Compiled by Odaily Planet Daily ( @OdailyChina )

Translated by Azuma ( @azuma_eth )

Editor’s Note: This article is a market forecast and response plan for 2025 by well-known analyst and trader 0xKyle .

In the following article, 0xKyle analyzes and hypothesizes multiple possible scenarios for Bitcoin and altcoins in 2025, and discusses why active portfolio management will outperform passive portfolio management in the new year. 0xKyle also lists his favorite sectors and tracks at the end of the article, which may be helpful for the layout of the new year.

The following is the original content of 0xKyle , translated by Odaily Planet Daily.

GM.

Predicting the future is difficult, but as traders and investors we should have a plan. Like all other plans, this one will change as the underlying scenario changes - the market is constantly evolving. This plan is based solely on my predictions of market developments over the next year. It provides insights into my thinking through 2025, but should not be construed as financial advice.

Let me first review my plan for 2024 (Odaily Note: Since this part is mainly a review of Kyle’s personal operations, this article chooses to pass it directly).

Let’s jump right in. As usual, I’ll start by discussing the macro expectations/scenarios and then move on to the thematic narrative.

Scenario Assumptions

A new cycle of “2024 - ??” has begun. I personally believe that this cycle began at the end of 2023, but if we look at this cycle in a more rigorous way, the progress so far is:

→ On January 10, Bitcoin ETF was launched;

→ BTC hit a new high, briefly triggering an alt season ;

→ Then it entered the volatile period of Q2 and Q3, with BTC hovering between $50,000 and $60,000;

→ After the election day, BTC hit a new high, rising all the way to $100,000;

→ It has not been able to effectively break through the 100,000 mark yet and is currently hovering above 90,000 US dollars.

