Original author -Nansen

Compiled - Odaily Nan Zhi

introduce

zkSync Era is one of the current leading Rollups, providing users and developers with a scalable general-purpose smart contract platform. Since the launch of March 2023 (Era mainnet), user metrics, DApps, and integrations have all grown exponentially. Today, zkSync has over $456 million in net traffic andMore than 2.26 million unique users, these users are only bridged through the Ethereum mainnet.

zkSync user analysis

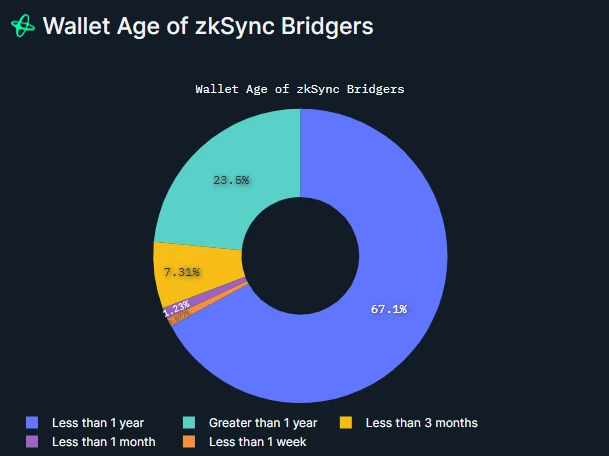

We can get a better idea of the wallet age on zkSync by looking at when an address first became active on Ethereum. Over 71% of wallets were created in the last year, indicating that there are many new wallets interacting with zkSync.

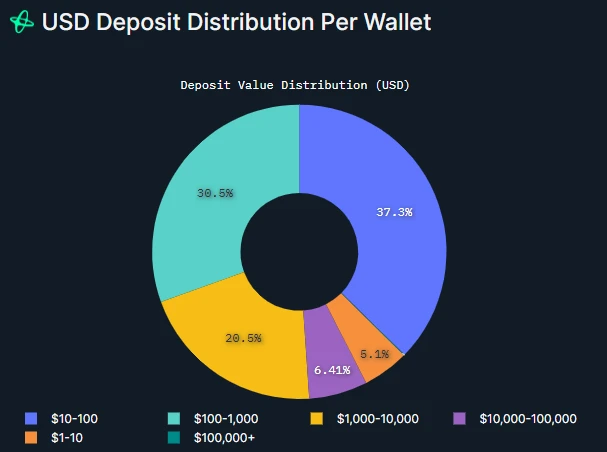

Beyond address age, what is the distribution of value deposited into zkSync?

Most funds entering the zkSync Era from the mainnet are mainly wallets with amounts under $1,000. As for measuring activity over time, we can look at unique users over time.

daily independent depositors

We visualize data on daily and cumulative unique depositors who cross-chain from Ethereum to zkSync using the native cross-chain bridge. This shows that the demand for new addresses has increased since the inception of zkSync. The number of new users peaked in May 2023 and has been on a downward trend since then. However, as of March 13, 2024, the average daily independent depositors still exceeded 8,280.

Cross-chain is a good indicator, but let’s see who is really active on the zkSync Era in 2024.

zkSync activity analysis

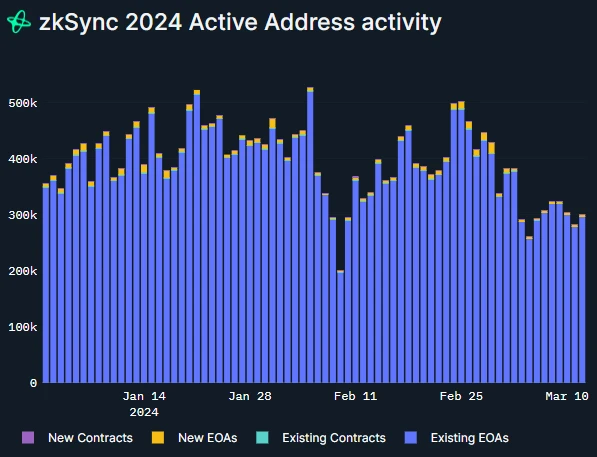

We visualized the active addresses on the 2024 zkSync Era and grouped them into four categories: new and old EOA addresses and new and old contract addresses. Compared to many new addresses joining zkSync, most activity is dominated by existing EOA addresses (Existing EOA).

(Note: Nansen states here that existing EOA addresses can also be referred to as long-term active users.)

zkSync whale positions and activities

We compiled the top 30 addresses based on their token balances in USD as of March 14th.We filter addresses based on:

Active in 2024;

Average 50 transactions or less per day (filtering out noisy addresses);

An entity that is not part of zkSync or the Ethereum mainnet;

Non-exchanges, contract addresses, MEV robots, NFT washers.

