1. Outlook

1. Macro-level summary and future forecasts

November CPI is the last major data that Fed officials will focus on before the December monetary policy meeting. The market generally believes that milder inflation data may not change the Feds decision, and the Fed may continue to cut interest rates in December.

Although a rate cut in December has become a general consensus, some economists said that upward price pressure in the United States remains stubborn, which sends a signal for the Federal Reserve to cut interest rates more cautiously in the coming year.

2. Cryptocurrency market changes and warnings

On December 9, the global cryptocurrency market experienced a violent deleveraging process. On this day, market volatility rose sharply, and investors sold assets to reduce leverage, causing cryptocurrency prices to fall sharply in a short period of time. However, unexpectedly, after this wave of violent deleveraging, the overall cryptocurrency market quickly stabilized and showed a strong rebound momentum. Subsequently, the market as a whole continued to climb, and most currencies not only recovered their lost ground, but also set new highs.

Although market sentiment has fluctuated from time to time, overall, the cryptocurrency market has remained relatively stable amid high volatility. This trend shows that market participants still have strong confidence in the future of the cryptocurrency market, and investors remain optimistic about the development prospects of the industry.

3. Industry and track hot spots

Influenced by the arrest of Luigi Mangione on murder charges, the market value of the meme coin Luigi Inu inspired by him reached a new high of $60 million, and the BRIAN cryptocurrency appeared at the same time; Google released the Willow quantum chip, which triggered controversy over the security of Bitcoin. Although mainstream encryption experts said that the chip is not enough to threaten Bitcoin at present, it highlights the importance of post-quantum encryption.

The native chain game Seraph combines blockchain technology. Players can play for free and obtain rare assets through the game. It has a unique economic model and NFT equipment system. The $SERAPH token has multiple uses, but the game faces the difficulty of finding a balance between long-term player participation and providing rewards for participants contributions; the supercomputer project Nexus completed a US$25 million Series A financing round and launched a test network, aiming to realize the application of verifiable computing on an Internet scale, and improve the total throughput and proof efficiency of zkVM through a variety of technologies.

2. Market hot spots and potential projects of the week

1. Performance of hot tracks

1.1. LUIGIs market value reaches an all-time high of $60 million after Luigi Mangione was arrested on murder charges

Luigi Inu, a meme coin inspired by Luigi Mangione, hit a new high of $60 million in market value. The market volatility coincided with the arrest of Mangione by Pennsylvania police for murder.

So who is Luigi Mangione? According to police, Luigi Mangione is suspected of being involved in a premeditated and well-planned attack that killed Brian Thompson, CEO of UnitedHealthcare, in Manhattan. Surveillance video also captured Luigi Mangione leaving the scene shortly after the shooting. In addition, Mangione also published a declaration of dissatisfaction with American companies, which further fueled the spread of meme coins associated with him.

Tokens like LUIGI inspire the fear of missing out (FOMO) by leveraging viral narratives associated with wealth, similar to sports betting, a point supported by Alex Beene. However, these tokens lack the fundamental value and stability of traditional assets, making them highly volatile and risky to invest in.

The tracking data for a cryptocurrency called “BRIAN” with the tagline “Justice for Brian Thompson” is shown. The data shows that its market cap has dropped 25.23% to $68,000, with a 24-hour trading volume of $691,000 and liquidity of $33,000.

Many netizens are trading LUIGI tokens, with some actively supporting the anti-establishment ideas that Mangione is believed to be promoting. However, there are also many in the cryptocurrency community who condemn the incident and seek justice for the victims. In addition, a new token called $BRIAN has emerged with the goal of seeking justice for Brian Thompson.

Reviews

As an alternative meme, LUIGI does not belong to the theme currently favored by the mainstream cryptocurrencies. That is to say, apart from AI, Desci and Musk-related themes, this theme has not been verified by the market for a long time. Therefore, it is most likely the result of short-term speculation. From the market point of view, as of now, the price has fallen 64% from the highest point. If it stabilizes around US$0.02085, you can consider buying the dip in moderation. If it falls below, the support will be around US$0.0188.

1.2. Googles Willow quantum chip has brought the Bitcoin security controversy forward by 10 years. Is this a threat to Bitcoin?

Google recently released its latest innovation, the Willow quantum computing chip, sparking discussions in the crypto community about its potential impact on the security of Bitcoin encryption.