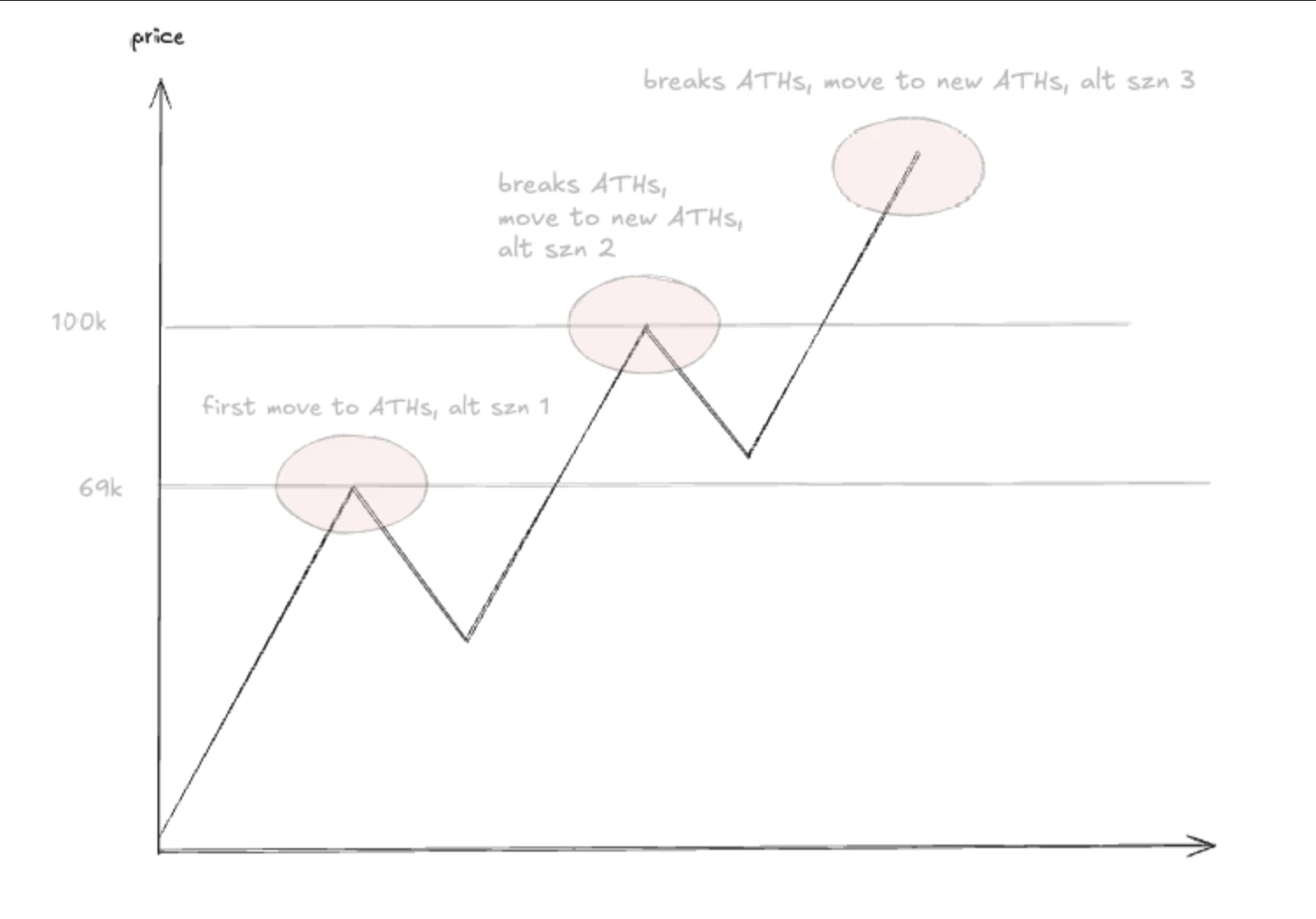

It is important to note that the alt season often begins at the high point of Bitcoin . The first time was when BTC was hitting $69,000 but failed to break through effectively; the second time was when BTC was hitting $100,000.

The next altcoin cycle will likely begin after BTC stabilizes above $100,000 . I can’t predict the future, and while I hope this will happen in Q1 2025, it’s also possible that we’ll see a repeat of the 2024 Q2/Q3 volatility in the coming months — I have to be prepared for that. So here are all the scenarios I drew up.

Scenario 1: Bitcoin and altcoins rise together

In that case, the rise will be the only theme in 2025, and we will enter another round of alt season. As Bitcoin continues to rise, all currencies will perform well, and we will repeat the last two months of 2024, with the entire market rising, rising, rising.

Likelihood: 30% - 40%

Corresponding strategy: Take advantage of the current panic to buy and get on board strong altcoins.

Hypothesis 2: Bitcoin rises, while other currencies rise slightly

This will be a repeat of 2024, where we will see altcoins oscillating over the next few months, but Bitcoin is more bullish (because only Bitcoin is going up). Some altcoins will also perform well.

Likelihood: 50% - 60%

Corresponding strategy: Still buy during the current “panic”, but you need to invest in altcoins in specific sectors. The key is to avoid areas with high attention and look for the next narrative that may rise.

Hypothetical Scenario 3: Bitcoin rises, altcoins fall

This means that the top is now in for altcoins, although Bitcoin will continue to perform well.

Likelihood: 20% - 30%

Corresponding strategy: Sell all altcoins. Although we have to bear some retracements, if the altcoins do not rise, we may have to sell them all.

Scenario 4: Bitcoin falls, altcoins fall

Probability: 10% - 20%.

I believe several things will happen. I believe BTC’s next new high will not take as long as 2024 because the backdrop of macro tailwinds is real. In a cycle where the regulatory environment is hell, ETFs have been launched, but TradFi still needs to work hard to sell the story of BTC to customers because the world does not believe in the importance of Bitcoin.

Now that Trump is about to take office, there is a lot of talk about a Strategic Bitcoin Reserve (SBR). Market sentiment has changed, and I will not speculate on the possibility of establishing a Strategic Bitcoin Reserve system - I have no experience with the intersection of politics and finance.

What I care about is the narrative — the fact that this new regime coming in has brought a lot of new attention to digital assets, and it’s easier to convince people to buy Bitcoin now that even the president of the world’s largest country is discussing it so frequently.

