Original | Odaily Planet Daily ( @OdailyChina )

Author: Azuma ( @azuma_eth )

At 8:30 a.m. PST on December 10 (0:30 a.m. BST on December 11), Microsoft will push forward a major shareholder proposal on Bitcoin, which is to evaluate whether including Bitcoin in the balance sheet is in the long-term interests of shareholders through a shareholder vote. As BTC hovers around $100,000, the vote is widely considered by the market to be another key event that will affect the trend of the cryptocurrency market this week, in addition to CPI and the situation in South Korea.

The Proposal

The shareholder proposal was originally submitted by the National Center for Public Policy Research (NCPPR), a conservative think tank in the United States.

The reason given by the NCPPR at the time was that during a period of sustained inflation, the success of a company depends not only on its operating performance, but also on its profit preservation. According to the Consumer Price Index (CPI), the average inflation rate in the United States over the past four years has been 5% (the NCPPR believes that the actual inflation rate may be higher). Therefore, in addition to increasing profits, companies also have a fiduciary responsibility to protect profits from depreciation. However, since Microsoft invested most of its assets in US government securities and corporate bonds, it failed to effectively protect its assets from depreciation.

In its proposal, NCPPR emphasized that although Bitcoin has a certain degree of volatility, Bitcoin is still an excellent, or even the best, inflation hedge tool, and therefore recommended that Microsoft evaluate allocating at least 1% of its assets to Bitcoin.

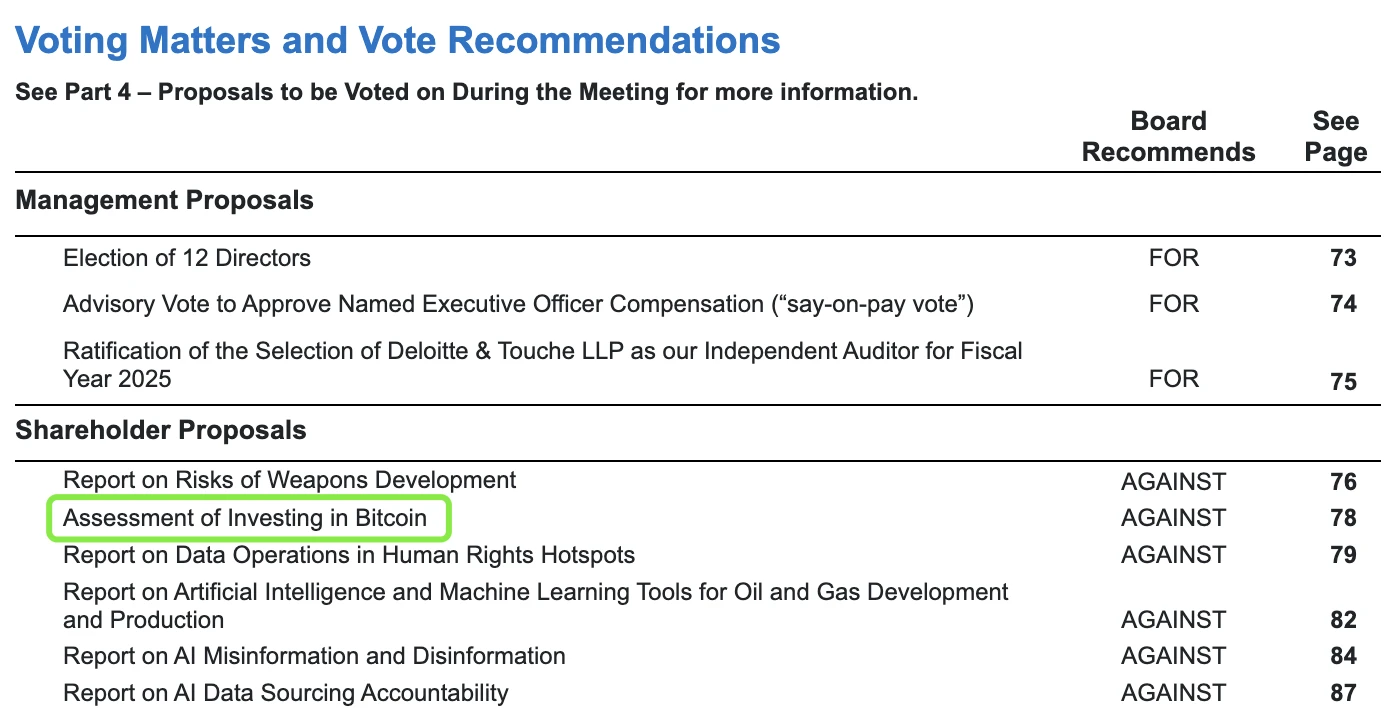

According to documents now filed with the U.S. Securities and Exchange Commission (SEC), the proposal is expected to be put to a shareholder vote on December 10 local time along with several other proposals.

