Original | Odaily Planet Daily ( @OdailyChina )

Author: Azuma ( @azuma_eth )

The market is falling again and the demand for financial management is rising again. There seems to be an inverse proportional function with unknown parameters between the two.

In the past two weeks, we have successively shared the first issue of U-based Financial Management Strategy More Suitable for Lazy People (February 24) and the second issue of U-based Financial Management Strategy More Suitable for Lazy People (Second Issue) , aiming to cover the relatively low-risk return strategies based on stablecoins (and their derivative tokens) in the current market ((systemic risks can never be ruled out)), and help those users who hope to gradually expand the scale of funds through U-based financial management to find more ideal interest-earning opportunities.

In this issue, we will continue to focus on the latest trends in the U-standard financial management market.

Base rate

Odaily Note: The base interest rate is tentatively set to cover the single-currency financial solutions of mainstream CEX, as well as mainstream on-chain lending, DEX LP, RWA and other DeFi deposit solutions.

Affected by the sluggish market, the base interest rates of major CEXs and DeFi have also been sluggish - the annualized rate of return of USDT single-currency wealth management in OKX has dropped to 1%, and Ethenas sUSDe APY has also dropped to 4.99% .

For CEX, except for the funds currently planned for bargain hunting in the short term and the share that can receive subsidies (generally within 500 U, currently Gate and Bitget are relatively higher, and you can get the benefits from multiple exchanges and accounts), it is not recommended to keep the remaining funds in CEX. After all, the interest-bearing efficiency is too low.

The situation in DeFi is relatively better, but not ideal. It is difficult to find pools with more than 10% on the most mainstream chains such as Ethereum, Solana, and Base, but there are still some in small ecosystems. For example:

Shadow on Sonic: USDC.e/USDT LP 18.3%;

Kyo on Soneium: USDT/USDC.e LP 17.37%;

Echelon on Aptos: sUSDe 17.14%, USDC 13.53%;

In addition, you can pay attention to Fluid, which will be deployed on Polygon soon. According to the latest proposal , it is expected that both parties will provide some additional incentives. In addition, Fluids deposit APR is relatively high among mainstream lending protocols, and the expected rate of return after the incentive will be good.

