Original | Odaily Planet Daily ( @OdailyChina )

Author: Wenser ( @wenser 2010 )

Last week, Bitcoin experienced a major correction, falling about 15% from its all-time high of $108,300, with the price falling to around $92,000. Currently, as market sentiment gradually stabilizes, the price of Bitcoin has recovered to around $96,000, entering a volatile phase.

The decline over the past few days has caused altcoins to lose a lot of blood, and the prices of many tokens have even fallen to the prices before October, wiping out the Trump effect brought about by Trumps election as the US president. Despite this, with the arrival of the Christmas holiday, many people believe that the Christmas robbery will further aggravate the markets downward trend.

However, as 2025 is approaching, a series of favorable factors such as Trumps inauguration and the Bitcoin strategic reserve plan are ready to take off. By then, the cryptocurrency industry is still expected to usher in a new round of dawn moment.

Odaily Planet Daily will summarize the opinions of industry insiders, institutional buying and some on-chain activities in this article to provide readers with a more comprehensive perspective on the market.

A look at industry insiders’ views: most are bullish, a few are bearish

From the perspective of mainstream industry insiders, most people believe that the current correction of the BTC market is only temporary. The main reason is that the new high of around $108,000 was broken too quickly. At the same time, altcoin holders were eager to sell, which caused the market to fluctuate downward. As 2024 is coming to an end and 2025 is approaching, BTC is expected to continue to reach new highs.

CZ: Waiting for new headlines, Bitcoin continues to hit new highs

Binance co-founder CZ recently posted a message saying that Bitcoin continues to hit new highs, waiting for new headlines. Earlier, CZ tweeted four years ago that BTC collapsed from $101,000 to $85,000, waiting for news headlines .

Cathie Wood: BTC will become more scarce than gold due to institutional demand

Cathie Wood, CEO of Ark Invest, said Bitcoin is “becoming more scarce than gold” due to institutional demand, and she previously predicted that the BTC price will exceed $1 million by 2030.

Bitwise CIO: BTC has three unstoppable sources of demand, including ETFs and MicroStrategy

On December 19, Matt Hougan, chief investment officer of Bitwise Asset Management, pointed out three unstoppable sources of demand for Bitcoin, namely ETFs, Microstrategy, and the government itself as a possible buyer of Bitcoin. He added: Ultimately it comes down to supply and demand. There is too much demand and not enough supply, so I think the price will be higher in 2025.

Trader Peter Brandt: BTC may continue to rise, with a near-term price target of $125,000

After recently falling below the $91,000 mark, BTC has rebounded strongly this weekend and is currently trading slightly back around $96,000. In the process, veteran trader Peter Brandt reiterated his bullish view on BTC and said that it could continue to rise in the future. In addition, other on-chain indicators also indicate that BTC has good momentum in the future. In a recent analysis, Brandt said that BTC could reach $108,358 in the coming days.

K-line analysis by Peter Brandt

However, he also cited technical charts to warn that BTC prices could pull back to $76,614 in an uptrend, adding that “this is not a prediction,” pointing out the risks in the market. He said that these analyses only reflect “possibilities, not probabilities, not certainties.” In addition, he recently set a BTC price target of $125,000.

Lark Davis: The current correction is not the end of the bull market, the market still has plenty of fuel

Lark Davis, a crypto KOL and industry analyst, believes that the current crypto market correction is not the end of the bull market based on historical data analysis . He said: In December 2020, BTC fell 12% after a 77% increase from October to November. Subsequently, it rose from US$17,000 to US$41,000 (an increase of 136%) in the next 23 days. A similar thing is happening now. Bitcoin has fallen another 13% after a sharp rise in the fourth quarter. Its not that this is the bottom, we may see another 10-15% correction. But there is still plenty of fuel for Bitcoin and the cryptocurrency market.

