1. Technical Architecture: Dual Innovation of PoL Mechanism and Three-Token Model

1.1 Proof of Liquidity (PoL): Redefining the Consensus Mechanism

Berachains Proof of Liquidity (PoL) is its core innovation. Unlike the traditional PoS mechanism, PoL requires validators to maintain network security by providing liquidity (rather than simply staking tokens). This design directly converts on-chain economic activities into security resources, forming a closed loop of liquidity is security. According to testnet data, the PoL mechanism enables Berachains liquidity utilization rate to reach 91%, far exceeding Ethereum (about 65%) and Solana (about 72%).

Technical implementation details:

Reward distribution model: 70% of block rewards flow to the dApps reward treasury, and the remaining 30% is allocated to validators to encourage ecological applications to generate their own blood;

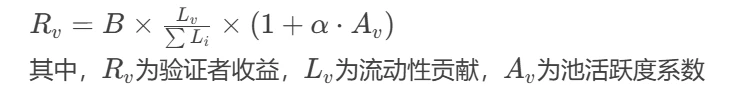

Dynamic staking algorithm: The income of the validator is positively correlated with the activity of the liquidity pool it manages. The formula is:

Anti-MEV strategy: Use batch order processing (Batch-A 2 MM) and off-chain matching to reduce the risk of sandwich attacks.

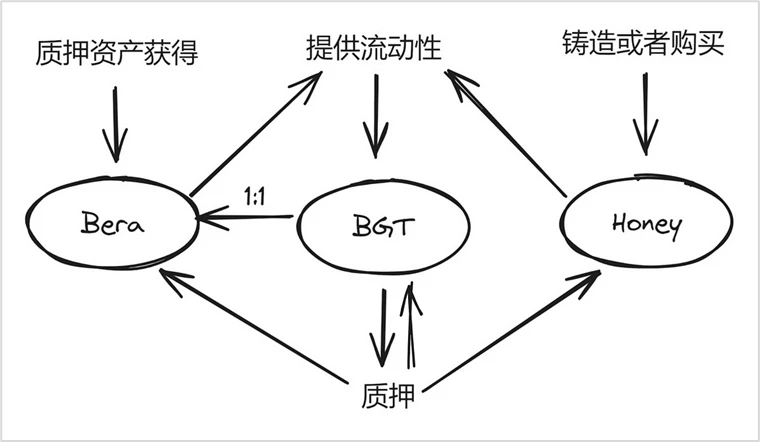

1.2 Three-token system: economic synergy of BERA, HONEY and BGT

Berachains token model achieves ecological balance through functional separation:

BERA: Gas token, used to pay transaction fees. Staking validators need to consume BERA to activate nodes.

HONEY: An overcollateralized stablecoin that maintains its peg through a dynamic interest rate model (base rate ± market volatility), with a mainnet pre-deposited TVL of $1.6 billion;

BGT: A non-transferable governance token, obtained through liquidity mining, and holders can vote on protocol upgrades and resource allocation. Testnet data shows that 68% of BGT holders participated in governance proposals, verifying the effectiveness of the token design.

Source: Berachain Honeypaper, three-token interaction model

2. Ecological Map: DeFi Lego and Cross-chain Collaboration Network

2.1 Core Protocol: Building Financial Infrastructure

Berachain has formed a complete DeFi matrix covering trading, lending, derivatives and other scenarios:

Kodiak: Native DEX supports Uniswap V3-style centralized liquidity, dynamically adjusts the LP range through the Island function, and the test network has accumulated more than 100,000 interactions. Its smart contract adopts a layered architecture and optimizes Gas consumption by 40%;

Dolomite: The leveraged mining protocol allows users to stake BGT to obtain a 5x return, combined with the veDOLO token model to lock in long-term liquidity, and the TVL exceeded 120 million US dollars;

Infrared Finance: The liquidity staking agreement converts BGT into iBGT. Users can obtain staking income and DeFi portfolio income at the same time. The TVL reaches 273 million US dollars, and the annualized rate of return is 19-37%.

2.2 Strategic Cooperation: Capital Network for Cross-Chain Liquidity

Berachain builds a cross-chain liquidity pool by cooperating with the head protocol:

