1. Bitcoin Market

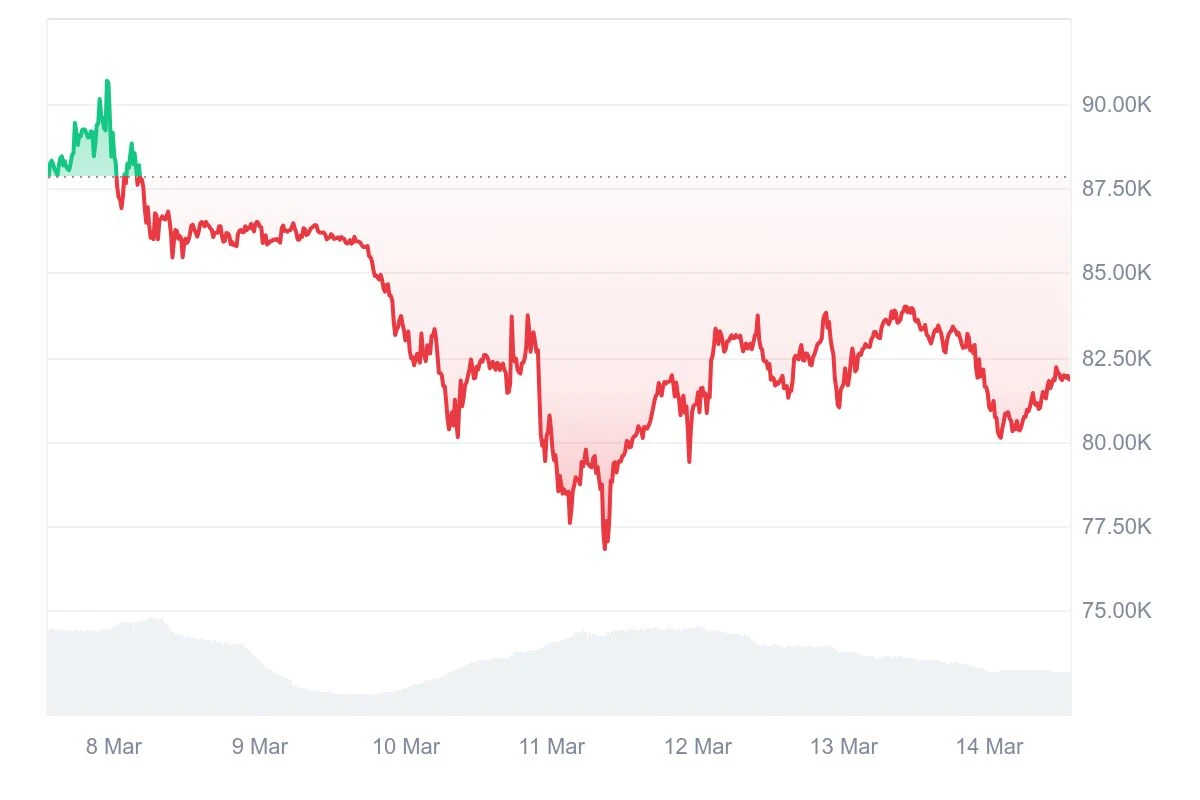

From March 10 to March 14, 2025, the specific trend of Bitcoin is as follows:

March 10: Bears dominate the market, breaking key support levels

On March 10, Bitcoin showed an overall downward trend, with bears dominating and the price falling below the critical support level of $80,000.

On that day, Bitcoin fell from around $83,000 to $82,327 before rebounding briefly, but then further dropped to $80,232. Although the market tried to rebound and the price once rose to $83,552, the upward pressure failed to continue, and Bitcoin fell again and fell below the $80,000 mark, hitting a low of $79,639.

March 11: The market rebounded quickly after an accelerated decline, and the bulls and bears competed fiercely.

Continuing the decline of the previous day, Bitcoin fell further on March 11, hitting a low of $77,703 before briefly rebounding to $79,642. However, bearish sentiment remained strong, and the market quickly broke through the $77,000 support level, falling to a low of $76,905. Subsequently, market sentiment quickly recovered, and Bitcoin rebounded strongly to $81,961, and finally stabilized around $81,250.

March 12: Fierce competition between long and short positions, intensified short-term volatility

On March 12, the price of Bitcoin rebounded to $83,341 and remained above $82,480. At around 10 a.m., short sellers once again pushed the price down from $83,962 to $80,896. Despite the large drop, it did not fall below the $80,000 mark, and short-term speculation in the market was evident.

