Original author: Kevin, the Researcher at Movemaker

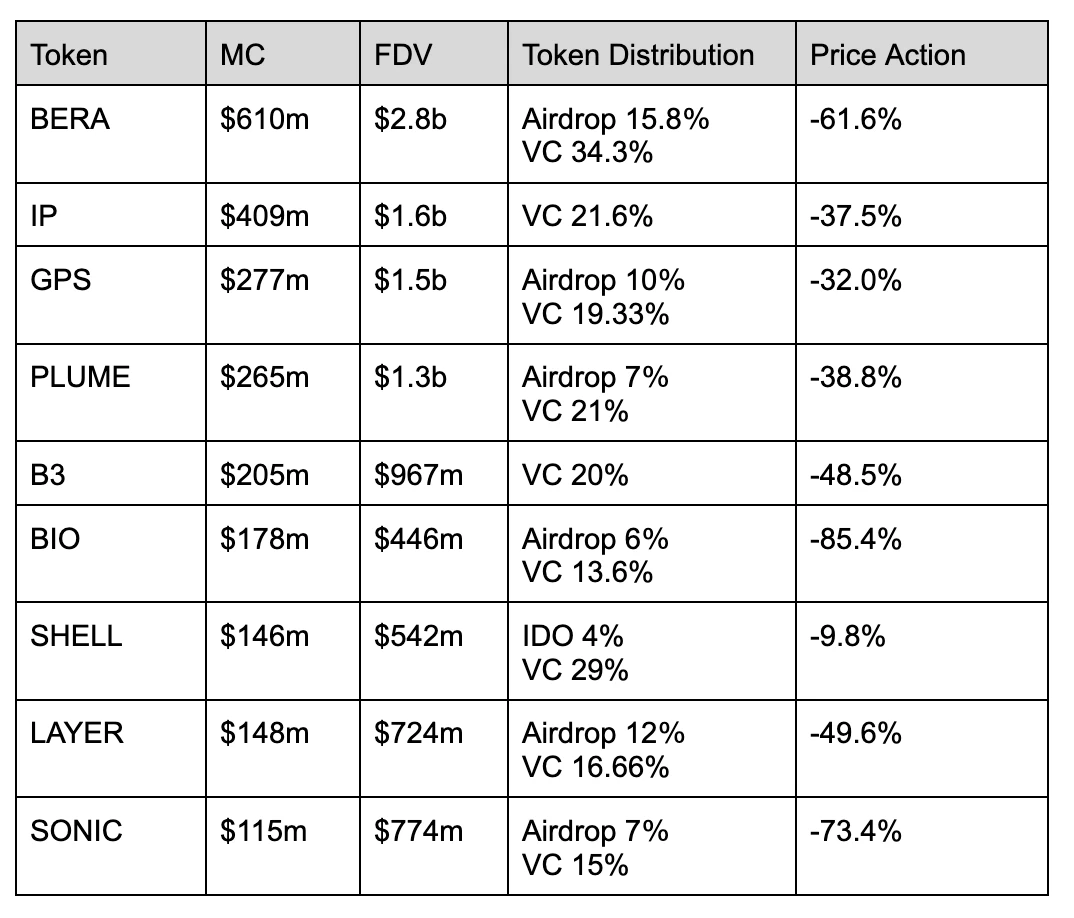

The VC share of the above projects is generally between 10% and 30%, which has not changed much compared with the previous cycle. Most projects choose to distribute tokens to the community through airdrops, which is regarded as a reasonable way of community distribution. However, in reality, users do not hold tokens for a long time after receiving airdrops, but tend to sell them immediately. This is because in the minds of users, project parties often hide a large number of tokens in airdrops. Therefore, after TGE, there is huge selling pressure in the market. The concentration of token chips is not conducive to the effectiveness of airdrops. This phenomenon has been around for the past few years, and the way of token distribution has not changed much. It can be seen from the performance of token prices that VC-driven token prices perform very poorly, and tokens often enter a unilateral downward trend after issuance.

Among them, $SHELL is slightly different. It distributes 4% of its tokens through IDO, and the projects IDO market value is only 20 million US dollars, which is unique among many VC-driven tokens. In addition, Soon and Pump Fun chose to distribute more than 50% of the total token supply through fair launch, and combined with a small number of VCs and KOLs to conduct a large proportion of community fundraising. This way of giving benefits to the community may be easier to accept, and at the same time, the proceeds from community fundraising can be locked in advance. Although the project party no longer holds a large number of tokens, it can repurchase chips in the market through market making, which not only sends a positive signal to the community, but also recovers chips at a lower price.

