Original author: Nathan Frankovitz, Matthew Sigel

Original translation: Wu said blockchain

Driven by favorable regulations brought by Trumps election, Bitcoin successfully broke through its historical high. As market attention continues to increase, various key indicators show that the strong momentum of this round of bull market is expected to continue.

As we predicted in September, Bitcoin (BTC) prices have seen a high volatility rally following the election. Now that Bitcoin is entering uncharted territory with no technical price resistance, we believe the next phase of the bull market has just begun. This pattern is similar to the post-2020 election, when Bitcoin prices doubled by the end of the year and rose further by approximately 137% in 2021. Investor interest is increasing rapidly following a significant shift in government support for Bitcoin. We have recently seen a surge in investment inquiries, with many investors realizing that they are significantly under-allocated in this asset class. While we are closely watching the market for signs of overheating, we reiterate our forecast of a $180,000/BTC price target for Bitcoin in this cycle as key indicators we track show continued bullish signals.

Bitcoin price trend

Market sentiment

Bitcoin’s 7-day moving average (7 DMA) reached $89,444, a new all-time high. On election night, Tuesday, November 5, Bitcoin surged about 9% to a new all-time high of $75,000. This is consistent with our previous observation that when the probability of Trump’s victory increases, the price of Bitcoin will rise. Trump’s campaign explicitly promised to end the SEC’s “enforcement regulation” strategy and make the United States the “world capital of crypto and Bitcoin.”

After Trump was elected president, regulatory resistance turned into a driving force for the first time. Trump has begun to appoint pro-crypto officials in the executive branch, and the Republicans have a coalition government, which increases the likelihood of the passage of relevant supporting legislation. Key proposals include plans to establish a national Bitcoin reserve and rewrite legislation related to crypto market structure and stablecoins. It is expected that FIT21 will be rewritten with market- and privacy-friendly terms, while the new stablecoin draft will allow state-chartered banks to issue stablecoins without the approval of the Federal Reserve.

At a time when countries such as the BRICS are exploring alternatives such as Bitcoin to circumvent dollar sanctions and currency manipulation, stablecoins offer a strategic opportunity to export dollars globally. By removing regulatory barriers and allowing state-chartered banks to issue stablecoins, the United States can maintain the global influence of the dollar and take advantage of the faster adoption of cryptocurrencies in emerging markets, where there is a strong demand for financial services, hedging local currency inflation, and decentralized finance (DeFi).

We expect the SAB to be repealed within the first quarter of Trump’s presidency, if not by the SEC, then by Congress, prompting banks to announce crypto custody solutions. If Gary Gensler has not resigned, Trump may make good on his promise to replace the SEC chairman with a more crypto-friendly candidate and end the agency’s notorious “regulation by enforcement” era. Additionally, by 2025, the U.S. Ethereum (ETH) ETF will be amended to support staking, the SEC will approve a 19 b-4 proposal for the Solana (SOL) ETF, and physical creation and redemption of ETFs will make these products more tax efficient and liquid. Given that Trump has previously acknowledged the commonality between Bitcoin mining and artificial intelligence (AI) in terms of energy intensity, energy regulations are expected to be relaxed, making baseload energy (such as nuclear) cheaper and more abundant, thereby promoting the United States’ global leadership in energy, AI, and Bitcoin.

The election marks a bullish turning point, reversing the capital and job outflows caused by previous hard-line policies. By spurring entrepreneurial activity, the United States is poised to become a global leader in crypto innovation and employment, turning cryptocurrency into a key domestic growth industry and an important export to emerging markets.