March 13: After a high, the price fell back below $80,000 again

On March 13, Bitcoin quickly stabilized and resumed its upward trend, climbing to a high of $84,163 before falling under pressure. It then fluctuated downward and fell below $80,000 again, hitting a low of $79,986. The overall market showed a trend of rising and then falling back.

March 14: Range-bound, new trend to be confirmed

On March 14, Bitcoin fluctuated between $80,000 and $85,000, and gradually started a new round of upward trend. As of writing, the price has risen to $81,850, and the market direction still needs further confirmation.

Summarize

On March 14, the price stabilized and rebounded, but the overall trend is not yet clear. The market is still in the range consolidation stage, and the subsequent breakthrough direction needs to be further observed. The market has fluctuated greatly recently, but the support below is still relatively solid. Long-term investors can pay attention to low-level buying opportunities, and at the same time, combine the macro market and capital flows to judge the medium- and long-term trends. It is necessary to pay attention to changes in market sentiment, especially the impact of external macro factors on the trend of Bitcoin, such as the Federal Reserves monetary policy, market liquidity conditions, and institutional capital trends.

Bitcoin price trend (2025/03/10-2025/03/14)

2. Market dynamics and macro background

Fund Flows

Whale holdings and exchange flows:

Whales have acquired around 60,000 BTC in the past month, marking one of the most aggressive accumulation phases in recent history, indicating that there is still strong institutional and large-cap investor demand in the market.

At the same time, CryptoQuant community analyst Darkfost pointed out that whale selling activity on Binance is slowing down, and its exchange whale ratio, which measures the proportion of inflows in the top 10 exchanges, is declining, indicating that whale selling pressure is decreasing and the number of bitcoins sold is beginning to decrease. However, Bitcoin miners may become a new source of selling pressure. The analysis believes that miners are experiencing market conditions similar to those after the most recent Bitcoin difficulty adjustment, which usually precedes a large-scale sell-off by miners (miner capitulation), or will have further impact on the market.

Exchange capital inflow:

As of March 12, 2025, the total market value of the cryptocurrency market was US$2.74 trillion, and the total trading volume was US$137.92 billion, a decrease of 25.1% from the previous trading day, indicating a slowdown in market trading activity.

Technical Analysis

Key support and resistance:

Bitcoin price hit a long-term support trendline that has held for 2 years and 4 months, showing a significant lower shadow on the weekly chart, indicating strong buying interest at these levels, hinting at the potential for a bullish reversal or continued gains.

In addition, BitMEX co-founder Arthur Hayes shared his market views on March 10, saying that Bitcoin may retest the $78,000 support level. If it falls below, the next key support level is $75,000. He also pointed out that there are a large number of options open interest (OI) in the market concentrated in the $70,000-75,000 range, and if the price enters this range, it may trigger more violent market fluctuations.

Overall this week, Bitcoin has repeatedly received support near $80,000, indicating that this point is an important psychological level in the market. On the upside, the $84,000 to $85,000 area forms a strong resistance, limiting the upside.

Indicator analysis:

RSI (Relative Strength Index): The RSI is sloping down on the daily chart, meaning that the underlying momentum of Bitcoin’s price trend is negative.

MA (Moving Average): Bitcoin’s 50-day moving average (MA) is $0.165 and its 200-day MA is $0.150, both below the current price, indicating a bullish medium- to long-term trend.

MACD (Moving Average Convergence Divergence): MACD is flashing red histogram bars below the neutral line, meaning that the underlying momentum of Bitcoin’s price trend is negative.

Market sentiment

On March 11, the price of Bitcoin fell below $80,000 again within 24 hours, hitting a low of $76,000, and market panic spread. As of March 13, 2025, the price of Bitcoin fell 3% to $81,148, market sentiment was depressed, and the trading volume of centralized exchanges fell by 21%.

Recently, Bitcoin market sentiment has become cautious. Technical indicators show oversold conditions, derivatives markets remain resilient, and ETF inflows have recovered. Macroeconomic pressures and policy changes affect market trends, and the US governments establishment of a strategic Bitcoin reserve may promote long-term opportunities. In the short term, key support levels need to be paid attention to, and long-term investors can focus on policies and institutional behavior.

Macro Background and Industry News

Macroeconomics:

U.S. economic data: The U.S. Consumer Price Index (CPI) rose 2.8% year-on-year in February, lower than the expected 2.9%, indicating a slowdown in inflation.

Federal Reserve Policy: The market expects the Fed to start cutting interest rates in June, with three 25 basis point cuts possible this year.

