Original author: BitMEX

Welcome back to our weekly analysis of options investment strategies. Today, we will share a unique trading opportunity that stems from a significant difference in Bitcoin prediction probabilities between the BitMEX options market and prediction platform Polymarket.

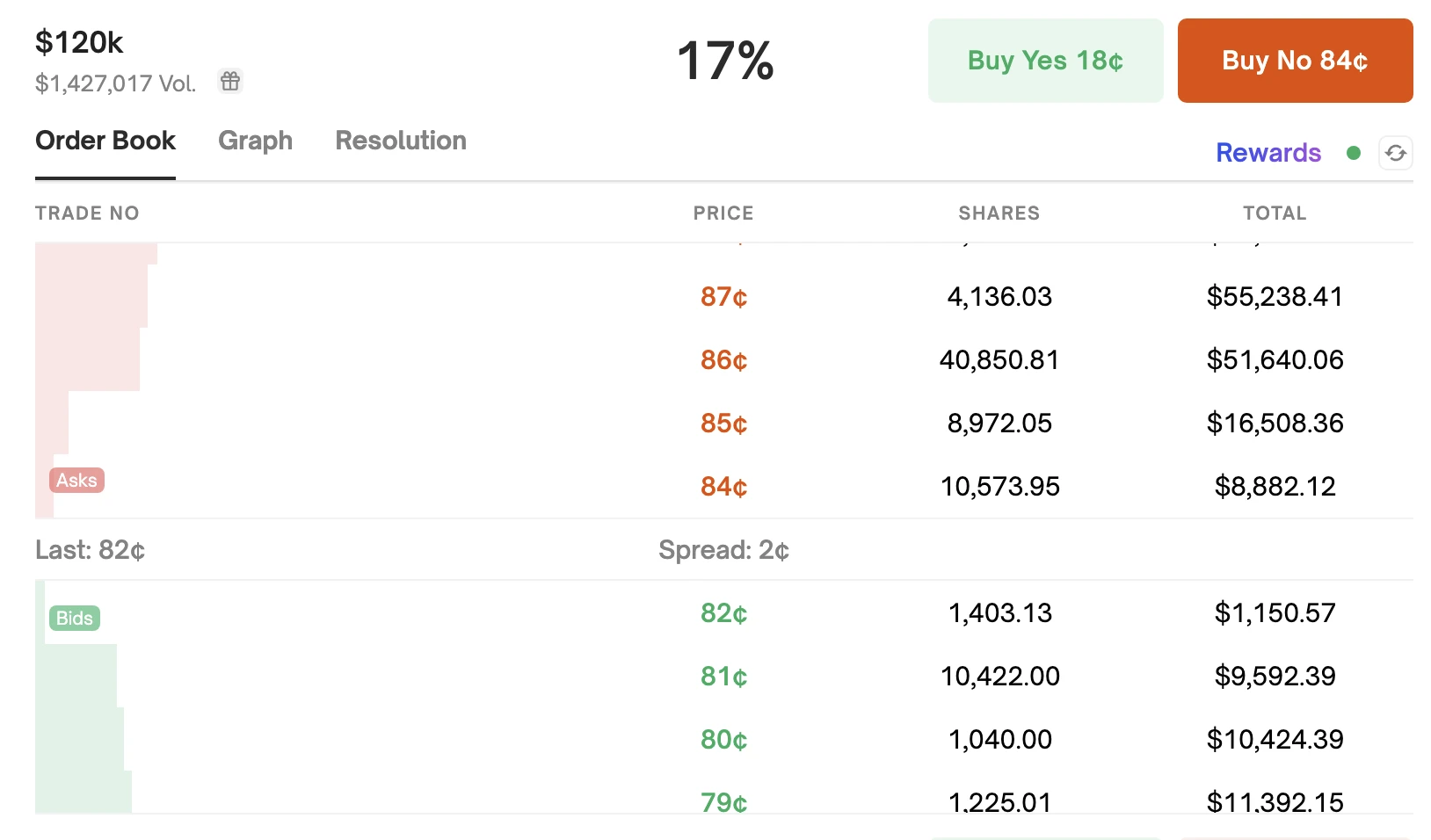

The last out-of-the-money Bitcoin call option with a strike price of $120,000 (expiring on December 27) on BitMEX shows that the risk-neutral probability of Bitcoin reaching this price is about 8%. However, participants on the Polymarket platform have priced the probability of Bitcoin reaching $120,000 before December 31 at about 17%. This significant difference may bring arbitrage opportunities for savvy traders.

In this article, we take a closer look at this price mismatch, detail how the 8% probability is calculated, propose a trading strategy to exploit this discrepancy, and highlight key risks — specifically when even a slight increase in Bitcoin could result in a loss.

Let’s start with the detailed analysis.

Differences between BTC options implied probability and Polymarket

Polymarket prediction markets show a 17% probability of BTC reaching $120,000 by December 31 — more than double the options-implied probability of 8%.

