Original author: Despread

Original compilation: Deep Chao TechFlow

1 Introduction

The much-anticipated approval of a Bitcoin spot ETF has been a reality since late 2023, leading to an influx of institutional money. As a result, Bitcoin prices are back at four-year highs for the first time since November 2021. During this period, trading volumes on centralized exchanges like Binance and Upbitover $1 trillion, the rising popularity of CEX mobile applications indicates increased market participation among individual investors.

There has also been an increase in investors withdrawing assets from CEXs to use them to earn interest on digital assets or receive airdrops in decentralized finance. This has resulted in total value locked (TVL) in the DeFi space compared to the second half of last yeardoubled.

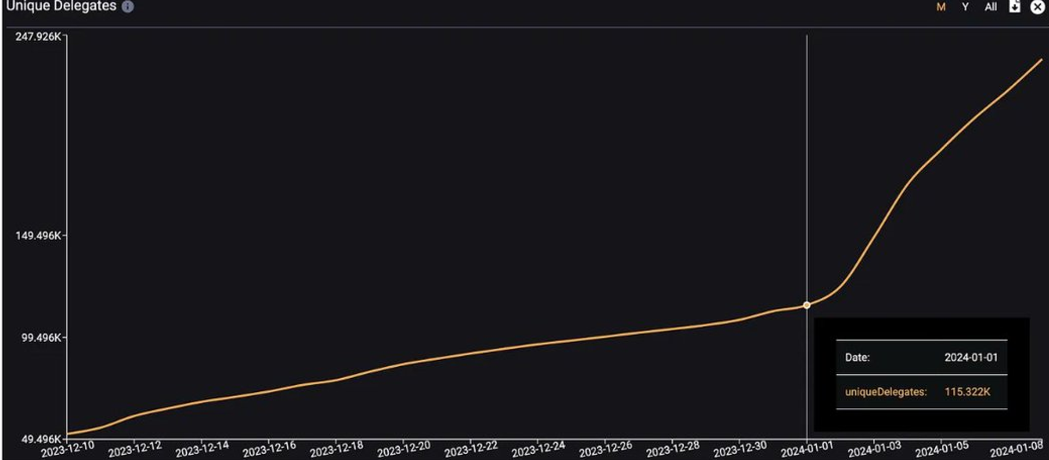

Among these developments, EigenLayer, which is based on the Ethereum network, has increased its TVL approximately tenfold from the beginning of 2024 to the present, quickly rising to third place in the overall TVL ranking of DeFi protocols. The significant growth of TVL has had a profound impact on the rise of TVL in the DeFi space.

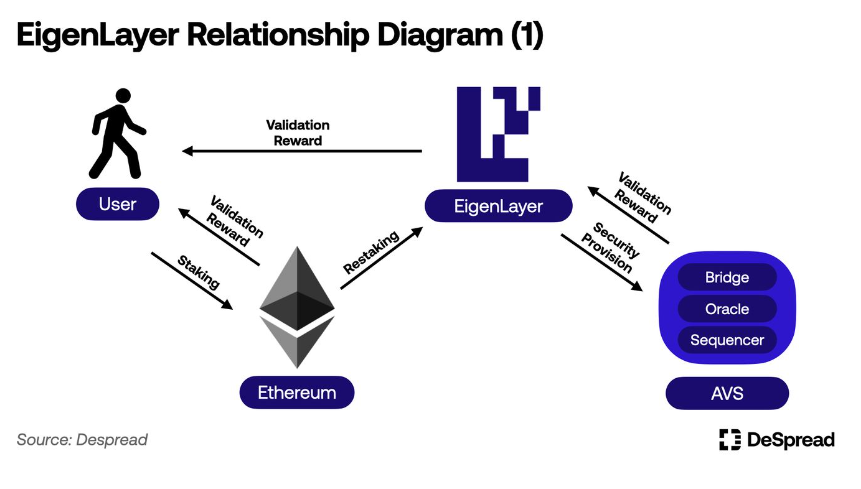

EigenLayer shares security with other protocols by proposing a restaking feature that utilizes ETH staked for verification on the Ethereum network, while providing additional interest to protocol participants. Thanks to its proposal to maximize the efficiency of Ethereum network capital and security, EigenLayer has attracted about$160 millioninvestment.

In addition, it also raises investor expectations through the effective use of various point systems that have become an important part of airdrops. Through various derivative protocols that take the points system to its extreme, EigenLayer’s TVL has been on a straight-line upward trend since the beginning of the year.

This article will cover the overall aspects of EigenLayer while focusing on the synergies created by various derivative protocols with EigenLayer.

2.What is EigenLayer?

After the Ethereum network transitioned from a Proof-of-Work (PoW) consensus mechanism to a Proof-of-Stake (PoS), approx.980,000 Ethereum verification nodesStake 32 ETH each on the beacon chain to participate in network verification. In PoS, the value staked in the network is directly tied to the security of the network, meaning approximately 31 million ETH are ensuring the reliability of the Ethereum network. Ethereum’s decentralized applications (Dapps) can deploy smart contracts on the Ethereum network, thereby sharing its trust and security.

However, protocols known as Active Validation Services (AVS), such as bridges, orderers, and oracles, face significant challenges when using only the capabilities of the Ethereum network. This is because they act as intermediaries between chains or require faster synchronization times than the Ethereum network can provide. Therefore, these AVS are faced with the task of establishing their own trust network in a decentralized manner and need to have their own consensus mechanism in the process.

AVS, which is eager to build its own trust network through a PoS structure similar to the Ethereum consensus mechanism, encountered several problems in the process of launching the network:

Lack of ways to promote the project and attract stakers

Stakeholders typically need to purchase the native tokens of the AVS network, which are often volatile and difficult to obtain, resulting in reduced accessibility compared to ETH

AVS must offer a higher annualized yield (APY) than ETH to attract stakers, who incur higher capital costs by giving up other asset management opportunities to participate in network validation

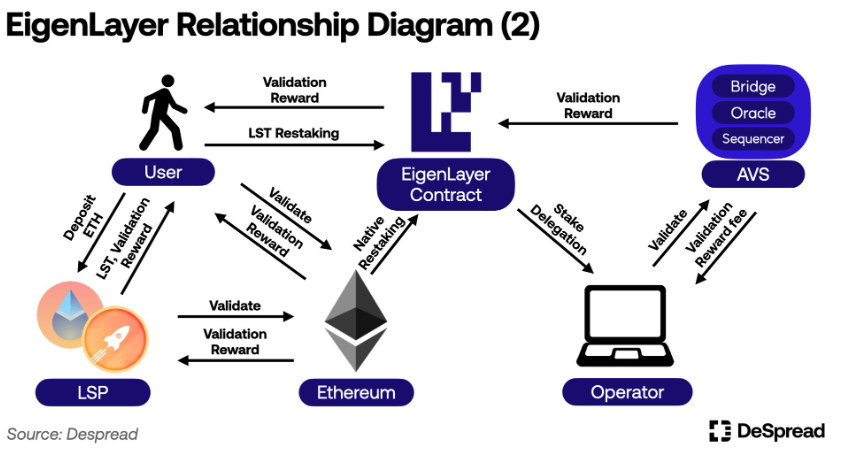

EigenLayer solves these problems with a feature called restaking, which allows ETH staked on the Ethereum beacon chain to be used again to participate in AVS verification. Re-staking offers re-stakers the opportunity to participate in AVS network validation and earn additional validation rewards without purchasing other network tokens, using ETH or LST. For AVS, EigenLayer aims to provide an environment where they can promote their projects and build a network of trust based on the liquidity of re-stakeholders recruited through EigenLayer.

