FAFO -- Geopolitics

For readers who are not familiar with this term, FAFO is the abbreviation of F— around and find out, which may be the most appropriate description of the current global situation.

President Trump’s second term has gotten off to a turbulent start that may have exceeded the expectations of even his most loyal supporters, with investor sentiment swayed by his extreme tariff and military negotiating tactics with America’s former and current allies, U.S. asset markets continue to oscillate while Wall Street begins to accept that a slowdown may be coming as the administration attempts to re-privatize key parts of the economy.

Judging from the major headlines over the past week, there is still considerable confusion behind Trump’s geopolitical moves:

Trump cuts Canada, Mexico tariffs - WSJ

Trumps erratic tariff policy confuses markets - Bloomberg

China imposes retaliatory tariffs on Canadian canola oil, pork - Bloomberg

Fed Chair Powell says no rush to adjust rates - Bloomberg

Although the market has always been good at ignoring bad news, it is not good at dealing with uncertainty. Wall Street has begun to be unable to withstand the Trump administrations repeated and inconsistent policy statements and is actively seeking easing.

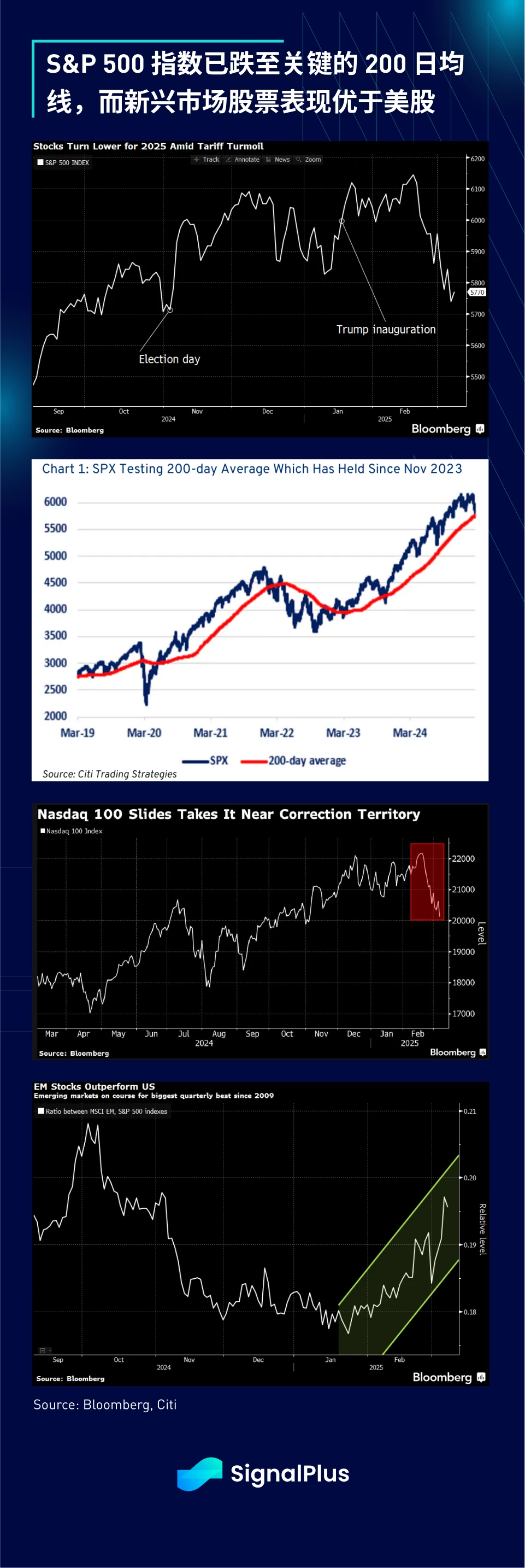

FAFO -- Stock Market

Since hitting a year-to-date high in mid-February, the MSCI World index has fallen 4.6% and the SPX has fallen more than 6%, now approaching its 200-day moving average, which has been held since the end of 2023. With the tech-heavy Nasdaq down nearly 10% and Nvidia down nearly 20%, while emerging market stocks have outperformed U.S. stocks by the most in a decade, does this mean the U.S. markets outperformance is coming to an end?

We discussed the oft-misunderstood “Trump-put” at length last week, and recently Trump reiterated it, claiming that he is “not paying attention to the market” and blaming the recent decline on jealous “globalists.”

“I think it’s caused by globalists who see that America is going to get rich and they don’t like it.”

This has nothing to do with the market. Im not paying attention to the market at all, President Trump said. -- CNBC

