This article comes from: 0xDíaz

Compiled by Odaily Planet Daily ( @OdailyChina )

Translated by Azuma ( @azuma_eth )

Pendle (PENDLE) has become the dominant fixed-income protocol in DeFi, enabling users to trade future earnings and lock in predictable on-chain returns.

In 2024, Pendle promoted the development of major narratives such as LST (liquidity staking tokens), re-staking, and yield-based stablecoins, and it itself became the preferred launch platform for asset issuers.

In 2025, Pendle will expand beyond the EVM ecosystem and evolve into a comprehensive fixed-income layer for DeFi, targeting new markets, products, and user groups, covering native cryptocurrency markets as well as institutional capital markets.

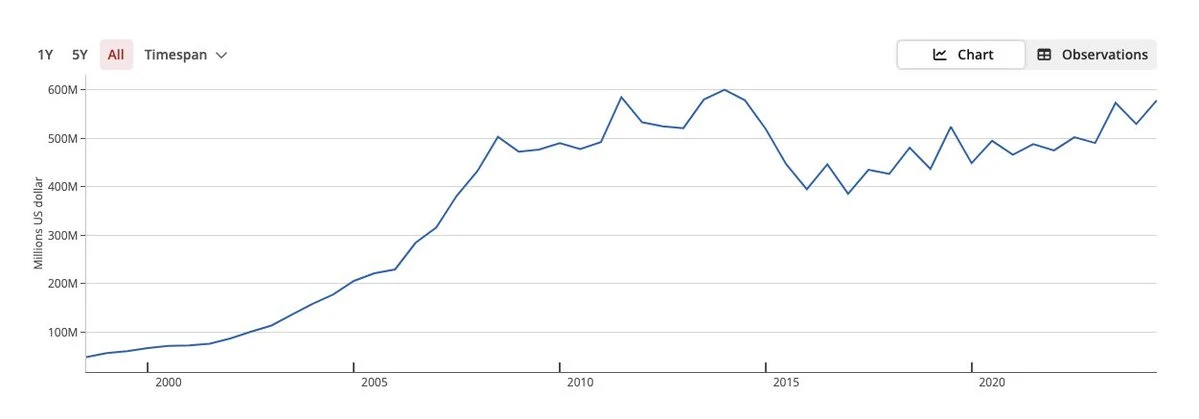

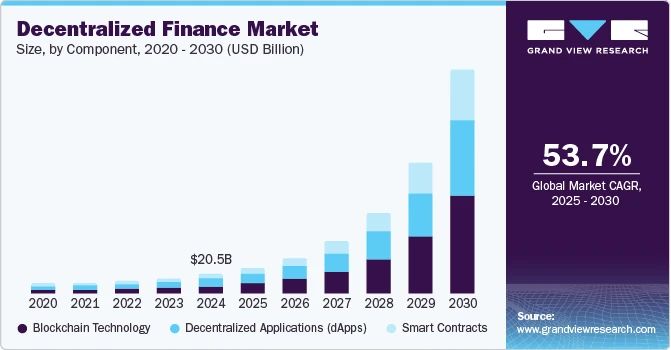

The yield derivatives market in the DeFi world can be compared to one of the largest segments in the traditional finance (TradFi) world - interest rate derivatives. This is a market of more than $500 trillion, and even a tiny percentage of this market represents a multi-billion dollar opportunity.

