Original author: Ignas , DeFi researcher

Compiled by Odaily Planet Daily ( @OdailyChina )

Translator: CryptoLeo ( @LeoAndCrypto )

Just now, DeFi researcher Ignas wrote an article analyzing the distribution of SOL tokens, including the SOL in stake, the SOL data of locked stakes, and the proportion of SOL held by wallets . Odaily Planet Daily compiled it as follows:

Last year, I wrote about the distribution of ETH, Eekeyguy Made a great public dashboard to check where all the ETH is stored. Now it’s SOL’s turn.

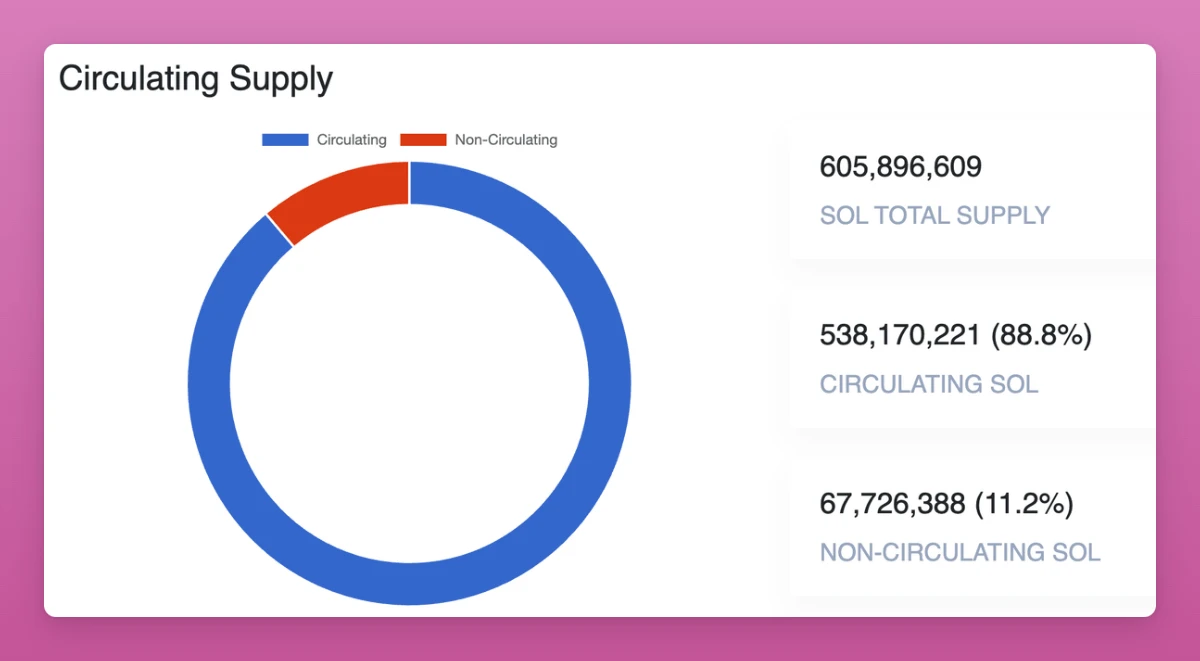

Data shows: 88% of the SOL supply is in circulation, about 538.17 million pieces.