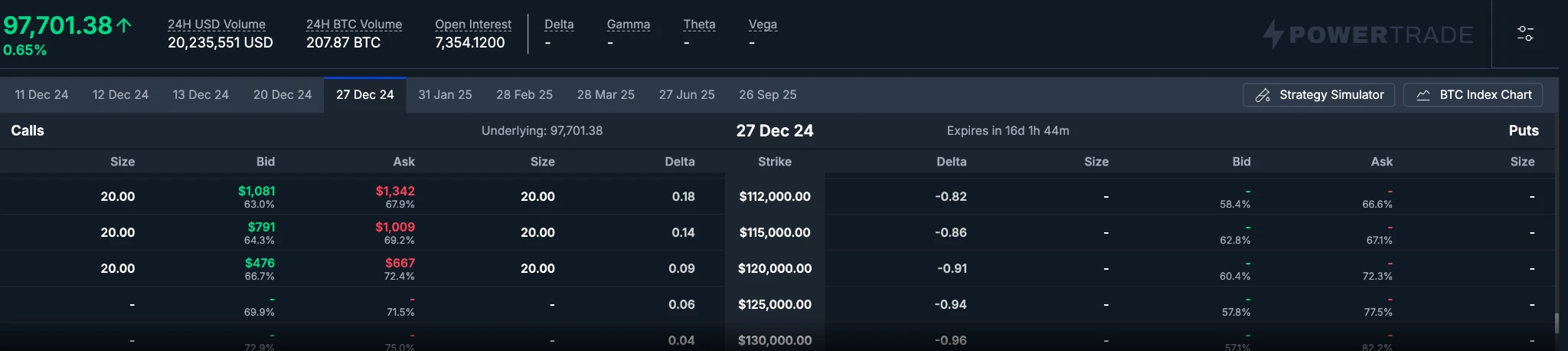

The calculation process of 8% implied probability in BitMEX options market:

Lets do a quick calculation using the Black-Scholes model (omitting some intermediate steps):

Spot Price(S): $97,500

Exercise Price(K): $120,000

Remaining term (T): about 16 days, or 0.0438 years

Risk-free rate (r): 4.5%

Implied volatility (σ): 72.4%

By calculating the parameter d 2, we can get the risk-neutral probability N(d 2)

Final result:

N(d 2)≈ 0.08, or 8%

This suggests that the options market (which is typically more mature and closer to fair risk-neutral pricing) assesses the probability of Bitcoin breaking $120,000 much lower than the sentiment-driven pricing in the prediction market. This difference creates an opportunity for arbitrage.

Arbitrage strategy: short Polymarket and buy out-of-the-money call options

If you agree with the more conservative 8% probability assessment of the options market, then the 17% pricing on Polymarket may be too optimistic. Here is the specific strategy:

1. Sell the Yes contract on Polymarket (17%): If Bitcoin does not reach $120,000 before December 31, you will receive the entire premium proceeds.

