Recently, a round of financing led by ParaFi and Greenfield Capital attracted the authors attention. At first, I thought it was just a task platform, but it was able to raise 2.5 million US dollars in 2021, 3.7 million US dollars in 2022, and 15 million US dollars in 2024. This makes people wonder where Layer 3 is based.

1. Overview

We have witnessed an explosive growth of on-chain communities, and tokens constitute the most powerful tool for communities because they provide shared purpose, goals, and interests.

However, when the prices of these tokens dropped, the community was shaken.

In other words, when participants rush in, overwhelmed by the surge in value, it will be difficult for them to recognize whether it is a common interest and value or something else? In this way, they will gradually drift away from the community.

The core value of Web3 projects is how to grab user attention resources in such a fragmented environment. Marketing planning based on ones own strength is often ineffective. In the context of the prevalence of airdrop culture, there is a need for a platform such as Layer 3. Note that it does not refer to a certain chain of L3, but an application on the public chain. As a platform for the aggregation and distribution of attention resources, through the construction of the full-chain identity infrastructure, users and project parties can obtain the resources they need through this platform.

Not only does it provide an interesting way for new users to enter the Web3 ecosystem, it also encourages existing users to explore new protocols and applications.

Therefore, Layer 3 is not just a platform, but an experience of a brand new token economic model, showing the combination of Gamefi and the new model of attention economy. It releases trillions of market value through the strategy of trinity (attention economy, full-chain identity and token distribution protocol).

2. Current status of Web3 task platform track

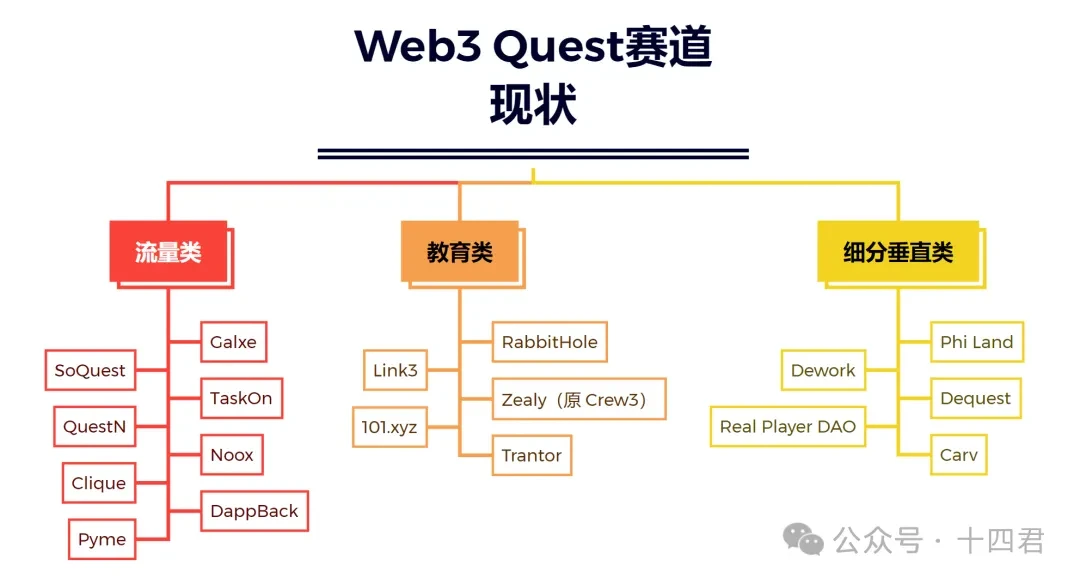

The marketing needs of Web3 task platforms have driven the rapid development of the platform, which can be divided into three categories: traffic (such as Galxe, SoQuest, TaskOn), education (such as Layer 3, RabbitHole) and vertical subcategories (such as Phi Land and Dework). For more, see the table below.

[Sorting out projects of various categories]

Traffic platforms attract users through tasks, educational platforms enhance users understanding of crypto projects, and sub-categories platforms focus on specific areas. At present, the overall market heat has declined, and the growth of second-tier platforms has slowed down, facing competition from top platforms and homogenization challenges. Improving user activity and solving robot problems are the keys to the development of task platforms. The profit model is not perfect at present, and future competition will revolve around innovation and user conversion.

The platform needs to transform into a long-term traffic pool, optimize user experience, and build a unique profit model. How to reunite the community through interests and then gather value is a key growth point that needs to be explored in the future.