The end of the Memecoin bubble carnival: liquidity siphoning and the collapse of market structure

The transition from a market equilibrium state dominated by VC-driven builders to a pure pump coin issuance bubble model has made it difficult for these tokens to avoid a zero-sum game, which will ultimately only benefit a few people, while most retail investors are more likely to leave the market at a loss. This phenomenon will exacerbate the collapse of the primary and secondary structures of the market, and reconstruction or chip accumulation may take longer.

The atmosphere of the Memecoin market has fallen to the extreme. When retail investors gradually realized that the essence of Memecoin is still controlled by the conspiracy group, including DEX, capital parties, market makers, VCs, KOLs and celebrities, the issuance of Memecoin has completely lost fairness. The sharp losses in the short term will quickly affect the psychological expectations of users, and this token issuance strategy is approaching a stage end.

Over the past year or so, retail investors have made the largest profits in the Memecoin track. Although the Agent narrative has driven market enthusiasm by taking open source community innovation as the core of culture, it has been proven that this wave of AI Agent enthusiasm has not changed the essence of Memecoin. A large number of Web2 individual developers and Web3 shell projects have quickly occupied the market, leading to the emergence of a large number of AI Memecoin projects disguised as value investment.

Community-driven tokens are controlled by conspiracy groups and speed-passed by malicious price manipulation. This approach has a serious negative impact on the long-term development of the project. The former Memecoin project alleviated the selling pressure of tokens through religious beliefs or support from minority groups, and achieved a project exit process that users could accept through market makers.

However, when Memecoins community no longer uses religion or minority groups as a cover, it means that the markets sensitivity has decreased. Retail investors are still looking forward to the opportunity to get rich overnight. They are eager to find tokens with certainty and look forward to projects with deep liquidity at the opening, which is a fatal blow to retail investors by the conspiracy group. Bigger bets mean more lucrative returns, which begin to attract the attention of teams outside the industry. After these teams gain benefits, they will no longer use stablecoins to buy cryptocurrencies because they lack faith in Bitcoin. The withdrawn liquidity will leave the cryptocurrency market forever.

VC coin death spiral: inertia trap and liquidity strangulation under short-selling consensus

The strategy of the previous cycle has failed, but a large number of project parties still use the same strategy out of inertia. Small shares of tokens are released to VCs and highly controlled, so that retail investors pay in the exchange. This strategy has failed, but inertial thinking makes project parties and VCs unwilling to make changes easily. The biggest disadvantage of VC-driven tokens is that they cannot gain early advantages during TGE. That is, users no longer expect to get ideal returns by issuing coins to buy, because users believe that the project parties and exchanges hold a large number of tokens, which puts both parties in an unfair position. At the same time, the VC return rate has dropped significantly in this cycle, so the amount of VC investment has also begun to decline. In addition, users are unwilling to take over in the exchange, and the issuance of VC coins faces huge difficulties.

For VC projects or exchanges, going directly to an exchange may not be the best option. The liquidity that celebrity tokens or political token teams have drawn from the industry has not been injected into other tokens, such as Ethereum, SOL, or other altcoins. Therefore, once a VC coin is listed on an exchange, the contract fee will quickly become -2%. The team will not have the motivation to pull the price because the goal of listing has been achieved; the exchange will not pull the price because shorting new coins has become a market consensus.

When a token enters a unilateral decline immediately after issuance, the more frequently this phenomenon occurs, the more the market users’ cognition will be strengthened, and the situation of “bad money drives out good money” will occur. Assuming the next TGE, the probability of project parties issuing coins and then smashing the market is 70%, and 30% are willing to protect the market and make the market. Under the influence of the successive market-smashing projects, retail investors will engage in retaliatory short selling, even if they know that the risk of short selling is extremely high when issuing coins. When the short selling situation in the futures market reaches its extreme, project parties and exchanges will have to join the short selling to make up for the target returns that cannot be achieved by smashing the market. When 30% of the teams see this situation, even if they are willing to make the market, they are unwilling to bear such a huge price difference between futures and spot to pull the market. Therefore, the probability of project parties issuing coins and then smashing the market will further increase, and the number of teams that create a benefit effect after issuing coins will gradually decrease.

Unwilling to lose control of the chips, a large number of VC coins have no progress or innovation at the time of TGE compared to four years ago. Inertial thinking has a stronger constraint on VCs and project parties than imagined. Due to the dispersed liquidity of projects, the long VC unlocking cycle, and the constant replacement of project parties and VCs, although this TGE method has always had problems, VCs and project parties have shown a numb attitude. A large number of project parties may be establishing projects for the first time. When faced with difficulties they have never experienced, they tend to have survivor bias and think they can create different value.