Analyst: Bitcoins pullback is highly correlated with Coinbases sell-off since October 26

The recent price drop in BTC marks a sharp shift in market sentiment, which has quickly shifted from extremely bullish to uncertain and cautious. As altcoins have been hammered, Bitcoin’s pullback has raised concerns about the sustainability of its recent gains.

Top analyst Maartunn recently highlighted that the correction coincides with the worst sell-off on Coinbase since October 26, when BTC was trading at $66,000. The increase in selling pressure clearly indicates a shift from a bullish market to one filled with fear and hesitation. The combination of reduced buying activity and rising selling pressure suggests that the market is struggling to maintain its upward momentum. Moreover, Bitcoin is currently testing the $92,000 mark for support.

Bitfinex: Bitcoin could reach $200,000 by mid-2025 and will maintain a mild correction trend

In a recent market report, Bitfinex analysts said that Bitcoins decline in 2025 will be short-lived due to strong institutional demand, predicting that the best case scenario is that the price of Bitcoin will double by June 2025, with a minimum price estimate of $145,000 by mid-2025, and may rise to $200,000 under favorable conditions.

“We believe any correction in 2025 will remain mild due to institutional inflows,” the analysts said. They noted that while Bitcoin is expected to experience volatility in the first quarter of 2025, “broader trends” suggest its price will continue to rise, driven by continued inflows into spot Bitcoin ETFs and increased global and institutional adoption.

CryptoQuant CEO: This is not a traditional alt season, but an independent market for individual tokens

On December 20, CryptoQuant CEO Ki Young Ju wrote that Bitcoins market share fell by 6% (of which XRP contributed 3%), but has now begun to recover. Currently, only a few altcoins are attracting new liquidity, and the scale of funds rotating from Bitcoin to altcoins is limited.

He believes that this is not a traditional alt season, but an independent market trend of individual tokens with outstanding performance.

Trader Eugene: Altcoin investors are eager to sell spot, the market may enter a longer consolidation phase

Well-known trader Eugene Ng Ah Sio expressed his views on the altcoin market, saying : Altcoins (Alts) quickly fell back to these levels again in less than 48 hours after forming the lower shadow lows (wick lows), indicating that investors are extremely anxious about holding spot assets and are eager to sell. The market may enter a longer period of adjustment, or fall rapidly in a short period of time.

Analyst: It’s ‘very typical’ to see big pullbacks during crypto bull run

Earlier, Bitcoin had just hit a record high of more than $108,000, and this round of decline in the cryptocurrency circle has had a greater impact on altcoins such as Ethereum and Dogecoin. Last Thursday, a group of U.S. exchange-traded funds (ETFs) that directly invest in Bitcoin ended their 15-day streak of inflows, setting a record of $680 million in outflows, highlighting the shift in market sentiment.

Strahinja Savic, head of data and analytics at FRNT Financial, said it was “very typical” to see such a sharp pullback in a cryptocurrency bull run, while QCP Capital said in a report that the underlying cause of the sell-off was the market’s “overly optimistic” positioning.

Strong buying: BTC ETF continues to flow in, and both the state and enterprises follow suit

Judging from the basic buying in the market, it is still in the strike zone of institutional trading. Funds including US BTC ETF, El Salvador, US listed companies and Japanese listed companies are continuing to purchase BTC, and the holding cost is not much different from the BTC spot price. Institutions are relatively optimistic about the future performance of BTC.

