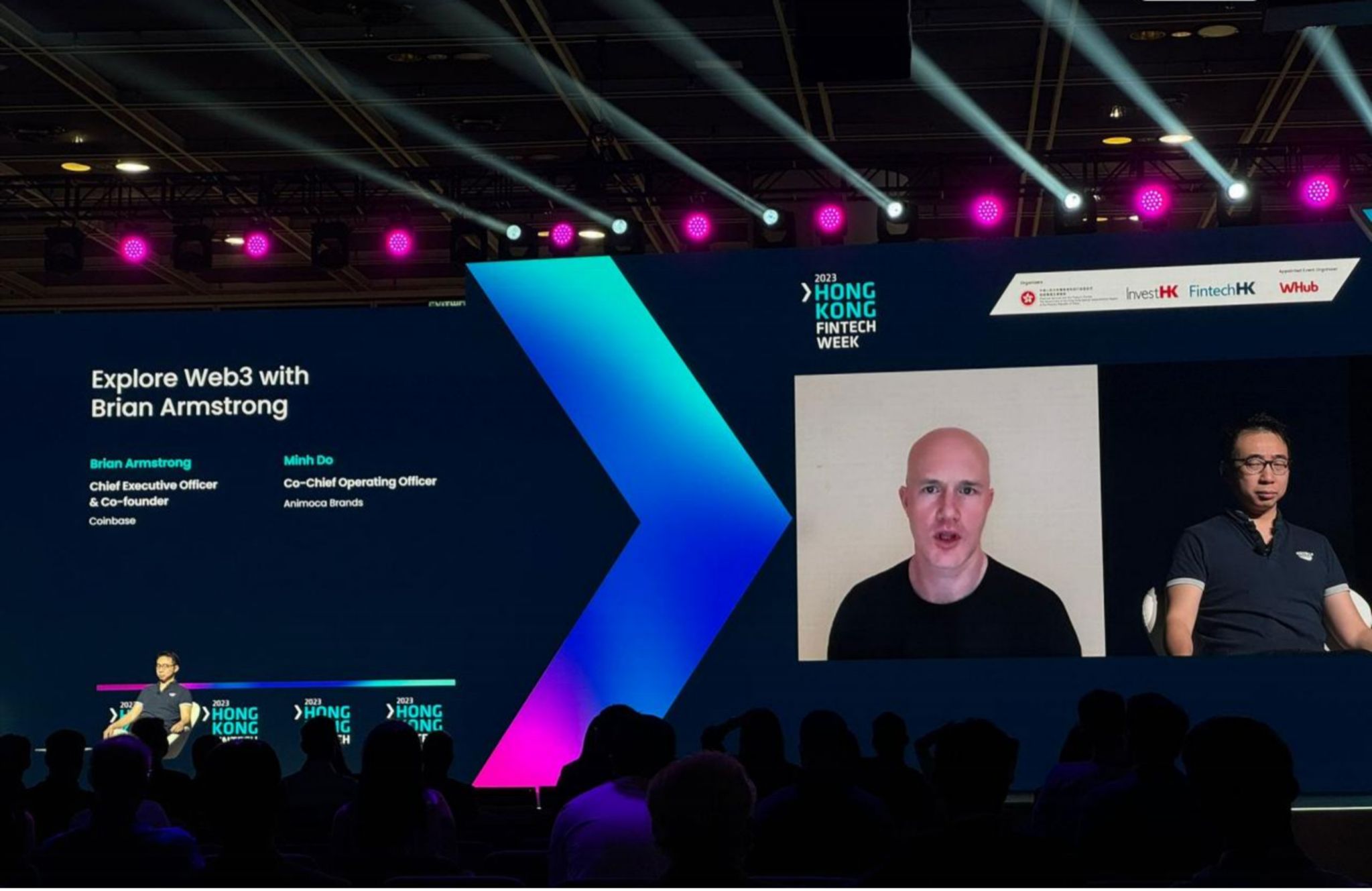

Coinbase emphasizes international transparency in Hong Kong’s virtual asset regulation

(Photo credit:RTHK)

Coinbase’s presence at this year’s Hong Kong Fintech Week underscores Hong Kong’s central position on the global fintech stage. Coinbase co-founder and CEO Brian Armstrong participated in the forum via video link. He praised the Hong Kong Securities and Futures Commission and the Monetary Authority for their transparency and clarity in the regulation of virtual assets. Armstrong noted that a clear regulatory framework enables banks to collaborate more deeply in the crypto space and highlighted Hong Kong’s leadership in shaping the market’s openness to virtual asset businesses. This shows that Hong Kong not only occupies an important position in the international dialogue on fintech, but its regulatory model also provides a reference for global markets. Coinbases participation confirms Hong Kongs prominent position in leading the development of Web3 and related financial technologies.

Conclusion: Hong Kong serves as a bridgehead for global financial technology innovation and cooperation

At this Hong Kong Fintech Week, wonderful speeches from all aspects gathered together to form a clear outlook on the future of Hong Kong’s Fintech. From Chief Executive Lee Chia-chaos reaffirmation of Hong Kongs unique advantages, to Secretary for Financial Services and the Treasury Hui Ching-yus measures to benefit the real economy from financial technology, to Peoples Bank of China Deputy Governor Zhang Qingsongs outlook on China-Hong Kong financial technology cooperation, all show that Hong Kong is in The current strategic position and future direction in the global financial technology arena.

The depth and breadth of these speeches reflect that Hong Kong, as an international financial center, has a pivotal influence not only in Asia but also in the global financial technology field. Hong Kongs regulatory clarity, openness to innovation and cooperation, and active promotion of Web 3.0 jointly outline a fintech development blueprint full of opportunities. Against this background, Hong Kong Fintech Week is not only a platform to showcase the latest developments, but also a strong proof of the synergy of all parties to jointly promote Fintech innovation and application.