Will the vote pass?

Although the current cryptocurrency community has high expectations for this vote, considering the current situation, it is still largely unknown whether Microsoft shareholders will agree to the proposal.

In a filing with the SEC, Microsofts board of directors explicitly expressed its opposition to the proposal, arguing that Microsoft management had evaluated the topic but believed that corporate funds required stable and predictable investments to ensure liquidity and operating funds.

Although the top leaders have made their stance clear, the relevant organizations/individuals who support the proposal are still actively preaching and trying to push the proposal into implementation.

On the one hand, BlackRock, which holds a 7% stake in Microsoft, is expected to directly participate in the vote and is likely to cast a support vote; MicroStrategy co-founder Michael Saylor has also presented a 44-page PPT to Microsoft CEO Satya Nadella and the board of directors, emphasizing the changes in the Bitcoin regulatory environment, hoping to reverse the attitude of Microsofts top management.

On the other hand, on the more radical Reddit forum, there are also a large number of proposal supporters actively calling on Microsofts medium and small shareholders to vote in favor.

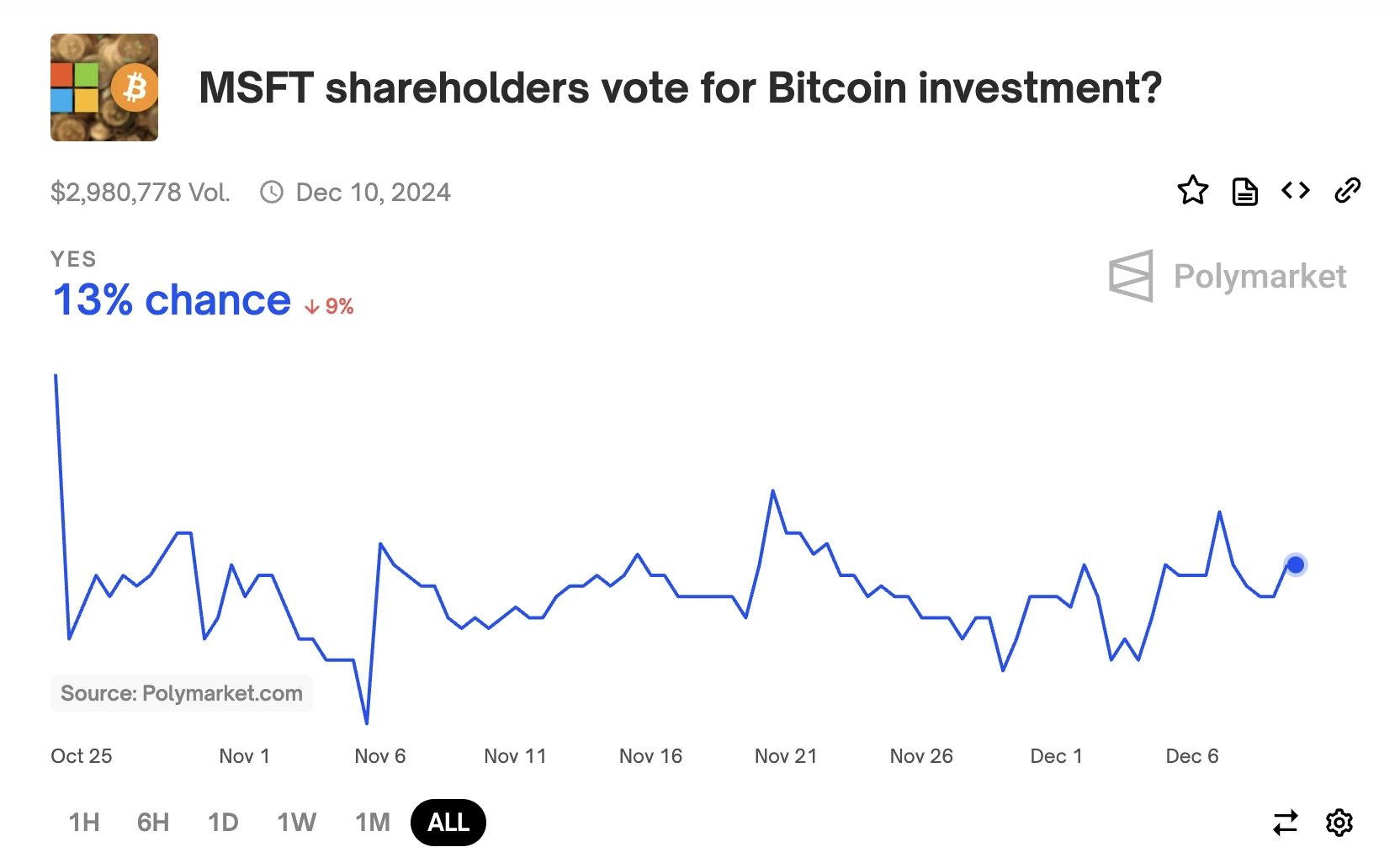

However, even so, the markets expectations for the passage of the proposal are still not good. Polymarket real-time betting data shows that the probability of the proposal passing is only 13%.