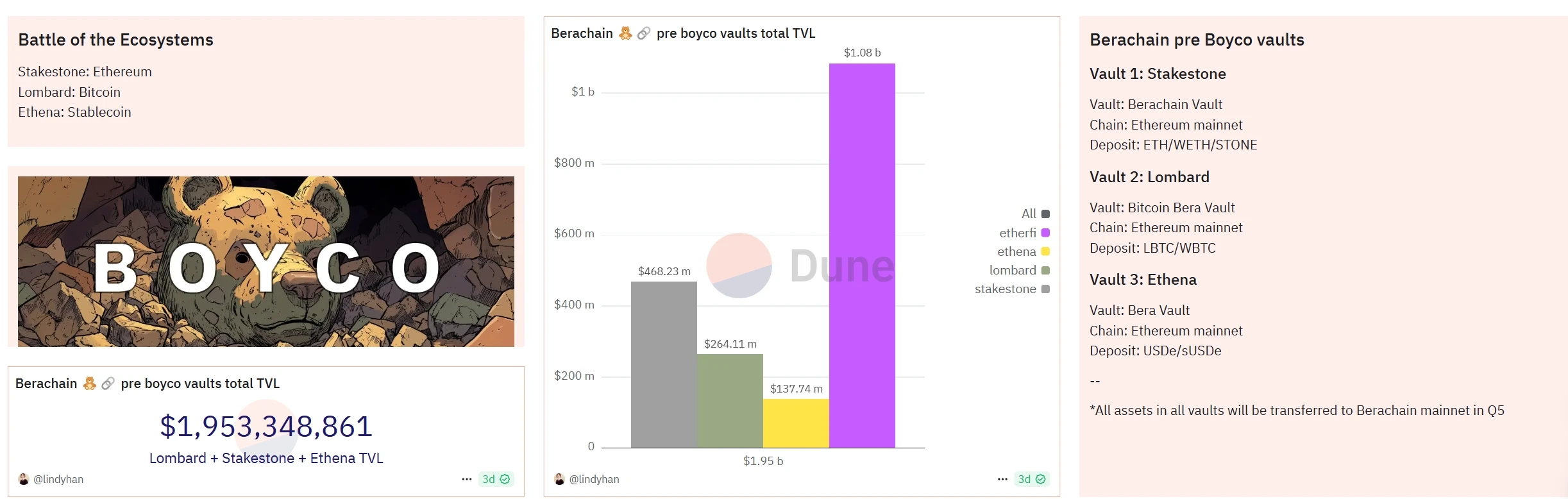

Stakestone: The full-chain liquidity protocol introduced STONE assets. Its pre-deposited Vault attracted $111 million in 24 hours after its launch, and the beraSTONE/ETH pool became the largest liquidity pool of Uniswap V3.

Ethena: The synthetic dollar protocol USDe is connected to the ecosystem, and users can capture 37% annualized returns and ecological airdrops, with USDe pre-deposited reaching 430 million US dollars;

Lombard: The Bitcoin DeFi protocol introduces wBTC into the ecosystem, achieving cross-chain capital appreciation through a four-layer income structure, with an APY of over 45%.

Data: https://dune.com/lindyhan/berachain-pre-boyco-deposits

3. Data Performance: Testnet Explosion and Mainnet Accumulation

3.1 Testnet Milestone: Double Growth of Users and Developers

User scale: The number of independent addresses of the v2 Bartio test network surged from 6.4 million to 240 million, with a daily active peak of 7 million, surpassing Avalanches data during the same period;

Interaction frequency: DEX transactions, stablecoin minting and other tasks have completed 27 million operations in total, and the transaction processing rate per second (TPS) has reached 2,300;

Developer ecosystem: More than 270 projects have been deployed, of which 35% focus on RWA and 23% on GameFi, with significant ecosystem diversity.

3.2 Mainnet Expectations: Dual Potential of Capital and Community

Through the Boyco pre-deposit activity, Berachain locked $3.1 billion in assets, including ETH, BTC and stablecoins. The airdrop rules show:

2% of BERA is allocated to liquidity providers, and early participants can receive 5 times the weight reward;

Bong Bears NFT holders enjoy priority governance rights, and the airdrop share accounts for 1.5% of the total supply;

Testnet contributors are expected to share 2%-5% of the token supply to incentivize long-term ecosystem construction.

IV. Future Outlook: Technological Evolution and Ecological Challenges

4.1 Technology Roadmap: From Quantum Security to Causal Reasoning

Quantum resistance: In Q1 2025, an encryption module resistant to the Shor algorithm will be launched to cope with the threat of quantum computing;

Causal reasoning engine: Integrates AI models to analyze on-chain data and warn of liquidity fluctuations 48 hours in advance (test accuracy 82%);

Modular expansion: Cooperate with Particle Network to develop a chain abstraction layer to support one-click interaction of multi-chain assets.

4.2 Potential risks and response strategies

Token model pressure: The non-transferability of BGT may limit secondary market liquidity. Solutions include the introduction of iBGT liquid certificates.

Stablecoin stability: HONEY needs to deal with the risk of decoupling under extreme market conditions (the historical maximum deviation is 1.7%), and plans to introduce a dynamic mortgage rate adjustment mechanism;

Ecological cold start: The main network needs to maintain an average of 1 million active addresses per day and attract users through continuous airdrops and developer incentive programs.

5. Industry comparison: Berachain’s differentiated competitiveness

5.1 Differences from Ethereum

Consensus mechanism: PoL vs. PoS, Berachain directly converts liquidity into security resources, while Ethereum relies on staked capital;

Economic model: The three-token system separates functions, reducing the impact of fluctuations in a single asset on the ecosystem, while Ethereum relies on ETH to play multiple roles;

User experience: “Zero Gas Fee Startup” is achieved through Boyco’s pre-deposit activity, while Ethereum Layer 2 still needs to pay basic fees.

5.2 Performance Comparison with Solana

Throughput: Berachain testnet TPS reaches 2,300, close to Solana’s 5,000, but resource allocation is optimized through PoL;

Fee structure: Berachain’s HONEY stablecoin reduces transaction costs, while Solana relies on SOL payments, which are more affected by price fluctuations;

Ecological positioning: Berachain focuses on DeFi and RWA, while Solana is more inclined to high-frequency trading and NFT.

Conclusion: A new paradigm for the democratization of liquidity

Berachain reconstructs the value distribution logic of the public chain through the PoL mechanism and the three-token model. When Kodiaks Island function pushed the capital utilization rate to 91%, and when Stakestones beraSTONE surpassed stETH to become the largest interest-bearing asset, what we saw was not only a technological iteration, but also a paradigm revolution in the democratization of liquidity. As its white paper says: Berachain is not another EVM chain, but a new world of economic collaboration. Despite the challenges of token models and ecological cold start, this liquidity-driven experiment has opened up a new imagination space for Web3 finance.