Original author: Tiger Research Reports

Original translation: TechFlow

Summary of key points:

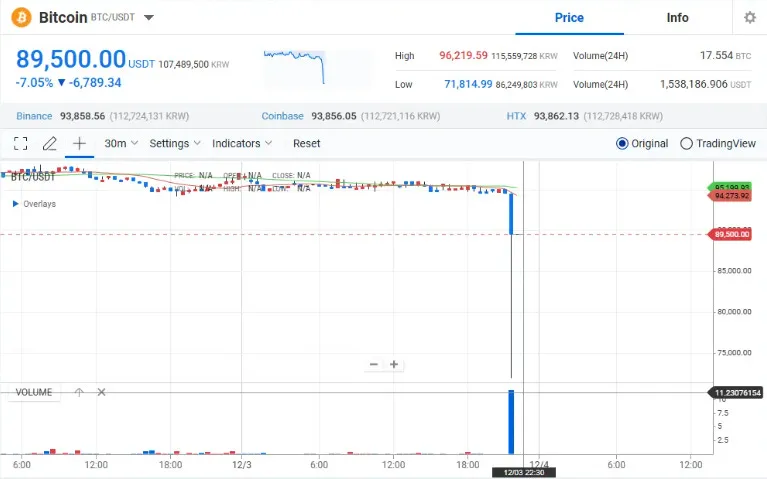

Market shock: The announcement of martial law triggered a massive sell-off on South Korean cryptocurrency exchanges, with a total of about $33.3 billion. The price of Bitcoin fell to $62,300, and the local market briefly recorded the highest trading volume in the world.

Investor Exodus: Due to price volatility and system failures on local exchanges, Korean investors are expected to turn to overseas exchanges and DeFi platforms.

Industry shrinkage: Political instability has prompted South Korean blockchain projects to move overseas. Major legislation, such as the Virtual Asset User Protection Act, may be delayed as a result.

1. Introduction

Source: Yonhap News

South Korea’s cryptocurrency market was rocked last night by President Yoon Seok-yeol’s sudden announcement and lifting of martial law. The price of Bitcoin fell to $62.3K on Upbit, South Korea’s largest exchange. Upbit and Bithumb, the two largest South Korean exchanges, recorded 24-hour trading volumes of $26.9 billion and $6.4 billion, respectively, the highest levels this year. This reflects a massive sell-off by South Korean investors after the martial law was announced. During this period, South Korean exchanges briefly became the world’s most traded market, highlighting the extreme volatility of its market.

2. Declining trust in Korean won assets and rising demand for cryptocurrencies

The martial law incident has severely undermined trust in Korean won assets. As foreign capital withdraws, the stock and bond markets may become more volatile. As a result, investors are gradually turning their attention to decentralized assets such as cryptocurrencies.

Investors are choosing cryptocurrencies to protect their assets amid rising geopolitical risks. Major cryptocurrencies such as Bitcoin have attracted attention because they are not controlled by governments. Cryptocurrencies have been seen as safe haven assets in past crises, such as the Hong Kong protests and the Russia-Ukraine war.

3. The double-edged sword of strict regulation and the accelerated transfer of exchanges overseas

Cryptocurrency exchanges in South Korea maintain high security through strict travel rules and KYC regulations. The Act on the Reporting and Use of Information on Designated Financial Transactions strengthens anti-money laundering (AML) measures and improves investor protection. These efforts put South Korea at the forefront of regulatory compliance.

Source: Upbit

However, the market crash revealed the double-edged sword effect of strict regulation. Strict rules maintained the inverse kimchi premium, widened the price gap with the global market, and made it difficult for investors to make rational decisions.

Wild price swings and system instability on local exchanges have eroded investor trust. Upbit and Bithumb’s servers crashed as overnight trading volume reached $33.3 billion. This instability makes local exchanges appear unreliable, unlike overseas exchanges.

These issues are expected to accelerate the migration of Korean investors to overseas exchanges and DeFi platforms. Binance and Coinbase provide a stable trading environment and diversified financial products, making them ideal choices for Korean investors.

4. South Korean blockchain projects are accelerating their relocation

The investment environment for blockchain projects in South Korea has been affected by political instability. Many large projects have already moved overseas, and this trend is expected to continue. Nexons blockchain unit Nexpace has relocated to Abu Dhabi, Klaytn and LINE Finschias Kaia Foundation moved to Singapore, and Wemades Wemix moved to Dubai. These companies chose blockchain-friendly countries to circumvent regulatory uncertainty and political risks in South Korea. More projects are expected to move to Singapore and the UAE, where regulations remain clear and stable.

The overseas migration of blockchain startups has raised concerns about brain drain. This trend could weaken South Koreas competitiveness in the blockchain field. Against the backdrop of the rapid development of Web3 and blockchain technology, brain drain could have a long-term negative impact on South Koreas technological advantage. This outflow has exacerbated the sense of crisis within the industry.

In addition, the impeachment issue could delay the process of important legislation. Laws such as the Virtual Asset User Protection Act, which is being discussed in the National Assembly, may face delays. These delays could further hinder the institutionalization process of the Korean cryptocurrency market.

5. Conclusion

The martial law incident exposed the structural weaknesses of the Korean cryptocurrency market. In just one night, $33.3 billion worth of transactions disappeared and the servers of major exchanges were paralyzed. The market saw extreme price fluctuations and significant price gaps compared to global exchanges. These events highlighted the political risks in the market and the fragility of the current trading system under pressure.

In the short term, market instability is expected to continue. However, with appropriate institutional improvements and system strengthening, this crisis could also be a turning point. These efforts will help enhance the stability of the Korean cryptocurrency ecosystem and promote its global development. It will be worth paying close attention to where it goes next.