Pendle Zone

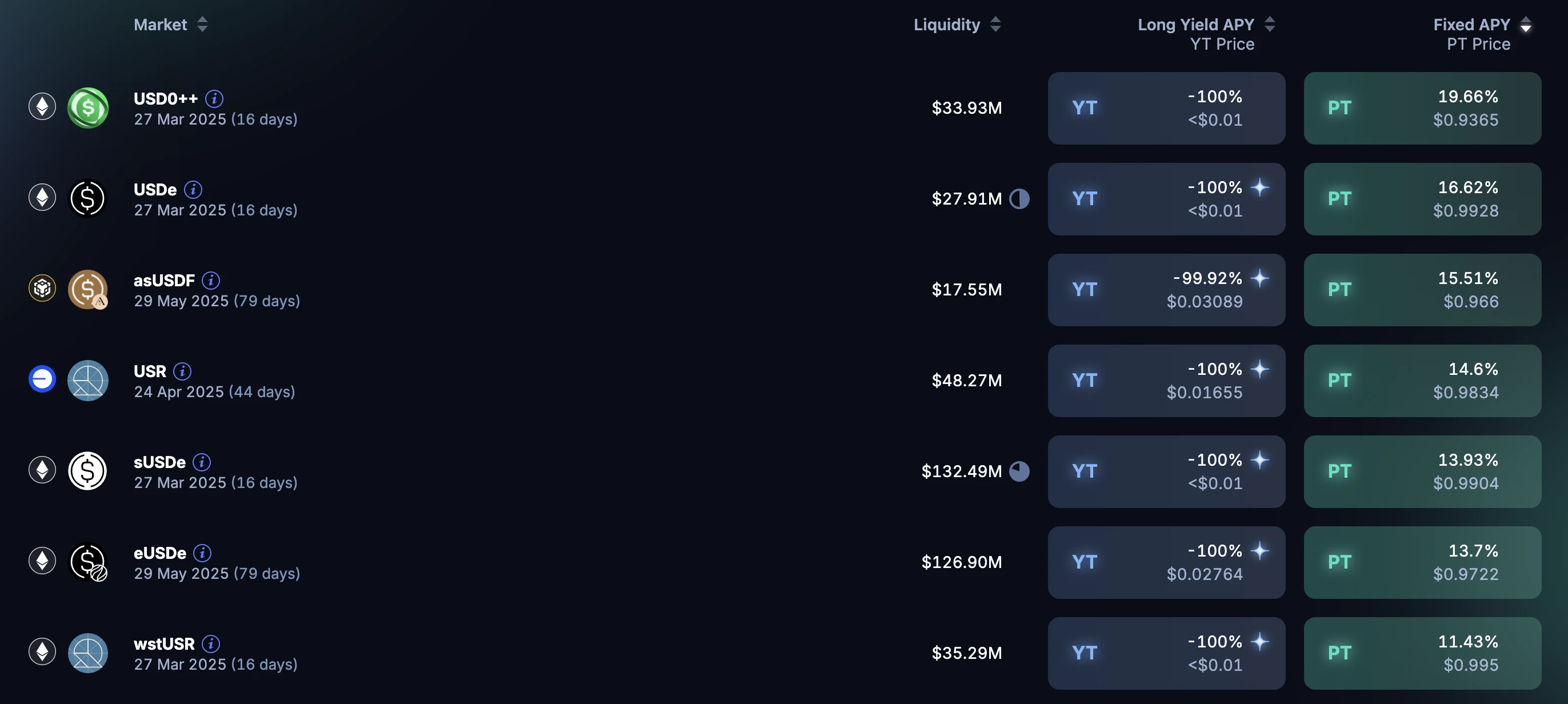

Let’s talk about fixed income first. The real-time ranking of PT yields of major stablecoin pools in Pendle is as follows. Considering the status of the underlying assets (reputation, liquidity, etc.) and the expiration time, I would recommend USR (PT 14.6%) on Base, which expires on April 24, and eUSDe (PT 13.7%) on the main network, which expires on May 29.

This week, I want to talk about Pendle and focus on the movements of giant whales.

