1. Outlook

1. Macro-level summary and future forecasts

Last week, the US macroeconomic data showed that the job market was recovering, but the slight increase in the unemployment rate caused people to worry about the future economic direction. The market generally believes that the Federal Reserve will implement loose policies at the upcoming meeting to cope with economic uncertainties. In the coming months, especially the inflation data to be released, will play an important role in the Feds decision-making.

2. Cryptocurrency market changes and warnings

On December 5, the price of Bitcoin, a world-renowned cryptocurrency, broke through the $100,000 mark for the first time, climbing to a high of about $104,000. This remarkable price jump was mainly driven by the general optimism in the market and investors firm confidence in the future value of Bitcoin. However, due to the important psychological pressure line significance of the $100,000 price level, Bitcoin was not able to gain a firm foothold at this price level, but fluctuated up and down many times, repeatedly testing this key integer price level. Later, TRX took over the banner of the bull market when Bitcoin entered an uncertain market. It nearly doubled in just two days and set a record high, and caused a general rise in other platform currencies, which was unimaginable in the past. As the Tron ecosystem continues to flourish, TRX holders may usher in very considerable returns.

As the price of Bitcoin breaks through $100,000 and altcoins consolidate at high levels, investors should fully consider the markets phased profit-taking strategies to ensure maximum investment returns and controllable risks.

3. Industry and track hot spots

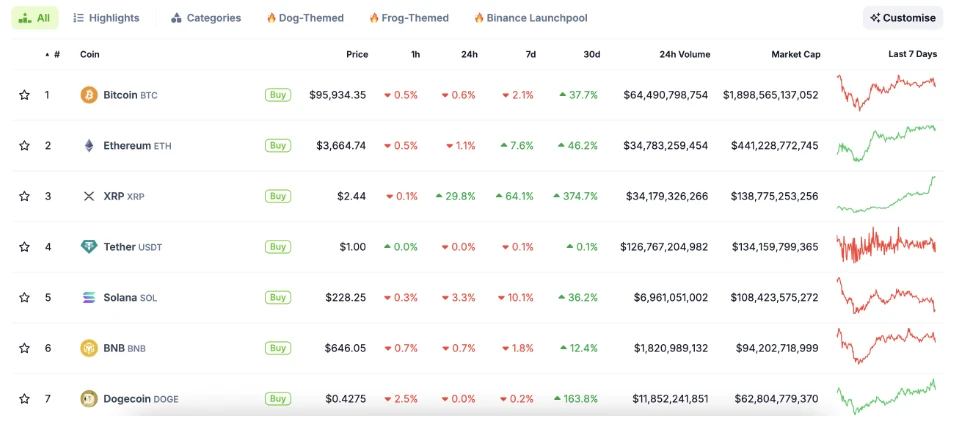

Recently, XRP successfully counterattacked and surpassed Tether, returning to the third place in the cryptocurrency market value rankings; TRX nearly doubled in less than two days. Digital asset infrastructure giant BitGo announced the launch of a new retail platform that integrates trading, staking, lending, wallets, cold storage and self-custody services. It aims to provide global retail users with the same security, transparency and compliance guarantees as institutional customers.

The mainnet launch and TGE (Token Generation Event) of the modular computing layer and RaaS platform Lumoz are approaching, and its airdrop activities have attracted the attention of millions of users. On the other hand, Sonic Labs, a Layer 1 blockchain project spun off from the Fantom network, also received good news. Its new blockchain has successfully generated the first transaction block and is expected to be publicly released soon.

2. Market hot spots and potential projects of the week

1. Performance of hot tracks

1.1. Is there a chance for an XRP ETF? XRP surpasses Tether and returns to being the third largest cryptocurrency

XRP’s surge, surpassing Tether to become the third largest cryptocurrency, is mainly due to the following reasons:

a) Ripple’s legal victory against the SEC

As mentioned earlier, Ripple Labs has made positive progress in its long-running legal battle with the U.S. Securities and Exchange Commission (SEC). In July 2023, the court ruled that XRP trading in the retail market did not constitute illegal securities sales, which was a major victory for Ripple and boosted market confidence in XRP. This directly drove up the price of XRP and boosted investor confidence.

b) XRP price surges

XRPs price has surged on the back of legal developments. XRPs market capitalization has grown rapidly as retail and institutional investors have reinvested. Ripples potential in cross-border payments continues to be viewed favorably, providing strong support for XRP.

c) Tether’s stability and USDT’s stagnant growth

Tether (USDT) is a stablecoin whose value is pegged to the U.S. dollar (1 USDT ≈ 1 USD). Since stablecoins do not experience price fluctuations or growth like XRP or Bitcoin, when XRP experiences a surge, its market capitalization rises rapidly, while Tether remains stable. In addition, USDTs market capitalization growth is relatively stable, and Tethers growth rate is relatively slow due to regulatory concerns, etc.

d) Changes in crypto market sentiment

In the overall crypto market, investor sentiment has changed, and many people have begun to shift funds from stablecoins to L1 blockchains (such as Ethereum and XRP), which have real-world application scenarios. As XRP performs strongly, more funds are pouring in, pushing up its price.

1.2. BitGo launches a dedicated retail platform for buying, selling, trading, custody and staking crypto assets

Digital asset infrastructure provider BitGo has launched a dedicated retail platform, offering its regulated digital asset trading, staking, lending, wallet, and cold storage and self-custody services to users around the world for the first time.

BitGo was founded in 2013 and has been serving institutional clients until now, providing services such as custody, trading and settlement. The company is also one of the approved companies to help the bankrupt Mt. Gox exchange compensate customers, and provides custody services for Ark Invest/21 Shares and Valkyrie (now CoinShares)s US spot Bitcoin exchange-traded funds (ETFs). It is currently the custodian of WBTC, the largest wrapped Bitcoin asset on the Ethereum chain.

BitGo claims to have safeguarded billions of dollars in crypto assets for institutional clients, and its new retail solution aims to provide retail users with the same level of security, transparency and compliance as its institutional clients.

Mike Belshe, CEO of BitGo, said: “We are very excited to launch BitGo’s dedicated retail platform and provide retail investors with the same white-glove crypto-native solution we have provided to the global institutional market since 2013. Retail investors demand a crypto-native platform that puts security first, and we are excited to be their trusted partner. We look forward to enhancing the retail investing, trading, storage and staking experience for investors around the world.”

The platform is now live for global investors, with eligible users in the U.S. having the opportunity to win a full Bitcoin upon registration.