Bitcoin Dominance

The 7-day moving average of Bitcoin dominance, a measure of Bitcoins market capitalization relative to the total market capitalization of all cryptocurrencies, rose 2 percentage points this month to 59%, reaching its highest level since March 2021. While the upward trend from 40% in November 2022 may continue in the short term, it may peak soon. In September, we noted that a Harris victory could boost Bitcoins dominance due to clearer regulatory status as a commodity. In contrast, Trumps pro-crypto stance and his expanded cabinet team could drive broader crypto market investment. As Bitcoin reaches new highs in an innovation-friendly regulatory environment, the wealth effect and reduced regulatory risk are expected to attract crypto-native capital and new institutional investors into DeFi, thereby boosting returns for smaller projects in the asset class.

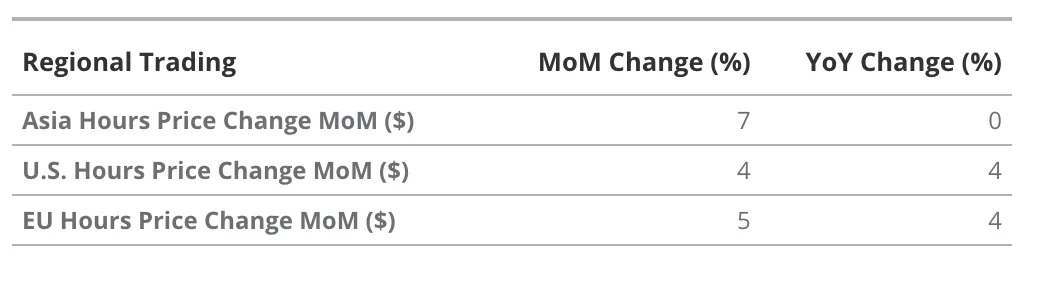

Regional Trading Dynamics

At first glance, traders during the Asian trading hours appear to have significantly increased their Bitcoin holdings this month, a reversal from the trend in recent years where Asian traders have generally been net sellers while European and US traders have been net buyers. However, the surge in Bitcoin prices on election night occurred during the Asian trading hours, likely due to a large number of US investors trading around the election. This particular event makes it difficult to attribute such price movements entirely to regional dynamics. Consistent with historical behavior, traders during the US and European trading hours continue to accumulate Bitcoin, maintaining the price performance trend observed in October.

Source: Glassnodeas, 11/18/24 (Past performance is no guarantee of future results.)