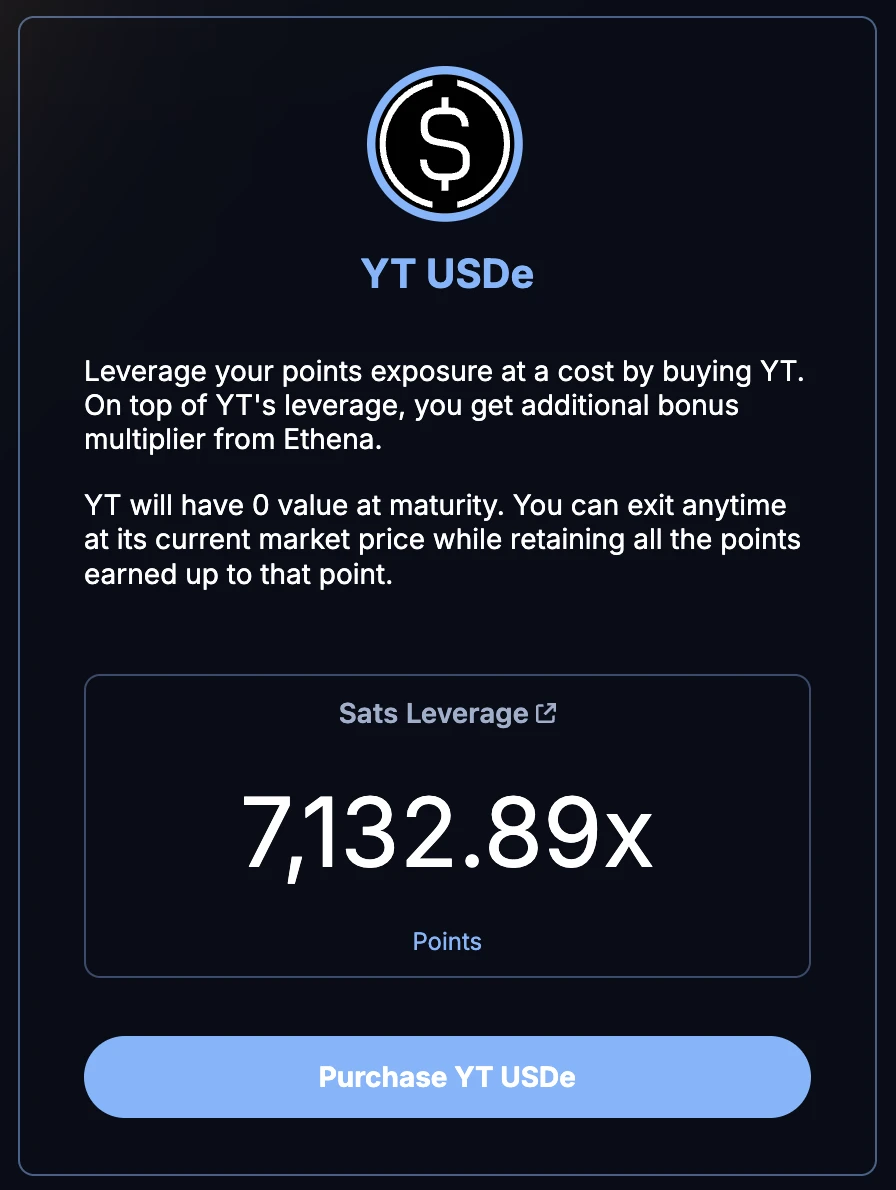

On March 8, whales swept up $70 million of USDe YT (expiring on March 27), which means that these whales are quite optimistic about the Ethena S 3 airdrop that will be launched this month. So now we need to consider how to accumulate Ethena points more efficiently and keep up with the whales.

Let me just say that the leverage ratio of USde YT points expiring on March 27 is as high as 7132.89 times. If you want to obtain accumulated Ethena points as quickly as possible, directly purchasing YT would be the most efficient way - given that the price of YT will return to zero on the expiration date, this is actually a trading behavior and is not covered by this series of articles.