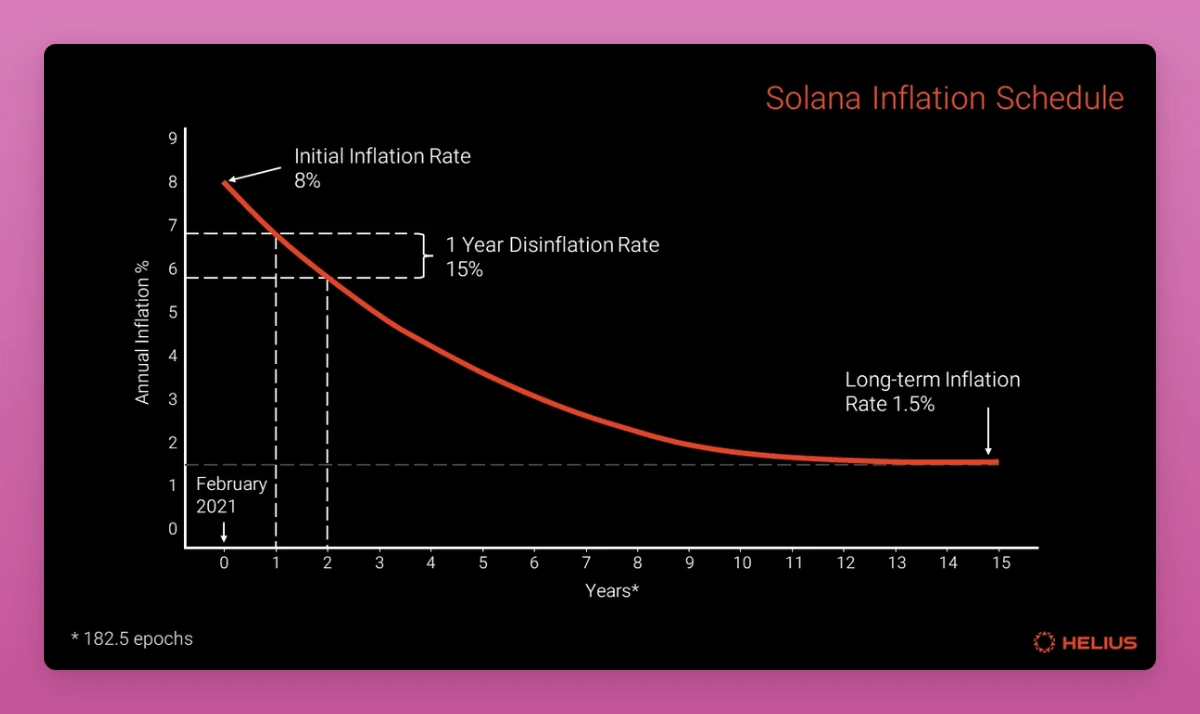

It’s important to note that Solana has an uncapped total supply (like ETH ), an inflation rate of 4.395%, and an annual deflation rate of 15%, which should eventually stabilize at 1.5%.

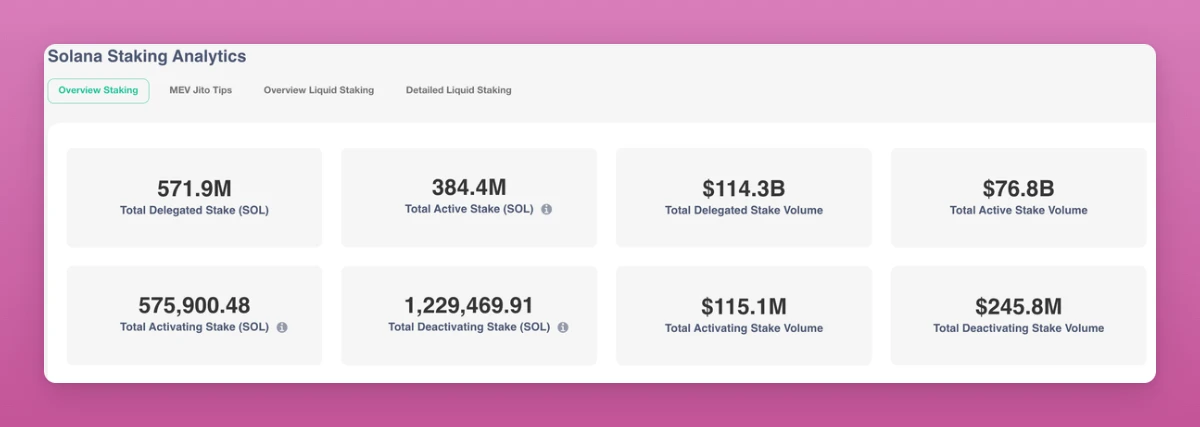

Solscan data shows that 71% of SOLs circulating supply is being staked. (Compared to 30% for ETH.)

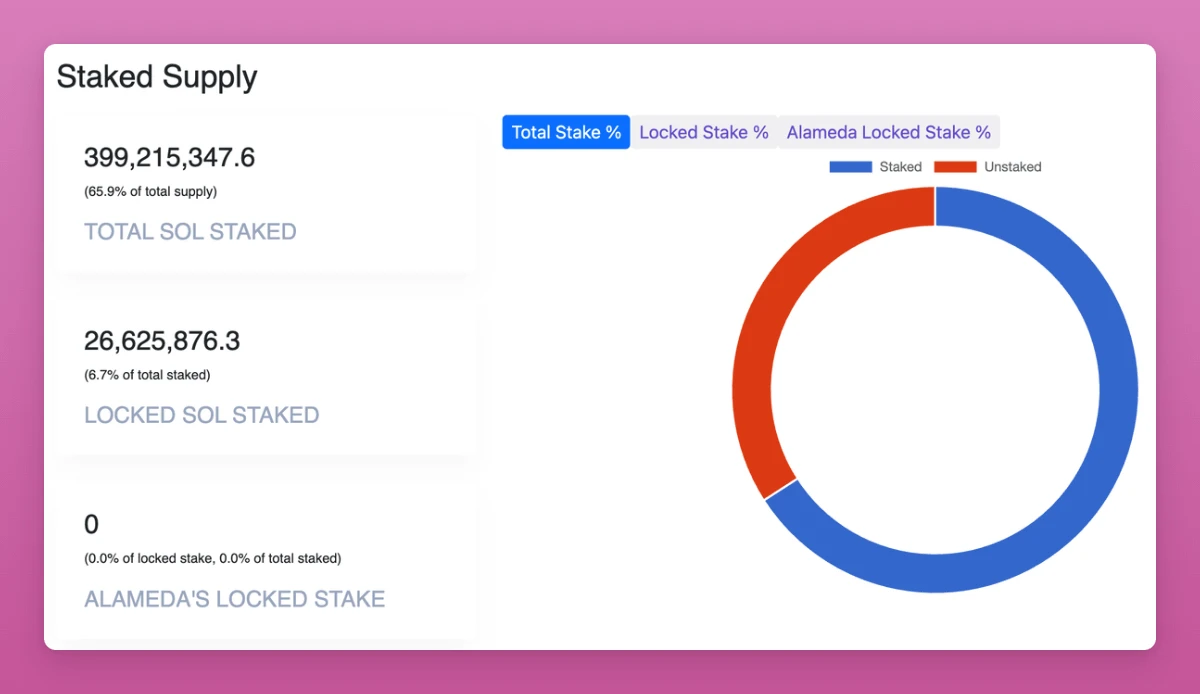

Solanacompass data shows that 6.7% of SOL is being locked up and pledged, which may be the behavior of venture capital/team/insiders, but I can’t figure out who the specific holders of this part of SOL are.

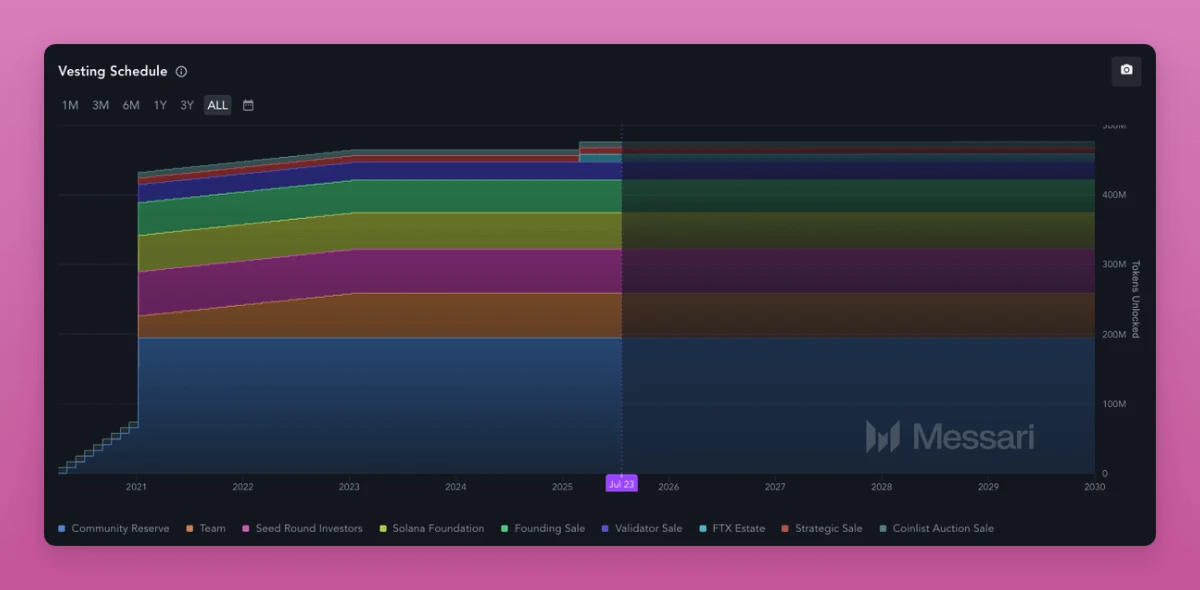

According to Messari data, 99.88% of SOL has been unlocked. Currently, there are only 600,000 SOL tokens locked, which are held by FTX (or have been sold in OTC transactions).

So what are the 11.2% of SOL tokens locked that Solanacompass and CMC report?

Institutional SOL Holders

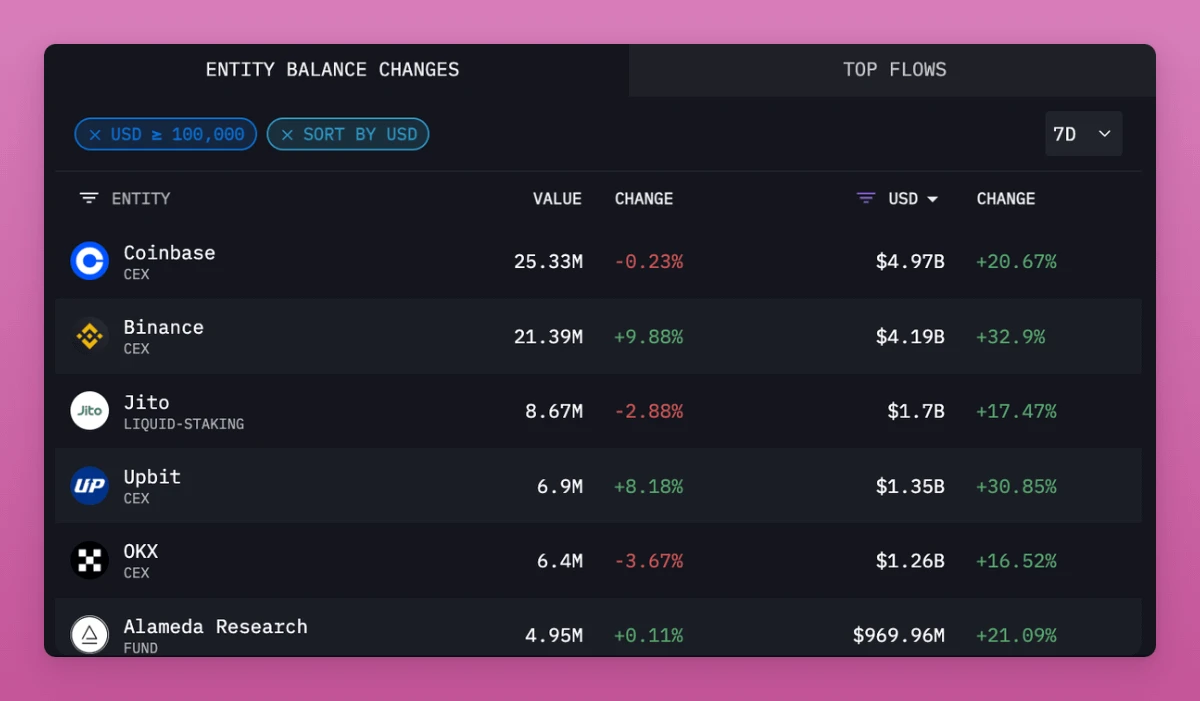

According to Arkham Intelligence data, Coinbase holds $5 billion worth of SOL, accounting for 4.7% of the total supply of SOL.