On December 9, Google CEO Sundar Pichai described the Willow chip as a breakthrough in quantum computing. The chip has a reduced error rate and 105 quantum bits, reaching a new milestone in computing power.

A quantum leap in computing

Pichai revealed that the Willow chip completed a benchmark calculation in less than five minutes, which would take a modern supercomputer about 10 zettaseconds (10^24 seconds) - a time far exceeding the 13.8 billion years of the universes age.

In addition, Willows design uses low-error quantum gates and high-connectivity algorithms, marking an important step in the quest for scalable quantum computing.

This progress highlights the revolutionary changes that quantum computing could bring to fields that rely on complex calculations, such as drug development, nuclear fusion energy and battery design. Pichai pointed out: We see Willow as an important step in our journey to build a practical quantum computer with real applications.

However, this development has also raised concerns about the security of encryption systems, passwords and other cryptographic protection mechanisms.

Bitcoin security draws attention

Concerns quickly emerged about the potential impact of the Willow chip on Bitcoin’s cryptographic security, with critics arguing that the chip could weaken the top cryptocurrency’s security framework in the future.

However, experts in the mainstream encryption field say the technology is not yet sufficient to pose a threat.

Adam Cochran, a venture capitalist in the crypto space, noted that while the Willow chip highlights the importance of adopting post-quantum cryptography, it does not threaten Bitcoin at this time. He said the milestone means the crypto industry has a shorter timeline to address the risks of quantum computing than 10 years.

Cochrane further explained: “With this breakthrough, we see the timeline for Bitcoin and other cryptocurrencies to start taking post-quantum cryptography seriously shortened by 20 years. Another breakthrough of similar magnitude would make these issues rapidly imminent.”

Ava Labs co-founder Emin Gün Sirer expressed a similar view, emphasizing that Bitcoin is still safe at present. However, he suggested taking proactive measures, especially for the Bitcoin minted by Satoshi Nakamoto in the early days, which used the outdated payment to public key (P2P K) format. Unlike modern wallets, this format exposes the public key, which may cause potential vulnerabilities if quantum computing is further developed.

Sirer suggested freezing these early bitcoins or setting an end date for all P2P K-based transactions as a precautionary measure.

Reviews

The birth of quantum computing chips is indeed a leap in the field of computing. Once this super computing power is concentrated, it will indeed pose a strong threat to the security of Bitcoin. But from another perspective, evildoers are increasing the cost of doing evil. Honest miners will also use quantum chips to consolidate their walls for the benefit of their own network. Then, when the power of both good and evil is growing synchronously, the evil side will not have an advantage. Of course, the birth of high-computing-power chips will definitely change the landscape of the mining industry. Whether it can cause a Bitcoin fork is something the future market should worry about.

1.3. Can the Diablo-like native blockchain game Seraph take off with the upcoming revival of the NFT sector?

Seraph is an action role-playing (ARPG) looting game developed by Seraph Studio. The game is inspired by classic ARPGs and brings players an exciting and immersive experience. Players will embark on an epic adventure in the game, discover hidden treasures, and craft unique equipment.

Seraph combines engaging gameplay with innovative blockchain technology, allowing players to truly own in-game assets. By addressing the limitations of early crypto games, Seraph proves that blockchain games can deliver quality and fun comparable to traditional games. The game is designed to appeal to both cryptocurrency users and regular gamers, providing a smooth and refined gaming experience for everyone. Whether exploring its fascinating world or battling powerful enemies, Seraph promises an adventure like no other.

Players can play Seraph for free and earn rare in-game assets through the game. By equipping Seraph NFT equipment and other items, players can also generate Soul Spars in the game. Soul Spars are the key trading currency in the game and have a wide range of application scenarios. Its circulation is regulated by multiple parameters to manage inflation and maintain economic balance. In order to alleviate problems such as hyperinflation and negative cycles, Seraph uses a variety of mechanisms to encourage players to build their own equipment and develop unique game styles, thereby stimulating creativity and enhancing player engagement.