2.1. Exploiting Ethereum’s security through re-staking

Currently, validators on the Ethereum network can have their 32 ETH stake slashed by up to 16 ETH if they take actions that compromise the security of the network. If their staked ETH falls below 16 ETH, they will lose validator status. This means that if there was a way to use the pledged liquidity as collateral, it would be possible to leverage up to 16 ETH of the pledge elsewhere and continue to participate in Ethereum network validation as long as the pledge balance remains above 16 ETH.

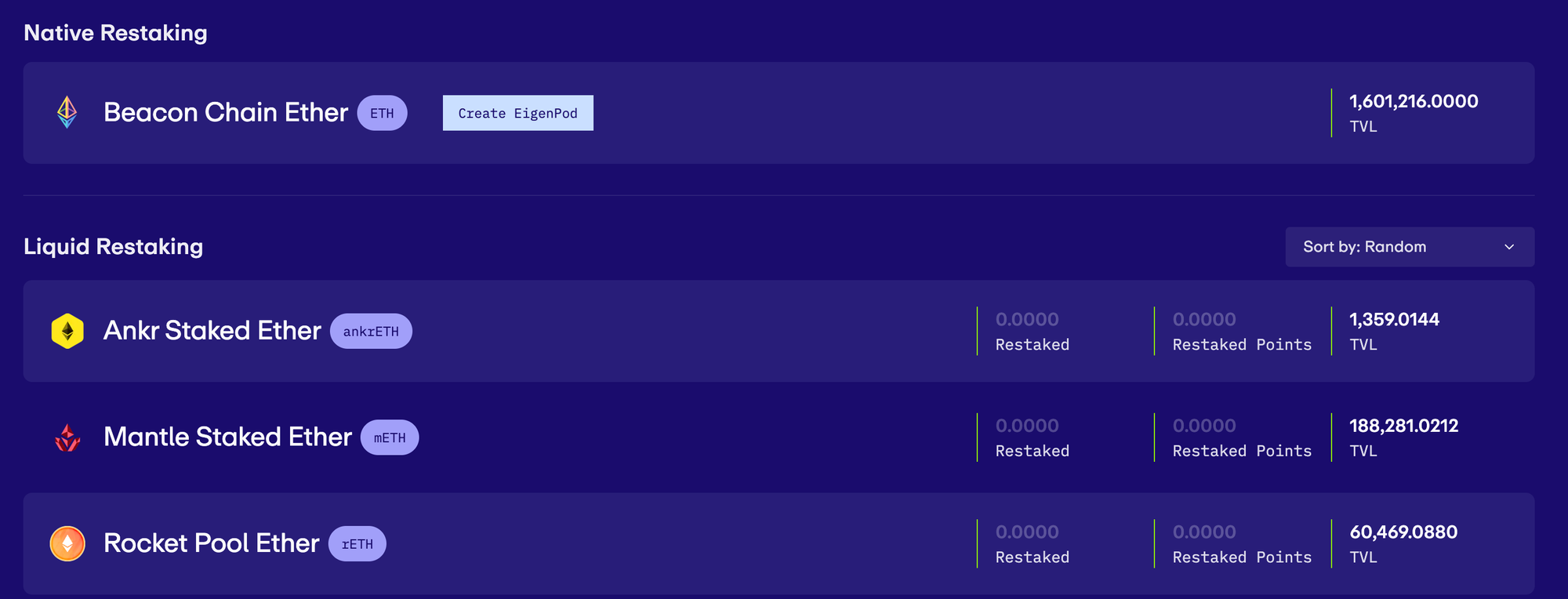

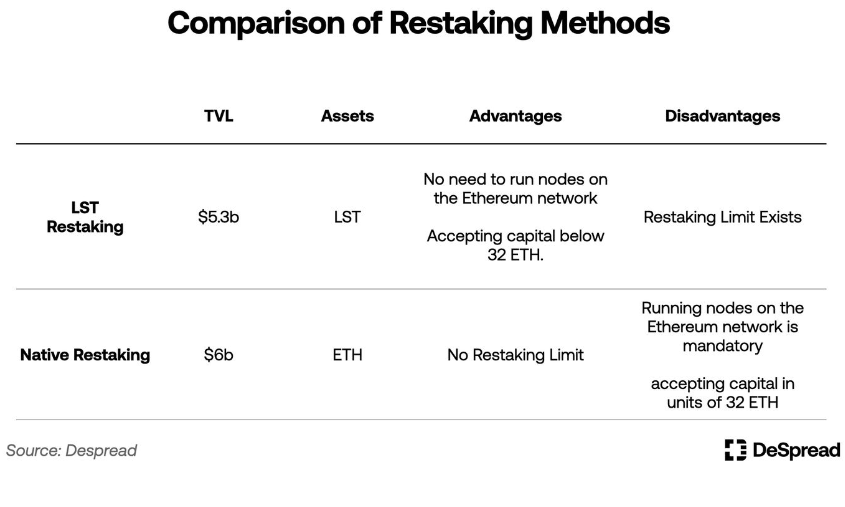

Re-staking in EigenLayer refers to utilizing validators to pledge the idle portion of ETH as collateral, by exposing it to the slashing criteria of AVS using the PoS consensus algorithm, and leveraging it for verification to provide security. Currently, EigenLayer supports two re-staking methods: LST (Liquidity Staking Token) re-staking and local re-staking.

LST re-staking: Although it is called liquid re-staking in EigenLayer, this article will refer to it as LST re-staking to reduce confusion with the concept introduced later.

2.1.1. LST re-pledge

LST (Liquid Staking Tokens) are deposit certificates issued by the LSP (Liquid Staking Protocol) that connect depositors of ETH to entities operating Ethereum nodes on their behalf. LSP addresses certain limitations of staking on the Ethereum network, such as:

Allows users to participate in Ethereum network verification and receive verification rewards with capital of less than 32 ETH.

Allows LST to be used in DeFi protocols to generate additional revenue, or by selling LST on the market without waiting for the unstaking period, effectively providing the same benefits as being unstaking.

One well-known LSP, Lido Finance, currently has approx.10 million ETH deposit. Many DeFi protocols have begun adopting the LST issued by Lido Finance, stETH, as an asset that can be used within their protocols, making it an infrastructure within the Ethereum ecosystem.

EigenLayer provides a re-pledge feature that involves depositing Ethereum network deposit certificates, LST, into the EigenLayer smart contract and participating in AVS verification, exposing it to the AVS network’s penalty criteria. This method is called LST re-staking.

With its mainnet launch in June 2023, EigenLayer began supporting re-staking of stETH, rETH, and cbETH, and currently supports a total of 12 types of LST re-staking.

The EigenLayer development team works hard to ensure the decentralization and neutrality of the protocol, achieving these measures by setting limits for each type of LST. These include only accepting LST re-pledge deposits during certain time periods, or limiting the incentive and governance participation rights an individual LST receives from EigenLayer to a maximum of 33%. EigenLayer’s LST restaking limit has been increased five times to date, and as of this writing, no further plans to increase deposit limits have been announced.

2.1.2. Local re-pledge

While LST re-staking involves participating in AVS validation using LST as collateral, local re-staking is a more direct method in which Ethereum PoS node validators connect their staked ETH in the network to EigenLayer.

Ethereum node validators can participate in AVS validation by using their staked ETH as collateral. They do this by setting the address that receives unstaking ETH to their own wallet address rather than the address of a contract called EigenPod, which is created through EigenLayer.