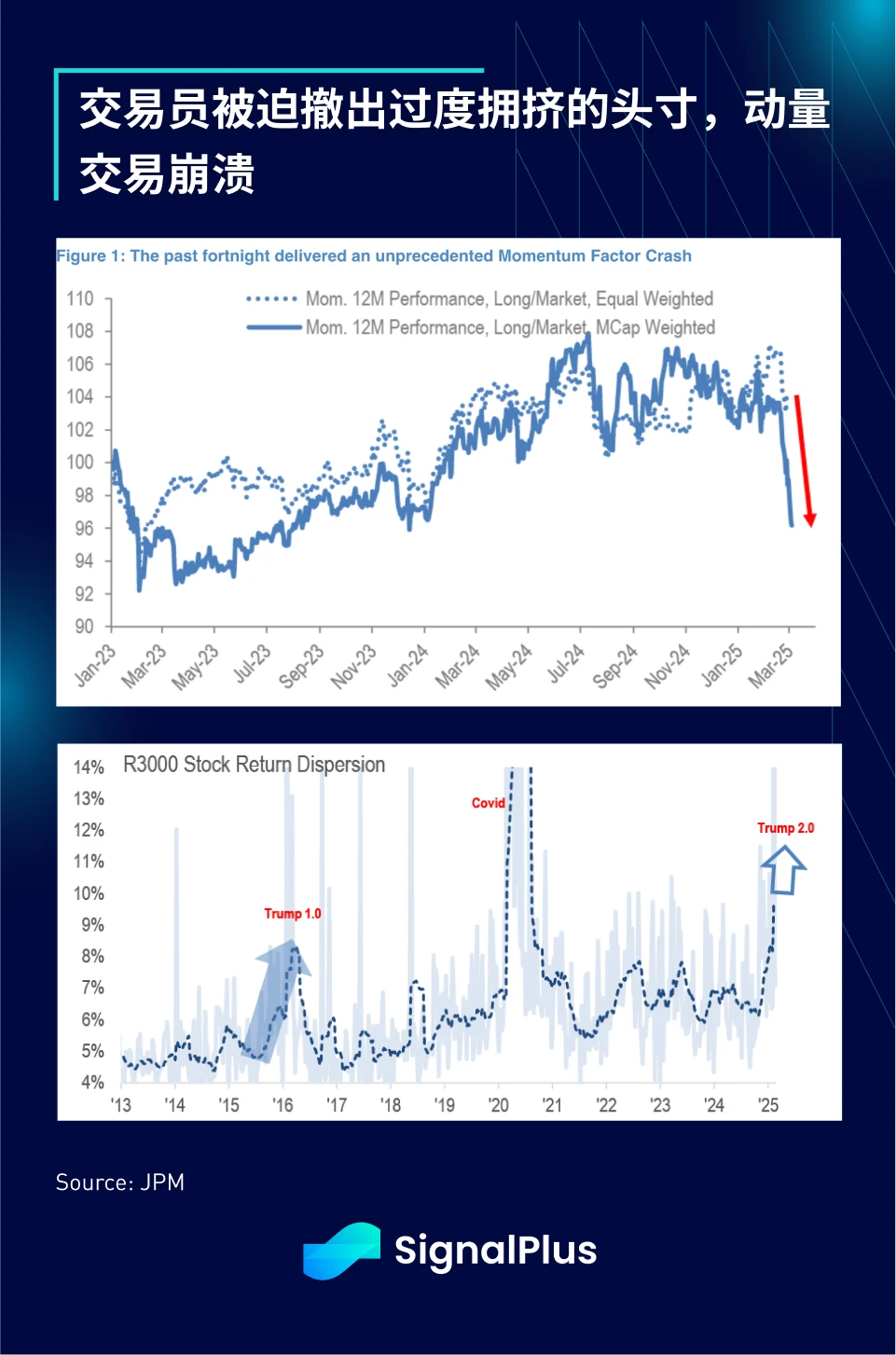

In response, U.S. investors quickly exited crowded momentum trades, widespread liquidations and systemic strategy deleveraging triggered a rapid factor collapse, equity return dispersion jumped to its highest level since the pandemic, and cross-asset portfolios suffered their biggest losses since 2023 due to slowing economic growth, tariff uncertainty, and a major shift in European fiscal policy.

FAFO -- American Economy

In addition to the capital markets, investors now realize that the Trump administration is trying to make some unconventional adjustments to the U.S. economy. The impact of increasing tariffs, tightening immigration policies, and cutting government spending has surpassed the positive effects of tax cuts and loosening corporate regulations. As economic growth forecasts continue to be lowered, the market consensus has gradually shifted to believe that the government will begin to implement more policies to stimulate growth after the 2026 mid-term elections, and now it is necessary to endure short-term pain and wait for these radical policies to take effect.