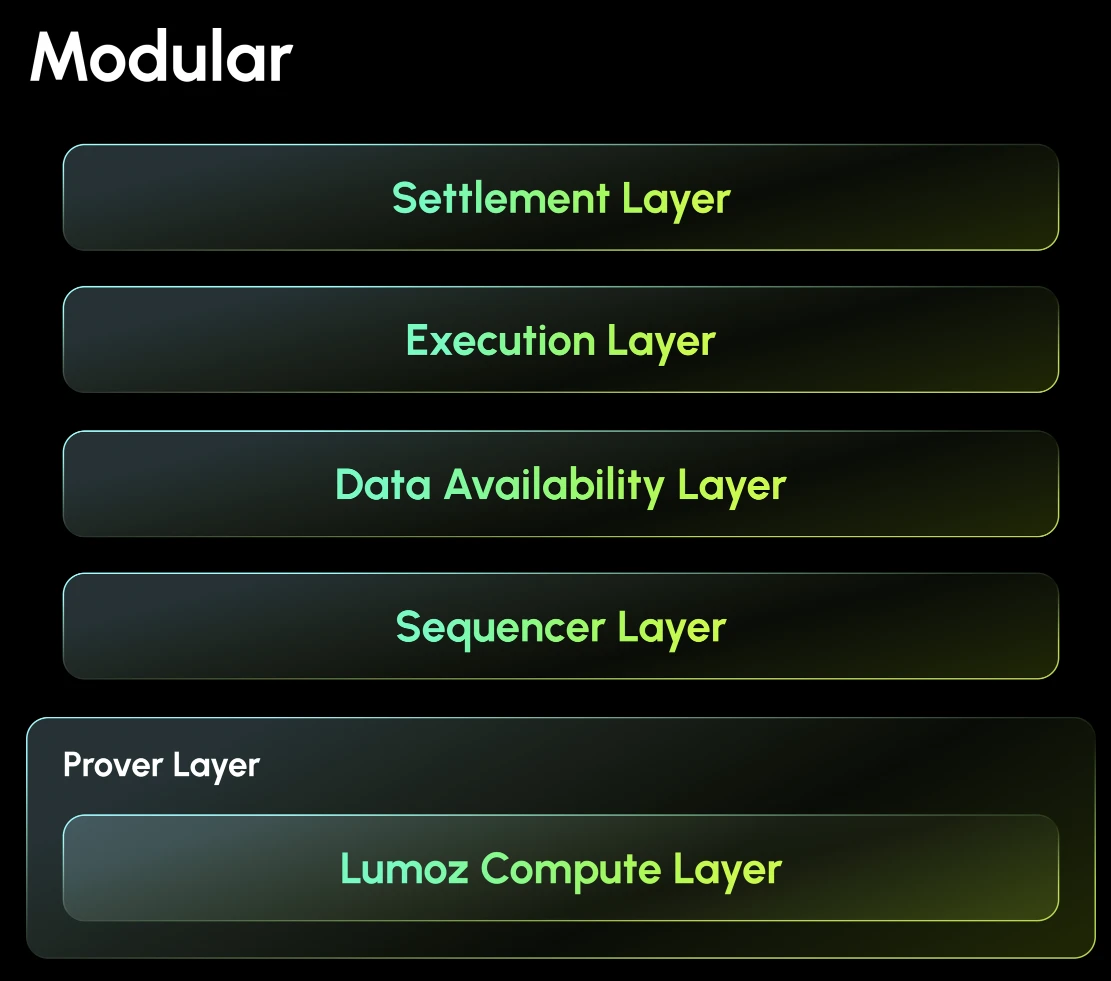

1.3. The modular protocol Lumoz TGE is coming soon. Can it become the leader of the sector?

The crypto market is getting hotter, and the last big coin of 2024 is finally here. The modular computing layer and RaaS platform Lumoz is about to launch its mainnet and TGE. Its airdrop event launched on November 5th accounts for 10% of the total supply of tokens (the total supply of tokens is 10 billion). According to the valuation of the previous round of financing, the total airdrop is worth about 30 million US dollars. The ETH ecosystem, Move ecosystem, etc. are all within the scope of the airdrop. The wide coverage and large amount of this event have attracted widespread attention from the market, attracting more than 5 million users to query and confirm the number of esMOZ.

The core of Lumoz is its unique computing layer. As a computing module, it has the following features:

1. Decentralized computing: The Lumoz computing layer runs as a blockchain network, using a hybrid consensus mechanism (Proof of Stake POS and Proof of Work POW) to ensure decentralized computing power. This architecture provides continuous ZKP computing power for zkRollups and a secure data processing and model training environment for AI applications.

2. Powerful computing stability: Lumoz computing nodes are composed of thousands of GPU/CPU nodes, ensuring not only continuous computing power for ZKP and ZKFP, but also supporting the large-scale parallel computing required by AI, ensuring efficient execution of computing tasks.

3. Wide compatibility: Lumoz is highly compatible with mainstream Rollup solutions in the blockchain industry, such as Polygon zkEVM, zkSync, Scroll, and Starknet. It also meets various computing needs in the AI field and provides strong support for different technology stacks through its unique computing mechanism.

4. Cost-effectiveness: Lumoz’s decentralized computing layer combines a comprehensive economic model to bring low-cost ZKP generation. This cost-effectiveness also applies to AI computing tasks, providing users with a cost-effective AI and blockchain computing solution.

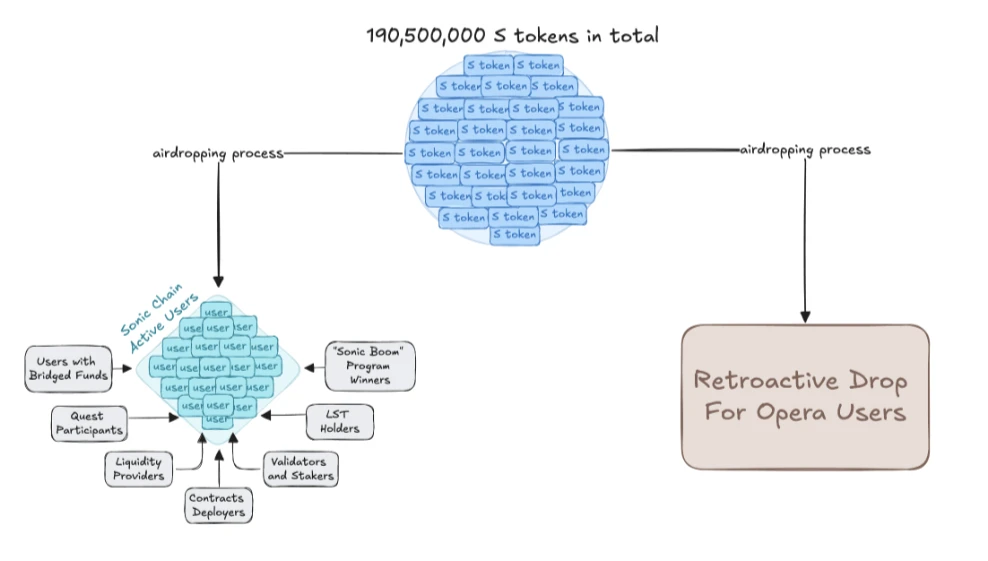

1.4. Sonic Labs said that its L1 public chain will be publicly released shortly after the airdrop snapshot

Sonic Labs, a Layer 1 blockchain project spun off from the existing Fantom network, announced that its new blockchain has successfully generated its first transaction block. With “Genesis” achieved, the network is expected to “launch publicly” soon, the company said in an X post on Monday.

The news comes days after Sonic Labs revealed an upgraded default “testnet 2.0” called Blaze for its EVM-compatible blockchain. According to a statement in late November, the Sonic testnet achieved “amazing performance gains” in its first 221,000 blocks, including an average block time of 1.17 seconds and a final confirmation time of 0.85 seconds.

Sonics ultimate goal is to achieve sub-second confirmations and set a new standard for high-performance chains with 10,000 transactions per second and confirmations within one second.

Sonics native token is S, which is used to pay transaction fees, pledge, run verification nodes, and participate in governance. When the new network goes online, users holding FTM will be able to convert FTM into S tokens at a 1:1 ratio.

The Sonic team has designed a deflationary airdrop system that uses a unique linear decay mechanism and introduces game theory to address the challenges of airdrop incentives on active chains. Specifically, this airdrop needs to be strategically designed to minimize the drastic fluctuations in the circulating supply in a short period of time, and we believe that linear decay and destruction mechanisms can solve this problem.

The airdrop model employs a unique burn factor that encourages recipients to increase on-chain activity while waiting for their preferred exit burn. Recipients can choose to wait for their airdrop position to fully mature, or choose to claim it early but pay a burn penalty. For recipients who choose neither of these options, there will be a market for them to sell their S airdrop shares to speculative buyers.

The project is derived from Fantom’s Opera blockchain, which launched in late 2019. Sonic Labs has raised $10 million from notable investors, including Stani Kulechov, Robert Leshner, Michael Egorov, and Tarun Chitra, and counts Andre Cronje as CTO, with investors keeping an eye out for details of its airdrop in the near future.

