Your weekly crypto market statistics, news headlines and trading ideas, all in one place.

Brief Overview

● This week has seen a notable market rebound, with Bitcoin surging to as high as the $64,000 level — a one-month high — following the Federal Reserve’s unexpectedly aggressive 50 basis point rate cut on Wednesday.

● The altcoin market performed strongly, with several tokens recording impressive gains. Notably, TIA, SUI, and Popcats stood out as the best performing tokens, demonstrating the breadth of the current market uptrend.

● Given the current macroeconomic backdrop, traders should remain optimistic about short-term market dynamics. However, it will be critical to keep a close eye on the upcoming Bank of Japan meeting, as its outcome could significantly impact the JPY/USD exchange rate, which in turn could affect broader market sentiment.

Data Overview

Outperforming currencies:

● $TIA (+49.5%): TIA is seeing a strong short squeeze as many are betting against it due to the upcoming massive token unlock.

● $SUI (+37.8%): SUI surged for the second week in a row, driven by positive news including inclusion in Grayscale’s investment trust and the launch of the native USDC.

● $POPCAT (+38.4%): POPCAT was the best performing memecoin on BitMEX this week.

Underperforming Coins:

● $DOT (+1.3%): As attention and liquidity focus elsewhere, DOT lags behind emerging L1 tokens, which dominate the list of top performers.

● $ADA (+1.3%): Cardano, another “traditional” L1, unsurprisingly underperformed the broader market.

● $KLAY (+1.2% ): Despite its recent rebranding and potential synergies with Line and Kakao, it’s disappointing to see KLAY once again on the losers list.

News

Macro:

● ETH ETF weekly outflow: -$32.8 million ( source )

● BTC ETF weekly inflows: +$305.2 million ( source )

● The Federal Reserve cut interest rates by 50 basis points, launching the first easing cycle in four years ( Source )

● Trump bought burgers with Bitcoin at PubKey, a cryptocurrency gathering place in New York ( source )

● Ray Dalio says the Fed faces a difficult balancing act in the face of massive debt ( Source )

● Fridays Bank of Japan meeting will test the fate of yen-sensitive Japanese stocks ( Source )

project

● Binance CEO says the cryptocurrency exchange has seen a 40% increase in institutional and corporate investors this year ( source )

● LayerZero and a16z have launched the lzCatalyst program, which aims to provide up to $300 million in investment for full-chain Dapps ( source )

● Stablecoin USDC is now available in Brazil and Mexico, supporting direct exchange with local fiat currencies ( source )

● Crypto VC firm Dragonfly Capital is seeking to raise $500 million for its new fund ( source )

● British fintech company Revolut plans to issue its own stablecoin ( source )

● Hemi Labs completes $15 million funding round, securing investment in its modular blockchain network ( source )

● Bitget and Foresight Ventures made a $30 million strategic investment in TON blockchain ( source )

Trading Alpha

NOTE: The following does not constitute financial advice. This is a compilation of market news and we always encourage you to do your own research before executing any trades. The following is not meant to express any guaranteed returns and BitMEX cannot be held responsible if your trades do not perform as expected.

The Fed cuts rates by 50 basis points – what happens next?