In other words, Ethereum network validators give up the right to receive their deposited ETH directly, participating in local re-staking to participate in AVS validation. This leaves their staked assets exposed not only to the Ethereum network’s penalty standards, but also to those of AVS, albeit with the potential for additional rewards.

Performing local restaking requires staking 32 ETH and directly managing an Ethereum node, which provides a higher barrier to entry compared to LST restaking. However, it is not subject to LST re-staking.

2.2. Operator

After restaking in EigenLayer, restakers have two options: either run an AVS validator node directly or delegate their restaking share to an operator. Operators participate in AVS verification on behalf of restakers and receive additional verification rewards.

Operators grant penalty rights to the collateral they hold or entrust to AVS, install the software required for AVS verification, and then participate in the verification process. In return, they can collect a self-set fee from re-hypothecaters.

However, the process of sharing security with AVS is currently only running on testnet. Therefore, at this moment, there are no operators or AVS in EigenLayer and restakers do not receive any additional validation rewards. Recently, EigenLayer mentioned that in order to launch the first AVS, EigenDA, on the main network,Phase 2 activation of AVS verification has entered the final phase of preparation。

To summarize, the relationship diagram of EigenLayer is as follows:

2.3. EigenLayer points

EigenLayer awards one EigenLayer point per hour for each ETH deposited by a re-stakeholder as a measure of contribution. While the team has yet to clearly specify what the points will be used for or announce any details about the launch of the EigenLayer token, many users are re-staking in anticipation of a points-based airdrop when the token is eventually launched.

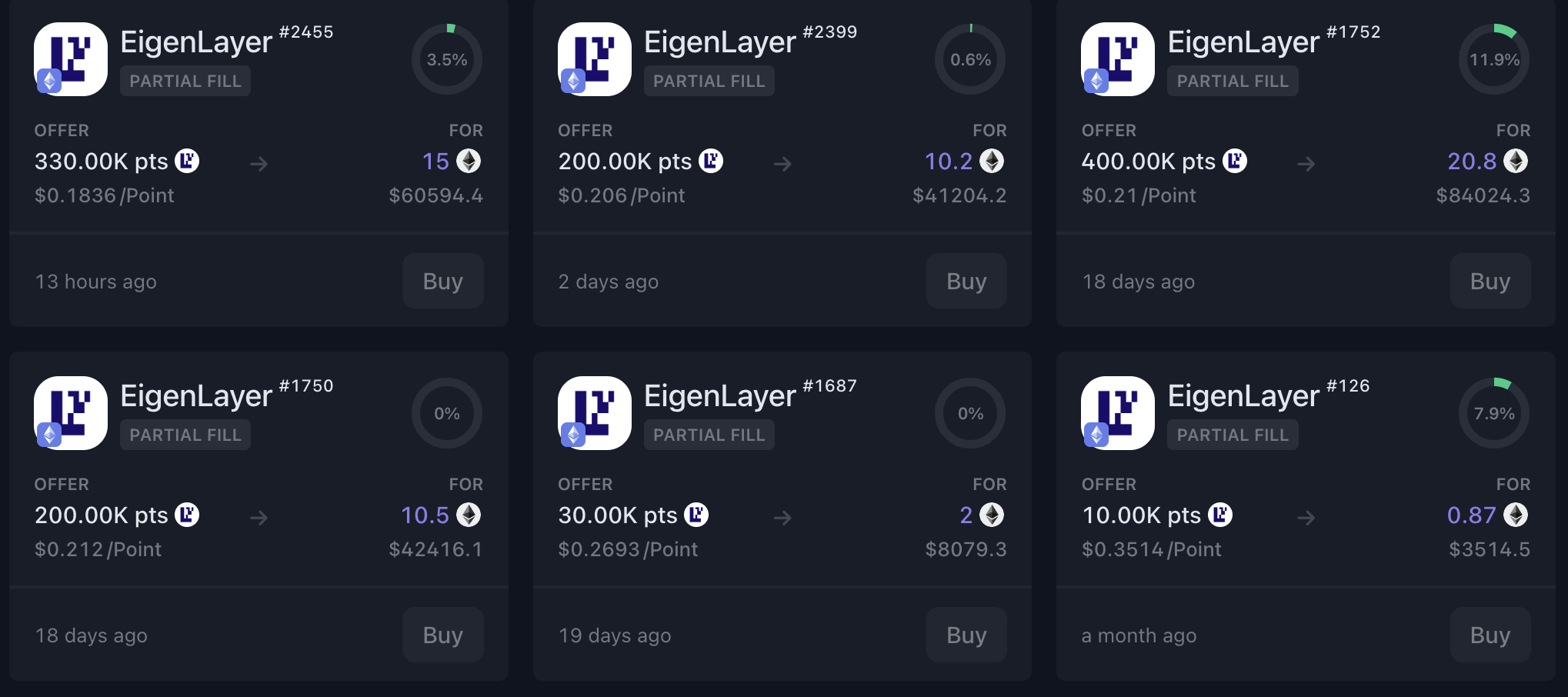

As of this writing, approx.2.6 billionEigenLayer points to all re-stakers, while OTCmarketOn, each EigenLayer point is trading at $0.18.

This allows the market to estimate the expected value of the EigenLayer token airdrop at around $440 million, compared to Celestia’s value of $120 million based on the price on the day of the airdrop, showing considerable market anticipation and interest in the airdrop.

However, users who re-stake for the purpose of airdrop points face some inconveniences:

There are restrictions on LST re-staking, preventing users from depositing as much funds as they want.

Local restaking requires 32 ETH of capital and involves running an Ethereum network node directly.

Re-staking freezes EigenLayer’s liquidity, forcing users to forego other opportunities to generate additional revenue.

Canceling re-staking in EigenLayer to obtain bonded liquidity requires waiting for a 7-day escrow period.

To mitigate these disadvantages and make re-staking more efficient, LRP (Liquid Redemption Protocol) emerged. Utilizing LRP for EigenLayer points has become a more attractive investment option for users.

3.LRP (Liquid Re-Pledge Protocol)

LRP accepts ETH or LST deposits from users and re-stakes them on EigenLayer on behalf of the user. In addition, LRP issues LRT (Liquid Re-pledge Tokens) as proof of deposit assets, allowing users to generate additional income by leveraging these LRTs in DeFi protocols, or sell them on the market, thus bypassing the escrow period waiting for EigenLayer to cancel the re-pledge to restore their deposits. LRP is structurally similar to LSP except that the assets are deposited into EigenLayer.

LSP (Liquid Staking Protocol): A protocol used to replace the verification of the Ethereum network

LST (Liquid Staked Token): issued by LSP to depositors as proof of principal amount

LRP (Liquid Redemption Protocol): An alternative to re-staking on EigenLayer

LRT (Liquid Re-pledged Token): a certificate issued by LRP to depositors as a principal amount

Additionally, most LRPs offer their own protocol points to depositors in addition to issuing EigenLayer points. Therefore, leveraging LRP offers several advantages over restaking directly through EigenLayer, such as:

Create added value through the use of LRT.

Close rehypothecation position by selling LRT

Earn additional airdrops through protocol points

However, the EigenLayer points generated by re-staking through LRP are not the wallet address of the user who deposited the assets, but the ownership address of the LRP. As such, LRP promises to distribute any EigenLayer token airdrops it receives to its depositors and provide users with a dashboard to check the EigenLayer points they have accumulated through LRP.

In the following sections, we will classify LRPs based on two criteria and proceed with a detailed explanation.