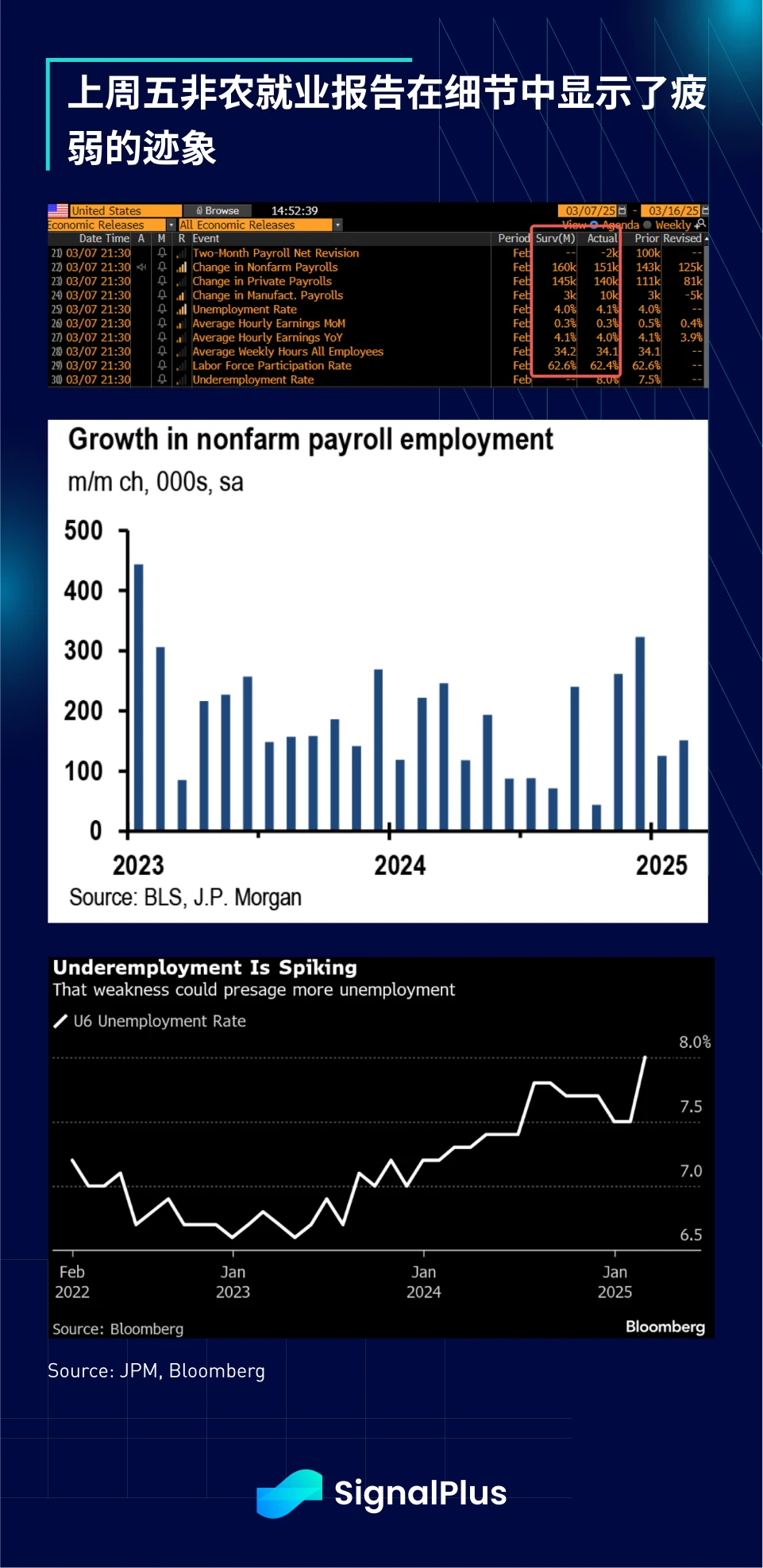

The trajectory of economic slowdown has begun to be reflected in recent data. The details of the non-farm payrolls report last Friday revealed clear signs of weakness, and the underemployment rate surged to a five-year high, exacerbating market concerns about a recession, and expectations of interest rate cuts were brought forward to this summer, and U.S. bond yields fell further.

Although Chairman Powell tried to project confidence at the Chicago Monetary Forum last Friday:

*POWELL: The Fed does not need to rush and can wait for more clear signals

*POWELL: Despite uncertainty, U.S. economy is in good shape

*POWELL: Tariffs push up short-term inflation expectations

-- Bloomberg

But Finance Minister Bessent took a completely different tone, saying the government had inherited an economy that was already cooling and warning: As we move from public to private spending, there will be a natural adjustment in the market.

If that wasnt clear enough, he went a step further and added:

Markets and the economy have become accustomed to huge government spending and now have to go through a detox. -- CNBC

Regarding the Trump put option, Bessent stated flatly:

“There is no put option,” he said. “If we have good policies, then the market will naturally go up.”

This is a necessary course correction, Bessent said of Trumps economic policies. Well see if theres any pain. I believe if we get the policies right, it will be a very smooth transition. -- CNBC

Basically, the administration is claiming that they are moving the economy away from the Democratic-era model, and that this process will be painful and the markets should be prepared for that.