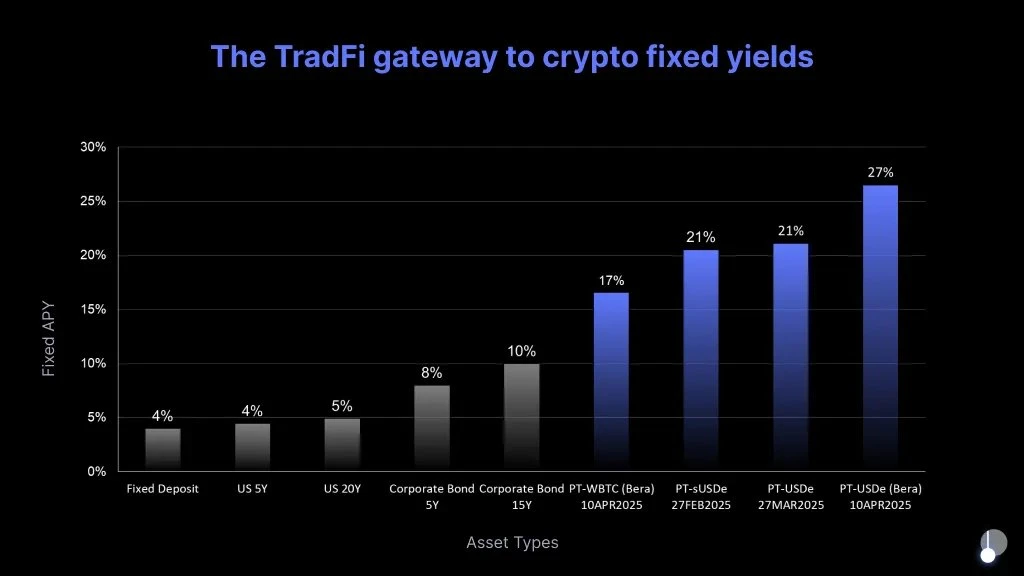

Most DeFi platforms only offer floating returns, which inevitably exposes users to market volatility, but Pendle introduces fixed-rate products through a transparent and composable system.

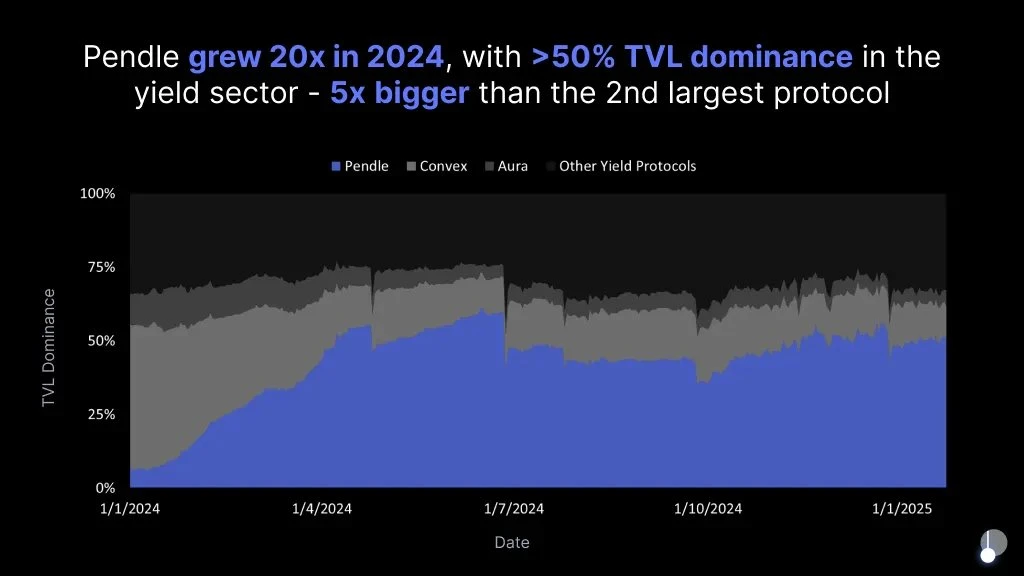

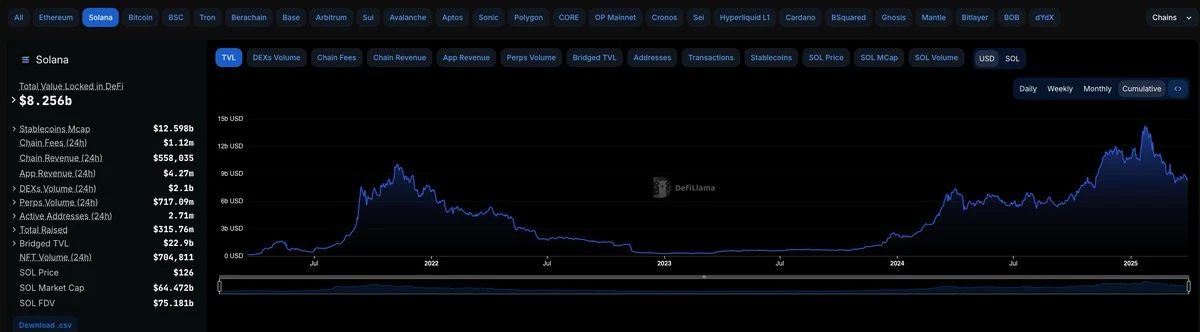

This innovation reshaped the $120 billion DeFi market and made Pendle the dominant yield protocol. In 2024, Pendles TVL grew more than 20 times, and its TVL currently accounts for more than half of the yield market, which is 5 times that of the second largest competitor.