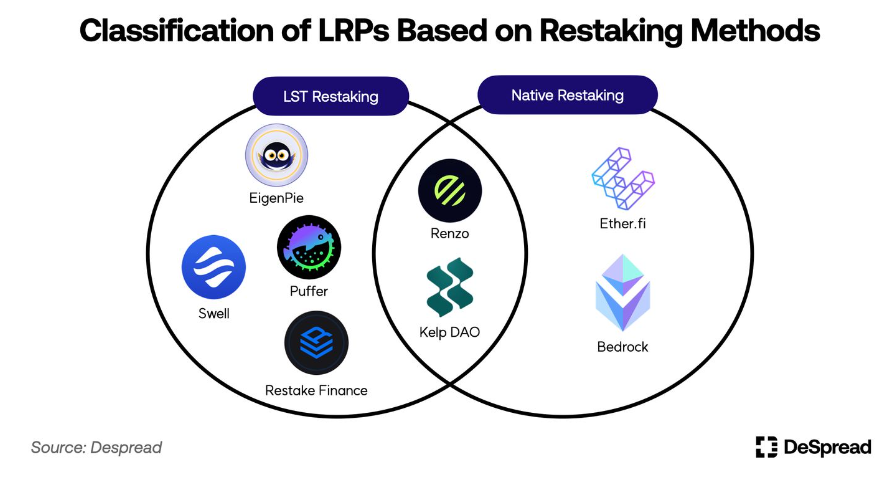

3.1. Classification of LRP based on re-pledge method

As discussed earlier, EigenLayer has two restaking methods: LST restaking and local restaking. These methods differ in the types of assets accepted for deposit and whether they involve operating an Ethereum network node.

LRP that adopts the LST re-staking method can build its protocol through a relatively simple mechanism. They accept users’ LST, deposit it into the EigenLayer contract, and then issue equivalent value of LRT to depositors. However, they are directly affected by the LST re-pledge limit. Therefore, unless EigenLayer reopens LST for re-staking, LST deposited during the restriction period will remain within the LRP protocol, and depositors will not accumulate EigenLayer points until their assets are re-staking.

On the other hand, LRPs with a native restaking approach must directly manage and operate Ethereum network nodes as they accept ETH from users. This requires more work to build, operate and manage the protocol than LRP using the LST re-staking method. However, unlike the restrictions in the LST restaking method, there are no restrictions on local restaking, allowing depositors to start earning EigenLayer points immediately after depositing funds.

Based on these characteristics, LRPs offer re-staking methods that fit their protocol concepts, and they do not necessarily need to adhere to one re-staking method. For example,Kelp DAOLST re-staking was initially supported to quickly aggregate TVL after the launch of EigenLayer, and a strategy was subsequently adopted to provide native re-staking functionality.

3.2. LRP classification based on LRT issuance method

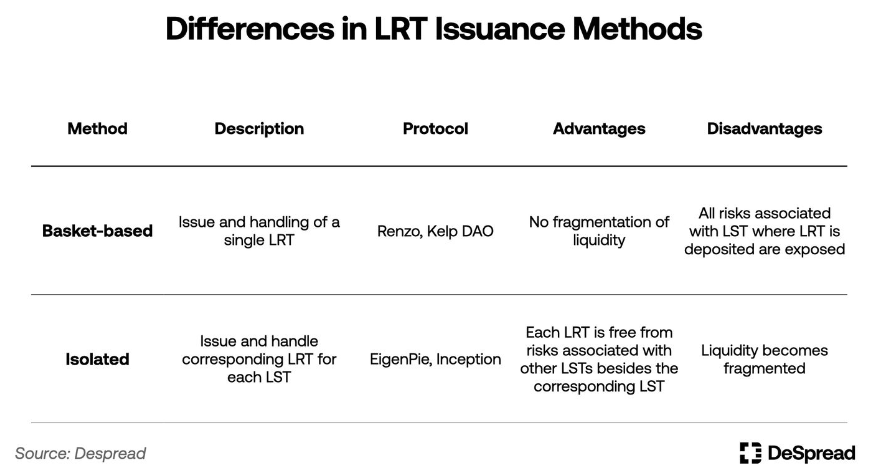

In LRPs that accept various LST types or replace a single asset with ETH and perform reinvestment, the method of issuing LRT can be divided into basket-based and stand-alone.

The basket approach deals with a single type of LRT, with one type of LRT being issued and disbursed regardless of the type of LST a user deposits into LRP. Since it only handles one type of LRT, it is intuitive and understandable for users and has the advantage of not distracting from LRT liquidity. However, one disadvantage is that the entire LRP is exposed to the individual risks of deposited LST, requiring adjustments to the LST deposit ratio within the LRP to protect against these risks.

The stand-alone approach, on the other hand, issues and pays a different LRT corresponding to each LST processed by the LRP. This means that while it has the disadvantage of diversifying LRT liquidity, the risks associated with each LST are also isolated, eliminating the need to adjust deposit ratios.

Most LRPs adopt a basket approach, although a stand-alone approach carries less risk and is relatively easier to set up and operate. This approach is simpler for users and facilitates cooperation with DeFi protocols.

In addition to these basic characteristics, LRP also attracts users by highlighting its unique features and market entry strategies through various examples. Lets examine these aspects in more detail with some examples.

3.3. Discover noteworthy LRPs

3.3.1. Ether.fi

Ether.fi started out as an LSP with the concept of allowing stakers to have full control over their deposited ETH, and was the first LRP to support native re-staking following the launch of EigenLayer. This enables Ether.fi to provide its depositors with EigenLayer points farms through native re-staking, allowing them to continuously increase their TVL even during periods of restricted re-staking.

Ether.fi issues two types of LRT: eETH and weETH. eETH is the basic LRT obtained after depositing ETH into Ether.fi, using a buyback mechanism, with interest reflected in the number of tokens. Repurchasing tokens adjusts the token balance in the holders wallet when interest is paid, maintaining a 1:1 value ratio with the underlying assets. However, some DeFi protocols do not support this token mechanism. To enhance compatibility between LRT and DeFi protocols, Ether.fi offers the ability to wrap eETH into weETH, a reward-based token that reflects interest.

