1. Pump’s valuation is 4 billion and its token issuance is

On July 9, Pump.fun officially announced the launch of the platform token PUMP. The maximum supply of PUMP is 1 trillion. According to official disclosures, 33% of the tokens will be used for the initial token offering. The private and public rounds of tokens are priced at $0.004 per token, with an overall valuation of $4 billion and will be fully released in the initial token offering. This means that there is at least $1.32 billion in potential selling pressure after PUMP opens. As of July 11, its pre-market trading price on Hyperliquid and Binance was about $0.0051, a premium of about 22% over the fundraising price.

The moment Pump.fun announced the token issuance, it added pressure to the already tense on-chain sentiment. The current market is facing liquidity tightening and low sentiment. As the leader of the MEME launch platform, Pump.funs daily revenue and user activity have declined significantly compared to its peak period, and its market share has been gradually eroded by new competitors. In this context, its high-valuation public offering is generally believed to have structural problems: the token has no actual value, the initial selling pressure is large, the teams unlocking plan lacks transparency, and the valuation is obviously overdrawn in the downward cycle of the altcoin. In addition, because the Pump.fun team has previously continued to sell the fee income it has obtained for cash instead of replenishing the community, many people are worried that this round of high-valuation fundraising is more like an exit liquidity operation rather than a long-term development plan for the project, and the team lacks the motivation and ability to continue to support the market.

