On November 26, the Move language infrastructure Movement Network Foundation officially announced the token economics of its token $MOVE.

$MOVE is Movements utility token and will be used to achieve the goals of the Movement Network Foundation.

60% of the total $MOVE supply will be allocated to the community, including the ecosystem and community, the foundation, and initial claims.

Features of Movement

Movement is the first Move blockchain based on Ethereum, providing higher security, high TPS and near-instant finality.

Unlike most Ethereum L2s, $MOVE is the native token of Movement, used to pay for gas and staking.

https://www.movementnetwork.xyz/article/movement-foundation-move-token

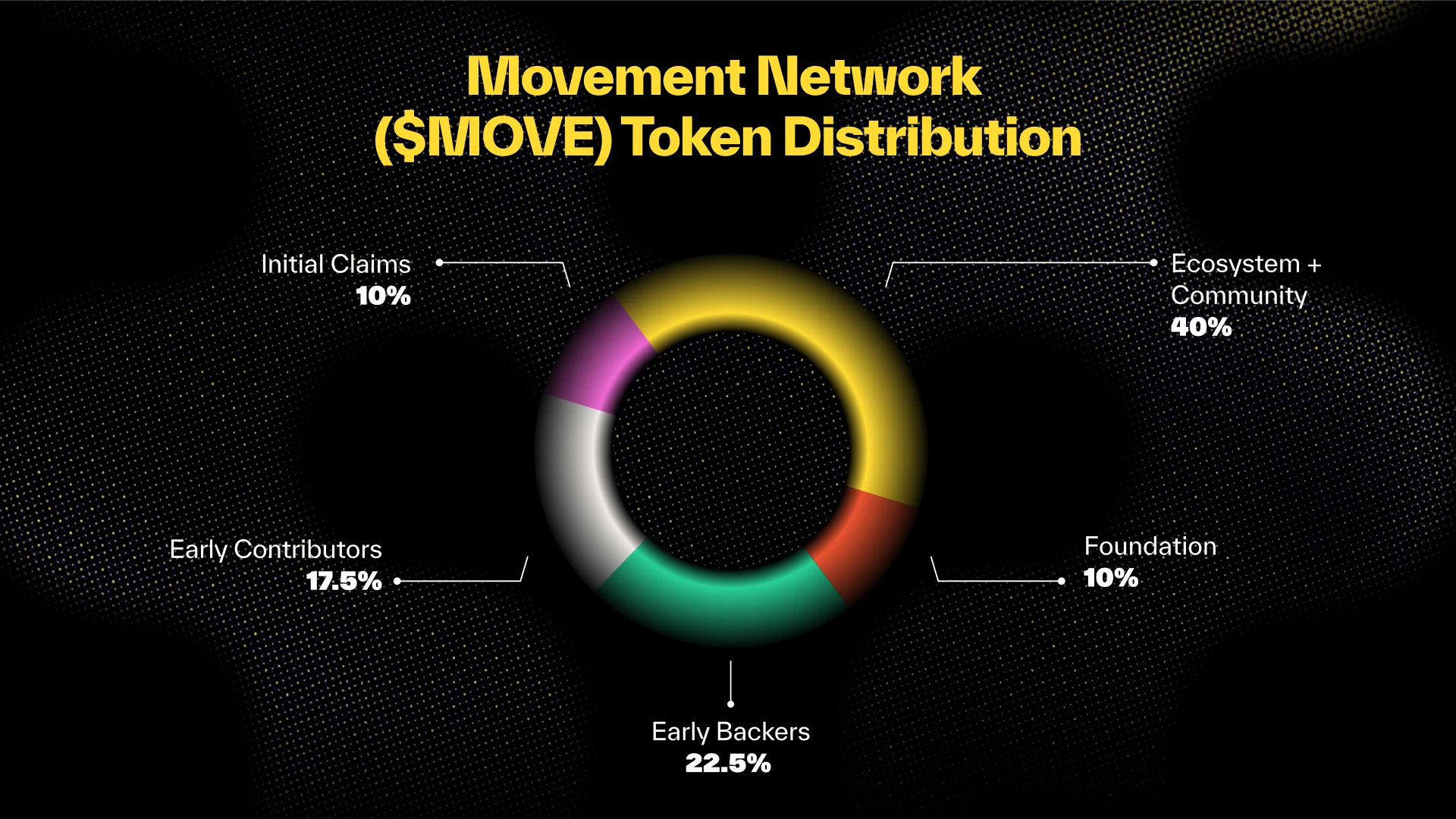

$MOVE Token Distribution

40% Ecosystem + Community

10% Initial claim

10% Foundation

17.5% Early Contributors

22.5% Early Investors

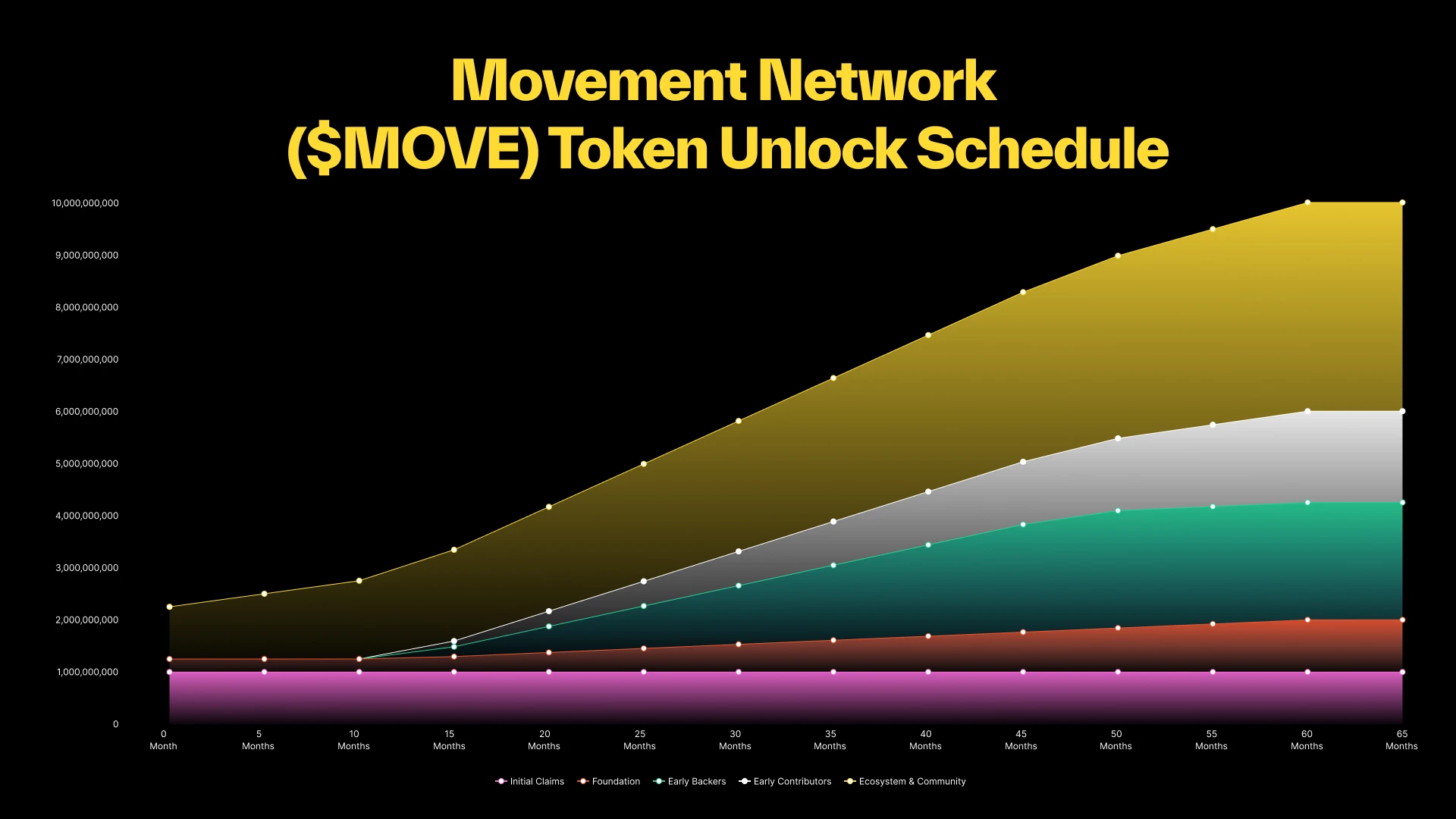

$MOVE total supply: 10 billion, $MOVE initial circulation: ~ 22%.

$MOVE tokens will be TGE on Ethereum mainnet as ERC-20 tokens. After Movement public mainnet is launched (coming soon), $MOVE holders can migrate to Movement across chains.

$MOVE will be gradually unlocked over 60 months. The team and investors cannot participate in staking in the early stage.