Pendle is more than just a yield protocol, it has evolved into the core infrastructure of DeFi, driving liquidity growth for those leading protocols.

Finding the fit: From LST to Restaking

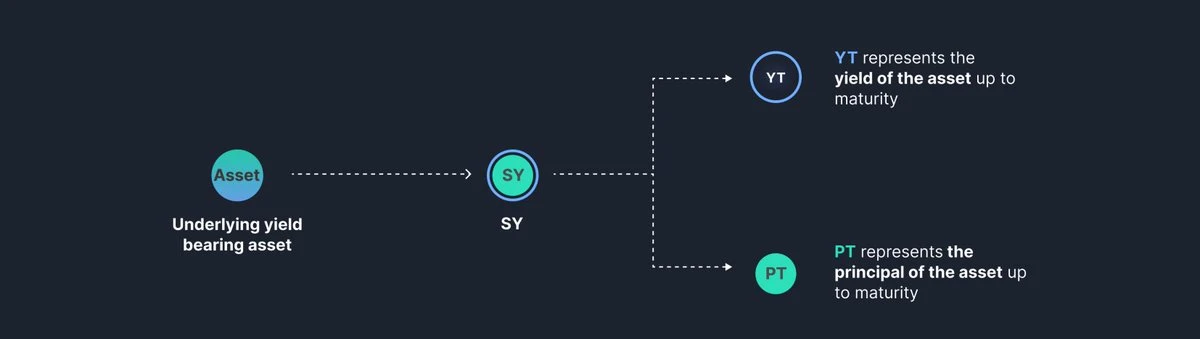

Pendle gained early market attention by solving a core problem in DeFi - the volatility and unpredictability of returns. Unlike Aave or Compound, Pendle allows users to lock in fixed returns by separating principal from returns.

With the rise of Liquid Staking Tokens (LST), Pendles adoption rate has surged to help users unlock the liquidity of their staked assets. In 2024, Pendle successfully captured the restaking narrative - its eETH pool became the largest pool on the platform just a few days after its launch.

Today, Pendle has played a key role in the entire on-chain yield ecosystem. Whether it is providing a hedging tool for volatile funding rates or serving as a liquidity engine for interest-bearing assets, Pendle has unique advantages in growth areas such as Liquidity Re-Pledge Tokens (LRT), Real World Assets (RWA), and on-chain currency markets.

Pendle V2: Infrastructure upgrade

Pendle V2 introduces a standardized yield token (SY) to unify the packaging of interest-bearing assets. This replaces the fragmented and customized integration solution of V1 and enables seamless minting of principal tokens (PT) and yield tokens (YT).

Pendle V2s AMM is designed specifically for PT-YT transactions, providing higher capital efficiency and better price mechanisms. V1 uses a general AMM model, while V2 introduces dynamic parameters (such as rateScalar and rateAnchor) that adjust liquidity over time, thereby narrowing spreads, optimizing yield discovery, and reducing slippage.

Pendle V2 also upgrades the pricing infrastructure, integrating native TWAP oracles into the AMM, replacing the V1 model that relied on external oracles. These on-chain data sources reduce the risk of manipulation and improve accuracy. In addition, Pendle V2 adds order book functionality, providing an alternative price discovery mechanism when the AMM price range is exceeded.

For liquidity providers (LPs), Pendle V2 provides a stronger protection mechanism. The fund pool is now composed of highly correlated assets, and the AMM design minimizes impermanent loss, especially for LPs who hold to maturity - in V1, due to the lack of professionalism, LPs earnings results are more difficult to predict.

Pushing the boundaries of the EVM: Enter Solana, Hyperliquid, and TON

Pendles planned expansion to Solana, Hyperliquid, and TON marks a key turning point in its 2025 roadmap. To date, Pendle has always been limited to the EVM ecosystem - even so, Pendle has occupied more than 50% of the market share in the fixed income track.

However, the multi-chain nature of cryptocurrency has become a trend. By breaking through the EVM island through the Citadel strategy, Pendle will reach a new pool of funds and user groups.