Dual-Drive Paradigm Migration: On-chain Transparent Game Breaks the VC Coin Pricing Deadlock

Why choose VC+community dual drive? The pure VC-driven model will increase the pricing error between users and project parties, which is not conducive to the price performance of tokens in the early stage of issuance; while the completely fair launch model is easy to be maliciously manipulated by the conspiracy group behind it, resulting in the loss of a large number of low-priced chips, and the price will go through a cycle of ups and downs in one day, which is a devastating blow to the development of subsequent projects.

Only by combining the two can VCs enter the project at the early stage of its establishment, provide reasonable resources and development plans for the project party, reduce the teams financing needs in the early stages of development, and avoid the worst outcome of losing all chips due to fair launch and only obtaining low-certainty returns.

Over the past year, more and more teams have found that the traditional financing model is failing - the routine of giving VCs a small share, highly controlling the market, and waiting for the exchange to pull the price is no longer sustainable. VC pockets are tightening, retail investors are refusing to take over, and the threshold for listing on major exchanges has increased. Under the triple pressure, a new set of gameplay that is more adaptable to the bear market is emerging: uniting top KOLs and a small number of VCs to promote projects in a large-scale community launch and low-market-value cold start manner.

Projects represented by Soon and Pump Fun are opening up new paths through large-scale community launches - jointly endorsed by top KOLs, distributing 40%-60% of tokens directly to the community, launching projects at valuations as low as $10 million, and achieving millions of dollars in financing. This model builds consensus FOMO through the influence of KOLs, locks in profits in advance, and exchanges high liquidity for market depth. Although the short-term control advantage is given up, tokens can be repurchased at low prices during bear markets through compliant market-making mechanisms. In essence, this is a paradigm shift in the power structure: from the VC-dominated game of passing the parcel (institutions take over - exchanges sell - retail investors pay), to a transparent game of community consensus pricing, where project owners and communities form a new symbiotic relationship in liquidity premium.

Recently, Myshell can be seen as a breakthrough attempt between BNB and the project. 4% of its tokens were issued through IDO, and the IDO market value was only 20 million US dollars. In order to participate in IDO, users need to buy BNB and operate through the exchange wallet, and all transactions will be recorded directly on the chain. This mechanism brings new users to the wallet while enabling them to get fair opportunities in a more transparent environment. For Myshell, the operation of market makers ensures a reasonable increase in prices. Without sufficient market support, the price of tokens cannot be maintained in a healthy range. With the development of the project, the gradual transition from low market value to high market value, and the continuous enhancement of liquidity, the project has gradually gained market recognition. The conflict between the project and VC lies in transparency. When the project launches tokens through IDO, it no longer relies on the exchange, which can solve the contradiction between the two parties in terms of transparency. The token unlocking process on the chain has become more transparent, ensuring that the conflicts of interest that existed in the past are effectively resolved. On the other hand, the dilemma faced by traditional CEX is that the price of tokens often plummets after issuance, which causes the trading volume of the exchange to gradually decline. Through the transparency of on-chain data, exchanges and market participants can more accurately assess the true situation of the project.

It can be said that the core contradiction between users and project owners lies in pricing and fairness. The purpose of fair launch or IDO is to meet users expectations of token pricing. The fundamental problem of VC coins is the lack of buying after listing, and pricing and expectations are the main reasons. The breaking point lies in the project owners and exchanges. Only by giving tokens to the community in a fair way and continuously advancing the construction of the technology roadmap can the value growth of the project be achieved.

As a decentralized community organization, Movemaker has received millions of dollars in funding and resource support from the Aptos Foundation. Movemaker will have independent decision-making power, aiming to efficiently respond to the needs of Chinese developers and ecosystem builders, and promote the further expansion of Aptos in the global Web3 field. Movemaker will take the lead in building the Aptos ecosystem in a community + VC dual-driven way, including DeFi, the deep integration of artificial intelligence and blockchain, innovative payments and stablecoins and RWA.

About Movemaker

Movemaker is the first official community organization authorized by the Aptos Foundation and jointly initiated by Ankaa and BlockBooster, focusing on promoting the construction and development of the Aptos Chinese ecosystem. As the official representative of Aptos in the Chinese region, Movemaker is committed to building a diverse, open and prosperous Aptos ecosystem by connecting developers, users, capital and many ecological partners.

Disclaimer

This article/blog is for informational purposes only and represents the personal opinions of the author and not Movemaker. This article is not intended to provide: (i) investment advice or investment recommendations; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Holding digital assets, including stablecoins and NFTs, is extremely risky and may fluctuate in price and become worthless. You should carefully consider whether trading or holding digital assets is appropriate for you based on your financial situation. If you have questions about your specific situation, please consult your legal, tax or investment advisor. The information provided in this article (including market data and statistical information, if any) is for general information only. Reasonable care has been taken in the preparation of these data and charts, but no responsibility is assumed for any factual errors or omissions expressed therein.