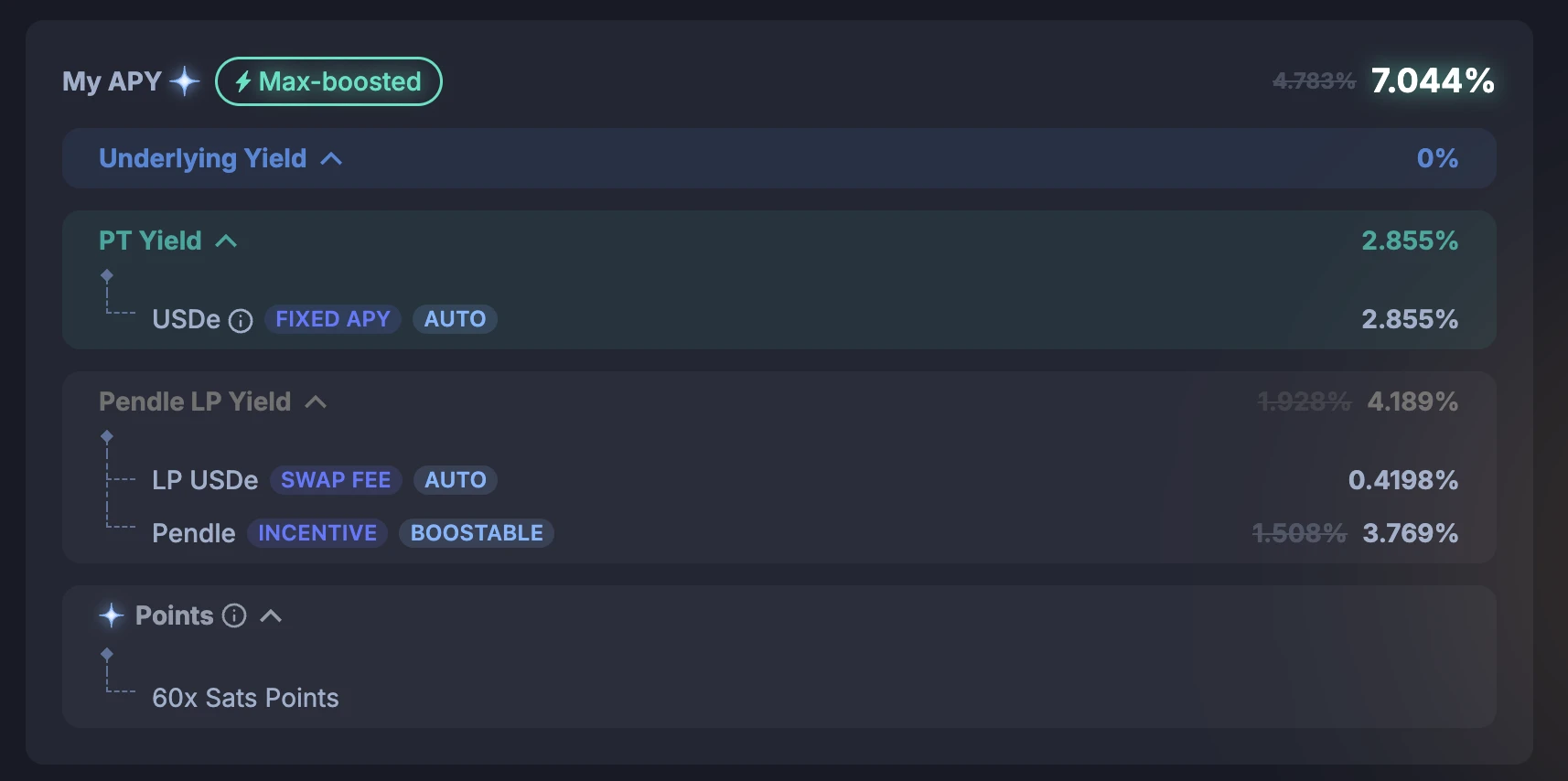

If you do not want your principal to be worn out , rather than buying PT (higher fixed income), we recommend that users participate as LPs (lower apparent returns + retaining point exposure). We recommend the USDe pool that expires on July 31 with a maximum multiplier of 60 times.

Other Opportunities

Last week, in addition to this series, we also compiled and shared some scoring strategies on Sonic (see Three Leverage Strategies to Help You Efficiently Capture Sonics June Airdrop ), but these strategies either require futures and spot coordination (spot + equal position shorting) to hedge, or rely on the native protocol on Sonic, which raises certain security concerns.