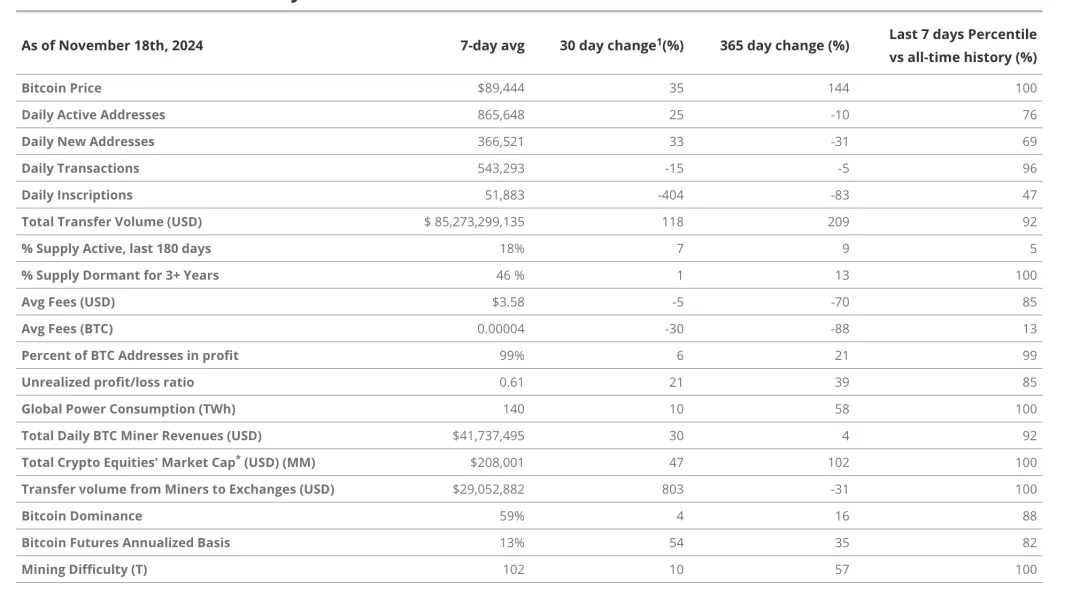

Key Metrics

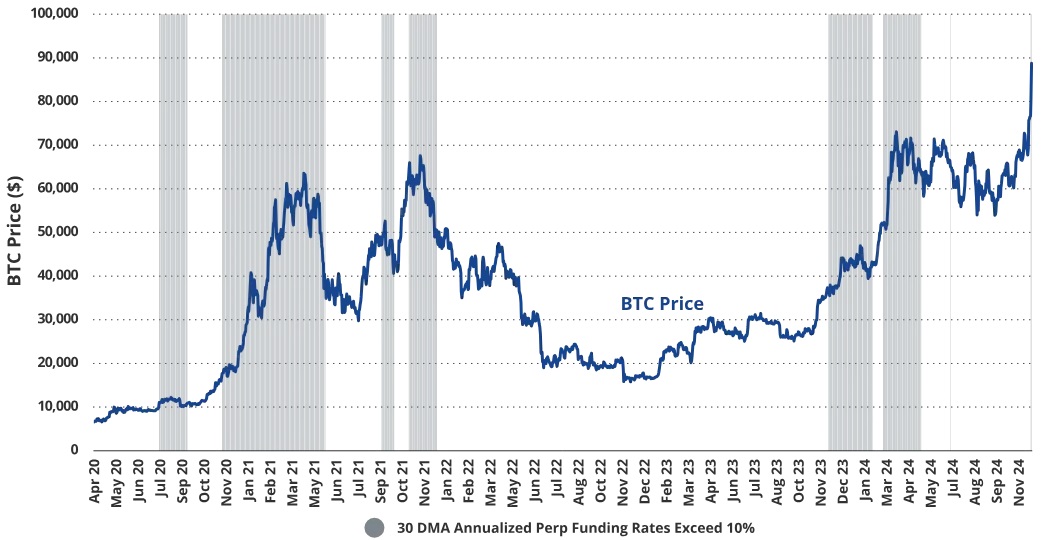

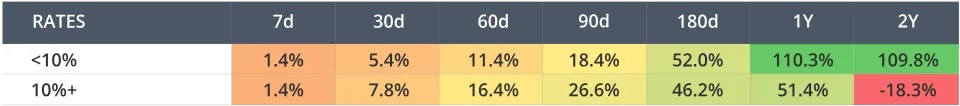

To assess the potential upside and duration of this bull run, we analyze some key indicators to evaluate the level of market risk and possible price tops. This month, our analysis starts with perpetual contracts (perps), where the performance of funding rates provides insights into market sentiment and helps measure the likelihood of overheating in the market.

Bitcoin prices typically show signs of overheating when the 30-day moving average funding rate (30 DMA Perp Funding Rates) exceeds 10% and lasts for 1 to 3 months.

Comparison of BTC average return and perpetual funding rate (January 4, 2020 - November 11, 2024)