Seraph Gear NFTs (Gear NFTs for short) enhance the gameplay experience by providing unique properties and skills in the Seraph universe. Although these NFTs can be traded, their main purpose is to enrich the players gaming experience. Players can equip these items to improve their performance, especially in difficult dungeons. By enhancing NFTs, players can achieve additional customization, greater adaptability, and a deeper gaming experience. Each NFT Gear has the following properties: Treasure Value, Chaos Energy, and Chaos Affixes. To activate these properties, the NFT Gear must be embedded in the games gear. Players can un-embed at any time to restore the NFT to a tradable form.

$SERAPH is the native token of the Seraph ecosystem, designed to unlock game features, craft items, and drive player engagement.

Specific uses of $SERAPH tokens include:

Reforge Chaos Affixes on NFT gear every season.

Displays the properties of NFT equipment obtained through drops.

Participate in unique opportunities such as airdrops for Soul Spar and Seraph Gear NFTs.

Participate in future community governance activities.

Reviews

Crypto games face the difficulty of finding a balance between long-term player engagement and providing rewards for participant contributions. Many token economic models fail to address sustainability issues, resulting in poor player experience. Unsustainable systems often cause significant losses to participants, forcing them to make high-risk decisions or exit the ecosystem entirely.

These challenges highlight the need for a balanced approach to promote participation and stability in the ecosystem. In terms of Seraphs current economic model, it remains to be seen whether the setting of soul fragments can control the inflation of in-game tokens, and the role of SERAPH governance tokens seems to be closely linked to the in-game NFTs, that is, whether your NFTs are valuable requires players to first accumulate a certain amount of SERAPH in their accounts. In other words, the probability of getting valuable NFTs for free in this game is almost impossible. On the other hand, if the NFT has been identified and put on the shelf, then the role of SERAPH will be much smaller, which is one of the possible reasons for its future sale.

1.4. The Nexus supercomputer project, which has completed a $25 million Series A financing round, is now online!

This week, the supercomputer project Nexus launched a new test network. Nexus founder and CEO Daniel Marin said that just two hours after the new test network was released, it attracted the active participation of 10,000 users.

Nexus aims to enable internet-scale applications of verifiable computation. To this end, we propose a system by which the aggregate throughput of the Nexus zkVM can be increased by orders of magnitude. It does this by aggregating the collective CPU/GPU power of a heterogeneous network of computers to build an extremely parallelized large-scale proof generation system for the Nexus zkVM. This enables the zkVM to operate at a scale proportional to the collective computational power of the network (measured in CPU cycles per proof per second).

The Nexus zkVM process starts with a normal Rust program provided by the user. After compilation, it executes the program and generates a trace of its execution. The zkVM then divides the execution trace into multiple chunks, which are distributed to participating computers by the Nexus network, enabling an efficient and greatly parallelized proof process. Finally, the network aggregates these individual proofs together to generate a single concise proof as the final output of the machine.

Nexus Prover

For the first time, production-grade versions of folding scheme provers such as Nova, SuperNova, and HyperNova were implemented, supporting efficient incremental verifiable computation (IVC).

Nexus Virtual Machine (NVM)

A minimal, general-purpose virtual machine designed to optimize the performance of provers. NVM can run programs written in any high-level language, with a particular focus on Rust programs, or emulate any instruction set architecture (ISA) (e.g., RISC-V, EVM, Wasm) with minimal overhead.

Nexus precompilation system

Nexus precompilers extend the instruction set of NVM, accelerating the execution of specific calculations such as SHA-256, matrix multiplication, etc. Developers can write their own custom precompilers and obtain and contribute code from the open ecosystem. This is due to support for non-uniform incremental verifiable computation (IVC).

Proof Compression System

A series of recursive SNARKs, each time compressing the proof smaller and smaller. Nexus (Nova) proofs themselves are usually large, but can be compressed to just a few bytes using this system.

Nexus Compiler

A safe and correct compiler infrastructure that compiles high-level languages and other instruction set architectures (ISAs) to NVM while optimizing to maximize prover performance.

Memory checking mechanism

By using Merkle trees as a vector commitment mechanism, zkVM ensures global memory consistency across multiple IVC steps.

Reviews

Through the introduction of the current project, it is certain that Nexus wants to improve the current Rollup proof efficiency and privacy security through Zk proof technology, especially SNARK. It seems that there is a large overlap with Lumozs business, but the specific details are completely different, especially Lumoz focuses on the concept of modularization, while Nexus seems to want to be an integrated protocol, covering a wider range of levels than Lumoz. For users, it is definitely valuable to make money from such projects, because ZK technology infrastructure will definitely be the most relied-on proof technology in the blockchain field in the future, without a doubt, and with the support of a strong background, the potential benefits that its points can bring in the future will be huge.