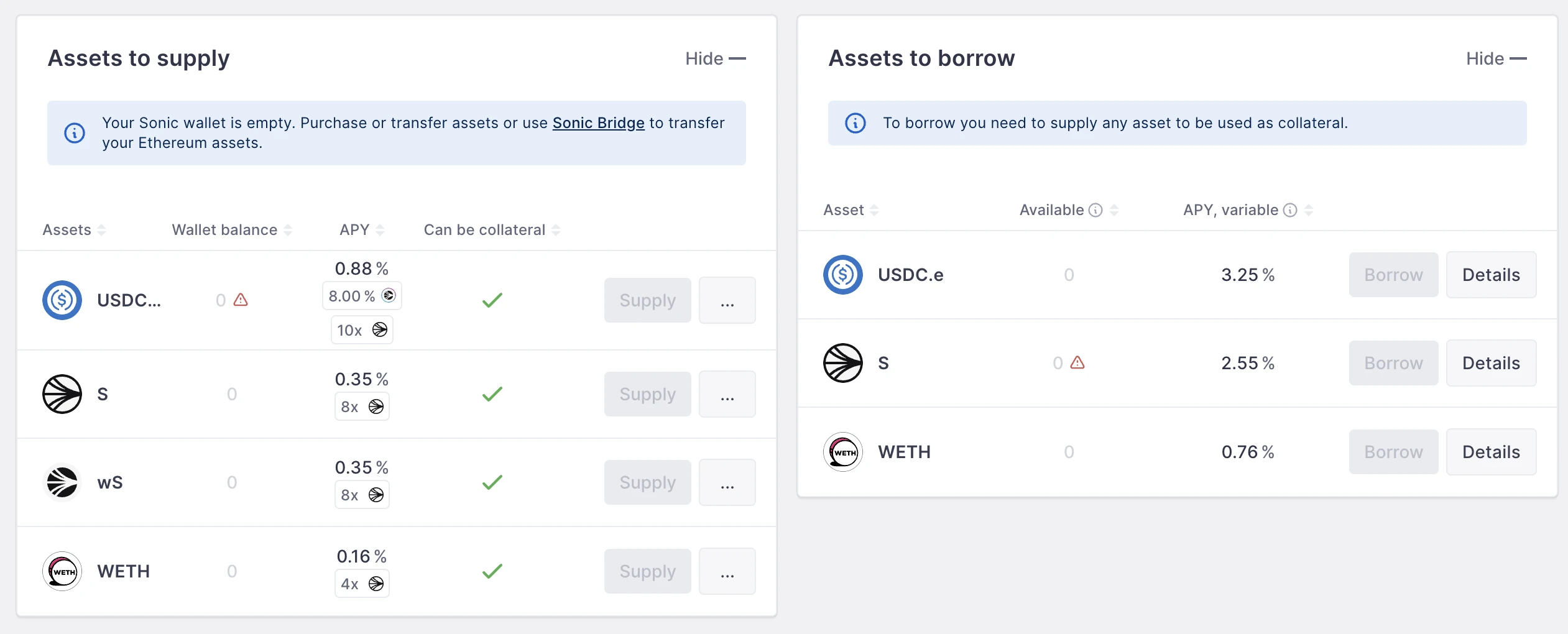

Now the situation has changed! Aave has quickly raised the capacity limit of the stablecoin pool (USDC) to 70 million since it was deployed to Sonic last Monday. Now the pool can get 8% fixed incentives (incentives need to be collected through Aavechan in the future, in addition to 0.8% deposit apy), and can also eat 10 times the Sonic points.

Here comes the point. Since Aave itself supports the deposit and borrowing of the same asset (deposit USDC and borrow USDC), there is no need to worry about price feed fluctuations (such as the S/stS pool, there is always a worry about accidental depegging), so you can leverage without restraint - the current borrowing cost of the pool is 3.25%, and the deposit income is sufficient to cover it. After several rounds of circular lending, the basic income and point rate can be increased n times.

So again, just use aave!

In addition, Noble also launched the interest-bearing stablecoin USDN last week and simultaneously launched a points activity. The embarrassing thing is that depositing in the points pool cannot get the original income of USDN (4.3%), so there is no way to kill two birds with one stone . In contrast, the income of the non-points pool has increased by 14.1%. Whether to clarify the income or points is a matter of opinion.

Finally, Movement is expected to open its public mainnet on March 10. There may be some first-time mining benefits at that time, so stay tuned. If I see a good pool, I will update it in time on X ( @azuma_eth ).