2. Buy a $120,000 Bitcoin call option (expiring on December 27): This option is priced closer to the 8% probability assessment and can provide hedging protection when Bitcoin breaks through $120,000 before December 27. If Bitcoin rises sharply, the option gains can offset Polymarkets losses.

Strategic advantages:

You are essentially betting that Polymarket is overestimating the likelihood of Bitcoin breaking $120,000, while using that discrepancy to buy relatively cheap out-of-the-money call options.

Call options act as a hedging tool, providing protection if the price of Bitcoin surges.

Specific operation method

Example analysis:

Assume that a $120,000 call option on BitMEX costs $654.

Short the Yes contract on Polymarket at $0.18. To cover the $654 option cost, you need to short approximately 3,633 Polymarket contracts (approximately $654).

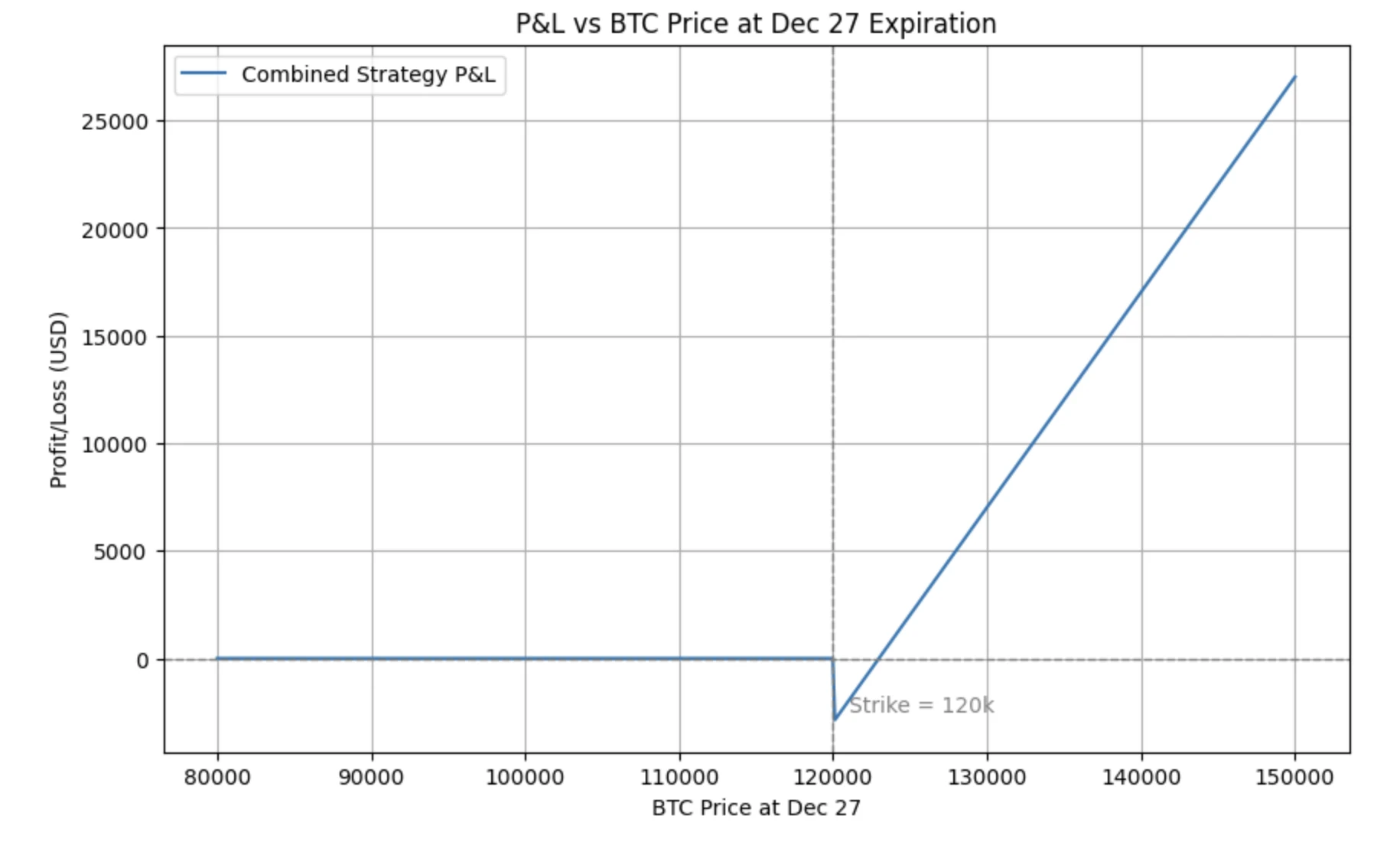

Scenario Analysis and Revenue Structure

1. Scenario 1: Bitcoin does not reach $120,000 before December 31

○ The call option expires at zero ($654 loss)

○ Polymarket Yes contract is not triggered, you keep the $654 profit

Net result: roughly unchanged

2. Scenario 2: Bitcoin breaks through $120,000 before December 27 Assuming Bitcoin reaches $130,000 at the expiration date on December 27

○ Call option: Intrinsic value = 130,000 - 120,000 = $10,000 gain

○ Polymarket: Event occurred, $3,633 to be paid ($1 per contract)

Net Profit: 10,000 - 3,633 = 6,367 USD, a significant profit

3. Main Risk: Bitcoin Only Slightly Surpasses $120,000 Assume that Bitcoin reaches $121,000 on December 27. At this point the event is likely to occur before December 31 and the Polymarket Yes contract will settle at $1.

○ Call option profit: 121,000 - 120,000 = 1,000 USD

○ Polymarket payment: $3,633

Net loss: 1,000 - 3,633 = -2,633 USD

This is a key risk point: if Bitcoin only slightly exceeds $120,000, your option gain is limited, but you still have to pay the full $3,633 Polymarket payout. Since we are trying to fully offset the option cost by shorting a large number of Polymarket contracts, the fixed Polymarket payout may far exceed the small option gain. In short, a small breakout of Bitcoin (only slightly exceeding $120,000) will result in a large net loss.

