Author of the article: Meta Era guest author Giovanni Chen」

In October last year, Hong Kong, as the financial center of Asia, launched the most friendly Web3 Policy Declaration on the Development of Virtual Assets in Hong Kong in history.It is comprehensively determined that Hong Kong’s future focus on virtual assets will be its main direction. Now that the first anniversary has passed, let us review the three major substantive breakthroughs in Hong Kong this year:

1. Virtual Asset Trading Platform License (VASP)

Starting from June 1, 2023, the Monetary Authority will start the licensing of virtual asset service providers (VASP), stipulating that corresponding institutions must meet a series of requirements for companies settled in Hong Kong, personnel qualifications, and the number of users. In August 2023, Hashkey and OSL obtained licenses for retail users in Hong Kong. Other exchanges including Binance, OKX, HTX and others have also announced that they are applying for licenses.

2. Asia Virtual Currency Futures ETF

On December 16, 2022, the Hong Kong Stock Exchange successfully introduced Asias first crypto-asset ETF, the Ethereum and Bitcoin futures ETF launched by CSOP Asset Management, investing in the standardized Bitcoin and Ethereum of the Chicago Mercantile Exchange futures. In January 2023, the third Samsung Bitcoin ETF was launched.

3. Digital Hong Kong Dollar e-HKD

In May 2023, the Hong Kong Monetary Authority launched the Digital Hong Kong Dollar e-HKD Pilot Plan, teamed up with 16 institutions to conduct use case experiments, and released the Digital Hong Kong Dollar Pilot Plan Phase I Report on October 30 this year to study its use scenarios. Including six major scenarios: payment, programmable payment, offline payment, tokenized deposit, Web3 transaction settlement and tokenized asset settlement. The conclusion in the report affirms the value of the digital Hong Kong dollar in payment ecology and economic activities. The HKMA concluded in the first stage that more research and evaluation work is needed to determine further guidelines and policies. At the just-concluded FinTech Week, the HKMA confirmed that the second phase of the pilot scheme will launch in 2024.

During this year, with the strong support of the Hong Kong government, people from all walks of life in traditional industries and Web3 are gearing up in this financial center, preparing to build Hong Kongs leading position in the Eastern Web3 industry. Hong Kong is indeed facing unprecedented excellent opportunities and first-mover advantages in many fields. So in the next year, what are the three major opportunities for Hong Kongs Web3 in the ecological landscape of Web3?

1. Can cryptocurrency trading volume jump due to Hong Kong?

Trading volume is one of the key indicators in any financial market. In the emerging financial market of Web3, trading volume also represents market sentiment, user participation, the quality of financial product targets and the real needs and scenarios of its use. For Hong Kong, a financial center, transaction volume represents the economic activities and capital flows here. Hong Kong needs new funds and trading volume to supplement the downturn and lack of liquidity in the Hong Kong stock market. In the face of the Federal Reserves rapid interest rate hikes and entering a bear market in 2022-2023, Web3s trading volume has also plummeted. Web3+Hong Kong can be said to be like sleeping on the pillow.

A good question is, can Hong Kong help bring in capital to Web3 and spur higher transaction volumes? There are four major highlights here.

1.1 OTC transactions

Hong Kongs OTC cryptocurrency trading has always been a major local feature. In the crypto bull market of 2021, a large number of OTC physical stores, ATMs, etc. have emerged in Hong Kong. These physical stores are convenient for deposits and withdrawals, and have become a channel for many retail investors to invest and withdraw money. There are now more than 100 OTCs in Hong Kong, handling billions of Hong Kong dollars in cash transactions every year.

Not only investors and tourists use these OTC services, but also users of middle and upper age groups. OTC makes it easier for users to conduct transactions. There are also many businessmen who use USDT for international trade, and OTC helps them convert USDT into legal currency.

However, when the JPEX collapsed in September, many related OTC stores were closed down for investigation. Relevant Hong Kong agencies are also studying and promoting supervision work, including OTC.

At present, how to properly supervise OTC, curb criminals from making profits, and maintain the prosperity of OTC trading in Hong Kong is an important issue that needs to be considered by Hong Kong supervision.

1.2 Hong Kong stocks and securities companies

Currently, the Hong Kong stock market has entered an unprecedented downturn, with 26% of more than 1,000 stocks experiencing zero trading, and trading volume hitting record lows. The entire Hong Kong stock market is in a crisis of low valuations, weakened financing capabilities, and tight liquidity.

Against this background, Hong Kong securities firms are taking advantage of the benefits of Web3 to actively carry out cryptocurrency business, including Futu Securities, Tiger Brokers, Victory Securities, Interactive Brokers, Nanhua Securities, Longbridge Securities, Fuqiang Securities, Quam Securities, etc. Provides cryptocurrency services to users, hoping to bring more than 4 million Hong Kong stock investors into the world of cryptocurrency, and soon allow investors to purchase cryptocurrency on the app. Brokers can cooperate with licensed cryptocurrency providers such as hashkey and osl, or they can apply for a license from the Hong Kong Securities and Futures Commission. In this area, brokerage firms such as Futu, Tiger, Interactive Brokers, and Victory are in the leading position.