Industry News:

U.S. Strategic Bitcoin Reserve: U.S. President Trump signed an executive order to advance plans to establish a strategic Bitcoin reserve and incorporate Bitcoin into the national reserve framework.

EU Tariff Impact: Analysts point out that EU retaliatory tariffs could cause Bitcoin to pull back to $75,000.

Overall, from March 10 to March 14, 2025, the price of Bitcoin showed significant fluctuations, affected by multiple factors such as capital flows, technical factors, market sentiment, industry news and macroeconomic background.

3. Hash rate changes

Between March 10 and March 14, 2025, the Bitcoin network hash rate fluctuated as follows:

On March 10, the Bitcoin network hash rate fell from 827.66 EH/s to 782.83 EH/s, and then rebounded slightly to 846.22 EH/s. After a brief adjustment, the hash rate dropped again to 753.63 EH/s, and then quickly rebounded to 901.00 EH/s, showing violent fluctuations overall. On March 11, the computing power fluctuated between 850 EH/s and 900 EH/s, and broke through 900 EH/s in a short period of time, reaching a maximum of 907.63 EH/s. However, this level failed to maintain, and the hash rate quickly fell back to 753.88 EH/s, and then entered a new round of rising channel. On March 12, the hash rate continued the trend of the previous days recovery, first rebounding to about 800 EH/s, and then quickly rising to 918.26 EH/s. Subsequently, the hash rate briefly remained around 910 EH/s, then fell back to 834.06 EH/s, and remained relatively stable within this range. On March 13, the hash rate climbed to 923.34 EH/s, briefly fell back to 835.68 EH/s, and then rebounded to 879.06 EH/s, and then started a downward trend. On March 14, continuing the downward trend of the previous day, the hash rate fell back to 854.78 EH/s and continued to decline, eventually approaching 800 EH/s. Overall, the hash rate showed significant fluctuations during this period, reflecting that the networks hash rate changes frequently.

Bitcoin network hash rate data

4. Mining income

Between March 10 and March 14, 2025, Bitcoin miners’ earnings were affected by multiple factors, including Bitcoin price fluctuations, mining difficulty adjustments, and market sentiment.

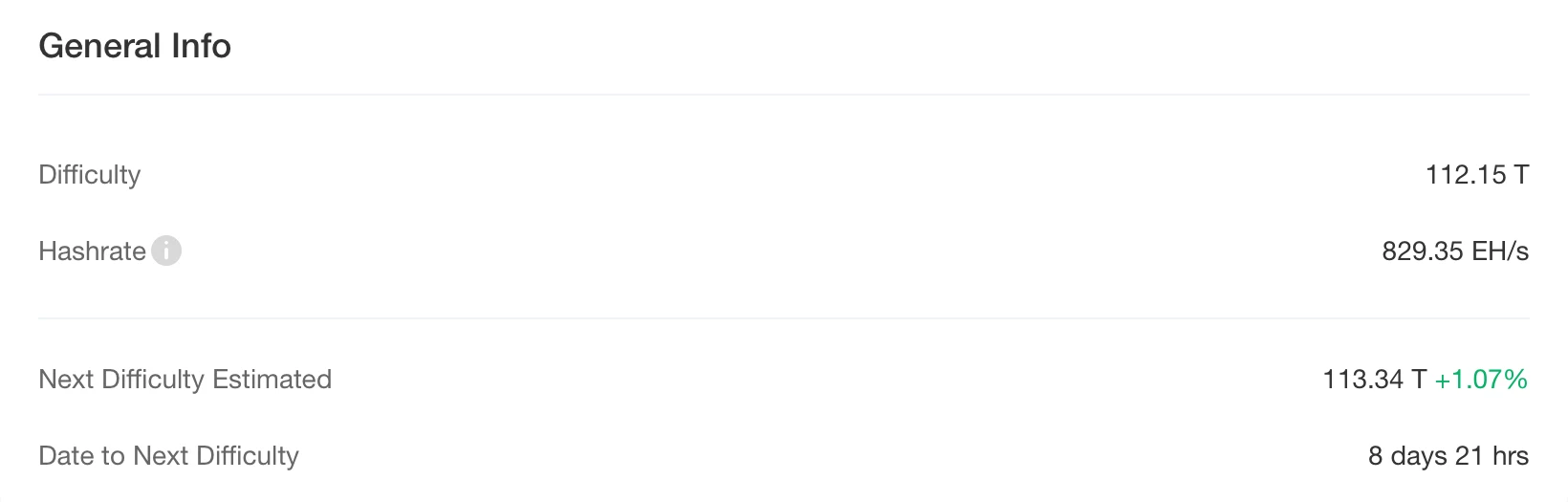

Bitcoin network difficulty adjustment

According to CloverPool data, Bitcoin mining difficulty increased by 1.43% to 112.15 T at block height 887,040 (23:58:46 Beijing time on March 9, 2025), close to the historical high (114.17). According to Hashrate Index data, the average computing power of the entire network in the past seven days is 834.27 EH/s.