2. Inventory of potential projects of the week

2.1. Why did DEX dark horse Hyperliquid dominate the list of the most popular protocols this week?

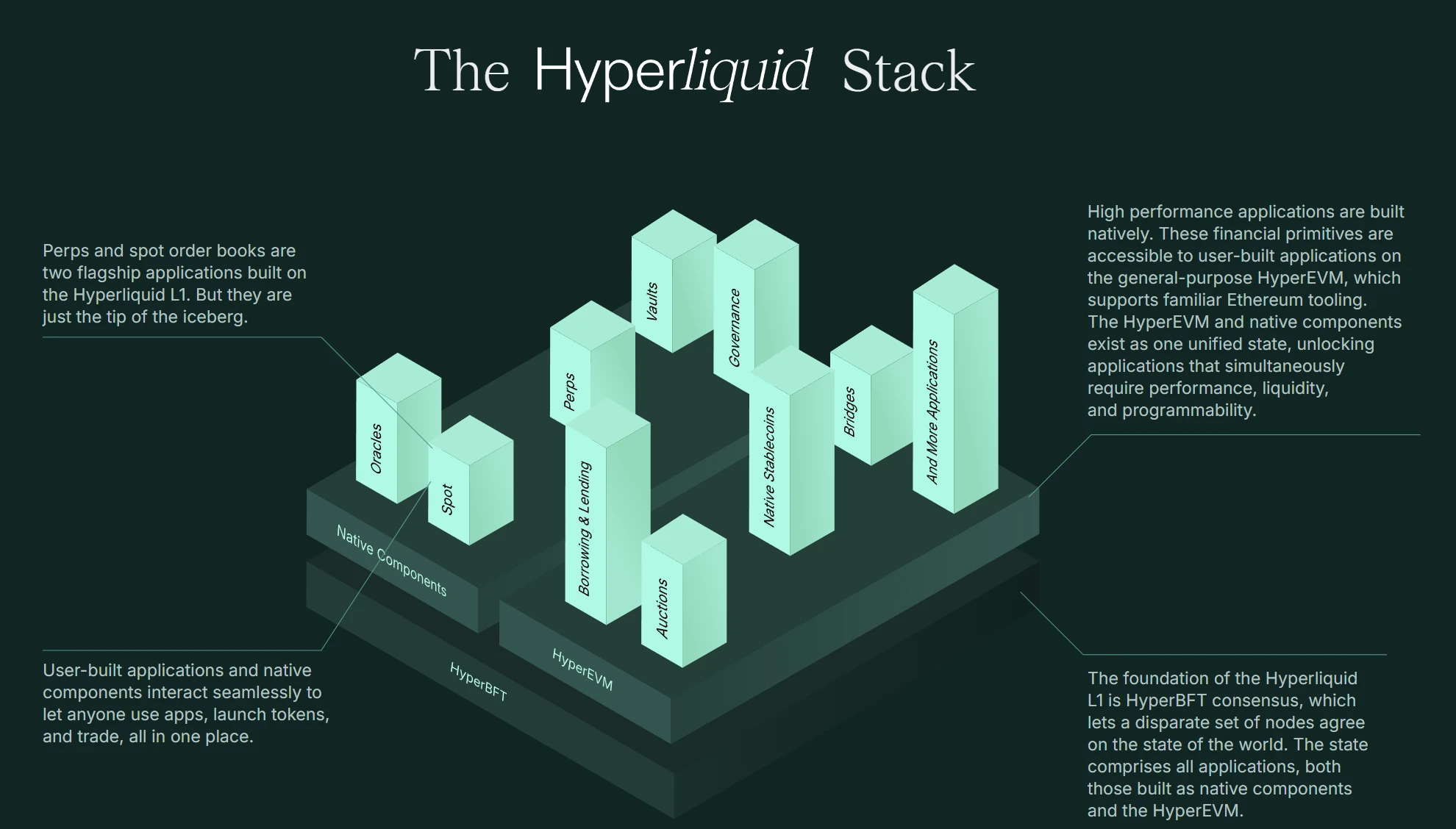

Introduction

Hyperliquid is a high-performance L1 public chain optimized from the bottom up. Its vision is to create a completely open financial system on the chain, where user-built applications interact with efficient local components without compromising the end-user experience. Hyperliquid Labs is a core contributor to Hyperliquid, led by Jeff and iliensinc, who are classmates at Harvard University. Other members of the team are from Caltech and MIT and have worked at companies such as Airtable, Citadel, Hudson River Trading, and Nuro.

Hyperliquid L1’s performance is sufficient to support a fully open ecosystem of financial applications—every order, cancellation, trade, and liquidation occurs transparently on the chain, with a block latency of less than 1 second. The chain is currently able to support 100,000 orders per second.

Hyperliquid L1 uses a custom consensus algorithm called HyperBFT, which is inspired by Hotstuff and its successor algorithms. The algorithm and network stack are optimized from the bottom up to specifically support the operation of L1.

Its flagship native application is a fully on-chain order book perpetual contract exchange - Hyperliquid DEX. Future development plans include native token standards, spot trading, permissionless liquidity, etc.

Technical Analysis

Hyperliquid L1 is purpose-built around a high-performance derivatives exchange, with its flagship native component being a perpetual contract order book exchange. The key reasons for choosing this application are as follows:

1. It is a real-world application with infrastructure requirements that exceed what any existing L1 can handle.

2. It is the most valuable vertical in decentralized finance (DeFi), and the vast majority of user-built applications can benefit from it.

3. It attracts real users to interact with the underlying L1 infrastructure.

Hyperliquid L1 continues to drive chain optimizations through its flagship native perpetual contract DEX, which are key missing pieces in the design of general purpose chains.

It is important to note that the L1 state includes all margin and matching engine states. Importantly, Hyperliquid does not rely on off-chain order books. A core design principle is to be fully decentralized and achieve a consistent transaction order through BFT consensus.

Delay

The current consensus algorithm uses an optimized consensus algorithm called HyperBFT, which specifically optimizes end-to-end latency. End-to-end latency refers to the duration from sending a request to receiving a confirmation response.

For orders from geographically close clients, the median end-to-end latency is 0.2 seconds and the 99th percentile is 0.9 seconds. This performance allows users to easily migrate automated strategies from other crypto trading platforms with almost no modifications, while also providing instant feedback through the UI.

Throughput <br/>The mainnet currently supports ~100k orders/second. The current bottleneck is execution. The consensus algorithm and network stack are capable of scaling to millions of orders per second, and throughput will increase further once execution capabilities are improved. There are plans to further optimize the execution logic as the need arises.

HyperEVM (testnet only)

Hyperliquid L1 includes a general-purpose EVM (Ethereum Virtual Machine) as part of the blockchain state. It is worth noting that HyperEVM is not a separate chain, but is secured by the same HyperBFT consensus mechanism as the rest of L1. This enables EVM to interact directly with local components of L1, such as spot and perpetual order books.

For example, ERC 20 tokens are fungible with their associated native spot assets. Users can trade project tokens on the native spot order book with minimal fees and deep liquidity, while seamlessly using the same assets in applications built on top of the EVM.

Bridge

Hyperliquid uses an EVM bridge secured by the same validator set as Hyperliquid L1.

Deposits: Deposits are signed by validators on L1 and are credited when more than 2/3 of the staking power signs the deposit.

Withdrawals: When withdrawing from L1, the funds are immediately held in escrow on L1 and the validator signs the withdrawal as a separate L1 transaction. When 2/3 of the staking power signs the L1 withdrawal, an EVM transaction can be sent to request a withdrawal.

Withdrawal dispute period: After a withdrawal request, there is a dispute period during which the bridge can be locked to prevent malicious withdrawals and ensure that withdrawals are consistent with L1. To unlock the bridge, a cold wallet signature from 2/3 of the stake-weighted validator set is required.

Withdrawal confirmation: After the dispute period ends, the system will send a final confirmation transaction to distribute USDC to the corresponding destination address.

Validator set maintenance: There is a similar mechanism for maintaining the active validator set and their corresponding stakes in the bridge contract.

Withdrawal fee: Users do not need to provide Arbitrum ETH when withdrawing. Instead, they need to pay a withdrawal fee of 1 USDC on L1 to pay the validators Arbitrum gas fee.

The bridge and its logic related to L1 staking have been audited by Zellic.

Clearinghouse

The Perpetual Contract Clearing House is a core component of the Hyperliquid L1 exchange state. It manages the perpetual contract margin status of each address, including balances and positions.

Deposits: Deposits are first credited to the cross-margin balance of the address. Positions are also opened in cross-margin mode by default.

Orphan Margin: Orphan margin is also supported, which allows users to allocate margin to a specific position, isolating the liquidation risk of that position from other positions.

Spot Clearing House: Similarly, the spot clearing house manages the spot user status of each address, including token balances and holdings.

Oracle

Validators are responsible for publishing spot oracle prices for each perpetual swap asset every 3 seconds. These oracle prices are used to calculate funding rates and are a component of the mark price, which is used for margin, liquidation, and triggering take profit/stop loss (TP/SL) orders.