Once the channels for Hong Kong stock investors are opened, it is expected to bring tens of millions of Hong Kong dollars to the cryptocurrency market. This emerging cryptocurrency market can activate a series of traditional financial institutions in Hong Kong including banks, auditing companies, insurance companies, asset management and investment institutions.

1.3 Retail trading

Hong Kong began to implement the Virtual Asset Service Provider Licensing System (VASP) after June 1. For the two existing licensed traders, OSL and Hashkey, they have been able to provide mainstream currencies BTC/HKD to retail investors. and ETH/HKD trading pairs, altcoins are open to professional investors.

At the same time, the project qualifications open to retail investors have certain scoring requirements. Currently, there are 13 crypto assets that can be used as alternative materials for retail investors to trade, namely: BTC, ETH, ADA, SOL, MATIC, DOT, LTC, AVAX, and UNI , LINK, AAVE, BCH and CRV.

Currently, Binance, OKX, HTX exchanges, etc. have announced that they are applying for, planning to apply for, or have applied for a Hong Kong encryption license.

1.4 Spot ETFs

The recent expectation that the spot Bitcoin ETF is about to be approved in the United States has pushed Bitcoin to $35,000, and the time for the spot ETF to be approved seems to be getting closer.

Judging from a series of recent trends, Hong Kong is also evaluating whether it can allow investment in spot ETFs. Recently, Hong Kong Securities and Futures Commission chief executive Leung Fengyi said in an interview that Hong Kong is considering allowing retail investors to participate in spot cryptocurrency ETFs if regulatory issues are met.

We welcome proposals to use innovative technologies that improve efficiency and customer experience, Leung Fengyi said. As long as new risks are mitigated, we are willing to try them.

As the United States is about to launch its first Bitcoin ETF, Hong Kong is also expected to consider launching a spot ETF, subject to regulatory framework.

2. Can high-quality Web3 companies and talents land in Hong Kong?

Teams, projects and talent are at the heart of making funding and projects successful. Especially in the face of a large number of Chinese entrepreneurs, mainland China has sufficient technology development, product and operation personnel. Hong Kong, with its friendly policies, needs to vigorously attract outstanding talents and keep people and technology in Hong Kong.

Hong Kong’s talent attraction plan has continued to develop. Cyberport has provided financial support to Web3 practitioners in the four stages of start-up-incubation-acceleration-leap, namely: the Cyberport Creative Micro Fund in the initial start-up stage. , the Cyberport Incubation Program in the incubation stage, the Cyberport Accelerator Support Program in the accelerated development stage, and the Cyberport Investment Venture Fund in the breakthrough stage. Starting from HKD 100,000, HKD 200,000, HKD 300,000 and HKD 500,000 and five levels of investment venture funds.

At the same time, Hong Kong Cyberport provides the Technology Talent Admission Scheme, which aims to import overseas and mainland technology talents to Hong Kong for qualified technology companies to engage in research and development work through fast-track arrangements. The Hong Kong Science and Technology Parks Corporation (HKSTP) and Hong Kong Cyberport Tenants of Cyberport Management Company Limited (Cyberport) and incubated Web3 companies are eligible to apply.

Cyberport also provides shared offices, and its Smart-Space allows Web 3.0 project parties to apply online for three types of venues: offices, workstations and flexible spaces.

Hong Kongs policy to attract global AIWeb3 talents has now begun. As of May, approximately 84,000 related projects have applied to land in Hong Kong, of which 49,000 projects have received approval to operate in Hong Kong. And Hong Kong plans to attract at least 1,100 multinational companies to set up branches in Hong Kong between 2023 and 2025.

3. Can compliant stablecoins be introduced?

Stablecoins are a bridge between the crypto market and legal currency, an important medium for transactions, and provide liquidity for innovative ecosystems such as DeFi, NFT, and RWA. Stablecoins supported by Hong Kong need to provide stability and have close ties with traditional business institutions and supervision in order to quickly gain user trust.

On January 31, 2023, the Hong Kong Monetary Authority released a consultation summary on the discussion paper on cryptoassets and stablecoins, recommending that stablecoins be included in supervision. Today, the Hong Kong Monetary Authority is studying the regulatory system for stable currencies with the goal of implementing relevant supervision in 2024. In addition to the licensing of virtual asset platforms, a compulsory licensing system for stablecoins will be launched from 2023 to 2024.

In numerous discussions, the industry believes that Hong Kong can launch a Hong Kong dollar stable currency and a US dollar stable currency backed by Hong Kong’s foreign exchange reserves. One solution is for issuers to choose Hong Kong as the place of issuance and accept the supervision of the Hong Kong Securities Regulatory Commission. Private institutions can issue compliant products under the supervision of the Hong Kong government. Some institutions have already begun to take action to lay out stablecoins in Hong Kong. For example, the licensed exchange Hashkey Group revealed during the financial week that it will join forces with Yuanbi Technology and Zhongan Bank to jointly issue stablecoins.