Solana has become a major hub for DeFi and trading activity - with TVL hitting an all-time peak of $14 billion in January, a strong retail base, and a rapidly growing LST market.

Hyperliquid relies on its vertically integrated perpetual contract infrastructure, while TON relies on Telegrams native user funnel. Both ecosystems are growing rapidly, but both lack mature yield infrastructure. Pendle is expected to fill this gap.

If successfully deployed, these initiatives will significantly expand Pendles total addressable market. Capturing fixed income flows on non-EVM chains could bring hundreds of millions of dollars in incremental TVL. More importantly, this move will consolidate Pendles position in the industry not only as an Ethereum native protocol, but also as a DeFi fixed income infrastructure across major public chains.

Embracing traditional finance: building a compliant income access system

Another key initiative in Pendle’s 2025 roadmap is the launch of a KYC-compliant version of Citadel designed specifically for institutional funds. The solution aims to connect on-chain yield opportunities with traditional regulated capital markets by providing structured, compliant access to crypto-native fixed income products.

The plan is to work with protocols such as Ethena to manage an independent SPV structure managed by a licensed investment manager. This setup eliminates key friction points such as custody, compliance, and on-chain execution, allowing institutional investors to participate in Pendles income products through a familiar legal structure.

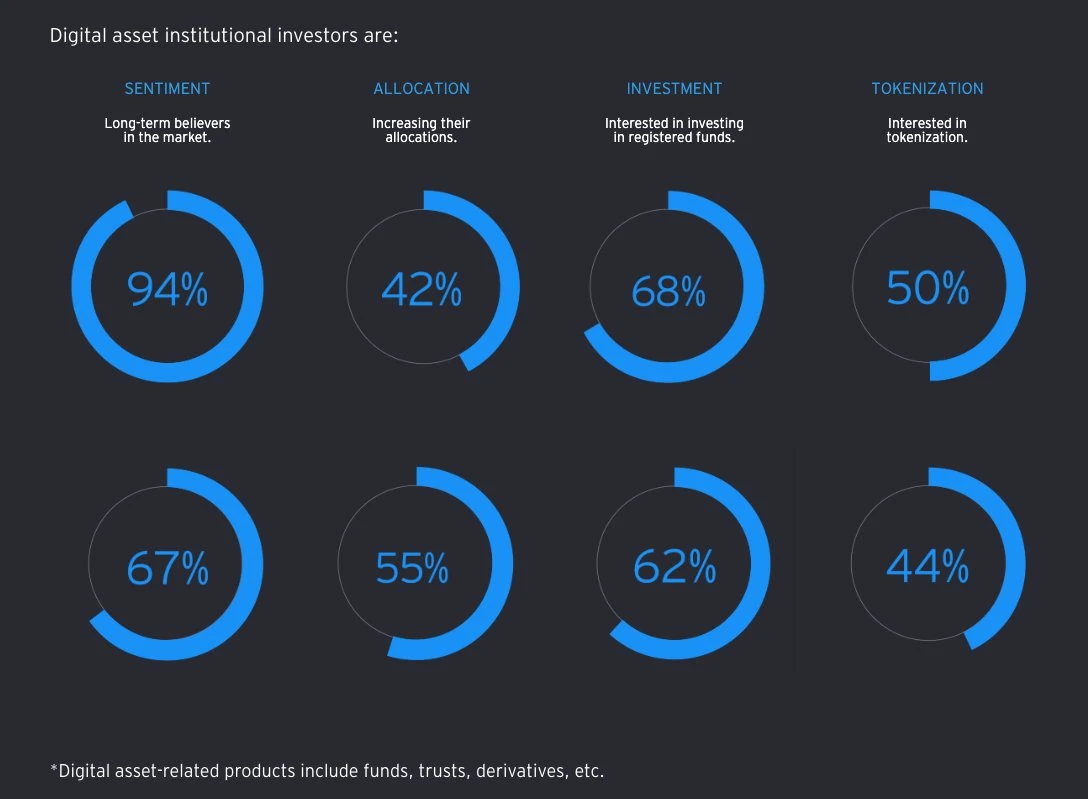

The global fixed income market is worth more than $100 trillion. Even if institutional funds only allocate a small proportion to the chain, it may bring in billions of dollars of capital inflows. According to the 2024 Ernst Young Parthenon survey, 94% of institutional investors recognize the long-term value of digital assets, and more than half are increasing their allocations.