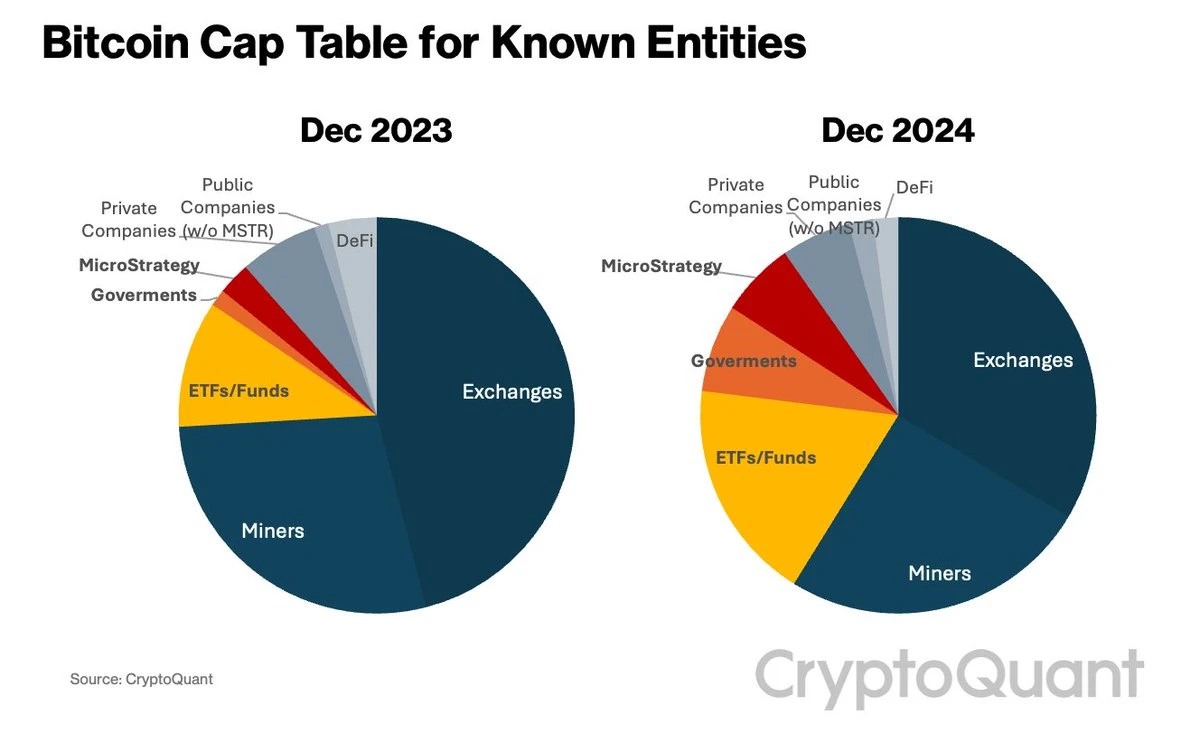

Bitcoin Cap Table: ETFs, Governments, and MSTR Now Hold 31% of All Bitcoin, Double the Number in Last Year

CryptoQuant CEO Ki Young Ju released an update on the Bitcoin holdings pie chart , saying that ETFs, governments and MSTR now hold 31% of all Bitcoin, up from 14% last year.

BTC holdings pie chart information

US Spot Bitcoin ETFs Have $26 Billion in Volume in Week 50, With $17.5 Billion Inflows So Far in Q4

According to Trader T’s monitoring , the US spot Bitcoin ETF had a net inflow of $463 million in the 50th week, with a trading volume of $26 billion. In addition:

Bitcoin ETF inflows are $17.5 billion so far in Q4 (best quarter ever);

BlackRock IBIT inflows were $1.452 billion;

Other ETFs saw outflows of $989 million.

El Salvador increases BTC purchases, mid-term goal is to increase holdings by 20,000 BTC

On December 21, according to Bitcoin Magazine, Max Keiser, a senior Bitcoin adviser to the President of El Salvador, revealed: President Bukele has increased his daily Bitcoin purchases, with a medium-term goal of holding an additional 20,000 Bitcoins. On December 22 , the El Salvador wallet address once again increased its holdings by approximately 11 BTC (worth $1.06 million) for its strategic Bitcoin reserves.

Previously, El Salvador reached an agreement with the International Monetary Fund (IMF) to obtain a $1.4 billion credit line, but there was a requirement to reduce Bitcoin risks; when asked about the legal currency status of Bitcoin in El Salvador, IMF spokesman Kozak said that the use of Bitcoin would be voluntary.