This change in the macro backdrop is significant. As such I believe Bitcoin will continue to have tailwinds in 2025, while altcoins are a similar but different story.

Total 3 (Odaily note: the total value of altcoins excluding BTC and ETH) reaches the 2021 high in the first quarter of 2024, and then reaches the cycle high in the fourth quarter of 20424. To be honest, there is not much difference between my scenario one and scenario two.

It’s all about positioning and timing. I’m bullish on 2025, but I don’t know how long it will take for the rally to arrive — while I do think the rally will come faster than 2024, altcoins will still bleed in the absence of a catalyst.

My plan is to always be net long, whether its Bitcoin or anything else, as long as the cycle hasnt peaked. I dont think 2025 will be a repeat of the summer of 2024, but I think well have a period similar to now - the market is just relatively quiet, but prices are still well maintained.

The on-chain world is completely different, and on-chain markets can easily see -70% swings when the tide recedes. So for on-chain markets, my goal is always to sell at the peak of attention and reinvest funds into the top altcoins (top 20), and then slowly start to deploy further.

I don’t think altcoins will top here, just as I don’t think Bitcoin will continue to rise while altcoins die, and I don’t think Bitcoin will reach a cyclical top at this location.

So my conclusion is: BTC will continue to rise, and the increase will exceed 2024; for altcoins, my theme is still offense, but we need to know when to switch to defense, but the defensive tendency will be lower than in 2024.

risk

Cyclical peak risk

Cycle top predictions are subject to constant self-correction. While I do not believe we are close to a cycle top, it must be reassessed on a weekly basis. A cycle top is not necessarily an “event” but more of a spectrum that is approached over time.

SBR Cashing Risk

With a new president in office, everyone will be watching his actions. While Bitcoin is expected to have regulatory tailwinds, it would be a pretty bearish event if the president completely forgets about it. The possible risks in my opinion include: SBR being forgotten; or the more likely scenario that SBR does not happen, but is pushed forward in some other way.

In the latter case (changing the SBR scheme), this could be an initially bearish but ultimately bullish event, as long as the scheme itself is supportive of Bitcoin.

In summary: the appearance of a bullish signal means that the bull market will continue; the appearance of a bearish signal means that plans must be reviewed - the bull market may continue, but the probability will decrease.

Supply Risk

In 2024, we witnessed crazy macro conditions in the summer, with stock markets hitting all-time highs, but the cryptocurrency market fell more than it rose, because the market continued to be hit by selling pressure again and again from major supply holders such as Mt. Gox, the German government, and Grayscale GBTC.

Supply risk can never be eliminated. There will always be someone holding a lot of Bitcoin - the UK government, Silk Road, FTX holdings, or any other entity. This is something you have to keep an eye on, but in my opinion, if everything goes well, these events will be good opportunities to buy on the dip.

Macro risks

I think a smaller rate cut is still a rate cut. While this is less bullish, the fact is that as long as rates continue to fall, liquidity will improve.

Once again, the emergence of bullish signals means that the bull run will continue. Unless there is a rate hike or no rate cut, the macroeconomics should be favorable for digital assets.

Themes and Tokens

Now comes the part you’ve all been waiting for. But before I get into the specific themes and tokens, I want to reiterate what I just said about “playing offense, but knowing when to switch to defense” — active portfolio management will beat passive portfolio management in this investment cycle.

The days of “buy and hold forever” are gone. Despite a 10x increase in 2023, Solana’s overall performance in 2024 is almost on par with Bitcoin; so-called leaders like TAO have not benefited from the AI boom we have seen in recent months; and for meme tokens, dogs don’t wear hats anymore (WIF), chill guys don’t chill anymore, and hippos (MOODENG) look like spent forces…

Nothing on this list is likely to make you a “buy and hold.”

In addition, I like to think about a question - who are the marginal buyers? In this market, there are basically 3 main marginal buyers - institutions (traditional financial players), funds (liquidity funds/cryptocurrency native funds) and gamblers (contract traders, on-chain players, etc.).