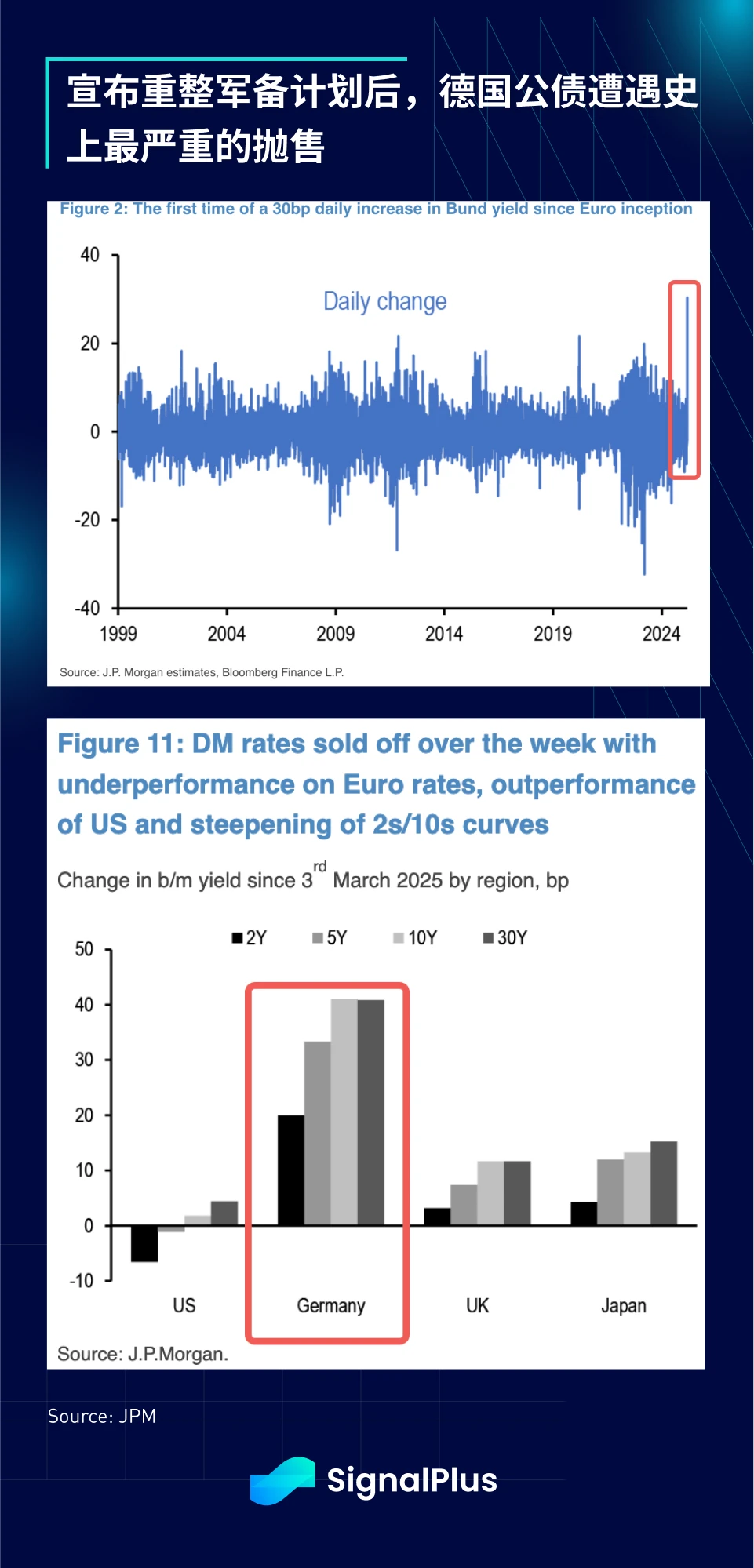

FAFO -- European Rearmament

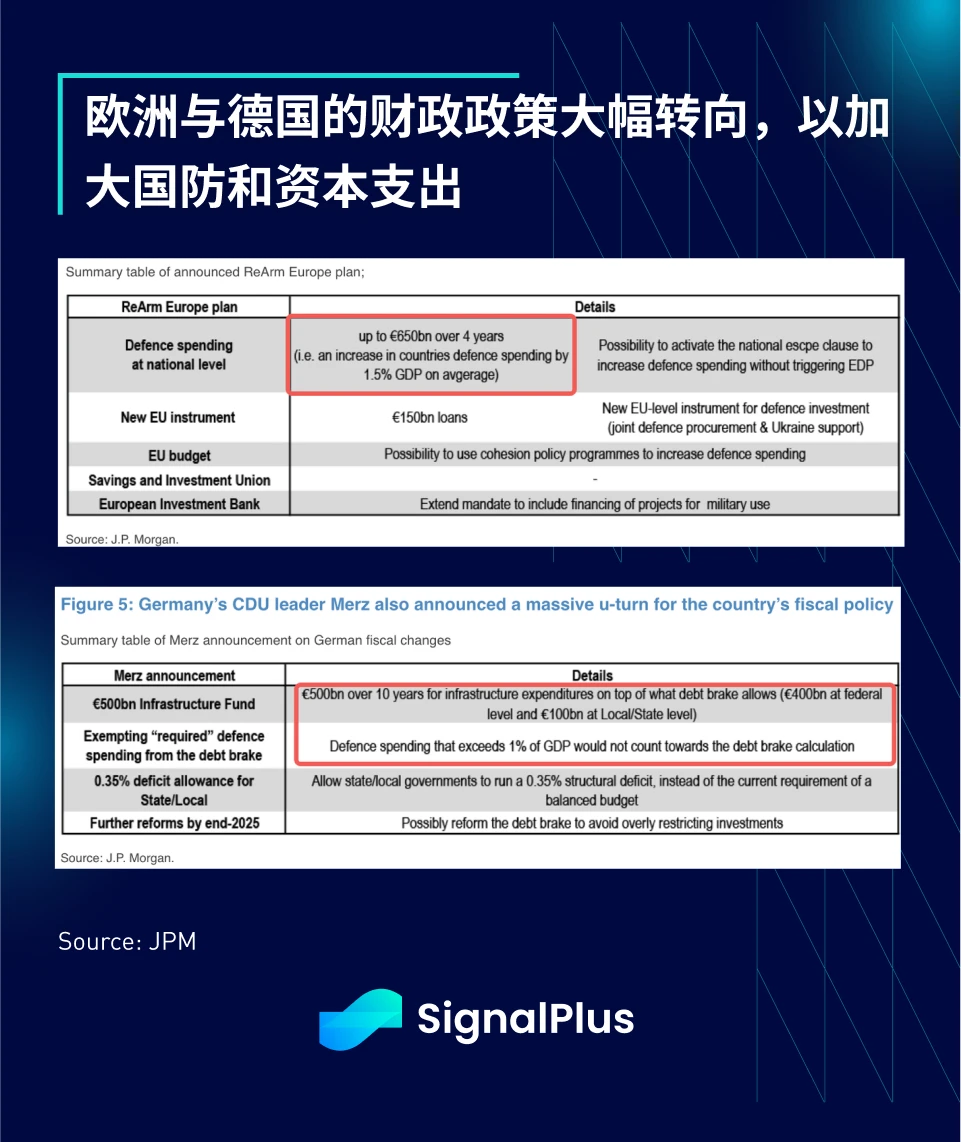

The Trump administrations shift in position on the Russia-Ukraine conflict and suspension of military aid have led to changes in Europes attitude towards defense and fiscal spending. Investors are shocked by Europes rearmament plans and fiscal spending plans. European and German bonds have suffered the worst sell-off since the birth of the euro, with German government bond yields rising 30 basis points in a single day, breaking the previous record.

The EU rearmament plan is expected to invest 800 billion euros in European defense in the coming years, of which 650 billion euros will be borne by individual member states. Following the announcement, Germany further announced a major shift in its fiscal policy, including the establishment of a special fund of 500 billion euros for infrastructure spending over the next decade, exemptions from the limit on defense spending exceeding 1% of GDP, and other measures to increase the debt ceiling in the coming years.

As for the impact of a rearmament Germany on the European continent? This is a highly sensitive topic and we will not discuss it in depth. But in any case, bond issuance and supply will definitely increase.

FAFO -- Cryptocurrency Strategic Reserve

Crypto assets have had a choppy week that ended in disappointment after a previous strategic reserve announcement and a much-anticipated White House crypto summit did not result in any substantial purchases.

Simply put, the Strategic Bitcoin Reserve only counts the BTC seized by the government into the reserve, and does not sell them directly on the market. This is no different from considering slower weight gain as successful weight loss, which is definitely not the good news expected by the cryptocurrency market.