Risk Warning

Expiration mismatch: The option expires on December 27, while the Polymarket contract lasts until December 31. Bitcoin may not break $120,000 until after the option expires, at which point you will lose the option hedge protection.

Non-linear payoff structure: The most dangerous area is just above $120,000. If Bitcoin fails to break through the strike price significantly, the fixed $1 payout per Polymarket contract may far exceed your small option profit.

Difference between risk-neutral and actual probabilities: Option markets use risk-neutral probabilities, while polymarkets may reflect market sentiment. This difference may persist or widen.

Market liquidity and execution risk: Spreads, slippage and position size are all important. Large transactions may affect market prices and undermine the initial strategy settings.

The magnitude of the breakout is critical: only a significant breakout above $120,000 would be necessary for options gains to significantly outweigh Polymarket’s losses.

Summarize

This strategy targets the 8% probability difference between the options market and the prediction market, which is 17%. On the surface, it looks tempting: short a potentially overvalued contract on Polymarket, while hedging with relatively cheap out-of-the-money call options.

However, the risks cannot be ignored. If Bitcoin breaks through $120,000 modestly, the option gains may not be enough to offset the huge Polymarket payout, resulting in a large loss. This strategy requires careful consideration of various ratios, payoff structures, and target prices. If you do not have a strong belief that Bitcoin is either well below $120,000 or breaking through significantly, you may be stuck in a costly middle ground.

Please trade with caution, control your positions appropriately, and always pay attention to the maturity mismatch and yield curve shape before deciding whether to deploy this strategy.