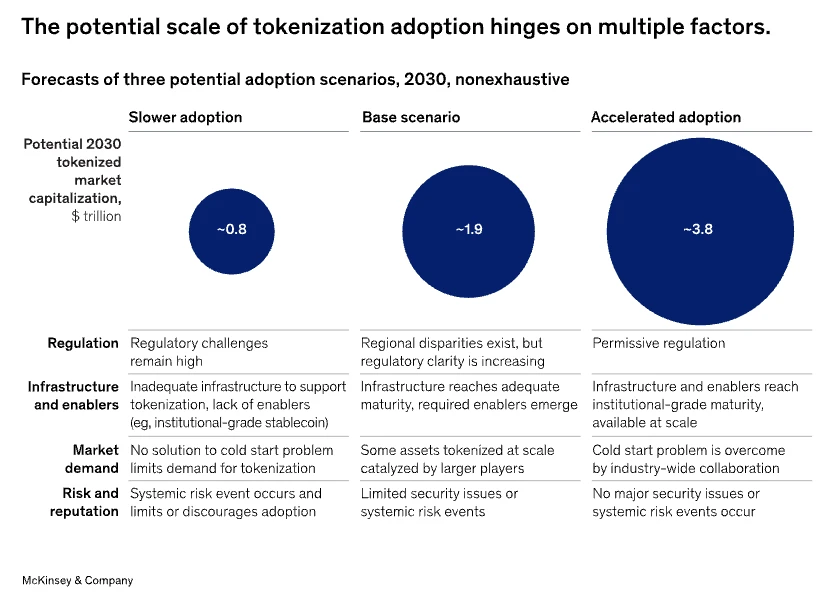

McKinsey predicts that the tokenization market size may reach 2-4 trillion US dollars in 2030. Although Pendle is not a tokenization platform, it plays a key role in this ecosystem by providing pricing discovery, hedging and secondary trading functions for tokenized income products. Whether it is tokenized treasury bonds or interest-bearing stablecoins, Pendle can serve as the fixed income infrastructure layer for institutional-level strategies.

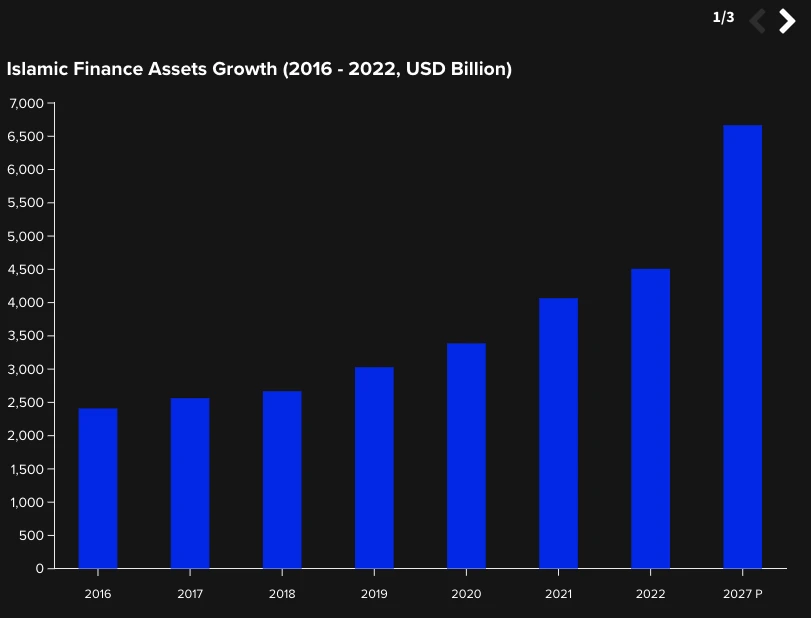

Islamic finance: A new $4.5 trillion opportunity

Pendle also plans to launch a Sharia-compliant Citadel solution to serve the $4.5 trillion global Islamic finance market - an industry that covers more than 80 countries and has maintained a 10% compound annual growth rate over the past decade, with particular growth in Southeast Asia, the Middle East and Africa.

Strict religious restrictions have long hindered Muslim investors from participating in DeFi, but Pendles PT/YT structure allows for the flexible design of Sharia-compliant income products, which may take the form of Islamic bonds (Sukuk).