“The Strategic Bitcoin Reserve will be capitalized with BTC acquired by the U.S. government through criminal or civil asset forfeiture.” -- David Sachs via X

The government tried to keep a glimmer of hope for the market, suggesting that it might still buy Bitcoin (and other tokens) in the future, but market confidence has been hit. From a legislative perspective, there are still extremely complex procedures and obstacles to actually promoting any additional cryptocurrency purchases, which is not an issue that the current government is capable of promoting.

The U.S. Department of Commerce and the Secretary of the Treasury are “authorized to develop budget-neutral strategies to acquire additional bitcoin, provided that such strategies do not impose additional costs on the U.S. taxpayer.” - White House

Additionally, the executive order establishes a “US Digital Asset Stockpile,” comprised of digital assets other than Bitcoin acquired by the government in criminal or civil asset forfeiture proceedings.

The government will not acquire additional digital assets beyond those obtained through forfeiture proceedings.

The primary purpose of the reserve is to ensure that the Treasury is responsible stewards of the governments digital assets. -- David Sacks via X

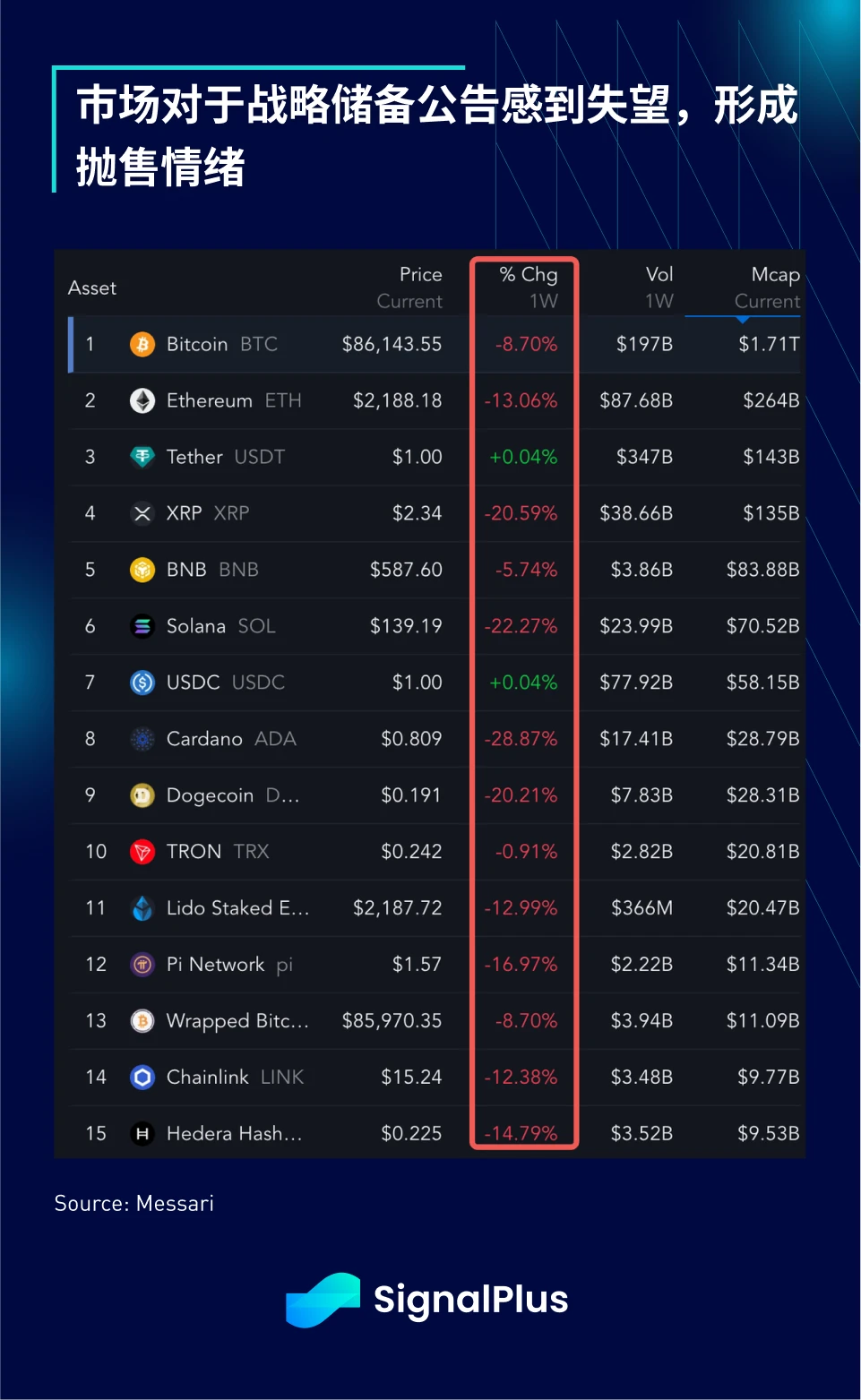

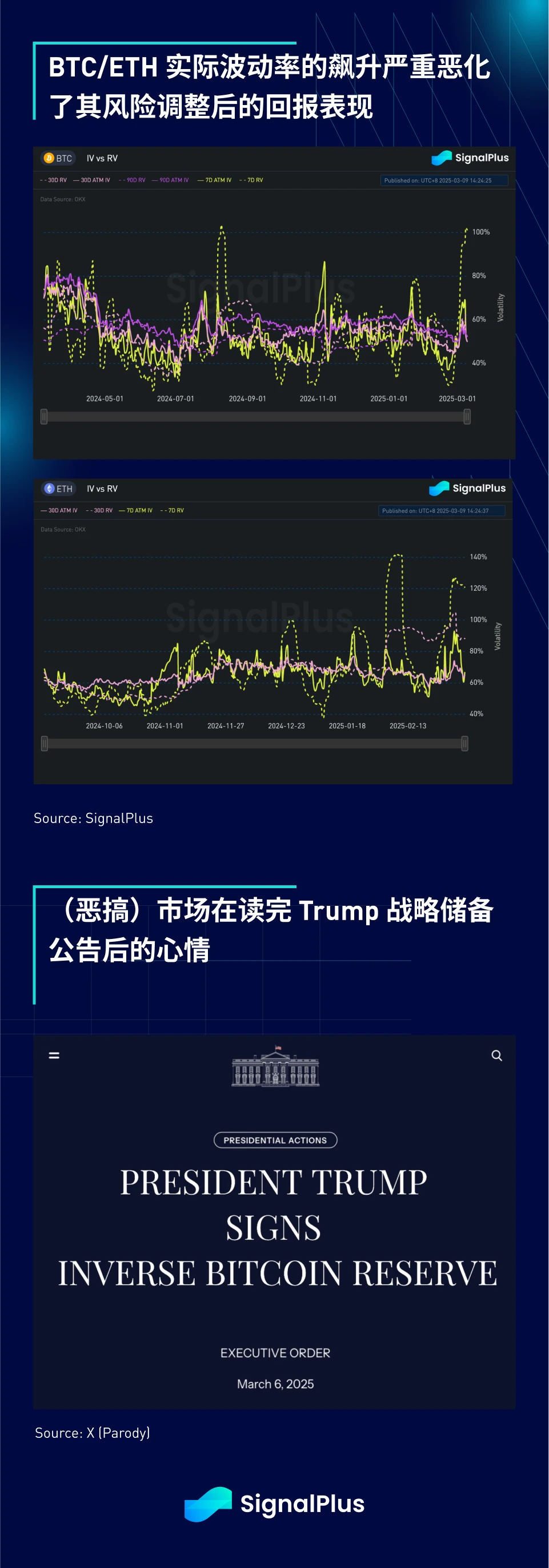

A series of misfortunes have hit the sentiment of the entire ecosystem, and the token price has fallen by 10-20% last week. From a technical perspective, the price trend has become very negative, and the high realized volatility has further deteriorated the risk-adjusted BTC return indicators. There are currently almost no short-term positive factors in the market that can support a price rebound.

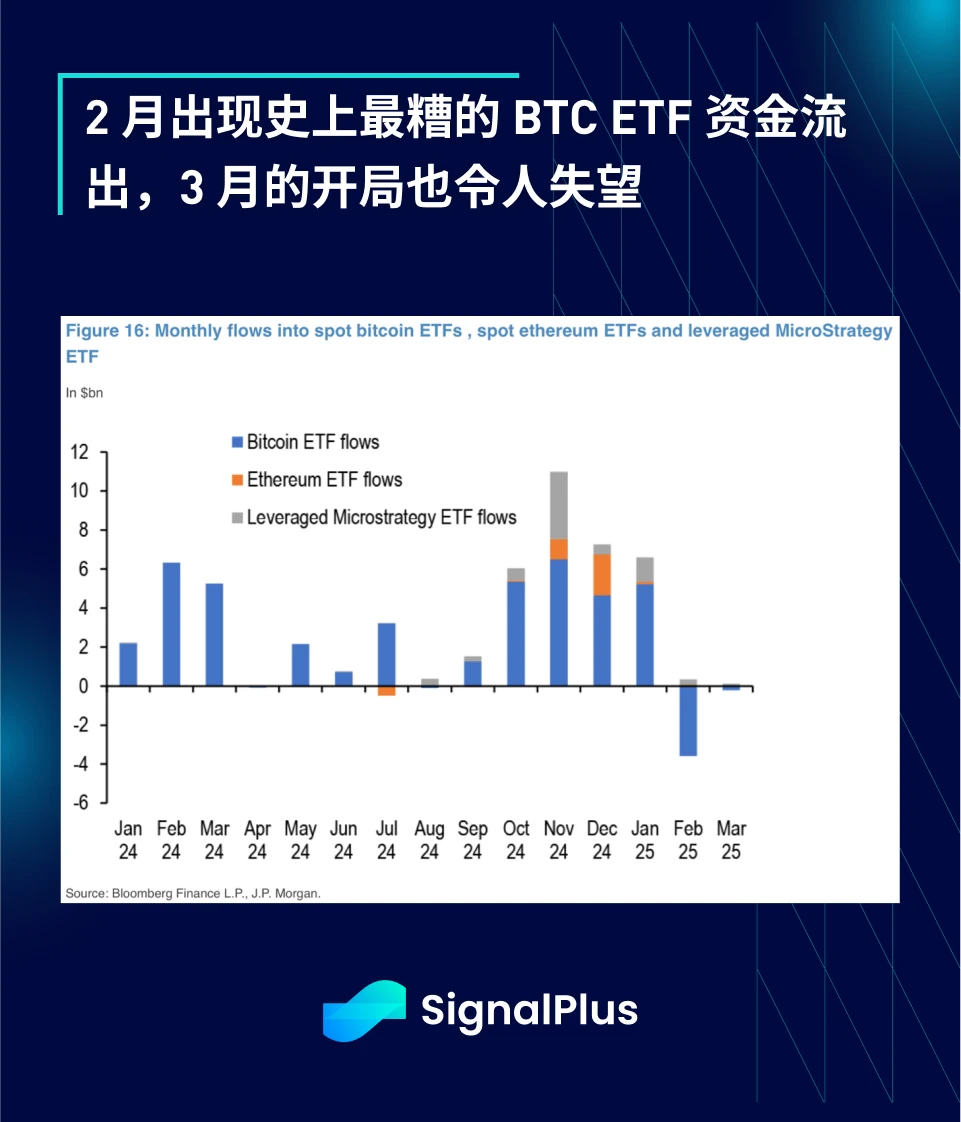

At the same time, as retail investors begin to cut their risk exposure due to widespread liquidation in the overall risk market, the flow of funds to BTC ETFs is also expected to remain weak.

With the strategic reserve issue behind us, the Trump administration is now turning its focus to rebuilding the Digital USD and institutional dominance through stablecoin policies.