A good narrative must be bought by at least one of the parties. Let’s get straight to the point.

Theme 1: AI

Yes, AI will continue to be a hot topic. As mentioned above, we have already experienced several waves of AI, but if you read my paper on AI tokens ( link here ), I believe the next wave is coming soon.

Macro level: hype > fundamentals > practicality;

Micro level: Reply guy > Infrastructure > Applications/avatars.

Buying and holding wont end well. GOAT is the stock that started it all, but its down 60% from its highs and will likely continue to underperform.

Top picks: Applied technologies, Swarms, Gaming, Consumer-focused AI.

Things like ALCH (game development), Griffain (agent that helps control wallets), Digimon, ai16z (the king of all AIs) are all top choices in my opinion, and there are probably many more that I missed.

Topic 2: DeFi

This also goes without saying. DeFi will continue to be a great narrative, however investing in DeFi is very difficult because there are really few tokens that will benefit from it. Even if they do benefit, they may not go up (look at the LST track).

To be honest, this would not be my first choice in terms of risk-reward, but I think this will be a narrative that continues to grow into 2025.

Top choices: AAVE / ENA / Morpho / Euler / USUAL;

Secondary options: Stablecoins/payment related tokens.

Topic 3: Layer 1

Im going to get a lot of hate for saying this, but I believe that Layer 1 trading is back. HYPE is undoubtedly doing great, but SUI was actually looked down upon by many when it was around $1, but it went to $2 and now its at $4. I think the market has been missing out on Layer 1 trading - its one of those areas that no one is paying attention to, but theres a huge opportunity there (HYPEs 10x is proof of that).

Top choices: SUI/HYPE;

Secondary options: Abstract.

I dont know how much I like Monad and Berachain. But Im very excited about Abstract, which I think could be a blockbuster.

Topic 4: NFT Tokens and Game Tokens

I like this theme as well. I have been buying some gaming items recently, and I think the NFT token space is also worth paying attention to. PENGU has slowly recovered, Azuki will have ANIME, Doodles will also issue tokens... I dont think NFT will recover, but I think their tokens will.

Game tokens are also interesting, and Off-The-Grid has shown us that it is possible to make an interesting game. Given that this sector is so underappreciated, I think it’s worth digging deeper to find some really interesting games that are about to launch tokens.

Top choices: PENGU / ANIME (Azuki) / Spellborne / Treeverse;

Secondary options: PRIME / Off-The-Grid (if issuing coins) / Overworld.

Theme 5: Other Narratives

The following are all on my watchlist, I don’t particularly like them, but they are fun.

Datatokens: Kaito/Arkm;

meem token: I only like PEPE, the others...seem outdated;

DePIN: PEAQ/HNT;

Ordinaries;

Old Shanzhai: XRP;

Old DeFi: CRV/CVX.

Predictions for 2025

This one is really just for fun, just something that I think sounds a little bit unbelievable, but not impossible.

DePIN was implemented in a serious way by a serious company, probably through an acquisition;

Binance lost market share as a top exchange not to Hyperliquid but to Bybit/OKX;

As VR technology makes new progress, Metaverse tokens are given new life;

ICOs are becoming popular again;

Ethereum “on-chain season” will not happen;

SUI prices reach double digits (at least $10);

Ethereum’s staking yields are approved for inclusion in ETFs, giving rise to more yield products for staking other tokens, as well as yield aggregators like we saw in 2021;

A major artist uses NFTs and tokens to track and reward his or her fan base;

Bitcoin reaches $200,000;

More Layer 1s saw their CEO/founder leave after seeing Aptos;

Base lost the on-chain race and another Layer 1 took its place. Solana maintained its position.

Conclusion

That roughly summarizes my expectations for 2025. I expect reality to be quite different from my predictions, just as I planned for 2024.

The best advice and takeaway is to “stay flexible and enjoy the ride.” The market will continue to change, but that’s just part of the game of life.

“No one can execute the same trade twice. Because the trades are different, the people are different.”

Good luck, and we’ll see you on the other side. If you make a life-changing profit along the way, use it to change your life.