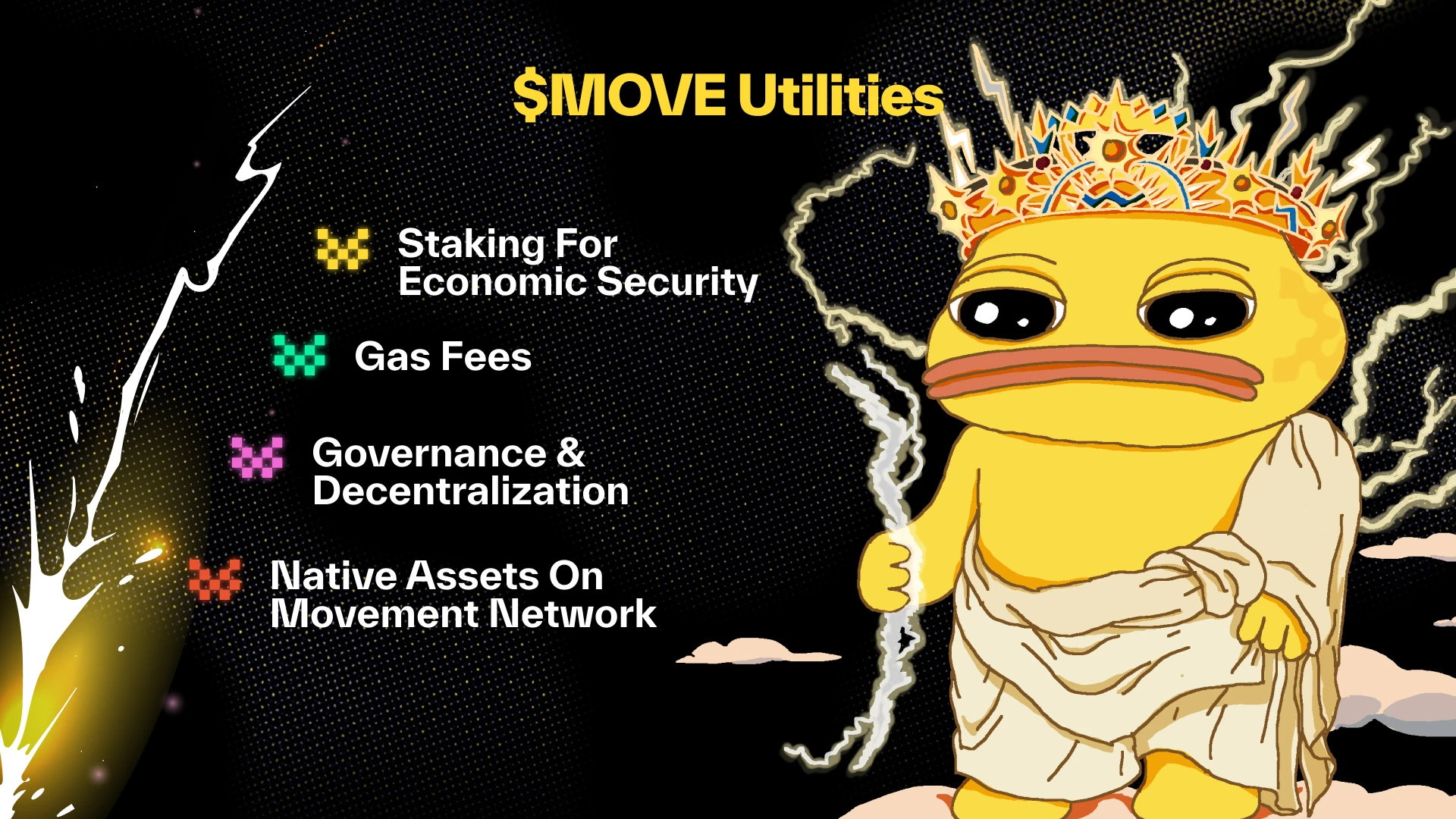

$MOVE Token Use Cases

The Movement Network Foundation is committed to providing multiple utilities for $MOVE, including:

1. Economic security pledge

Once the Movement public mainnet is launched and supports staking, validators will be able to stake $MOVE. Active validators will receive staking rewards for $MOVE by providing economic security for Movement.

2. Gas Fees

The gas fees of the Movement network are denominated and paid in $MOVE, part of which will be used to pay for transaction settlement on Ethereum. In the future, L2 built on MoveStack is also expected to use $MOVE to pay gas fees.

3. Governance and decentralization

In the future, the community will play a key role in the governance of the Movement Network. $MOVE holders can propose governance proposals and vote on network parameter adjustments.

4. Movement Network’s Native Assets

$MOVE will become the native asset of the Movement Network, and DApps on the Movement Network can use it for:

Liquidity

Collateral

Payment

More scenes

Why release $MOVE before mainnet launch?

This is to enable the postconfirmations mechanism to start correctly.

Post-confirmation makes it possible for Movement to achieve transaction finality in as fast as 1 second (or even less). Movement’s post-confirmation requires pre-established economic security. By establishing economic security for $MOVE before the mainnet launch (via the liquidity deposit contract), we can optimize post-confirmation in a real-world environment.

https://blog.movementlabs.xyz/article/postconfirmations-L2s-rollups-blockchain-movement

By combining the security of Move and the efficiency of MoveVM with the network effects of Ethereum, Movement brings a huge leap forward for Ethereum. $MOVE will play a key role in realizing Movement’s vision.

Stay tuned for more exciting content.