I want to clearly express my strong support for the efforts of lawmakers in Congress who are working on bills to provide regulatory certainty for dollar stablecoins and digital asset markets. They are putting a lot of effort into this, Trump said at a gathering of cryptocurrency executives at the White House.

We will use stablecoins to ensure the dollars dominance as a global reserve currency, Besset said. -- CNBC

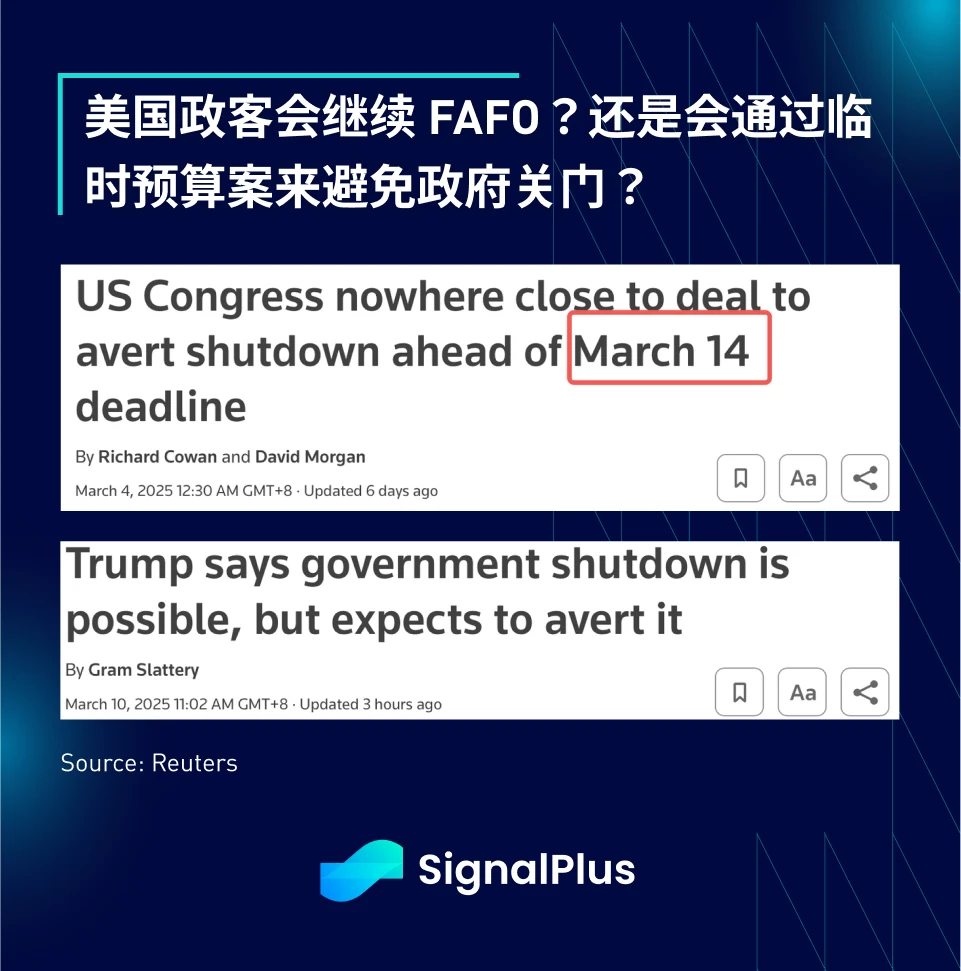

FAFO -- US government shutdown crisis?

So, what to expect next? Can we take a breather and get away from these FAFO situations?

Risk assets should be close to the conditions for a short-term rebound. The current Fear Greed Index of the stock market has fallen to an extreme low, and most US stock indices also show technical oversold conditions.