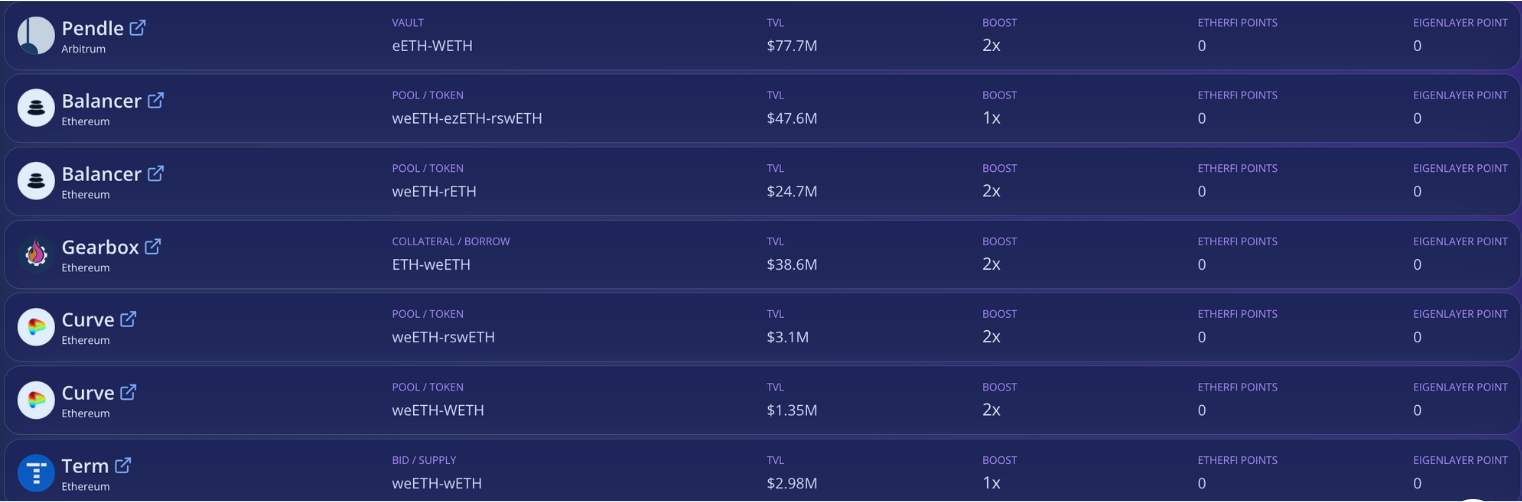

Ether.fi rewards LRT holders with EigenLayer Points and its proprietary protocol points, known as ether.fi Loyalty Points. In order to reduce the selling pressure of LRT and expand its use, Ether.fi cooperates with various DeFi protocols to allow users to deposit LRT into DeFi protocols and continue to accumulate EigenLayer points. Ether.fi also hosts events to increase ether.fi loyalty points for users who use their LRT at DeFi events.

Users can use eETH or weETH to participate in various DeFi activities, such as:

Provide liquidity to the weETH/WETH pool on decentralized exchanges such as Curve and Balancer.

Offer weETH as collateral in lending protocols like Morpho Blue and Silo.

Issuing over-collateralized stablecoins using weETH as collateral in protocols like Gravita.

Use weETH in derivatives protocols like Pendle and Gearbox.

Through these events, users can earn both EigenLayer and ether.fi loyalty points while earning interest from DeFi protocols or using tokens earned as LRT collateral. Ether.fi recently supported the bridging of LRT on Ethereum L2 Arbitrum and Mode Network, providing users with lower gas fees for using LRT in DeFi.

On March 18, Ether.fi announced the TGE of its governance token $ETHFI, with an airdrop of 6% of the total supply based on ether.fi loyalty points. The second quarter airdrop is scheduled for June 30, and 5% of the total ETHFI supply will be distributed.

Currently, Ether.fi has the highest TVL among LRPs,Approximately $3 billion, accounting for approximately a quarter of EigenLayer’s total re-pledge liquidity.

3.3.2. Kelp DAO

Kelp DAO started out as a basket-based LRP that provided LST re-hypothecation for two assets, Lido Finance’s stETH and Stader Labs’ ETHx, and issued a single LRT, rsETH.

Initially, as the EigenLayer LST restaking limit increased, a large number of users quickly filled the limit, but faced the inconvenience of high gas fees and time zone differences. In response, Kelp DAO proposed a solution where users can deposit their LST into the protocol and Kelp DAO will handle re-staking once the deposit limit is reached. Depositors will receive Kelp DAO’s proprietary protocol points, Kelp Miles, which attracts a large user base. Like other LRPs, it designed its system to boost Kelp Miles when users use their LRT to participate in specific DeFi protocols, encouraging restaking and LRT usage.

Kelp DAO has now added native restaking to its offering, offering depositors unlimited EigenLayer Points earning activity. andEther.fiSimilarly, it focuses on enhancing user convenience by offering restaking on the Arbitrum network, making it easier for users to hold and use their LRT in DeFi.

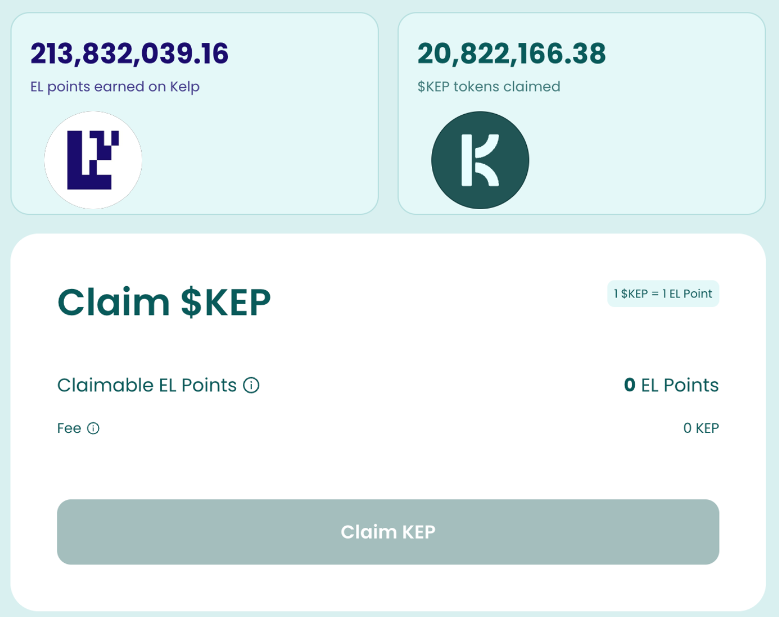

Additionally, Kelp DAO differentiates itself from other LRPs by enabling users to redeem their farm’s EigenLayer points for a token called $KEP.

Users can convert their accumulated EigenLayer points into $KEP tokens by paying a 0.5% fee. They can then sell these tokens on the market, monetize their EigenLayer points orProviding liquidity on decentralized exchanges such as Balancer, thereby generating additional revenue and earning Kelp Miles. In addition, users who have not deposited assets with Kelp DAO can also purchase $KEP on the market, effectively receiving the same benefits as accumulating EigenLayer Points through Kelp DAO.

3.3.3. EigenPie

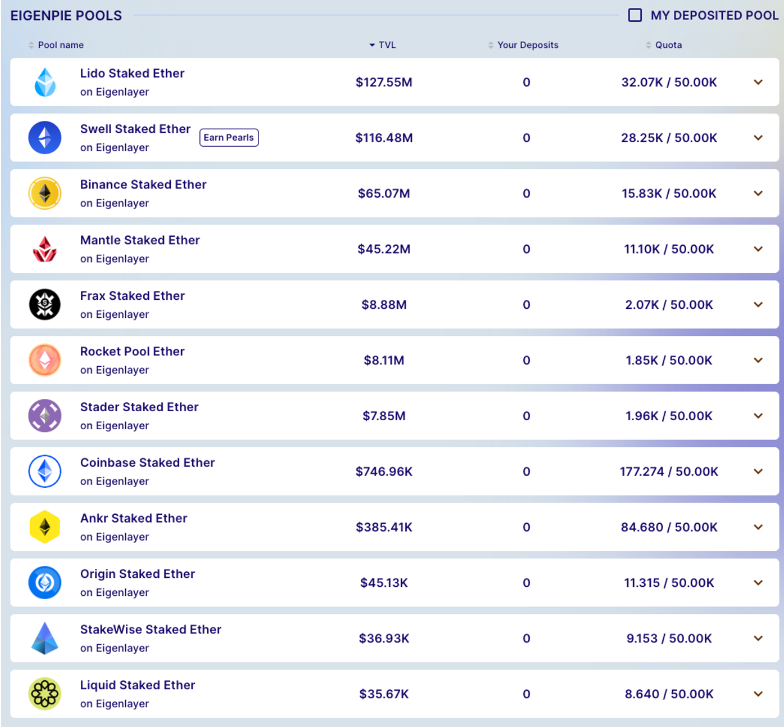

EigenPie isMagPieA sub-DAO launched by the ecosystem that aims to aggregate governance tokens and have a significant impact on DeFi protocol decisions, especially for EigenLayer. It supports the re-pledge of all LST supported by EigenLayer and adopts an independent approach to issue and distribute different LRT for each deposited LST.