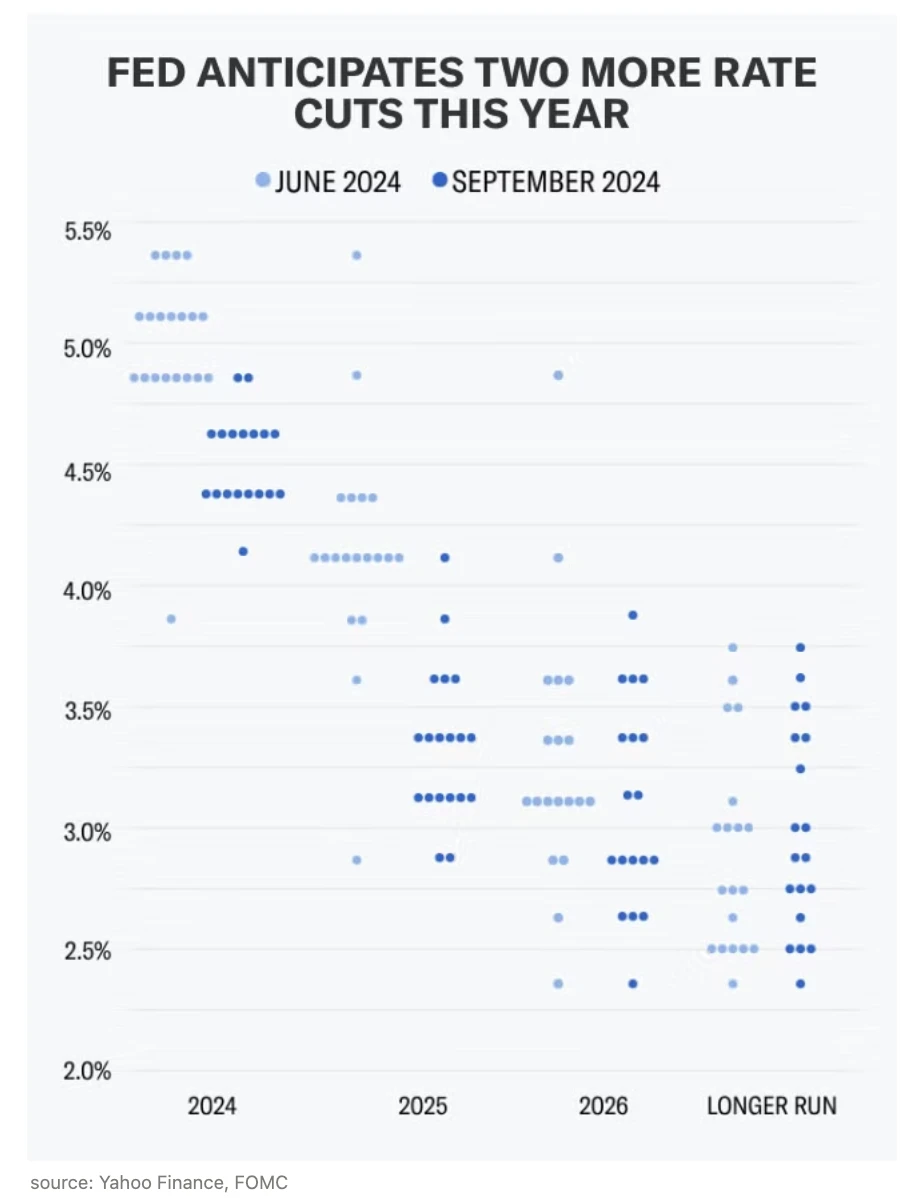

The Federal Reserve decided to cut interest rates by a massive 50 basis points, lowering its benchmark rate to 5% — below the expected 5.25%. This marked the Feds first rate cut since March 2020, and the median forecast showed two additional 25 basis point cuts in 2024. Although Governor Miki Bowman cast a dissenting vote, Fed Chairman Jerome Powell expressed confidence that the aggressive action would help maintain economic strength and a stable labor market while making progress toward the 2% inflation target.

Does the rate cut signal the start of a crypto bull run?

There is clear short-term upside potential given the macro tailwinds: improved liquidity and an economy supported by rate cuts. The 50 basis point rate cut showcases the Feds proactive approach, prioritizing economic indicators such as unemployment over inflation. Since June, Fed officials outlook for deeper rate cuts has increased significantly. The latest dot plot shows that almost all officials agree that rates will fall more than previously expected.

Continued strong expectations of rate cuts, combined with a potentially high inflation, low interest rate environment, create the perfect storm for Bitcoin to rise.

What should we pay attention to in the short term?

The JPY/USD exchange rate will be most critical. Friday’s Bank of Japan (BoJ) meeting will determine the fate of the yen exchange rate, and a strong yen could have a negative impact on risk assets, including Bitcoin and cryptocurrencies. After the unexpected rate hike in July, there is still “a concern” that the BoJ may take action. However, if these concerns prove unfounded, the resulting calm should make the case for Japanese stocks being undervalued more apparent.

Given rising inflation in Japan, the BoJ will inevitably raise yen rates. With the Fed’s aggressive 50bp rate cut, the yen is likely to strengthen gradually, although the move itself will be relatively mild.

Which coins to buy?

As mentioned in previous issues, here are some coins that traders may be interested in and have the potential to outperform:

Bitcoin: The BTC ETF has resumed significant positive inflows, with its unique attributes once again establishing its position as the undisputed king of cryptocurrencies.

New L1: Alternative Layer 1 blockchains continue to be the outperforming sector, especially $SOL, $SUI, $APT and $AVAX.

DeFi: DeFi tokens are facing multiple tailwinds, including lower interest rates, an improved regulatory environment, and Trump’s involvement in DeFi projects. The main tokens to watch are $UNI and $AAVE.