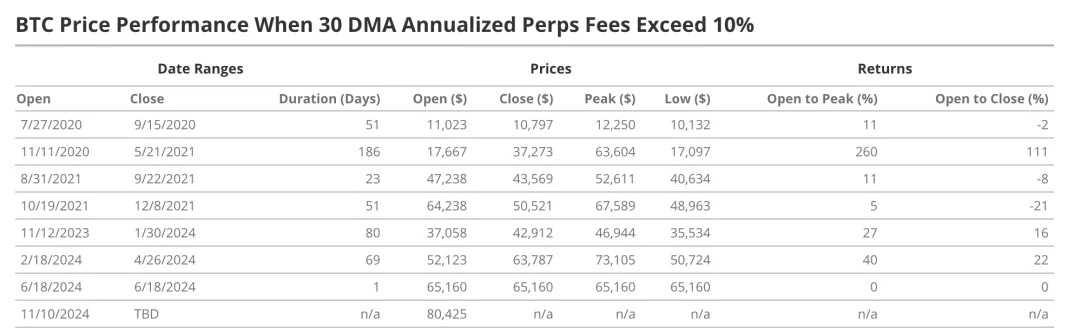

BTC price performance when 30 DMA annualized Perps exceeds 10%

Source: Glassnode, as of November 12, 2024

Starting in April 2020, we analyzed periods when the 30-day moving average perpetual funding rate was above 10%. The average duration of these periods was approximately 66 days, with an average return of 17% from open to close, although the duration of each period varied significantly. The only exception was a single-day spike on June 18, 2024, reflecting short-term market sentiment. The rest of the cases lasted for several weeks, highlighting structural bullish sentiment, which typically leads to significant short- to medium-term gains.

For example, the high funding rate phase that began on August 31, 2021 lasted for 23 days, was followed by a 28-day cool-down period, and then continued again for 51 days on October 19. If this short interval is taken into account, the total duration of high funding rates in 2021 reaches 99 days. Similarly, the current high funding rate phase that began on November 12, 2024 lasted for 80 days, was followed by a 19-day interval and resumed a high funding rate period of 69 days, for a total of 168 days, which is comparable to the 186 days from November 11, 2020 to May 21, 2021. It is worth noting that when Bitcoin purchases were made on days when the funding rate was above 10%, the average returns in the 30-day, 60-day, and 90-day time frames were higher than those on days with lower funding rates.

However, the data shows a pattern of underperformance over longer time frames. On average, Bitcoin purchased on days when the funding rate was above 10% began to underperform the market starting at 180 days, and this trend became increasingly pronounced over 1-year and 2-year time frames. As market cycles typically last about 4 years, this pattern suggests that sustained high funding rates are often associated with cycle tops and can be an early sign that the market is overheating, indicating that it is more vulnerable to long-term downside risks.

Source: Glassnode, as of November 13, 2024

As of November 11th, Bitcoin has entered a new phase with the Funding Rate once again exceeding 10%. This shift suggests stronger momentum in the short to medium term, as higher Funding Rates have historically been associated with higher 30-, 60-, and 90-day returns, reflecting higher bullish sentiment and demand. However, as Funding Rates remain elevated, we may be moving out of a phase where long-term (1-2 year) returns are equally favorable. Given the current regulatory environment that supports Bitcoin, we expect another period of high performance similar to the post-2020 election, when sustained 10%+ Funding Rates fueled 260% growth in 186 days. With Bitcoin currently trading near $90,000, our $180,000 price target remains feasible, reflecting a potential cycle return of approximately 1,000% from cycle trough to peak.