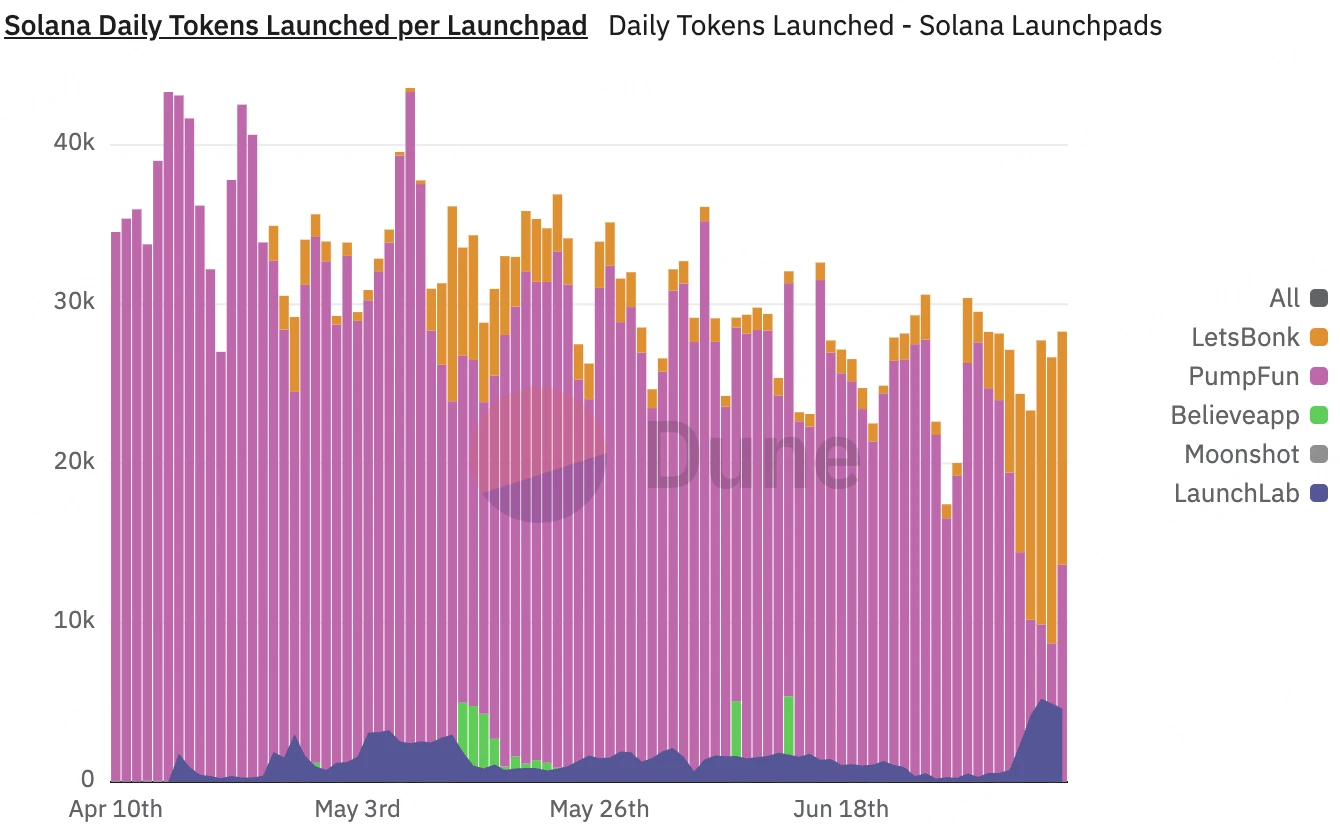

Since its launch in January 2024, Pump.fun has accumulated nearly $670 million in revenue, with a peak daily fee of nearly $7 million. This once allowed it to monopolize the Solana ecosystem MEME token launch platform. However, just as PUMP was about to be issued, its competitor letsbonk.fun rose strongly. With 15,600 token issuances, it surpassed Pump.funs 11,500, and with a market share of 49.8%, it overturned the formers 40.9% monopoly. This is the first time that Pump.fun has been surpassed by its rival in Solana MEME market share since January 2024. Although Pump.fun subsequently returned to the top of the market, this experience of being surpassed has raised questions about its monopoly position in the market, and also shows that it is likely to be replaced by other platforms in the short term.