2. Inventory of potential projects of the week

2.1. Exploring the reasons behind the thousand-fold surge in RIF and URO against the trend: What is the DeSci concept platform Pump.Science?

Introduction

Pump.science is a crypto-powered research protocol designed to enable anyone to initiate and fund research experiments, starting with longevity research. Pump.science was born out of the belief that when barriers to scientific creation are broken down, more good ideas and breakthroughs emerge.

The project will change:

Science is too closed -> Open science to everyone by live streaming experiments.

Research progress is slow -> High-throughput scientific experiments are achieved with the help of robots and artificial intelligence.

Science is led by scientists -> Anyone can be a citizen scientist, no PhD required.

Research is expensive and funding is hard to come by -> Use crypto transaction fees to fund scientific research.

Technical Analysis

How Pump.science works (current phase)

Submit: Drug developers submit interventions for testing through the Pump.science platform.

Launch Token:

If the submitted intervention passes various checks (such as safety and usability), the Pump.science platform will issue a new token for the compound and related experiments. Drug developers can purchase the first tokens through the bonding curve.

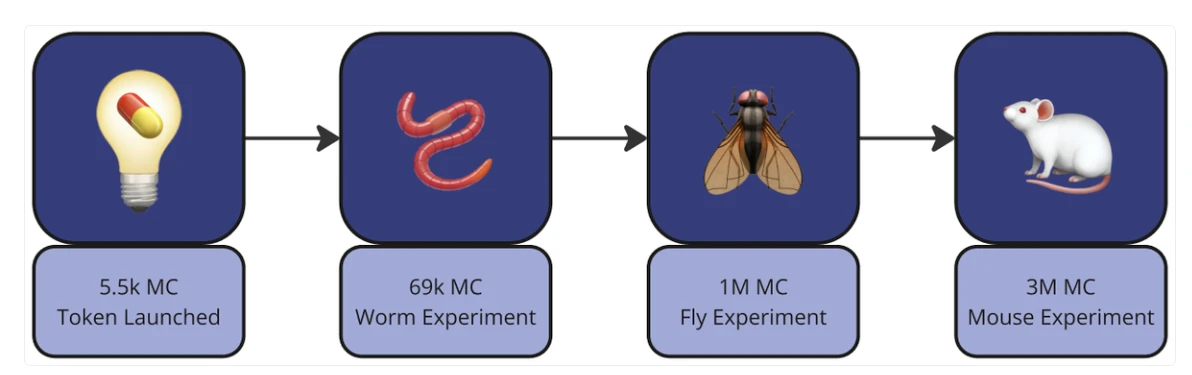

Token Milestones:

When the token market value reaches a certain threshold, the experiment will be officially launched. The experiment will test the effects of interventions on the following animal models:

Nematodes (C. elegans): Tested on the Wormbot from Ora Biomedical.

Drosophila: Tested in the FlyBox from Tracked Biotechnologies.

Mice: Tested using the MouseWatcher system from Tracked Biotechnologies.

(More experiment types will be added in the future.)

Follow Experiments:

On the Pump.science platform, watch the experiment progress with regular data updates to see if the compound extends the animals lifespan.

C. elegans data: View replays of previously completed experiments (live streaming will be available soon).

Drosophila Data: Real-time updates of ongoing experimental data.

Trade Tokens:

As experimental data is released, users can buy and sell tokens based on their judgment of the effects of the compounds.

Own the Rights:

Chemical suppliers can purchase interests in these interventions from token holders.

What youll see

Home - Mission Control

In the Live tab, cards show the science experiments currently in progress. Each card displays the following information:

The compound being tested (e.g., Rifampicin).

The name of the token to be traded (e.g. $RIF).

Market value and the progress of the experiment.

The type of animal being tested (e.g. 🪱 nematodes, 🪰 fruit flies, or 🐁 mice).

In the screenshot below, this means there are currently two experiments running in fruit flies, one testing Rifampicin and the other testing Urolithin A.