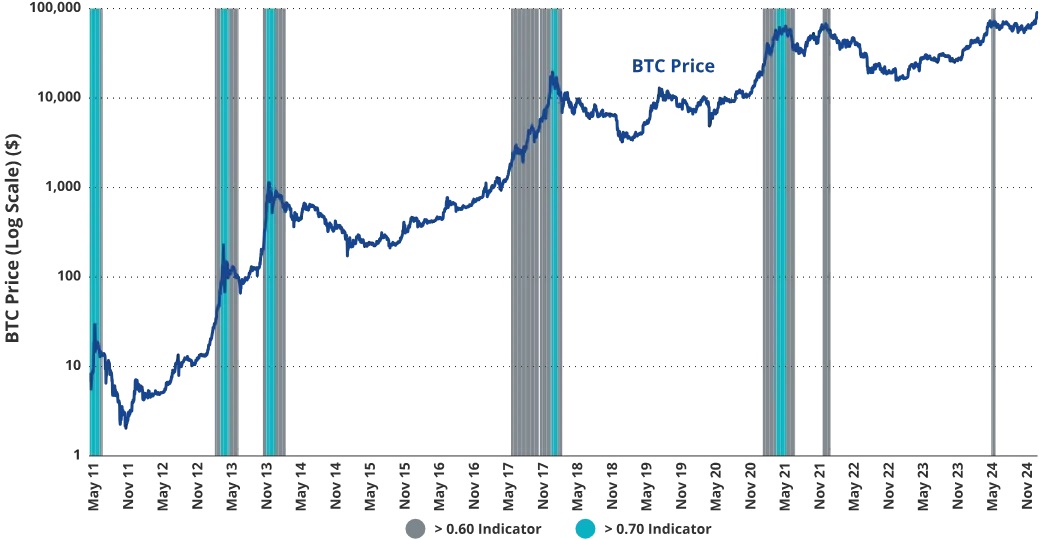

Higher 30-day moving average (DMA) relative unrealized profit levels (>0.60 and 0.70) have historically signaled tops in Bitcoin prices.

BTC average return vs. 30-day moving average relative unrealized profit (RUP) (November 13, 2016 — November 13, 2024)

Source: Glassnode, as of November 13, 2024

BTC average return vs. 30-day moving average relative unrealized profit (RUP) (November 13, 2016 — November 13, 2024)

Source: Glassnode, as of November 13, 2024

Next, we look at relative unrealized profit (RUP), another important indicator used to measure whether the Bitcoin market is overheated. RUP measures the proportion of Bitcoins total market value that is made up of unrealized gains (i.e., profits that have been booked but not yet realized through sales). When the price of Bitcoin exceeds the last purchase price of most holders, the indicator will rise, reflecting that more markets have entered a profitable state, thus reflecting market optimism.

Historically, high 30-day moving average (DMA) RUP levels, especially above 0.60 and 0.70, often signal strong and potentially overheated market sentiment. As shown in the red band in the chart, when the RUP 30 DMA exceeds 0.70, it often coincides with market tops, as a higher percentage of unrealized profits triggers more profit-taking. Conversely, when the RUP level is below 0.60, it indicates more favorable market conditions for long-term buying, and historical data shows that buying below this threshold has higher 1-year and 2-year returns.

Analysis of the past two market cycles shows that 30 DMA RUP levels between 0.60 and 0.70 generally deliver the highest short- to medium-term returns (7-day to 180-day). This range generally reflects the mid-stage of a bull market, when market optimism is rising but has not yet reached excessive levels. In contrast, when RUP exceeds 0.70, returns across timeframes are consistently negatively correlated, reinforcing its role as a strong sell signal.

As of November 13, Bitcoins 30 DMA RUP was around 0.54, but daily values have been above 0.60 since November 11. According to our detailed data table, the risk is gradually increasing when the RUP approaches 0.70, emphasizing the importance of short-term trading in the 0.60 to 0.70 range. However, if the 30 DMA of RUP rises to close to 0.70, it may indicate that the market is overheated and caution should be exercised for long-term positions.

Search popularity of cryptocurrency in the United States

Source: Google Trends, as of November 18, 2024

The popularity of cryptocurrency as a Google search keyword is an important indicator of retail investor interest and market momentum. From historical data, the peak of search popularity is usually closely related to the peak of the total market value of the cryptocurrency market. For example, after the search popularity reached its historical highs in May and November 2021, there were significant market declines: after the May peak, there was a correction of about 55% in about two months, and after the November peak, there was a bear market of about 12 months, with a total decline of about 75%.

Currently, search interest is only 34% of the peak in May 2021, slightly lower than the local peak of 37% observed in March 2024 (when Bitcoin reached its highest price in this cycle). This relatively low search interest suggests that Bitcoin and the broader crypto market have not yet entered the speculative frenzy phase, which leaves room for further growth and has not yet reached the level of mainstream attention typically associated with market tops.

