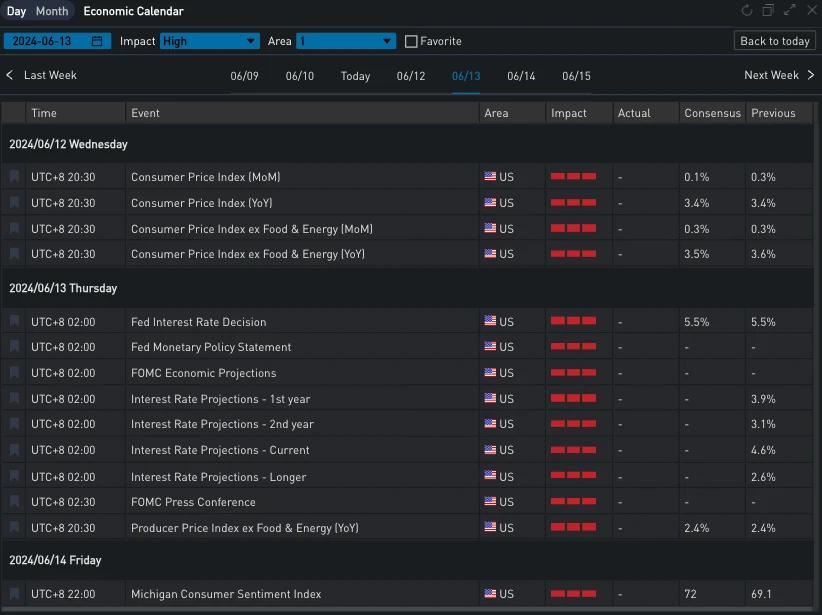

The United States will hold a new round of FOMC meetings on Thursday morning, and before that, there will be heavy CPI inflation data released on Wednesday night, which has made the global market sit on pins and needles. According to Jinshi, Federal Reserve mouthpiece Nick Timiraos said that most buy-side economists and other professional Fed observers now expect the Fed to cut interest rates once or twice in September or December. There are two risks at this stage. One is that the Fed will regard the sound economic activity as a signal that the policy is not tight enough and the high interest rate will not be maintained for long enough; the other risk is that the Feds attempt to preemptively strike may ignite the market.

Source: SignalPlus, Economic Calendar

In fact, the upcoming inflation data and the outlook for the Feds interest rate are crucial for BTC. The recent strong economic data in the United States and the rising negative correlation between Bitcoin and U.S. Treasury yields give investors reason to be wary of potential increased volatility before major economic data. In the past 24 hours, BTC has fallen continuously to a one-week low after a brief rebound to the $70,000 mark. Such a market situation is really worrying. Although the BTC spot ETF has continuously injected a large amount of funds in the past week, it cannot provide investors with enough confidence support in the critical 36 hours. Anand Gomes of Paradigm commented that the crypto market is like an addict who constantly needs good news to support it, No news is bad news in crypto.