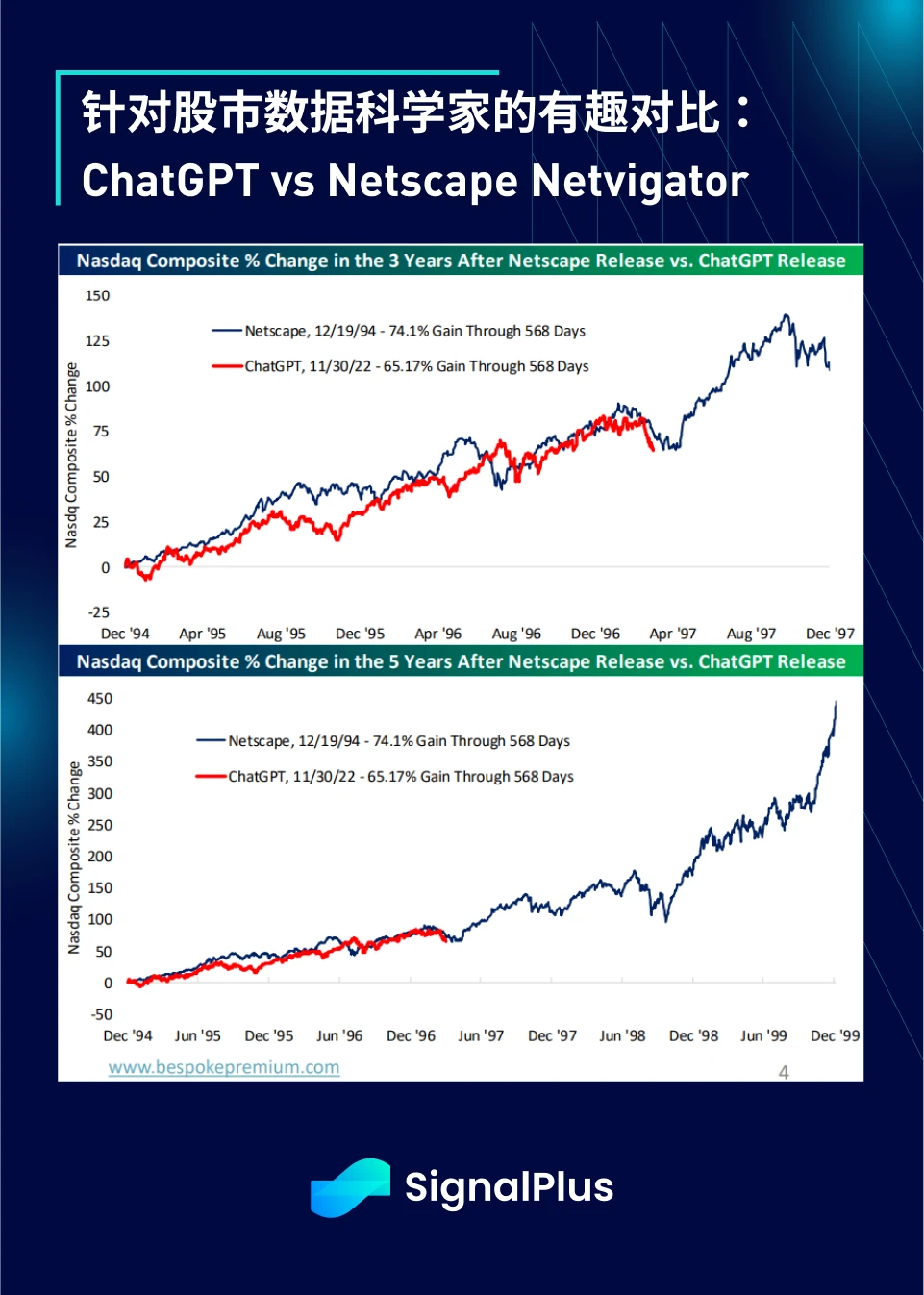

In addition, some creative market analysts compared the launch of ChatGPT with the birth of the Netscape browser, believing that the former promoted the popularization of AI and LLM, and that the influence of both was equally far-reaching.

We don’t have a strong opinion on this analogy, but it is an interesting way to analyze the data.

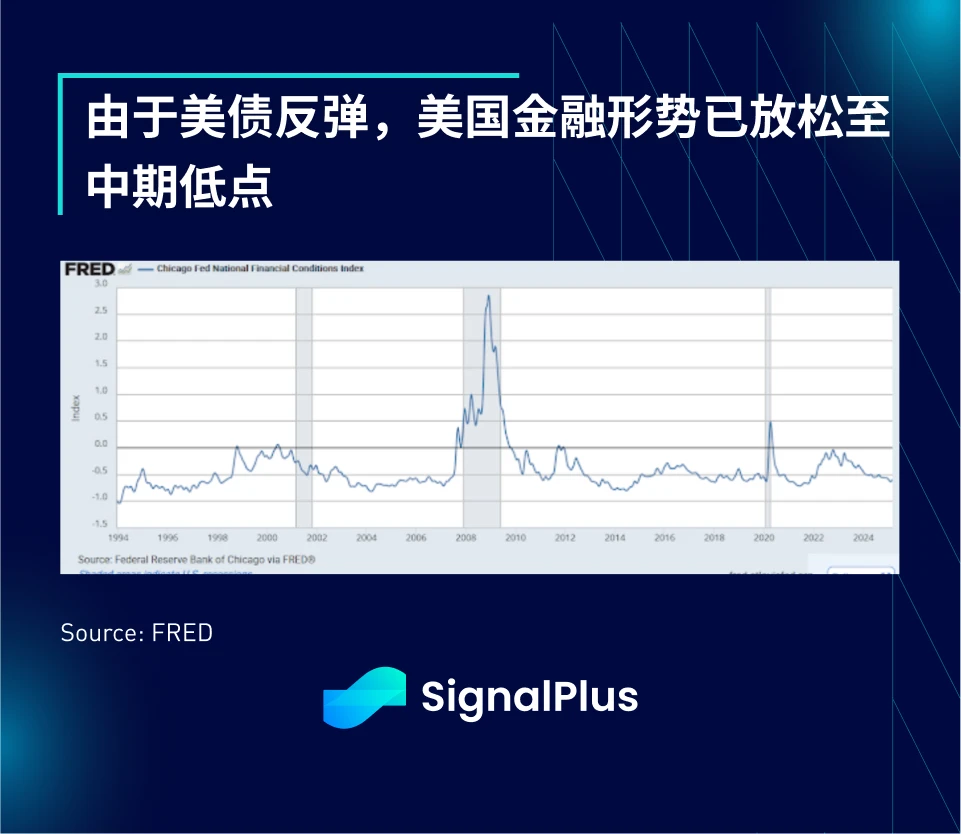

In addition, with U.S. Treasury yields retreating, financial conditions remain very loose, which would normally be a positive situation for cryptocurrencies, gold and risky assets, were it not for the markets deep concerns about an impending economic slowdown.

So is it time to jump in and grab a bargain? Will the Trump administration take a break from making shocking statements?

Unfortunately, the market is about to face the US Congress debt ceiling deadlock, and considering the White Houses recent extreme decision-making style, this negotiation is likely to be more uncertain. Will the government really be temporarily shut down because of the two parties bluffing at the negotiating table? Or will an agreement be reached after repeated tugs and turns, just like the US-Canada/US-Mexico tariff issue?

From a rational point of view, it should not develop into a full-scale crisis. The market may consider tentatively covering risk positions in the short term... But who can be completely sure? This may be the ultimate FAFO.

I wish you all a successful trading week!

You can use the SignalPlus trading vane function at t.signalplus.com to get more real-time crypto information. If you want to receive our updates immediately, please follow our Twitter account @SignalPlusCN, or join our WeChat group (add the assistant WeChat, please delete the space between the English and the number: SignalPlus 123), Telegram group and Discord community to communicate and interact with more friends. SignalPlus Official Website: https://www.signalplus.com