The increase in mining difficulty means that miners need to invest more computing power to obtain the same Bitcoin reward, which may lead to a decrease in the profit per unit of computing power. However, as some high-cost miners may exit the market due to declining profits, the network computing power may decrease, which will reduce the mining difficulty in future difficulty adjustments and provide some relief for the remaining miners.

Bitcoin Price Trends

As of March 14, 2025, the price of Bitcoin fluctuates between $76,500 and $85,000. The decline in Bitcoin prices directly affects the dollar-denominated income of miners, resulting in a narrowing of profit margins, which may cause some miners with higher operating costs to face the risk of losses.

Miners’ response strategies

Faced with price fluctuations and profit pressure, some miners choose to hoard Bitcoin in the hope of selling it when prices rise to achieve higher profits. For example, Bitcoin miners in the United States choose to hoard cryptocurrencies to cope with the intensified competition for resources as profit margins shrink.

In addition, miners can also maintain profitability by improving equipment efficiency, reducing electricity costs, etc. It is worth noting that long-term holders have added 131,000 BTC in the past month, which shows confidence in the future value of Bitcoin.

Overall, the decline in Bitcoin prices and the increase in mining difficulty between March 10 and March 14, 2025 had a negative impact on miners revenue. However, miners still have the opportunity to maintain profitability in the face of market fluctuations by adjusting strategies and optimizing operations. In the future, market sentiment and macroeconomic factors will continue to affect Bitcoin price trends, and miners should pay close attention to market dynamics to develop effective response strategies.

5. Energy costs and mining efficiency

According to CloverPool, Bitcoin mining difficulty increased by 1.43% to 112.15 T at block height 887,040 (23:58:46 Beijing time on March 9, 2025), close to the historical high (114.17 T). This adjustment reflects the continued growth of the Bitcoin network computing power, and miners on the network have invested more computing power in order to compete for more block rewards. As of March 14, when writing, the Bitcoin network computing power has reached about 829.35 EH/s, and the current mining difficulty is 112.15 T. Based on the current trend, it is expected that the Bitcoin mining difficulty will be further increased by about 1.07% to 113.34 T at the next difficulty adjustment (about 8 days later).

According to the latest data from MacroMicro, the current total production cost of Bitcoin is about $84,690.49, and the mining cost-to-price ratio is 1.01, which means that the cost required for miners to produce each Bitcoin is almost the same as the market price, resulting in relatively small profit margins for miners. This ratio reflects the operating pressure of miners, especially when Bitcoin prices fluctuate greatly, miners profitability becomes more sensitive.

In this context, miners not only need to continuously improve mining efficiency, but also need to optimize energy use to ensure profitability in the fierce competition. In the future, the computing power of the Bitcoin network is expected to continue to grow, and miners may need to rely more on advanced cooling technology, solar energy and other renewable energy sources to reduce their carbon footprint and energy costs, thereby gaining an advantage in the long-term competition.

Bitcoin mining difficulty data

6. Policy and regulatory news

Progress of Bitcoin Reserve Legislation in U.S. States

Texas :

The Texas Senate passed SB-21 by a vote of 25 to 5, allowing the state government to invest in Bitcoin and establish a Bitcoin Reserve Advisory Committee to ensure transparency of the investment. In addition, the state legislature introduced HB 4258, which allows the state auditor general to invest no more than $250 million in economic stabilization funds in Bitcoin or other cryptocurrencies, while allowing local governments to invest up to $10 million in Bitcoin. The bill is expected to take effect on September 1, 2025.

Utah :

The Utah State Senate passed a Bitcoin bill, but deleted key provisions that originally planned to establish a state-level Bitcoin reserve, retaining only content such as Bitcoin custody protection.

Senator Cynthia Lummis :

Resubmitting the Bitcoin Act: On March 11, Loomis resubmitted the Bitcoin Act, which plans to purchase 1 million bitcoins within five years to establish a strategic bitcoin reserve. Compared with the previous version, the new bill changes the plan to purchase 200,000 bitcoins per year from up to to must, and strengthens the provision that bitcoins cannot be sold during the holding period.