The spot oracle price is calculated by each validator using a weighted median of the spot prices of Binance, OKX, Bybit, Kraken, Kucoin, Gate IO, MEXC, and Hyperliquid. The weights of each platform are: 3, 2, 2, 1, 1, 1, 1, 1.

The oracle price ultimately used by liquidators is the weighted median of the oracle prices submitted by each validator, with validators weighted by their staked amount.

Order Book

The Hyperliquid L1 state includes an order book for each asset. The order book works in much the same way as all centralized exchanges. The price of an order must be an integer multiple of the minimum price change unit (tick size), and the quantity of an order must be an integer multiple of the minimum transaction volume (lot size). Orders are matched according to the price-time priority rule.

The operation of the order book requires reference to the clearing house, as all positions and margin checks are handled by the clearing house. Margin checks are done once when a new order is opened, and again on the order maker each time an order is matched. This ensures that the margin system remains consistent even after an order is placed due to oracle price fluctuations.

Summarize

For the platform token HYPE, it plays a key role in the HyperLiquid ecosystem, has multiple functions, and enhances the practicality and decentralization of the platform. HYPE can be staked to secure HyperBFT, an optimized proof-of-stake (PoS) consensus mechanism that ensures network security and promotes decentralization. In addition, HYPE is the native fuel token of HyperEVM, used to pay transaction fees. The high trading volume at the launch of HYPE marks the growing emergence of decentralized exchanges (DEX) and perpetual contract platforms. DEX is increasingly becoming the preferred platform for token issuance, bypassing centralized exchanges (CEX) that have been criticized for their lack of transparency and community docking.

3. Industry data analysis

1. Overall market performance

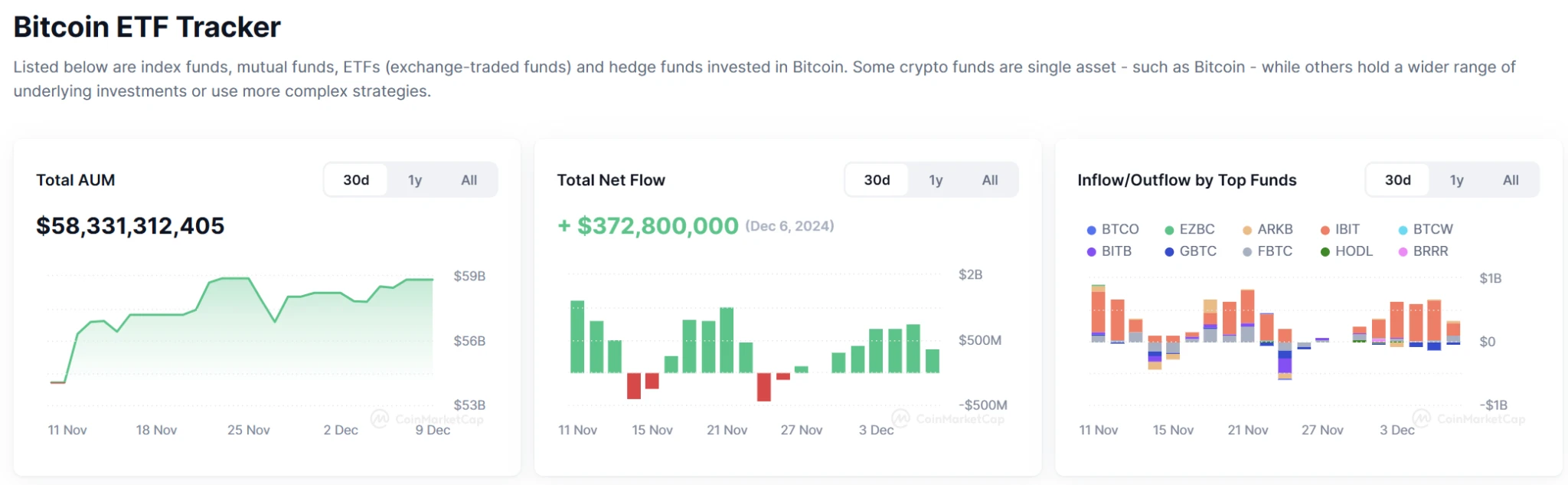

1.1 Spot BTCÐ ETF

Analysis

Last week (December 2 to December 6, Beijing time), Bitcoin spot ETFs had a net inflow of $2.73 billion, reaching the second highest weekly net inflow in history. Among them, Grayscale ETF GBTC had a net outflow of $303 million, and the current historical net outflow of GBTC is $20.82 billion. The Bitcoin spot ETF with the largest weekly net inflow last week was BlackRock ETF IBIT, with a weekly net inflow of $2.63 billion, and the current total net inflow of IBIT is $34.37 billion. The second is Fidelity ETF FBTC, with a weekly net inflow of $262 million, and the current total net inflow of FBTC is $11.72 billion.

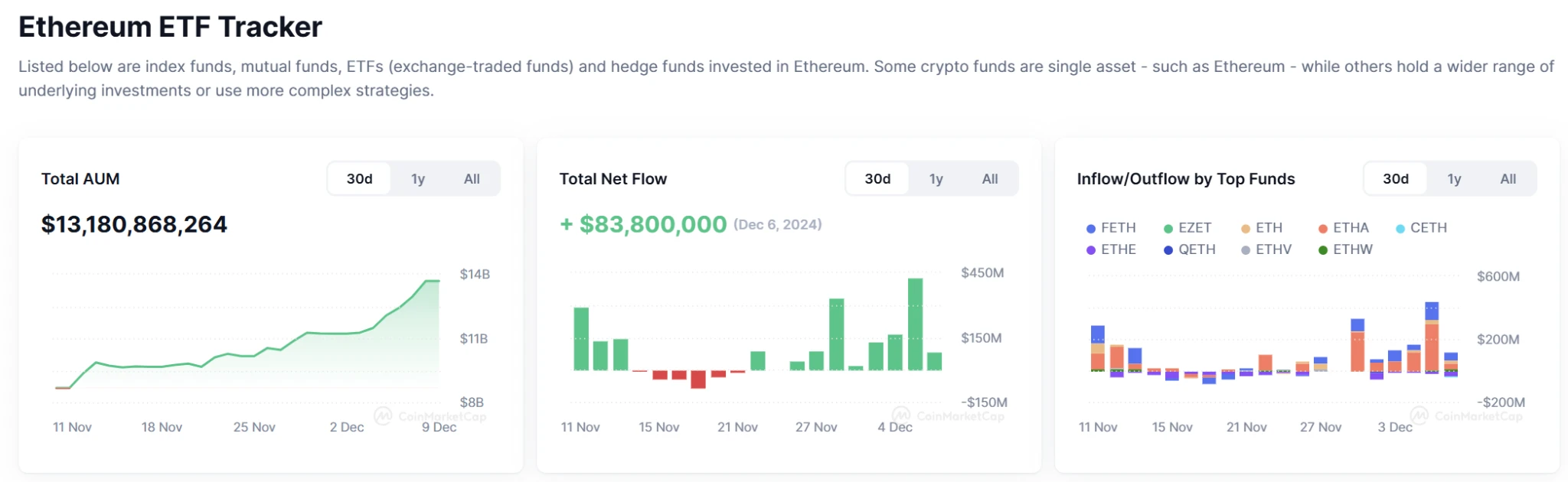

Analysis

Last weeks trading day (Beijing time December 2 to December 6), the Ethereum spot ETF had a net inflow of US$837 million last week, reaching a record high for weekly net inflow. Among them, Grayscale Ethereum Trust ETF ETHE had a weekly net outflow of US$101 million, and the current historical net outflow of ETHE is US$3.47 billion. The Ethereum spot ETF with the largest weekly net inflow last week was Blackrock Ethereum ETF ETHA, with a weekly net inflow of US$573 million, and the current total net inflow of ETHA is US$2.68 billion. The second is Fidelity Ethereum ETF FETH, with a weekly net inflow of US$296 million, and the current total net inflow of FETH is US$1.12 billion.