Isolating the pool of each LST frees EigenPie from the risks posed by the concentration of specific LSTs and makes it easier to establish partnerships and conduct activities with specific LST protocols. For example, LSPSwell NetworkAhead of the launch of its native restaking feature, a collaboration with EigenPieActivity, rewards users who deposit their native LST, swETH, in EigenPie with Swell Network’s proprietary points.

EigenPie depositors can accumulate EigenLayer Points and EigenPie Points at the same time. Officials have announced that users who earn these points will have the opportunity to participate in its upcoming governance token $EGP.Airdrops and IDOs。

However, EigenPie does not support local re-staking, making it subject to EigenLayer’s LST re-staking cap. In addition, since twelve types of LRT are issued, its liquidity is more fragmented compared to other LRPs, resulting in relatively little cooperation with DeFi protocols.

4. Leverage Points

LRP provides users with convenient access to EigenLayer points by acting as an intermediary for re-staking and providing LRT. Additionally, by introducing their proprietary protocol points system and working with DeFi protocols to increase these points through events, they have attracted a large number of airdrop enthusiasts to the EigenLayer ecosystem.

However, when LRP first emerged, there was a lack of lending protocols that could work with LRP to use LRT as a collateral asset. Therefore, users participating in protocol point enhancement activities can only honestly farm EigenLayer Points based on the amount of LRT they hold.

Gravitais an over-collateralized stablecoin issuance protocol that allows users to use Ether.fi’s weETH as collateral to issue stablecoins. Users can then leverage their positions through a so-called looping process – using stablecoins collateralized by LRT to buy and deposit more LRT, thereby earning more EigenLayer Points. However, the Ethereum network’s high gas fees and Gravita’s minimum usage requirements (at least 2,000 stablecoins issued) create significant barriers to entry for many users trying to cycle.

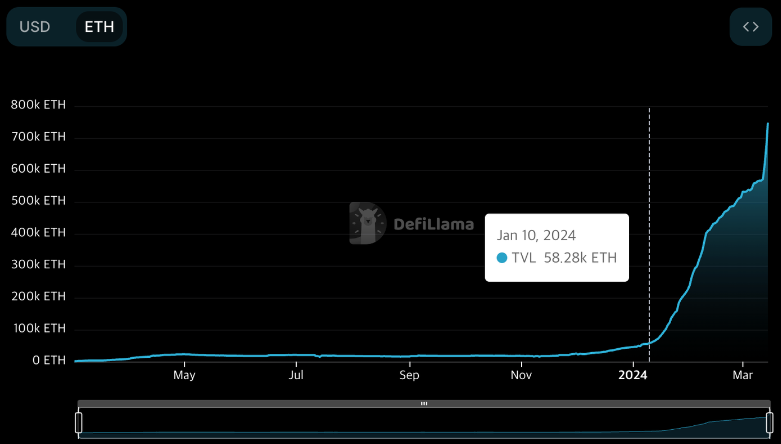

That changed on January 10, 2024, when Pendle Finance started supporting eETH from Ether.fi, allowing users to leverage points farming with a small amount of capital. This development has generated considerable interest among airdroppers who use Pendle Finance for EigenLayer points farming. As a result, EigenLayer and LRP saw significant growth in TVL.

4.1. Pendle Finance

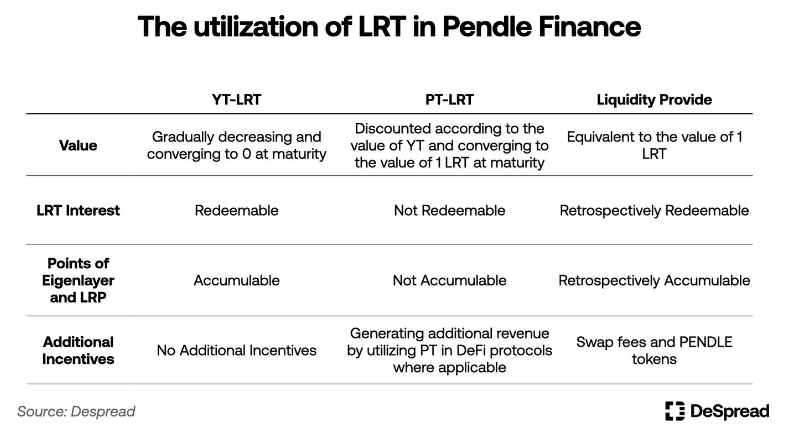

Pendle Finance is a DeFi protocol that allows trading of yield-bearing tokens, such as LST and LRT, by setting a specific expiry date and splitting them into a principal token (PT) and a yield token (YT).

The total value of YT and PT is always equal to the value of the underlying asset, and YT holders are entitled to claim accumulated interest from the beginning of holding until maturity. Therefore, as the expiration date approaches, the value of YT will tend towards zero, while the market value of PT will discount proportionally as the demand for YT tokens increases.

Pendle Finance has partnered with Ether.fi to launch Ether.fi’s eETH as the first LRT available on its platform. Ether.fi has designed a system to distribute EigenLayer Points and Ether.fi Loyalty Points to users who hold eETH’s YT token (YT-eETH). This enables users to purchase YT-eETH that is approaching expiry (which is getting cheaper) and accumulate interest and points up to that date.

Here is an example:

The above picture is based on the status of Pendle Finance eETH products as of the time of writing. The details are as follows:

Product expires on June 27, 2024, approximately 103 days from the date of writing.

eETH’s 7-day average annualized return is 3.13%, and its current price is $3,872.

The price of YT-eETH is $196, and if purchased at that value, the annual interest yield is -99.8%.

The price of PT-eETH is $3,676, and if purchased at that value, the annual interest yield would be 20.02%.

As of the date of writing, the exchange ratio of eETH to YT-eETH is approximately 1:20. Ether.fi is running a campaign offering double Ether.fi loyalty points to users holding YT-eETH. Therefore, a user who exchanges one eETH for YT-eETH and holds it until maturity will receive the following interest and points:

Interest on holding 20 eETH

EigenLayer points holding 20 eETH

Ether.fi loyalty points equivalent to holding 40 eETH

However, as the value of YT-eETH will gradually drop to zero, all holders will actually be able to recover is the base interest generated from 20 eETH. At current prices, that’s around $640, which is about one-sixth of the $3,872 that one eETH is worth, indicating that users are willing to take this loss to participate in points farming activities by purchasing cheaper YT-eETH.

As the value of YT-eETH for points farming is highly regarded, discounted PT-eETH also becomes an attractive investment option with an increased discount rate. Additionally, demand to contribute LP to Pendle Finance’s eETH product trading pool has increased as users seek to earn incentives. Currently, of all LRT issued on Ethereum, approximatelyone thirdUsed by Pendle Finance.

Following its partnership with Ether.fi, Pendle Finance continues similar collaborations with other LRPs, increasing the number of supported LRTs and providing leveraged point farms for EigenLayer and LRT through the Arbitrum network. Recently, derivatives utilizing undervalued PT-eETH as collateral emerged inSilo Finance, enabling Pendle Finance to benefit from the EigenLayer ecosystem, with TVL increasing approximately tenfold since the beginning of the year.

4.2. Gearbox

Gearbox is a leveraged yield protocol that captures users’ attention in a different way than traditional lending protocols like Pendle Finance.