Review of stablecoin-related bills: On March 13, as the chairman of the Senate Banking Digital Assets Subcommittee, Loomis presided over the final review of the GENIUS Act proposed by Senator Hagerty. The bill aims to clearly define payment stablecoins, establish clear procedures for institutions seeking to issue stablecoins, and promote responsible innovation while protecting consumer rights.

Rep. Nick Begich :

Congressman Nick Begich announced that he would reintroduce the Bitcoin Act of 2025 in the House of Representatives, which proposes that the United States acquire 1 million BTC and emphasizes the right of individuals to self-custody.

Legislative progress in other states :

So far, 24 states have considered establishing digital asset reserves as a tool to fight inflation. However, due to factors such as the high volatility of Bitcoin, five states, including Montana, Wyoming, North Dakota, South Dakota and Pennsylvania, have rejected the proposal.

Top U.S. Democrats pressure Treasury to halt Trumps strategic Bitcoin reserve plan

On March 14, Gerald Connolly, the Democratic leader of the U.S. House Oversight and Government Reform Committee, urged the U.S. Treasury Department to stop plans to create a strategic cryptocurrency reserve after President Donald Trump pursued the establishment of a national Bitcoin reserve and a personal cryptocurrency reserve.

In a letter to the Treasury Department on Thursday, the Virginia Democratic congressman pointed out that Trumps push for the reserve presents clear conflicts of interest. Gerald Connolly said Trump did not consult Congress and did not seek congressional authority to establish the reserve. Establishing a strategic cryptocurrency reserve will enrich the President and his closest allies at the expense of the American taxpayer, the letter said. I urge a halt to all plans to establish a strategic cryptocurrency reserve and request a briefing for the staff of the Committee on Oversight and Government Reform.

South Korean financial experts and opposition lawmakers call for consideration of Bitcoin reserves

South Korean financial experts and opposition politicians urged South Korea to include Bitcoin in its national reserves and develop a won-backed stablecoin at a seminar held by the main opposition Democratic Party in Congress last Wednesday. The seminar analyzed potential responses to the United States move to establish a Bitcoin-centered national reserve, according to the Korea Herald. The discussion was held just before President Trump signed an executive order on Thursday to establish a Bitcoin reserve and a cryptocurrency reserve.

Kim Jong-seung, CEO of blockchain company xCrypton, said at the event on Wednesday: South Korea needs to respond with clear policies. In addition to Bitcoin reserves, seminar experts also stressed the importance of creating a won-backed stablecoin. Kim warned that South Korea could lose its monetary sovereignty if dollar stablecoins dominate the digital economy. We need to develop a model that connects the dollar stablecoin and the won stablecoin for trade transactions, he said.

Kim Min-seok, head of the Democratic Partys policy preparatory committee, said that if the party returns to power, it will reshape South Koreas cryptocurrency regulatory framework. Min Jung, an analyst at Presto Research in Singapore, said: South Korea is slower than most countries in general. We have just approved corporate accounts for cryptocurrencies, and Bitcoin and Ethereum ETFs are still not allowed to be traded. It looks like South Korea is just trying to catch up.

Related images

UK Treasury says it has “no plans” to introduce US-style Bitcoin reserves

March 10 news, market news: The UK Treasury said it has no plans to introduce US-style Bitcoin reserves. Volatility makes Bitcoin less suitable as a reserve asset for the UK.

Nebraska signs Bitcoin ATM regulation bill

On March 13, Nebraska Governor Jim Pillen officially signed LB 609 on Wednesday to regulate Bitcoin ATMs and other electronic transaction terminals to prevent fraud and protect consumer rights. The bill requires Bitcoin ATM operators to clearly disclose all terms of use and provide users with eye-catching anti-fraud warnings. In addition, if users report fraud to operators and law enforcement within 90 days, they can get a full refund.

The U.S. Treasury Department met with three crypto companies to discuss Bitcoin reserve custody solutions

On March 14, people familiar with the matter revealed that the U.S. Treasury Department met with executives from three crypto custody companies this week to discuss how to keep the countrys strategic Bitcoin reserves. Anchorage Digital was one of the institutions participating in the meeting. Anchorage CEO Nathan McCauley said that Treasury officials made detailed inquiries on the best practices of Bitcoin national reserves and digital asset custody, and explored how custody affects stablecoins and market structure.

Congressional sources said that the Treasury Department is currently in the research stage and has not yet formed a clear position, but is actively seeking opinions from industry insiders. The current preference is for a third-party institution to custodian the governments Bitcoin reserves, and the long-term goal is for the government to eventually achieve self-custody. As for the various types of seized digital assets controlled by the government, they may still need to rely on third-party custody for a long time. The U.S. Treasury Department did not comment on this.