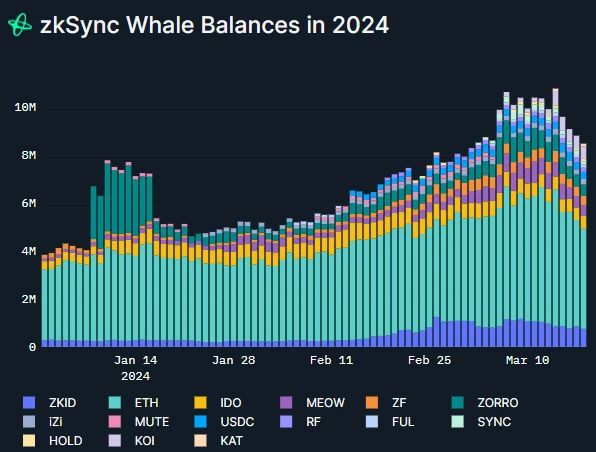

The top 10 coins held by these wallets as of January 1, 2024 are shown below.

The top-ranked coin by dollar amount is ETH, followed by ZKID, IDO, and KOI.

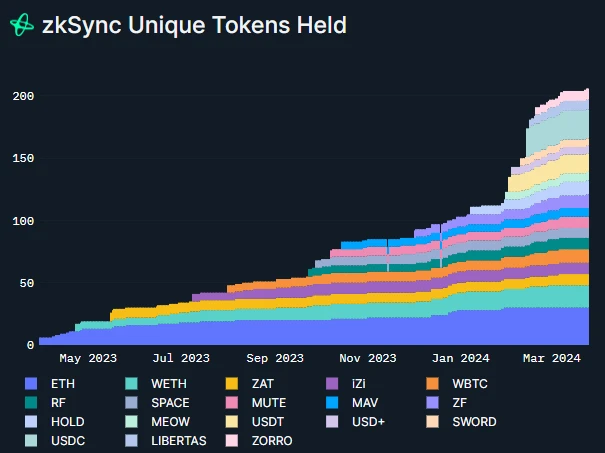

Below we visualize the number of addresses owning a specific token. We only count these 30 whale wallets, so if the number of addresses is 10, 33% of whales own a given token. Not all addresses will be active in 2023, so we will see an increase in the number of assets until today.

Not surprisingly, all whale addresses hold ETH, followed by USDC, WETH, USDT and wBTC. This shows that most whales’ asset exposure is tilted towards mainstream coins and stablecoins. However, over time, we have seen an increase in zkSync native asset holdings.

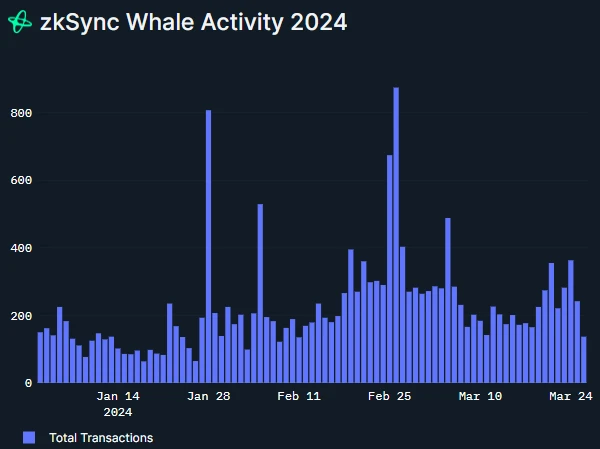

Similar to general account activity, whale activity peaked at the end of February 2024. Their activity has been quite stable, with an average of over 189 transactions per day during the 2024 zkSync Era.

Nansen Conclusion

From 2023 to 2024, the zkSync Era marks a strong evolution in user engagement and asset allocation. With over 2.26 million unique users, the platform is showing strong growth momentum, driven primarily by new entrants. Activity on zkSync remains active and supported by a large number of long-term users, especially EOA addresses.

Overall, the zkSync era as an ecosystem has been experiencing rapid growth, characterized by an expanding user base, continued participation from existing players, and growing token preference.

Summarize

It is undecided whether zkSync will be airdropped and when it will be snapshotted. However, some evaluation criteria can be gleaned from the report, including cross-chain amount, single-day excessive activity, address creation time, etc. In addition, zkSync officials left three questions when forwarding the report, among which March 23, 2024What is the average cost of a zkSync transaction? “Relates to a specific date, or may be an allusion to related events.