In the latest news, Stacy Herbert, director of the El Salvador Bitcoin Office, clarified that even after the agreement, the country will continue to accelerate its purchase of Bitcoin as part of its strategic Bitcoin reserve strategy. Herbert also explained that Bitcoin will remain the countrys legal tender and the government will continue to sponsor several cryptocurrency-focused educational programs. The Bitcoin Office reported that the 1 BTC per day purchase plan will continue.

Furthermore, the country has made additional purchases, adding 30 BTC in the last 7 days and 53 BTC in the last 30 days.

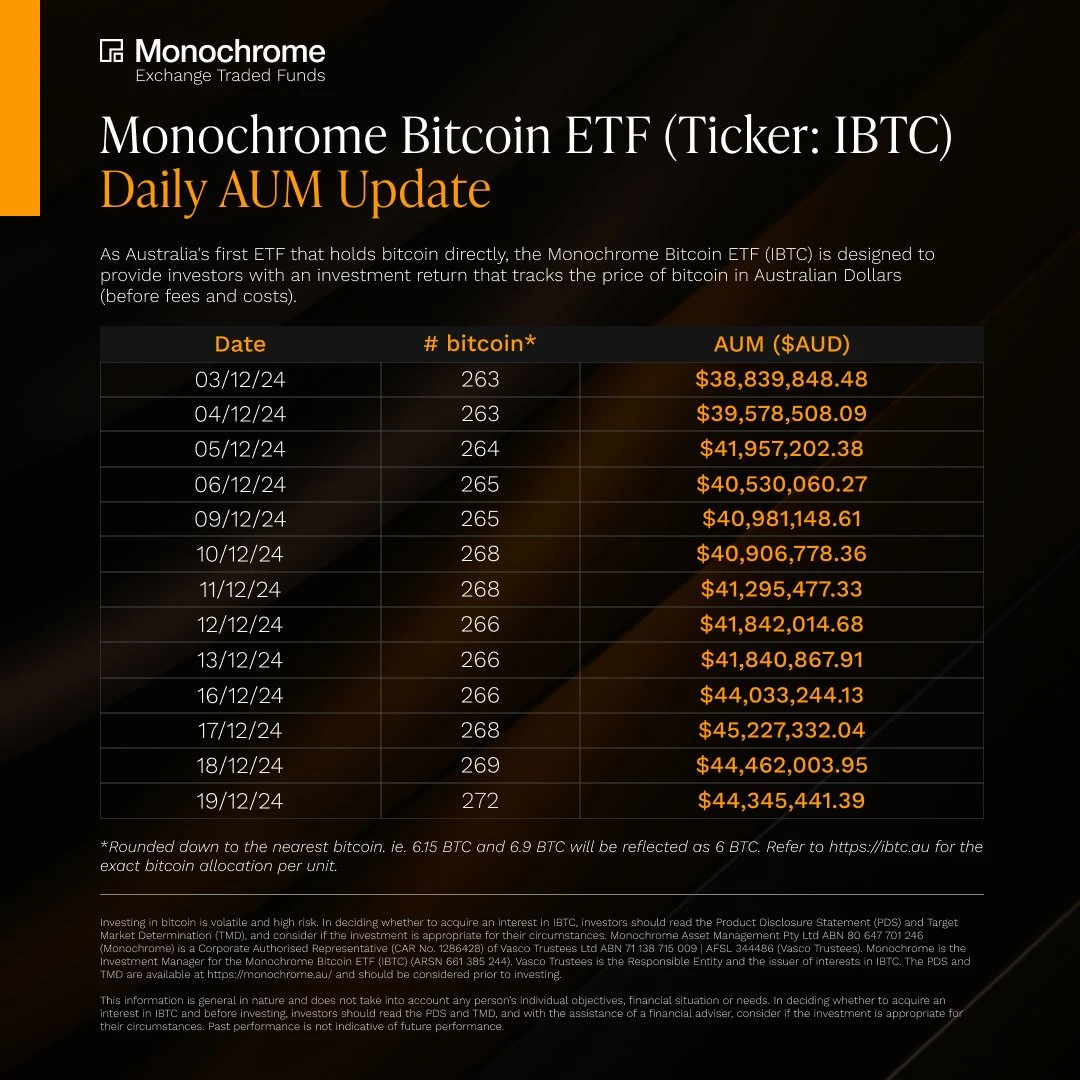

Australias Monochrome Spot Bitcoin ETF holds 272 BTC

As of December 19 , Australias Monochrome Spot Bitcoin ETF (IBTC) held 272 BTC, with an AUM of approximately US$44.3454 million.

Australian BTC ETF continues to increase holdings

Statistics: At least 10 companies are adopting or considering MicroStrategys Bitcoin strategy

According to statistics , at least 10 companies are currently or considering adopting MicroStrategy’s Bitcoin strategy, including:

Artificial intelligence company Genius Group: currently holds 294 BTC;

Pickup truck solutions provider Worksport: The company’s board of directors approved the initial purchase of $5 million worth of BTC and XRP;

Amazon: Shareholders propose that the companys board of directors evaluate the potential benefits of adding Bitcoin to its financial strategy;

MicroStrategy: currently holds 439,000 BTC;

MARA Holdings: currently holds 44,394 BTC;

Tesla: currently holds 9,720 BTC;

Coinbase: Currently holds 9,480 BTC as part of its reserves;

Hut 8 Mining Corp: currently holds 10,096 BTC;

Block Inc.: currently holds 8,027 BTC;

OneMedNet: Currently holds 34 BTC.

Among them, Bitcoin mining company MARA previously disclosed that it had raised $1.925 billion through convertible notes in November and December and bought 15,574 BTC at an average price of $98,529, worth about $1.53 billion, and repurchased the total principal of its existing convertible notes due in 2026 of about $263 million, and expected to use the remaining proceeds to buy more Bitcoin. Hut 8 surpassed Tesla on December 19 and became the fourth listed company to hold more than 10,000 BTC.

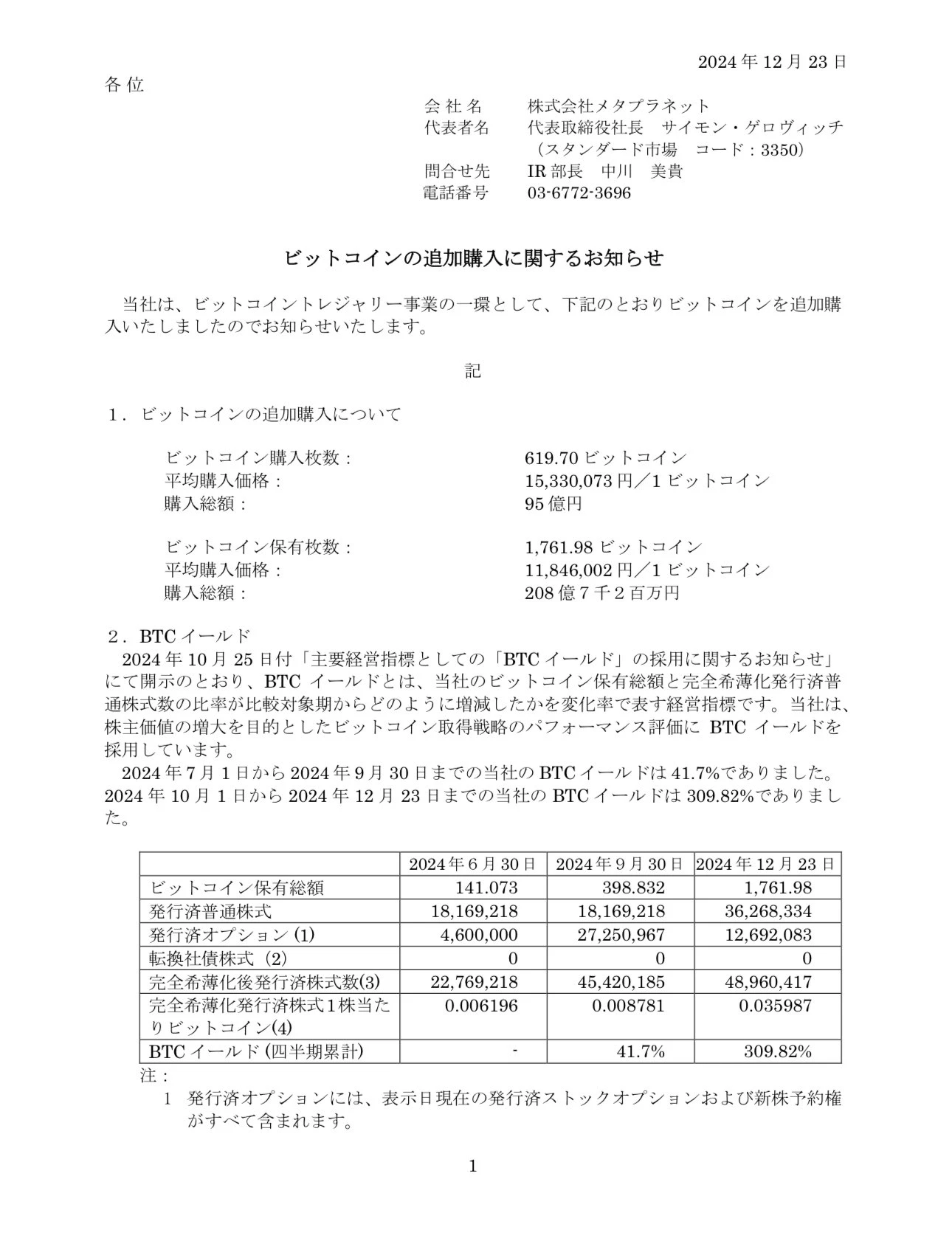

Japanese listed company Metaplanet increased its holdings by 619.7 BTC

On December 23, Metaplanet, a Japanese listed company, announced that it had increased its holdings by another 619.7 BTC , spending a total of 9.5 billion yen (approximately 60.68 million US dollars), with an average purchase price of approximately 97,800 US dollars; its total BTC holdings increased to 1,761.98.