Ethereum spot ETF total net outflow of $10.9256 million (November 1, EST)

1.2. Spot BTC vs ETH price trend

Analysis

Last week, BTC whales finally started to take profits after the price broke through $100,000. Of course, judging from the magnitude of the spike in the middle of the week, this wave of profit-taking only accounted for a small part, and the deleveraging operation has just begun. Therefore, regardless of whether the recent contract traders are long or short, medium- and long-term holdings are at risk of being liquidated by spikes, so choosing short-term and ultra-short-term operations may be the best strategy.

For spot holders, the fact that the bottom has remained above $90,000 in the past two weeks means that bulls are currently resting. If the price forms a shock box in the range of $90,000 to $103,800 in the next week or even a month, there is a probability that it will continue to rise and set a new high, but this cycle may be longer. Once it falls below the bottom of the box at $90,000, you can directly pay attention to the support range of $86,000 to $88,000. If the price runs to this range, it will be a low-cost buying point.

Analysis

Ethereum started a relatively stable upward trend after Bitcoin entered a pullback period of failed highs. However, given that the current price hit the resistance of the high point of $4,100 in March this year and then failed to retreat, it means that at least in the short term, this resistance has become the biggest obstacle for bulls. However, if the short-term retracement can stabilize above the support of $3,880, then the probability of hitting a new high this week is high. However, if the subsequent rebound volume continues to shrink, there is a probability that a staged top will be formed and then a small box shock market will start for a period of time. As long as the subsequent retracement does not fall below $3,550, Ethereums bullish trend will remain unchanged. Otherwise, it will enter a battle to defend $3,000.

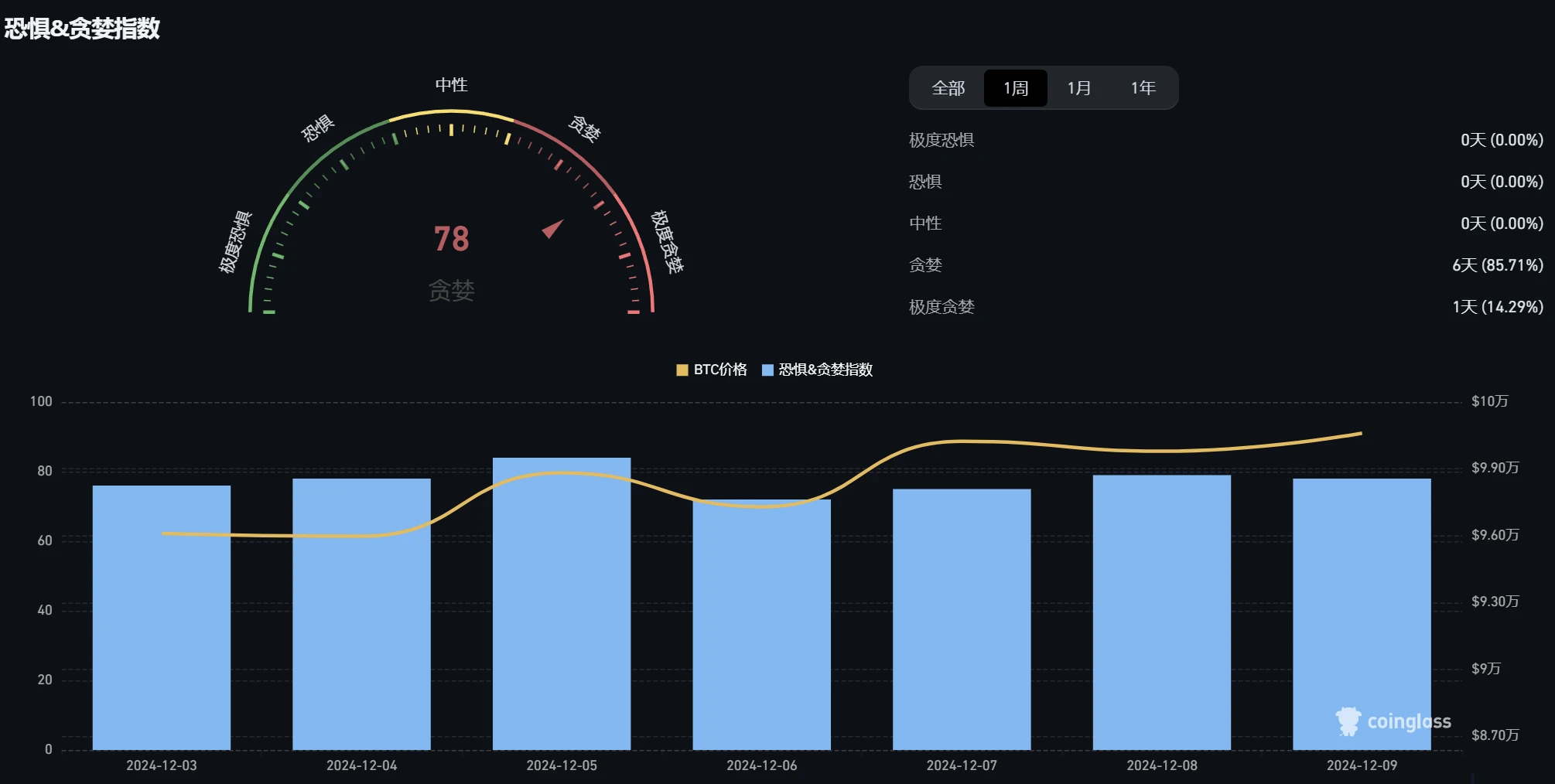

1.3. Fear Greed Index

Analysis

This week, Bitcoin and other major cryptocurrencies have experienced large price fluctuations, which has affected market sentiment. Although Bitcoin and some mainstream cryptocurrencies have performed well recently and prices have continued to rise, there is still a certain degree of uncertainty and panic in the market compared to the extreme greed stage. In November and early December 2024, the rise in Bitcoin prices was accompanied by a certain retracement, causing some investors to become alert and dare not let go completely. Such cautious sentiment has put the market in a state of greed but not extreme greed.