Data source: Dune

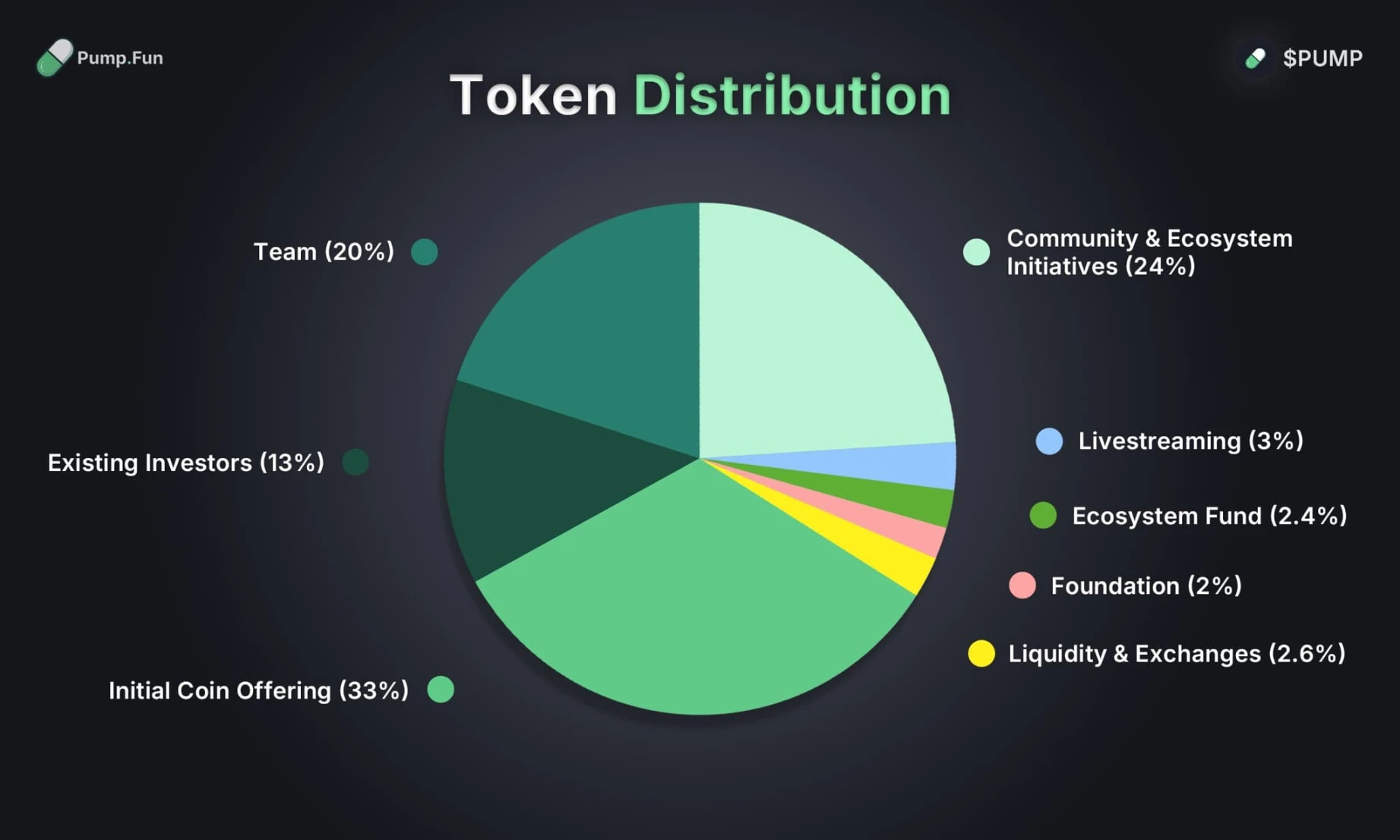

2. Introduction to PUMP Token Economy

33% will be sold in the ICO

24% allocated to community and ecosystem initiatives

20% allocated to the team

2.4% for the ecosystem fund

2% for the Foundation

13% to existing investors

3% allocated to live streaming

2.6% for liquidity + exchanges

PUMP Token Information

PUMP Token Sale:

The token issuance raised 33% of the total supply. The private round accounted for 18% (private offering for institutions), and the public round accounted for 15% (public offering on 6 centralized exchanges). The fundraising price for both rounds was $0.004 per token, with a total valuation of $4 billion. All tokens were fully unlocked on the first day of listing.

Time Schedule:

Start time: July 12, 2025 (Saturday) UTC 14:00

End time: July 15, 2025 (Tuesday) UTC 14:00 or tokens sold out, whichever comes first

Token distribution: Distributed within 48-72 hours after the sale ends, and freely transferable within 48-72 hours after distribution

Requirements for participation:

Must complete KYC real-name authentication

Residents of the United States, United Kingdom and other restricted jurisdictions are prohibited from participating

Purpose of PUMP tokens:

$PUMP is the token of the pump.fun platform. Its only purpose is to promote the pump.fun platform. It does not have any rights to equity, revenue, voting rights, platform fees, etc.

Use of token sale proceeds: used as platform operating reserve or for paying service provider fees.

Source: Pump.fun

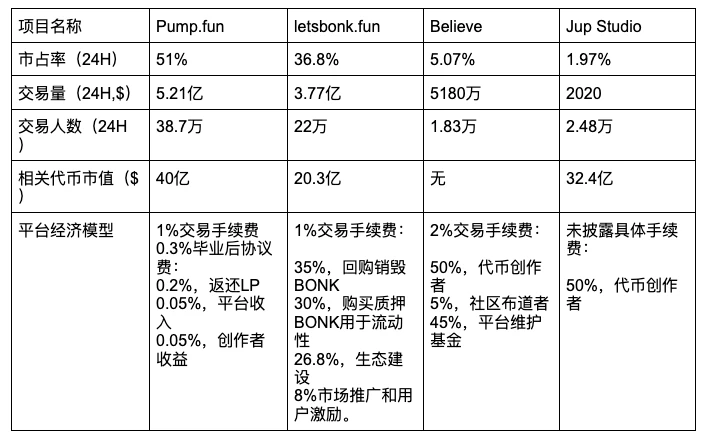

3. Competitive Product Analysis

Note: July 10, data for the past 24 hours Source: Jupiter

From the perspective of market share and trading activity, Pump.fun still maintains a leading position, but due to the rapid rise of competing products such as letsbonk.fun, Pump.funs market dominance is being eroded. In addition, in terms of the core competitiveness of the token economic model, Pump.funs platform token PUMP has obvious defects. The official clearly stated that the only purpose of PUMP is to promote and disseminate the platform. The token does not have any economic rights - including but not limited to platform ownership, profit sharing, governance rights or handling fee refunds, etc., which makes its intrinsic value basis close to zero, basically belonging to a pure narrative token. Tokens that lack value support are difficult to motivate long-term holdings, and also weaken the interest binding relationship between users and platforms.