Most airdrops in Web3 are essentially a combination of future incentives and community participation, which increases the value by creating scarcity of tokens. However, the value created by consuming the future is not enough to support the long-term prosperity of any project.

Thomson points to a key problem with today’s Internet: The Internet is a world of abundance, and there is a new power that matters: to understand that abundance, to index it, to find the needle in the proverbial haystack. That power resides in Google’s hands.

The world of Web3 is also a world of abundance, but no one has yet managed to gather this abundance in the ocean of Web3. However, it is difficult for today’s community to identify or motivate the most active members, and the value of members is being wasted.

Interestingly, in the context of continuous development, people have gradually realized the importance of attention. Attention is like the soul bound to the token. By recording user participation, it gathers the high-quality resources of Web3. Any person or project can recognize each other through similarities.

To take a step back, how to realize the new economic model of attention and the social graph of attention resources is a vision that brings higher value to every participant.

Why is this important?

Because creators on Web3 need to know which audiences their works will attract. Let’s follow the author’s footsteps to see how Layer 3 describes its vision for the future:

3. Layer 3 workflow

3.1 For C-end users

The core value of Web3 has always been to return data and value sovereignty to individuals .

As an infrastructure platform for full-chain identity, Layer 3 is realizing this vision, maximizing the commercial benefits of data while allowing data to originate from real individuals and return the generated value to individuals.

How to find a high-value return project that suits you?

How to generate sustainable benefits from personal data?

This is also a necessary condition for the platform to generate value sustainably. Let’s briefly talk about how Layer 3 is done. The arrangement and layout of Layer 3 tasks can be said to be from breadth to depth:

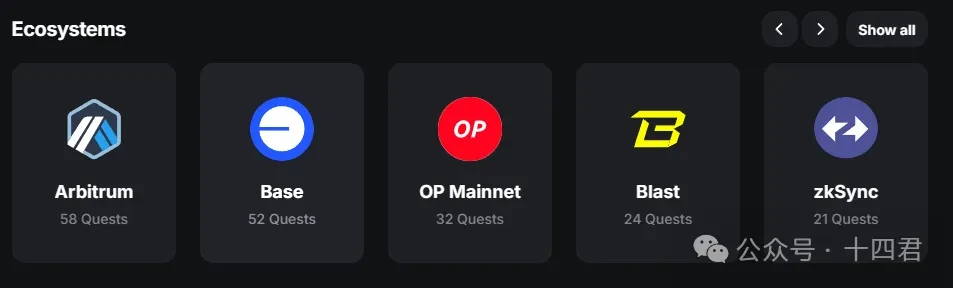

In terms of breadth : Layer 3s task system adopts an ecological classification method, with different ecosystems as a large category, and each category has different tasks.

In depth : Similar tasks will be gradually advanced according to the game mode of breaking through levels, and tasks of different difficulty levels will have different experience values and rewards. Each time a task is completed, an NFT CUBE with on-chain identity information will be obtained to record the data information of the challenger.

For users

We can quickly subscribe to all the projects we are interested in. Through the popularity of the project and the overall task progress, we can learn about the development prospects of the project and quickly identify high-quality projects.

As mentioned earlier, when we complete a task, we can mint a CUBE as our on-chain identity, which provides us with a way to make money. When other developers or project parties need to access this CUBE, a certain fee is required. Part of these fees will be given back to the entire ecosystem, and the amount of income depends on our activity on the platform. The main idea is that the harder you work, the luckier you will be, and you can get rich.

Finally, you can kill two birds with one stone. Relying on the ecology of Layer 3 itself, you can currently obtain CUBE by completing tasks on the platform. CUBE is a factor in obtaining Layer 3 airdrops. In addition, there are high-quality projects on Layer 3 that have not yet issued airdrops. Doing such projects in advance will also help you obtain more shares when airdrops are issued in the future, thus achieving multiple benefits from one operation.

3.2 For B-side users

In the web2 project, major advertising businesses can deliver advertisements that are accurate and in line with user preferences, based on the memory of user groups historical behavior on the Internet, which has led to the emergence of personalized advertising.

To put it bluntly, this is all thanks to credential data and big data analysis, which is one of the most important application areas of data credentials.

Web3 is no exception.

In addition, due to the traceability and immutability of blockchain, it is more friendly to the creation and tracking of credential data. There are many data credentials on the chain, such as the credit record of which lending project we have borrowed but has not been liquidated. The record of providing liquidity in a certain LP pool.

These behavioral credentials can help the projects operation and promotion.

The Project Galaxy team believes that: Digital credentials are important because they have high-frequency application scenarios. Protocol developers can use credentials to calculate the credit scores of various users, the target audience of applications, and reward community contributors, etc. With the development of Web3 and DAO, the behavioral data of participants in the Web3 world will explode, and Project Galaxy will provide the necessary infrastructure to help these new participants establish vital digital credentials.

So how does Layer 3 collect on-chain credentials? And how does it help the project? Below we will discuss from the following perspectives.

1. CUBE Voucher

The on-chain data certificate is similar to a resume in reality, recording personal behavior. On Layer 3, the users resume is recorded in the form of ERC-721 tokens through CUBE.

Each CUBE contains applications, chains, and ecosystems for different tasks. These credentials help explorers unlock new opportunities and allow protocols to identify high-quality users.

For users, minting CUBE can unlock rewards in the Layer 3 attention economy, such as tokens and dynamic rewards for completing tasks. This makes users more willing to do this, thereby generating more credential data.

The full-chain data of these CUBEs is also a kind of attention resource.

Why do I say this? Because every participant on the chain has his or her own focus. If the project owner can effectively identify and obtain these attention resources, they can better carry out targeted promotion and reward push to expand the projects share in the market and consolidate its position.

This resource is built into relevant infrastructure on Layer 3, and every organization in need can access these attention resources by creating an open identity, incentive, and interface network owned by participants.

2. More converged tools

For any project that wants to access Layer 3, they can seamlessly integrate the Layer 3 experience on their native website with two simple lines of code.

Additionally, anyone can paste a link on their blog, technical guide, or internal documentation to embed a task or streak, with no additional code required!

This is the lowest-cost promotional activity for small projects, by interoperating with the vibrant ecosystem of Layer 3 and attracting users directly on their platforms through attractive rewards, social networking and partnerships.

In addition, Layer 3 integrates all the tool chains required for the task. For example, we need to perform the corresponding official task on chain A, but there is no asset on chain A, but there are idle assets on chain B. In this way, we can use the cross-chain bridge integrated on Layer 3 to perform cross-chain asset operations. It is worth noting that cross-chain asset operations are also primary tasks on Layer 3, which makes Layer 3 assume the attribute of cultivating users from novices to veterans.

What will be left to the project parties are users with their own insights and cognition. Such users are more cautious about the projects, but also more persistent and active.

3.3 Summary

It can be said that Layer 3 has never been ToC or ToB, but as a connecting bridge from ToC to ToB, it provides a warm and efficient platform for both parties, allowing them to get to know each other and thus match a suitable partner.

Layer 3 protocols have a beautiful flywheel, new protocols bring new users, and new users attract more protocols, which forms the cornerstone of crypto marketing solutions.

Even if initiatives or airdrops occur outside of Layer 3 infrastructure, contributors will curate and incentivize them for users to explore, providing a global access point for each ecosystem.

4. Layer 3 Token Economy

4.1 Why is the token economy so important?

The development of any Web3 project is inseparable from one relationship - supply and demand.

The token is its basic foundation, so the design of the token economic model is particularly important, affecting the short-term and long-term supply and demand relationship of the project. An excellent token economic model not only guarantees the long-term value of the token, but also creates a basic foundation for the sustainability of the projects value.

For a detailed discussion of the theory and role of token economics, please refer to: In-depth understanding of token economics (see Appendix)

4.2 Discussion on the Token Economic Model of Layer 3

Layer 3 is the first platform to build a full-chain identity infrastructure based on the attention economy. I would like to explore its economic model from two aspects:

How does the economic model of Layer 3 ensure the long-term sustainability of its projects?

How does its economic model bring tangible benefits to users?

As an infrastructure platform that aggregates attention resources, the core of the platforms sustainable development is to ensure that C-end users benefit while providing high-quality user traffic to B-end project parties.

Below, the author summarizes the entire Layers economic model as follows:

Regarding the economic model, we will look at it from three dimensions (token supply, token utility, and token distribution).

There are many angles to analyze the token framework. If you want to know more about it, you can read more: Token Economics: A Brief Analysis of the Token Economic Model of Web3 Mainstream Projects (see Appendix)

1. Token Supply

[Tips: The current market value and circulation are estimated results]

It should be made clear that the economic model of Layer 3 adopts deflation .

As mentioned above, the value of the token itself is affected by the relationship between supply and demand. In order for the token to not become a worthless air coin, these three points are particularly important, but the most important one is the token destruction mechanism: continuously reducing the token supply is deflation; on the contrary, continuously expanding the token supply is inflation.

This is also an economic model determined by the protocol design at the supply level. The burning mechanism of Layer 3 can be divided into two levels:

1. From the user’s perspective:

Under the economic model design of Layer 3, the users behavior in the ecosystem is linked to the burning mechanism, and users can obtain privileges in the ecosystem by destroying L3 tokens. For example:

When some project tasks are put on the shelves, users can access them first, so as to seize the favorable time point first.

There are discounts and preferential policies for related costs incurred in completing tasks or transaction fees.

Obtain some exclusive NFTs by destroying L3 tokens.

This series of designs are all designed to stimulate users to destroy a certain amount of tokens. In this model, users gain benefits, while the platform tokens maintain the goal of deflation.

2. From the community’s perspective:

The ecological regulation undertaken by the community is more important than that of individual investors. For a financial market, the value of a token does not rely solely on its rarity, but also requires good liquidity. The essence of liquidity is trading. So how does the model balance liquidity and rarity?

The mechanism for maintaining the rarity of tokens is relatively simple. Just like the method designed from the users perspective above, the communitys behavior in the ecosystem also requires the destruction of L3 tokens, except that the communitys behavior is reflected in the release of tasks, deployment of incentives, and access to CUBE credentials. In addition, the proposals and votes initiated by the community during governance also require the destruction of corresponding L3 tokens.

What about liquidity? This is not difficult to understand. The essence of liquidity is buying and selling. If the users behavior is tied to destruction, then for the community, the behavior is not only tied to destruction but also to buying. In this regard, the model stipulates that some behaviors of the community require the purchase and destruction of L3 tokens.

The act of buying is bound to be accompanied by a sellers market. It is worth noting that, apart from the community, the only three parties that own a large number of tokens are users, issuers, and investors. However, the tokens of issuers and investors have a time limit for unlocking, which means that the tokens that can be circulated are currently in the hands of users. This results in a huge source of sellers being users, which also brings a new possibility for increasing user income.

For the two sets of destruction mechanisms of Layer 3, it maintains the deflation model of tokens from the perspective of token circulation and holdings, and token deflation will make positive feedback on the price of tokens.

A high-value ecosystem will inevitably attract users, and the destruction method can also counteract the impact of a large influx of tokens caused by linear unlocking of time on the economic system. A stable economic system is conducive to the long-term development of the project.

Secondly, the act of deflation burning is accompanied by the transfer of interests, which is the transfer of interests by the project party and the community to the users. This also brings considerable benefits to the users on the platform and creates a new economic value.