7. Mining News

Cybersecurity firm Kaspersky: Hackers blackmail YouTuber for promoting crypto mining Trojan

On March 12, cybersecurity company Kaspersky discovered that hackers used copyright complaints to threaten YouTube content creators, forcing them to add the crypto mining Trojan SilentCryptoMiner to the video description. The malware is based on XMRig and is used to mine cryptocurrencies such as Ethereum, Ethereum Classic, Monero, Ravencoin, and control botnets through the Bitcoin blockchain.

The hackers main target is YouTubers who provide Windows Packet Divert driver installation tutorials. They first file a false copyright complaint against the video, then contact the creators claiming to be the developers of the driver and ask them to add malicious links. Currently, a YouTuber with 60,000 followers is known to have been victimized, causing more than 40,000 people to download infected files. Kaspersky estimates that at least 2,000 devices have been infected.

Kaspersky security researcher Leonid Bezvershenko warned that hackers are taking advantage of the trust between YouTubers and their audiences, and such threats may spread to platforms such as Telegram. He advised users not to trust tutorials that require them to turn off antivirus software, and to verify the source before downloading any files to prevent infection with crypto mining Trojans.

A small miner independently mined a Bitcoin block with 3.3 TH computing power, with a probability of less than one in a million

On March 12, according to ckpool developer Dr -ck, a miner successfully mined Bitcoin block 887212 (block hash: 000000000000000000006414aea39be567cf1d5ff6cbf2d77254fe7c714b0d81) at solo.ckpool.org using a 48 0G H Bitaxe mining machine with only 3.3 TH computing power.

The miners address is bc1qaxccz85rx6ywy2xw6ugtm6u37mvew6qqn7lgtd. Theoretically, the probability of discovering a block every day is less than one in a million, and it usually takes 3,500 years to find a block.

Delaware court rules Bitcoin mining rig hosting companies cannot block tenants from accessing their mining rigs

On March 14, a Delaware court has temporarily approved a temporary restraining order filed by a Pennsylvania Bitcoin mining company against its hosting company, which blocked access to its mining machines due to a payment dispute. The restraining order prohibits the hosting service provider from blocking access and otherwise taking over the miner’s 21,000 mining machines on the property.

Vice Chancellor Morgan Zurn on March 12 granted a temporary restraining order filed by bitcoin miner Consensus Colocation and system owner Stone Ridge Ventures against Mawson Hosting, which provides hosting and colocation services to bitcoin miners. The companies disagreed over alleged unpaid fees, terms of the agreement, and Consensus’ relocation plans, which allegedly led Mawson to block miners from accessing the site.

The companies also claim that Mawson has been operating the miners for its own benefit since February 28, after blocking Consensus from accessing the premises. However, Mawson claims that they have the right to use the miners under the terms of their agreement with Consensus and that they have the right of first refusal over their relocation plans.

8. Bitcoin related news

Bitcoin holdings of global companies and countries (statistics for this week)

Australia Monochrome: As of March 7, Monochrome Bitcoin Spot ETF (IBTC) holdings fell to 303 BTC, 17 fewer than the previous day, with a holding value of approximately US$42.534 million.

Strategy (formerly MicroStrategy): The market value of Bitcoin holdings fell below $40 billion. It currently holds 499,096 BTC. Based on the current price of $79,998.5, the total value is approximately $39.97 billion.

El Salvador: In the past two days, it has increased its holdings by 6 bitcoins, with an average price of $82,308. The current holdings are 6,112.18, with a total value of $491.6 million. In the past 30 days, it has accumulated 41 BTC. Despite pressure from the IMF, the country continues to accumulate BTC.

StarkWare: Announced the establishment of a strategic Bitcoin reserve and plans to hold more BTC in the future, but did not disclose specific holdings. The company is valued at $8 billion and has invested a lot of resources in Bitcoin research in recent years.

Ming Cheng Group (Lead Benefit): On February 28, the Hong Kong subsidiary spent $27 million to purchase 333 bitcoins at an average price of $81,555. Previously, it purchased 500 BTC on January 9, with a total investment of $47 million.

Metaplanet: Plans to issue 2 billion yen (about 13.506 million US dollars) of interest-free ordinary bonds to purchase Bitcoin. In addition, the company purchased 162 new BTC, and the total holdings increased to 3,050, with a total value of 38.452 billion yen.

Ark Invest: Increased holdings of Bitcoin by $82.6 million (Source: BITCOINLFG, March 13).

