Original | Odaily Planet Daily ( @OdailyChina )

Author: Wenser ( @wenser 2010 )

It is less than two weeks until Trump takes office as the US President. He may announce a series of governing policies on January 20, the first day of his inauguration. Among the many speculations, whether Trump will promote the establishment of a national strategic reserve of Bitcoin in the United States has become the focus of attention. Odaily Planet Daily has sorted out the major countries that currently hold Bitcoin to help readers get a sneak peek at the current basic situation of the Bitcoin national strategic reserve plan.

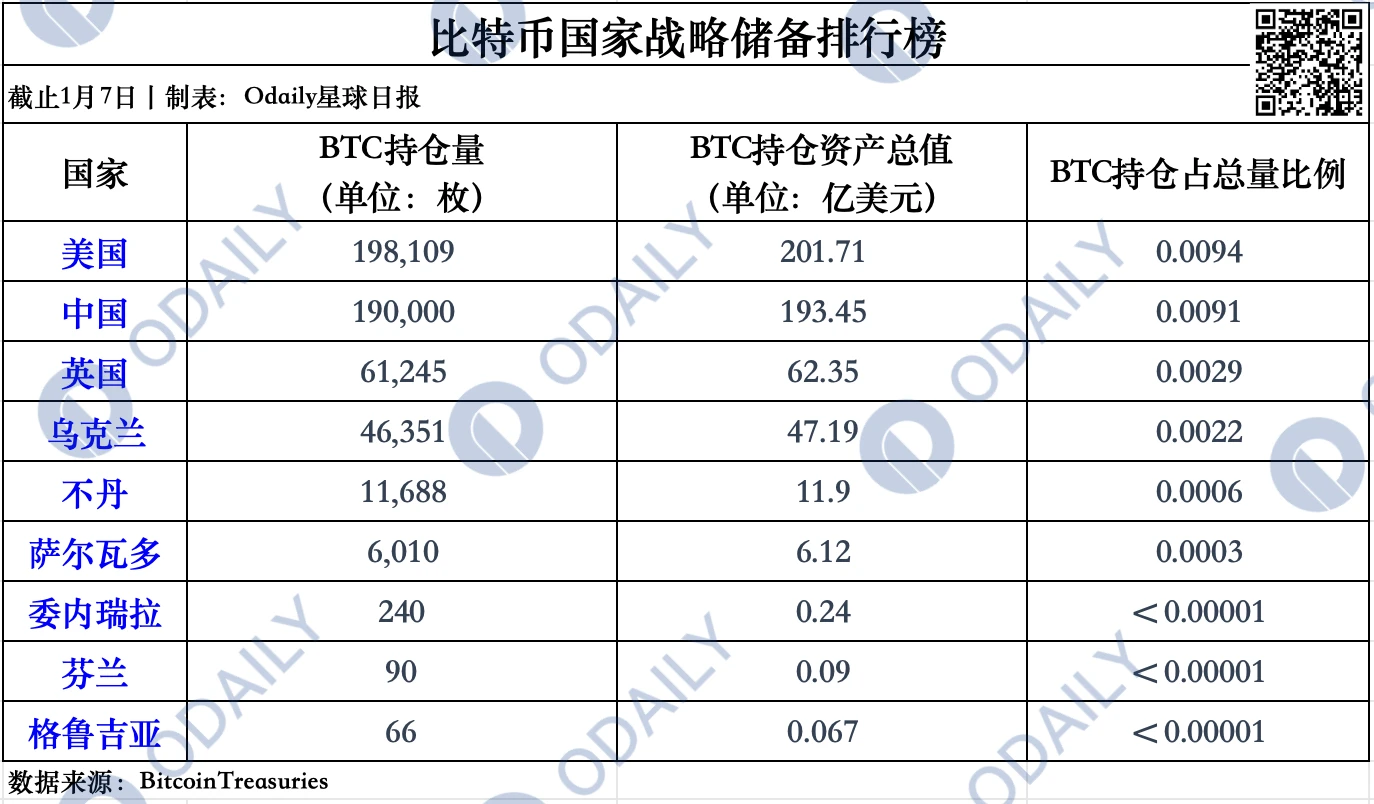

Bitcoin national reserve rankings: four major echelons, with a total holding of more than 510,000 BTC

National BTC reserves data at a glance

First tier: The United States and China are far ahead

The first thing to talk about is naturally the large holders - the United States currently holds 198,109 BTC, worth US$20.171 billion, and the number of holdings accounts for about 0.94% of the total BTC; China holds 190,000 BTC, worth US$19.345 billion, and the holdings account for about 0.91% of the total BTC.

It is worth mentioning that according to information from the BitcoinTreasuries website , the U.S. governments BTC holdings all come from fines and confiscations from the Silk Road website. Trump had previously promised to release Silk Road founder Rose after taking office. This matter may also become a major hype hotspot; and according to the websites sources, the Chinese governments BTC holdings may mainly come from the PlusToken hacking incident in 2020, when the number of BTC confiscated was about 194,000. Some believe that its BTC holdings may far exceed this number.

Second tier: Britain and Ukraine follow closely behind

Compared with the first tier, the number of BTC holdings in the second tier, the United Kingdom and Ukraine, has dropped by an order of magnitude.

The former owns 61,245 BTC, worth about US$6.24 billion. According to feedback from sources , the main source of this batch of BTC is also confiscated funds, and this money also comes from China.

In January 2024, according to Skynews, a woman who previously worked as a delivery girl in a Chinese restaurant was investigated after trying to buy a £23.5 million Hampstead mansion, and the police subsequently seized more than £1.4 billion worth of Bitcoin. It is understood that Ms. Wen, 42, acted as a front figure to help money launderer Qian Zhimin handle part of the profits from a £5 billion investment fraud case carried out in China between 2014 and 2017. At that time, British police seized 61,000 BTC. Subsequently, according to Arkham platform on-chain data monitoring , the British government bought 245 BTC at an average price of $59,376 in September 2024, and its holdings have since grown to 61,245 BTC.