If it passes, how big is the potential buying?

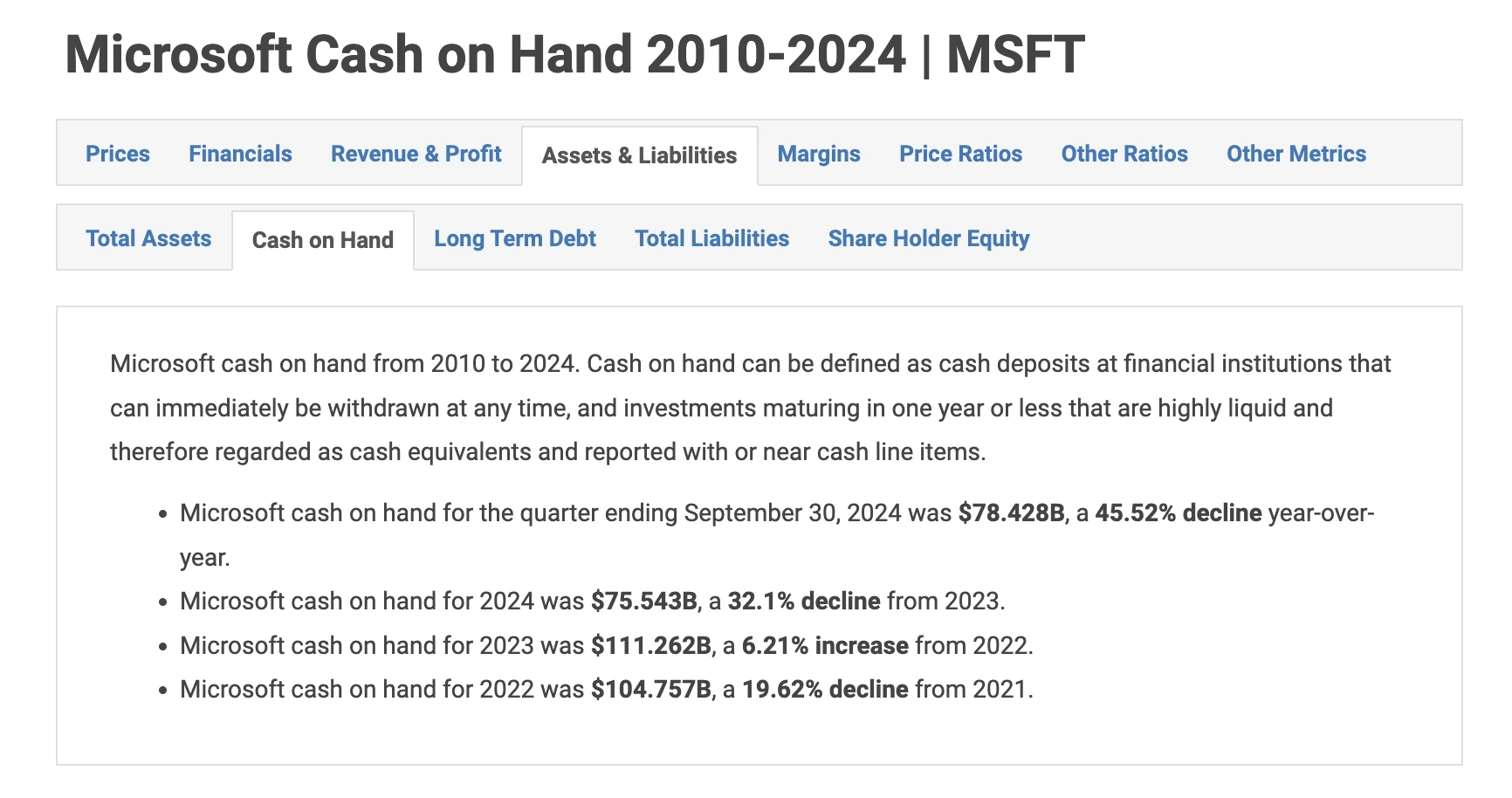

Although the voting expectations are still unclear, we can still use Microsoft’s reserves to get a preliminary glimpse of how much money Microsoft can use to buy BTC if the proposal is passed.