Grayscale Research Director: Bitcoins further appreciation does not need to rely on the US crypto strategic reserve

On March 10, it was reported that US President Trump has signed an executive order to establish a strategic Bitcoin reserve and a separate digital asset reserve. In this regard, Zach Pandl, head of research at Grayscale Investments, believes that Bitcoin does not need the United States strategic reserves to appreciate further this year. He expects that as the adoption rate increases, the price of Bitcoin will be pushed up. At the same time, Bitcoin will begin to play a role as a means of storing value this year, especially amid concerns that Trumps tariff policy may cause inflation to rise again.

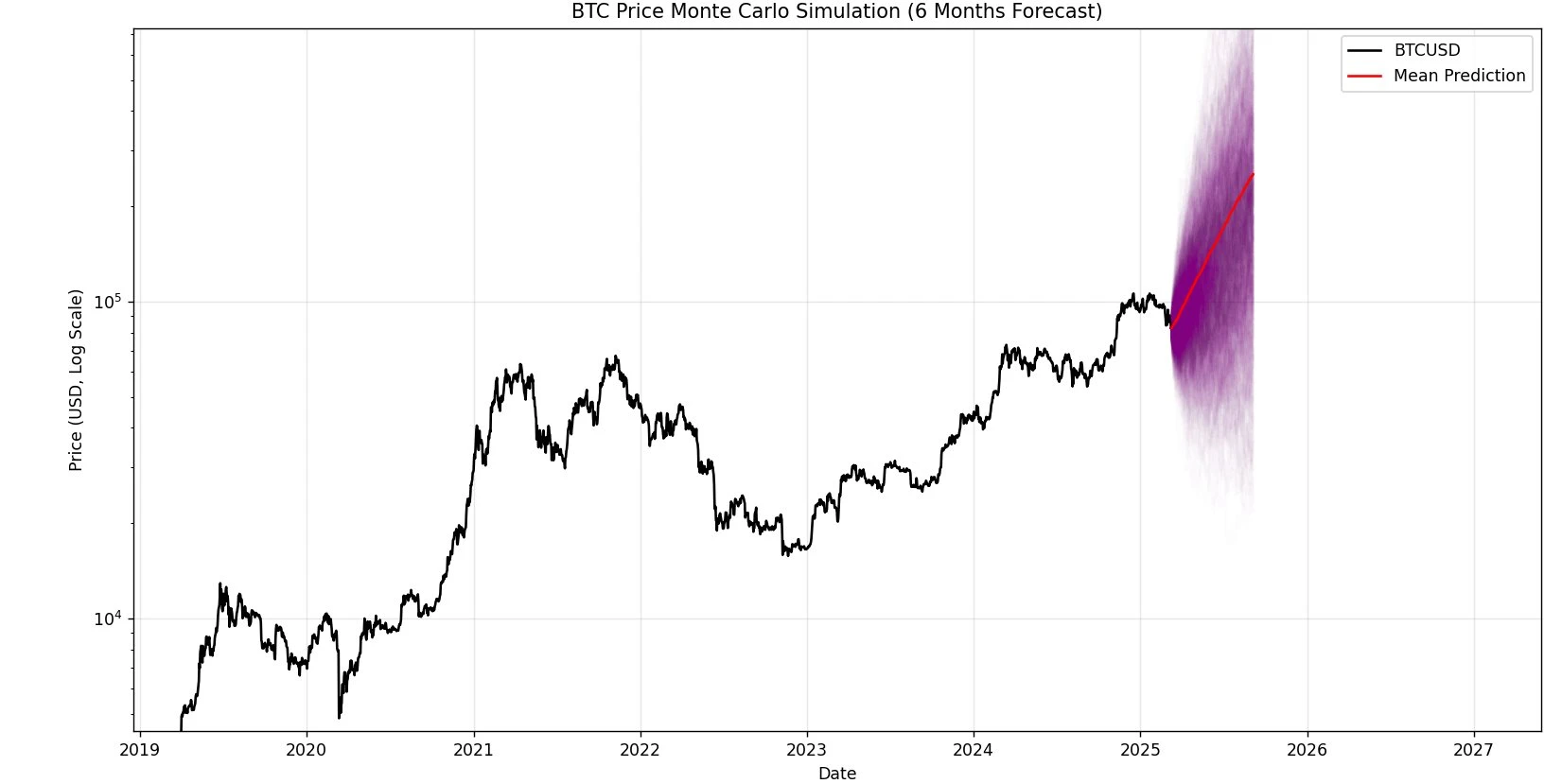

Analysis: Monte Carlo model predicts Bitcoin price will peak at $713,000 in 6 months