If successfully implemented, the Citadel will not only expand Pendle’s geographical coverage, but will also verify DeFi’s ability to adapt to a diversified financial system - thereby consolidating Pendle’s position as the global fixed income infrastructure for the on-chain market.

Entering the funding rate market

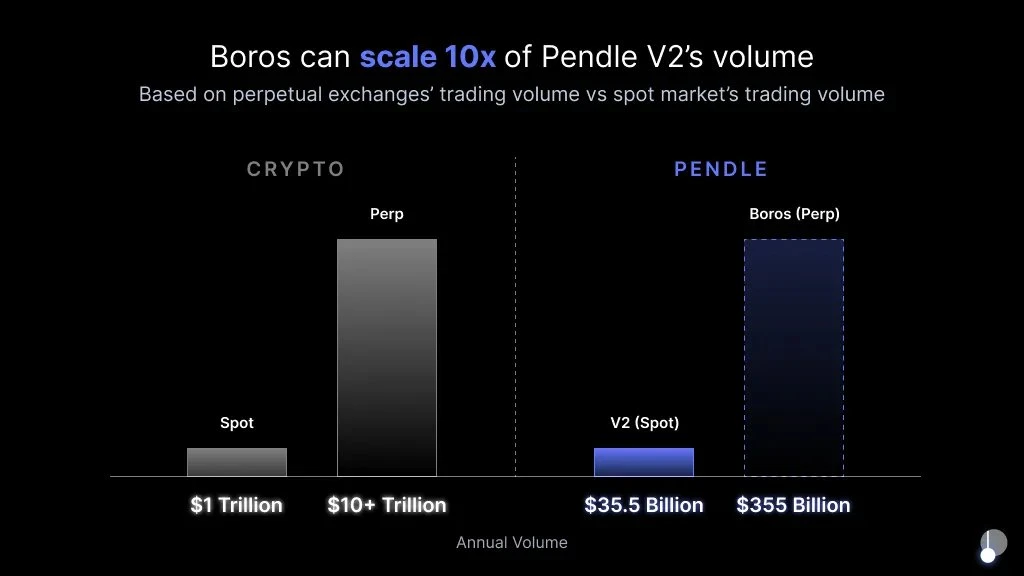

Boros is one of the most important catalysts in the Pendle 2025 roadmap, aiming to bring fixed-rate trading to the perpetual contract funding rate market. While Pendle V2 has established its dominance in the spot yield tokenization market, Boros plans to expand its business footprint to the largest and most volatile source of yield in the crypto space - perpetual contract funding rates.

The current perpetual contract market has over $150 billion in open interest and an average daily trading volume of $200 billion. This is a large market with a severe shortage of hedging tools.

Boros plans to provide more stable returns to protocols like Ethena by implementing a fixed funding rate — critical for institutions managing large-scale strategies.

For Pendle, this layout contains huge value. Boros is not only expected to open up a new market worth billions of dollars, but also achieve an upgrade in the positioning of the protocol - from a DeFi income application to an on-chain interest rate trading platform, and its functional positioning is comparable to the interest rate trading desk of CME or JPMorgan Chase in traditional finance.

Boros also strengthens Pendles long-term competitive advantage. Instead of chasing market hot spots, Pendle is laying the foundation for future yield infrastructure: whether it is funding rate arbitrage or spot holding strategies, it provides practical tools for traders and fund management departments.

Given the current lack of scalable funding rate hedging solutions in both DeFi and CeFi, Pendle is expected to gain a significant first-mover advantage. If successfully implemented, Boros will significantly increase Pendles market share, attract new user groups, and consolidate its core position as DeFi fixed income infrastructure.

Core team and strategic layout

Pendle Finance was founded in mid-2020 by anonymous developers TN, GT, YK and Vu, and has received investments from top institutions such as Bitscale Capital, Crypto.com Capital, Binance Labs and The Spartan Group.

Funding milestones:

Private placement round (April 2021): raised US$3.7 million, with investors including HashKey Capital, Mechanism Capital, etc.

IDO (April 2021): raised $11.83 million at $0.797 per token;

Binance Launchpool (July 2023): 5.02 million PENDLE (1.94% of total supply) distributed via Binance Launchpool;

Binance Labs strategic investment (August 2023): accelerate ecosystem development and cross-chain expansion (amount not disclosed);

Arbitrum Foundation Grant (October 2023): Received $1.61 million for Arbitrum ecosystem construction;

The Spartan Group strategic investment (November 2023): driving long-term growth and institutional adoption (undisclosed amount).