The latter owns 46,351 BTC, worth about $4.72 billion. There is no accurate information about the specific source of Ukraines BTC holdings, but according to statistics from multiple channels, it began to hold BTC on September 14, 2022, when the BTC price was only $20,185. Compared with the current price above $100,000, the increase has been as high as 400%. Combined with the Russian-Ukrainian war that broke out in early 2022, we have reason to speculate that this holding may be partly derived from crypto donations.

The third tier: Bhutan and El Salvador become firm holders

Bhutan and El Salvador in the third tier are more like national-level players.

The former’s BTC holdings mainly come from the mining income of the Bhutanese royal family. Currently, they hold more than 11,000 BTC, worth $1.19 billion. It is worth mentioning that the Bhutanese royal family is not a diamond hand from beginning to end. They have sold small amounts of BTC many times. In December last year, they sold 420 BTC at a price of about $98,000 and 103 BTC at a price of about $97,000.

Compared to Bhutan, El Salvador is more like a firm believer in holding positions - the country not only took the lead in implementing the BTC national strategic reserve plan, but has also been implementing the plan of buying one BTC every day; and there are additional holdings. The latest on-chain data shows that El Salvadors BTC holdings have grown to about 6,010, worth $612 million.

Fourth tier: Venezuela, Finland, Georgia hold a small amount

The BTC holdings of countries in the fourth tier have dropped sharply to hundreds or even dozens of coins.

As a Latin American country, Venezuela has been plagued by inflation. Previously, the Venezuelan president used cryptocurrencies to circumvent US sanctions , Venezuelan oil companies accelerated their embrace of USDT stablecoins , and Venezuelan authorities seized more than 11,000 Bitcoin mining machines and cut off power connections at multiple mining sites . Last September, Venezuelan opposition leader María Corina Machado also proposed that Bitcoin be used as a national reserve asset . The current source of its holdings is Forbes magazine.

The Finnish authorities BTC holdings once reached 1,981, worth nearly 75 million euros, mainly from assets seized by Finnish customs in drug raids before 2018. After the outbreak of the Russian-Ukrainian war in 2022, the Finnish authorities sold 1,891 BTC , which was worth $47.35 million at the time, with an average selling price of only about $23,000.

There is no specific source for Georgias BTC holdings. According to the information on the BitcoinTreasuries website , we only know that these 66 BTC were purchased at an average price of US$20,185 in September 2022. The specific information remains a mystery.

Other countries: Bulgaria and Germany: Always making money from selling flights

In addition to the above countries, Bulgaria and Germany are worth mentioning separately.

According to media reports , the former had seized more than 200,000 BTC from criminals. It is understood that the Southeast European Law Enforcement Center (SELEC), a regional organization consisting of 12 member states including Bulgaria, issued a notice stating that a total of 213,519 bitcoins were seized that month. The operation arrested 23 Bulgarian nationals. The arrest and subsequent asset seizure were carried out after an investigation into an alleged customs fraud case. At the time, the price of BTC was about $15,524, with a total value of about $3.3 billion. According to a media report in 2022 , the funds were eventually secretly sold by the Bulgarian government to Asian investors and sovereign wealth funds at an average price of about $16,900, with a total value of about $3.6 billion, and the funds raised were mainly used to form a new aircraft squadron for the Bulgarian army. Now, the Bulgarian government is equivalent to selling about $17 billion, which can be called the most expensive price in history.

The German government is another example of making money forever by selling planes, and compared with the long history of the Bulgarian governments selling of planes, it is undoubtedly a fresher case.

In June 2024, the German government sold all 50,000 BTC seized from the pirated movie website Movie 2k at an average price of about $60,000, which caused a sharp drop of about 15% in the price of BTC at that time, causing panic in the market. After Trump was successfully elected as the next president of the United States, BTC gradually broke through the new high of about $108,000. In a sense, in the eyes of people in the crypto industry, the German government has undoubtedly become the biggest clown in the cryptocurrency field - its selling funds exceeded $2.5 billion, and the time difference was only less than 6 months.

One cannot help but sigh that even a national entity may not be able to grasp the windfall when faced with it. It is truly a matter of time and fate.

Summary: It will take some time for the national strategic reserve of Bitcoin to be opened

The latest news shows that Dennis Porter, co-founder of Satoshi Action Fund, which advocates the establishment of a national strategic reserve of Bitcoin, has published an article stating that the 14th state in the United States is now preparing to introduce strategic Bitcoin reserve legislation. At the same time, Simon Gerovich, CEO of Metaplanet, a Japanese listed company that followed MicroStrategys purchase of BTC reserves and ushered in a surge in stock prices, previously stated that if Trump adopts a strategic reserve of Bitcoin, other Asian countries may follow suit.

In addition, according to betting information from Kalshi, a well-known American prediction platform , the probability that Trump will push for the establishment of Bitcoin reserves by January 2026 is currently reported at 53%, which is a significant drop from the high point of 67.6%.

At present, Trump still needs to go through a lot of tests to fulfill his promise at the Nashville Bitcoin Conference. But in any case, the continued inflow of funds into BTC spot ETFs is a foregone conclusion, and the mainstreaming of cryptocurrencies has gradually accelerated. 2025 will surely be an important year for the penetration of cryptocurrencies to increase again.

Can the US BTC holdings grow further? Can the US BTC strategic reserve be established soon? What will be the specific operation mode?

Only time will tell us the final answer.

Recommended reading: