Original text from CoinTelegraph, translated by Odaily Planet Daily Moni

On the eve of the Lunar New Year, the artificial intelligence model DeepSeek caused a great shock to the global market. The model has extremely low cost, but its effect is comparable to AI products of American companies such as OpenAI.

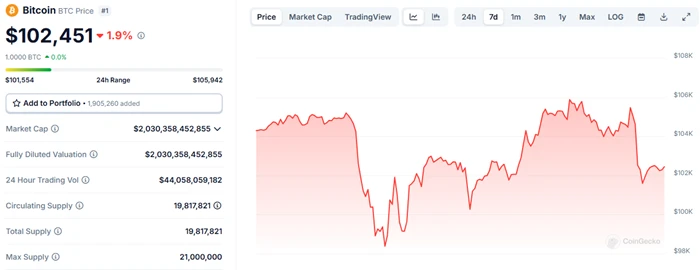

The US technology stocks were hit hard, with the Big Seven - Apple, Nvidia, Tesla, Microsoft, Amazon, Meta and Alphabet (Google) - all falling, and Nvidias stock price falling by nearly 17%. The cryptocurrency market was not immune, with Bitcoin and Ethereum falling by 6% and 7% respectively, and some altcoins losing double digits, which seems to indicate once again that cryptocurrency is indeed a risky asset and is subject to market forces similar to traditional finance.

DeepSeek Rocks Tech Stocks, Bitcoin, and the Broader Crypto Market

Marc Andreessen, founder of a16z, called DeepSeek the Sputnik moment in the field of AI. One of the main reasons is that DeepSeek surprised the global market. After all, the mainstream narrative in the field of artificial intelligence has always regarded the United States as the industry leader. (Note: The Sputnik moment refers to the moment when people realize that they are threatened and challenged and must redouble their efforts to catch up.)

Jean Rausis, founder of decentralized exchange SMARDEX, said that despite seemingly having nothing to do with DeepSeek, the share prices of cryptocurrencies and crypto-related companies such as MicroStrategy have fallen, and cryptocurrencies may be just one of the victims in the broader market sentiment. Exodus CEO JP Richardson explained that cryptocurrency is a risk-on asset, and when there is any volatility or panic in the stock market, such as the emergence of unexpected artificial intelligence models, it will see a decline, and the stock market is correlated with cryptocurrencies and Bitcoin, which in turn causes a simultaneous decline in prices.

(January 27, 2025, cryptocurrency prices fell across the board)

Analysts at cryptocurrency market maker Wintermute believe that while cryptocurrencies lack a short-term narrative, correlation with the stock market is driving capital flows, while de-risking has also been flagged.

In other words, if cryptocurrency investors are spooked by the stock market, they will also choose to sell.

As digital assets gain wider adoption and acceptance in traditional financial markets, the correlation between Bitcoin and stock prices has been studied. BitMEX pointed out in its investor report that the correlation between cryptocurrencies and stocks is likely to continue for quite some time. Dow Jones Market Data shows that the six-month rolling correlation indicator between Bitcoin and the Nasdaq Composite Index hit 0.5 on Monday, the highest level since March 2, 2023.

(Note: The correlation between Bitcoin and the Nasdaq Composite Index is calculated on a scale of -1 to 1, measuring the degree to which two assets move in relation to each other. A correlation of 1 indicates a perfect positive correlation, where the two assets move in lockstep, while -1 indicates a perfect negative correlation, where the two assets move in opposite directions. A correlation of zero indicates that changes in one asset have no effect on the other.)

Fortunately, the recovery of cryptocurrencies was relatively fast, and after a short-term shock, Bitcoin rebounded above $100,000 this weekend.

Andre Dragosch, head of European research at asset management company Bitwise, pointed out that the fact that Bitcoin stabilized while the Nasdaq continued to decline is extremely optimistic. Even with the broader market volatility, many people are optimistic and believe that cheaper artificial intelligence models like DeepSeek will bring long-term benefits.

DeepSeek makes artificial intelligence cheaper and has little impact on Bitcoin prices in the long run

Technology experts and market observers quickly noticed that DeepSeek is open source, which means that other AI developers can adopt some of DeepSeeks advantages to build and improve their own models. Standard Chartered Bank analyst Geoff Kendrick said: The market positioning of artificial intelligence will be clearer. In any case, if lower-cost AI tools (at the margin) reduce inflation, then risk assets unrelated to AI, such as Bitcoin, should benefit.

As risks recede for the time being, Bitcoin’s momentum appears to be building up again. Geoff Kendrick predicts that Bitcoin may be just days away from its next all-time high, and appears set to surpass its record of around $109,000 next week, with prices potentially reaching as high as $130,000 between February and March.

Paul Howard, an executive at liquidity provider Wincet, further analyzed that DeepSeek will accelerate the development of artificial intelligence in the United States and overseas, denying artificial intelligence hegemony, and its potential impact on cryptocurrencies is actually small. DeepSeek provides few functions that other LLM trading models cannot provide, and its lower cost has little impact on the way institutional participants interact with the cryptocurrency market, because the cryptocurrency market is the risk-amplifying end of the stock market.

On the other hand, there has been some positive news at the macro level recently for Bitcoin and the broader cryptocurrency market.

According to the Financial Times, if the plan proposed by Czech Central Bank Governor Aleš Michl is approved, the Czech Central Bank may eventually convert 5% of its 140 billion euro foreign exchange reserves into Bitcoin. Geoff Kendrick calculated: At the current price, the Czech Central Bank will hold 69,000 Bitcoins. The country with the largest number of Bitcoins is El Salvador, which holds 6,049. In addition, the Swiss National Bank also seems to be moving towards embracing Bitcoin. The Swiss Federal Government has officially begun to review the referendum proposal called Building a Financially Strong and Responsible Switzerland (Bitcoin Initiative), which has been published in the Federal Gazette and entered the signature collection stage. It aims to incorporate Bitcoin into the Swiss national financial system through a constitutional amendment. Although it may take some time, this move is significant because Switzerlands foreign exchange reserves are six times that of the Czech Republic.

The cryptocurrency community predicts that the U.S. establishing a Bitcoin reserve will trigger other countries to establish their own Bitcoin reserves, which will significantly increase the price of Bitcoin. Although Trump has not yet taken action, his order does make room for the establishment of a reserve, which means that the United States may retain the 207,000 Bitcoins it already holds. At the same time, the U.S. Securities and Exchange Commissions cancellation of Staff Accounting Bulletin No. 121 (SAB 121) will also boost institutional demand for digital assets.

Overall, as a powerful artificial intelligence model, the development and application of DeepSeek will more or less have a certain impact on the traditional financial and encryption markets. After all, it recently triggered a short-term crash in the Bitcoin and cryptocurrency markets, but in the long run it does not seem to have a significant impact on prices, so think of DeepSeek as a gift for creating better, cheaper, faster, open and free AI.