Coinbase App Store Ranking

Source: openbb.co, as of November 15, 2024

Similar to Google search popularity for cryptocurrency, Coinbases ranking in the App Store is also an important indicator of retail investment interest. On March 5 of this year, Coinbase re-entered the top 50 App Store rankings after the price of Bitcoin surged by about 34% in 9 days and retested the 2021 all-time high of about $69,000. Although Bitcoin reached a new high of about $74,000 later that same month, retail interest waned as price volatility fell to a summer doldrums and public attention turned to the presidential election. However, Bitcoins breakthrough on election night rekindled retail interest, and Coinbases App Store ranking jumped from 412th on November 5 to 9th on November 14. The surge in participation drove further price increases while setting a new record for Bitcoin ETF inflows.

Bitcoin Network Activity, Adoption, and Fees

Daily Transactions: The 7-day moving average of daily transactions is approximately 543,000, down 15% month-over-month. Despite the decline, activity remains strong and is at the 96th percentile level in Bitcoin history. Despite the decrease in the number of transactions, this is offset by a greater transaction load, as can be seen in the increase in transfer amounts.

Ordinals: Daily Ordinals (NFT and meme coins on the Bitcoin blockchain) trading volume increased 404% month-on-month, reflecting a resurgence of speculative enthusiasm driven by rising prices and favorable regulations.

Total transfer volume: Bitcoin transfer volume increased by 118% month-on-month, and the 7-day moving average was approximately US$85 billion.

Average transaction fee: Bitcoin transaction fees fell 5% month-on-month, with an average fee of $3.58. The average transaction load was approximately $157,000, and the corresponding transaction fee rate was approximately 0.0023%.

Bitcoin Market Health and Profitability

Proportion of profitable addresses: As the price of Bitcoin reaches a record high, about 99% of Bitcoin addresses are currently profitable.

Unrealized Net Profits/Losses: This ratio has increased by 21% in the past month to 0.61, showing a significant increase in the ratio between relative unrealized profits and unrealized losses. As an indicator of market sentiment, the ratio is currently in the Belief-Denial range, corresponding to the phase of the market cycle where there is rapid expansion and contraction between peaks and troughs.

Bitcoin Chain Monthly Dashboard

Source: Glassnode, VanEck Research, as of October 15, 2024

Bitcoin Miners and Total Crypto Market Value

Mining difficulty (T):

Bitcoins block difficulty has risen from 92 terabits to 102 terabits, reflecting that miners are expanding and upgrading their fleet of equipment. The Bitcoin network automatically adjusts the difficulty every 2,016 blocks (approximately two weeks) to ensure that each block is mined in about 10 minutes. The increase in difficulty indicates increased competition among miners and also represents a strong and secure network.

Total daily income of miners:

Miners daily income increased by 30% month-on-month, benefiting from the rise in Bitcoin prices, but transaction fees denominated in BTC fell by 30%, which had a certain impact on total revenue.

Transaction volume transferred by miners to exchanges:

On November 18, miners transferred approximately $181 million in Bitcoin to exchanges, equivalent to 50 times the previous 30-day average, pushing the 7-day moving average up 803% month-over-month. This extreme movement is the highest level since March, and similar levels were seen before Bitcoins most recent halving. While continued high transfers from miners to exchanges could indicate an overheated market, this peak occurred after a low miner sell-off in the summer, suggesting that this was profit-taking for operational and growth purposes rather than a signal of a market top.

Total crypto market capitalization:

The 30-day moving average of the MarketVector Digital Asset Stock Index (MVDAPP) rose 47% month-over-month, outperforming Bitcoin. Major index constituents like MicroStrategy and Bitcoin mining companies directly benefit from the rise in Bitcoin prices through their Bitcoin holdings or mining operations. Meanwhile, companies like Coinbase are taking advantage of broader crypto market gains as price increases drive expectations of increased transaction fees and other revenue sources.

Source farside.co.uk, as of 18 November 2024