In contrast, the competitor letsbonk.fun has a more structural advantage in token mechanism design. Although its BONK token also does not give holders platform equity, it has built a strong value support logic by introducing economic cycles and deflation models: the platform uses 35% of the 1% handling fee for each transaction to repurchase and destroy BONK in the market, and injects 30% into BONKs liquidity pool to form an automatic market-making mechanism and enhance liquidity depth. Such deflation and liquidity dual mechanisms effectively enhance the attractiveness of holding BONK tokens and their price support capabilities. In addition, in terms of governance and community participation mechanisms, other platforms are also building a more complete token value closed loop. For example, Jupiter Studios official token JUP, in addition to community governance functions, also supports staking to obtain platform incentives, forming a certain degree of governance-revenue linkage. Compared with the empty shell attributes of PUMP, the mechanisms of JUP and BONK are more competitive in the long run in empowering users and building platform consensus.

IV. Conclusion

In the context of the sluggish altcoin market and the recent poor performance of Pump.fun itself, its platform token issuance plan is bound to attract market attention and controversy. At present, the main risks of PUMP tokens are as follows:

First, despite its long-term leading position in the market, its market share has been surpassed by competitors such as letsbonk.fun many times recently. Against the backdrop of intensified market competition, Pump.fun still chose to issue platform tokens at a valuation of up to $4 billion, which is significantly higher than its competitor BONK ($2 billion), causing the market to question the rationality of its pricing;

Second, PUMP’s token model has obvious flaws: it does not have any basic economic rights such as governance rights, revenue sharing or fee refund mechanisms, and only relies on brand narratives to support its value, which leads to a lack of incentives for holding coins in the medium and long term. Therefore, PUMP is more like a pure narrative token, and the market generally believes that its intention to issue coins is more inclined to cash out the team rather than promote the long-term construction of the platform;

Third, at the macro market level, although Bitcoin has recently hit a new high, driving the overall risk appetite to rebound, the altcoin market is still in a state of tight liquidity. According to CMC data as of July 11, the market value of altcoins has returned to 1.3 trillion in May this year, and there has been no structural change in the current market (data source: CMC ). Therefore, users remain cautious about tokens with high valuations and high selling pressure. In the absence of sufficient narrative space and capital relay, PUMP faces a high risk of breaking the issue price;

Fourth, the amount of this public offering of Pump.fun is as high as 600 million US dollars, which is far beyond the industry norm. Most potential buyers are expected to subscribe directly through the primary market, resulting in a serious shortage of buying in the secondary market. At the same time, 33% of the tokens will be unlocked to primary financiers (about 1.32 billion US dollars) at the opening. In the absence of continuous relay funds in the market, the selling of early investors after the opening will further aggravate the price pressure and liquidity risk in the short term.

In general, although Pump.funs token issuance has continued its brand influence, its high valuation and high selling pressure structure can easily amplify market uncertainty under the multiple pressures of increasingly fierce market competition, lack of support for token mechanisms, and conservative capital sentiment. The future performance of PUMP will largely depend on whether the project party can build a more sustainable token value system in a timely manner after the pressure in the secondary market is released, and re-strengthen its market dominance and user confidence through product innovation or ecological integration.

Risk Warning:

The information provided is for informational purposes only and should not be considered a recommendation to buy, sell or hold any financial asset. All information is provided in good faith. However, we make no representations or warranties, express or implied, as to the accuracy, adequacy, validity, reliability, availability or completeness of such information.

All cryptocurrency investments (including returns) are highly speculative in nature and involve significant risk of loss. Past, hypothetical or simulated performance is not necessarily indicative of future results. The value of digital currencies may rise or fall, and there may be significant risks in buying, selling, holding or trading digital currencies. You should carefully consider whether trading or holding digital currencies is suitable for you based on your personal investment objectives, financial situation and risk tolerance. BitMart does not provide any investment, legal or tax advice.