Original author: rosie

Compiled by | Odaily Planet Daily ( @OdailyChina )

Translator | Ethan ( @ethanzhang_web3 )

Editors note: In the crypto industry, there are many suggestions on how to issue coins: there must be interaction, venture capital, and hype. However, when we actually use data to verify these consensuses, the results are disturbing - the loudest voices are often the farthest from the truth.

Odaily Planet Daily compiled a systematic research article based on Simplicity Groups research on 40 mainstream token issuance projects in 2025 and more than 50,000 data, trying to restore a fact that is obscured by emotions, algorithms and fake KOL noise: interaction ≠ success, venture capital ≠ value, hype ≠ growth. In the TGE season with frequent hot spots, I hope this article can provide a calm and reliable reference for project owners, operators and investors. Data does not lie, but we have not listened carefully for too long.

Spoiler: The people with the loudest voices often have the worst opinions

Crypto Twitter likes to teach you how to launch a token: get 100,000 followers first; use “tasks” to increase interactions; raise funds from top VCs; circulate only 2% of tokens; and create the biggest buzz during TGE week.

Here’s the thing: it’s all bullshit.

I recently dug into an amazing study by @SimplicityWeb3 — they analyzed 50,000 data points on 40 major token launches through 2025, and the results… will disturb anyone who subscribes to conventional Crypto Twitter wisdom.

The Big Lie of Engagement Volume

Everyone (including me) is obsessed with Twitter metrics: likes, retweets, replies, exposure - the whole vanity metric circus. Projects spend thousands of dollars to increase engagement, complete tasks, and buy followers.

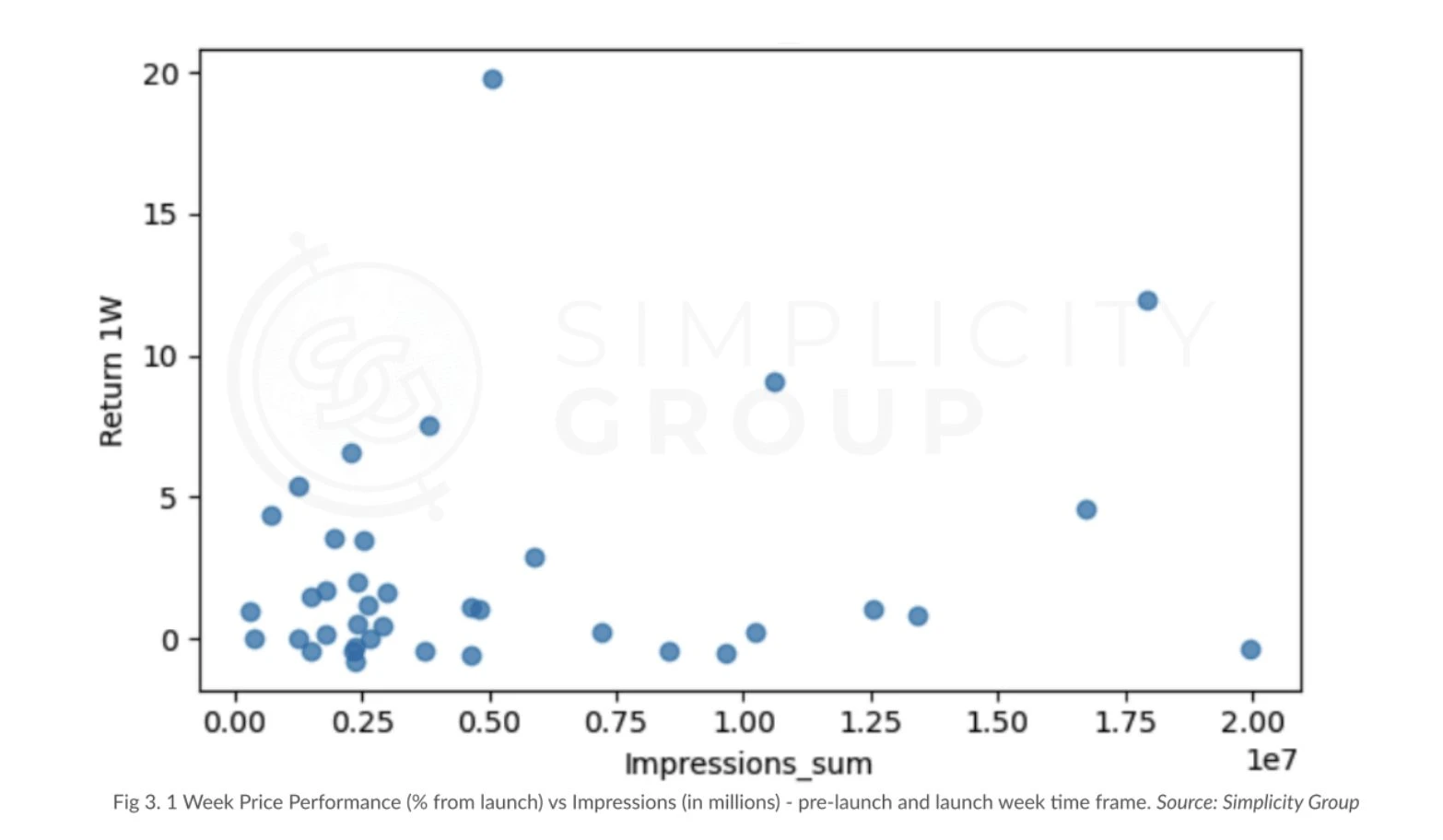

Correlation with weekly price performance? Basically zero. Simplicity Group’s regression analysis shows an R² of just 0.038 between the engagement metric and price performance. In short: engagement volume explains almost no difference in the success of a token.

Likes, comments, and retweets are even slightly negatively correlated with price performance. This means that projects with more interactions sometimes perform worse. Projects like GoPlus, SonicSVM, and RedStone post frequently but receive interactions that are not commensurate with their user base.

Data source: https://docsend.com/view/khn4nms2ehjjskv3

The only metric that showed any positive correlation was actually surprising: retweets in the week before release. The coefficient was 0.094 (a p-value that barely approaches statistical significance), and even then the correlation was woefully weak.

So, when you spend money on bots and design complex task campaigns, you are essentially burning money in exchange for Instagram-level satisfaction.

The low circulation myth

Crypto Twitter is obsessed with the issuance of Low Float High FDV. The narrative logic is: issue with a very small circulation, create artificial scarcity, and wait for the price to rise.

Wrong again.

The ratio of initial circulating supply to total supply has zero correlation with price performance. The study showed no statistical significance.

What really matters is: the USD value of your Initial Market Cap.

With an R² of 0.273 and an adjusted R² of 0.234, the relationship is very clear: for every 1 unit increase in log(initial market cap), the weekly return rate decreases by about 1.37 units.

In layman’s terms: for every 2.7x increase in initial market cap, first month price performance drops by about 1.56%. This relationship is so strong that it can almost be considered causal.

Lesson: It’s not what percentage of tokens you unlock that matters, it’s the total USD value that’s dumped into the market.

The illusion of VC endorsement

“Wow, they raised $100 million from a16z, this coin is going to go to the sky!”

Narrator: It didnt go up to the sky.

The correlation between the amount of funding raised and the one-week return is 0.1186 (p-value 0.46); the correlation with the one-month return is 0.2 (p-value 0.22). Neither is statistically significant. There is no relationship between how much money a project raises and how its token performs.

Why? Because larger rounds usually mean higher valuations, which require overcoming greater selling pressure. Additional funding does not magically translate into better token performance.

Yet Crypto Twitter uses funding announcements as buy signals. That’s like judging a restaurant based on how much the owner pays in rent.

Perfect example: projects in the study that raised large amounts of money did not automatically outperform projects that raised more modest amounts. A $100 million round does not guarantee better token economics or a stronger community than a $10 million round.

The fallacy of marketing timing

Conventional wisdom says: save the biggest announcements for launch week. Create the most FOMO and grab everyone’s attention when the token goes live.

The data says just the opposite.

Post-launch engagement is dead. Your carefully curated post-launch content is ignored as users chase the next shiny airdrop.

Projects that perform consistently build awareness before launch week, not during it. They understand that pre-launch attention brings real buyers, while launch week attention is just “tourist.” Projects like Kinto have peak engagement before the TGE (when they publish pre-launch content leading up to the launch), not after the launch (when everyone moves on to the next opportunity).

What really works?

If Twitter interactions, low liquidity, VC endorsements and hype timing don’t matter, then what does?

Actual product benefits:

Projects that generate content organically (e.g. Bubblemaps provides on-chain surveys, Kaito tracks market narratives) outperform meme-heavy accounts. Bubblemaps and Kaito have huge and sustained engagement because their products organically create alpha-rich content.

Transaction volume retention:

Tokens that were able to maintain trading volume after the initial pump had significantly better price performance. The Spearman rank correlation coefficient was -0.356 (p= 0.014) - the more the trading volume dropped, the worse the price performance tended to be. The highest quartile of volume retention (Q4) group had significantly higher median and mean price performance one month after issuance.

Reasonable initial market value:

This is the strongest predictor of success (the coefficient is -1.56 and is statistically significant). Issue at a reasonable valuation to have room to rise; issue at a valuation of $100 million or more and you are defying gravity.

Sincere communication:

A consistent, product-matched communication tone. Powerloom raised $5.2 million but used an overly playful tone, which didn’t match the two — its token POWER plummeted 77% in the first week and is down 95% since launch. Walrus, on the other hand, used humor sincerely and rose 357% a month after the TGE. Hyperlane stuck to factual updates and soared 533% in the first week.

Why did Crypto Twitter get it wrong?

This disconnect is not out of malice, but structural.

Crypto Twitter rewards engagement, not accuracy. Posts like “10 Ways to Boost Your Token Offering 100x” get more retweets than “What the Data Actually Says”.

Influencers build audiences by catering to existing beliefs rather than challenging them. Telling people their engagement is meaningless and doesn’t make money.

Furthermore, most Crypto Twitter celebrities have never launched a coin themselves. They are commenting on a game they have never played in. Meanwhile, projects like Story Protocol that have actually delivered a product have seen consistent performance regardless of their Twitter followers.

Real Strategy

According to the data, successful projects actually do:

Focus on building things people actually want to use

Setting a reasonable price for the token at launch

Communicate sincerely with your audience

Measure what really matters, not just the number of likes

I know, this sounds like a revolutionary discovery.

Take Quai Network for example: they focus on in-depth explanations of their unique blockchain consensus model and provide educational content. The average pageviews during the TGE were around 24,000. Their token QUAI rose 150% in the first week after launch. This is not because they have millions of followers, but because they have built genuine interest around real innovation.

In contrast, the tokens of projects that burned money on task platforms and interaction inflators plummeted because no one understood or cared about what they were building.

Ironically, while everyone was gaming the Twitter algorithm, the projects that were quietly building useful products and launching them safely were the ones that were truly successful.

Bad example: Zora failed to communicate token economics details in a timely manner and plummeted 50% in the week after TGE. Projects that are transparent about their plans and focus on product-driven content continue to outperform.

Crypto Twitter isn’t intentionally lying. But when incentives reward “hot opinions” instead of hard data, the real signal gets lost in the noise.