The ecological cooperation matrix is as follows:

Base (Coinbase L2): Deployed to the Base network, accessing native assets and expanding fixed income infrastructure;

Anzen (sUSDz): Launched the RWA stablecoin sUSDz to enable fixed-income transactions linked to real-world earnings;

Ethena (USDe/sUSDe): Integrate high APY stablecoins, access crypto native returns and strengthen DeFi synergy;

Ether.fi (eBTC): Launched the first BTC native yield pool, breaking the ETH asset boundary;

Berachain (iBGT/iBERA): As one of the first infrastructures to settle in, it will build a fixed income framework through native LST.

Token Economic Model

The PENDLE token is the core of the Pendle ecosystem, with both governance functions and protocol interaction permissions. By splitting interest-bearing assets into principal tokens and yield tokens, Pendle has created a new paradigm for yield management - and PENDLE is the key tool to participate in and shape this ecosystem.

The key figures are as follows (as of March 31, 2025):

Price: $2.57

Market value: $410.6 million

Fully diluted valuation (FDV): $725.2 million

Circulating supply: 161.31 million (57.3% of maximum supply)

Maximum supply: 281,527,448

Deflation mechanism: Starting from September 2024, PENDLE weekly emissions will decrease at a rate of 1.1% (initial weekly emissions of 216,076). After 29 weeks of adjustment, the current weekly emissions have dropped to approximately 156,783. The deflation plan will last until April 2026, after which the protocol will switch to an annualized inflation rate of 2% to maintain long-term incentives.

vePENDLE Governance Model

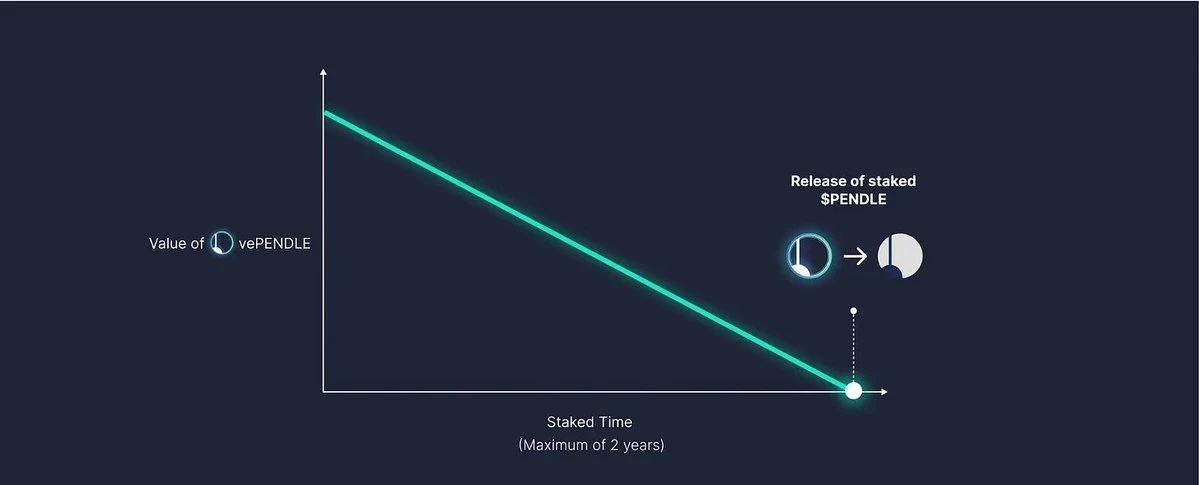

Pendle improves governance and decentralization through vePENDLE. Users can obtain vePENDLE by locking PENDLE. The longer the lock-up period (up to two years) and the more PENDLE locked, the more vePENDLE they will get. Over time, vePENDLE will decay linearly to zero, at which point the locked PENDLE will be unlocked.

This lock-up mechanism reduces the circulating supply, aids price stability, and aligns with the ecosystem’s long-term incentives.