Source: TradingView

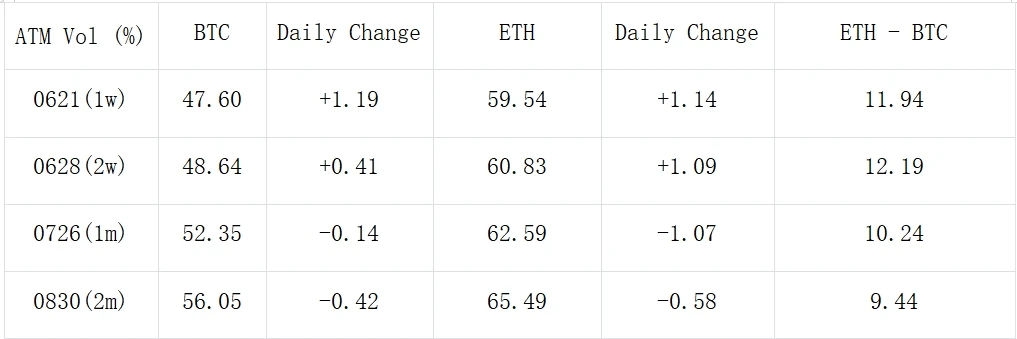

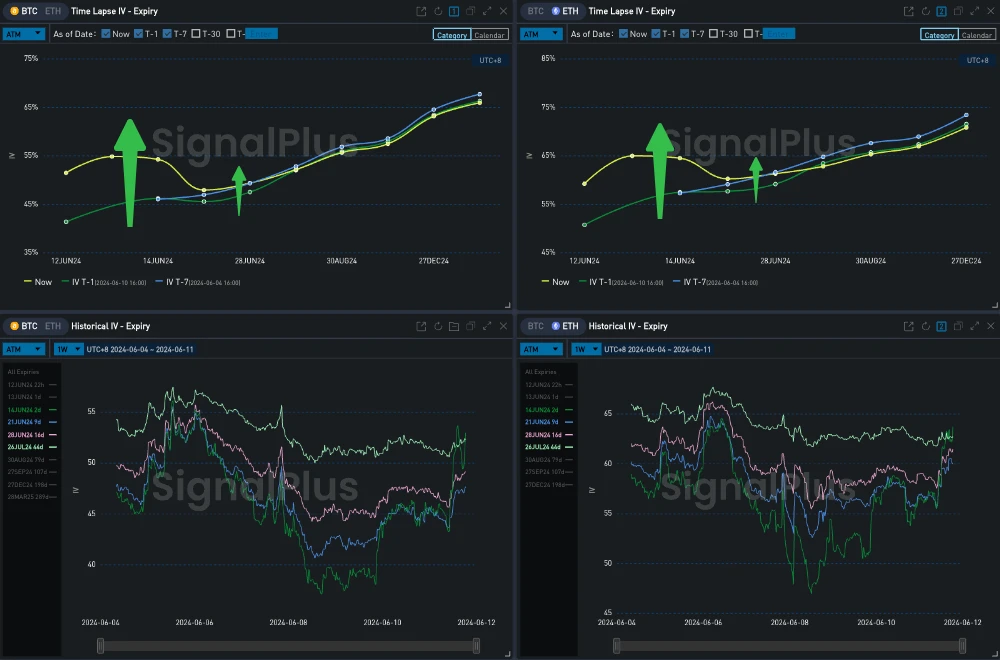

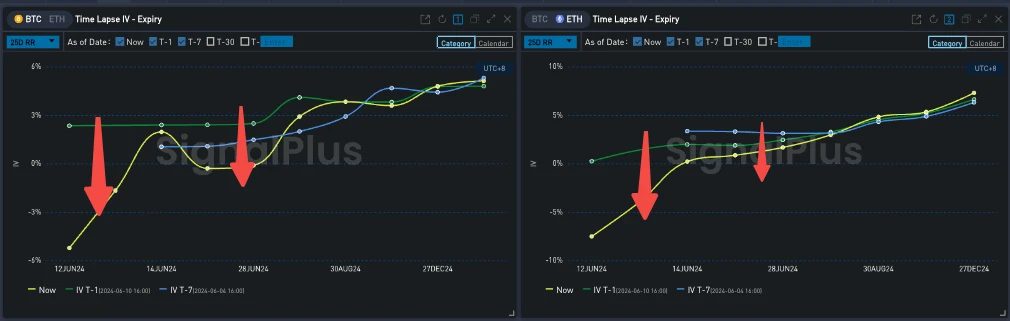

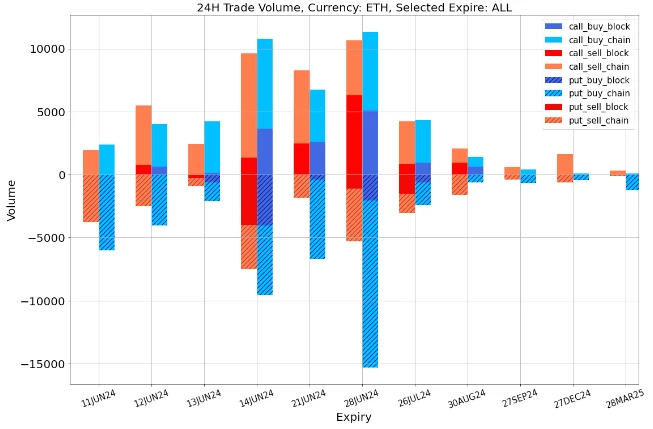

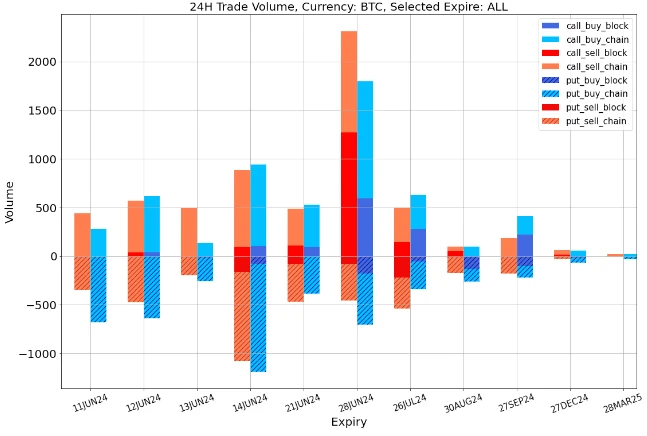

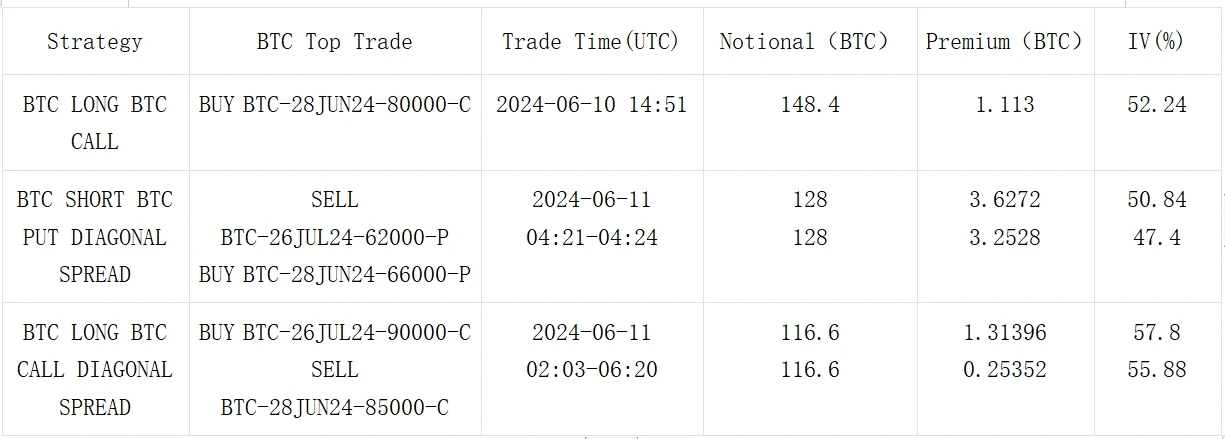

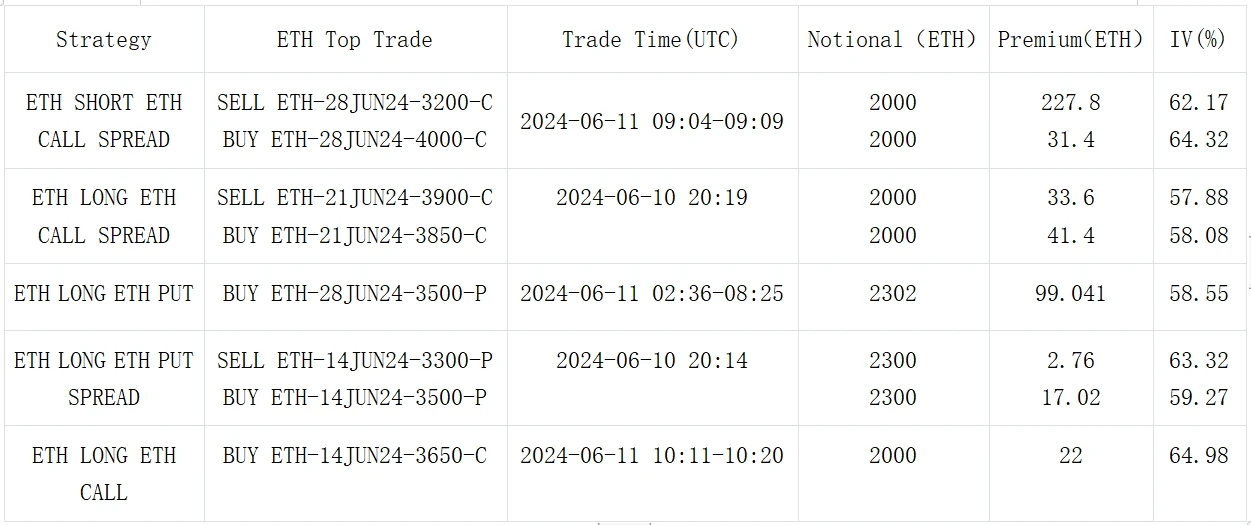

In terms of options, the front-end IV rose sharply amid the uncertainty brought about by the US economic data and the decline of Bitcoin due to selling. A large number of put option purchases of various maturities in June appeared in ETH, and the proportion of BTC front-end put purchases was also increased. However, at the same time, the call options with an upward price of 70,000 at the end of June were sold in large quantities, which jointly caused a sharp and synchronous decline in the front-end Vol Skew of the two currencies.

Source: Deribit (as of 2 MAY 16: 00 UTC+ 8)

Source: SignalPlus, front-end IV surge

Sourc: SignalPlus, Front-end Vol Skew Down

Data Source: Deribit, overall distribution of ETH transactions

Data Source: Deribit, overall distribution of BTC transactions

Source: Deribit Block Trade

Source: Deribit Block Trade

You can search for SignalPlus in the Plugin Store of ChatGPT 4.0 to get real-time encryption information. If you want to receive our updates immediately, please follow our Twitter account @SignalPlus_Web3, or join our WeChat group (add assistant WeChat: SignalPlus 123), Telegram group and Discord community to communicate and interact with more friends. SignalPlus Official Website: https://www.signalplus.com