There are two experiments currently running on the home page. On each card, you can see the intervention being tested (Rifampicin, Urolithin A), the token symbol ($RIF, $URO), the market cap ($1.4M, $1.3M), and the percentage of completion of the experiment (2.74%).

When you click on a card, youll see the data flow for that experiment.

Inside the laboratory

Fruit fly experiment

Drosophila lifespan experiments are performed by giving a compound or a placebo control to a group of flies:

There were about 15 fruit flies in each test tube.

Some test tubes were labeled compound group (compounds added to the fruit flies food).

The other test tubes are called the control group (nothing was added to the food).

Your goal is to predict whether a compound will cause fruit flies to live longer than control flies.

To make predictions, you need to monitor the flies through videos uploaded by Pump.science, which are uploaded after recording. Here you can watch the flies flying around in the test tube in real time.

Technical Details

By clicking on the Chart tab, you can see the data output generated by the AI model, including:

Survival Count: The number of fruit flies that are still alive and flying.

Speed: The average flying speed of fruit flies.

Flight distance: The total flight distance of the fruit fly.

The number of survivals (Count) is the most important indicator because the goal of the experiment is to predict whether the compound can extend the lifespan of fruit flies.

The Speed and Distance graphs can help you predict which flies are likely to drop out of the experiment first.

An example graph of AI output showing the average distance flown by fruit flies under certain experimental conditions.

Final score

Each experiment ends with a PLE (percent lifespan extension) - how much longer the animals given the compound lived compared to the control group.

The goal of the game is to find more compounds that increase PLE in all animals tested.

Pump Science Protocol v1

End-to-end process

Currently, Pump Science focuses on testing supplements when selecting compounds. Why? Because we want to provide our users with the best longevity supplements in the world. All compounds are checked for safety before experiments begin.

Token Listing:

A token will be listed on the Pump Science app. Users can buy and sell tokens to back the compound through a bonding curve.

Achieve market value target:

When tokens purchased on the Bonding Curve reach the $69k market cap target:

$X of liquidity will be deposited in ______ for trading.

The previously recorded video of the C. elegans experiment will begin playing.

Unlock new experiments:

If the new market value target is achieved and the compound does not shorten the lifespan of the animals, the next animal trial will be unlocked.

Transaction Fees:

Transaction fees from Compound tokens are used to fund experiments.

Real-time experiment:

Once ready, Pump Science will begin live streaming of the next experiment.

Behind the scenes

Note: Some preparation time is required between reaching your goal and starting the experiment.

This is scientific research, the fruit flies need to be hatched and the laboratory needs to be set up.

But once you are in the process, you can receive data streams in real time on Pump.science.

Supplements:

When Pump Science launches the new token, users will have the opportunity to pre-order the supplement.

Orders will be fulfilled if the minimum order quantity requirement is met.

You do not need to hold tokens to pre-order refills.

Summarize

Both the private and public sectors are striving to extend lifespan and healthspan, but rising healthcare costs make this difficult to achieve. Healthcare systems around the world are optimized to treat disease rather than promote health. This is particularly evident in the United States, where life expectancy is declining despite rising per capita healthcare spending.

There are many potential reasons for this, but let’s stay positive and explore how Pump.science is changing the game:

Prevention-oriented scientific exploration:

Pump.science focuses on longevity and health research, and is committed to discovering supplements and interventions that can extend life and improve health, and finding practical and effective solutions through scientific experiments.

Democratized research process:

Through an open platform and token economic model, Pump.science enables more people to participate in health research and achieves full participation from scientists to ordinary users.

Transparency and real-time data:

The experimental process and data are transparent to the public, and users can understand the effects of compounds on health and lifespan in real time.

Invest in your health:

Through the token mechanism, Pump.science directs funds to health optimization experiments, supports breakthrough research, and gives users the initiative to make healthy choices.

To accelerate progress toward a healthier future, we must develop new financing and science systems that de-risk interventions (prove their safety and effectiveness) and help people become healthier. Why is this necessary?

The drug approval process is lengthy and expensive:

Getting a drug candidate through the U.S. Food and Drug Administration (FDA) is a long and expensive process that is unaffordable for most scientists unless they receive significant funding from the private sector, such as venture capital.

FDA does not consider aging a disease:

The FDA only approves compounds that are used to treat disease, not those designed to slow aging.