Stable currency is an important infrastructure that promotes the local development of Web3 in Hong Kong. If the Hong Kong dollar stable currency is implemented, it can also promote the development of cross-border trade payments settled in Hong Kong dollars and bring Web3 innovation to Hong Kong. If the stable currency is successfully launched, it will not only connect the virtual asset market and Hong Kongs financial market, attract more talents and funds, but also further enhance Hong Kongs voice in the field of virtual assets and Web3.

The market has high expectations for the launch of the Hong Kong dollar stablecoin.

New Advantage: E-HKD Stablecoin in Digital Hong Kong Dollar Pilot Program

On October 30, the Hong Kong Monetary Authority just released a report on the first phase of the E-HKD digital Hong Kong dollar pilot. The report points out that retail E-HKD can add value to the payment ecosystem and enable new economic transactions, but further investigation and evaluation are needed to promote large-scale real-life applications, similar to Mainland Chinas digital renminbi.

However, in terms of the role of the digital Hong Kong dollar as a Web3 stable currency, the Hong Kong Monetary Authority recognizes that relying on Hong Kongs unique advantages, the digital Hong Kong dollar can become a bridge between the real economy and the Web3 economy, promoting the vigorous development of Web3. This requires giving the digital Hong Kong dollar compatibility on the blockchain to open up a decentralized world channel with Web3.

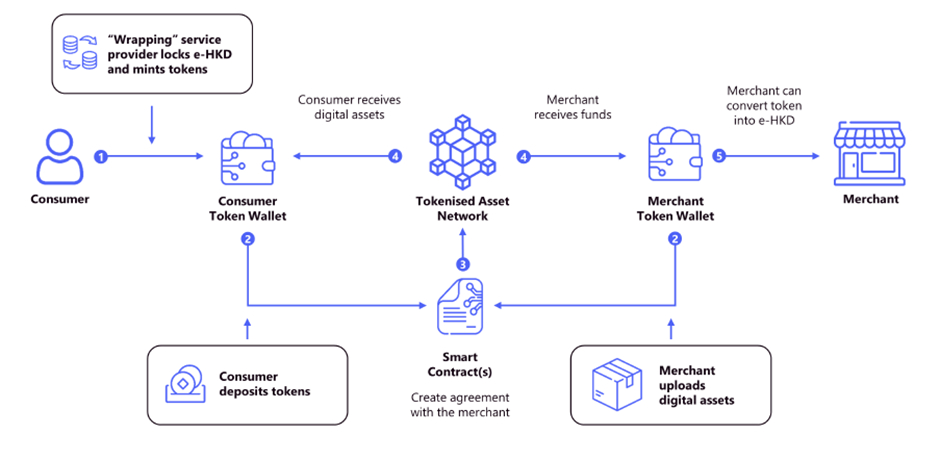

In the pilot program of E-HKD, Mastercard has successfully minted digital Hong Kong dollars and distributed them to the consumption and exchange scenarios of the tokenized network, purchasing physical assets and physical corresponding NFT certificates and other virtual items. The digital Hong Kong dollar circulates in the network in the form of wrapping to the Web3 world, maintaining the value of the digital Hong Kong dollar, and smart contracts ensure that the transaction program can run normally.

Through such a solution, the digital Hong Kong dollar can act as an intermediary for today’s stablecoins and provide value to the transaction network.

In the second phase of the pilot program, new digital Hong Kong dollar applications will continue to be explored. At the same time, the Hong Kong Monetary Authority has listed the digital Hong Kong dollar as a financial technology strategy for 2025. There is a high probability that the digital Hong Kong dollar will be officially launched in 2025.

In August this year, at the Hong Kong Crypto Finance Summer Forum hosted by Meta Era, guest Xiao Feng, chairman of Wanxiang Blockchain, said that it is unimaginable not to have a stable currency based on the Hong Kong dollar. Hong Kong International Financial Center 2.0 will use tokenization to find ways for blockchain, Web3, and virtual assets to serve the real economy, support technological innovation, and further upgrade the financial center; stablecoins will connect the virtual world to the real world, and the real economy to Digital economy, private ledger to public ledger, bank account to blockchain account, CeFi to DeFi, fiat currency to digital currency, non-programmable to programmable bridge.

Hong Kong must have a stable currency, Xiao Feng said.

postscript

As the first financial center in the East in the Newland Port, Hong Kong Web3 can carry many functions and missions. Web3 can not only improve local capital liquidity and attract global funds to invest in the construction of Hong Kong Web3, but also play a role in Hong Kongs development. Take the lead in the Web3 field and use rapid innovation to build Web3 infrastructure.

As the first Web3 city in Asia, Hong Kong has a future full of opportunities and challenges. I believe that by following the pace of the times and combining its own advantages, Hong Kong can complete this historical mission of financial technology transformation.

Article reference:

[ 1 ] https://www.jinse.cn/blockchain/3664050.html

[2] https://metaera.media/detail/headline/CktR7NmE

[3] https://www.hkma.gov.hk/eng/news-and-media/press-releases/2023/10/20231030-3/

[4] https://www.metaera.media/gw_detail?id=163889

[5] https://www.metaera.media/gw_detail?id=161623