In addition, some institutions also hold large amounts of SOL, the data are as follows:

Binance - 3.97%

Jito - 1.61%

Upbit - 1.28%

OKX - 1.19%

Alameda - 0.92% (or part of the locked tokens as mentioned by Messari)

Marinade Finance - 0.79%

Robinhood - 0.74%

Kraken - 0.53%

Bybi - 0.49%

Jump Crypto - 0.33%

Crypto com - 0.33%

Wintermute - 0.14%

Bitstamp - 0.13%

In summary, Arkham can trace back 20% of the SOL circulating supply. In addition, we can also discover more SOL holding and staking entities through the data platform Dune.

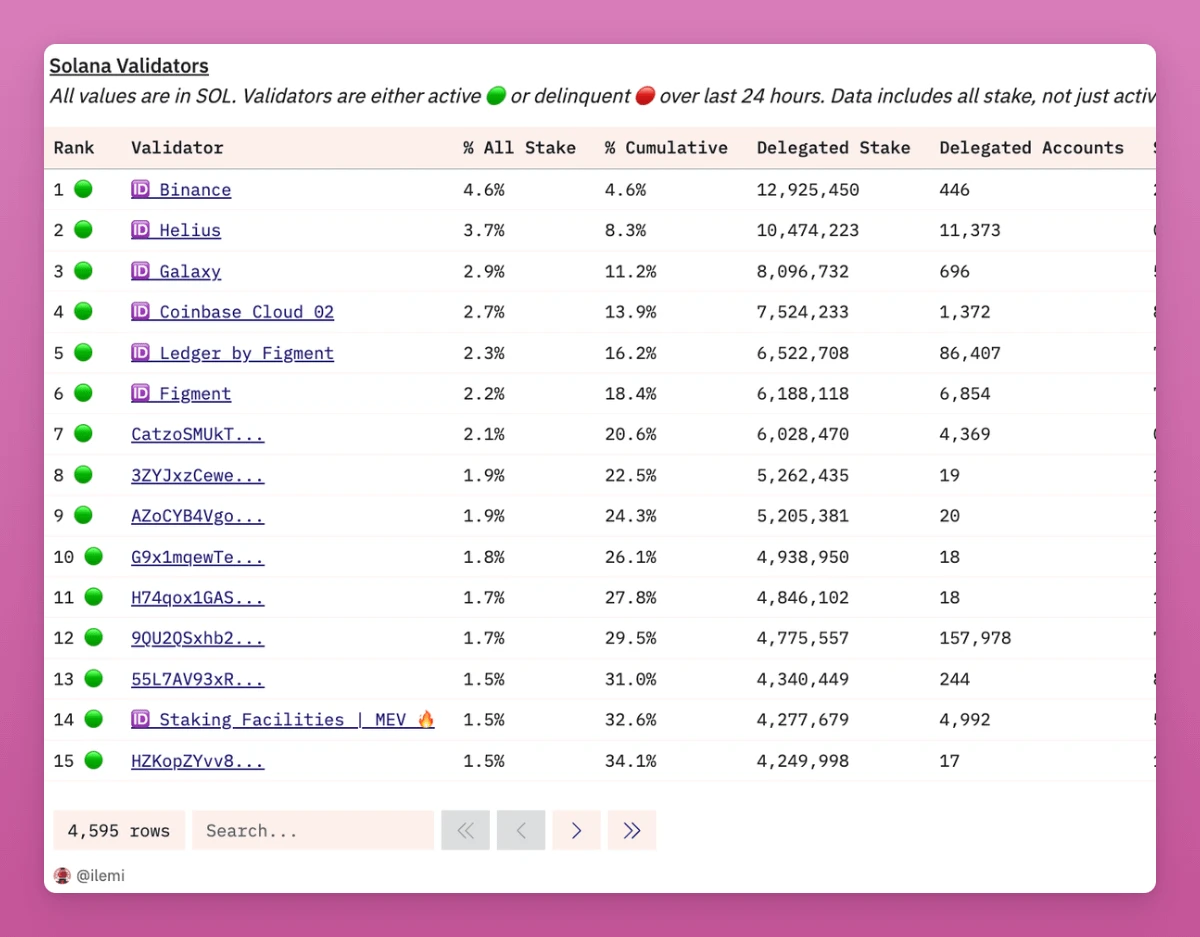

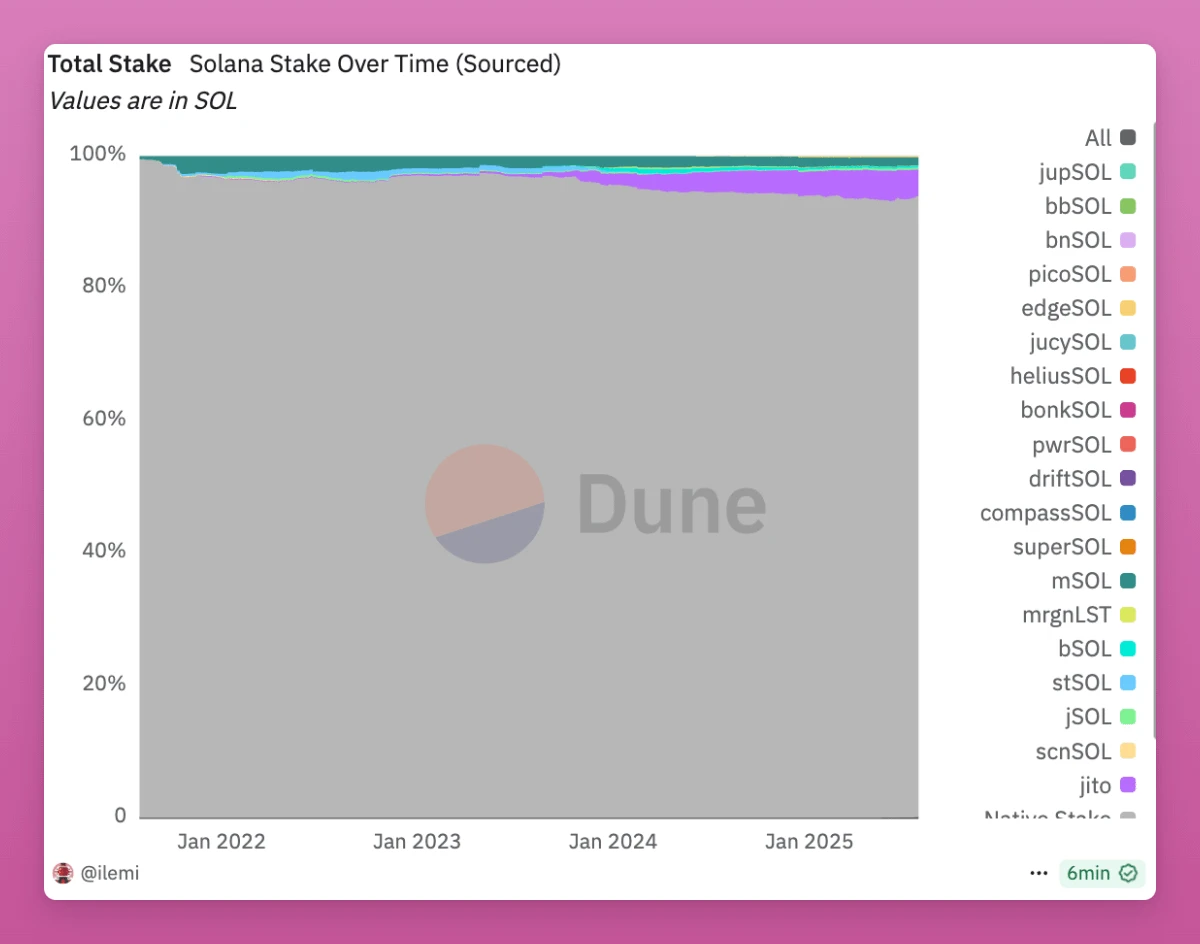

The above chart shows that in addition to Binance and Coinbase mentioned above, you can also see that Helius has 3.7% of the active staking supply. In addition, Galaxy has 8 million staking SOL delegates, as well as Ledger, Figment, Kiln 1, Everstake, etc. But many wallets in the top 15 are marked. Surprisingly, only 6.6% of SOL comes from the liquid staking token LST, which limits the growth potential of DeFi. If the native staking ratio of SOL is higher and all staking comes from LST, the Solana DeFi ecosystem may grow by billions of dollars.

Independent SOL Holder

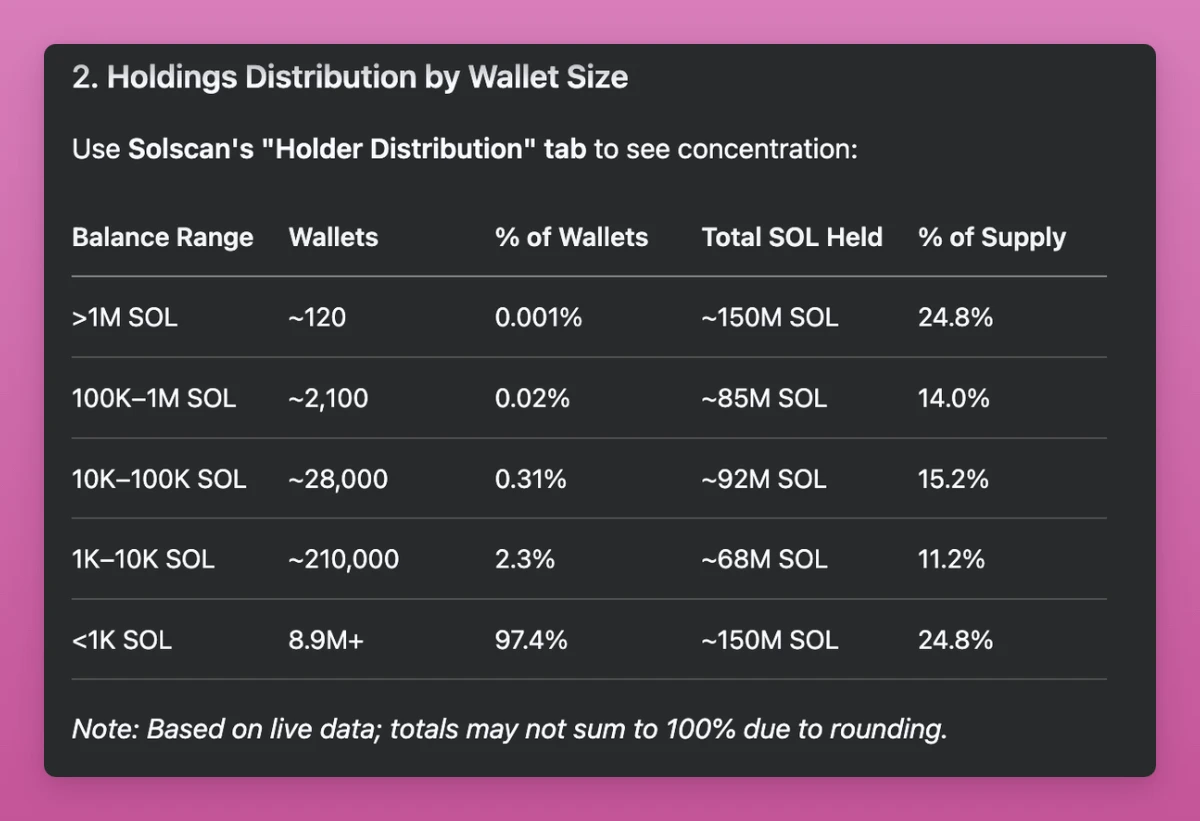

Below I will use AI to calculate the SOL holder data. (There may be errors, the data is not completely accurate.)

According to AI data, there are as many as 120 wallets holding more than 1 million SOL, with a total of more than 150 million SOL;

The number of wallets with less than 1,000 SOLs exceeds 8.9 million;

The average number of SOLs held per wallet is 16.8 (biased towards a small number of holders).

Overall,

Concentration: 0.33% of wallets (30,220) control 54% of SOL supply (but this includes CEXs, custodians, etc.);

Retail Dominance: 97.4% of wallets hold less than 1,000 SOL, representing 24.8% of the supply.

Disclaimer: This article is still under development, comments are welcome to provide new data about the current state of SOL and its ownership.