2. Public chain data

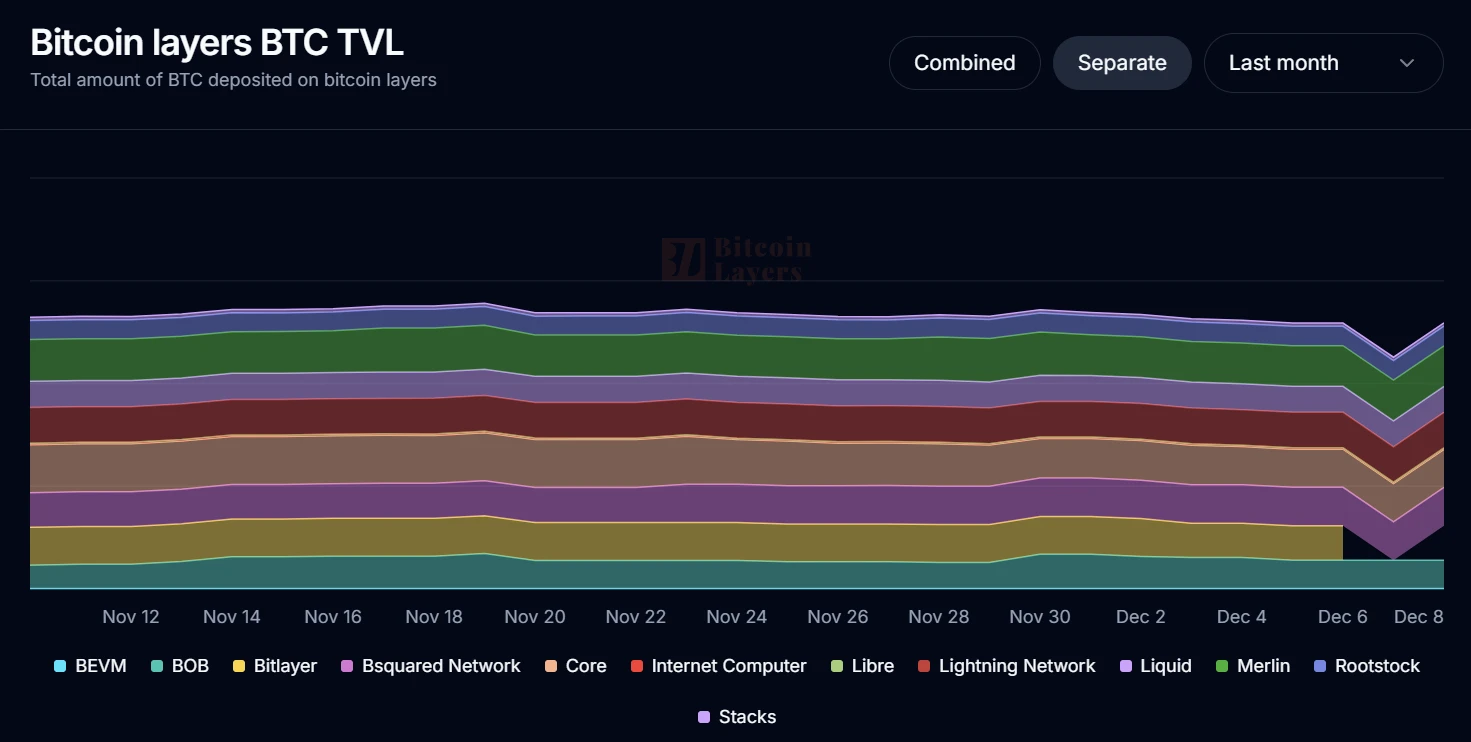

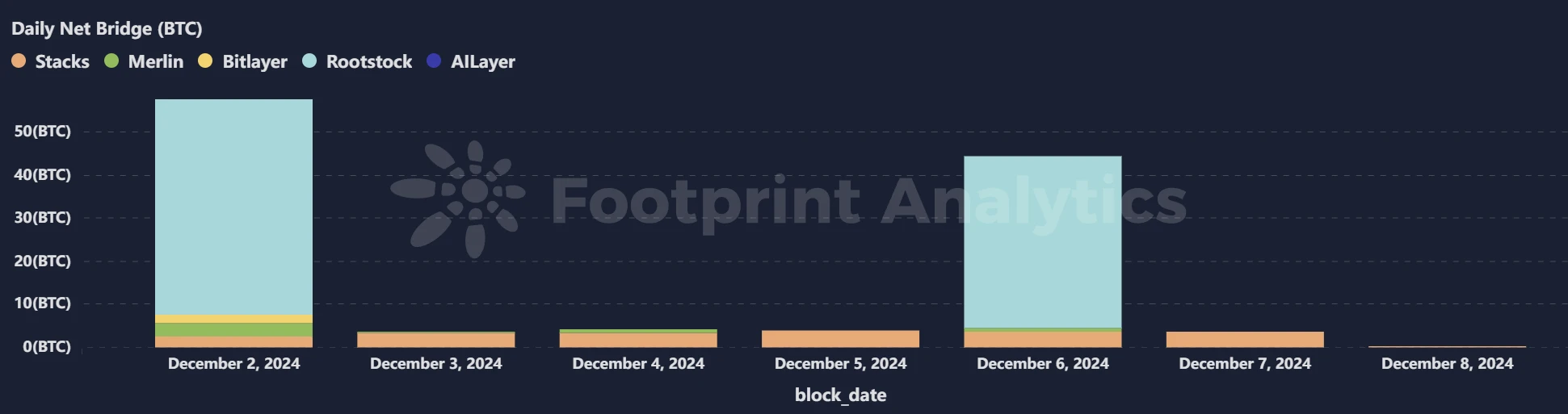

2.1. BTC Layer 2 Summary

Analysis

This week, BTC L2 TVL fell first and then rose. On the 7th, except for BEVM, the other top L2s all fell to varying degrees, but then rebounded the next day. From the perspective of the number of bridged BTC, Rootstock became a shining star last week.

Unlike other Layer 2 solutions such as Ethereum or Polygon, Rootstock aims to bring smart contracts and DeFi functionality to the Bitcoin ecosystem while maintaining the security of the Bitcoin network. It achieves this goal through sidechain technology, making it easier for Bitcoin to interact with DeFi and smart contracts. Rootstock is designed to take advantage of Bitcoins security and decentralization, which is an important attraction for users who want to use Bitcoin without completely leaving the Bitcoin ecosystem. Therefore, more Bitcoin holders are willing to choose Rootstock as a bridge channel.

Rootstock may have recently upgraded or enhanced its bridging service, making cross-chain transfers of Bitcoin more efficient and cost-effective. This technical improvement and the smoothness of the network may have attracted more BTC holders to participate in Rootstocks L2 ecosystem, promoting the number of Bitcoin bridges.

As DeFi applications and liquidity pools on Rootstock increase, BTC holders may see more diverse investment and yield opportunities, further promoting Rootstock to become the preferred platform for BTC bridging L2.

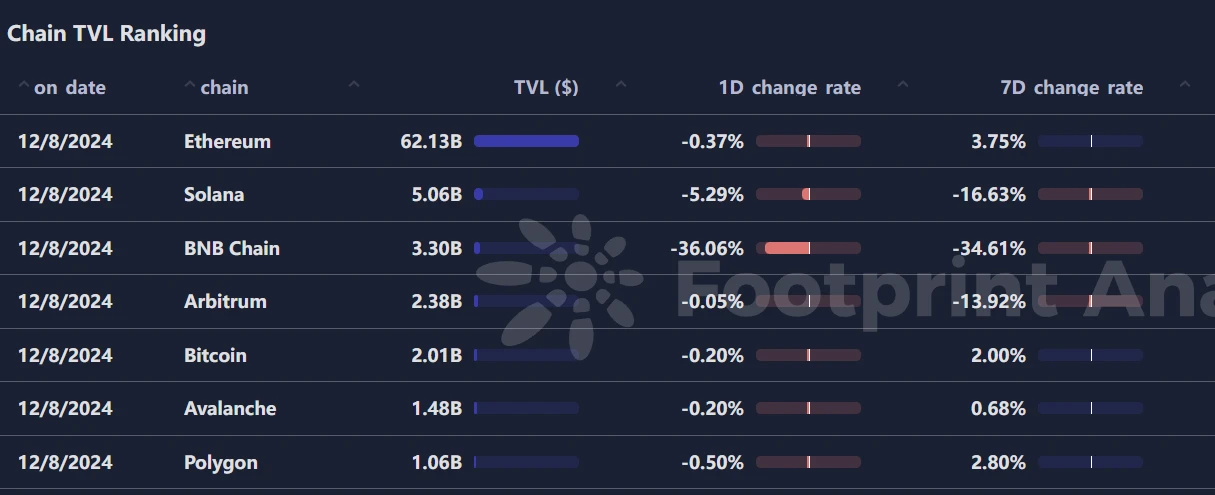

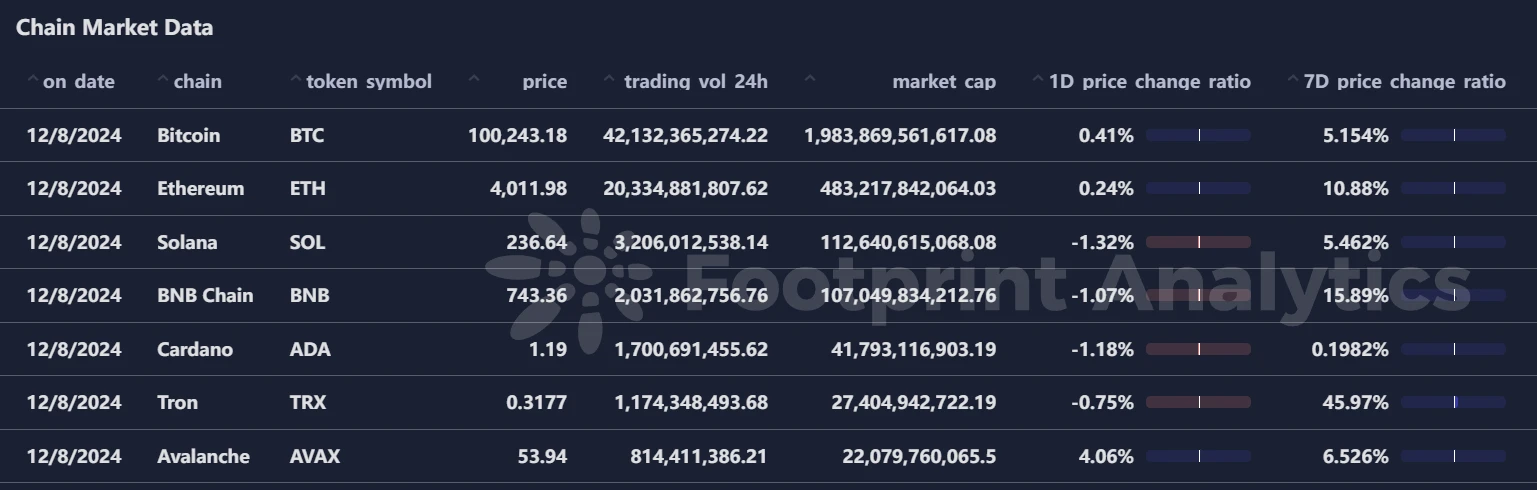

2.2. EVM non-EVM Layer 1 Summary

Analysis

Although the public chain had a certain degree of negative growth in TVL last week, and Solana and BNBchain had a large amount of capital outflow, the top L1 protocols all had positive growth in platform token prices, among which BNB and TRX became the most dazzling stars.