In Gearbox, borrowers must create a smart contract called a credit account before borrowing an asset. They can then leverage their positions by depositing their pledged assets and borrowed assets from the protocol in a credit account. Borrowers can then engage in margin trading powered by Gearbox via a credit account with leveraged spot assets, or participate in various DeFi yield farming opportunities such asConvexandYearn Finance。

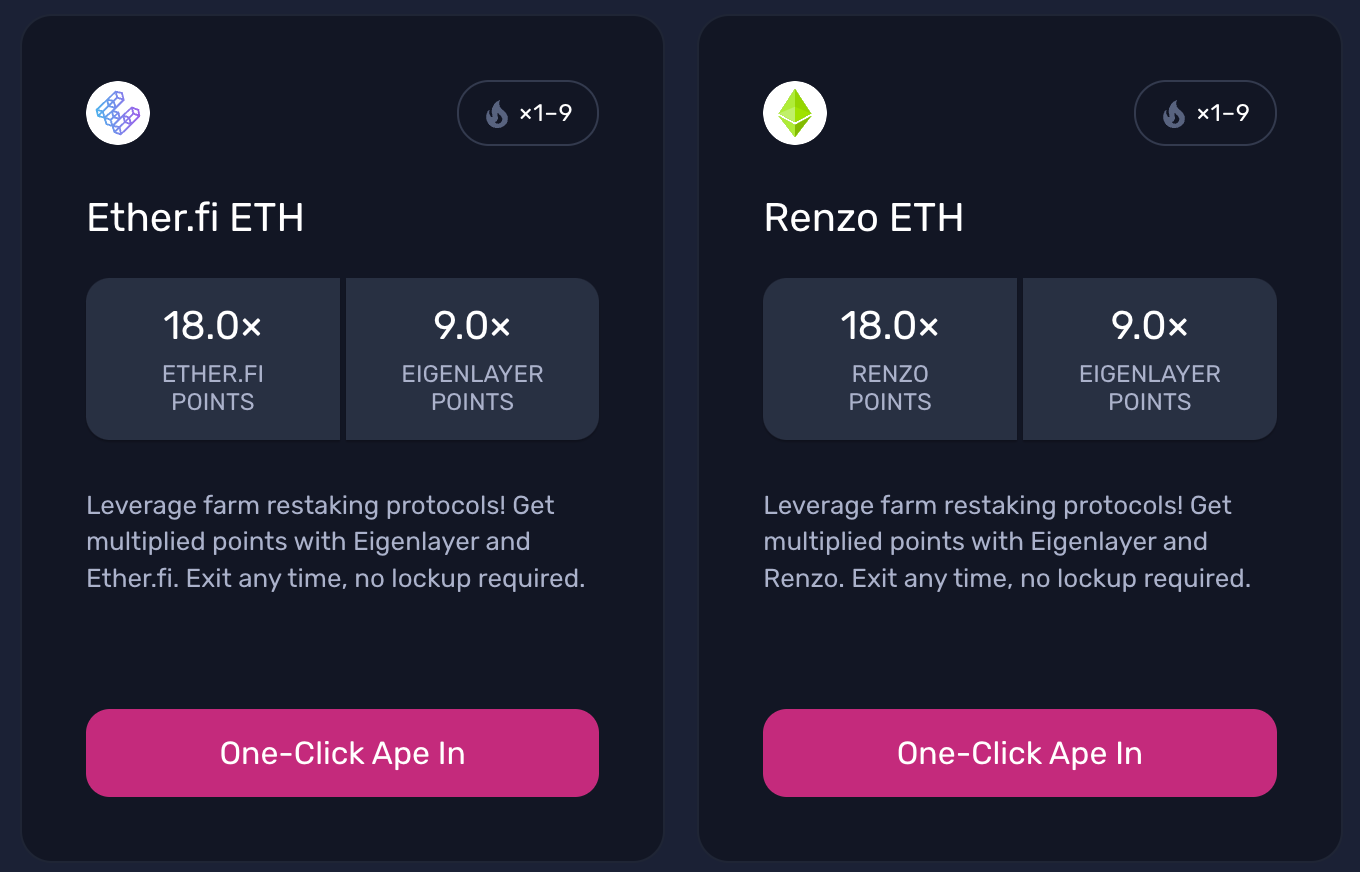

With this structure, Gearbox launched a leveraged points strategy through a partnership with the LRP protocol. Gearbox allows EigenLayer points and LRP local points to be accumulated in credit accounts and sent to the borrowers wallet, providing users with up to 9x leverage points.

Gearbox Leverage Points Farm, source:Gearbox

Compared with Pendle Finance, Gearbox provides a more intuitive UI/UX, and even users who are unfamiliar with DeFi can easily access the leverage points farm. In just three weeks since the leveraged points farm feature launched, Gearbox was able to increase TVL by approximately 5x.

5.Risk

Many protocols that use ETH deposited on the Ethereum network as collateral are connected to each other, forming a large ecosystem. Currently, derivative protocols using LRP, LRT, and EigenLayer points are emerging, and there is a lot of discussion about the growth potential of the EigenLayer ecosystem. However, there are also many voices expressing concerns about the potential risks of EigenLayer.

In the EigenLayer white paper, the basic risks associated with EigenLayer are outlined: collusion among operators providing AVS security to misappropriate AVS funds in this way; penalties due to unintended vulnerabilities such as AVS programming errors. Improvements targeting operator collusion include implementing systems to monitor the potential for collusion and diversifying operators by incentivizing them to focus on smaller AVS. Improvements to address unexpected penalties include a thorough AVS security review and community veto over penalties.

Even if the above risks are mitigated, there are still unobserved risks due to the delegation of staking to EigenLayer operators and the functionality that primarily provides AVS security yet to run on mainnet. In addition, when using LRT and its derivative protocols, there are additional risks such as vulnerabilities in the contracts and oracles of each protocol that may be attacked. Additionally, even a minor penalty from EigenLayer for over-borrowing LRT via a derivatives agreement could lead to significant cascading liquidations.

Vitalik Buterin, the founder of Ethereum, also announced theDont Overload Ethereums ConsensusThe article expressed concerns about EigenLayer, suggesting the possibility of validators staking EigenLayer to conduct social consensus attacks in order to hard fork the Ethereum network for their own benefit.

6.The future of EigenLayer

In the short term, EigenLayer is preparing to launch its first AVS –EigenDA, with a Phase 2 update coming soon, which will allow secure sharing and re-earning on AVS.

Created by EigenLabs, the team behind EigenLayer, EigenDA is an AVS (Availability Security Sublayer) that leverages the security of EigenLayer to provide a data availability layer where there is no independent consensus algorithm. Currently, several second-layer chains including Celo, Mantle, and Fluents have mentioned EigenDA as their data availability layer.

Additionally, following the launch of the Phase 2 mainnet, a Phase 3 test is planned that will allow security to be shared with other AVS outside of EigenDA. Many famous projects such asEthos、HyperlaneandEspressoWe are preparing to obtain the security of AVS from EigenLayer after the launch of the third phase of the mainnet.

During this journey, it is still uncertain whether EigenLayer will launch a token, and if so, what role the token will play within EigenLayer and what incentives will be provided to users who accumulate points. However, if EigenLayer goes ahead with token airdrops, let’s judge the mid- to long-term future of EigenLayer based on the author’s opinion.

6.1. EigenLayer’s token economics

Assets stored in EigenLayer are used for AVS security. Therefore, EigenLayers TVL metric does not just indicate how much assets are stored in EigenLayer, but can also be interpreted as the overall security index of AVS. However, after the airdrop, EigenLayer’s TVL may decrease as airdroppers withdraw their re-staking liquidity.