Benefits for vePENDLE holders include:

Voting rights to participate in protocol decision-making

Income and expense allocation

Exclusive incentives and airdrops

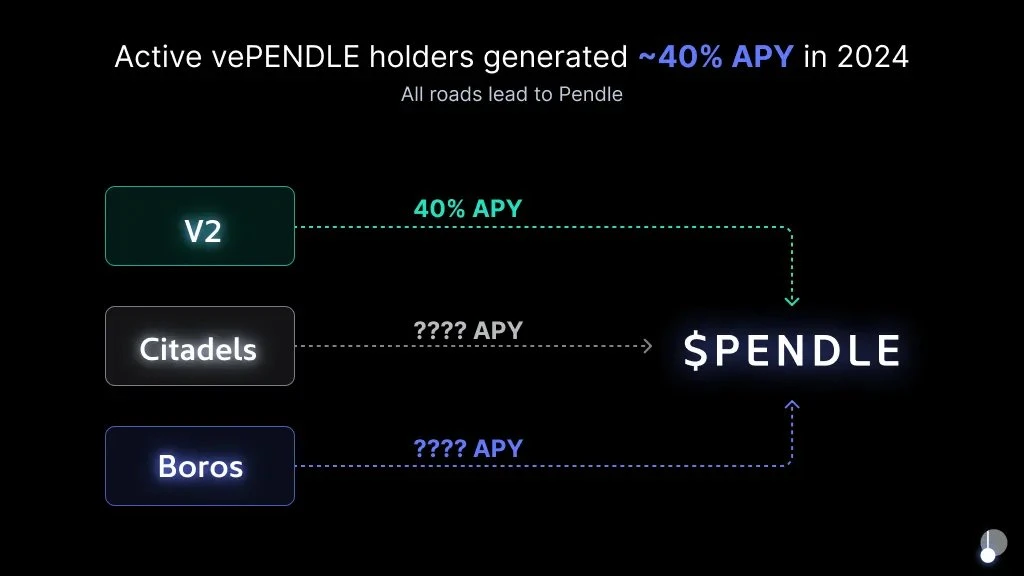

In 2024, active vePENDLE holders earned an average annualized yield (APY) of approximately 40%, not counting the separate $6.1 million airdrop distributed in December.

Pendle’s Revenue Flywheel

Pendle absorbs value through the following three channels:

Protocol fee: 3% of the interest-bearing token income is injected into the treasury;

Transaction fee: 0.35% per transaction (0.3% goes to LP, 0.05% goes to the treasury);

Profit sharing: Part of YT’s profits are directly distributed to vePENDLE holders;

As V2, Citadel, and Boros advance, more value will flow to vePENDLE holders, further consolidating its core position in the ecosystem.

Main risks and challenges

Although Pendle has taken a dominant position in the DeFi ecosystem, it still faces several risks. The complexity of the platform remains a barrier to its widespread adoption, especially for users who are not familiar with the mechanics of yield trading. To achieve a new round of growth, Pendle needs to continue to simplify the user experience and reduce the learning curve for PT, YT, and fixed income strategies.

Pendles total locked value (TVL) is highly concentrated in USDe, which makes the protocol highly dependent on a single asset and its funding dynamics. Under bull market conditions, USDe offers attractive returns. But if funding rates drop or incentives shift to other areas, capital may flow out, affecting Pendles overall TVL and usage.

Other factors to consider include smart contract risks, oracle reliability, and market volatility of the underlying assets. Low liquidity in certain pools may also lead to slippage or reduced capital efficiency when users exit.

In addition, Pendle’s recent growth has been partially driven by airdrops and points incentives. As these programs are phased out, continued momentum will rely more on the core utility of the protocol, diversified revenue sources, and the continued launch of products such as Boros and multi-chain Citadels.

Conclusion

Although market cycles often cause fluctuations in investor sentiment and attention, Pendle has always adhered to the long-term vision and continued to build. Pendles customizable fixed income strategy is at the forefront of DeFi innovation, helping users effectively manage volatility, hedge risks, and obtain stable returns - This makes Pendle a natural bridge between traditional finance and the composability of on-chain markets.

Looking ahead, Pendle’s 2025 roadmap lays out a clear path for broader adoption and deeper liquidity. The key to further development lies in the simplification of the user experience and the ability to move beyond short-term narratives.

As the stablecoin market grows and tokenized assets surge, Pendle is expected to become the fixed income layer that drives the next wave of asset issuance, and its recent strong performance reflects market demand and market confidence. If executed smoothly, Pendle may become a core pillar of the future of DeFi fixed income.