2. Token Utility

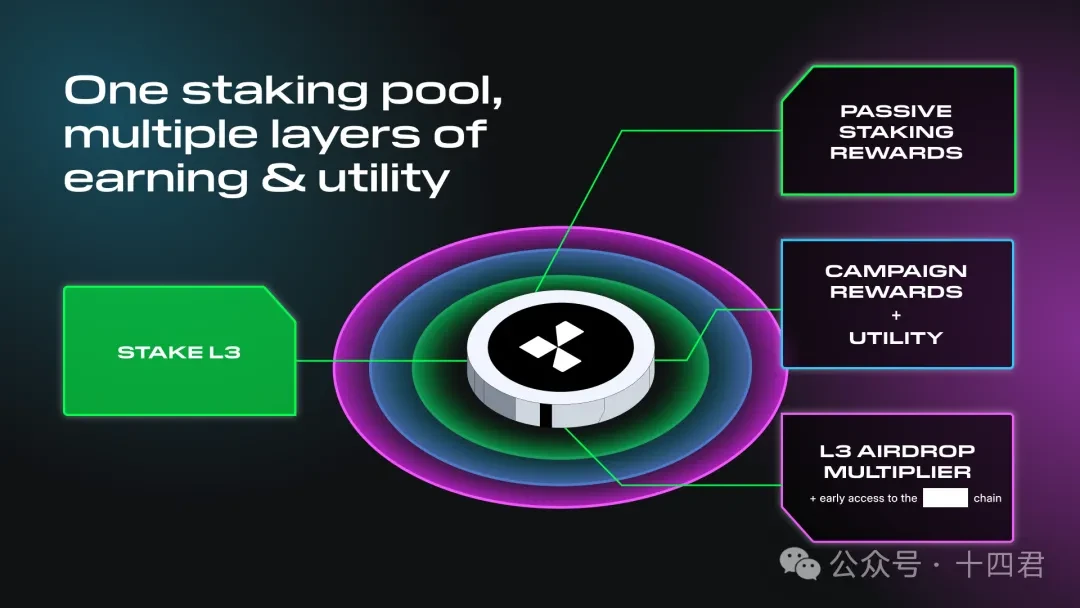

The utility of a token represents the value of the token, whether there are actual use scenarios, and whether it can attract more people to join, that is, the demand side of the token. The point that the author is most concerned about in the Layer 3 economic model is the accumulation of value. This is the use case that most reflects the good or bad in the design of the token model because it is directly linked to the users income. The core concept of L3s utility can be attributed to the value of the token being consistent with the growth of the network and the participation of users. To this end, Layer 3 adopts an innovative staking model, called layered staking. Its main design points are as follows:

The passive income is calculated by combining the pledge amount and pledge time.

Users actively participate in activities to increase the reward multiplier, thereby increasing the stickiness of the community and preventing administrative inaction by users who occupy the majority.

Regarding the first point, under the L3 design model, users can pledge liquidity in the system and provide LP for the entire ecosystem, and users can passively obtain the income brought by LP, and the users trust in the platform will also be taken into consideration to form a two-way mutually beneficial relationship. The income is no longer based on the pledged amount. The length of the pledge is also an important part of the income acquisition coefficient. A user who is willing to take root for a long time will inevitably obtain more income than a short-term wool party.

As for the second point, I think it is the most interesting point in the entire economic model design. In the past, the income standards provided by other platforms were all based on the amount of pledged, and some also considered the time factor. Although this can attract long-term users, it cannot guarantee the acquisition of high-quality users and more complete user behavior data.

In the L3 model design, the users enthusiasm for participating in activities also becomes a factor in how much profit can be obtained, which means that a user who stakes a large amount but is not active will earn less than a user who stakes a small amount but is active.

This can guide users to actively participate in the platforms activities to obtain airdrops and double-income welfare cards, which is undoubtedly an innovation to improve user quality and stickiness.

3. Token Distribution

Token distribution reflects the fairness of the project and the project team’s confidence in the long-term success of the project. Therefore, there are several aspects of a project’s tokens that need to be considered from the perspective of distribution, including the holders and proportion of the tokens, and the release time of the tokens.

The token distribution plan of Layer 3 takes into account the interests of the community, core contributors, investors and consultants, ensuring the fairness and long-term development of the project. The lock-up period and gradual release mechanism effectively prevent the volatility of the token market and enhance the confidence of all parties in the long-term success of the project. Overall, such a distribution system can balance the interests of all parties while ensuring the sustainable development of the project.

The detailed token distribution plan can be read: Distribution of Layer 3 Foundation (see Appendix)

It is worth noting that once the cliff is reached, vesting is generally done on a daily basis rather than a monthly or quarterly basis.

A large amount of unlocking after a long wait could trigger a prisoner’s dilemma, as token owners would be forced to sell at an accelerated pace to secure the best price.

Daily vesting allows all parties to trade to eliminate the above risks, so there will be no panic selling.