Therefore, if EigenLayer were to announce a token economics plan, it would be possible to design token economics centered around maintaining the liquidity that has been re-staking so far, attracting more AVS based on that liquidity, and encouraging more re-staking to enhance network effects.

Especially at the initial launch, it is expected that tokens will be offered as an additional incentive to diversify operations. Additionally, when multiple AVS register with EigenLayer to receive security, EigenLayer tokens are expected to be distributed to operators and restakers providing security to AVS as an additional incentive for risk diversification.

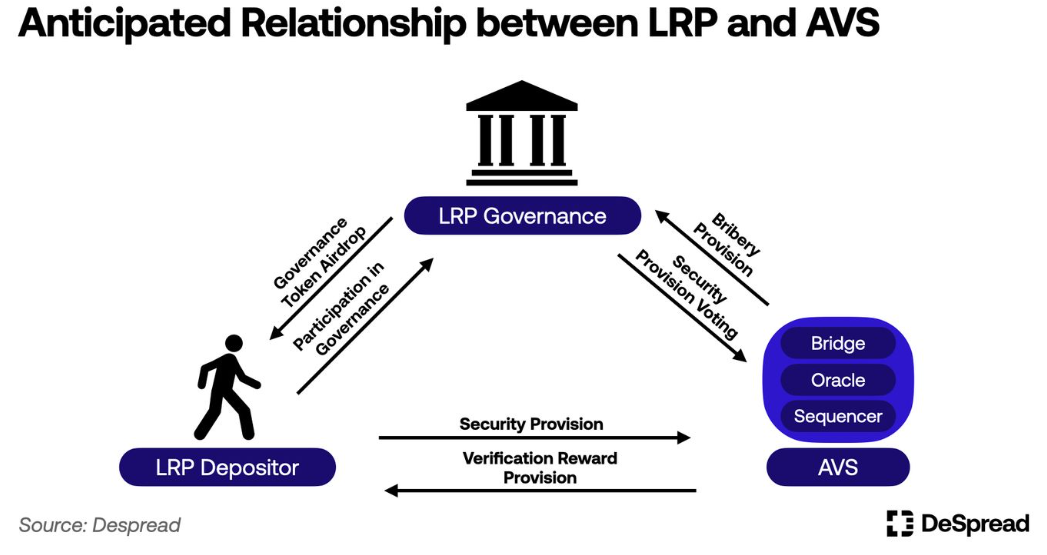

6.2. Relationship between LRP and AVS

AVS may airdrop its own tokens to re-stakeholders to attract additional security. RaaS (Rollup as a Service) protocol that will soon become AVS on EigenLayerAltLayerhas issued its own token $ALT and airdropped part of it to EigenLayer’s re-stakeholders.

In January 2024, protocols such as Dymension and SAGA announced the adoption of Celestia as their data availability layer and revealed plans to airdrop their native token $TIA to their investors, resulting in a doubling of the amount of $TIA in the network. Similarly, airdrops targeting restakers of AVS like AltLayer have the potential to drive restaking as a dominant narrative in the market following the launch of the EigenLayer token.

Furthermore, from the perspective of AVS, promoting their AVS through LRP, where re-stakers and security options are numerous, can achieve greater results at a lower cost of capital, rather than promising an airdrop to an unspecified majority and conducting Unilateral promotion. Therefore, expect an increase in various collaboration announcements between LRP and AVS. For example, support for rollup inter-network messagingOmni Networkhas announced a partnership with Ether.fi and revealedReceived approximately $600 million in staking support from Ether.fi. The announcement sparked anticipation for an airdrop of Omni Network tokens among Ether.fi stakers.

Additionally, it is expected that LRPs will attempt to systematize their interoperability with AVS through tokenomics. For example, an LRP might distribute governance tokens to re-stakeholders, allowing them to choose AVS that provide security. By using these governance tokens, users who vote on AVS may receive rewards in the form of AVS’s native token. This structure will enhance incentive alignment between LRP re-pledgers, LRP governance token holders and AVS.

6.3. Evolution of practicality of LRT

Currently, most restakers use LRT in DeFi protocols such as Pendle Finance to maximize points leverage and thereby optimize their point farms in EigenLayer. However, the sustainability of the points system after the EigenLayer token is issued remains uncertain. However, as the expected value of EigenLayer Points among re-stakeholders decreases, it may result in a decrease in the TVL that facilitates the leveraged points protocol.

However, LRT has the potential to offer the highest interest rates after providing AVS security, and these rates may be higher than tokens pegged to the value of ETH. Therefore, DeFi protocols that previously used ETH or LST can provide users with higher returns by integrating LRT.

Currently, likeMorpho BlueandSilo Financesuch loan agreement, andGravitaPlatform for over-collateralized stablecoin issuance that allows the use of LRT as collateral. Furthermore, likeWhales MarketSuch platforms facilitate OTC trading with weETH (Ether.fi’s LRT) as collateral. The usefulness of LRT is expanding, starting with the recent launch of Ether.fiLiquidAs can be seen from the function, this function enables Ether.fi’s LRT to generate revenue in various DeFi protocols.

LRP like Ether.fi andRenzoOfficial support for LRT bridging and native re-staking on layer 2 networks such as Arbitrum, Mode Network and Blast, allowing DeFi protocols to adopt LRT as an asset on layer 2 networks. Additionally, projects aiming to become a liquidity hub for modular rollup networksMitosisarePartnering with Ether.fi, extending LRT’s interoperability on different chains.

6.4. Super Liquidity Redemption

Returning to the re-staking area discussed earlier, the EigenLayer white paper introduces a method called super-liquidity re-staking, which exists in parallel with local re-staking and LST re-staking.

Hyperliquidity re-staking involves providing liquidity to AMM DEX pools containing ETH and LST, such as Uniswap and Curve, and re-staking the obtained LP tokens to EigenLayer. This approach allows investors to both receive restaking rewards and earn interest from fees generated by the pool.

Although the possibility of EigenLayer supporting super-liquidity restaking has not been officially mentioned in the white paper, the possibility remains open. If EigenLayer adopts this feature in the future, it could pave the way for various derivative protocols to emerge, creating another aspect of the ecosystem.

Vector ReserveIt is a protocol designed with super-liquidity re-hypothecation in mind. It provides various LRT and LST as liquidity to the DEX pool and issues index tokens vETH that are supported by the value of LP tokens. Vector Reserve plans to launch after EigenLayer starts supporting super-liquidity re-stakingenhance its functionality。

7.Conclusion

EigenLayer has evolved from a simple concept of sharing Ethereum network security and generating additional revenue to expanding its ecosystem to meet the needs of infrastructure builders and investors, launching numerous spin-off projects. AVS like bridges and orderers leverage Ethereum’s security to build their own network security, while investors see the potential to maximize ETH’s capital efficiency by leveraging LRT beyond LST.

Despite the high risk as EigenLayer-based AVS is not operational yet, many users still participate in re-staking to obtain points with no clear purpose. Additionally, user interest in EigenLayer points has been accelerated through LRPs and derivative protocols, allowing capital in the current phase of EigenLayer-backed LRT to be used to build vast empires.

EigenLayer has certainly sparked interest and expectations within the infrastructure industry and crypto market, and with its mainnet launch fully operational, it will be necessary to closely monitor whether EigenLayer will bring the new DeFi Summer to Ethereum that some are looking forward to, or whether it will give Ethereum the new DeFi Summer that some are looking forward to. As some fear, it will increase the complexity of Ethereum and possibly lead to a chain collapse.