Health Insurance Limitations:

Health insurance only pays for compounds that treat disease, so the private sector generally does not invest in compounds that extend life because they are not covered by insurance.

The potential of chemical tools is underutilized:

While lifestyle and dietary changes can have significant impacts on health, chemical tools are a powerful and underexplored means to optimize our health, not just treat disease.

Pump.science is committed to empowering individuals to help solve these major unsolved problems and drive innovation in science and health.

3. Industry data analysis

1. Overall market performance

1.1 Spot BTCETH ETF

Analysis

This week, the U.S. Bitcoin spot ETF had a cumulative net inflow of $2.167 billion, including:

BlackRock IBIT: +$1.514 billion

Fidelity FBTC: +$598 million

Bitwise BITB: +$67.8 million

ARK ARKB: +$61.6 million

Grayscale GBTC: -$221 million

Grayscale Mini BTC: +$144 million

This week, the purchase costs of leading institutions such as BlackRock and Fidelity are mostly concentrated in the range of US$94,500 to US$98,000. Therefore, from November to mid-December, the purchase cost of ETFs has almost remained above at least US$90,000. Therefore, US$90,000 to US$100,000 will become the new position building range for institutions. Putting aside the small selling operation of Grayscale GBTC (Grayscales holding cost is much lower than that of institutions such as BlackRock), this kind of profit-taking behavior of small funds is a basic operation, so the continued upward trend of Bitcoin in the future is a foregone conclusion.

Analysis

This week, the U.S. Ethereum spot ETF had a cumulative net inflow of $854.8 million, including:

BlackRock ETHA: +$523 million

Fidelity FETH: +$258 million

Grayscale ETHE: -$49.3 million

Grayscale Mini ETH: +$121 million

Ethereum spot ETF had a net inflow of $855 million last week, reaching a record high for weekly net inflow. In comparison, Ethereum has already started the path of institutional buying. When the leading institutions believe that the purchase of Bitcoin is sufficient, it is time for Ethereum to continue to rise, because compared with Bitcoin, Ethereum is still an extremely undervalued asset.

Ethereum spot ETF total net outflow of $10.9256 million (November 1, EST)

1.2. Spot BTC vs ETH price trend

BTC

Analysis

After only about 10 days of narrow consolidation, Bitcoin continued to rise at the hourly level from around $94,000. At around 23:00 on the 15th, buying funds suddenly increased, and the price of the currency directly broke through the previous high and once touched $106,000. Although the subsequent trend quickly fell back, the short-term correction was supported by $104,000, which was higher than the previous high of $103,500. Therefore, from the perspective of form alone, the upward trend at the hourly level has not been destroyed, and the subsequent bullish view remains unchanged. The bullish trend is considered to be temporarily over only when the price falls below the support of $103,500. However, even so, investors are reminded that based on the recent ETF purchase cost price, the decline of Bitcoin is also small and short-lived, and the long-term trend is still bullish, and the concept of being bearish but not shorting should still be upheld.

ETH

Analysis

Ethereums current upward trend is weak, but as Bitcoin enters short-term consolidation, a rebound is inevitable. The support for the week is 3930 and 3830 US dollars. If they are not broken, it will continue to be bullish. If the upward trend starts, the resistance strength near 4100 US dollars is limited. Although this point is the previous high point, the bull market has no top, and the real resistance strength is around 4250 to 4300 US dollars. The staged support can be directly focused on around 3530 US dollars. If it is not broken, it will continue to be bullish in the long term.

1.3. Fear Greed Index

Analysis

From December 9 to 15, 2024, the Crypto Fear Greed Index showed Extreme Greed, which may have several reasons:

Market price rise: Bitcoin and other major cryptocurrencies continue to rise after stopping their decline near $94,000, and investor sentiment continues to turn optimistic, driving greed. For example, recent market prices breaking through certain important technical support levels or reaching new highs may trigger optimistic expectations among investors.

Active participation of institutional investors: Increased participation of large institutional investors or hedge funds, especially cross-border investment in traditional financial markets, often drives the market to higher valuations. The inflow of funds from these institutional investors is seen as a sign of market confidence.

What investors need to note is that during the extreme greed stage, prices usually show a high degree of instability. Investor sentiment is easily affected by small negative news, and the market may fluctuate violently. Although the market rises in the short term, this volatility also means that once sentiment turns negative, there may be a rapid price correction.