The Tron blockchain is accelerating its expansion in the fields of decentralized finance (DeFi) and NFT, attracting more developers and users. TRXs gains are partly due to its increased market share in these fields. For example, the increased activity in the decentralized lending, trading, and NFT markets in the Tron ecosystem has directly driven the demand for TRX.

Justin Suns influence in the market has also had a positive impact on TRX prices. Sun has enhanced the overall strength of the Tron ecosystem in recent years by acquiring other projects (such as BitTorrent) and continuously promoting Trons cooperation with other mainstream blockchain projects. These initiatives have helped to enhance TRXs position in the market, which in turn has driven its price up. Trons cross-chain capabilities and cooperation with other blockchains (such as cross-chain bridges with Ethereum, Binance Smart Chain, etc.) have increased the market demand for TRX. This cross-chain capability provides TRX with a larger market space and drives up prices.

The sharp rise in BNB and TRX prices in the first week of December 2024 was driven by multiple factors, including innovation and expansion of their respective platforms, recovery in market sentiment, increased risk appetite among investors, and linkage with Bitcoin and the overall market. BNBs rise benefited from Binances compliance progress and expansion of its decentralized platform, while TRXs rise was closely related to the growth of the Tron blockchain in the DeFi and NFT sectors.

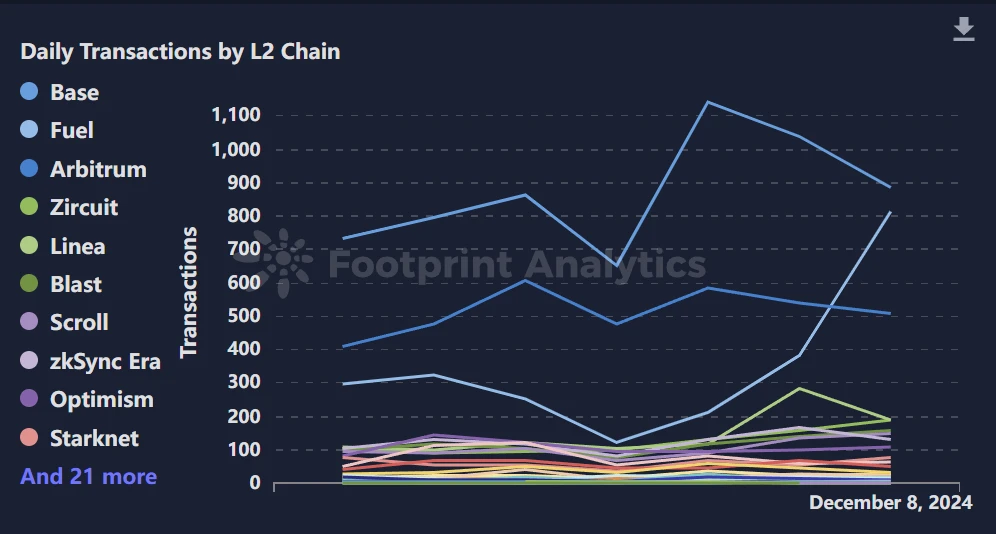

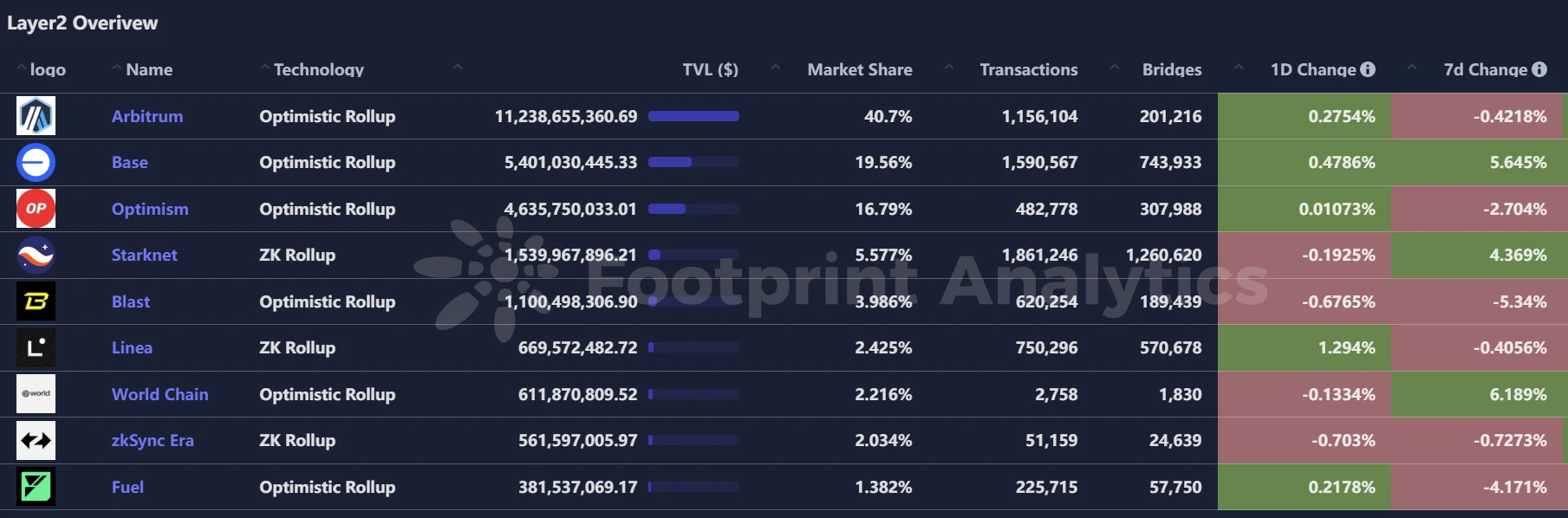

2.3. EVM Layer 2 Summary

Analysis

Last week, in L2, Base, Starknet and Worldchain became the top TVL protocols with positive growth.

Among them, the Base network is the most active. Clanker has undoubtedly become the main contributor to most of the activity on the chain. Since its launch, Clankers transaction volume has reached 1 billion US dollars and its revenue has reached 10 million US dollars. Base ecological AI agent aixbt launched the Meme token CHAOS on the Base network through the Simulacrum AI agent. The market value of CHAOS token once reached 20 million US dollars.

Base credit currency market 3 Jane will start private testing in the first quarter of next year. 3 Jane aims to provide crypto users with instant, permissionless credit lines, secured by their creditworthiness and future cash flows. It is underwritten based on on-chain assets, verifiable Coinbase balances, bank cash and cash flows, and FICO scores, unifying on-chain and off-chain credit data. USD 3 will serve as its yield stablecoin and will be supported by a credit pool, allowing depositors to provide USDC minting.

For Starknet, the biggest benefit is that Lido announced that wstETH has been launched on Starknet, supporting users to use the StarkGate cross-chain bridge to cross wstETH to the Starknet ecosystem. The subsequent cross-chain bridge StarkGate v2.0 was officially launched on the mainnet. This version improves the user experience, adds support for more tokens, and additional features for all bridgegoooors. This version will make Starknets data more efficient, and the Blob Gas cost on the mainnet has been reduced by about 5 times, which means that the fees for all Starknet users will become lower.