On March 10, Cointelegraph reported that although the Cryptocurrency Fear and Greed Index on March 10 continued to show extreme fear, a Bitcoin market simulation still predicted a bullish trend in the second half of 2025. Cryptocurrency researcher Mark Quant used Monte Carlo simulation to analyze Bitcoin prices and provided a six-month forecast for the crypto asset. The Monte Carlo model is a computational method that simulates price predictions and assesses risks through random sampling. It can generate multiple possible scenarios based on variable factors such as volatility and market trends. Based on an initial price of $82,655, the study estimates that the average final price of Bitcoin by the end of September 2025 will be $258,445. However, from a broader perspective, Bitcoin prices are expected to fluctuate between $51,430 (the 5th percentile return) and $713,000 (the 95th percentile return).

However, it is important to note that Monte Carlo models rely heavily on the Geometric Brownian Motion (GBM) model, which assumes that asset values follow a random path with a constant drift parameter. In this analysis, Bitcoins inherent volatility is incorporated into the model, capturing long-term historical performance and patterns while adapting to future changes. In essence, Monte Carlo analysis is like rolling the dice with uncertainty. Last week, Quant also highlighted the correlation between the total cryptocurrency market capitalization and the Global Liquidity Index, which suggests that the total market capitalization could reach a new high of more than $4 trillion by the second quarter of 2025.

Related images

Nansen: Bitcoin’s pullback to $70,000 is part of a bull market “macro correction”

On March 12, Aurelie Barthere, chief research analyst at crypto analysis platform Nansen, said that most cryptocurrencies have broken through key support levels, making it difficult to estimate the next key price level. For Bitcoin, the next level may be $71,000 to $72,000, which is the top of the trading range before Trumps election. Although investor sentiment has declined, cryptocurrencies and global markets are still in a macro adjustment in the bull market. The market is still in the adjustment stage of the bull market. Stocks and cryptocurrencies have already been realized and are being priced, and the Federal Reserve has not taken any measures.

Standard Chartered Bank analyst: Bitcoins recent decline is related to the overall weakness of risk assets, and it is still bullish to $200,000 in the long term

On March 12, Geoff Kendrick, head of digital asset research at Standard Chartered Bank, said that the recent price fluctuations of Bitcoin are consistent with the performance of risky assets such as the Big Seven in the U.S. Stock Market, rather than a problem with cryptocurrencies themselves. He pointed out that the decline of Bitcoin is mainly affected by the overall market sentiment, and the future rebound may rely on two major catalysts: the overall recovery of risky assets or good news about Bitcoin (such as sovereign purchases by the United States or other countries). If the Federal Reserve quickly turns to rate cuts (such as the probability of a rate cut in May rising from 50% to 75%), it may drive a rebound in Bitcoin; but if the downward trend continues, Bitcoin may fall below $76,500 and test the $69,000 support level.

Despite the short-term pressure, Kendrick remains optimistic about Bitcoins long-term prospects, predicting that it will reach $200,000 by the end of 2025. He emphasized that the current market volatility increases the possibility of the Federal Reserves interest rate cuts, further consolidating his long-term bullish view. At the same time, Trumps tariff policy and the Federal Reserves interest rate decisions will continue to affect market sentiment and bring uncertainty to Bitcoins trend.

Analyst: Bitcoin is approaching bottoming out and is expected to rebound in the second quarter

On March 12, Joel Kruger of LMAX Digital believed that the current weakness in the crypto market was more of a sell-off effect after news realization and an overdue technical adjustment than anything else. But of course, there are more factors at work. The uncertainty of the US economic outlook has triggered risk aversion in the market.

Despite this, Kruger still believes that Bitcoin is close to bottoming out and is expected to rebound in the second quarter. In the previous resistance range between $69,000 and $74,000, Bitcoin should be extremely supported. Kruger previously said that Bitcoins value storage narrative may help it break away from the misleading correlation with traditional risk assets.

Ark Invest: Still optimistic about Bitcoins long-term prospects, current market sentiment is too pessimistic

On March 12, despite the sharp market decline in March, Cathie Woods investment company ArkInvest remains optimistic about Bitcoin. On Tuesday, ArkInvest said in a report: Ark remains optimistic about the long-term prospects of Bitcoin and believes that policy changes and technological breakthroughs in fields such as artificial intelligence and robotics will re-stimulate spending and improve productivity.

ArkInvest also pointed out that deregulation and tax cuts are potential major drivers for Bitcoin to recover from the current market chaos. The market has become too pessimistic about the current macroeconomic and geopolitical sentiment.