In the past week, market volatility has rapidly increased. Will the volatility continue? Recently, weak US economic data has raised expectations for interest rate cuts. According to traders predictions, the US is unlikely to cut interest rates this month and the Ethereum spot ETF cannot be launched for the time being. Coupled with the sell-off expectations brought by MtGox and central banks of various countries, Bitcoin rose first and then fell this week. After breaking through $63,000, it plummeted today. Only a few mainstream value coins outperformed the market, while the trend of altcoins continued to be weaker than value coins.

Macro environment

The recently released minutes of the June Fed meeting reiterated the wait-and-see stance of Fed officials. The minutes showed that they believed that more data was needed to confirm whether they were confident in starting to cut interest rates, and most people believed that the US economy was cooling down. The New Fed News Agency also stated in X that Fed officials hinted that they were not in a hurry to cut interest rates and were generally satisfied with the wait-and-see stance. According to current FedWatch data, most traders bet that there will be no interest rate cut at the meeting at the end of this month.

Federal Reserve Chairman Jerome Powell remained equivocal about a September rate cut and stressed that employment data was the data he cared most about.

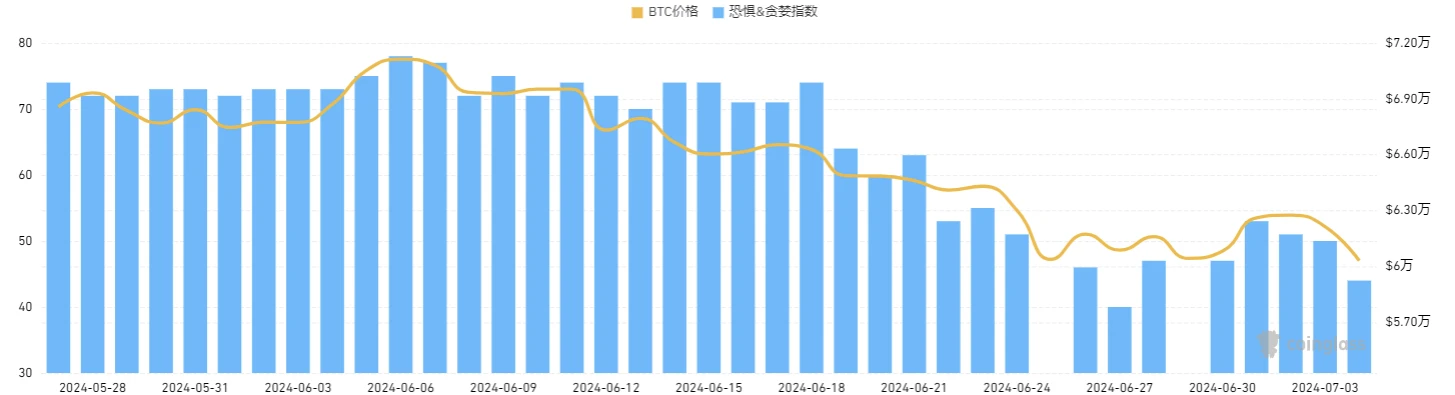

Due to the Mentougou incident and the expected sell-off by central banks, the price of Bitcoin (BTC) continued to be under pressure this week, driving the market to weaken. On July 4, the Ethereum spot ETF failed to land as expected last week, exacerbating the markets gaming sentiment. Affected by this, the Bitcoin panic index turned from greed to a neutral range.

Thursday’s decline was driven primarily by whales. As dZaheer shared in a tweet, a whale sold $180 million worth of Bitcoin in three minutes, which may have triggered a chain reaction of stampedes that day.

Compared to the SP 500 and gold, Bitcoins recent performance is relatively weak. Considering the possibility of a subsequent reversal of sentiment, the massive sell-off in Mt. Gox may become an important buying opportunity for short-term trading.

High-quality track

1) Ton Section

Profit determination:

The TVL (total locked value) of the entire TON ecosystem has grown rapidly since March this year, increasing more than 6 times in just four months. The fees of the Telegram advertising platform will all be settled in TON.

Using TON as the only settlement asset for Telegram’s advertising platform is a major move for TON’s empowerment, which is equivalent to directly empowering Telegram’s 900 million users to TON. For TON, this is equivalent to the Telegram platform continuously buying back TON through advertising revenue.