2. Public chain data

2.1. BTC Layer 2 Summary

Analysis

As of the week of December 9-15, 2024, some major BTC Layer 2 projects continued to develop and attract a lot of attention:

1. Lightning Network

Development progress: Lightning Network (LN) remains the main second-layer expansion solution for Bitcoin, and continued to expand its payment capacity and number of nodes this week. According to the latest statistics, the channel capacity and number of network nodes of the Lightning Network have increased slightly, continuing to improve its transaction throughput and payment speed.

Technical progress: Lightning Network continues to optimize its protocol, reduce payment delays, and improve cross-chain payment capabilities. In addition, some new off-layer payment technologies have been further experimented, which may provide more possibilities for future cross-chain payments.

2. Stacks (STX)

Development progress: Stacks continues to build decentralized applications (dApps) and smart contracts on the Bitcoin network. Stacks protocol connects Bitcoin to its second-layer platform through the Proof of Transfer (PoX) mechanism, allowing Bitcoin to perform decentralized computing in its ecosystem.

Technology Progress: Stacks is expanding its smart contract capabilities, adding support for NFT (non-fungible tokens) and DeFi (decentralized finance). This week, the Stacks protocol has undergone several upgrades, improving the efficiency of on-chain operations and adding more development tools to attract developers and project parties to participate.

Ecosystem development: Multiple developers and projects have released new applications on the Stacks platform, especially in the fields of NFT and games. The Stacks ecosystem has been further expanded, attracting more and more decentralized application developers.

3. RSK (Rootstock)

Development progress: RSK, a smart contract platform for Bitcoin, released a new protocol update this week, improving the stability and transaction throughput of the network. RSK is based on Bitcoins sidechain and enhances Bitcoins functionality through the merge consensus mechanism (Merge Mining).

Technological progress: RSK has added more DeFi and NFT projects this week, making Bitcoin not only a value storage tool, but also a platform for the development of smart contracts and decentralized applications in its ecosystem.

Ecosystem expansion: RSK continues to cooperate with multiple DeFi projects to promote the expansion of Bitcoins application scenarios to a wider range of financial services.

2.2. EVM non-EVM Layer 1 Summary

Analysis

SUI is still the star of the public chain this week, because among the top protocols, only SUI has achieved positive growth in TVL. The rest have different degrees of capital outflow.

The favorable analysis for SUI is as follows:

1. Technological progress

Network optimization and upgrades: SUI public chain released several network optimization and technical upgrades this week, especially in terms of consensus mechanism and data storage efficiency. The optimization of SUIs Narwhal and Tusk consensus protocols has further improved its network throughput and transaction confirmation speed. These upgrades help SUI continue to maintain its competitiveness in high throughput and low latency.

Resource Management Optimization: This week, SUI continued to advance improvements to its resource management system, especially in terms of gas fees and transaction execution costs, reducing the cost burden on network users while improving transaction execution efficiency.

2. Developer Ecosystem and Tools

Developer Support Tools: SUI continues to enhance its support for developers, launching a new developer toolkit (SDK) and documentation updates this week to help developers build decentralized applications (dApps) more easily. These updates include improvements to the Move programming language, further simplifying the process of writing and deploying smart contracts.

Developer activity: SUI has an active developer community, and many new projects and applications have begun testing and deploying on its network, especially in the fields of NFT, DeFi, and Gaming. SUI is attracting more and more developers into its ecosystem.

2.3. EVM Layer 2 Summary

Analysis

As of the week of December 9 to 15, 2024, both Worldchain and Fuel have made positive progress in blockchain technology, ecological development, and community interaction.

Worldchain Ecosystem Development

dApps and DeFi protocols: Worldchain added multiple decentralized applications (dApps) and DeFi protocols this week, especially in the areas of lending and decentralized exchanges (DEX). The newly launched liquidity pools and derivatives trading platforms have attracted widespread attention from developers and investors.

NFT Market: Worldchain is gradually expanding its influence in the NFT market. This week, several well-known NFT projects announced that they will be issued on Worldchain.

Developer Events: Worldchain held several developer conferences this week, introducing new SDK toolkits and documentation to developers, further promoting the growth of the ecosystem. The developer communitys support for Worldchain is gradually increasing, and more and more developers are starting to build projects on the Worldchain platform.