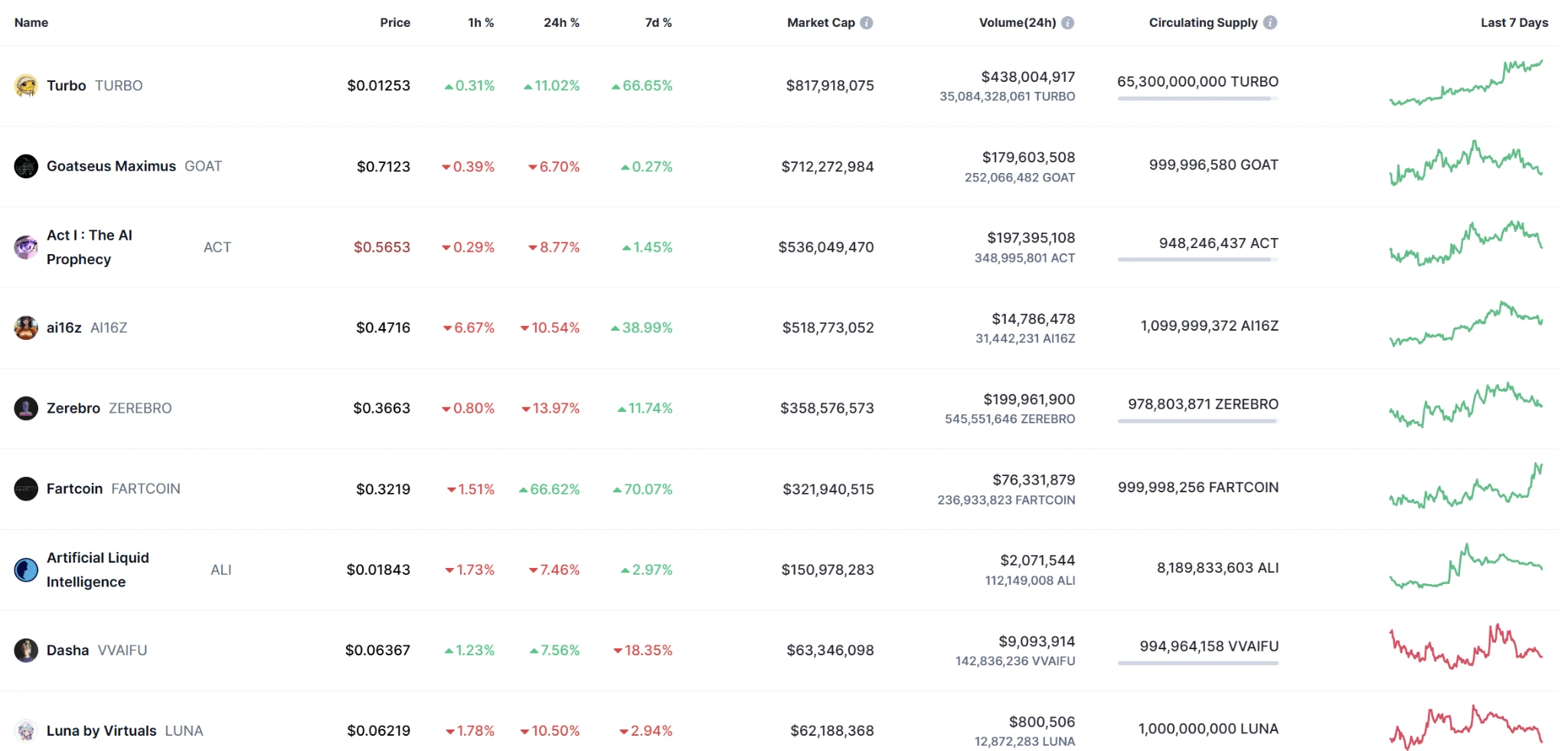

2.4. AI meme Summary

Analysis

Since Hashkey Global, Coinbase International Station and Bithumb launched Turbo in the last two months, unlike many other memecoins, TURBO may be associated with artificial intelligence technology to some extent. This combination makes it more than just a pure entertainment token, and it may also attract investors who are interested in AI through AI applications, technical endorsements or brand influence. Although it belongs to the memecoin category, TURBO may also provide additional value through certain decentralized financial (DeFi) applications or AI-driven smart contracts. For example, there may be some application scenarios that combine AI technology with TURBO tokens to enhance its practicality in the blockchain ecosystem.

As for another star, Fartcoin, it is a typical memecoin with highly entertaining and social-driven characteristics. Its name and concept are full of humor and spoof, aiming to attract investors through community support and social media spread. Like other memecoins, the value of Fartcoin may be mainly affected by speculative funds and social media effects, rather than supported by technology or practical applications. Investors interest in this token is usually short-term, focusing more on price fluctuations and speculative opportunities rather than the long-term potential of the token.

4. Macroeconomic data review and key data release nodes next week

In November, the number of new non-farm jobs reached 227,000, far exceeding the market expectation of 200,000 and significantly higher than the previous value of 36,000. This data shows that the US labor market is gradually recovering, even after the disruptions of hurricanes and Boeing strikes.

The unemployment rate rose slightly to 4.2%, in line with expectations, but up from the previous value of 4.1%. Analysts pointed out that this increase may be more of a short-term fluctuation, and the overall job market is still improving.

Important macro data nodes this week (December 9-December 13) include:

December 11: U.S. November unadjusted CPI annual rate

December 12: Initial jobless claims in the United States for the week ending December 7 (10,000 people)

V. Regulatory policies

Influenced by positive news such as Trumps nomination of Paul Atkins as SEC Chairman, Bitcoin broke through the $100,000 mark on December 5. The market predicts that after Trump takes office, the review of crypto companies listed on the US stock market will be simplified, and the influence of the crypto industry in the entire financial field will be further amplified. Subsequently, loose regulation has gradually surfaced.

USA

On December 5, President-elect Trump announced that he would nominate Paul Atkins as Chairman of the U.S. Securities and Exchange Commission (SEC). If the nomination is confirmed by the Senate, Atkins will take over the leadership of this major U.S. regulatory agency with a broad mission, including protecting investors, monitoring markets, and combating fraud.

On December 6, Trump nominated David O. Sacks as the Crypto Czar, whose specific position is the White House Director of Cryptocurrency and Artificial Intelligence, responsible for leading U.S. policy and regulatory affairs in the field of cryptocurrency.

Russia

On December 4, Putin spoke at an investment forum in Moscow, advocating BTC as a global reserve asset instead of the U.S. dollar. In addition, Putin also criticized the U.S. government, saying that it used the dominance of the U.S. dollar to further control the currencies of other countries and thus influence their politics.

Czech Republic

On December 6, Cointelegraph reported that the Czech Republic, with the unanimous consent of the parliament, exempted Bitcoin held for more than three years from capital gains tax.

India

On December 4, Cointelegraph reported that the Indian government found that major crypto exchanges including Binance and WazirX owed a large amount of goods and services tax (GST). Pankaj Chaudhary, Minister of State for Finance of India, said that the government found that several cryptocurrency exchanges owed 82.4 billion rupees (97 million U.S. dollars) in GST. According to reports, the authorities have launched several related investigations into cryptocurrency exchanges, including WazirX, CoinDCX and CoinSwitch Kuber. Indian law enforcement agencies had asked Binance to pay 72.2 billion rupees (85 million U.S. dollars) in unpaid taxes in August.

Hong Kong

Hong Kong, China will submit the Stablecoin Bill to the Legislative Council for first reading on December 18. The bill aims to improve the regulatory framework for virtual asset activities to address the potential risks posed by fiat stablecoins to financial stability, ensure that users have adequate protection, and maximize the benefits that virtual assets and related technologies can bring. Under the proposed licensing system, anyone who conducts any of the following activities must first obtain a license from the Monetary Authority: issue a fiat stablecoin in Hong Kong in the course of business; issue a fiat stablecoin that claims to be anchored to the value of the Hong Kong dollar in the course of business; or actively promote the issuance of its fiat stablecoin to the Hong Kong public.