Increase holdings description document

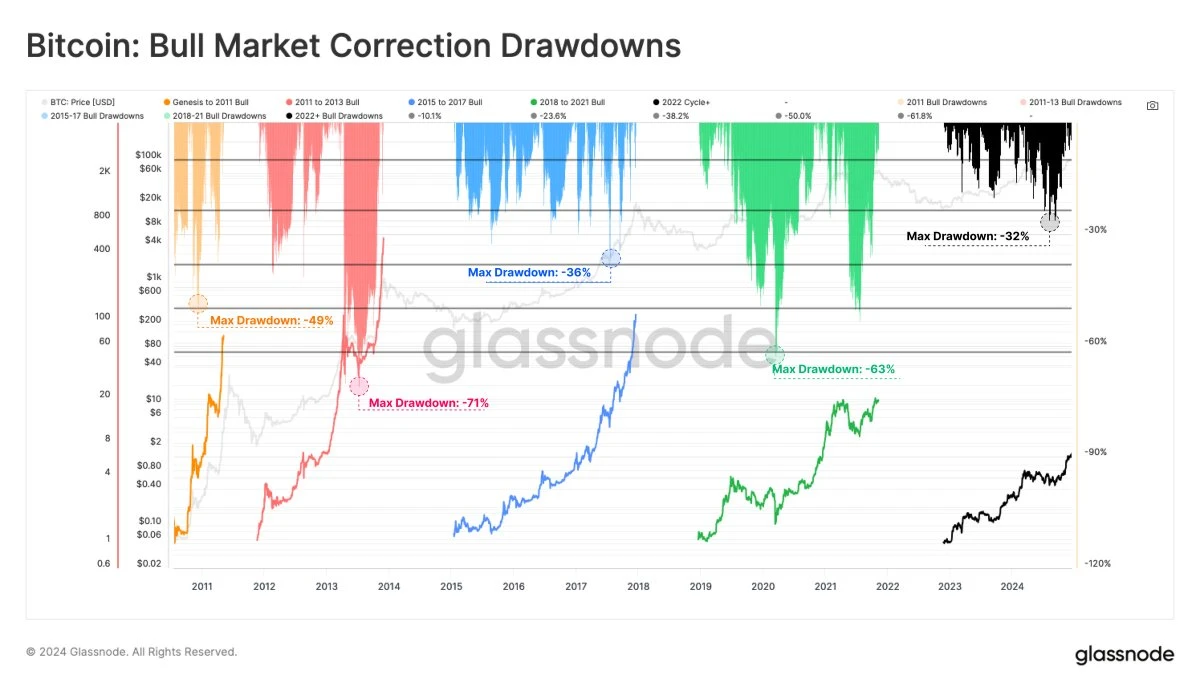

Glassnode: The bull market trend of Bitcoin has reduced its retracement degree, and most of the retracements are about 25%.

Glassnode officials previously stated , Interestingly, as the market grows, the severity of Bitcoins retracements in the bull market uptrend has decreased. The deepest retracement in this cycle was -32% (August 5, 2024), while most callbacks were only about 25% below the previous high, reflecting the demand for spot ETFs and growing institutional interest.

Glassnode tends to see a gradual decrease in retracements

On-chain activity: wallet address count increases, dormant addresses awaken, long-term holders exit

On-chain activities show a polarized phenomenon: on the one hand, as the time scale lengthens, the number of addresses holding mainstream cryptocurrencies has increased to varying degrees, at least 25%; on the other hand, ancient BTC addresses that have been dormant for more than 10 years have also awakened, and many long-term BTC holders have slowly left the market.

In the past two years, the number of BTC and ETH non-empty wallets has increased by 27% and 47% respectively.

Santiment said in a post that the number of cryptocurrency holders has increased significantly over the past two years. Here are the numbers of non-empty wallets for the top four cryptocurrencies by market capitalization:

BTC: 54.7 million (+27%)

ETH: 134.9 million (+47%)

USDT: 6.57 million (+66%);

XRP: 5.75 million (+28%).

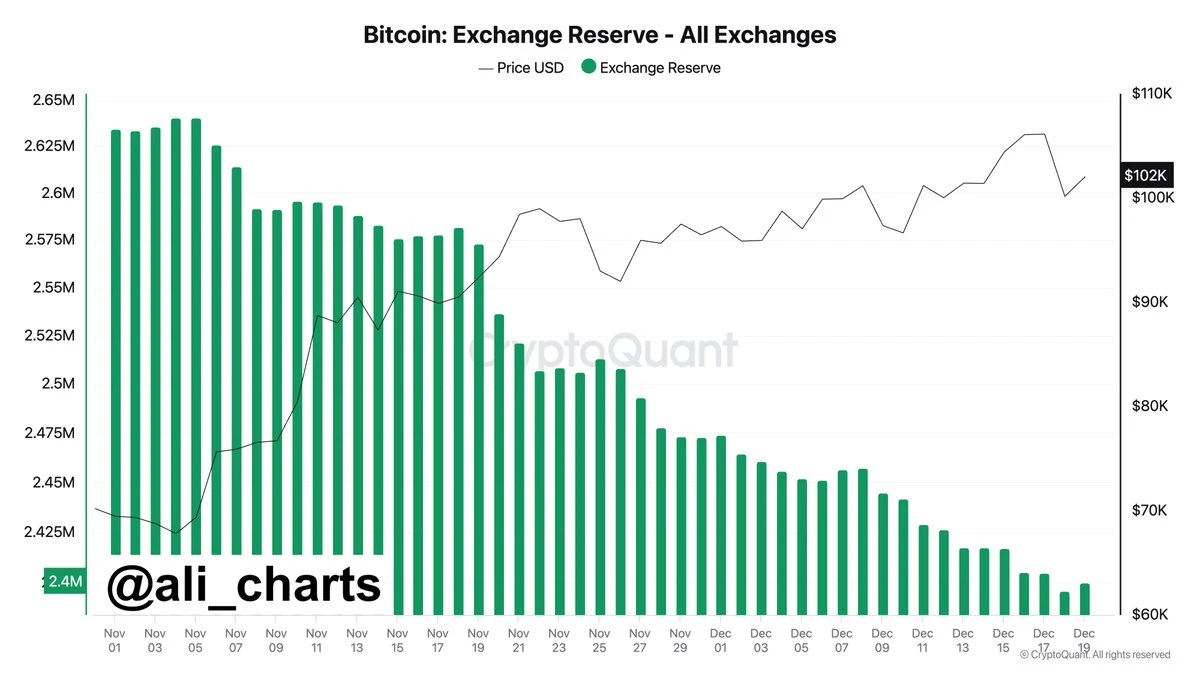

Analyst: As of December 20, 74,052 BTC have been withdrawn from exchanges this month

On December 20, crypto analyst AIi wrote that as of now, 74,052 BTC have been withdrawn from exchanges in December, and the trend does not seem to be slowing down.

BTC continues to flow out of exchanges

Long-term Bitcoin holders have sold 1 million Bitcoins since September

Long-term Bitcoin holders have been selling large amounts of Bitcoin, reducing their holdings to about 13.2 million in mid-December from about 14.2 million in mid -September. Bitcoin is currently trading 13% below its all-time high of around $108,000, the highest level since Trump won the U.S. election in early November.

According to Glassnode data, long-term Bitcoin holders sold nearly 70,000 BTC on December 19, the fourth largest single-day sell-off this year.

Recently, multiple addresses holding over $20 million worth of cryptocurrencies were activated after years of dormancy.

Bitcoin fell below $96,000 on Dec. 22, down about 11% since topping $108,000 on Dec. 17, 2024.

At the same time, at Bitcoin network block height 875,560 , a wallet that had been dormant since July 25, 2015 was activated and transferred 44.99 BTC, which was its first activity since its creation. The same user actually transferred a total of 59.99 BTC, transferring funds from three legacy addresses (P2P KH) to two payment witness public key hash (P 2 WPKH) wallets. 44.99 BTC came from 2015, when BTC was trading at $290. Then, 43 blocks later, a dozen legacy wallets from 2017 became active, transferring a small amount of Bitcoin (0.00000547 BTC) at block 875,603.

This pattern of sending bitcoin in pieces cleverly masks larger transfers. Once the satoshis are settled, a newly minted P2WPKH wallet receives 99.999 BTC, worth $9.7 million at current prices. On Saturday, a wallet was activated after 12 years of dormancy, transferring 104.99 BTC, which was worth just $11 at the time, for a total value of $1,200. Today, those BTC are worth more than $10 million. The transfer also moved from the old P2PKH address to the new P2WPKH address.

BTC outflow from exchanges continues: Coinbase bleeding accelerates

Coinglass data shows that the current balance of Coinbase Pros Bitcoin wallet is 733,076.34 coins, ranking first among CEXs; 16.69 coins flowed in in the past 24 hours, 14661.50 coins flowed out in the past 7 days, and 70185.16 coins flowed out in the past 30 days .

The balance of Binance Bitcoin wallet is 571,802.93 , with an inflow of 1458.46 in the past 24 hours, an inflow of 4199.11 in the past 7 days , and an outflow of 10412.79 in the past 30 days .