Community Governance: Worldchain’s governance mechanism entered a new phase this week, beginning to make more community decisions through DAOs (decentralized autonomous organizations), promoting decentralized governance of the network.

Fuel Development Progress

On-chain performance: Fuel continues to improve its high-performance computing capabilities, especially in compatibility with ZK-Rollups and Layer 2 solutions. This week, Fuel released a new network upgrade that increased its transaction processing speed and optimized support for smart contract execution, ensuring low latency and high throughput.

2.4. AI meme Summary

Analysis

This week, the market performance of AI Meme Token fluctuated greatly, but overall showed signs of recovery. In particular, some small tokens (such as $PEPEAI, $FlokiAI, etc.) performed strongly, while some other more mature projects (such as $AI, $MEME, etc.) remained stable. The potential of combining AI and blockchain, as well as the promotion of social media, are still the main factors driving market sentiment and may continue to attract more investors attention in the future.

Among the top projects, TURBO ($TURBO) showed strong volatility this week, with an overall increase of about 10%. The price increase was mainly affected by technological progress, enhanced cross-chain capabilities, and the recovery of market sentiment. TURBOs DeFi and cross-chain technologies provide it with long-term growth potential. ACT ($ACT) performed relatively steadily this week, with an increase of about 22%. The rise of $ACT was mainly driven by the projects technological innovation, smart contract platform, and NFT-supported expansion. ACTs strategic cooperation in the fields of Web3 and Metaverse has attracted more attention in the market.

In general, the price increases of TURBO and ACT are closely related to their technological progress, ecological expansion, and social media popularity.

4. Macroeconomic data review and key data release nodes next week

The US Consumer Price Index (CPI) rose 0.3% month-on-month and 2.7% year-on-year in November. This shows that inflation continues to rise moderately, supporting the markets expectation that the Federal Reserve will continue to cut interest rates this month. However, given the slowdown in inflation and the increase in uncertainties in the economy, analysts believe that the Federal Reserve may slow down the pace of interest rate cuts in the future.

Important macro data nodes this week (December 16-December 20) include:

December 17: US November retail sales monthly rate

December 18: U.S. EIA crude oil inventories for the week ending December 13

December 19: Fed rate decision (upper limit)

V. Regulatory policies

The US President-elect Trumps proposal to establish a US Bitcoin strategic reserve during the campaign has come to a follow-up. Trump reiterated that the United States will become a leader in the field of cryptocurrency, and the new Chairman of the House Financial Services Committee, French Hil, also echoed this. This move has attracted the attention of Russia, which may also follow the pace of the United States. In other regions, the taxation measures on cryptocurrencies are moving forward in a tug-of-war. Perhaps considering the impact of the slowdown in global economic growth, Italy and South Korea have lowered or postponed the standards and introduction of tax bills.

USA

On December 15, Trump recently answered the question of whether the United States would establish a strategic reserve of Bitcoin similar to oil reserves in an interview with CNBC. Trump said, Yes, I think so. We will do some great things in the field of cryptocurrency... Others are accepting it, but we want to be leaders. Earlier on the 13th, French Hill, the incoming chairman of the U.S. House of Representatives Financial Services Committee, also said, The value of Bitcoin reserves to the United States or the Treasury Department must be seriously considered.

Italy

According to Reuters, Italian politicians said on December 10 that they would reduce the increase in cryptocurrency capital gains tax. According to the 2025 budget to be approved by Parliament at the end of December, the Ministry of Finance intends to increase the capital gains tax on cryptocurrencies such as Bitcoin from 26% to 42%. The League said that this move would face the risk of boosting the shadow economy. Political sources said that the government may even decide to keep the 26% tax rate unchanged.

Russia

On December 10, Russian State Duma deputy Anton Tkachev proposed establishing a strategic Bitcoin reserve for Russia to counter financial risks posed by geopolitical instability.

South Korea

According to Korean media hankyung, the plenary session of the South Korean National Assembly passed the Income Tax Act Amendment on the 10th, which includes the abolition of financial investment income tax and the postponement of virtual asset tax for two years. The Income Tax Act Amendment was passed by 275 registered members, with 204 votes in favor, 33 votes against, and 38 abstentions.