Macrotrends data shows that as of September 30, 2024, Microsoft held cash reserves of US$78.428 billion.

This means that if the proposal passes and at least 1% of funds are deployed as the NCPPR recommends, that would be at least $780 million in buying power.

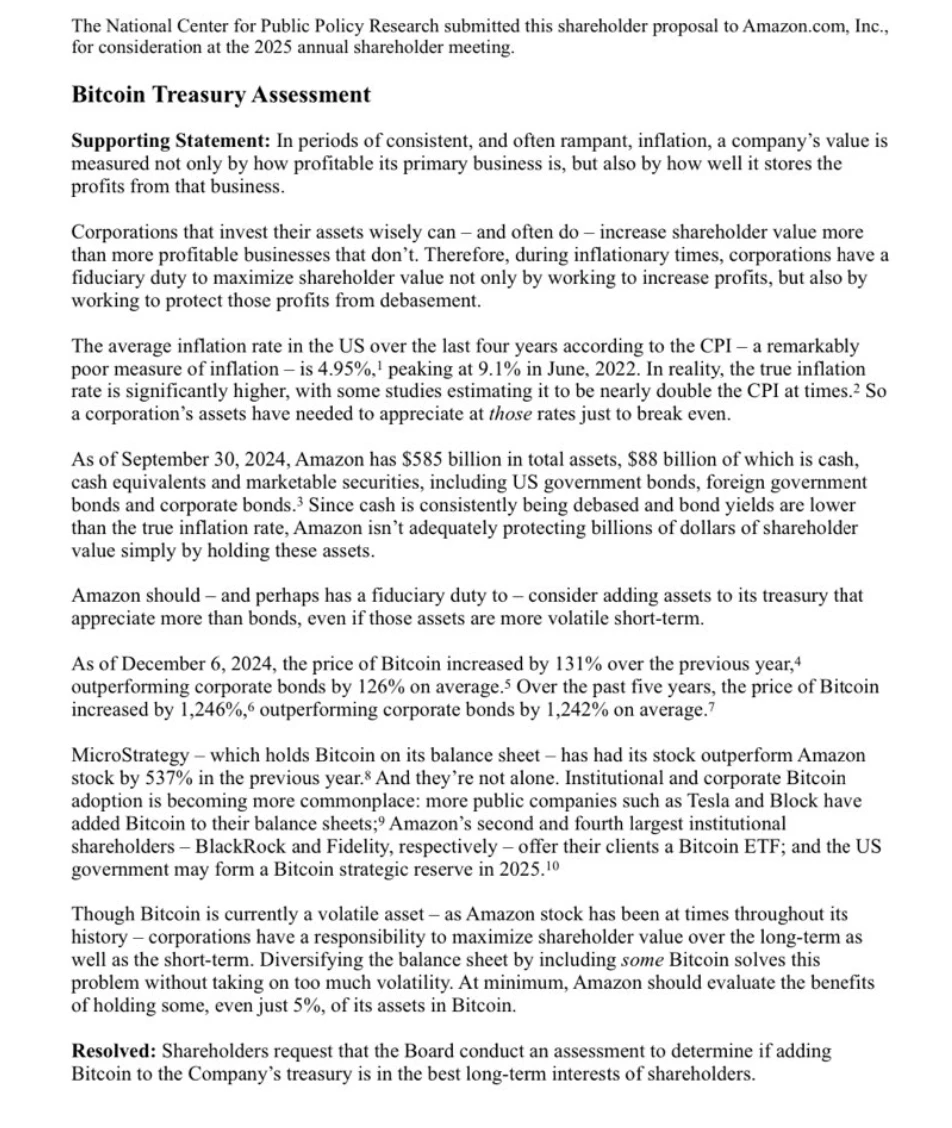

NCPPR continues to make efforts, after Microsoft, is Amazon next?

This morning, NCPPR submitted a similar shareholder proposal to another major technology giant, Amazon, suggesting that Amazon evaluate the inclusion of Bitcoin in the companys asset reserves. This time, NCPPR suggested that Amazon invest at least 5% of its total assets.

CZ also commented on the incident through his personal account X and asked when Amazon would accept Bitcoin payments.

Although the SEC has not yet listed the progress of the proposal, Jubilee Royalty founder and CEO Tim Kotzman said that the relevant statement is not expected to be released until April 2025, so it may be discussed at the 2025 annual shareholders meeting.

From MicroStrategy and Tesla, which have already joined the market, to Microsoft and Amazon, which are expected to join the market, the pace of Bitcoins expansion into the mainstream world seems to be accelerating. Although the upcoming Microsoft conference is likely not to pass this vote immediately, judging from the trend, this may only be a matter of time.