4.3 Full-view review

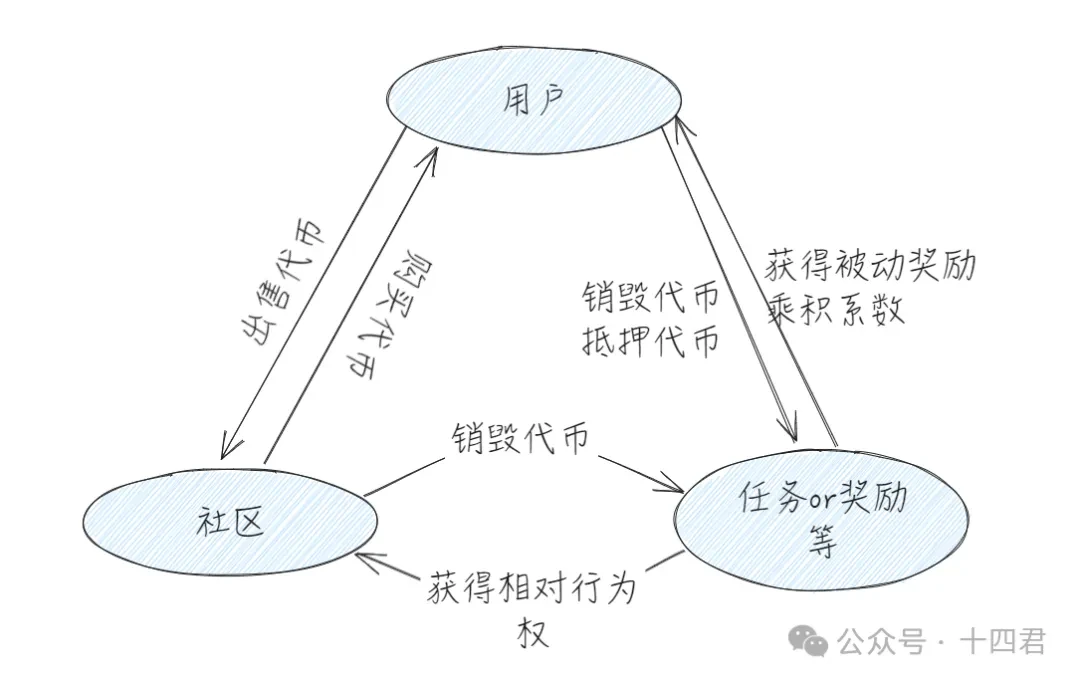

Let’s return to the overall process perspective to look at the operation of the entire economic model. The entire L3 economic model is like a stable triangle structure, and its core concept has three aspects:

Users, communities, and institutions build buying and selling markets to realize the ecological liquidity of tokens, thereby giving tokens certain value attributes.

From the perspective of pure buying and selling, the economic model is not able to resist market risks. This risk comes from the impact of a large number of tokens flowing into the market due to linear unlocking over time, which has an impact on the stability of tokens. Therefore, in the design of the economic model, tasks and rewards are introduced and linked to the burning mechanism at the same time, and the impact of this influx is resisted by the burning of tokens by ecological members in their activities.

The core of the platform lies in user traffic and providing high-quality users. Therefore, a good economic model must also consider how to provide incentives for the entire process from customer acquisition to customer activation. This is bound in the model through the concept of income = passive income + other rewards * product coefficient.

After discussing the entire model, we will find that L3s token economic model must have three major elements: a reasonable staking mechanism, more application scenarios and steadily growing passive income.

It is worth pointing out that the token economic model is very important, but a good token economic model is by no means dependent on the project itself. Such a token can only be a useless air coin. In addition to being self-sufficient in the ecosystem, a good token model must also be able to continuously adapt to the impact of various external market risks in the rapid evolution of Web3 projects. The relationship between the project and the economic model is not a simple parasitic relationship, but a complementary and progressive relationship.

5. Summary

There are still many dynamics and innovations worth exploring in the field of Web3 task platforms. As cutting-edge tools to promote project development, they not only efficiently promote the ecological prosperity of the project party through various means, but also provide users with a window to obtain information, and more importantly, bring practical benefits and a sense of participation.

Achieving growth in Web3 is never achieved overnight. Project owners can choose to grow together with the task platform while gaining traffic. Paying attention to the platforms own growth data will help project owners make more informed decisions and lay a solid foundation for the healthy growth of users.

As fragmentation grows and competition for user attention intensifies, the means of attracting users by major projects are still relatively simple, mainly relying on joint activities between projects. These activities usually provide some rewards to attract users, some of which are even free of charge, lacking the motivation for sustained growth. In addition, the quality of users attracted is uneven, and user stratification cannot be achieved.

Only by building a suitable bridge for the key and the lock, and finding a key that belongs to both parties, can we unlock unprecedented growth and value creation.

appendix

《In-depth understanding of token economics》

https://www.coinlive.com/zh/news/deep-understanding-of-token-economics

《Distribution of Layer 3 Foundation》

https://docs.layer3foundation.org/tokenomics

Token Economics: A Brief Analysis of the Token Economic Model of Web3 Mainstream Projects

https://foresightnews.pro/article/detail/24604