Specific currency:

Notcoin: As a click-to-earn game, Notcoin is the most popular Web3 application in Telegram Apps Center and the most well-known project in the Ton ecosystem. In just a few months, its user base has exceeded 40 million.

Catizen: Catizen is the largest gaming application platform in the Telegram ecosystem. Its total number of users has exceeded 20 million, with more than 500,000 paying users and more than 1.25 million on-chain users.

Uxlink: Uxlink is the largest social infrastructure project in the Telegram ecosystem. It is based on the rapid fission of acquaintance social networking in Telegram. The currently published registered user data has exceeded 10 million, becoming the social infrastructure with more than 10 million users in the SocialFi track.

2) Tron

Reliable income:

TRON has industry-leading user activity, and its TVL and total market value of on-chain stablecoins are both ranked second among global public chains, and it has carried more than US$12 trillion in transactions.

On July 1, TRONs transaction volume exceeded 7.49 million, setting a new high for the year. In the past 30 days, TRONs average daily transaction volume exceeded 6.78 million, a month-on-month increase of 6.6%. In the first half of the year, TRONs protocol revenue reached US$245 million, far exceeding Ethereum.

Reasons for bottom-fishing:

As the most stable token in this bull market, TRON has a much higher winning rate than other tokens. Currently, since TRON is not the most concerned token in the market, its winning rate is higher. When the market is bearish, it is worth considering to deploy TRX.

User attention

1) Popular Tokens on Twitter

$ZK

In its 3.0 roadmap, ZKsync introduced an “elastic chain” architecture, which will enable ZKsync to evolve from a single ZK-Rollup to a network of multiple ZK chains. First proposed in 2022, this idea was originally called “bridgeless hyperchain”, and ZKsync said that this scheme achieves native, trustless and low-cost interoperability between ZK chains.

Elastic Chain is an effective solution in the current L1 and L2 layers. As the threshold for blockchain launches becomes lower and lower, traditional protocols usually continue to expand the supported network as the number of chains increases. Based on Elastic Chain, traditional protocols can directly connect to the chains and projects newly added to the network, thus saving development and promotion resources.

$JUP

Jupiter is a Solana-based DEX aggregator designed to provide liquidity to traders seeking to obtain the best possible prices and minimal slippage. Although originally conceived as an exchange engine, the protocol has evolved to include multiple products such as dollar cost averaging (DCA), limit orders, and perpetual trading to meet different types of user needs.

On the X platform, Jupiter announced that if you have voted on any JUP DAO proposal in the past 3 months, you will be eligible to receive an ASR commensurate with your staked JUP and voting activity. The total pool includes: 50 million JUP, 7.5 billion WEN, 7.5 million ZEUS, 7.5 million UPT, and 750,000 SHARK.

$MANTRA (OM)

MANTRA is a high-quality first-layer blockchain designed for real-world assets (RWA) that aims to bring global finance to the blockchain. As a permissionless chain, it complies with and enforces real-world regulatory requirements. By providing advanced technical modules, compliance mechanisms, and cross-chain interoperability, developers and institutions can easily participate in the growing RWA tokenization field.

Today, MANTRA and MAG, a leading real estate developer in the UAE, announced a major collaboration that will involve tokenizing MAG’s $5 billion real estate portfolio. MAG’s real estate portfolio is valued at over $50 billion, and the partnership aims to revolutionize real estate investment through blockchain technology.

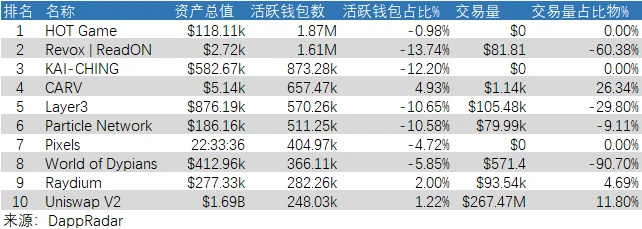

2) Popular DApps

World of Dypians is a metaverse sandbox and virtual game created by Dypius, where players can explore endless maps and participate in various activities, such as finding rewards or purchasing items with digital currency. This virtual world provides unique opportunities for your adventure, presenting interactive and growing experiences in an immersive digital environment. DYP is the base token of this ecosystem, supporting in-game transactions, rewards and other operations. You can use DYP to perform cross-chain bridging operations, realize the transfer of tokens between different public chains, and maximize assets with the Dypius Earn product.